BE THANKFUL WHEN THE WEEK ENDS!

One of the problems when looking back on any given period of time...say the week before Thanksgiving, or the last quarter of the year for example, it assumes that every year conditions are always pretty much the same. Well folks, this year, it appears that we have put a financial meltdown on the table. Europe continues to circle the drain and we see nothing coming today that indicates that the ECB will step foward and stop their problems. Over the weekend Germany's position of no bailouts for Greece, Italy, Spain, or anyone else. only got harder. The bond market has been successful in overturing another government as Spainish elections have thrown out the socialists. Meanwhile the shock of all shocks was that there was no deal on the budget from the Washington Super duds. So the markets are set to open down sharply lower this morning, More on that later.

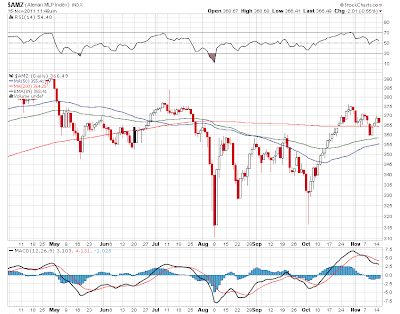

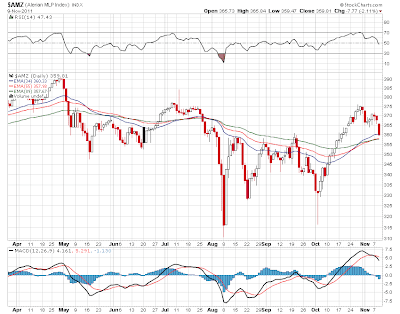

Let us, for now suspend the world for awhile and look at mlps. The chart has yet to break down and actually remains locked in this sideways pattern we've been in pretty much since May. Buying down at 320 has been smart. Selling up here around 370 has been also smart. 390 is the all time high which is not that far away. So what puts an end to this lovely little world? If the world does meltdown again ala 2008 than we will see our little group unravel. I would point out that we probably have more people invested in mlps now than we've ever had before. (there are commercials running on CNBC!). Fundamentally the group looks pretty solid so it will give us the chance to gather shares on the cheap again.

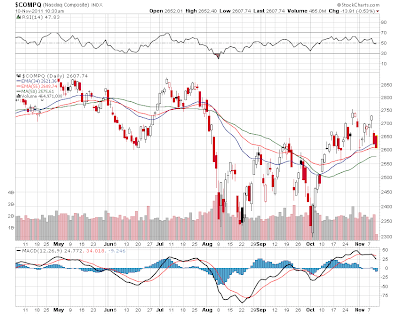

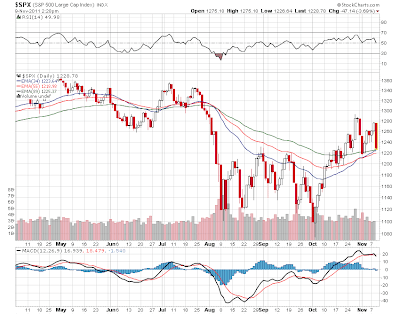

Back to the markets note that last week did damage. Starting with the Nasdaq the rising moving average support lines did not hold. The dow chart is the last one to breakdown and will do so at the open this morning. I use fibbonacci based, expotential moving averages, but the simple 50 day moving average which is widely followed sits at 1206 and that goes at the open. The 1200 level might hold for awhile today but ultimately it will go as well.

For the dow industrials that average sits at 11523 and it will probably get there at some point today if the selloff accelerates later today. Note that the dow is the last chart to break down. The broader index charts broke down first and that is not good.

The nasdaq composite which is the most speculative of the indexes was the first to breakdown late last week.

So with the breakdown of all major support i think we can pretty much look to the October 4th bottom for a serious retest of that level. Given everything we are facing right now, the odds of that level holding are shrinking fast especially if Europe unravels.

Okay back to MLPS we have Global Partners (GLP)

annoucing a deal this morning that is accretive to earnings. Otherwise its a relatively quiet morning here with no other news and no upgrades or downgrades.

Markets are down pre open as mentioned but a little off the lows of the morning as Europe comes a little off its lows of the day. Crude is down and Brent is down to 106. 100 is critical there. The dollar is stronger pretty much across the board. Nat gas is down a little. No cold air in the US right now to make a difference. Weather patterns may change to colder across the midwest and northeast later next week. Gold is down on the idea that when you need to raise cash you sell what you have. So the open looms on what does not look like a good day ahead.