Tuesday, February 28, 2006

Losers include Kinder Morgan down 65 cents and down nearly half a dollar on Enterprise Products Parterns, Pacific Energy Partners and Teppco.

Meanwhile waiting for after market news.

Global LP earnings were good so the stock is up 25 cents. Crosstex (XTXI) is down 2 while the LP is down 40 cents. No other news is moving these stocks today. Big Oil XOI is down 12.

Monday, February 27, 2006

On the winning side Atlas Pipeline is up 55 cents....following Atlas America which is holding a nearly 6 point gain today. Crosstex LP is up 37 cents...every thing else is sitting between -25 cents and +25 cents.

No news during the day. Lets see what the close and beyond brings us.

Plains All American is down 86 cents. Otherwise MLPS are trading between -25 cents and + 25 cents. Just a non event kind of day so far.

Should be back to normal trading this week after last week's vacation week for a lot of folks. Crude oil and natural gas are down this morning with stock futures higher. No corporate developements so far. MLPS continue to inch higher and chart formations look fairly constructive for the most part. I will search around today and post some of the better looking ones. Earnings this week for Atlas Pipeline Partners...they come out Wednesday.

Friday, February 24, 2006

Energy Transfer Partners (ETP) is doing a note exchange. I missed this one on Hiland where they announced their 2006 guidance. Recent IPO LIN Energy; Key Banc starts it at a buy.

Never any fun bloggin with a great tan and an ear infection! But i'm on meds.

This week has felt like a holiday week trading wise. No news to speak of this morning on the corporate front and no major developements over night. Stock futures higher this morning. Crude up 1.oo this morning, nat gas down 12 cents.

Thursday, February 23, 2006

Vacation is over and am back home this morning. Spent the last morning on the beach and then came down with 102 fever and spent the rest of the day in bed. No fun flying fully medicated.

Plains All American Pipeline came out with earnings this morning and the market approves. No other corporate developements this morning. Most MLPS are firm and up fractions. Not much else going on heading into the noon hour.

Will unpanck...medicate..and post later.

Wednesday, February 22, 2006

You have to laugh when someone is so behind the curve that they inevitiably miss the boat. After peaking at 14 bucks and change and now that we've had a 50% haircut in the price of Nat gas....Lehman Brothers (bless their hearts) has downgrade the nat gas sector...also sees crude oil under 60 bucks...This may be the contrarian buy signal.

Not much else happening this morning. Enbridge Energy Partners ceo on CNBC Squawk Box says he sees nat gas prices stable going foward. No impact on Enbridge stock down a few pennies. Most MLPS are flat from yesterday's close.

Tuesday, February 21, 2006

Afternoon trading is firm but off the days highs in MLPS. Nice fractional gains in Hiland LP, Penn Virginia which sold off sharply 2 weeks ago has made half of it back...also nice gains in Atlas Pipeline, Buckeye, and Energy Transfer.

Losers today are down less than 50 cents and are not news driven. Northern Borders and TCLP continue to consolidate gains, Markwest Energy is down 44 cents after an upgrade Friday.

Meanwhile in the appointment only trading department take a look at Holly Partners (HEP) which has traded all of 600 shares today...up a nickel. The market maker on this one must be on a long lunch.

Waiting for the open...just moments away!

Just to be clear today when i qoute crude it will be from the friday close of 59.88. We're at 61.47 right now + 1.59. The holiday sometimes throws things off a bit. Energy stocks look to open higher. MLPs should also open higher today with supportive tone continuing the rally in the group that began last wednesday.

No corporate developements this morning so far. Will try to day trade Crosstex (XTEX) on the wide preopen bid and ask...will try a buy at the bid this morning.

Monday, February 20, 2006

Anyway with markets closed today...overseas markets were trading. Friday's crude rally gained steam on Monday where trading...and sits at 61.oo as of this post...+1.09 as of this post time. Look for energy stocks to play catch up to this on Tuesday when trading begins. Natural gas which has quietly crashed from its 14 dollar high is up 13 cents. Look for bitter cold air to spread into the Northeast this weekend and early next week and the pattern looks very cold for the next 10 days. But the heating season is winding down so how much impact that will have remains to be seen.

We continue to benefit from the Northern Borders news of midweek where Oneok is putting 3 billion in assets into the company and the market responded by marking up NBP by 5 points and has been marking up prices in the entire group since. Weekly charts for most of these look playable to the upside and with long rates generally behaving I think the rally in prices should continue.

I will post in the morning with overnight developements and any corporate news.

Friday, February 17, 2006

A couple of things to start off this morning. First off with Teppco and Enterprise Products as they will jointly develope the Jonas project. Why don't these guys just merge and get it over with please!

In the coverage department Sander Morris( would sound better in reverse..Morris Sanders!) begins coverage on Markwest Energy (MWE) and they start it with a buy.

Crude oil is up sharply this morning $1.11 higher, telegraphed yesterday by the 20 point upide move in the XOI. Ten year yield back down to 4.56% after PPI numbers which were not great but not disastrous either. Should be another firm open for the group. The Northern Borders deal from Wednesday morning has lit a fire under these guys. Chart wise we have successfully tested the December lows.

Finally bright sunshine and mid to upper 70s today on the beach in Pompano. Gulfstream race track in my view for Sunday! Wish y'all were here!

Thursday, February 16, 2006

Duke Midstream is down 65 cents...Northern Borders is down 50 cents after trading up to 49.95. Copano (CPNO) is down 40 cents...Holly Energy and Sunoco Logistics also down but not by much.

i'm in Florida for a week of vacation. I thought it would be easy to get on line here but three hours of absolute agony trying to set up a dial up account with net zero and then aol and then msn..each one had a roadblock of one thing or another...finally i'm on.

I will blog when i can here but that Northern Borders deal really woke the group up and there is green all over the screen today again. Northern Borders trying to get its neck to 50..almost there. Nice solid fractional plusses across the board here. Martin Midstream, Copano and Duke Midstream are the only losers today and they are down fractions.

Headed for the pool...will blog later.

Wednesday, February 15, 2006

Nothern Borders is +5.59 and near its high for the day.Up 1 or more Williams (WPZ) and TCLP (TCLP)...Up nearly 1 Valero LP (VLI) and Sunoco Logistics (SXL). Up Major fractions Teppco(TPP), Buckeye (BPL) Plains ALL American(PAA), Atlas Pipeline (APL), Global Partners (GLP). Other gains generally under 50 cents include Energy Transfer (ETP), Enterprise Product Partners(EPD) and Martin Midstream (MMLP). Up on light volume...Holly Partners and a few others.

No outstanding losers other than Crosstex (XTXI) -1.31 and Enbridge Energy (ENB) down 50 cents...the LP of Enbridge(EEP) is up however.

Expecting last hour buying to push these to close near their highs of the day.

The overall market has turned lower as Bernanke continues his congressional grilling and the ten year which fell to 4.56 at one point this morning has risen back to 4.62 right now.

Just noticed today that most of the GP's are down today while most of the LP's are up. Not sure if this means anything other than a knee jerk response to the Northern Borders deal...or perhaps there is no meaning to it.

Messages on the Yahoo NBP board for those interested in other viewpoints on today's deal should link here to start.

Major oils are up a little bit...the XOI is up 2 and the XNG is up 1. Ten year yield dropping to 4.56% as 4.60 holds again at least for now.

Some goings on this morning at Northern Borders Partners who were supposed to issue earnings last night but waited till this morning. Looks like the company beat by a nickle..71 cents vs expectations of 66 cents. I'm waiting for the full business wire story and will post the link when it comes. Meanwhile ONEOK is selling 3 billion in assets to Northern Borders Partners. This is significant because they have done nothing but sit on their hands until now. The question is whether the assets will help NBP resume distribution growth. Conference call has been delayed until 12:30pm. Stay tuned.

Crude and Natural gas are up a touch this morning...Crude now under 60 bucks. S&P futures down slightly. No other breaking corporate news or headlines at this time.

Tuesday, February 14, 2006

Not sure yet whether this a sign of a bottom (positive MACD divergence...positive relative strength divergence...key reversal today)...or just another ledge build before a breakdown...my heart says the former...my portfolio is betting on it! Valero LP +52 cents at 50.83

Also note Atlas Pipeline is on sale today with an 8.2% yield...Martin Midstream (MMLP) also in the land of 8% yields.

Not sure yet whether this a sign of a bottom (positive MACD divergence...positive relative strength divergence...key reversal today)...or just another ledge build before a breakdown...my heart says the former...my portfolio is betting on it! Valero LP +52 cents at 50.83

Also note Atlas Pipeline is on sale today with an 8.2% yield...Martin Midstream (MMLP) also in the land of 8% yields.

Not sure yet whether this a sign of a bottom (positive MACD divergence...positive relative strength divergence...key reversal today)...or just another ledge build before a breakdown...my heart says the former...my portfolio is betting on it! Valero LP +52 cents at 50.83

Also note Atlas Pipeline is on sale today with an 8.2% yield...Martin Midstream (MMLP) also in the land of 8% yields.

Buckeye was lower now higher...Hiland is higher as well; both by fractions. The XOI tested support around 1000 and so far is holding. And Penn Virginia Resources (PVR) is doing what any dead cat will do when it hits bottom....it is bouncing $1.49 higher!

Good morning!

Not much happening so far this morning as crude and nat gas are down while stock futures are up. No corporate developements so far today. Northern Borders Partners earnings are due out after the close.

MLPs and Oil stocks for the most part tried to hold yesterday. Look for that divergence where crude drops and the stocks begin their rally for a sign that a bottom is in place. No sign of a bottom in that PVR chart above. I might be tempted if we see 50.

Monday, February 13, 2006

By the way i just want to thank those of you who have visited my sponsors...it helps very much and i appreaciate it!

Some news after the close today as Sunoco Logistics aquires a pipeline in Texas.

By the way i just want to thank those of you who have visited my sponsors...it helps very much and i appreaciate it!

By the way i just want to thank those of you who have visited my sponsors...it helps very much and i appreaciate it!

THE CRB INDEX SINCE JUNE 2004

PENN VIRGINIA RESOURCES...

I put these charts up for your enjoyment. The CRB index shows that pullback in the last week or so and it looks like the uptrend is in tact.

Penn Virginia Resources (PVR) has fallen off a cliff along with some other coal and resource stocks...even after posting excellent earnings last week. Wonder if anything else is going on or is this just an over-reaction to the commodities based sell-off?

Both Crosstex's are down with the GP down 1.31...the LP down 40 cents. Hiland is down 50 cents on no volume.

Norther Borders(NBP), Teppco(TPP), Martin Midstream(MMLP) and Enbridge Energy(EEP) are all winners today up about 50 cents apiece.

Overall the tape has turned higher so lets see if the firmness spreads to our group.

We begin this morning with crude and natural gas showing small gains after trading lower overnight. Stock futures are a little softer. No corporate drivers so far. The group has been pressured by the general selling in everything energy last week...and while dropping and crude and nat gas have little impact on these companies...hedge funds and traders tend to shoot first and ask questions later. As pointed out last week...the weekly charts on most of these look okay.

On the watch for the open...have to plow more snow after the blizzard.

Testing this link to Forbes. Its a video on the future of oil and energy prices and related shares...i was hoping to have the player run in the blog but i haven't figured out how to do that yet. Just click inside the box or click here.

Sunday, February 12, 2006

Okay enough about me me me.....a quick look at crude futures...down slightly...nat gas futures up slightly..stock futures on the S&P down a point. No energy headlines to speak of corporate wise. I always check headlines Sunday evening in case a merger is announced (VLI KPP eg) ....but nothing out there.

See you guys monday morning.

Saturday, February 11, 2006

Take a look around and feel free to ask any questions or leave comments . And to my regulars please link above to see a good site loaded with information from financial stuff and opinions to even some great astronomy pics...definitely worth it! And the link is also on the blogroll.

Snow getting underway here in NYC...heading home from work after 11pm and hope the drive is not too bad.

BTW its Saturday night and that means the weekly post from CJ on the Northern Borders Message board and good ole CJ has posted early.

Friday, February 10, 2006

Plains Virginia is down another 2...otherwise most losses are 75 cents or less. Hopefully there will be more green on the screen before days end.

Meanwhile the XOI which dropped nearly 20 pts to the weekly support line is now only down 8. Duke Midstream is up 5 cents on the Key Banc agressive buy upgrade but way off its high. Holly Partners is up a nickle as well. Northern Borders Partners is up 21 cents.

Magellan's GP is trading under the IPO price which is a surprise...The partners MMP is down 40 cents.

Good Morning.

Crude and Nat gas up 2 and 3 cents respectiively. No corporate news this morning. Just about all MLPS are done with their distributions...checks should be arriving in the next several days or so...a few at the end of the month. Note that the Tortoise Funds (TYG,TYY) have not gone ex-dis and won't for another week or so.

Also note that Magellan Midstreams GP...Magellan Holdings (MMG) priced its ipo last night and begins trading today.

To follow up on last night's post here are two examples of weekly charts which a screaming avoid...at least for right now. And i guess its no surprise which companies they are.

Thursday, February 09, 2006

Putting the XOI charts led me to revisit the weekly charts of these 4 MLPS...and in spite of the daily charts which may not be the prettiest...i have had the feeling that they have been basing. The weekly charts of these 4 MLPS look like they are on the verge of breaking out. It has been very encouraging during this energy sell-off that MLPS at least so far have not dropped as hard as they did in November-December....volume the last few days has been quite light. There has been a push and pull feel to the tape the last several days.

Meanwhile unlike last quarter...no stock sales at least so far. Perhaps these companies are done issuing more shares at least for now.

Putting the XOI charts led me to revisit the weekly charts of these 4 MLPS...and in spite of the daily charts which may not be the prettiest...i have had the feeling that they have been basing. The weekly charts of these 4 MLPS look like they are on the verge of breaking out. It has been very encouraging during this energy sell-off that MLPS at least so far have not dropped as hard as they did in November-December....volume the last few days has been quite light. There has been a push and pull feel to the tape the last several days.

Meanwhile unlike last quarter...no stock sales at least so far. Perhaps these companies are done issuing more shares at least for now.

Not pretty is the XOI daily chart which has dropped 100 points since the beginning of the month. There is a bounce point coming up around 1025. The weekly charf still looks okay and the index has bounced off the 34 day expotenial moving average every time its come down to this level holding the uptrend in tact. That average is sitting around 1000. I wonder given the action whether we are building some kind of intermediate term top...or perhaps we are headed into a trading range bounded by 900 at the bottom and 1150 at the top. Crude is up 33 cents in overnight trading.

Some after market action as Magellan Holdings...GP of Magellan Midstream prices its IPO. 22 milion shares at 24.50 per share.

On the other hand 10 year yields rallied strongly to 4.52% on the 10 year and the yield curve went negative on the new 30 year bond! This may have put a floor under MLPS at least so far.

Watching for after market developements!

Duke Midstream which is one of the new kids on the block came out with earnings this morning and announces a new pipeline project.

Meanwhile there are no other developemens this monring. The energy complex is bouncing this morning...Crude up 45 cents. Nat gas is higher as well.

Snowstorm possible for the northeast big cities this weekend! Winter has finally arrived.

I will be on the road this morning so I'll post when i can.

Wednesday, February 08, 2006

Please note that i've added several political blog links on the blog roll like little green footballs and hugh hewitt...enjoy them; they are very informative.

Also added Asset Allocator blog which has lots of investment info and opinion. Take a look.

BTW if any of you have some blog suggestions please by all means send the links along and i'll take a look and add them to the blog roll.

A couple of upticks among some MLPS but nothing to write home about. They were not impressed with Teppco when they would say nothing about potential distribution increases in the conference call. Stock has been see-sawing all day but is down 48 cents to just above 36.

In the losers group Penn/Virginia (PVR) down 99 cents..Copano down 80 cents (so much for the breakout attempt yesterday)...Amerigas down 75 cents...and then its a sea of fractional losers like Crosstex (XTEX)...Markwest Energy (MWE)...Buckeye Partners (BPL)...Pacific Energy (PPX) and Sunoco Logistics (SXL) among others. If there is any consolation here is that its being done on light volume.

No corporate headlines to speak of.

Energy under pressure again at least at the open. MLPS open mixed to lower. Buckeye Partners is the biggest loser down 44 cents.Teppco is the biggest gainer.

Oil inventories at 10:30am

Highlights

Non cash adjustments did not effect financials

Net income up 19%

Net income per unti 45 cents vs 42 cents

Record EBITA

Record EBITA for Q4...downstream segment + 25 %M

Midstream up for Q4 but down slightly for the year

Hurricane damage from Rita was minimal reducing net income by 3 million dollars due to insurance and minor damage.

Upstream Segment q4 income 11 million + 22% Increase transportation and terminal volumes.

1 million dollar charge to settle an indemnity.

24.1 million in Midstream Segment down 9 percent due to transaction expenses and the Jonas startup. Also a large inventory gain.

EBITA 156.9 MILLION + 12% over 2004.

Downstream...income 27 million up 48% from 2004. Record propane deliveries in the northeast.

2006 OUTLOOK...ebita 400-420 million 1.70-1.90 per share...Cap spending will rise to 210 million.

Q &A

8882031112 CODE 2353714 for replay at 11am

Q from Wachovia...

reviewing cap spending numbers and the breakdown for 06.

returns from growth cap ex?

15% rates or higher predicted.

John Freeman Raymond James.

Question about sale of Pioneer Nat gas...response is that the facility was not material to Teppco's operation.

Another analist from Wachovia..

Teppco/Seaway issues.....also analist surprised by midstream decline in Q4. Company says there were some unusual items in Q4 that impacted midstream.

Kevin Gallagher from RBC Capital Markets.....distribution growth...outlook...we will not pre announce distribution growth!!!! He then mentioned projects going foward but made no indication about future payouts.

Not too much happening this morning...Crude is up slightly after yesteday's big losses. Stock futures are slightly firmer.

The big MLP corporate developement is the Teppco (TPP) conference call which is at 9am. I think the driving question is the future of distributions and whether they will be increasing them later in the year. The actual earnings beat estimates.

Tuesday, February 07, 2006

Conference call for Teppco is scheduled for 9am tomorrow morning. You can get there from here! Earnings are not out yet.

Penn Virginia is the big loser as coal is getting hit hard. Penn/Va down 2 and change. Also General Marine is down nearly 1. No corporate news on either one.

On earnings watch for Teppco after the close....Conference call should be a mover.

Teppco (TPP) earnings out after the close...thought i'd show a five day chart of TPP vs EPD which has been the long talked about potential buyer...note last 2 days (which not a trend make) that TPP has been outperforming EPD. Not sure what this means if it means anything at all but i put it out there for you to ponder!

Soft goings this afternoon as we have a handful of small risers like Tortoise Energy (TYG) which is up 60 cents...and Copano (CPNO) Sunoco Logistics and Buckeye are up as well. But the rest are fractional losers. There is one notable loser in the mineral MLP group and that's Penn Virginia (PVR) which is down $2.39 as the commodities sell-off is having some impact there.

Some cross currents this morning with British Petroleum earnings a disappointment which is impact oil shares early (BP -2..Exxon -.25). That plus a sell-off in crude oil that began late yesterday and continues today. On the other hand 10 year rates are supportive this morning as yields drop...now 4.52%.

No corporate drivers this morning however leftover from last night is a news item from Holly Partners, Holly Energy, and Enbridge because they are joining forces to build a new pipeline to bring oil down from Canada! Also leftover from last night, Atlas America as it announces a 3 for 2 stock split!

As for earnings Teppco has numbers today after the close...and these numbers and the outlook will probably tell us where this company is going...back to 40 or back to 33.

Monday, February 06, 2006

Good Monday Morning!

We begin this morning with news from NRGY...earnings are out! and they look good! And the chart looks like it is attempting a bottom. NRGY is up 79 cents in the premarket.

No other breaking corporate news this morning. X-distribution MLPS this morning include Markwest Energy out 82 cents and Sunoco Logistics 71.25 cents. Yahoo continues to have trouble with X-DIS dates so i think beginning this quarter i will post the x-dis dates on a seperate link for your shopping convienence.

No upgrades or downgrades either at least so far that have been released on the news wires. IRAN is weighing on traders in Crude Oil as it is up sharply this morning. Also please note the the weather pattern across the United States has changed to favor below normal temperatures for gas consuming areas for the next 2 weeks and perhaps beyond. This should be a driver for Nat gas Prices.

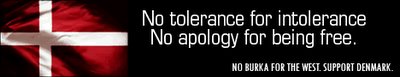

Also i have added a daily political cartoon above in response to the Danish Cartoon issue and the ensuing radical Muslim reaction. Here is a google link to news stories related to the Iran mess.

Sunday, February 05, 2006

Hope you are all enjoying your weekends. My horse was claimed out of her race so i no longer own her...Came home Friday evening tired..and blogger.com has been having issues so i could not post.

Gathering info for Monday morning and the opening of trading. BTW...on my Crosstex day trade i successfully sold at 35.77 for a nice profit...still long Energy Transfer and hoping the stock takes out 38.

Friday, February 03, 2006

My horse is running today at Aqueduct N.Y. 9th race so i'll be leaving around noon eastern time...and will not be blogging this afternoon.

Trades are still open for me.

Energy Tranfers GP opened for trading at 23.00 now at 23.20 which is above the ipo price. Otherwise its softness and more x-distribution trading across the board. Pressure on the big oils as the XOI drops another 14 and well below 1100.

On the open today Crosstex (XTEX); 9100 shares traded at 34.60...so if you were to have bought...lay an order in at a higher price. It is a big advantage if you have level 2 quotes so you can put the order in where there might not be a lot of shares waiting...say ahead of a 10,000 share block.

Nothing done yet on my orders.

Its unemployment numbers day so that will have market focus and impact on yields so MLPS will have that on one side. No corporate news to speak of so far this morning. The GP of Energy Transfer Partners was IPO'd last night and begins trading today under the symbol "ETE". Valero LP, Atlas Pipeline and Buckeye will be going ex-distributions today. Scroll down to my last post from last night and read about the 10000 share (ten thousand) open market purchase by a Valero LP director. That is putting ones money where ones mouth is.

I discussed yesterday about putting my trading activity for the day. I am reluctant to do this if only because I dont want somebody getting screwed on my account. Let me start this off by stating a few things.

First off I've been successful (more winners than losers) because I have been very disciplined about the trading approach in MLPS. The premise is to try and exploit certain characteristics of trading regarding certain stocks. This is especially true of the Over the Counter MLPS which have a tendency to trade thinly and with wide spreads. The approach is to exploit those spreads and make some money. The other rule and this is most important...it requires you to sit tethered to you chair and watch trading pretty much all day long (okay piss breaks are fine..even a 45 minute trip to the gym as long as you have phone trading access.) Also crucial is execution. Does your brokerage firm you trade with give you great execution at the best price?

Other rules...rarely do i use market orders. I never use them before the open...and i only use them when i know the size of the bid or ask is equal to or greater than my position.

Okay lets begin with an example. Crosstex Energy (XTEX). The pre-opening bid and ask here is

34.50 x 37.02 which is huge. Want you want to do is buy as close to the 34.50 bid as possible with the idea of selling at a higher price later in the day. Or if you are long the reverse...that is sell as close to 37.02 (and of course above the price you bought it at). For my purposes today I will be trying to sell 1000 shares i got long late yesterday...purchased at 35.17. So i will lay an order near 36.50. If i wanted to buy i would place an order a little above 34.50.

Sometimes at the open you will have a large buyer or seller. Many times you will see a huge price swing with a big lot trade in either direction and you are there to exploit the situation. Bear in mind this does not always work and occasionally you get left holding the bag. I am willing to hold the stock for awhile if need be...so i deal in stocks that i don't mind holding.

Of course the trading can be so thin that you could wait all day or all week for that matter and accomplish nothing. Markwest Energy (MWE) is like that....trading so thin that when it does trade the market maker must celebrate openly. So you have to be careful which ones you choose. I am stuck holding this one right now.

Another thing to remember is to try to use MLPS that are either in uptrends or at worst moving sideways. It is alot harder and far more unnerving when they are in downtrends. This does not work well with NYSE MLPS...here the approach is different. Spreads being tighter the opportunity presents itself in a broader sense and one must be extremely nimble. Energy Transfer yesterday for example...i bought late Wednesday when it looked like the correction was over and tried to sell at the open...i missed my price buy 2 cents...then the stock dropped from 37.10 to 35.70 and then rally back to 36.94. The plan was to sell and then watch. As the second wave of selling developed i might have gotten back long at say 36. But the best laid plans of mice and men!

Anyway its a long post this morning and i will update as we go along.

Thursday, February 02, 2006

Also Energy Transfer Partners General Partner IPO (SYMBOL EPE) was priced tonight and starts trading friday morning.

Sorry for the lack of posts today...had to run to the race track to get my racing license...my horse runs tomorrow in the 9th race at Aqueduct...Vroom Hilda. (PIC ABOVE)

Looks like a mixed finish. Nice trip on Energy Transfer which opened up at 37.03...dropped to 35.70 and rallied all the way back to 36.94 +.16!

Okay here were my trades today....

Bought 1000 shares Crosstex yesterday on the close at 35.30 and sold at 35.80 this morning...bought back before the close at 35.17

Energy Transfer Partners...bought yesterday afternoon 2000 shares at 36.72 average...tried to sell this morning at 37.12 and just missed (too bad). Still long.

Also long Markwest on a trade waiting for that thing to move at all (appointment only trading sucks sometimes...) 47.73 is my target...long from 46.70

WARNING WARNING WARNING WARNING

This is for the nimble only...and you have to watch the tape all day to make this work at all!

NO GUARANTEES FROM THE MANAGEMENT HERE!!!!

I trade MLPS on a daily basis and i am debating the pros and cons of actually posting my trades at the end of the day. I also hold a core long position which i do not trade. This strategy was very profitable for me in 04 and 05. Its not for everyone and the downside is I'm tied to a chair 5 days a week and it requires patience in holding when things go against you.

Any feedback is appreciated.

Otherwise not much going on this morning. Penn Virginia (PVR) +1.39 for you coal lovers. Global Partners is up a solid fraction...Otherwise its mostly noise trading.

Natural gas numbers were as expected....look for much colder weather to overspread the United States after this weekend...should put some upside support under prices.

News wise we begin this morning with earnings from Pacific Energy Partners. Also they are providing guidance for 2006. No indication as to how it relates tp past guidance.

We also have earnings and dividend information from Enbridge Energy (ENB) and the outlook looks good from there as well.

No other news so far this morning.

Wednesday, February 01, 2006

Buckeye Partners closed its deal on NGL..BPL down 14 cents. Magellan Midstream Partners...the ipo of its GP ticker symbol MMG commenced this afternoon.

Losing major fractions this afternoon Kinder Morgan Partners (KMP) Hiland Partners (HLND) Northern Border Partners (NBP)....Holly Partners was down 38 cents.

The closed end funds Tortoise (TGY,TYY) and First Energy Income Trust (FEN) gained solid fractions.

Amerigas (APU) is out with good earnings and affirms guidance...stock up 42 cents

Talk about quiet this morning...all the noise is about Google which means the tape should be defensive today and good for MLPS....at least that will be the case early. No corporate developements this morning...A few ex distributions today include Penn Virgina (for you coal lovers)...Plains All American (PAA)..Duke Midstream (DPM)...and Global Partners (GLP)

No upgrades or downgrades this morning at least so far.