Monday, April 30, 2007

No headlines after the close so far.

Looks like the group surge continues as we head into the final hour.

Not many on the losers list. Enbridge Energy Partners (EEP) is down 1 and change on a downgrade. Hiland LP (HLND) is down 80 cents but off its lows. Smaller fractional losses in a small group of issues...some of last weeks bigger winners like Genesis LP (GEL) is on that list.

Monday morning news begins with earnings and we have Boardwalk Partners putting up numbers that technically were 3 cents below estimates but we don't pay to much attention to that. Distortions include a stock offering and the company did raise the distribution last week which is of course more important. And what they say for the rest of 2007 and hopefully they will in the conference call. Alliance Resource Partners (ARLP) puts up strong earnings numbers. Now they did not raise the distribution however they usually only do that in January and July. And one piece of news left from Friday as Holly Energy Partners (HEP) raised its distribution by a penny but the stock has really taken off recently. The yield on this one is down to 5.1% which is pretty low. The float here is very small.

Of course that chart above looks parabolic which is amazing that we're saying that about anything in this group. Meanwhile Boardwalk has been moving sideways since its stock offering in March. We'll see what the impact of the morning news is.

Energy markets remain extremely tight and i paid $3.19 for gas last night. Isn't that fabulous! At least my investments are providing an effective hedge. Those markets are flat but lately they have been sensitive to any breaking news so we'll keep an eye there. In upgrades and downgrades Wachovia cuts Enbridge Energy Partners (HEP) to market perform from outperform. We also have relatively new issue Cheniere (CQP) which Citigroup starts at a hold.

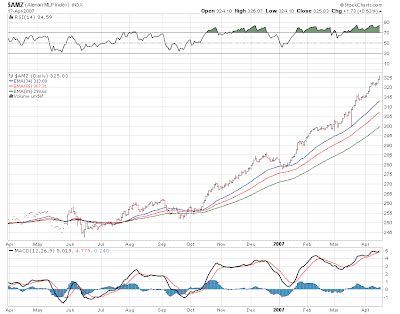

MLPS are hovering just below their all time high set last week when the index went down on one day, mainly due to ex-distribution activity. More ex-distributions set for this week so look for more distortions although the heavy weights like Kinder Morgan for example are already done. So i guess we'll see a challenge to new all time highs today.

Sunday, April 29, 2007

Its Sunday evening and i am contemplating what the week ahead will bring. The MLP index continues to roll along and still no signs of a top. Citigroup has an MLP Index and the symbol is CITIMLP and the total return index is CITIMLPT. More information is found here about it.

Electronic markets will begin trading shortly. I did not find any MLP related news over the weekend. So i guess we wait for Monday morning headlines if any to see what this new week will hold. A whole bunch more ex-distributions will occur this week and checks will be in the mail shortly. My eyes are glued for any clues of an impending correction but the group is moving as an overall market leader so until the stock market tops short term or if a big correction developes in the energy sector, i suspect we continue to move higher.

Friday, April 27, 2007

Atlas Pipeline is still down about 2 bucks on earnings and a downgrade and the lack of a distribution hike. The rest of the losers list seems to be populated by either ex distribution stocks or ones that have run up recently and are seeing profit taking.

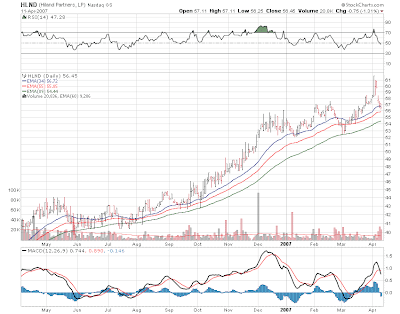

Now let me address Atlas Pipeline Partners (APL) which not only had no distribution increase but had to deal with a Citigroup downgrade from buy to hold. Let me just say the drop to 48 this morning...nearly 4 points was ridiculous and the market has now brought the stock back to 50.75...far more reasonable loss of 1.25. At 4.8 this stock was priced to yield 7.1% which is absurd. Considering how yields have compressed in the entire group this one has been yielding far higher. And rightfully so since this is the second quarter of no growth. My guess is holders of Atlas saw what happened to Hiland in the last 2 days and figured..sell first and do the math later. Well the math says even for a non distribution grower of 2 quarters...50 should be the floor.

And of course guess who owns all three stocks?

Oneok(OKS) is up 2 on good earnings and a solid outlook and so is Genesis LP (GEL) as todays big winners.Genesis was up 5 yesterday and was up another 3 at one point as it buys assets and doubles its size. The market obviously likes this.

The MLP index is down a small fraction..ex-distributions taking a smaller toll on the index today than yesterday.

MLPS FINISH LOWER YESTERDAY

Good Friday morning and we begin this morning with a ton of news leftover from last night. First off we had earnings and a distribution announcement from Atlas Pipeline Partners (APL) and also one from Buckeye Partners (BPL). Atlas did not raise the distribution for the second quarter in a row however they did say there operations are running on all cylanders so the outlook is good for later in the year. The stock is among the highest yielding MLPS in the mid 6% range so a flat distribution is priced in imho. Buckeye boosted their distribution. Atlas Energy Resources (ATN) announces a 43 cent distribution for the quarter. Earnings from Oneok LP are out and the company reaffirms guidance for the rest of the year. Meanwhile nobody raises distributions better than Magellan Midstream Partnerts (MMP) which raises for the 24th quarter in a row...6 years! And for the 5th quarter in a row Magellan Midstream Holdings (MGG) raises its distribution. Williams Partners boosted their distribution 3 cents to 50 cents even or 2 bucks annual. And Boardwalk Partners gave its shareholders a distribution boost.

MLPS had a rare down day yesterday as the index dropped a point and a quarter. Most of that was ex-distribution distortions of some of the big players like Kinder Morgan (KMP) and a few others. Look for more of this over the next 5 days as most MLPS pass their ex-distribution dates. Stock futures are a little soft...crude oil was flat and natural gas was higher this morning.

Its an early post and at this juncture no morning headlines and no upgrades or downgrades but it is early and i will post headlines as they break.

Thursday, April 26, 2007

Both Hilands are down 2.10. So much for a bottom there.

Hiland GP is now down 2 and change and under 29. There is a 23000 share block sitting at 29 at this time. The MLP index is down just a little over a point as it comes off the lows. Oneok(OKS) is up 2 points and leads the list of winners.

The MLP index dropped down over 2 points at one juncture this morning. There are a few distortions going on. Oneok is ex distribution today as is Teppco and Kinder Morgan Partners so they are all dragging the pure number on the MLP index. Actually most MLPS are higher today.

Holly Partners (HEP) is ripping the cover off the ball today up 1.50. No news. Oneok LP is up 70 cents after you adjust for the distribution. And there are lots of fractional gainers on the board.

No surprise to see downgrades of Hiland LP (HLND) and Hiland GP (HPGP) but i wonder if most of the selling was done yesterday. Both are down 1 and change but Hiland LP beginning to stablize in here. We'll see.

DUKE MIDSTREAM UPS NICELY

MLPS did it again yesterday with a nearly 1% gain which was a large move for this group. The big market rally just carried the group along. And it looks like another up open is ahead with the overall market strength bleeding into this morning's trading.

Amerigas (APU) gets an upgrade to outperform from market perform by the folks at Wachovia. They are downgrading Hiland Holdings (HPGP) to underperform from market perform after yesterday's non distribution hike. Hiland Partners (HLND) gets taken down to market perform from outperform.

Duke Midstream (DPM) raised its distribution by 3.5 cents...which is a nice boost!

More coming as headlines cross this morning

Wednesday, April 25, 2007

After the close Duke Midstream (DPM) announced a nice increase in its distribution.

The AMZ index is up 2.50 points as of 1pm. 1 point plus gains in Markwest (MWE) E V Partners (EVEP) and Tortoise Energy (TYG). And we have tons of fractional gains elsewhere. Only a few small losers like Williams (WPZ) Holly Partners (HEP) and one or two others.

NEW ALL TIME HIGHS KEEP ROLLING ON

HIGHER HIGHS AGAIN TODAY?

Another all time high close on the MLP index which hit 330 yesterday. More on that later but it appears we have another higher open this morning. Stock futures are positive and the energy complex is trading higher in the pre-market. Distribution announcements for Hiland Partners (HLND) and Hiland Holdings (HPGP). No increase in the distributions this quarter...and i was hoping for a stock split but none announced.

Lehman Brothers takes Sunoco Logistics straight from overweight to underweight and not stopping at equal weight. Lately downgrades haven't done much to take down prices which is the signature of a bull market. We'll see if it does something to a stock in which most anal-ists have been neutral at best. Nothing else on the upgrade downgrade list. RBC starts Inergy (NRGY) at market perform.

Since this bull move in MLPS began last September the AMZ MLP Index is up from 270 ish to 330 or 60 points or 22.5% and that does not include 3 distributions (including the ones coming up in the next few weeks) which brings your total return on the index to nearly 27%! It has been an amazing move and I think now might be a good to re-evaluate. My initial view was that the rally which is being driven by stable 10 year rates...rising energy prices...and an increase in interest from investors could take us to the 400 level on the index. This would mirror the move that occured in 2000-2001 which took the index from 190 to 270 while the rest of the market tanked. There are new investors coming into the group. I have noticed in the last few weeks a sharp rise in new visitors to this blog for instance that have gotten here through their google searches. I have seen a 40% increase in my page views in the last few months. Good for me of course, the more readers the better. But i think this is an indicator of a new group of buyers putting their cash to work. As a result of this new market view of MLPS there has been a compression of yields. This new driver of prices could take us to higher levels. So until we see otherwise the path of least resistence continues to be up; although I must admit that a correction at some point my be nice to shake out a few weak hands and bring prices down for fresh investing. Bull markets are seldom accomodating.

I am working again this morning so i will try and post again around lunchtime.

Tuesday, April 24, 2007

The MLP index traded over 230 this morning but it has pulled back..still higher by a few ticks as of this posting. More MLPS are down than up but nothing too big on the losing side at least so far. Markwest Hydrocarbon (MWP) and Atlas Pipeline Partners (APL) are the 2 biggest losers so far down around 70 cents each.

Calumet LP (CLMT) Nustar (NS) and Duncan Partners (DEP) are solid winners today up major fractions but nothing news driven. Holly Partners(HEP), Hiland LP(HLND), Oneok LP (OKS)and Sunoco Logistics (SXL) all showing solid gains as well.

WAITING FOR MORE DISTRIBUTION INCREASES

Global Partners (GLP) announces a distribution increase.

more to follow shortly

Monday, April 23, 2007

Penn Virginia Resources (PVR) and Calumet (CLMT)are down 40 and 80 cents respectively as the 2 biggest losers. Penn Virginia got a downgrade this morning. No news on Calumet.

MLP rally is unrelenting and 330 could go today especially if the overall market mounts an all out assault on 13k. Look you know things are good when Crosstex (XTEX) doesn't raise its payout and the stock is up anyway!

STILL NO SIGN OF A TOP

Its a Monday morning following Friday's melt up of 150 on the dow. MLPS closed higher but finished below an all time high close so we wait for the open. After the close Friday Linn Energy came out official with its already announced distribution increase and is affirming the next quarter increase as well. Crosstex LP (XTEX) and Crosstex (XTXI) announces their respective payouts no increase but that was expected.

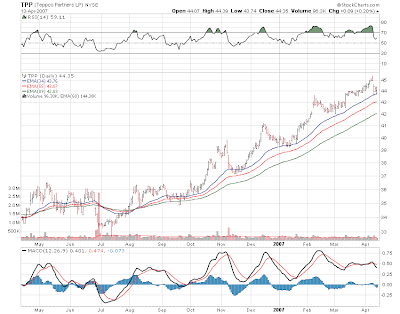

Friedman Billings is on the wire this morning as they are dropping coverage on a host of MLPS include Plains All American (PAA), Oneok (OKS), Teppco (TPP) and Enbridge (EEP,EEQ). They had market performs on all of them.

The MLP index was up about a point on Friday and i guess we'll start on the upside today. This should be a busy week for earnings and distribution increases. News headlines when they break.

Saturday, April 21, 2007

Friday, April 20, 2007

Markwest Energy raised its distribution for the quarter in news issues last night and it has also will be switching to the the NYSE. The stock is up 2o cents this morning.

I am running around this morning so i will repost a little later with an update.

Thursday, April 19, 2007

TC Pipelines (TCLP) did a nickle boost in the distribution and the stock is up 2 bucks. Duncan Partners (DEP)otherwise leads the short list of winners up 38 cents.

Very weak S&P futures setting the tone this morning on the financial markets so i guess it means a down open for MLPS although i've been fooled by this before. It apparently started in Asia last night and spread to Europe this morning. So with that backdrop we have soft crude oil and stronger natural gas. Gasoline is flat. One issue that will be down at the open anyway is Penn Virginia Group (PVG) which was cut to hold from buy at Wachovia. Stifel Nicholas starts it at hold along with Penn Virginia Resources (PVR). Also this morning Natural Resource Partners (NRP) starts trading with a 2-1 stock split.

Not much else is happening this morning. No clues on the impact of Kinder Morgan Partners (KMP) on its stock in the premarket. Scroll down to last nights final post for news after the close on several issues. Nice distribution increase from Copano as they up 2.5 cents. So far no indication of the distribution increases being already priced into MLP prices.

Two observations. On the discussion group of Energy Transfer Partners (ETP) "chart" (a wise mlp sage from upstate NY) points out that a major repricing of MLPS has been underway. The way in which MLPS have been viewed by the market as a bond proxy seems to be changing to the view that these are companies that sell products and make money. I agree with this. Also I have also noticed an increase in my own page views and when I check the sources for the increase I am seeing many more google searches on MLPS than i did just 6 months ago. Mean MLP yields continue to drop and are sitting under 6%. This does not include any distribution increases coming this quarter. So there is definitely more going on here than just an MLP rally as the stock market makes new highs.

Wednesday, April 18, 2007

Kinder Morgan earnings and distribution announcement.

Copano (CPNO) raises its distribution.

TC Pipelines raises its distribution by a hefty nickle.

Energy Transfer Partners (ETP) expanding its propane business. Not sure what is new here.

More as any headlines break. Kinder Morgan has some stock for sale below the close but no takers so far.

Calumet LP (CLMT) is down 2 and change as the biggest loser but this one has been a stellar performer. No news so it may just be profit taking. Suburban Propane is down 64 cents. The coal lp's and gp's are down as coal stocks are selling off hard today. Alliance LP (ARLP) and Penn Virginia Resources (PVR) showing fractional losses.

Heading for lunch. Overall market is firming so i expect another rally and another all time high close this afternoon.

We'll probably trade off some news after the close yesterday as Oneok LP (OKS) ups its distribution again. The old Northern Borders Partners was stuck at an 80 cent distribution it seemed like forever and the stock had traded around or under 40 dollars forever...and we're now near 70 as the distribution has gone from 3.20 annual to near 4 bucks now. Not bad. Plains All American (PAA)raised its distribution yesterday afternoon.

The AMZ MLP index opens today just under 326...new all time highs (AGAIN)

No sign of a top...we're up 8 of the last 9 days...long in the tooth short term but i'm not good enough to predict when a correction will come.

Hiland LP and GP (HLND,HPGP) announced that its long time leader would be stepping down in the next few months and he has done just that with an interim president and ceo in place until the permanent one is named...which is expected soon. No other news this morning and no upgrades or downgrades.

Tuesday, April 17, 2007

Meanwhile up nearly 1 on the index as the overall market is firm..energy is higher and 10 year rates are lower.Energy Transfer Partners, Magellan Midsream and Constellation Partners are fractional winners and leading the way up.

Markwest Hydrocarbon (MWP) is down 1 and Natural Resource and Nustar are fractional losers at the moment.

Good Tuesday morning on this the most evil of days...tax day! My fed and state (NY) were 165 pages thick and cost 4 dollars each to mail. I've seen thinner novels published. Anyway better to make money and pay taxes than not to make money and not pay taxes. MLPS this morning start today 2 points higher than yesterday and at the usual morning perch at new all time highs. I think its clear that MLPS are among the market leaders in this rally phase that broadly began last October. Even the 500 pt down day in Feburary did nothing but produce a tiny blip for our group that you can barely find on the chart. So now we are beginning to see the distribution announcements for Q1 so we'll be watching for how the stocks react to earnings and distribution increases and whether those increases are priced in...or not. Also i think its time we see some stock splits..Hiland LP (HLND) looks like a candidate for a 2-1 split which would take it out of the appointment only trading list. Maybe its time for Oneok LP (OKS) which has gone from 40 to near 70. Natural Resource Partners (NRP) and Calumet (CLMT) also may be candidates. I am just putting the idea out there not that they really make any difference in the long run but it is something to trade on.

CPI will be dictating the pace this morning in the overall market which is a little softer pre-open. Tortoise Energy Infrastructure is getting its target upped by Stiefel Nicholas from 43 to 43.50 (why bother...50 cents? ). Otherwise the upgrade downgrade list is MLP free.

Please note that last night we got distribution announcements from Enterprise Products Partners (EPD) and Duncan Partners (DEP). Duncan is a new issue and the amount was pro-rated for the quarter. I posted about it along with a correction so scroll down or read it here.

Monday, April 16, 2007

Thanks to Alan for calling attention to this. Also after the close Enterprise Products Partners announces its distribution and so does Duncan Partners.

Not many losers on the board..Hiland LP (HLND) is down 50 cents as the biggest loser..and there are small losses confined to just a handful of issues.

WACHOVIA CUTS NATURAL RESOURCE

HOW MUCH CAN A PENNY GET YOU?

Meanwhile this morning Wachovia is cutting Natural Resource Partners from buy to hold. The stock has run from low 50s to 70 in this move so why not take some money off the table, at least in Citigroup's eyes. Crude is up this morniing and back to about 64 dollars so the energy complex continues to remain firm.

Finally there is Teppco which on Friday raised its distribution for the first time in ages by 1 cent! (who loves you baby! Telly Savalas?). The chart of Teppco has been a winner so the question is whether the 1 cent increase will be a disappointment or will it be viewed as Teppco at the beginning of a string of distribution increases?

Btw i finally got all my taxes done yesterday....165 pages thick between federal and state. It was a good year but frankly the IRS ought to at least send me a thank you card!

Sunday, April 15, 2007

Friday, April 13, 2007

One of those days where the MLP tape is like watching paint dry. Enterprise Partners (EPD) has cut its losses to a quarter of a point and that has put less of a drag on the MLP index.

Thursday, April 12, 2007

K-Sea (KSP) is adding another 75 cents to yesterday's big gains. Crosstex (XTEX) and Copano (CPNO) are both fractionally higher.

Well folks the winning streak of 6 days in a row has come to an end with yesterday's 1 point loss. I was starting to wonder whether we'd see a down day again. Close examination of several of the biggest moving MLPS in this bull run show that some MLPS have undergone or are undergoing a pullback. Hiland LP (HLND), Global Partners (GLP)Markwest (MWE) and E V Partners (EVEP) had downgrades providing the catylist for the pull backs.

Note that Hiland, Markwest and Global have moved to their moving average support lines and could be in a place where shares can be accumulated.( i am long Hiland and Global in the interest of disclosure). E V Partners began its drop yesterday and it could fall to 34-35 in order to meet its moving average. So if i were looking to buy this one back...that would be the place to start looking. Meanwhile there are some other issues that made new 52 week highs yesterday. Lets see first however if we experience 2 down days in a row before we call an end to this current upmove.

This morning is quiet on the news front and no upgrades or downgrades so far. Crude and nat gas are higher this morning ahead of nat gas numbers. 10 year rates are falling this morning. So we'll bring on the open and see where the morning trading takes us.

Wednesday, April 11, 2007

On the downside are the three stocks that were cut this morning with E V Partners (EVEP) down the most...1.50 at this time. Magellan Midstream (MMP) and Teppco (TPP) are down 50 cents each. Williams (WPZ) Copano (CPNO) and Nustar (NS) are all down fractions.

Still working on my taxes...what a mess! But the good news with respect to UBTI (unrelated business income) in my ira account is that it is a huge negative number. And Schwab says that number gets carried over into future years!

A.G. Edwards is downgrading 3 MLPS this morning and they have a good record at timing downgrades. They cut E V Partners (EVEP), Magellan Midstream (MMP) and Teppco (TPP) all from buy to hold. Oddly enough someone took 2000 shares of Teppco at 2 bucks above yesterday's close! I wonder whether the buyer got the news backwards! All three stocks have had great runs and some money should come out today.

MLPS made it 6 in a row yesterday and we'll see if today makes 7. Nothing out there other than these 3 downgrades to drag the group so we'll bet on another up close. But we got to get a down day sometime.

Crude a littlehigher this morning as is nat gas and gasoline. Stock futures are firm as we head into the open.

Finishing up my taxes this morning so i will post when i can.

Tuesday, April 10, 2007

Lunchtime now...we'll see if we can make it 6 in a row.

Btw my friend Stevie Applebee is blogging away on the Imus brohaha...a worthwhile read as always from a man who lives in his own sit-com!

The first earnings report of the quarter is out in the MLP group and its from Energy Transfer Partners which reports higher profits thanks to a drop in costs while revenue was down a bit. Most of the time the market has this stuff figured out and its priced into the stock. Conference call to follow later this morning so we'll see if they say anything about the rest of 2007. Judging by the action of MLPS we are pricing in some good earnings and most importanly some healthy distribution increases. The rally has been pretty sharp so there is no room for error here.

Meanwhile we're up 5 days in a row here...7 points on the MLP index to 321.80 or a little over 2%.

I am beginning to get a little concerned here that we have not had a pullback of any real consequence since late December 2006. At some point we have to at least pull back to the moving average support area but i don't know what the catylist will be. More and more attention is coming to this group. We have a lot of new owners here and yields have been driven down to where the spread between MLPS and the 10 year has narrowed to less than 2%...to the ones growing their distributions the fastest the spread is less than 1%. Now maybe with 10 year rates in a tight range and high demand for energy the group is squarly in the pocket of a long term bull move and that we have much higher to go here. Maybe the correction comes as the stocks go ex-distribution later this month and in early May. I would favor the view that the correction would be a sideways move for awhile. Meanwhile until it comes we'll just keep making money.

Nustar (NS) is the old Valero LP (VLI) which has been ripping higher almost daily. Even yesterday when the stock was downgraded by one of the brokerage houses the stock was up nearly 2 points at one juncture yesterday and still closed higher by 1.33. These guys are refining gasoline and with the pressure on gasoline and increasing demand going into the summer, these guys are getting attention. As always its hard to buy 'em when they are soaring but if gasoline is headed for 4 bucks a gallon, these guys are poised to do well. There is also the General Partner Nustar Holdings (NSH) which is sitting around 28 bucks and may stand to do even better than the LP if distribution growth accellerates.

Nothing on the upgrade downgrade list this morning. Crude is up this morning as it bounces from yesterdays 3 dollar correction. Natural gas is higher as well. Stock futures are flat.

Monday, April 09, 2007

Otherwise the rally just goes on with a nearly 2 point gain and we sit above 322. A long list of winners.witn Copano up over 1 and a long list of fractional plusses on the board.

Hard to argue with these charts here but in case you were looking for entry points and assuming they drop that low...as always...the moving averages to me look like the logical places to put buy orders.

Of course the MLP Index has been just ripping higher and higher.

The weekly chart has not corrected at all since the up move began in late September 2006. There has been some discussion about the correction, when it comes, what form it will take. Its on the Yahoo ETP message board and its worth a read as the poster here (named "chart") will occasionally pontificate on MLPS and the faithful would be wise to read it!

Copano (CPNO) announced another purchase Thursday after the close...although it is a relatively small one.

No corporate news breaking this morning. Crude oil is down this morning but stock futures are up as we continue to trade off Friday's employment numbers which were out on a day where the market was closed. So lets bring on the open!

Thursday, April 05, 2007

A good way to go into the weekend.

Another day, another new all time high as we kick off the last day of this trading week. We're at 317.91 this morning and i guees with the 3 day weekend approaching why not go out on a high note.

What can i say...we're in a powerful bull move. No sign of a top.

Its one of those mornings where we have no news and no upgrades or downgrades so unless some news breaks we will await the open.

Wednesday, April 04, 2007

One of those days today where i had to take care of some college stuff with daughter number 1 and i found myself in a place where i could not get a wireless signal. I will attempt to get caught up bu we had another new all time high close on the MLP index. And now i'm at work exhausted so i'll get it up to speed for tomorrow.

Big news for Buckeye Holdings (BGH) which is being sold to a group that is led by a former big cheese of Plains All American (PAA).Also involved are Lehman Brothers and some priviate equity. It was good for nearly 3 points before settling up 1.43. Still thats a nice move for a 20 dollar stock.

Tuesday, April 03, 2007

Markwest (MWE) is down 1 on the Wachovia downgrade and they are the biggest loser. A few others a down a bit like E V Partners after a big run-up recently. Also Global Partners is down a fraction for the same reason.

Who can aruge with the performance of Natural Resource Partners (NRP)?. The stock has been ripping the cover off the ball for weeks now and has been one of the leaders in the MLP rally. Well the company is buying more coal reserves which is more of the same thing they've been doing for these last many months. Crosstex Energy (XTEX) is starting up a new pipeline in Northern Louisiana. Lehman Brothers takes the stock down to market perform from outperform which puts them in line with all the other brokerage houses. (there is no one left to downgrade and the stock might actually rally on this).

Compared to others in the group the Crosstex LP chart looks like a mess as its been in a tight range for quite awhile where as the chart below of Markwest Energy (MWE) is just fabulous!

Well Wachovia says this morning that it might be time to take some chips off the table as it downgrades the stock to hold from buy.

Meawhile this morning in the pre-market Kinder Morgan Partners (KMP) is trading up nearly a dollar higher as it is getting a goose from Jim Cramer. Actually Cramer does make the point that if Iran brings about a disruption of supply it could be very good for the domestic oil and gas pipelines. Something to bear in mind. Kinder Morgan has seen some trades nearly 1 dollar higher from yesterday's close in the pre-market.

The MLP index closed higher yesterday so it sits just shy of an all time high.

Still no sign of a pullback.

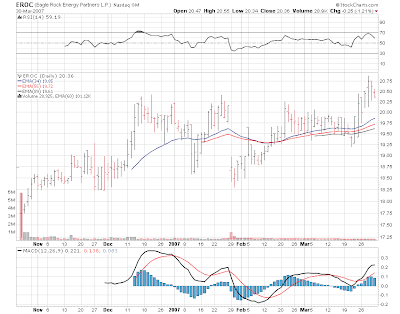

This morning we have strong stock futures strong and the energy complex is lower with oil down nearly 80 cents and nat gas down some pennies. News as it breaks this morning. Eagle Rock Partners (EROC) which announced a deal yesterday also came out with earnings last night.

Monday, April 02, 2007

NEW QUARTER BEGINS WITH NO SIGN

OF AN MLP TOP

Monday morning in a new month in a new quarter and we begin with a deal. Eagle Rock (EROC) is buying assets of Laser Midstream and others which will be paid with a priviate placement of shares. Stock should move higher on the news.

Also this morning we start a new quarter after 2 nearly straight up quarters and a 13% total return in q1 on the mlp index.

I have to think we have got to get a correction sooner or later but who knows when that will happen. Rather than predict it i'll just wait for it to evolve.

No upgrades or downgrades this morning so far.

Btw it took me 20 years but i finally won an emmy award last night! I'm a happy camper.