Wednesday, November 30, 2005

Some dumping of Atlas Pipeline....you can buy it at 40.90 with nearly an 8% yield and a record of increasing distributions....Some blocks on the buyside now at 41. Valero LP and Teppco holding...some selling in Buckeye. All in all its not pretty but i am turning more bullish as yields on these stocks are at their highest levels of 2005. Unless the 10 year yield spikes to 5% or higher....these stocks are at bargain levels...imho of course!

Some dumping of Valero LP shares at the open and at a new 52 week low...as is Teppco which continues die a death by a thousand cuts. Crosstex (XTXI) is up 1.14 to just under 66...the LP is up a few pennies. Otherwise its mostly lower and MLPS will have their 4th straight down month when trading closes today.

Good Morning.

Since there is not one iota of corporate news this morning... i waited until now for the first post of the day. Ten year yield dropping this morning to 4.46%. And while the energy market sold off on winter being cancelled...i will reinterate the weather pattern turns colder beginning Friday and remains so for the next 10-14 days.

Enterprise Products Partners priced an offerning last night at 25.54.

Watching and waiting for the open. Martin Midstream Partners has been firming on increasing volume for some reason or another.

Since there is not one iota of corporate news this morning... i waited until now for the first post of the day. Ten year yield dropping this morning to 4.46%. And while the energy market sold off on winter being cancelled...i will reinterate the weather pattern turns colder beginning Friday and remains so for the next 10-14 days.

Enterprise Products Partners priced an offerning last night at 25.54.

Watching and waiting for the open. Martin Midstream Partners has been firming on increasing volume for some reason or another.

Tuesday, November 29, 2005

Sorry for late posting today...2nd funeral in 2 days. They're dropping like flies around me lately.

MLPS continue to do nothing for the most part. Enterprise has some news about expanding its LNG storage. Ten year is back up to 4.48 yield. Energy is lower while big energy stocks are a little lower.

I need to get my head together here...will post a roundup this evening.

MLPS continue to do nothing for the most part. Enterprise has some news about expanding its LNG storage. Ten year is back up to 4.48 yield. Energy is lower while big energy stocks are a little lower.

I need to get my head together here...will post a roundup this evening.

Monday, November 28, 2005

So today they've decided there will be no winter and major energy is down hard...XOI -33 points. Let me point out that this pattern is transitory...that is we will be seeing swings like this over the next few weeks...but the overall trend will be for colder weather than normal speading across the midwest and northeast. Its just that today's focus seems to be on the "right now" and it is not even December yet.

MLPS are mostly lower but not by alot. Not much news out there other than the Lehman notes on Crosstex (outperform)...Crosstex up 60 cents...and Martin Midstream which is up 17 cents.

MLPS are mostly lower but not by alot. Not much news out there other than the Lehman notes on Crosstex (outperform)...Crosstex up 60 cents...and Martin Midstream which is up 17 cents.

There seems to be a silliness that has decended on the energy complex where apparently we're going to up or down tick on every up or downtick in temperature. Today its warmer than average weather...tomorrow will be the prospect of colder than average weather by weeks end. etc etc etc...

Meanwhile the ten year is at 4.41 and MLPS are mixed. Lehman's overweight of Crosstex is good for 38 cents so far. Otherwise moves are fractional and small in both directions.

Meanwhile the ten year is at 4.41 and MLPS are mixed. Lehman's overweight of Crosstex is good for 38 cents so far. Otherwise moves are fractional and small in both directions.

Good Morning and Happy post Thanksgiving!

We start this monday with an upgrade. Lehman Brothers starts coverage on Crosstex LP and humbly recommends an overweight position! Pre market bids are above Friday's close. No other news this morning...the 10 year is at 4.44%

Lets see if MLPS put in a solid trading low in mid november and if last weeks tepid rally can gain some steam.

Weather trends look colder in the northeast and midwest after midweek.

We start this monday with an upgrade. Lehman Brothers starts coverage on Crosstex LP and humbly recommends an overweight position! Pre market bids are above Friday's close. No other news this morning...the 10 year is at 4.44%

Lets see if MLPS put in a solid trading low in mid november and if last weeks tepid rally can gain some steam.

Weather trends look colder in the northeast and midwest after midweek.

Wednesday, November 23, 2005

Good Morning.

Wednesday before thanksgiving so its an early getaway today for most traders. I guess all of the days moves should be done by lunch time and then its just back and forth after that. No news to speak of this morning. Treasuries flat at 4.42 on the ten year. Energy complex a touch lower this morning. Weather pattern no longer looks very cold over the next 2 weeks...once we get past Friday.

Waiting for the open.

Wednesday before thanksgiving so its an early getaway today for most traders. I guess all of the days moves should be done by lunch time and then its just back and forth after that. No news to speak of this morning. Treasuries flat at 4.42 on the ten year. Energy complex a touch lower this morning. Weather pattern no longer looks very cold over the next 2 weeks...once we get past Friday.

Waiting for the open.

Tuesday, November 22, 2005

The fed may be hinting that there may be 2 more rate hikes and then done...and if that is the case the MLP correction that began in July may have run its course. Some upside today in the group took hold at 2:30pm and held into the close. Some losers however include Holly Partners back to 39.25 down .75 and Northern Borders Partners at 43 down 67 cents.

As mentioned earlier Atlas Pipeline Partners priced its offering at 42. And a big 5000 market purchase of Hiland Partners by an insider. This was reported after the close.

Sorry the blogging has been on the light side this week with Thanksgiving and some personal stuff. Looks like everything tomorrow will be in the first 45 minutes and then its nothing of consequence until Monday. Thats just a prediction.

Here is a list of MLP yields as of 11/10 thanks to Utility Stock Blog

As mentioned earlier Atlas Pipeline Partners priced its offering at 42. And a big 5000 market purchase of Hiland Partners by an insider. This was reported after the close.

Sorry the blogging has been on the light side this week with Thanksgiving and some personal stuff. Looks like everything tomorrow will be in the first 45 minutes and then its nothing of consequence until Monday. Thats just a prediction.

Here is a list of MLP yields as of 11/10 thanks to Utility Stock Blog

Good afternoon. Sorry for the late post today as one of my daughters had some minor surgery this morning and i just got home. Everything okay but can't blog and drive at the same time.

Doesn't look like i missed much anyway...looks mixed on the tape. Majors are higher with XOI +17 and back over 1k. Atlas Pipeline Partners priced its offering at 42.

Cactus Jack suggested 42.75 as an entry point for Northern Borders Partners. Its almost there now.

Doesn't look like i missed much anyway...looks mixed on the tape. Majors are higher with XOI +17 and back over 1k. Atlas Pipeline Partners priced its offering at 42.

Cactus Jack suggested 42.75 as an entry point for Northern Borders Partners. Its almost there now.

Monday, November 21, 2005

Good Monday Morning.

Holiday shortened week so my guess is trading that is more appointment only in nature but there is some leftover news from Friday that will move some MLPS.

Lets start off with Atlas Pipeline Partners which 3 news items late Friday. First off its a stock sale of 2.7 million shares. Also rhey will be selling some senior notes. And finally Atlas America is considering a restructering involving APL.

This morning the energy complex is higher. Weather prospects are positive as very cold air is heading for the great lakes, northeast and mid atlantic. And the pattern overall looks cold for the next 2 weeks.

Holiday shortened week so my guess is trading that is more appointment only in nature but there is some leftover news from Friday that will move some MLPS.

Lets start off with Atlas Pipeline Partners which 3 news items late Friday. First off its a stock sale of 2.7 million shares. Also rhey will be selling some senior notes. And finally Atlas America is considering a restructering involving APL.

This morning the energy complex is higher. Weather prospects are positive as very cold air is heading for the great lakes, northeast and mid atlantic. And the pattern overall looks cold for the next 2 weeks.

Friday, November 18, 2005

Typical Friday trading with no real movement since the open. Teppco continues to sag and while not at a 52 week low its close to it. Valero LP hit a 52 week low a couple of days ago and at least is bouncing. Atlas Pipeline (ATLS) is up 1 and change on a share buyback. Kinder Morgan nearing 50 again. Its been a relative outperformer in the group lately.

Good Morning! Sorry for the late posts since i was working this morning.

No real news to speak off...an upgrade for Enbridge Energy Partners (EEP) from underperform to market perform thanks to the brilliance of Wachovia. Otherwise the group is trading mixed this morning with mostly fractional moves in each direction. Magellan Midstream and Plains Pipeline are giving back yesterday's gains...others higher by 1/2 pt or less.

Ten year has that 4.5 handle on it.

No real news to speak off...an upgrade for Enbridge Energy Partners (EEP) from underperform to market perform thanks to the brilliance of Wachovia. Otherwise the group is trading mixed this morning with mostly fractional moves in each direction. Magellan Midstream and Plains Pipeline are giving back yesterday's gains...others higher by 1/2 pt or less.

Ten year has that 4.5 handle on it.

Thursday, November 17, 2005

Sorry guys...just got back after a day in nyc.

Okay to play catch up...citigroup upgrades Pacific Energy Partners to buy this morning. Another insider purchase this time at Martin Midstream Partners (MMLP). Please note that the only ones i regard as signficant is the open market purchases which is someone buying with their own cash at market prices.

Otheriwise it was a good day for MLPS for a change...just about the entire group was up soild fractions...Markwest was up 1.48. Will report on any late breaking news.

Okay to play catch up...citigroup upgrades Pacific Energy Partners to buy this morning. Another insider purchase this time at Martin Midstream Partners (MMLP). Please note that the only ones i regard as signficant is the open market purchases which is someone buying with their own cash at market prices.

Otheriwise it was a good day for MLPS for a change...just about the entire group was up soild fractions...Markwest was up 1.48. Will report on any late breaking news.

Wednesday, November 16, 2005

There was some dumping at the open at below market prices in many MLPS this morning. Buckeye as of this writing is still not open on the NYSE (BPL)...down 2 and change with no news. Enbridge imploded to 45 on its stock sale...now at 46.50. Crosstex (XTEX) and Hiland (HLND) are holding there own as there stock sales seem to be priced in. Atlas Pipeline Partners (APL) is up 25 cents. Yielding nearly 7.50% probably puts a floor under this one.

Good Morning

First off we have news from last night that will be impacting. Crosstex LP priced its equity offering at 33.25. Also on the equity pricing front we have Hiland LP pricing its offering last night at 41.77.

Also i may have missed this but Energy Transfer Partners came out with earnings on Monday night. My apologies for not catching it.

Ten year is continuing to move away slowly from the 4.67 high from last week...now at 4.53 on a decent CPI number. No other news breaking this morning on MLPS

First off we have news from last night that will be impacting. Crosstex LP priced its equity offering at 33.25. Also on the equity pricing front we have Hiland LP pricing its offering last night at 41.77.

Also i may have missed this but Energy Transfer Partners came out with earnings on Monday night. My apologies for not catching it.

Ten year is continuing to move away slowly from the 4.67 high from last week...now at 4.53 on a decent CPI number. No other news breaking this morning on MLPS

Tuesday, November 15, 2005

Looks like an open market purchase of Martin Midstream Partners if i read this correctly. Reported after the market closed. In fact this is a transaction involving a previous announced conversion of subordinated units into common. No dilution here btw as previously reported in this press release from 10/24.

Also Enbridge Energy Partners (EEP) announces a stock offering.

Another Insider purchase report this time from Holly Partners. At least its encouraging to see some folks stepping up to the plate here. Its an open market purchase which i think is the most important kind of insider buy. No exercise of option or company giving someone shares. This is going out and buying something at full price with your own money.

Also Enbridge Energy Partners (EEP) announces a stock offering.

Another Insider purchase report this time from Holly Partners. At least its encouraging to see some folks stepping up to the plate here. Its an open market purchase which i think is the most important kind of insider buy. No exercise of option or company giving someone shares. This is going out and buying something at full price with your own money.

Uglyness continues except for Atlas Pipeline and Pacific Energy which are up a few pennies and Kinder Morgan which is up a fraction....the group is getting nailed to the wall again for various reasons and none seem to be specific except for Crosstex with a stock offering -1.12. I'll settle for upticks in the ask prices!

Markwest is down 2...Valero and Hiland down between 1 and 2 pts...fractional losses of .25 to .75 cents on average for the rest of them.

Distributions should be appearing in your accounts so this at least allieviate some of the pain.

Markwest is down 2...Valero and Hiland down between 1 and 2 pts...fractional losses of .25 to .75 cents on average for the rest of them.

Distributions should be appearing in your accounts so this at least allieviate some of the pain.

Not very pretty out there. MLPS selling off rather hard today in some cases. Yields on some of these however have climbed to very attractive levels. With the 10 year at 4.55 here are a few examples.

Atlas Pipe Line (APL) 7.4%

Martin Midstream (MMLP) 7.10%

Energy Transfer (ETP) 5.9%

Teppco Partners (TPP) 6.9%

Valero LP (VLI) 6.2%

Magellan Midstream (MMP) 6.5%

Sunoco Logistics (SXL) 7.0%

I sampled just a few but there was a time last june where the spread between the ten year yield and the distribution yield on these was near or just under 2 pts...now we seem to rallying the spread back to nearly 3 points in some cases. The distribution growth has probably prevented the sell off from being worse. Atlas catches my eye with a 7.4% yield and distributions growing at a very fast rate.

Atlas Pipe Line (APL) 7.4%

Martin Midstream (MMLP) 7.10%

Energy Transfer (ETP) 5.9%

Teppco Partners (TPP) 6.9%

Valero LP (VLI) 6.2%

Magellan Midstream (MMP) 6.5%

Sunoco Logistics (SXL) 7.0%

I sampled just a few but there was a time last june where the spread between the ten year yield and the distribution yield on these was near or just under 2 pts...now we seem to rallying the spread back to nearly 3 points in some cases. The distribution growth has probably prevented the sell off from being worse. Atlas catches my eye with a 7.4% yield and distributions growing at a very fast rate.

A couple of stocks in the group are up but the vast majority are down today. Kinder Morgan Partners is a winner along with Atlas Pipeline Partners and Copano Energy. Kinder Morgan has some news on its deal with Sempre'.

Meanwhile among the losers Markwest Energy Partners (MWE) is down 1.66, Hiland (HLND) is down 1.49 Valero LP(VLI) -1.09 ...lots of fractional losers on the board. XOI is +10 and XNG is +6 though the complex is mostly lower this afternoon. Crosstex is holding 33.75 on its news of an offering of 3.5 million shares.

Meanwhile among the losers Markwest Energy Partners (MWE) is down 1.66, Hiland (HLND) is down 1.49 Valero LP(VLI) -1.09 ...lots of fractional losers on the board. XOI is +10 and XNG is +6 though the complex is mostly lower this afternoon. Crosstex is holding 33.75 on its news of an offering of 3.5 million shares.

Most MLPS opened lower...the downtrend continues. First in the news driven moves. Crosstex LP (XTEX) is down 47 cents and holding 34 so far. I'll wait another hour before determining whether the stock sale is priced in or not. Also Pacific Energy Partners is up a fraction on good earnings. Otherwise its fractional losses pretty much across the board. 1 point minuses in Markwest and Hiland but again most if not all of these moves comes on uninspired volume

Maybe the happiness fairy will help us out of this rut!

Some news from last night. At least now we know why Crosstex LP has been in a downtrend. They're selling more shares. Now this should put pressure on the stock this morning but i will point out 2 things. First off the stock may have anticipated this already and that could limit downside. And secondly Hiland LP announced its sale 2 weeks agao and the stock traded down from 43 to 41 and now its at 45. Lets hope! So far no pre market trading...bid and ask even with the close.

Earnings news and its good news from Pacific Energy Partners. Numbers were good and raising 05 view. (whats left of it.)

Energy complex is lower this morning but let me caution that a much colder weather pattern is evolving for the northeast and great lakes and it could be downright frigid for thanksgiving.

PPI number was very good....core down .3. Ten year yawning.

Monday, November 14, 2005

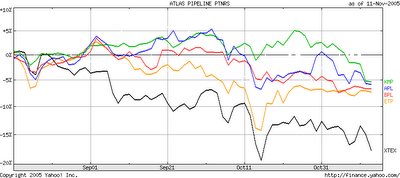

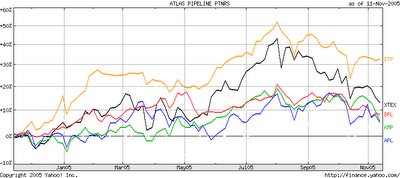

Corrections are never fun and this chart is proof. The first chart compares 5 MLPS and their performance in the last 52 weeks. Note that in this subset that all 5 stocks are up with KMP and APL near the bottom and XTEX AND ETP at the top.

Corrections are never fun and this chart is proof. The first chart compares 5 MLPS and their performance in the last 52 weeks. Note that in this subset that all 5 stocks are up with KMP and APL near the bottom and XTEX AND ETP at the top.Notice that in the last 3 months Kinder Morgan has outperformed the other four with Crosstex down the most. So the biggest gainers year over year are experiencing the sharpest pullbacks in here while there is a flight to quality into KMP. It seems to be a grinding correction in here from the July highs.

Meanwhile most MLPS remaining slightly higher and off the morning highs. No news to speak of on any in the group.

A firm open pretty much across the board this morning. A firm energy complex plus stable ten year rates are permitting some nibbling. No huge gainers just a lot of fractional plusses. Some of the bigger winners include Kinder Morgan Partners up 87 cents, Hiland up 98 cents and even Northern Borders Partners is up 77 cents today. No news on any of these stocks.

Good Monday Morning to all.

Lets start the day with news of a Yorktown sale of Crosstex Energy (XTXI). For those of you unfamilar with Yorktown they are a large holder of Crosstex Energy and will periodically dispose of shares. This time it was 1/2 a million shares as per the filing. No other earthshattering news this morning on the MLP front.

The energy complex is higher this morning which could be a bounce from an oversold condition. I promised last week i would blog about weather prospects over the next few weeks. I'll post about this later today. Meanwhile Hurricane season ain't done yet.

A couple of week's ago a friend of mine's horse broke his maiden at the Meadowlands. Here is the picture at the winner's circle. I'm the one smiling!

Friday, November 11, 2005

Time to look at a few charts and see where we may or may not be going. First off Crosstex. Short term downtrend from its 46 high back to a floor here at 36 which is the prior breakout point. Appears to be holding here.

Meanwhile the 10 year yield has hit a wall at 4.60 short term. Double top at least for now. Maybe a trip down to 4.40 yield into year end? A better looking chart in Atlas Pipeline...not a picasso but better than what follows!

A better looking chart in Atlas Pipeline...not a picasso but better than what follows!

Kinder Morgan chart looks like its broken down in here and at a 5/1/2 month low. Its been straight down since selling new shares in the 51.25 area.

Kinder Morgan chart looks like its broken down in here and at a 5/1/2 month low. Its been straight down since selling new shares in the 51.25 area.

Well we're past the open and we can hear the collective yawn. Most moves are small and favor the downside. Crosstex (XTXI) showing $1.88 loss at the open but this is one of the stocks where 3 or 4 buys can have it back to unchanged. No news to trade on.

Kinder Morgan Partners down another 70 cents and trading at a 5 1/2 month low here.

Meanwhile the 10 year yield has hit a wall at 4.60 short term. Double top at least for now. Maybe a trip down to 4.40 yield into year end?

A better looking chart in Atlas Pipeline...not a picasso but better than what follows!

A better looking chart in Atlas Pipeline...not a picasso but better than what follows! Kinder Morgan chart looks like its broken down in here and at a 5/1/2 month low. Its been straight down since selling new shares in the 51.25 area.

Kinder Morgan chart looks like its broken down in here and at a 5/1/2 month low. Its been straight down since selling new shares in the 51.25 area.

Well we're past the open and we can hear the collective yawn. Most moves are small and favor the downside. Crosstex (XTXI) showing $1.88 loss at the open but this is one of the stocks where 3 or 4 buys can have it back to unchanged. No news to trade on.

Kinder Morgan Partners down another 70 cents and trading at a 5 1/2 month low here.

Good Friday Veterans Day Morning!

From last night news of a public offering of Magellan's GP. Magellan Midstream has been a good performer over the last 2 years. Something to look foward to since GPS have done well asa group.

For Hiland Partners holders a conference call is scheduled for this morning. Also Martin Midstream partners announced a closing of its Prism deal

Bond market is closed today for Veterans Day so no trading in the 10 year. Energy complex continues to decline this morning. Look for trading to be light for the most and by appointment only!

Over the weekend i shall try to blog about future weather conditions, the winter ahead, and update the blogroll of links.

From last night news of a public offering of Magellan's GP. Magellan Midstream has been a good performer over the last 2 years. Something to look foward to since GPS have done well asa group.

For Hiland Partners holders a conference call is scheduled for this morning. Also Martin Midstream partners announced a closing of its Prism deal

Bond market is closed today for Veterans Day so no trading in the 10 year. Energy complex continues to decline this morning. Look for trading to be light for the most and by appointment only!

Over the weekend i shall try to blog about future weather conditions, the winter ahead, and update the blogroll of links.

Thursday, November 10, 2005

A sharp up open for Hiland Partners on earnings and expansion news. Lighting up the board right now +2.47. Martin Midstream traded + 1.49 on record earnings...now up 80 cents.

The two big losers are Kinder Morgan Partners - 1.26 and Crosstex (XTXI) -1.50. No news on either front. Copano - 1.22, no news either. Markwest still has not opened as it places stock privately.

Big oil and gas stocks getting hit very hard this morning. XOI down 27, XNG -9.

Natgas numbers due at any moment.

The two big losers are Kinder Morgan Partners - 1.26 and Crosstex (XTXI) -1.50. No news on either front. Copano - 1.22, no news either. Markwest still has not opened as it places stock privately.

Big oil and gas stocks getting hit very hard this morning. XOI down 27, XNG -9.

Natgas numbers due at any moment.

Good Morning.

News from after the close last night. We'll start with Pacific Energy Partners who was supposed to come out with earnings. but announced a delay. This would normally cause consternation amongst holders but apparently they found some money they did not know they had! They should call General Motors!

Martin Midstream Partners which usually trades by appointment only reported record earnings. Should provide some upside.

Earnings news from Hiland Partners which was 6 cents better than first call and they announce an expansion.

Markwest Energy announces a private placement of shares at 44.21

No upgrades or downgrades so far.

News from after the close last night. We'll start with Pacific Energy Partners who was supposed to come out with earnings. but announced a delay. This would normally cause consternation amongst holders but apparently they found some money they did not know they had! They should call General Motors!

Martin Midstream Partners which usually trades by appointment only reported record earnings. Should provide some upside.

Earnings news from Hiland Partners which was 6 cents better than first call and they announce an expansion.

Markwest Energy announces a private placement of shares at 44.21

No upgrades or downgrades so far.

Wednesday, November 09, 2005

Crosstex is back up on the day after a morning where it was +1 then -2 and now its +.21 going into the last hour. Meanwhile earnings are out from Trans-Montaigne LP and the stock is up 40 cents.

Hotel Bombs going off in Jordan...civil war in France...riots elsewhere. Ugh!

Hotel Bombs going off in Jordan...civil war in France...riots elsewhere. Ugh!

More red then green on the screen this morning... and it doesn't help that the ten year yield is back over 4.60%.

Copano (CPNO) down 75 cents as they sell the earnings news. Inventory numbers bearish overall but i find that oil stocks don't often react the way you expect them too. Right now the group is weak (XOI -12). Crude down 61 cents.

Oil executives testifying before the senate circus. If anything earthshattering is said...i shall report. But don't hold your breath.

Copano (CPNO) down 75 cents as they sell the earnings news. Inventory numbers bearish overall but i find that oil stocks don't often react the way you expect them too. Right now the group is weak (XOI -12). Crude down 61 cents.

Oil executives testifying before the senate circus. If anything earthshattering is said...i shall report. But don't hold your breath.

Good Morning!

We'll start with last nights news on Copano and earnings. Numbers look good. Pacific Energy Partners earnings due out after the close.

No breaking news this morning and no upgrades or downgrades. Ten year yield up slightly while the energy complex is lower.

We'll start with last nights news on Copano and earnings. Numbers look good. Pacific Energy Partners earnings due out after the close.

No breaking news this morning and no upgrades or downgrades. Ten year yield up slightly while the energy complex is lower.

Tuesday, November 08, 2005

Good Morning!

We begin the morning with earnings from Crosstex Energy LP (XTEX). You have to cut through charges one time gains etc etc. I think the most important figure to look at is distributable cash flow or DCF. Here is the relevant paragraph.

"The Partnership's Distributable Cash Flow for the quarter was $17.9 million, 3.50 times the amount required to cover its Minimum Quarterly Distribution of $0.25 per unit, and 1.54 times the amount required to cover its distribution of $0.49 per unit. As previously disclosed, the Partnership sold certain idle equipment for $9.0 million in 2005, and during the third quarter, the Partnership received the final $5.4 million of funds for the sale, which is included in Distributable Cash Flow for the quarter. The $11.5 million charge for the mark-to-market value of the puts did not affect Distributable Cash Flow. Excluding proceeds from the sale, Distributable Cash Flow for the quarter increased $2.1 million, or 20.2 percent, over Distributable Cash Flow of $10.4 million in the 2004 third quarter. Distributable Cash Flow is a non-GAAP financial measure and is explained in greater detail under "Non-GAAP Financial Information." Also, in the tables at the end of this release is a reconciliation of this measure to net income."

So we'll how the market reacts to this. I don't think there was any real surprise here. The conference call is at 11am eastern time and you can access it here.

No other new upgrades or downgrades so far.

We begin the morning with earnings from Crosstex Energy LP (XTEX). You have to cut through charges one time gains etc etc. I think the most important figure to look at is distributable cash flow or DCF. Here is the relevant paragraph.

"The Partnership's Distributable Cash Flow for the quarter was $17.9 million, 3.50 times the amount required to cover its Minimum Quarterly Distribution of $0.25 per unit, and 1.54 times the amount required to cover its distribution of $0.49 per unit. As previously disclosed, the Partnership sold certain idle equipment for $9.0 million in 2005, and during the third quarter, the Partnership received the final $5.4 million of funds for the sale, which is included in Distributable Cash Flow for the quarter. The $11.5 million charge for the mark-to-market value of the puts did not affect Distributable Cash Flow. Excluding proceeds from the sale, Distributable Cash Flow for the quarter increased $2.1 million, or 20.2 percent, over Distributable Cash Flow of $10.4 million in the 2004 third quarter. Distributable Cash Flow is a non-GAAP financial measure and is explained in greater detail under "Non-GAAP Financial Information." Also, in the tables at the end of this release is a reconciliation of this measure to net income."

So we'll how the market reacts to this. I don't think there was any real surprise here. The conference call is at 11am eastern time and you can access it here.

No other new upgrades or downgrades so far.

Monday, November 07, 2005

A lot of minus signs showing up now. Northern Borders Partners down 1, Crosstex (XTXI) pulls back from a breakout..-1.31. Teppco opened up 1.40 now up just 36 cents. Plains All American down 60 cents. Kinder Morgan Partners is down though it has news on its lng pipeline and who is supporting it.

Friday, November 04, 2005

Some MLPS have firmed up this afternoon after selling down this morning. Atlas Pipeline Partners has come back to the flat line...while Buckeye is higher and so are a few others.

Breaking news...an insider purchase of 4000 shares on the open market for Teppco!!!!

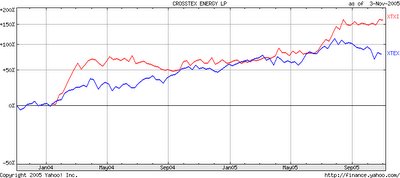

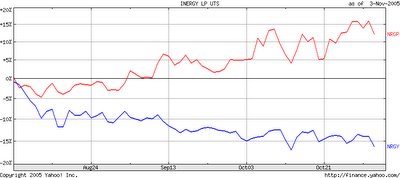

I've put up the above charts to illistrate that we may be in a period where General Partners are out performing the limited partnerships. This is especially true of Crosstex where the GP XTXI has sharply outperformed the LP XTEX. This outperformance seems to have become exaggerated since 10 years began to climb toward 4.75. While these outperformances can continue i wouuld suspect that GPS moving sharply higher should carry the LPS along for the ride at some point.

Last hour!

Energy related stocks are selling off hard this morning (outside the MLP group)...it has not spread to the MLPS per se' although some are down and ATLAS PIPELINE was down 1+ before rebounding a bit.

10 year at 4.67% and as long as that continues to rise it will put an upside cap on prices. But distributions are growing at a fast rate which probably takes the edge off.

Hiland (HLND) should be pricing its offering perhaps today.

10 year at 4.67% and as long as that continues to rise it will put an upside cap on prices. But distributions are growing at a fast rate which probably takes the edge off.

Hiland (HLND) should be pricing its offering perhaps today.

Thursday, November 03, 2005

Even good earnings and a 15% dividend increase wasn't enough to keep Enbridge from selling off after an initial pop over 31.20...now at 30.50. Meanwhile most MLPS aren't doing much. On the upside today is Valero LP EX-DIS by .855 and its up 1.25....no news. Crosstex (XTXI) as shown earlier is on the verge of a breakout again...up 1.10 at 67.10..Crosstex LP (XTEX) however lingers near the flat line and is 9 points off its high.

Kinder Morgan priced shares at 51.75 and its down 1 from there. Northern Borders rose initially on earnings but now is down a nickle.

Last hour underway.

Kinder Morgan priced shares at 51.75 and its down 1 from there. Northern Borders rose initially on earnings but now is down a nickle.

Last hour underway.

Opening was on the firm side for most MLPS....Northern Borders up a fraction on the earnings. TCLP which owns a ton of Norther Borders is +1 and change.

Kinder Morgan is selling more shares (again) and its down 80 cents. Crosstex Energy (XTXI) is breaking out to a new high and could be the beginning of another upleg into the 70s.

Good Morning.

A bunch of ex-dis MLPS this morning including Atlas, Buckeye, Sunoco Logistics, and Valero among others. No news this morning of any consequence. Teppco filed and 8k for an investors conference...I scanned through it and saw nothing new but if you wish you can scan for yourselves. If I missed something let me know.

Last nights Northern Borders issued its earnings and its seems its more of the same. While they raised guidance for the rest of this year they also set guidiance for next year which at first glance is lower than 05.

"Our results for 2006 are expected to be fairly consistent with 2005 from a base business perspective excluding non-recurring items," Cordes continued. "We anticipate net income to be in the range of $2.50 per unit to $2.60 per unit and distributable cash flow to be in the range of $3.65 per unit to $3.85 per unit."

It seems to me that they are playing the game of laying low expectations on the base earnings, this way they can raise guidance as they go along like they did this year. Most important is the DCF of 3.65-3.85 a unit which means that at least the 3.20 distribution is safe. Any upward revisions in DCF might mean (heaven forbid i say it!) a distribution increase? At least with these guys i'm in prove it to me mode. At a 45 closing price yield is at 7%. With the rising 10 year yield this and Teppco continue to look like dead money. I might get interested here if the yield returns to 8 % which means a price down near 40 dollars.

On to some side but related issues. Supposing you are at work or perhaps a smart dinner party surrounded buy those who say we need a windfall profits tax on oil and gas companies because they are so evil. Well thanks to Instapundit he provides a link to give you the necessary points to counteract socialist drivel!

Also if you haven't been to The Oil Drum lately we recommend that you check out recent posts regarding energy consumption.

Also from the strandpoint of political speech please read this blog..and call or email your congressman about protecting the right to blog.

Breaking news on Enbridge with great earnings and a 15% dividend increase! Is it possible that Cramer is right on this one???

Watching the open...

A bunch of ex-dis MLPS this morning including Atlas, Buckeye, Sunoco Logistics, and Valero among others. No news this morning of any consequence. Teppco filed and 8k for an investors conference...I scanned through it and saw nothing new but if you wish you can scan for yourselves. If I missed something let me know.

Last nights Northern Borders issued its earnings and its seems its more of the same. While they raised guidance for the rest of this year they also set guidiance for next year which at first glance is lower than 05.

"Our results for 2006 are expected to be fairly consistent with 2005 from a base business perspective excluding non-recurring items," Cordes continued. "We anticipate net income to be in the range of $2.50 per unit to $2.60 per unit and distributable cash flow to be in the range of $3.65 per unit to $3.85 per unit."

It seems to me that they are playing the game of laying low expectations on the base earnings, this way they can raise guidance as they go along like they did this year. Most important is the DCF of 3.65-3.85 a unit which means that at least the 3.20 distribution is safe. Any upward revisions in DCF might mean (heaven forbid i say it!) a distribution increase? At least with these guys i'm in prove it to me mode. At a 45 closing price yield is at 7%. With the rising 10 year yield this and Teppco continue to look like dead money. I might get interested here if the yield returns to 8 % which means a price down near 40 dollars.

On to some side but related issues. Supposing you are at work or perhaps a smart dinner party surrounded buy those who say we need a windfall profits tax on oil and gas companies because they are so evil. Well thanks to Instapundit he provides a link to give you the necessary points to counteract socialist drivel!

Also if you haven't been to The Oil Drum lately we recommend that you check out recent posts regarding energy consumption.

Also from the strandpoint of political speech please read this blog..and call or email your congressman about protecting the right to blog.

Breaking news on Enbridge with great earnings and a 15% dividend increase! Is it possible that Cramer is right on this one???

Watching the open...

Wednesday, November 02, 2005

n Last hour shenanigans here...looks like tech is the story today so MLPS on the back seat. Fractional moves across the board...no stock in a real hurry to go anywhere. Hiland down 2 and change as per the stock offering.

Northern Borders Partners earnings due after the close today. Stock down 1 ahead of the numbers. Its on the dead money list along with Teppco.

Northern Borders Partners earnings due after the close today. Stock down 1 ahead of the numbers. Its on the dead money list along with Teppco.

Good Morning!

We'll start the day with an offering to sell....Hiland Partners has filed to sell 1.5 million shares. We'll see where this takes us. No other news so far this morning. The energy complex is lower with crude oil keeping a 59 handle. The fed hike has come and gone so we're quiet on that front for awhile.

Last night Crosstex said they've completed there purchase from El Paso.

No upgrades or downgrades so far this morning.

We'll start the day with an offering to sell....Hiland Partners has filed to sell 1.5 million shares. We'll see where this takes us. No other news so far this morning. The energy complex is lower with crude oil keeping a 59 handle. The fed hike has come and gone so we're quiet on that front for awhile.

Last night Crosstex said they've completed there purchase from El Paso.

No upgrades or downgrades so far this morning.

Tuesday, November 01, 2005

Good Afternoon.

Kinda slow today...had some errands to run this morning so the blogging had to take a backseat so lets catch up.

First off MLPS selling off a touch today but not by alot. Some news on Valero LP with its earnings this morning and a distribution announcement which is static from the last quarter. Still chewing through the Kaneb Pipeline buy...

Holly partners still up 50 cents on followthrough from yesterday's good earnings.

Not much else happening here....losses are mostly under 50 cents. Take a look by the way at some of the closed end MLP funds...some are selling at discounts. First Energy Income trust (FEN) had a closing NAV 0f 23.34 yesterday and trades today at 20.95....2.39 discount is almost 12 percent!

Kinda slow today...had some errands to run this morning so the blogging had to take a backseat so lets catch up.

First off MLPS selling off a touch today but not by alot. Some news on Valero LP with its earnings this morning and a distribution announcement which is static from the last quarter. Still chewing through the Kaneb Pipeline buy...

Holly partners still up 50 cents on followthrough from yesterday's good earnings.

Not much else happening here....losses are mostly under 50 cents. Take a look by the way at some of the closed end MLP funds...some are selling at discounts. First Energy Income trust (FEN) had a closing NAV 0f 23.34 yesterday and trades today at 20.95....2.39 discount is almost 12 percent!

Subscribe to:

Posts (Atom)