Wednesday, February 28, 2007

Duke Midstream (DPM) and Calumet LP (CLMT) are the biggest fractional losers but they are off their lows.

Crude and Nat gas are down but the overall market seems to be dictating the flow.

It is the day after the meltdown. So after an overnight where the world did not end we see dow futures up 110 points so there will be a bounce at the open. I would rather a down open and a climactic selloff followed by a reversal and up close but they don't always put it on a platter for you. So where to from here? Certainly one would think that if this sell off is the beginning of something long lasting we should begin to see some money coming into defensive areas (MLPs,GP's etc) where yield will offset risk. Also if you were looking to get in on any issues, opportunities have presented themselves although sometimes the door is only open for a very short period of time. One thing for sure...yesterday's action cost me all of 1/2 of 1%. Not bad for a day where the market was down nearly 5% at one point. So I recommend a deep cleansing breath and remember that we are in a very good place.

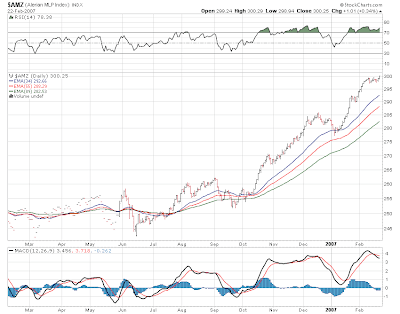

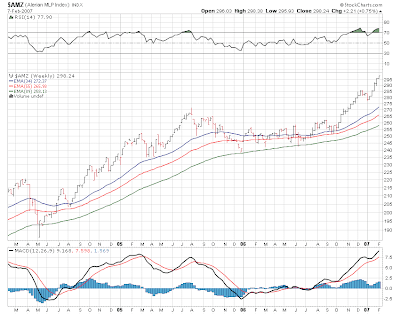

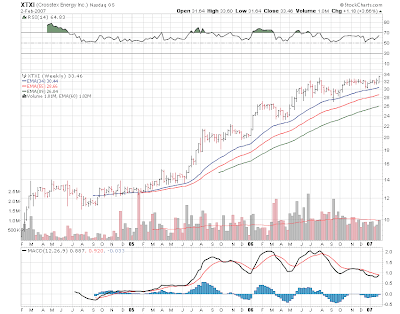

After all which is the better looking chart? We would lean to the one above and not the one below. And the index by the way can pull back to those support lines and the uptrend is still intact. And the weekly chart by the way is still locked in its uptrend.

Now for some news and we go back to last night. After the close E V Partners (EVEP) did a priviate placement of shares. This was done to reduce debt. Should be viewed as a positive but volitility rules here given market conditions. And one of the better performers in the last few months has been Buckeye Partners (BPL) which is taking advantage of the price rise by doing a stock offering. Buckeye is trading down 1.25 in the premarket. Kinder Morgan Partners (KMP) is entering the biodiesel business with a 100 million dollar investment. No upgrades or downgrades this morning. That list is relatively short this morning which is usually the case after a big selloff since no one wants to step to the plate with buy recommendations in the midst of a selloff.

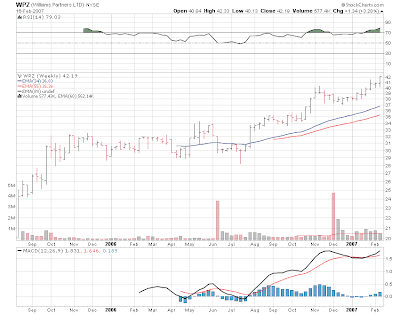

More on yesterday's mess. I was a victim of the bottleneck yesterday in an odd way. I bought Williams Partners (WPZ) at the open yesterday near the low and i tried to sell it yesterday afternoon as it rallied back. Well my order was stuck in the pipeline somewhere and watched trades go off at 20 to 30 cents higher than my price. This went on for nearly 2 hours! I finally was filled at my price but frankly i feel cheated out of 20 cents. It was very frustrating indeed. I hope these guys have a handle on things today.

10 year rates are up a bit after yesterday's flight to quality took yields down to 4.50%...now at 4.55%. GDP numbers will be a player this morning. Crude collapsed down to 60 dollars last night and while its down this morning it is off that 60 dollar low. So seatbelts fastened ladies and gentlemen and let the flight to yield safety begin! I will try and post during the first half hour so we can get a sense of what is going to happen today.

Tuesday, February 27, 2007

I'm headed to a hockey game tonight with my good friend Stevie Applebee of Frustrated Please Yell Here. Hopefully while we're there a fight will break out.

Big loser earlier included Calumet Products (CLMT) which was down over 3...Markwest (MWP) was down nearly 5 points...both have come off the lows as have some of the other losers.

The index is now down just .33 as oil and commodities rally after being down sharply earlier today. Should make for an interesting afternoon.

CRUDE AND NAT GAS SELLING OFF

EARNINGS AND NEWS TO PONDER

So we begin the day with a market selloff that started in China and has spread across the globe and now has arrived in New York; at least at the open. Dow futures are down 77 points and most other markets are down 1 to 2% Its been a long time since we've had a morning like this so it may produce opportunities. The 10 year is benefiting as the yield is down to 4.60%. So with that backdrop we have earnings last night from Oneok LP (OKS) which look good as revenue and profit surge. Also we have Atlas Pipeline Partners coming out with lower earnings blaming commodity price issues. Most of Atlas Pipeline's exposure is hedged but i guess there was some impact as prices declined in the last quater.

Teekay LNG Partners (TGP) and Teekay Shipping (TOO) are getting the ding from A G Edwards as they downgrade the pair from buy to hold. Both stocks are being offered in the pre-market below yesterday's close.

Okay so we know we're opening lower today and if this has impact on MLPS could this be a buying opportunity? Well certainly if you were looking for a place to buy some recent big winners at lower prices, you may get your chance. Again I like to use the 34 or 55 day moving averages as logical entry points. The AMZ MLP index if it gets caught in any overall market selloff could head back to the 295 level and do no damage to the uptrend.

E V Partners has been a recent winner and they have already pre-announced the distribution for Q1 so it has some natural support. A trip to 25 would be a real gift here.

Sometimes stocks pull back to the moving averages and sometimes the moving averages get pulled up to the stock price. In Linn Energy's case its been the latter as it has been in a very tight range for many days now. 32 is solid support and i may back up the truck if it drops there.

Duke Midstream (DPM) is another one that I like and 36 looks logical as an entry point.

So we wait for our day to start and it should certainly be an interesting beginning.

Monday, February 26, 2007

Its one of those days today after lots of driving this weekend...i'm tired and am just content to sit around and keep posting short. But i am watching and will post if anything happens in the last hour.

So its sort of an uninspired day...probably getting pushed and pulled by the overall market which is now lower after a strong open.

Stock futures are strong this morning as we have the TXU deal and the Dow Chemical story so at least stocks will be firm. Oil and Natural gas are slightly higher as ten year rates continue Friday's drop...yield on the 10 year at 4.64%.

So i don't have much to say here with all this quiet so we'll just wait for the open to go buy and see what the morning feels like.

Friday, February 23, 2007

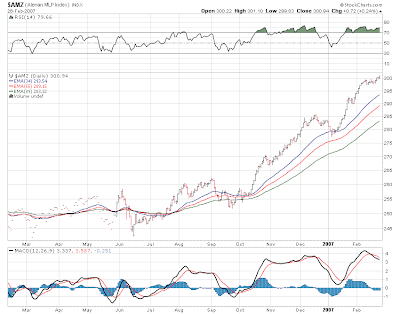

Yesterday's 2.50 tight trading range went out the window when MLPS took out 299.54 and ran up through 300 and closed at 300.25. So it looks like another upleg has begun here on a short term basis. I have put up the daily weekly charts here of the MLP index. I have pointed this out before and its worth repeating.

As far as the daily chart right above i would like to see confirmation today with another up close and decent volume action in the group

Note the weekly chart shows us up for the last 5 months since the rally began at the 255 bottom. Also note the last rally that took the index up 50% from 190 to 270 lasted over 1 year. So the long term chart action would suggest we are not even half way on this move. The last upleg was 50% so if this repeats we 're talking 400 on the MLP index. If we're talking in terms of points then we'll see 330-340. Either way it looks like we have more upside left.

Markwest Energy and Markwest Hydrocarbon are looking to do some sort of restructuring. This news actually hit late Wednesday evening and both stocks we're up nearly 3 points each yesteday. No guarantees from the management but both stocks are up huge. Markwest Energy (MWE) is up from 40 to 63...and Markwest Hydrocarbon (MWP) is up from the mid 20s to the low 60s in the last 5 months. And don't forget 2 distributions and 2 dividends that both companies increased substantially!

Plains All American (PAA) came out with earnings last night which looked good. They also bought an LNG storage facility. This may be priced in already so if the stocks sells off a touch it would not be a surprise as some others have done recently(DPM,WPZ). We're not talking much of a drop.

No news this morning in upgrade downgrade land. Crude oil is down slightly this morning as is natural gas.

Thursday, February 22, 2007

General Marine in the pre-market traded as high as 44.99...now at 43.73.

The MLP index begins the morning just pennies within its alltime high after a reversal and up close yesterday. Will today be the day when we break out above 300 and start another up leg?

Unless there is something out there and as long as the overall market continues to move sideways to higher...i think today indeed could be the day.

Meanwhile Duke Midstream (DPM) came out with earnings numbers last night which look good on the surface. We'll see what the market says shortly. If its buy the rumour sell the news the logical pullback spot would be in the high 35 low 36 area. Also last night General Marine (GMR) which i don't often mention was up 4 dollars after the close as it came out with earnings but more importantly announced a special 15 dollar dividend! So we know that's our big winner for the day.

No other breaking news this morning and so far no upgrades or downgrades so we await another open. Crude is a little lower ahead of the supply numbers at 10:30am. Natgas is a little lower as well...also awaiting supply numbers.

Wednesday, February 21, 2007

Just got to Boston. More later.

CPI out...looks a touch hotter than expectations. 10 year yield at 4.70%

We're still in a very tight trading range on the MLP index which has been sitting between 297 and 299.50 for the last 7 days. Yesteday's even close and not to far from the high of the day was encouraging. So today starts with not much happening. Earnings from Duke Midstream (DPM) are due out after the close today and they should be a good set of figures. No other corporate headlines so far this morning but its early and as of this posting no upgrades or downgrades.

EV Partners has been active recently thanks to a mention in Barrons a few weeks ago. Remember this one has already pre-announced a 6 cent distribution increase so it is priced to yield right now at just under 7%.

which means to me that there is some upside here to perhaps 29 or 30 by the time the next distribution rolls around and this assumes no other deals are done to add to numbers. A pullback to the moving averages might be a nice place to get in but lately in many MLPS trips down to support have been few and far between. We spent most of last week sitting tightly at 25.85 and yesteday we moved aboved it. So the risk is obvious...if you wait for a pullback it may never come...unless you buy here and then the pullback is a certainty (just because i'mnot paranoid doesn't mean they aren't plotting against me!) . Its never easy but i still think ultiamtely 30 is doable here in the next 2 months. BTW in the interest of disclosure i have built a position at just under 26.

I'm on the road to Boston today to take care of business so i will blog as soon as i can get to a Starbucks. Energy complex btw is down this morning as are stock futures so the morning begins with some headwinds.

Tuesday, February 20, 2007

Tuesday after a holiday weekend and we're seeing a slow start to action this morning. There are no corporate developements and no upgrades or downgrades so far. The energy complex is down. rates and stocks are flat. So there really ins't much to hang our hats on. The MLP index traded in a 2 point range all last week and i guess that continues today.

Over the weekend i spent some time looking over charts of many MLPS and have noticed that there are some that are looking very good. Some that look so-so and some that don't look too good. I am trying to get a feel for whether we are getting close to a top in this bull move.

Energy Transfer Equity has been on a nice uptrend that continues as the weekly chart shows. No sign of a top here and mid 30s (35-37) seems a reasonable place for this one to get to before the next distribution. Below we have Williams Companies which broke out on Friday above 42 and may have 44-47 in its view on this upleg.

Meanwhile Crosstex (XTEX) and (XTXI) continue to extend their bases on the weekly chart. Holding those moving averages is important of course but it looks to me for these 2 that more sideways movement seems likely and there might be better places to put short term money.

I'll be posting more charts as the day wears on.

Earnings just hit the tape for Hiland Partners (HLND)and Hiland Holdings(HPGP). Now i never can figure out whether the First call estimate is important or not so i'll put it out there. The estimate was for 36 cents so they look 6 cents below. But who knows what needs to be excluded or added back in. Hiland Holdings (HPGP) has some stock offered at the Friday closing price which usually is a sign of a down open. No clues from the premarket on HLND.

Monday, February 19, 2007

I have tried for 2 months or more to resolve the occasional mal-ware issue that seems to be occuring with my advertising company ad-brite and have gotten nowhere. So i am removing the ads that have been causing the problem. Hopefully this ends any problems with my blog regarding this issue. If you are still having problems please let me know.

Friday, February 16, 2007

E V Partners was up last week and Monday morning on a Barrons mention. It traded this week as high as 27.87 but it has pulled back to 25.85 late Tuesday and has been within a dime of that figure for 2 1/2 days. This may be a good entry point.

My very good friend Stevie Applebee has joined the blog world. Have you ever been frustrated and wanted to yell but had no place to do it...well now you do at Frustrated? Please Yell Here! Stevie will be blogging about many things that have a tendency to set off seizures in most normal people. Please visit his blog and feel free to comment on many of his observations. It will lower your blood pressue. I have also added the link to the side blog roll.

CALUMET EARNINGS OUT

Steifel Nicholas starts Williams Partners (WPZ) at a buy...which is nice. Nothing else so far in upgrades and downgrades.

We have a three day weekend and with kids on mid-winter break next week we could be in semi-vacation mode as far as trading goes. I remember it was a slow week last year so with the cold in the northeast alot of folks will probably get away...or at least enough to have some impact on volume. Oil is down this morning, Nat gas is up and 10 year rates are down to 4.68% as we wait for PPI at 8:30am

Thursday, February 15, 2007

Still like watching paint dry overall which i suppose is a good thing if given the choice between this and a hard sell-off

We've been in a tight range in the last 5 days on the AMZ MLP index bordered by 299.50 on the top side and 297.50 on the bottom side. We should break one way or the other soon. 10 year rates dropped big time yesterday to 4.72% right now. So at least from that angle we have support.

Thursday brings us earnings from Constellation Energy (CEP) which were down. This is the first earnings report since coming public for this company and the press release says the earnings were in line with company expectations. I would like to see the DCF number here. I'll post if i find it. If anyone sees that number please post it in the comment section. There is some stock offered below yesterday's close. Meanwhile in reaction to good earnings yesterday Natural Resource Partners (NRP) was re-affirmed by Friedman Billings at outperform although it lowered its price target by 3 dollars.

Not much is happening this morning. Distribution checks from some MLPS hit the accounts yesterday and more will be hitting today and tomorrow so enjoy your income! The open approaches so we sit and wait patiently for any developements!

BTW in case anyone is interested the CBOE begins trading options in Boardwalk Partners (BWP) today.

Wednesday, February 14, 2007

The MLP index is now down a nickel led down by a fractional loss in Kinder Morgan (KMP) which is a heavyweight in the index. Williams Partners (WPZ) and Hiland LP (HLND) are the biggest losers today down about 50 cents apiece but nothing here is news driven.

Earnings are out this morning from Natural Resource Partners (NRP) which were a record and distributable cash flow (DCF) was up 15%! The stock has run from low 50s to low 60s in the last 2 months so how much of this is priced in? We'll find out at 9:30am. No clues in the pre-market.

Nothing else happening so far this morning. Oil inventory numbers due out at 10:30am which should move the energy market. The complex is lower this morning but nat gas is higher by 6 cents.

Tuesday, February 13, 2007

Stocks are rallying in the overall market and i would think that would support prices here although it doesn't look like we are going to rip to the upside.

Good Tuesday morning which btw begins with Suburban Propane looking to open higher as Citigroup ups Suburban Propane (SPH) from hold to buy. RBC Capital Markets re-affirms Boardwalk Partners(BWP) at a buy and raises the price target from 34 to 39 dollars. Suburban is bidding higher in the pre-open; no indication on Boardwalk. Nothing else is happening on the corporate side. Btw for those of you who missed it Barrons did have positive mentions this weekend on E V Partners and Linn Energy. Scroll down as i posted a link to Seeking Alpha with a summary of the Barron's piece.

Crude oil has reversed this morning and is now slightly higher after dropping 2 dollars yesterday. Natural gas is slightly higher. Stock futures are higher so we should have a firm open in MLPS.

Crosstex LP held 37 yesterday and closed higher so lets see if the 5 day sell off is over and done with. Yesterday we had a down day in the MLP index but we are still withing easy striking distance of the 300 level with a good up day. I still think we're going through it and probably sooner rather than later. Its just getting harder to find nice entry points so watch for these rolling corrections that are occuring intraday and hitting different stocks on different days.

The open approaches.

Monday, February 12, 2007

Forgot what a losing day looks like...its been weeks since we've seen nearly 2 points downside on the MLP index.

By the way i having been trying to resolve the virus issue. If you have a problem with a specific ad could you let me know. I will email the information to support@adbrite.com and if you wish you can email them about any ad that is giving you a problem. Again i apologize for the inconvienece.

WILL TODAY BE THE DAY FOR 300?

Friday, February 09, 2007

Sunoco Logisitcs is down 1 and Crosstex LP is also down nearly 1 point and they lead the losers list. T.C. Pipelines is a fractional loser along with Global Partners, Copano and Buckeye Partners.

Looks like we're going out on the week under 300 on the index unless we get a last 2 hour surge which btw is not impossible.

Its Friday in an upside week which wasn't rip roaring but the trend continues higher and of course now where 1.12 away from 300. No corporate news this morning but Wachovia liked Suburban Propane's (SPH) earnings so much they up the stock to outperform from market perform. The stock was up nearly 2 dollars yesterday and there should be more upside today. Meanwhile i've been talking about the A G Edwards downgrade of Crosstex LP (XTEX) and it looks like the downside may have been completed yesteday as the stock spiked into the closed and finished at the high of the day.

Looks like Suburban Propane has broken out of an inverse head and shoulders pattern which is very bullish. Crosstex LP bounced off the 89 day moving average yesterday and could have a contra-trend bounce toward 39. But clearly Suburban has the better looking chart.

Meanwhile Crude is trying for the 4th time this week to break through 60 bucks. Lets see if today is the day. Cold weather should continue at least through next week and it could turn bitter cold later next week if a snowstorm developes in the mid-atlantic and northeast. Jury is out but we're watching.

Now i have touched on the idea of a correction and i have a tendency to start worrying about these things a bit early. Let me say that i don't see any immediate signs of a top and while 300 on the MLP index might be a logical point where some selling could occur, I believe that our group is tied to the overall market rally so i think we could have more upside here. However let us bare in mind that we have moved nearly 20% on the index (not including 2 distributions) since October 1st 2006. That is quite a move certainly so at some point we are going to need a pause. Again I don't see anything imminent and i tend to start worrying about sell-offs a bit early but i think it is wise to put it out there as a possibility.

So far individual issues have been undergoing sharp rolling corrections. Yesterday was Valero LP's(VLI) turn as it dropped nearly 2 points intra-day before cutting the loss in half by the close. Holly Partners (HEP) did the same thing over 2 days before rallying back late yesterday. This type of action is typical of bull moves and they do set up trading opportunities as long as the selloff is not corporate news induced.

Thursday, February 08, 2007

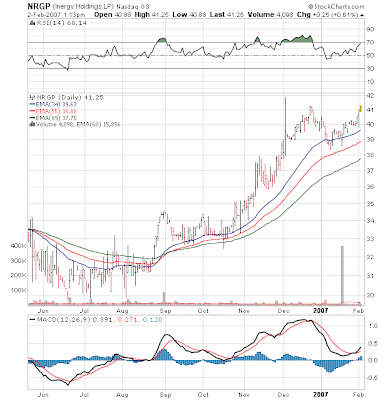

Holly Partners (HEP), Sunoco Logistics (SXL), Copano (CPNO) and Inergy Holdings (NRGP) are down major fractions this morning but nothing news driven...looks like profit taking here.

Natural Gas numbers were bullish and the energy complex is higher now.

FOR THE MLP INDEX

EARNINGS FROM SUBURBAN PROPANE

AND MORE ON A.G. EDWARDS AND CROSSTEX ENERGY!

The day begins at another new alltime high for the MLP index which starts the day at 298.24 so just 1.76 under the 300 level. With not much individual news driving the group today we may be at the mercy of what energy stocks do (they are weaker this morning in the pre-open) and the stock market itself which is a touch weaker but that really hasn't meant much recently.

Thursday brings us earnings from Suburban Propane (SPH) which showed an increase in net profit as revenues declined. Nothing else in the news department this morning as the earnings distribution cycle is past the peak. Crude oil is down this morning after trying 60 dollars for the third time yesterday and failing....rght now at 57.46. Stock futures are weak this morning on no particular news driver.

Crosstex LP (XTEX) has been selling off for 2 days now on a new A.G. Edwards report and downgrade from buy to hold. Granted its only been 2 points but basically the report is just less positive than before and pointing to slower distribution growth. This report is on the Yahoo Research group which is a great place to read reports like this one. The link is also located on the blogroll. A.G. Edwards also issued a downgrade and report on Atlas Pipeline Partners(APL) which is along the same theme as Crosstex; saying the company is at fair value and not much upside from here based on visibility and commodity exposure.

This morning we have Wachovia starting Atlas Resource (ATN) at a neutral. Nothing else on the upgrade downgrade list.

So here comes the open and i'll post after the noise is done.

Wednesday, February 07, 2007

Crosstex LP (XTEX) is still smarting from the A G Edwards downgrade yesteday and its down 75 cents. Profit taking on 2 recent big winners Buckeye Partners(BPL) and Holly Partners(HEP) as both are down nearly a point each.

One last quick check before lunch and the index is now up 40 cents.

MLP INDEX NEARING 300 LEVEL

Wednesday gets underway with earnings from Inergy LP and Inergy Holdings which look good and they affirm 2007 guidance. Also left from yesterday US Shipping Partners reported earnings. Looks like most MLPS are done now with earnings and distributions although we do have a few others to look foward to like Crosstex and Duke Midstream which come out later in the month.

The energy complex is ujp this morning as oil makes another run for resistence at 60 dollars. The ten year continues to see yields drop from 4.90%...now at 4.76%. Stock futures are higher and btw the S&P index is 5% away from an all time high. But we in MLP land are already in all time high territory and still no signs of a top.

In upgrades and downgrades it's quiet this morning a day after A G Edwards did a knife job on several MLPS.

Another day begins as we near 300 on the MLP index and we could possibly do it today if we have a very good day. At some point this group has to pull back and consolidate but there is no indication of when this will happen.

15 minutes until the open...we'll work through that and the oil inventory numbers at 10:30am.

Tuesday, February 06, 2007

The downgraded stocks are sitting just off their lows of the day. Not much else happening. Since the open everything else has been just marking time.

We just hit 298 on the MLP index....2 points from 300!

MLPS are higher on the index up .40 with Duke Midstream (DPM) is up 90 cents and just off its highs of the day. Holly Partners (HEP) is up again as it is getting mileage out of yesterday's good earnings....its 60 cents ahead today.

The stocks that AG Edwards downgraded are down..Inergy Group down 80 cents, Crosstex LP (XTEX) is down 40 cents and Markwest (MWE) is down 20 cents. Not much else happening as the group seems to be tugging back and forth between minus 20 cents and plus 20 cents.

Crude has pulled back from 60 dollars but it is still higher by 30 cents.

This Tuesday begins with A G Edwards busy with the cutting knife this morning as it downgrades a host of MLPS. Atlas Pipeline Partners (APL) Crosstex Energy LP (XTEX) Markwest Energy LP (MWE) and Inergy Holdings (NRGP) all cut to hold from buy. I don't know if the cuts were made strictly based on price or if there were more fundamental reasons for the cuts. All of them are up...some are up quite a bit like Markwest which has moved from 40 to 60 in the last few months. I will post any info as i find out details. Inergy Holdings was a recent buy of mine based on the chart looking like it was ready for another upleg. We'll see what today brings but let me point out that recently downgrades have done very little to keep prices down so after a price drop at the open don't be surprised if prices rally back by days end.

With the bitter cold covering the midwest and northeast energy is rallying this morning as crude is up 1 dollar and nears 60. Natural gas is approaching 8 dollars again this morning. So there will be wind at our backs at the open. Weather pattern will relax from the extreme cold late this week but temperatures will be still below normal much of the time in the next 2 weeks which should keep a bid under prices.

I am putting the question out there about a correction for MLPS not because i think one is beginning today or tomorrow (although it could) but just to put a few ideas out there. I watch the group trade all day long looking for trading opportunities. I have noticed that at least on a short term basis what has been happening is that individual MLPS are having some rather violent (relatively speaking) intra-day corrections of 1 to 2 points and occasionally more. The moves come fast and furious and unless you are watching tick by tick they may go un-noticed until you perhaps look at a chart.

Notice the trading action over the last few days has been all over the place particurally Friday and yesteday. Now some of this might be attributed to pre and post distribution action and perhaps that could be used to justify alot of these intra-day corrections. But whatever the reason the stocks are behaving like they should in a bull move..higher prices met every so often with a fast and furious correction. Now the group at some point is going to have to go through a correction of more than a few days. Trying to figure out when is another matter entirely

No sign of a top on the daily chart and no sign of a top on the weekly chart either.

I think the moral of this yarn is by the time we realize we're in a correction we will probably be about half way through it. In the meantime 300 on the MLP index is within striking distance.

No other corporate developements this morning as a few more MLPS go ex-distribution today including Markwest Energy (MWE) which is ex-dis by a dollar. So between that and the rating cut it could be down 2 or 3 dollars at the open.

Monday, February 05, 2007

On the losing side Duke Midstream(DPM) just turned lower by 50 cents as is Inergy Group (NRGP)and Inergy Holdings(NRGY)...all three are ex-distribution.

Crude was higher as at neared 60 bucks but seller shave moved in and its down 30 cents right now. Rates are holding near 4.80 and the market is slighty higher overall.

Its Monday morning and we begin with a piece of corporate news as Holly Partners (HEP) reports earnigns that were nicely higher. Stock could be a mover today. We are also seeing the last big round of ex-distributions today including Atlas Pipeline Partners (APL), Duke Midstream (DPM) Williams Partners (WPZ) and a few others but all the heavy weights in the MLP index went ex-distribution last week so there should be only minimal impact today. No action so far with regards to upgrades or downgrades.

The MLP index weekly chart still shows no sign of a top and is in re-accelleration mode. Now at some point this thing is going to plateau and we will enter another basing phase where we spent most of 2006. Plus we are getting a bit stretched with regards to yield compression as average yields in MLPs are in the low 6 range. But the perception right now is that distributions will continue to rise in a flat rate enviornment.

Holly Partners has been in a trading range for nearly 2 years and has shown signs lately of joing the party. Today's earnigns news could be a stock mover and propel this one out of the base.

Propane MLP Inergy has also been pretty much moving sideways but it looks like this one also may be starting a new upleg.

Last year"s stellar winner Crosstex (XTXI) which is the GP of Crosstex LP (XTEX) has been quiet for awhile but the chart may be telling us that a new upleg may be starting. The only problem here is that it had such a fantastic run from 10 to 30 that it might be a stretch to ask for a repeat performance. Still the chart looks positive here.

The energy complex is higher this moring especially natural gas which is up 36 cents and nearing 8 bucks. So we wait for the open and see what today brings us.

Friday, February 02, 2007

Sunoco Logistics(SXL) is up another 1 and change. Duke Midstream (DPM)is up 60 cents and over 36 dollars. Fractional gains in Valero LP (VLI)and Valero Holdings (VEH)along with Oneok LP ()KS).

Buckeye Partners(BPL) is down 70 cents and off its low and it its ex-distribution today. Natural Resource Partners (NRP)and Atlas Pipeline (APL)also down fractionally.

Its Friday in what has been a very a very eventful week with oil at $52 bucks one minute and $58 the next; Nat gas from just under 7 dollars to just under 8. MLPS comtinue to move along with only minor corrections along the way. The ex-distribution cycle continues and usually you see a sell off for a few days as each issue passes the record date. So far however there has been very little selling.

This has also been a week of anal-ist downgrades on a few MLPS. Earlier this week Goldman cut Calumet Products (CLMT) and yesterday Wachovia cut Atlas Pipeline (APL) and there have been a few others. However the cuts haven't really done much to knock down prices. Any selling has just been met with more buyers. So the market is telling us that even higher prices are coming and the rally will continue. This morning Boardwalk Partners getting cut to hold from Citigroup. Yesterday Boardwalk was up 1 and change to a new all time high at 36.50.

No other breaking news so far this morning. The overall market will take its cue from the employment numbers which will tell us whether the 10 year yield rallies to take out 4.90 or do we continue to fall through to 4.75% or lower.

Meanwhile in probably the most important fact when it comes to the certainty of global warming the glorified rodent in Pennsylvania has not seen his shadow so an early spring is coming.

Thursday, February 01, 2007

Energy Transfer Partners is the biggest loser down half a buck with a few other scattered losses but nothing that jumps out at you. Atlas Pipeline has the Wachovia downgrade to deal with and its down about 30 cents.

The Citigroup upgrade of Valero GP is bringing buyers in the pre-market. This one goes over 25 today. Wachovia downgrades Atlas Pipeline Partners (APL) from outperform to market perform.

Its hard to argue with this chart as we begin this Thursday at another all time high. Everything seems to be line with stocks rallying...energy rallying...yields on the 10 year that could not take out 4.90% and fell yesterday....excellent earnings...rising distributions. So i guess we should just enjoy the ride.

The 10 year chart above would lead me to worry. Note yields have been rising since early December and then crossed the moving averages. MLP's have shrugged this off and i think that if yields cross the 5% barrier you might start to see some pressure coming in. I think the MLP index hits 300 first but just something we should watch.

I have here the Calumet Specialty Products Partners (CLMT). I post this as an example of why i like to use the moving averages as logical entry points. The stock went ex-distribution yesterday by 60 cents and go a downgrade by Goldman Sachs. The stock closed at 45.80 on Tuesday and fell to 41 and change yesterday before bouncing back to 44. So a patient player could have made 2 quick points on this with a bit of luck. On that note i am posting the Linn Energy chart below.

This one has been a great performer and i think it has more upside although i think the easy money has been made. Still a pullback to to 31-31.50 means back up the truck for me. By the way if you use orders below the market price based on the moving average approach you have to check the chart every day since these numbers change especially when your in an uptrend.

Exxon Mobil earnings will probably dictate energy stocks today at least early on. No new this morning so far but this is an early post and no upgrades or downgrades yet. I will update as any news breaks.