Friday, September 30, 2011

You know your in a bear market when CNBC guests keep using the phrase " throw the baby out with the bathwater" which is so tiresome.

Interesing read on what just happened in Germany. It may not mean what you think it means.

Markets meandering around, lower by 100 on the dow as afternoon trading begins. MLP index down a little over 1 point.

Interesing read on what just happened in Germany. It may not mean what you think it means.

Markets meandering around, lower by 100 on the dow as afternoon trading begins. MLP index down a little over 1 point.

Judging from the action in the energy stocks, it appears there is an end of quarter pile on happening in select big energy issues like Exxon(XOM) and Chevron (CVX) to name just a few and im wondering whether we're seeing the same pile on in some mlps, which, come Monday will get pretty much undone especially if the market sell off continues.

MLPS are down just 1.47 with the dow down 100 points. List looks pretty mixed.

MLPS are down just 1.47 with the dow down 100 points. List looks pretty mixed.

LAST DAY OF AN UGLY QUARTER!

The quarter closes today and on the MLP index it was not a good one as we started at 367 and this morning we sit at 342 so we're down about 7% as opposed to the overall market averages which are down around 4-5%. Still it doesn't fell as bad especially if you are in stocks like EV Partners (EVEP) which is up on the quarter and at the August low it could still have been had for a price in the low 50s.

The quarter closes today and on the MLP index it was not a good one as we started at 367 and this morning we sit at 342 so we're down about 7% as opposed to the overall market averages which are down around 4-5%. Still it doesn't fell as bad especially if you are in stocks like EV Partners (EVEP) which is up on the quarter and at the August low it could still have been had for a price in the low 50s.

Same can be said for Oneok (OKS) and Sunoco Logistics (SXL) which also could have been had for relative bargain prices if you had been quick enough. Of course we're paid 3 to 4 times the 10 year yield to hold these things! And at least so far the group as a whole continues to hold the trading absolute lows at 320. Technically it looks to me like support short term lies around 335-340. If the market decides to take out that 1120 S&P bottom and head for 1000, (dow takes out the 10,600 low) then i think the MLP index goes along with it. We may be at the point where winners will have to be sold by traders. And of course the big pink elephant in the room is a Greek default and whatever turmoil could come with that. And make no mistake, its coming.

Same can be said for Oneok (OKS) and Sunoco Logistics (SXL) which also could have been had for relative bargain prices if you had been quick enough. Of course we're paid 3 to 4 times the 10 year yield to hold these things! And at least so far the group as a whole continues to hold the trading absolute lows at 320. Technically it looks to me like support short term lies around 335-340. If the market decides to take out that 1120 S&P bottom and head for 1000, (dow takes out the 10,600 low) then i think the MLP index goes along with it. We may be at the point where winners will have to be sold by traders. And of course the big pink elephant in the room is a Greek default and whatever turmoil could come with that. And make no mistake, its coming.No news and no upgrades or downgrades this morning. The volatility yesterday was nothing short of ridiculous and look for more today as we work through the last of the end of quarter nonsense. Europe is selling off today and they are running into the 10 year again as its down below 2%. Fasten your seatbelt.

Thursday, September 29, 2011

After the initial push down around 10:30 the market stablized...ran back to 11,200 and another lean into the rally begain at 12:30pm so we're near the lows of the day but still up 130. Nasdaq is down 6 as it nears its lows of the days. MLPS are up 2 and change after selling down almost to unchanged. I still think that there will pressure into this rally this afternoon. If 11,100 doesn't hold we could see selling really accelerate.

RALLY UNDERWAY BUT??????

Frankly these day in day out huge moves are really great for very nimble traders but it is getting to be too much of a casino and in the then that is not what bull markets are made of. Also a few disturbing things on the tape this morning is that after the initial surge of up up 25 points ofn the S&P we have pulled back nearly 10 points off the high. Also there isn't much strenght in energy stocks as a whole. The nasdaq is up less than 20 points. If no fresh buyers show up we could see this rally evaporate as the day wears on. None of these obstacles in and of itself will send the market tumbling but be advised that we are but one Greek headline away from circling the drain as far as today's rally goes.

MLPS were down nearly 8 yesterday and we've only gotten 2 of those points back today. So it appears to be nothing more then a dead cat bounce. We may be among the first groups to negative today if the market really starts to sell off. Nasdaq should also be among the first to turn.

Dow up 205, S&P UP 15, Nasdaq up 15 and MLSP up 2 points as of this post. Oh and ask yourself this question. If this rally is real, would the 10 year still be yielding 2%?

Wednesday, September 28, 2011

EV Partners (EVEP) is getting a 3 point lift on Utica Shale in Ohio which is all the rage these days. Thanks Josef for the news. There is a tug of war going on the tape today with the dow going back and forth. Right now we are re-testing the highs of the day up 75 points. MLPS are a little lower with the members split about 50-50 in either direction. Transmontaigne (TLP) is a 2 point winner. Global Partners (GLP) is down 1.77. I can't find any news here. And Amergias (APU) is down 1. Otherwise the rest of the group is pretty much sitting between plus 50 cents and minus 50 cents.

There is weakness under the tape so im betting on a selloff this afternoon..which if past is prologue means you should bet against me and go long.

There is weakness under the tape so im betting on a selloff this afternoon..which if past is prologue means you should bet against me and go long.

IS THE DEAD CAT BOUNCE DEAD?

Yesterday's violent late day reversal which took the dow from up 350 to up 98 in a matter of an hour only to close up 148 pretty much tells us that this was another one of these short covering rallies that began last Friday. I kept waiting for that one last climactic sell off on Monday and it never came. And as always with these things, MLPS tend to lag. The index closed up 5 points and we may say a little catch up this morning where the index lags if the market opens higher.

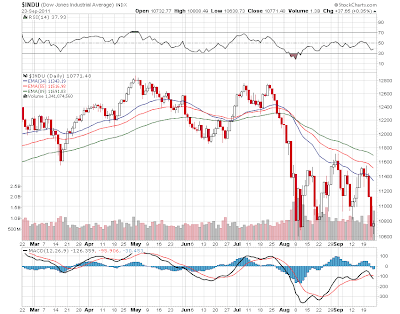

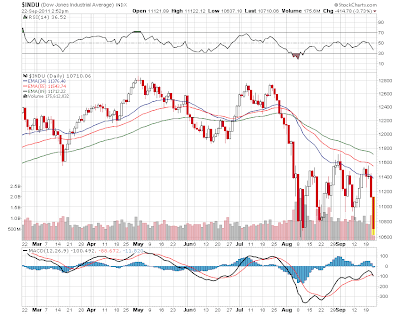

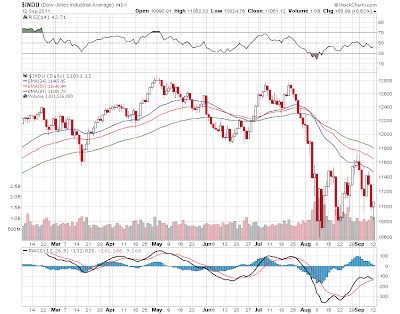

Notice on the Dow chart in what everyone is calling a range bound market with 10,700 at the bottom and 11,500 at the top, the market has turned twice at the 34 day moving average and we hit it again yesterday and sold off right from there. If we see followthrough today we could say that another short term top has been reached and we are headed back down to at least the bottom of the range.

Notice on the Dow chart in what everyone is calling a range bound market with 10,700 at the bottom and 11,500 at the top, the market has turned twice at the 34 day moving average and we hit it again yesterday and sold off right from there. If we see followthrough today we could say that another short term top has been reached and we are headed back down to at least the bottom of the range. I continue to argue that the bottom of that range is going to fail and we need to make a trip below 10,000. What the reason for the break will be? I think its the inevitiablity that Greece fails and the contagion spreads to the other Euroland countries. Certainly we have history on the side of this trade that Europe will continue to kick the can down the road but now the road is ending at the side of the cliff and the next kick will probably send it over the edge.

I continue to argue that the bottom of that range is going to fail and we need to make a trip below 10,000. What the reason for the break will be? I think its the inevitiablity that Greece fails and the contagion spreads to the other Euroland countries. Certainly we have history on the side of this trade that Europe will continue to kick the can down the road but now the road is ending at the side of the cliff and the next kick will probably send it over the edge.This morning in mlp land we have no news to speak of and no upgrades or downgrades. Stock futures are a little higher ahead of the open as the market seems to continue to trade with the Euro almost tick for tick. Crude oil is a little lower, euro markets are a little higher and gold is a little lower. The VIX is sitting just under 38 and the 10 year is at 1.98%. As i've said before, with those 2 metrics its hard to envision any rally lasting more than a few days. Shorting rallies has been a money maker lately and will probably remain so until proven otherwise.

Monday, September 26, 2011

BOTTOM OR BREAKDOWN?

The question posed in the headline can be applied to both charts but more so on dow chart below then the MLP chart above. MLPs as we know have held up much better than the overall market probably due to rates that continue to drop to record lows leaving yield spreads at elevated levels. However no such support exists for the Dow Industrials or the S&P 500 which are both sitting on their August lows this morning pre open.

The question posed in the headline can be applied to both charts but more so on dow chart below then the MLP chart above. MLPs as we know have held up much better than the overall market probably due to rates that continue to drop to record lows leaving yield spreads at elevated levels. However no such support exists for the Dow Industrials or the S&P 500 which are both sitting on their August lows this morning pre open. The market is making an attempt to hold this morning with higher futures but the rally is very tenuous at best since Europe did nothing over the weekend to resolve any of its many issues. And if markets break below support decisively today, we could see a mad dash for the exits. I would have rather come in to futures down 2 or 3 hundred points and head toward capitualtion. It appears we are going to put that event off at least for the open. My guess is that after the higher open the tape weakens pretty rapidly.

The market is making an attempt to hold this morning with higher futures but the rally is very tenuous at best since Europe did nothing over the weekend to resolve any of its many issues. And if markets break below support decisively today, we could see a mad dash for the exits. I would have rather come in to futures down 2 or 3 hundred points and head toward capitualtion. It appears we are going to put that event off at least for the open. My guess is that after the higher open the tape weakens pretty rapidly.MLPS don't have much to go on this morning. We do have earnings on Ferrellgas (FGP) which probably won't do anything to drive either the group or the stock. No other news and no upgrades or downgrades. The market opened higher as advertised. MLPS open fractionally higher as well. Gold is down. the Euro is holding for now. Another rollercoaster ride ahead for us today.

Friday, September 23, 2011

With gold down 100 bucks, somebody is liquidating and for a reason. I think we may find out over the weekend. Dow now down 20 as this tug of war continues and bulls trying to make the last stand at 10,700. MLPS down nearly 3 again as they try to hold 340.

Once again i mentioned a list of mlps that i may buy if we get a big capitulation self off Monday. I mentioned Kinder Morgan (KMP) but put the symbol up for Kinder Morgan common (KMI). I mean KMP, not KMI. Sorry for the confusion. Thanks Max for pointing that out.

I will be on news patrol this weekend and will post if i see anything breaking.

Once again i mentioned a list of mlps that i may buy if we get a big capitulation self off Monday. I mentioned Kinder Morgan (KMP) but put the symbol up for Kinder Morgan common (KMI). I mean KMP, not KMI. Sorry for the confusion. Thanks Max for pointing that out.

I will be on news patrol this weekend and will post if i see anything breaking.

ARE WE SETTING UP FOR

A CAPITULATION SELLOFF?

A CAPITULATION SELLOFF?

If past is prologue (and sometimes it is) we could be seeing the stage being set for a final capitulation selloff followed by a massive rally. If Art Cashin is correct, and he's been around for many of these types of selloffs it will work like this. Yesterday's big selloff is followed by a choppy day today. The weekend will be filled with hope only to have those hopes dashed. Then the trap door opens and Monday we see a bloodbath which could spill into Tuesday before a big rally ensues.

You can see that both the dow chart above and the S&P chart below are right at the bottom. Any break down from here can mean a fast trip to 10000 on the dow and 1050 on the S&P 500

You can see that both the dow chart above and the S&P chart below are right at the bottom. Any break down from here can mean a fast trip to 10000 on the dow and 1050 on the S&P 500

MLPS on the other hand have performed so much better in this selloff. And why not with 10 year rates down to 1.70%. There is a 5 point spread between the two. If we get a capitulation blooodbath and the index takes a drop to 330 or less i think i will be backing up the truck.

If this happens which mlps do we buy? I probably will stay with the big guys and the best performers for the biggest bang for the bounce. Kinder Morgan (KMI), Enterprise (EPD), EV Partners (EVEP) Sunoco Logistics (SXL) and Oneok (OKS) are the obvious candidates. Of course i've planted out a pretty picture and sometimes they don't play out this way. So of course caution when playing in the minefield. And btw with next week being the last week of the quarter, you have to wonder whether other distortions will appear because of the usual end of quarter game playing.

If this happens which mlps do we buy? I probably will stay with the big guys and the best performers for the biggest bang for the bounce. Kinder Morgan (KMI), Enterprise (EPD), EV Partners (EVEP) Sunoco Logistics (SXL) and Oneok (OKS) are the obvious candidates. Of course i've planted out a pretty picture and sometimes they don't play out this way. So of course caution when playing in the minefield. And btw with next week being the last week of the quarter, you have to wonder whether other distortions will appear because of the usual end of quarter game playing.No news and no upgrades or downgrades this morning in the group. Everyone is on tender hooks and headlines will cause swings in both directions today. Seatbelts and dramamine are the order of the day.

Thursday, September 22, 2011

The dow just went below 10,700 down over 400 points while the mlp index is back to its lows of the day down over 10 points. We're down 900 points in 2 trading days which is a lot so a bounce of some sort could come at any time but if we get one it will allow traders to sell out and get short again. Down 425 at this point. 10,700 is trying to hold here. And btw rallies may be measured in a matter of minutes or hours in this type of selloff.

MARKETS HEAD TOWARD PANIC???

When you start the day down 30 points on the S&P at least you know where the ceiling is. Big rally in the dollar with the Euro at 134 and change, and coming off yesterday's post fed collapse, and you have the seeds of a real mess. MLPS were even down yesterday by 5 points but you can see how much better the mlp chart looks. It has been my contention that we break the August dow closing low of 10,600 and head toward the big support at 9800 and that leg may have begun yesterday. And we could get there in a big hurry if 10,600 goes with no resistence.

No news and no upgrades or downgrades. Since we're in selling mode here its wise to stand back. But with the 10 year at 1.79% and the tax uncertainty over the group lifted, when the final selloff comes there could be some real bargains to be had...just not yet.

When you start the day down 30 points on the S&P at least you know where the ceiling is. Big rally in the dollar with the Euro at 134 and change, and coming off yesterday's post fed collapse, and you have the seeds of a real mess. MLPS were even down yesterday by 5 points but you can see how much better the mlp chart looks. It has been my contention that we break the August dow closing low of 10,600 and head toward the big support at 9800 and that leg may have begun yesterday. And we could get there in a big hurry if 10,600 goes with no resistence.

No news and no upgrades or downgrades. Since we're in selling mode here its wise to stand back. But with the 10 year at 1.79% and the tax uncertainty over the group lifted, when the final selloff comes there could be some real bargains to be had...just not yet.

Wednesday, September 21, 2011

Keep a watchful eye on the tape here as Goldman is about to break 100 and markets are not liking this. Also i don't mention it much because its in the fertilizer space but Terra Nitrogen (TNH) is an mlp and its down 13 bucks today at 158 but it has recently run up to the 180s. So technically it is today's biggest mlp loser.

Here is the full text of the republican letter to Ben. Poor Ben. He's in a box. He's dammed if he does and dammed if he doesn't. Its kind of like watching Tony Soprano. "Hey Ben..you got a nice fed here. It would be a real shame if something happened to it!"

Coal MLPS are taking it on the chin today with Alliance Resource (ARLP) down 1.65 and Natural Resource Partners (NRP) down 70 cents on Alpha Natural Resources (ANR) points to lower shipments and demand for coal in general which is killing coal stocks today. Otherwise the index is down all of 0.15 ahead of the fed with a split list of fractional movers. EV Partners (EVEP) is up 1 and change getting back some of what it lost yesterday as it sits just under 75.

Overall tape has been weaking and watch Goldman Sachs as it looks like it might break under 100 which i think might send stocks even lower. And of course the fed at 2:15pm.

Overall tape has been weaking and watch Goldman Sachs as it looks like it might break under 100 which i think might send stocks even lower. And of course the fed at 2:15pm.

FED DAY WILL LEAVE US TWISTING IN THE WIND?

If i hear one more time about "Operation Twist" which, unless you live in a hole in the ground, is probably the most telegraphed fed move in recent history. And since everyone seems to know about this i would think its all baked into the market. If the fed does more it could be viewed as bad because it may just send the signal that recession is imminent. Meanwhile the politics for the fed is getting rougher as republican leaders sent the fed a letter saying essentially to" stop doing what your doing, its not working!" Meanwhile Europe is down this morning which is putting a little pressure on stock futures ahead of the open.

MLPS meanwhile continue to benefit from the lifting of the tax cloud as the Obama administration has given up on trying to tax corporate jets and the like since the union machinists have told him that they are against it. We saw mlps up on Monday with the dow down 100 and yesterday they closed higher again. What was particularly interesting to me is that UBS downgraded Nustar (NS) and one or 2 others yesterday and even those stocks closed higher. So im thinking that MLPS will continue to outperform unless the overall market goes into some sort of death spiral, or if a major bank in Europe gets unwound, or if a country like Greece were to go under. But we of course know that those things just don't happen.

We don't have any corporate developements this morning and no upgrades or downgrades. Europe is lower, oil is lower, gold is lower, and the euro is lower. Again its all about the fed at 2:15pm. Back in August on fed day we saw the fed come out with its "we're not raising rates for 2 years" statement. The market after 2:15pm initially edged higher, then dropped to minus 200 to 10,600 and then at 2:45pm mounted a rally that took us to plus 300 by days end. Something tells me more volatility is ahead of us after 2:15pm.

Monday, September 19, 2011

S&P just downgraded Italy debt with the outlook still negative. No wonder the futures are suddenly down 100 points.

MLPS closed sharply higher by 7.55 on the index or over 2%. My guess is when the White House Tax proposal came out with no tax attack on mlps, the stocks had a relief rally and moved sharply higher. Overall the market came off its losses and closed down a little over 100 on the dow.

Tuesday brings more Euro woes and the fed.

Tuesday brings more Euro woes and the fed.

ARE WE GETTING READY FOR?????

Markets this morning are reacting to what Europe does so well when dealing with their problems which is have a meeting, serve espresso, and then head for vacation resolving nothing. The prospect of a default of Greece looms and with no plan in place on how to deal with it, we have the door opened for the possibility of chaos developing in the markets a-la 2008. If Greece goes in disorder does it spread to Italy and Spain and Ireland and, etc etc etc. And of course this spreads to the European banks which spreads to, well you get the idea. The chart is at a perilous point and i think the real test lies at dow 10,000 (ish). Last week's five day rally bounce was pretty good. Lets see how fast it gets undone.

The mlp index however is in a much different place than it was in 2008 when the Lehman unwind caused a major dislocation of prices, created the buying opportunity of a lifetime and, well we know the rest. The index sits at 348 which is still higher than the old 2007 all time high of 340 and still more than double the 2008 low. Through all of this distributions have continued to increase and holders of mlps have pretty much existed in a different world from the rest of the market. It remains to be seen however if this separate world we live in remains that way if we become victims of a major unwind of a bank or a sovreign nation. Should that happen we could be seeing another major buying opportunity unfold. It will just be a question of where that level is.

The mlp index however is in a much different place than it was in 2008 when the Lehman unwind caused a major dislocation of prices, created the buying opportunity of a lifetime and, well we know the rest. The index sits at 348 which is still higher than the old 2007 all time high of 340 and still more than double the 2008 low. Through all of this distributions have continued to increase and holders of mlps have pretty much existed in a different world from the rest of the market. It remains to be seen however if this separate world we live in remains that way if we become victims of a major unwind of a bank or a sovreign nation. Should that happen we could be seeing another major buying opportunity unfold. It will just be a question of where that level is.Over the weekend the Messiah announced a plan to raise taxes which is probably another non starter however i have been trying to find any mention of them going after the mlp tax structure. I have not seen anything yet but if there is something in there you can bet the mlp market will react and it won't be pretty. I will watch for headlines and the tape action for any indication of this.

MLP news this morning is an upgrade by UBS for Boardwalk Partners (BWP) to a buy. And Targa Natural Resources (NGLS) will be exporting international grade propane as it expands its business. Otherwise its all quiet on the corporate front. Stock futures are sharply lower ahead of the open by 19 S&P points as Europe opened lower and continues to sell off. The 10 year is under 2% again and this is something that sticks in my head. How can markets continue to rally with a 10 year under 2%? I just don't think they can. The Euro is sinking. Gold is higher and we have oil and nat gas lower ahead of the open. So fasten your seatbelts for a rather rocky Monday.

Sunday, September 18, 2011

Opening ticks on the futures not pretty with the dow down 125. The Euro which has a Sunday day session is down. Dollar/euro up over 1 cent so far. (the board may show it up but thats after the Sunday 5pm close). Greece is going to be front and center after a weekend were Euro leaders continue to twiddle their thumbs while Athens burns and their espressos cool.

Was looking at a S&P chart back from September 2008 and it so far its very similar, which if it continues does not look good for the next 3 weeks.

Was looking at a S&P chart back from September 2008 and it so far its very similar, which if it continues does not look good for the next 3 weeks.

Friday, September 16, 2011

COMING TO A HEAD!

When you look at the 2 snapshots of the MLP index and the Dow Industrials you come away with 2 different views. In reality we have 2 different markets going on here. The dow has ralled back to the top of the recent 2 month rage which is bound by 11,600 at the top and 10,700 at the bottom. We have rallied straight up from 2pm Monday and that has seemed to have come to an end this morning as markets after opening up have turned lower. MLPS have come back to the 350 level but has probably a less negative looking chart. Both markets are in downtrends but clearly the attraction of 6% yield continues to drive money here. My concern going foward is this. If the overall market is going to take out that 10,700 bottom what will be the catylist? Will it be an unraveling of Europe? And what if a major bank goes down like Barclays ( im not predicting here just illustrating), could we see another great mlp unwind? Im not predicting these things but im beginning to get the feeling that we are at the beginning of another 2008 like unwinding. MLPS are down nearly 5 points this morning. It could be one of those options expiration/futures distortions that we see here every once in awhile. But i think given what is happening around the world we need to pay attention.

Crosstex Energy (XTXI) is back almost to 15 and is up fractionally today. QR Energy (QRE) continues to benefit from the upgrade a few days ago and is now over 21...up another 1 and small change. Kinder Morgan (KMP) and Enterprise Products Partners (EPD) are solidly lower and are leading the mlp index down.

Thursday, September 15, 2011

Another goal line stand at 1200 as we speak. Dow ran to +150 before pulling back a bit. MLPS in their own little world up 3.50 and doing quite well today. I still think the market rally is going to run out of gas but as i have been known to be wrong on occasions..(seems like all the time on these short term calls)..we'll see after 2pm.

BATTLE GROUND AT S&P 1200

Yesterday's short covering surged peaked at S&P 1202 at 3;40pm before the markets sold off half their gains in a handful of minutes. This morning we ran right back up to 1202 only to get turned back to 1191 and now as the Euro markets are closed, we're back at 1200. No doubt this is line in the sand that bears have drawn. MLPS are up 2.50 on the index as most mlps are showing fractional gains in here. Watch the euro as it seems to me that the dow is trading tick for tick with that currency as the Euro crisis ebbs and flows depending on what time of day your checking.

Nat gas is down on inventory while crude is up a little. The tape feels a little weak today underneath all the averages so my guess is that traders will find a reason to sell into the rally this afternoon.

Wednesday, September 14, 2011

THE TUG OF WAR CONTINUES!

The daily trading pattern has been a tug of war back and forth. The dow was up 70, then down 100, now up 55 again. The question is whether this is a double or triple bottom formation or is it a bearish flag which will ultimately break down and break down hard. MLPS have been treading water for the most part as they have gone sideways and outperformed the broader tape. Still its hard for me to see a substantial rally with the 10 year still straddling 2%.

MLPS are up a small fraction but lagging the rest of the market which appears to be led by technology. Most mlps are moving fractionally in either directon.

Tuesday, September 13, 2011

The tug of war back and forth continues to show the struggle of both sides and the bulls seem to winning the argument with the dow now up 42 and the S&P up nearly 10 points as the broad market is rallying with more strength. MLPS are now higher on the index after being lower all morning however they are lagging.

Markets have been all over the place as the tape has a very nervous feel to it. The dow is down 29 points but the S&P is up and the russell is up much more on a percentage basis. Its all probably catch up from yesterday. MLPS meanwhile are down 1.50 and not playing catch up to yesterday's late day turn.

QR Energy (QRE) is up 2 dollars on an upgrade this morning by UBS and a 27 dollar price target. Plains Storage (PNG) is up fractionally on its upgrade. Otherwise its a mixed list with fractional moves in either direction with a downside bias. Most of energy is showing relative underperformance today. Nat gas is up nicely as cooler weather heads into the US for the second half of the week.

More frazzled nerves for the afternoon as markets swing on every piece of euro news.

QR Energy (QRE) is up 2 dollars on an upgrade this morning by UBS and a 27 dollar price target. Plains Storage (PNG) is up fractionally on its upgrade. Otherwise its a mixed list with fractional moves in either direction with a downside bias. Most of energy is showing relative underperformance today. Nat gas is up nicely as cooler weather heads into the US for the second half of the week.

More frazzled nerves for the afternoon as markets swing on every piece of euro news.

ARE WE AT A BOTTOM?

Yesterday's action had the feel of a bottom but i would be very cautious to rush to that conclusion just yet. We've basically been bouncing around after the initial thurst to 10,600 between that level and 11,500. And while the bottom part of that range held, all the Europe and Greece turmoil could make that bottom come out. I have been of the opinion that 10600 will go and that we will head down to below 10,000. Maybe a Greek default finally sends markets cascading down to those levels. Yesterday's late rally looks like it will get extended this morning. Futures overnight were up when i went to bed around 2am but sold off pretty hard before turning around about 45 minutes ago. MLPS showed signs of selling off yesterday and came back with a small loss. They will probably make up some ground at the open today.

Yesterday's action had the feel of a bottom but i would be very cautious to rush to that conclusion just yet. We've basically been bouncing around after the initial thurst to 10,600 between that level and 11,500. And while the bottom part of that range held, all the Europe and Greece turmoil could make that bottom come out. I have been of the opinion that 10600 will go and that we will head down to below 10,000. Maybe a Greek default finally sends markets cascading down to those levels. Yesterday's late rally looks like it will get extended this morning. Futures overnight were up when i went to bed around 2am but sold off pretty hard before turning around about 45 minutes ago. MLPS showed signs of selling off yesterday and came back with a small loss. They will probably make up some ground at the open today.UBS is raising Inergy (NRGY) to a buy but lowers its price target from 36 to 31. UBS is also raising Plains Gas Storage (PNG) to buy from a neutral. RBC is raising QR Energy (QRE) to outperform and a 27 dollar price target. QR is at 18 so that's a 50% move from here if RBC is right..which is of course a big if.

The open looms shortly and i would look for sellers to eventually try to take em down at some point today.

Monday, September 12, 2011

MLPs are underperforming today. Perhaps its the beginning of the end of the decline, perhaps not. The vix is at 41 and change so keep an eye for a spike up and indications that 10,6o0 on the dow holds or not. 1136 on the S&P is the magic number there. We're at 1145 now. The market looks like its trying to take a stand here. No guarantees.

Plains All American (PAA) is the days biggest loser down 1.39 and Kinder Morgan (KMP) is down 1.21. Markwest (MWE) is down 1.10. On the upside Amerigas (APU) stands alone up 0.23. Everything else in the group is down fractions to a point.

Plains All American (PAA) is the days biggest loser down 1.39 and Kinder Morgan (KMP) is down 1.21. Markwest (MWE) is down 1.10. On the upside Amerigas (APU) stands alone up 0.23. Everything else in the group is down fractions to a point.

CIRCLING THE DRAIN!

Perhaps my headline is a bit overstated but markets this morning are down sharply as Europe unravels as the Greek farce continues. Dow is set to open down about 170 or so. The 10 year is at 1.90% as the flight from fear continues in bonds. All of this so far has not really done much to mlps which are holding well above the 320 low from mid August. Back in 2008 when Lehman unraveled we saw yield spreads between mlps and bonds widen to ridiculous levels and ultimately to the buying opportunity of a life time. This time around we're seeing yield spreads widen again but not because of the fall in mlps but due to the collapse in yields. The 10 year was in the mid threes not that many months ago. Now we have the strongest mlps yielding about 4 to 5 points above the 10 year. However i would be careful about coming to the same conclusion that this is another buying opportunity. For one thing mlps were outrageously oversold in 2008. MLPS today are actually not that far from their highs. Money has been flowing to yield and while that can hold us up for awhile, i still contend that if the overall market breaks down below 10,600 mlps will join the sell off. And remember when they get around to selling mlps its usually toward the end of a move and not at the beginning of one.

RBC is raising its target price on EV Energy Partners (EVEP) which is the star performer in mlp land as it has gone from 10 to 75 in the last 2 1/2 years plus you got a rich distribution all the way up. No pre open action there. No other news in the mlp group. Crude oil is down 1 and change. Nat gas is off a few pennies. The dollar is trading lower against the Euro and Euro markets will continue to dictate the pace of our own day...which begins shortly.

Sunday, September 11, 2011

Sunday night futures opened down 100 points and have been trading in a range between minus 75 and minus 100 so far. Looks like its trading lockstep with the euro which was down earlier, then rallied about 1/2 a cent against the dollar but it is back to unchanged. Looks like a volatile overnight of pre market trading. No mlp news that i could see over the weekend.

Friday, September 09, 2011

Markets down 2 1/2% or 300 dow points but mlps down a little over 1% as rumours spread on the possibility of Greece defaulting this weekend which of course were denied. Germany has plan B in place to shore up their banks in case that happens. Markets are selling first and asking questions later. We've broken under 11,000 as we head into lunch time.

Sunoco Logistics (SXL) is up nearly 1 point on the RBC upgrade among a handful of mlp winners. Most mlps are down fractions to 1 point.

Sunoco Logistics (SXL) is up nearly 1 point on the RBC upgrade among a handful of mlp winners. Most mlps are down fractions to 1 point.

Natgas coming into seasonal bullishness..i suppose!

And in case you missed this from yesterday, what is the definition a Ponzi scheme?

And in case you missed this from yesterday, what is the definition a Ponzi scheme?

MLPS DOWN BUT MARKETS DOWN HARDER!

The relative outperformance of MLPS continues as the markets sell down hard at the open. The dow is down 1.65% while mlps are down just 0.55%. When you have a 10 year yield at 1.95 and you can get 6% (with some risk), thats hard to resist and money continues to flow into the group. Or at least the money coming out is less! So the list is showing mlps down but no big moves. RBC ups Sunoco Logistics (SXL) and Plains All American (PAA). Neither stock is doing anything inspiring on the news. No other news and no other upgrades or downgrades.

The euro markets remain front and center and the action there is driving action here. Futures overnight were actually firm and this morning they were holding up well until 9am when suddenly the air came out of the bag. We're down 200 as of this post and ultimately i think we have to go down to 10,600 and take that out with an eventual trip to 9800. Watch the VIX (volatility index) to head back up to 48 which was the high a few weeks ago. We are at 36 right now.

Thursday, September 08, 2011

While the mlp index is up fractionally at lunch time there are some standout movers today. EV Partners (EVEP) is up another 3 points to 75 dollars and a new all time highs. There is a Barrons story on line which appears accessible even to non members. Citigroup put out a note on mlps favoring Breitburn (BBEP) Legacy Partners (LGCY) and Vanguard Natural Resources (VNR). Calumet Specialty Products (CLMT) is down 1.50 on a stock offering. Alliance Natural Resources (ARLP) is down but no news to speak of there. Otherwise moves are small and fractional in nature around the group.

Bernake to speak at 1:30pm and the President tonight will speak on jobs. I can't imagine they will say anything that will make markets happy but i have been wrong before.

Bernake to speak at 1:30pm and the President tonight will speak on jobs. I can't imagine they will say anything that will make markets happy but i have been wrong before.

MLPS CONTINUE TO HOLD UP WELL!

One thing that is most annoying about trying to come up with something when reading a chart is that it's always back looking. That is you can look at something and see the top only after the decline is probably well underway. Same goes for bottoms. Right now short term it looks like we have a (tradeable) double bottom that was put in place last month. But we came up to the now declining moving averages and hit a brick wall. Still the group is doing pretty well compared to the rest of the market. But if the overall market decline has more to go, mlps will follow and i'm still waiting for the signal where mlps are thrown out the window to tell me we have a real tradable bottom....unless of course i'm wrong and we're already there. Such is the traders dilemma.

One thing that is most annoying about trying to come up with something when reading a chart is that it's always back looking. That is you can look at something and see the top only after the decline is probably well underway. Same goes for bottoms. Right now short term it looks like we have a (tradeable) double bottom that was put in place last month. But we came up to the now declining moving averages and hit a brick wall. Still the group is doing pretty well compared to the rest of the market. But if the overall market decline has more to go, mlps will follow and i'm still waiting for the signal where mlps are thrown out the window to tell me we have a real tradable bottom....unless of course i'm wrong and we're already there. Such is the traders dilemma.After yesterday's one day rally, you would hope for some followthrough this morning if you were a bull but the sellers are in control so far. Markets are opening lower and we will be looking for followthrough selling to tell us that yesterday's rally was just a one day event. Gold is up 40 bucks and Europe is down. No news for mlps individually and no upgrades or downgrades.

Tuesday, September 06, 2011

Dow opens down 2.3% and mlps open down 2.3%; down nearly 8 points on the index. So far everything moving in line. No downside "outperformance" by the mlp index; that is its down more than the overall market telling us the sell off is coming into a climax bottom. The vix is up 5 to 39. The August high that matched the bottom at 10,600 was around 48 or so. 10am brings us August ISM service sector measures which might move the tape.

POST LABOR DAY PAINS!

No question that the markets are in turmoil these days and it appears to me that 11,000 on the dow will not hold and then we will test and break down below 10,600 which was the August low to a trip eventually below 10,000. There you have it folks. I have it all figured out! Now set your trades and wait for the October trading bottom!

Somehow i doubt it will be all that smooth but certaininly today looks painful from the start as we catch up from being off yesterday and watching Europe take a big hit. One thing that is clear from the trading of the last few weeks is that MLPS are relatively outperforming the market. 320 is the August low in the group and a trip back down there is inevitable. Once again keep an eye on what mlps do in this downmove as they are among the last stocks to be sold hard before a tradable market bottom. This morning we have no corporate news items in the group and no upgrades or downgrades.

Through all of this we have another number to watch carefully and that is the 10 year yield which this morning is trading decisively below 2%. Now that we have a "1" handle on the 10 year, i can tell you that markets will not bottom until that yield stops going down. Where is the low in yield? Well outside of an out and out depression where yields go to zero (can you say Japan?), i would think that a dow trip to say 9800 would probably take is down to 1.50%. I suppose one can point to the yield spread of 5 points between that and mlps as a sign to buy mlps with both hands if we get there. Where mlps will be if we see 1.5 on the 10 year is another question. I would think it would be somewhere south of 320 on the mlp index, but perhaps not too far south.

Gold overnight went over 1900 bucks before pulling back. If this selloff gets really out of hand look for the selling to spread into the gold arena. That could be another sign to look at for a short term trading climax.

Friday, September 02, 2011

EMPLOYMENT NUMBER HORRIBLE!

Markets are unraveling this morning to an absolutely terrible employment number which show 0 non farm payrolls. Stock futures are down 20 on the S&P and the 10 year is down 2.03%. I think we have a shot for a 1 handle close on the 10 year. It does not look good today. MLPS will follow down but probably continue their relative outperformance. Nothing on the news front for mlps today and no upgrades or downgrades.

The employment number is due shortly and could take us to a 1 handle on the 10 year. We're around 2.10% right now. Fasten your seat belts.

Oh and btw did you know that MLPS are extremely overvalued?

Oh and btw did you know that MLPS are extremely overvalued?

Thursday, September 01, 2011

MLPS are down a little as markets mark time ahead of the employment number. They got a lift from the ISM number but have pulled off that high. The dow is now down a few points and the mlp index is down nearly a point at this stage. The mlps that got upgrades are moving small fractions so no noticable impact from the Wells Fargo action.

WELLS FARGO ON THE HORN!

We have upgrades this morning from Wells Fargo on Alliance Holdings Group (AHGP), Atlas Pipeline Partners (APL), Sunoco Logistics (SXL), and Enbridge Energy Partners (EEP) all to outperform from market perform. Now remember boys and girls that aside from the obvious, Wells believes that if markets go down, these stocks will go down less. So as long as MLPS as a group, outperform the market, then these stocks should do well. Again that is in the world according to Wells Fargo.

This morning we sit at critical levels for the mlp index as shown on the chart. We are working our way through moving average resisitence and it appears we have a chance to clear them. Of course this is happening with the expectation of the big employment number tomorrow. Markets have been rallying ahead of the number so unless its a very solid number, i think we are setting up for a disappointment.

Stock futures are flat ahead of the open today. Interest rates are lower with the ten year at 2.20%. I still maintain that markets can't significantly rally with the 10 year at 2.20%. Nat gas moved higher yesterday and is higher again today on the threat of a tropical storm developing in the Gulf of Mexico. Inventory numbers for nat gas are due out later this morning.

Stock futures are flat ahead of the open today. Interest rates are lower with the ten year at 2.20%. I still maintain that markets can't significantly rally with the 10 year at 2.20%. Nat gas moved higher yesterday and is higher again today on the threat of a tropical storm developing in the Gulf of Mexico. Inventory numbers for nat gas are due out later this morning.

Subscribe to:

Posts (Atom)