Friday, May 29, 2009

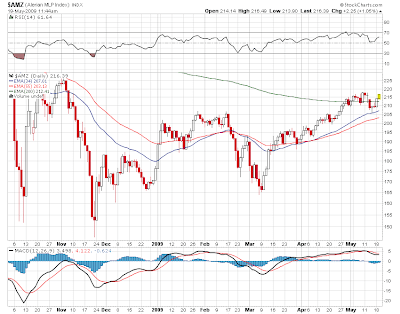

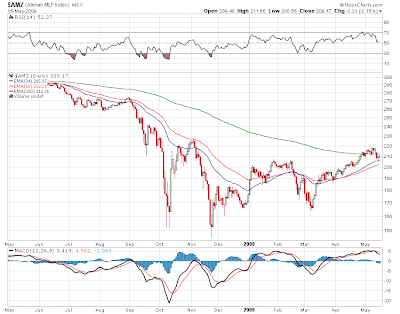

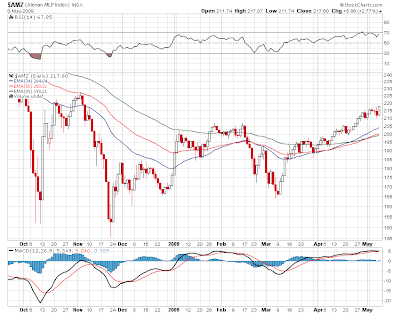

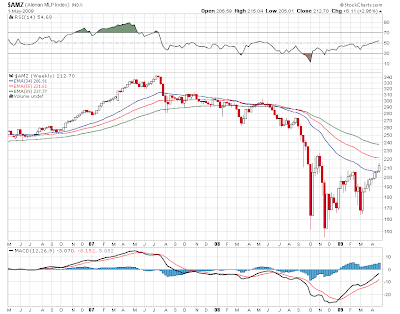

Closed at 227.05 which beats the early November high by 3 points as the dow rallies up 96 points at the close. This has got to be end of month stuff going on here but the path of least resistence is higher. A pullback could come at anytime of course and i will evaluate Monday's trading to get some clue as to whether we correct back to the 210 area (which is where the rising moving average support lines are) or do we run to the next level which is 240 on the MLP index.

A 4 point gain on the mlp index which is being led by Kinder Morgan Partners (KMP) up 1.65. Only 5 mlp issues are down and except for Exterran Partners (EXLP) the rest are occupying the land under 10 dollars.

I guess the intraday November high of 227.45 has a chance of being taken out especially since we could see some end of month action in the last hour.

I hope everyone's portfolio is feeling better these days.

I guess the intraday November high of 227.45 has a chance of being taken out especially since we could see some end of month action in the last hour.

I hope everyone's portfolio is feeling better these days.

At little after the noon hour and up 3 on the mlp index while the overall tape is essentially flat. Holly Partners (HEP) is up 1.30 and leads the winners list. Nustar (NS) and Sunoco Logistics (SXL) are up nearly 1 each and Nustar is at another 52 week high. Lots of fractional gains strewn across the board.

Not many losers on the list today. Looks like a nice finish to a nice week!

Not many losers on the list today. Looks like a nice finish to a nice week!

Up nearly 3 now at 225 plus so we have pretty much hit that 226 target in my book. At some point a pullback will be in order but with energy rising its hard to know when that point will be reached. Again if we decisively take out 225 then the next logical place on the chart is 240.

Nat gas numbers due out any minute. Might be nice if two of my holdings, Penn Virginia Holdings (PVG) and Exterran Partners (EXLP) move please. They've gone no where this week.

Nat gas numbers due out any minute. Might be nice if two of my holdings, Penn Virginia Holdings (PVG) and Exterran Partners (EXLP) move please. They've gone no where this week.

THE NOVEMBER HIGH!

I posted last night that my 226 target is within reach and looking at the way the markets and energy are behaving in the pre market we could get there in the first half hour!. Of course the obvious question is now what.

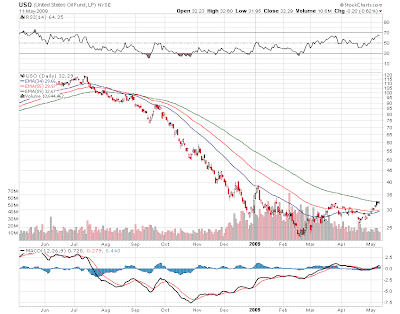

We are at a bit of an important inflexion point in my view. If we breakout above 226 and keep going i mentioned that the next logical stop would be 240 and that takes us back to last September before the meltdown. Certainly with crude above 60 dollars it is helpful to mlps that have been hurt extra hard by the collapse in oil to 33 bucks. Nat gas is only now perhaps coming off its low and is back above 4 dollars. There is room for nat gas to rally in here. Looks like laddering in for me was a good thing as i am now sitting on a nice profit after just a one day move.

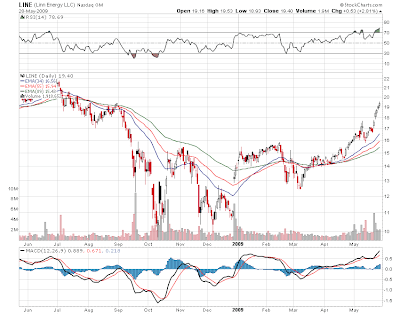

We are at a bit of an important inflexion point in my view. If we breakout above 226 and keep going i mentioned that the next logical stop would be 240 and that takes us back to last September before the meltdown. Certainly with crude above 60 dollars it is helpful to mlps that have been hurt extra hard by the collapse in oil to 33 bucks. Nat gas is only now perhaps coming off its low and is back above 4 dollars. There is room for nat gas to rally in here. Looks like laddering in for me was a good thing as i am now sitting on a nice profit after just a one day move.Linn Energy got another Cramer goose on mad money last night and the stock is back at 20 dollars this morning in the premarket.

20 takes us back to last September before the meltdown. Glory!

20 takes us back to last September before the meltdown. Glory!This morning no corporate news and no upgrades or downgrades so far. Crude is up a buck to 66 and nat gas up 11 cents to 4.07 as of this post. Nat gas numbers due out today are expected to be bearish showing a rise in storage. If thats already baked into the cake it could move higher. Stock futures are up 7 points before the 8:30 news onslaught begins.

Thursday, May 28, 2009

Nustar is making 52 week highs. In fact its at 18 month highs!!! All time highs are up around 60 bucks.

Those numbers above are the open intraday high low and close on November 4th. We're very close here! Now in the event that we clear that level the next important level in my view would be the 240 level.

| 4-Nov-08 | 222.92 | 227.45 | 222.92 | 225.05 | 0 | 225.05 |

Those numbers above are the open intraday high low and close on November 4th. We're very close here! Now in the event that we clear that level the next important level in my view would be the 240 level.

THE SAGA OF THE TEN YEAR!

In case you weren't paying attention the 10 year yesterday sent you a wake up call as rates soared yesterday some 20 basis points to 3.75% which sent the stock market into the toilet with a loss of 175 on the dow. MLPS held on to a fractional gain yesterday which considering what happened after 2pm yesterday was quite the victory.

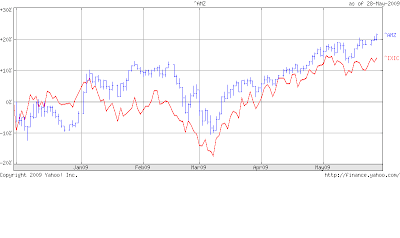

Now at least so far this rise in rates for MLPS has not been a bad thing at all. Notice that mlps and rates bottomed around the same time last December and they have rallied together. Remember i said at least so far it hasn't been a bad thing. Much of the rate rise has been the improvement in the credit markets. Now however the rate rise is taking on the fact that we have endless bond supply coming to the market and the fear that all this government action will mean inflation down the road. Fears need not necessarily mean reality however so until we see divergence between MLPS and the rise in yields, the uptrend remains intact.

Now at least so far this rise in rates for MLPS has not been a bad thing at all. Notice that mlps and rates bottomed around the same time last December and they have rallied together. Remember i said at least so far it hasn't been a bad thing. Much of the rate rise has been the improvement in the credit markets. Now however the rate rise is taking on the fact that we have endless bond supply coming to the market and the fear that all this government action will mean inflation down the road. Fears need not necessarily mean reality however so until we see divergence between MLPS and the rise in yields, the uptrend remains intact.This morning we have flat stock futures, flat energy prices, flatish gold, flat dollar except against the yen where its soaring for whatever reason. No corporate developements and no upgrades or downgrades.

Wednesday, May 27, 2009

One of the interesting developements in this rally phase is watching how mlp's behave during sell offs. They tend to outperform on a relative strength basis and this is a very good sign. Now after a day like today where the dow sells off 180 points we will probably play a little catch up tomorrow. Also interesting today is the fact that crude did not sell off with the market. And nat gas closed unchanged on the day.

Watching for any headlines after the close.

Watching for any headlines after the close.

We are now over 221 and up 2 and some change in here. 1 point plusses in Alliance Resource (ARLP) Energy Transfer (ETP) and Kinder Morgan Partners (KMP). Most mlps showing fractional gains in here including Penn Virginia Resources (PVR), Natural Resource Partners (NRP) Alliance Holdings (AHGP) and Enbridge Energy Partners (EEP). Looks like the coal mlps are leading today as coal (KOL) is up 4% today.

Not many losers and most are down 20 cents or less. Nothing of note there.

Not many losers and most are down 20 cents or less. Nothing of note there.

APPROACHING 220!

Nearing 220 on the mlp is where our target was when this sawtooth rally began in January and then began again in early March. Still no sign we've reached a top yet but 225 looms large and we will watch what happens when we get there.

Its a pretty quiet morning around here with no corporate news and no upgrades or downgrades so far. Curde is nearing 63 dollars. Nat gas traded lower and closed higher yesterday as it neared its low from a few weeks ago so a double bottom could be forming there (we can only hope and pray). Stock futures are flat to a little lower after yesterday's big rally.

Tuesday, May 26, 2009

A one and three quarter point gain on the MLP index on a day with dow up 150. No standout gainers as the biggest winners like Buckeye Partners (BPL) Transmontaigne (TLP) and Suburban Propane (SPH) are up major fractions but no one point winners yet.

A few mlps are down with Alliance Resource (ARLP) the biggest loser off 50 cents and Breitburn (BBEP) is down 46 cents as a larger percentage loser. Otherwises most losses are small fractions.

Markets have a tailwind today so i expect a challenge to the 220 level. later today.

A few mlps are down with Alliance Resource (ARLP) the biggest loser off 50 cents and Breitburn (BBEP) is down 46 cents as a larger percentage loser. Otherwises most losses are small fractions.

Markets have a tailwind today so i expect a challenge to the 220 level. later today.

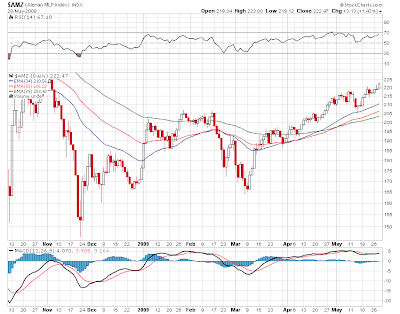

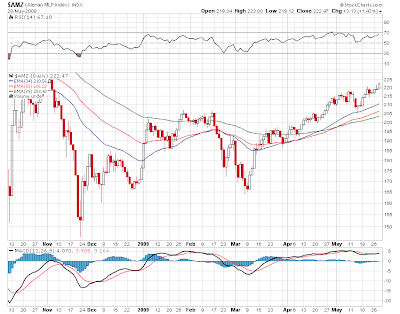

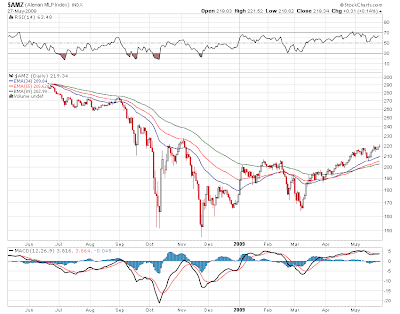

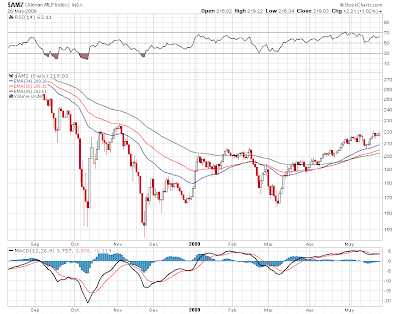

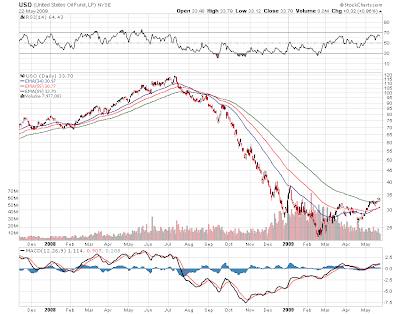

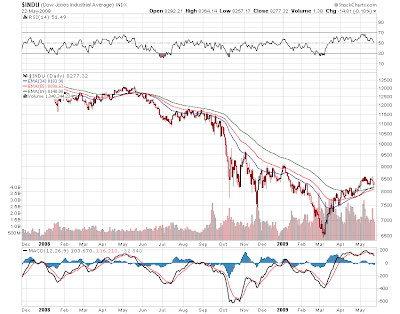

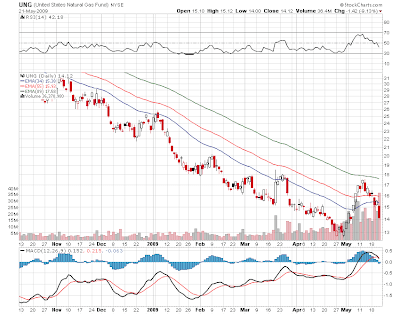

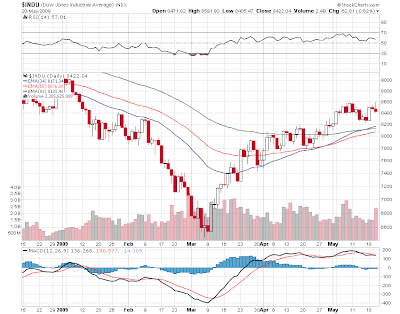

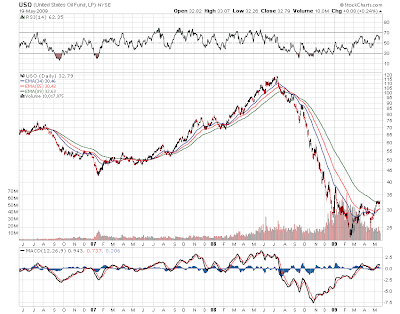

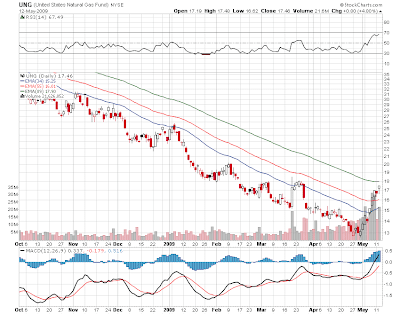

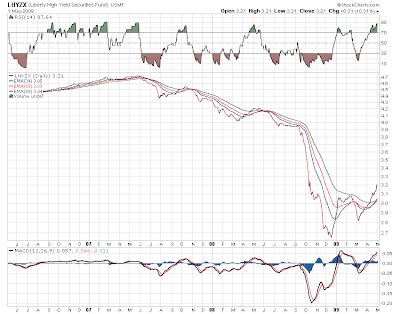

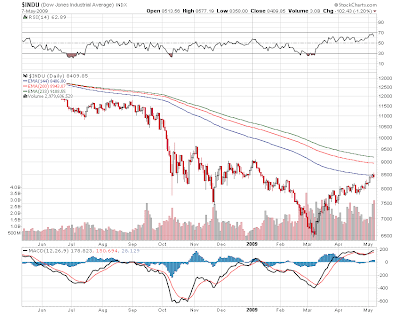

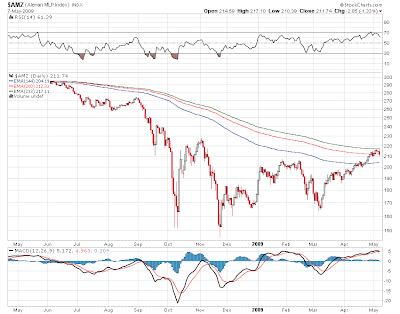

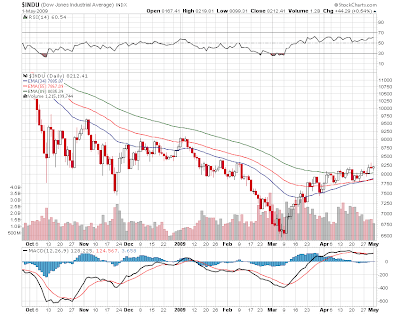

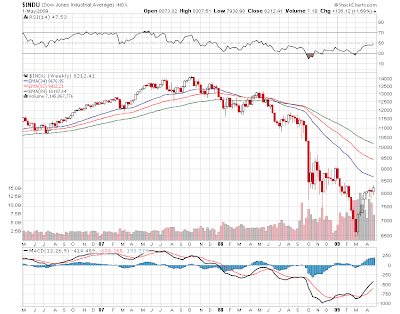

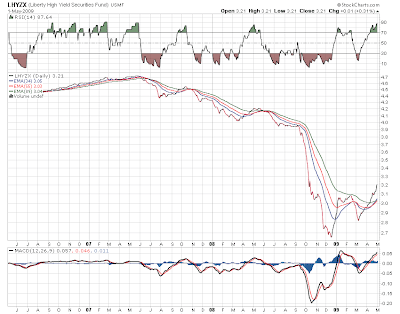

4 RELEVANT CHARTS

Tuesday after a long holiday weekend requires a little brain refreshing so here are 4 charts this morning and let us see what conclusions or ideas if any we can derive from them.

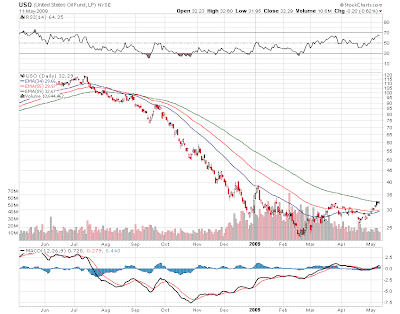

That Nat gas chart by far is the worst looking and it seems that only now that it is trying to carve out the beginnings of a bottom. The downtrend is broken but as measured by the UNG we could be in a range of 13-17 for a little while. I can't believe nat gas is going under 3.00 in the futures so this should be a safe place to accumulate in here.

The crude oil chart on the other hand looks a lot more constructive and we have a nice base built there. As measured by the USO it could run to 40 before being turned back. That takes us back to the December high. And of course equities will play a roll here as it appears 50 s&p points equals about 7 dollars in the crude price. Players can use the USO or for the more agressive the DXO which is the double crude and do "ladder" in.

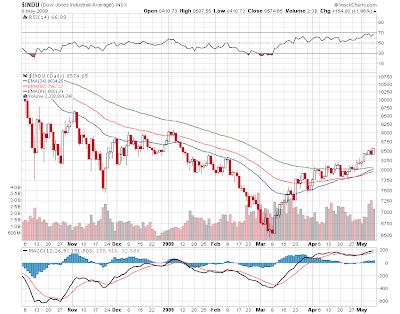

The dow chart is still in the context of a base and it has an inverse head and shoulders look but to confirm that we need to take out 9000 which only takes us back to January 1st on that chart. The mlp index of course has been in its own little world as its up nearly 30% total return since January 1st. If it ain't broke don't fix it is my view. We're the leaders here and there is no sign if that changing.

This morning is free of corporate developements. We do have Citigroup downgrading Legacy Reserves (LGCY) but they have a 14 dollar going priviate offer on the table. Stock futures are only slightly lower as they have rallied from the morning lows of -7 to -2 on the S&P. The open lies straight ahead.

Friday, May 22, 2009

CALL ME NUTS BUT I'M BUILDING

A NAT GAS POSITION

A NAT GAS POSITION

I know...I know...the chart looks awful but i think we're in a good place in here to build a position in Nat gas using UNG. I've been buying a little each day and if this hideous chart bears me out i think we are putting in a double bottom in here (i hope) in which case a rally to the low 20s seems doable.

Everything in nat gas is bearish. Its so bearish and we're in the 3.50 area in futures. I just think this is a good place and that its all sold out. The rest of energy has rallied and perhaps its time for nat gas to catch up. Just my lil ol humble opinion and no guarantees folks.

Okay its Friday ahead of the holiday weekend and coming off yesterdays 2 point loss in the mlp index which was well off the lows. Markets are firm this morning ahead of the open so perhaps we will go into the weekend on an up note. The 8250 level has held yet again on the Dow Industrials. I still have a 225-230 target on this move for MLPS so there is still some upside headroom. No corporate developements and no upgrades or downgrades at this early hour.

I will be running around today so i will post on the twitter bar when i can. Note that after midday i would think trading will slow to a crawl anyway.

Thursday, May 21, 2009

Looks like MLPS are having one of those sharp corrections with the index down nearly 4 points in the early going. Nat gas numbers due out shortly.

Energy Transfer Partners (ETP) and Alliance Resource (ARLP) are down 1 and some change as the biggest losers. A few fractional winners include Linn Energy (LINE) Transmontaigne (TLP) and Exterran Partners (EXLP) but the moves are relatively small.

Energy Transfer Partners (ETP) and Alliance Resource (ARLP) are down 1 and some change as the biggest losers. A few fractional winners include Linn Energy (LINE) Transmontaigne (TLP) and Exterran Partners (EXLP) but the moves are relatively small.

Linn Energy (LINE) got some nice attention on CNBC'S Mad Money! I have to post the link rather than embedd the video because for whatever reason the html embedd code screws up my blog! Ugh!

Linn up 75 cents in the pre market.

Linn up 75 cents in the pre market.

WHICH CHART WOULD YOU RATHER OWN?

A tale of 2 charts this morning of action from late December to yesterday. As to the answer to the question i think its pretty obvious.

Since January 1st the mlp index is up from 176 to 220 (yesterday's high) which is a 44 point gain or 25%!!! Add 2 distributions and you have total returns over 30% since January 1st. Also note the first rally in mlps took us to 206 before a pull back to 167 intraday and now from the March low we've rallied 55 points from there! So even if you missed the first entry point in December you had another chance to get in. From here if the overall market pulls back so will mlps but we are way ahead of the game as opposed to the Dow which is still down on the year!

Usually heading into a holiday weekend corporate news from mlps tends to dry up and we have no headlines this morning. Nothing on the upgrade downgrade list either so far. Crude is down 1 and change and off yesterday's peak at 62 dollars. Nat gas is 10 cents lower to under 3.90. Adding to my nat gas long position this morning via the UNG if the opportunity presents itself.

Holiday weekend approaching so look for the trading pace to begin to slow late today or tomorrow.

Wednesday, May 20, 2009

Crude near 62 dollars but the overall market has turned lower with the dow down 60 points as we head into the close. The mlp hit 220 intraday and is below it right now. The index is still up nearly 3 points with a few minutes to go into the close.

Only a handful of mlps are down and mostly small fractions except for Spectra Energy Partners down 1.22 on its stock offering. TC Pipelines is up 1.41 on its Transcanada deal and is the biggest winner along with Atlas Energy Resources (ATN).

Financials leading the sell off into the close. Looks like the 8600 level is being a bit difficult to get through.

Only a handful of mlps are down and mostly small fractions except for Spectra Energy Partners down 1.22 on its stock offering. TC Pipelines is up 1.41 on its Transcanada deal and is the biggest winner along with Atlas Energy Resources (ATN).

Financials leading the sell off into the close. Looks like the 8600 level is being a bit difficult to get through.

Unit holders of TCLP should be happy with this deal with Trans Canada which reduces the distribution rights from 50% to 2% to the general partners. Headlines here. News release when it comes.

Up open as crude nears 61 bucks.

Up open as crude nears 61 bucks.

ANOTHER STOCK OFFERING; CRUDE OVER 60!

Spectra Energy Partners (SEP) joins the long list of companies coming to market with equity and they are selling 9 million shares. This will probably take a couple of points out of the price today.

Notice the stock chart has been remarkably in a range between 20 & 24 except for the period when markets imploded from October through December. In fact this stock never went anywhere close when the rest of the markets made their lows in early March.

The above chart is the crude chart as measured by the USO which is a proxy for crude. It has put in some sort of bottom after an extremely steep decline. It looks like we have bottomed down around 33 bucks on crude which translates to 23 a share on the USO. There is room here for a run as high as 40 on the USO which could mean a trip to 65 to 70 dollars for crude itself. Maybe this all is tied to a run in stocks to the 200 day moving averageS (dow 8800-8900), S&P (945). MLPs as we have pointed out have already pushed above the 200 day so we have a tail wind to take us to 220-230 land before we get a setback. Gasoline btw continues strong and is up an other 3 cents this morning. BTW for those of you who have to contemplate things like heating oil contracts or buy lots of gasoline it occurred to me that you can hedge your personal usage with these oil and gas proxies like USO,UNG,or UGA(proxy for gasoline) or even use the DXO if you want to double leverage crude. Add up your energy use for a year and then buy an appropriate number of shares. Its that simple. Then you don't have to worry. Keep that argument handy when the energy conspiracy theorists start raging.

Not much happening so far this morning in corporate developements and its a little early but no upgrades or downgrades so far. Crude inventory numbers are due out later this morning and that could provide some volitility. Stock futures are higher this morning at least so far.

Saw this on the Street dot com about a heavy mlp investor and what he is doing.

Tuesday, May 19, 2009

Holding on to gains in here and heading back toward the highs of the day at 216.82. Right now at 216.58. The tape for mlps feels like it normally does as trading normalizes. No more wholesale dumping into no bids like a few months ago.

Enbridge (EEP) leads the way up 1 and some change. Energy Transfer Partners (ETP) is another leader today up 1.

Crude trying for a 60 dollar close. Nat gas under 4 dollars again. UNG position is a little under water but not by much. Some short covering into the close of nat gas futures causing a few upticks.

Enbridge (EEP) leads the way up 1 and some change. Energy Transfer Partners (ETP) is another leader today up 1.

Crude trying for a 60 dollar close. Nat gas under 4 dollars again. UNG position is a little under water but not by much. Some short covering into the close of nat gas futures causing a few upticks.

RALLY ROLLS ON AS UPSIDE TARGETS NEAR!

The trading action of the last few weeks continues to signal that the path of least resistence remains higher. The dow looks like it wants to test the year high on January 2nd of 9000k and the 200 day moving average which is decending at a slower rate and sits below 8900.

MLPS meanhwile are above the 200 day which has turned flat and we can head 10 points above there to take us back to the November 1st high around 225. Wind remains at our backs and the index is higher by 2 plus points today as we march toward lunchtime.

The vast majority of mlps are fractionally higher with Enbridge Energy Partners (EEP) and Natural Resource Partners (NRP) among the bigger winners today up 75 cents or more.

Crude just broke out above 55 dollars last week and it looks like it wants to take out 60 in here which would be the next key level. Traders are happy with this stair step rise thats been in place there. Nat gas remains underwater for now but that could be in retest mode here. Watching carefully.

No corporate developements this morning and no upgrades or downgrades moving any individual mlp issues so far today.

Monday, May 18, 2009

Got the opportunity to earn a living today so i missed out on a nearly 5 point mlp index gain. No real news drivers but we did have Goldman Sachs (GS) put Holly Energy Partners (HEP) on the conviction buy list...which begs the question if only someone convicted should buy it. None the less ex cons or whoever else took the stock up 2 points to.28.25. They cut Teppco (TPP) but that stock still went up as it is tied to Enterprise and a possible takeover threat there. Alliance Resource (ARLP) Buckeye Partners (BPL) Buckeye Holdings (BGH) and Exterran (EXLP) were all one point plus winners.

Dinner calls..more later.

Dinner calls..more later.

SURPRISE...ITS THE 200 DAY MOVING AVERAGE!

Wasn't paying close attention to the fact the mlp index nosed above the 200 day moving average last week before closing underneath up but only a by a couple of points. Signs the repair job continues but we are at a critical place here technically. The dow needs to get back to 8900 to reach its 200 day and the S%P 500 is around 948 for the 200 day. So if we get an extension of this rally to those levels the mlp index should get above the 200 day. Something to keep an eye on.

Monday morning brings higher stock futures and higher crude by a dollar. No corporate developements and no upgrades or downgrades but its a little early. So it looks like a firm start after last week's selloff. BTW we broke a 9 week winning streak and you have to go back to the srping of 2007 to find a longer winning streak. We're even getting close to the 200 week moving average on the weekly chart btw so its nice to see the repairs continue. You can at least make money trading in this enviornment.

Working this morning so i will try and tweet some posts when i can. Check the twitter posts on the sidebar.

Saturday, May 16, 2009

Friday, May 15, 2009

PREAKNESS 134!

Okay boys and girls its the second leg of the triple crown and this one has some much excitement not just for Kentucky Derby winner Mine That Bird going for the second leg of the triple crown; but we also have a lady in the bunch Rachel Alexandra who is going to make this a race to remember.

What you want to know however is who is going to win. Well its time for this players never to be humble opinion.

1. BIG DRAMA

Absolute speed ball in here as he has thrown down the sword in all of his races and wings out 3/4 miles in under 109. He comes into this race with 6 wins in a row. The Swale win at Gulfstream came with a track record time although he was disqualifed and placed second there. We add an 1/8th of mile here to his longest race to date and i think the big question here is can he build up a big enough lead on a speed favoring track and then hang on for dear life in the end. He is morning line 10-1 so there is value here. Tend to think he will fall short when push comes to shove but he will be a factor underneath. Using

2. MINE THAT BIRD

Put me on the list of those who believe he is not the real deal here however lets make no mistake here. Calvin Borel was brilliant in his ride in the Derby by saving every inch of ground and passing tired horses in the stretch. He won't be 50 to 1 this time around. He will be just outside the main speed here and that will allow new pilot Mike Smith to maneuver into a good position early without much traffic trouble. My guess is he will lay back and make one good run into the close hoping that Big Drama and a few others just kill each other off in a speed duel. Siding with others in here.

3. MUSKET MAN

A better trip in the Derby probably cost this horse second money as he got edged out by Pioneer of the Nile by a nostril. This horse fires every single time he runs with 5 wins and 2 thirds in 7 starts. He is a lay back off the pace type and would love a speed duel upfront to make a run at the 1/4 pole. I think he could be a real player in here especially if the speed upfront collapses. Certainly should use underneath and he should be 8-1 or so which is a nice price. Definitely playable and a win candidate.

4.LUV GOV

Maiden breaker race above came on Derby day in the slop but it took this D Wayne Lucas/Marylou Whitney entry 10 races to get to wire first. Was it the slop that day that made it the game changer? Possibly. No doubt this is a talented colt but we're in the deepest end of the pool here. A wet track brings this guys prospects up a bit but you are asking an awful lot for a recent maiden breaker to take on horses at the top of the game. He'll be boxcar odds and you will be payed well in the unlikely event he gets to the wire first.

5.FRESIAN FIRE

He was no where to be found in the derby as the favorite where is was a victim of all kinds of traffic trouble. So he is back in here to try it again in a smaller field and if the track comes up sloppy again he could repeat his Louisiana Derby win shown above. But he going to have Big Drama up front and he is likely to stalk behind and pounce should the speed ball fall apart at the head of the stretch. However he won't be alone looking to take the lead and i wonder which Fresian Fire will we see today. You might get 6-1 or higher to find out which gives us some value here. He'll have to have everything fall his way to get his picture taken today.

6.TERRAIN

He seems to be looking for that breakthrough race. He did not run badly at all in the Bluegrass at Keeneland and he could be a factor in the lane especially if we get a quick pace. He finished second to Square Eddie who is not here due to injury. If he gets a hot pace and a little luck he could be one of those horses closing down the stretch. He's going to need a little racing luck. Jeremy Rose takes the reigns here who one a couple of years ago on Afleet Alex who fell at the head of the stretch and somehow he managed to stay on. Definitely usable underneath and you will get 30-1 or higher on a win bet.

7. PAPA CLEM

Finished an okay 4th and its awfully tough to make up ground in the Churchill stretch when your running in the middle of the race track but 20 horse fields will do that to you. His 2 slop races saw him lose by some lengths including a 7 length second to Friesan Fire in the above race. Maybe a better trip will make a diffence here and if we get the Arkansas Derby winner tomorrow he will be tough. Mixed feelings here.

8. GENERAL QUARTERS

No where in the derby. Maybe it was the slop. Maybe it was the fact that he was steadied twice in the race. So lets toss that one out and look back at his Bluegrass win which was pretty nice at 15-1. He stayed close to the pace and pounced at the head of the stretch and drove to a win. He has Julian Leparoux aboard who has ice water in his viens when it comes to riding. Still he may be a cut below others in here especially as many of the Derby finishers are back here for seconds. Looking elsewhere.

9.PIONEER OF THE NILE.

Okay i admit it. Put me on the list of the unbelievers in here who thought his west coast races were not impressive. Credit Garret Gomez for getting the horse up front early and away from the calvary charge behind him. Finished second in the Derby but it doesn't get my pulses racing that he ran the last 1/4 mile in something like 27 seconds while Mine that Bird ran it in 25. He is popular in the west and likely to be overbet in here. On the plus side the slop didn't bother him nor did the first trip on dirt so he could improve in here. Can't blame anyone who would bet him.

10. FLYING PRIVATE

Had to go all the way back to his maiden special weight race in Saratoga last summer where he flashed some talent. Since then his stock was climbing going into the derby with a decent 2nd in the Lanes End and a not bad 5th to Papa Clem in the Arkansas Derby. He clearly did not like the slop and finished in another zip code in the Derby. Prospects for rain at Pimlico no help here and he has yet to show any kind of breakthrough performance that you could point to and say bet me. Still eligible to run in a non winners of one allowance which doesn't say much. He'll be box car odds in here again and deservingly so.

11.TAKE THE POINTS.

Like how this horse has progressed. He is lightly raced and while he was clearly second best in the Sham he was second to The Pamplemoose who maybe was the best 3 year old around until he got injured prior to the Santa Anita Derby. Prado is back on who has been on him for his 2 wins. He will be a decent price on the odds board. Seems to fire every time and i think i will land here for my longshot pick Preakness winner.

12.TONE IT DOWN

Can't find a video link to his Tesio Stakes try. He is another lightly raced colt who has yet to try graded stakes company so its right to the deep end today. His 2 wins were okay but nothing special and while he has last years Preakness jock winner on Big Brown, Kent Desormeaux its going to take alot to bring this boy home as his speed figures are well below the best in here. Should finish up the track but if you use underneath in exotic bets you will get a price.

13. RACHEL ALEXANDRA

Super filly as Tom Durkin calls her and no doubt about it. Her 20 1/4 length win took her into another league in the girls division. New owners have decided to try the boys in here and i guess who can blame them. Owners are also the owners of Curlin who nosed out Street Sense 2 years ago. However this time she is facing the toughest race of her career and she will not be able to just simply stalk and pounce as Big Drama will run at a pace she has not seen. She draws post 13 which i think will be a huge advantage to her as Calvin Borel (who comes off the derby winner to stay with her which is unheard of) will be able to see how the race shapes up in front of him and will put her in a good spot. He said he doesn't know how good she is and he will have a great opportunity here to find out. Its her race to lose and at less than 2 to 1 odds she will be overbet and offer no value. So while i think she could win this race i think from a betting angle you can find nice prices elsewhere. But i will be routing for her and using in all double, pick 3, and pick 4 tickets.

PAYDAY!

For MLP holders today is a nice day as payout checks arrive so enjoy! Or re-invest! Whatever! The money arrives in time for the weekend. Friday looks like its starting out a touch soft but we have been enjoying some relatively strong Friday action lately and it could happen today. This week's action as has been nothing more than corrective in nature and should be used to perhaps generating entry points for those of you shopping for more shares. I still think we have more upside ahead of us.

Not much happening this morning on the news front. Corporate wise its quiet. Upgrade/downgrades are also quiet for now. Crude is about 1 dollar lower at 57 and change after reversing and closing higher yesterday. I guess unless we get some surprise headlines we forge ahead to the open.

Thursday, May 14, 2009

If...and its a big IF...we are in a developing longer term bull trend it would be logical for MLPS to pull back to the 34 day moving average and it did so this morning and we've bounced from there this morning. Got down to 205.90 and now wer're back around 208 as of this posting; still down on the day but well off the lows of the session. So it's a good sign and for the overall market they can't seem to take them down more than a day at a time; also a good time.

No corporate news is driving mlp prices so moves are fractionally in either direction with the list evenly split between winners and losers. Bigger cap mlps seem to be more on the losers list which is the reason why the index is still under water for the day.

CRUDE TURNS BACK FROM 60 AS MARKETS DROP!

Yesterday we talked about crudes run to 60 dollars and that is right to the top of the longer term trading range that has evolved over these past many months. The price turned down yesterday afternoon and those losses continue this morning as worldwide use is forecast to drop. Shocker there i know. Energy stocks dropped off yesterday and MLPS had a double headwind of falling energy stocks and weakness in financials. So the mlp index dropped 5 points yesterday. Okay i know the change said 8 points but for some reason there was a price error from Tuesday's close so the 8 points was actually a 2 day loss. Maybe it had to do with ex-distribution corrections which they sometimes do on the index all at once, although that explaination makes little sense to me since you would ex-dis the price down and not up. Nonetheless down is down. And for traders there is a lot of profit in this group as we remain up nearly 20% since January 1st.

Early post here with no news and no upgrades or downgrades so far. Stock futures are flat this morning. Crude is down a buck and we have nat gas stats out later this morning.

I'm working this morning so posts will be on the twitter bar on the side when i can.

Wednesday, May 13, 2009

Down over 5 points now on the day for the mlp index and 14 mlps are down 1 point or more including all the large cap members of the index. Oneok (OKS) Enbridge (EEP) Sunoco Logistics (SXL) and Plains All American showing losses of 1.50 or more.

Linn Energy (LINE) priced its offering at 16.25. The stock is unchanged.

Linn Energy (LINE) priced its offering at 16.25. The stock is unchanged.

The mlp index has some kind of distortion in it today. It shows that its down 5 points but i think i was not reset to yesteday's close which was down around 213 and change. So its actually down a little over 2 points here. For some reason the close for yesterday shows unchanged from the day before.

Markwest (MWE) is up 50 cents and leads the short list of winners. Most MLPS down fracitons to 1 point with Plains All American (PAA) down a little over 1 point as the biggest loser.

CRITICAL JUNCTURES HERE FOR OIL & NAT GAS

Charts for crude and natgas show us we are at some important inflection points. The nat gas chart has finally stopped that long hideous decline that began in August of 2008. I'm using the UNG as a proxy for nat gas here. The crude chart has a nice looking base here and we have taken it to the very top of that range as we near 60 dollars this morning. So inventory numbers this morning could be the catylist for a breakout or fakeout move.

Yesterday we saw MLPS follow the financials down and then bounce off the lows in the last hour while energy stocks actually finished higher on the day. We continue to follow the moves in the yield market rather then energy as a whole. Yesterday financials sold down as equity comes to market and perhaps mlps could have been taking some of that same perception. After all when your group is up 25% since January 1st, it is not a bad move for companies to take advantage of a double digit stock price to sell some equity. So far Holly Partners (HEP) Energy Transfer (ETP) Plains All American (PAA) Inergy Partners (HEP) Sunoco Logistics (SXL) Enterprise (EPD) Kinder Morgan (KMP) and Linn Energy (LINE) have come to market in the last few months selling more shares. Linn did it yesterday. ( I think i got them all here). One way to look at this is if the mlp rally continues, the companies that have done the equity offerings already could be free to move higher since there is a low risk of them coming to market to sell more shares so soon.

I combed through the EV Partners conference call transcript courtesy of Seeking Alpha and picked up on a few things. One is the company is planning to do some sort of purchase with some equity and that the company has been paying down debt in this enviornment and that they are hedged out to 2013. Also they are not very bullish on the nat gas price. Also we have the Markwest (MWE) conference call transcript. The stock closed down over 1 point yesterday after the earnings and ahead of the call. I couldn't find anything to cause the pullback there so it may have been just buy the rumour sell the news. On a question of what it would cost to tap the credit markets in this enviornment and the response was that the cost of money was probably some where north off 11.5% which shows you just how tight things still are in the bond market for some of these companies. 1.4 times distributable cash flow coverage is healthy so the 64 cent distribution seems safe. Earnings last night from Western Gas Partners (WES) which look in line.

This morning we have slightly higher crude, slightly lower stock futures. I've noticed that financials have turned lower this morning and they could be leading us down at the open again. Its a little early but some far no morning news items and no upgrades or downgrades.

Here is a piece on Investorpedia on MLPS recommending a few of them. Nothing new here but its a short read.

Tuesday, May 12, 2009

Financials and MLPS moving in tandem today with the mlp index down 4 points at 212. Both groups have had big moves so no suprise that we are getting a correction in here. Only a handful of mlps are up..the rest are down. 1 point plus losers include Inergy Holdings (NRGP) which as been among the best performers in the group. Linn Energy (LINE) is chewing through a public offering of shares so its also down 1 and some change.

Crude remains higher but off the highs and big energy stocks are holding up better in here. But if we are going to see the selloff expand this afternoon i would expect these groups will also give up the ghost in here. Dow is down 29 points.

Crude remains higher but off the highs and big energy stocks are holding up better in here. But if we are going to see the selloff expand this afternoon i would expect these groups will also give up the ghost in here. Dow is down 29 points.

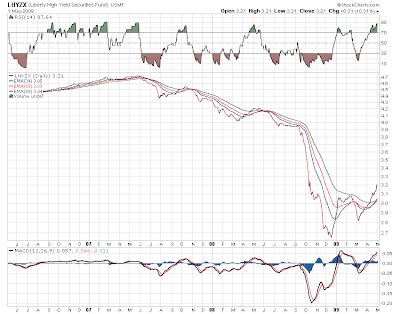

Thought i'd through up the high yield chart which is identical to the MLP chart. Note that we have a breakout here which is supportive for mlps. Also the crude price chart which is forming a nice looking base in here. The USO which represents crude i think needs to clear 40 for us to consider it a signficant upsde breakout.

OIL NEARING 60! BETTER TIMES AHEAD?

One of the points i have been making from time to time especially in private discussions (are there such a thing anymore?) is to watch the oil price as it will tell you whats really going on in the economy. If oil moves back up it will signalling that things are getting better. Well i want to take this out another step from there. 60 dollar oil is a magic number for many mlps that have commodity risk. Take Atlas Pipeline Partners(APL) for example. An average price above 60 dollars puts them in a much better financial position than at 40 dollars and it keeps them functioning without putting all sorts of lending and covenants in danger. Getting to 60 is one thing and keeping it there is another. But getting back to 60 is a good sign for all of us. Couple that with improving credit markets and MLPS continue to enjoy a tailwind that point to higher prices.

Earnings news leftover from last night include Markwest Energy (MWE). The company says they have the cash flow to pay that 64 cent distribution for the rest of the year. Thats good to hear. Also E V Partners (EVEP) put up earnings last night. I noticed that they used the March 31st oil price of 33 bucks and the company is 100% hedged out to 2011. Would like to have seen the coverage ratio but i will wait to hear it on the conference call.

Stock futures are higher after yesterday's apparently one day sell off of 100 points or so. Crude is up 1 and change pre market. Williams Companies (WPZ,WMZ) is having an anal-ist day so i will be looking for headlines in case anything is mentioned with respect to their mlp's. Also we have Linn Energy (LINE) doing a public offering of 4 million units.

Monday, May 11, 2009

The mlp index is down 1.34 which really isn't much on a down market day. Dow down 120 as i type.

DCP Midstream leads the winners list as its up over 19 bucks and ahead by 90 cents. Morgan Stanley raised the stock to equal weight from underweight. Inergy Holdings (NRGP) is up 80 cents and over 38 bucks.

On the losing side, K-Sea (KSP) is down 1 and change as the biggest loser but its the only one losing more than 1 point. Some of the coal mlps like Alliance Resource (ARLP) and Natural Resource (NRP) are down major fractions.

DCP Midstream leads the winners list as its up over 19 bucks and ahead by 90 cents. Morgan Stanley raised the stock to equal weight from underweight. Inergy Holdings (NRGP) is up 80 cents and over 38 bucks.

On the losing side, K-Sea (KSP) is down 1 and change as the biggest loser but its the only one losing more than 1 point. Some of the coal mlps like Alliance Resource (ARLP) and Natural Resource (NRP) are down major fractions.

Some breaking headlines for for you.

Hiland Partners (HLND) actually managed to make money.

Transmontaigne (TLP) downgraded by Stiefel Nicholas if anyone pays any attention to these things.

Regency earnings press release.

Atlas Pipeline (APL) and Energy Transfer (ETP) due out at any moment.

(added)...Dow Jones puts up on its headlines that Hiland reports a profit of 31 cents and it turns out to be a loss. Serves me right for depending on news services to actually be accurate!

Hiland Partners (HLND) actually managed to make money.

Transmontaigne (TLP) downgraded by Stiefel Nicholas if anyone pays any attention to these things.

Regency earnings press release.

Atlas Pipeline (APL) and Energy Transfer (ETP) due out at any moment.

(added)...Dow Jones puts up on its headlines that Hiland reports a profit of 31 cents and it turns out to be a loss. Serves me right for depending on news services to actually be accurate!

WEAKNESS TO START MONDAY MORNING

BUT NO SURPRISE!

BUT NO SURPRISE!

The runs have been pretty impressive on the short term charts and we're coming off a good week so it should be no shock really to anyone that we are starting the day with some weakness. The Dow chart is back to late fall levels and we are coming in toward the early November high of around 9000. MLPS pretty close to their fall highs and the wall there is around 225. MLPS are up 24% as measured by the index and that's without the 2 distribution checks!

News this morning from Regency Partners (RGNC). Headlines so far. No press release. Otherwise its a news free morning. Crude is down over a dollar and if it gets down to 55 this morning i may jump back in on the DXO which i sold out late last week. Though maybe a pullback was in order. If this is a bull move corrections will come sharp and not last long so eyes are on the tape with limit orders waiting. Nothing on the upgrade downgrade list.

Friday, May 08, 2009

Linn Energy (LINE) is up 1 and some pennies on an upgrade from Raymond James according to poster in the Linn message board and passed on by the great "printeam" thank you very much! Must be the reason why EV Partners (EVEP) has been tagging along with nearly a 1 point gain as well.

Plains All American (PAA) leads an expanding list of 1 point plus winners with the mlp index up 5.50 heading into the last 2 hours of trading!

Plains All American (PAA) leads an expanding list of 1 point plus winners with the mlp index up 5.50 heading into the last 2 hours of trading!

MLPS open sharply higher up 4 points on the index and getting everything back from yesterday's loss. Six mlps are lower. Everything else is higher. Buckeye (BPL) Teppco (TPP) Alliance (ARLP) Oneok (OKS) and Sunoco Logistics (SXL) all up 1 point or more. Inergy Holdings (NRGP) got a downgrade from Wachovia and even its up by a few pennies in early trading!

El Paso Partners (EPB puts up quarterly earnings and so does Constellation Energy Partners (CEP).

Futures still strong but off the highs of the morning ahead of the jobs number.

Futures still strong but off the highs of the morning ahead of the jobs number.

STEAMROLLER RALLY CONTINUES

AHEAD OF JOBS REPORT

AHEAD OF JOBS REPORT

Yesterday i posted weekly charts of the Dow and S&P index to show just how far down we are and how far we have to go just to get back to 4 year trendlines! The lesson there is that these markets can go pretty far and we would still be in the context of a long term bear market. Today lets look at the daily charts for some short term perspective.

These charts are signalling different things. The dow chart needs to run to almost 9000 to get to the 200 day moving average which is still decending but flattening out. The mlp index however has crossed its 200 day moving average only to close just underneath it yesterday. We have not been above the 200 day moving average since August of 2007. So after almost 2 years in a downtrend we may be seeing a reversal here which will have positive longer term implications. But markets will be markets and this is opinion and not a law of physics!

Stock futures are soaring this morning ahead of the employment numbers as the bank stress test is overwith and apparently the results made the market happy as far as future capital needs. We have some MLP earnings news on Crosstex LP (XTEX,XTXI) which has doubled this week ahead of these numbers. Of course thats from 2 to 4. Cheniere Energy (CQP) puts up earnings this morning as well. DCP Midstream posted last night and called their results "solid" which is nice to hear.

Dow futures up 105. Crude back up and at58 bucks. Looks like the employment numbers will be shrugged off unless they are worse than forecast. MLPS should rally with everything else. Yesterday's 3 point drop not a surprise considering the up move. Remember we are in bull mode for now so corrections will be sharp but short lived.

Has a colonoscopy yesterday which i posted "tweets" on the sidebar. I scoped clean and clear and i'm good for at least 5 years. Guys if you haven't had it done its really easy. The prep is the worst part of it as you clean out your plumbing the day before but the actual procedure is nothing. They knock you out for about 20 minutes and its done. No soreness afterwards, nothing! 24 hours of crap for peace of mind. Well worth it.

Thursday, May 07, 2009

Global Partners (GLP) announces earnings and a unit buyback! Breitburn (BBEP) puts up earnings this morning. Targa Natural Resources (NGLS) announces its quarterly numbers.

Linn Energy posts earnings. Atlas Energy Resources (ATN) posts earnings as well along with Suburban Propane (SPH).

ROLLING RIGHT ALONG, MORE EARNIGNS

& CRUDE HEADING TO ?

& CRUDE HEADING TO ?

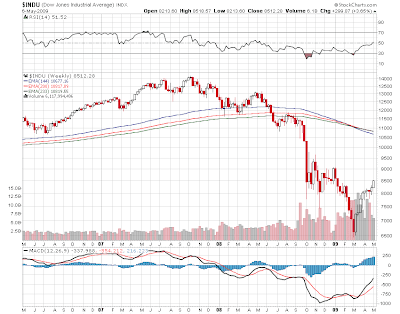

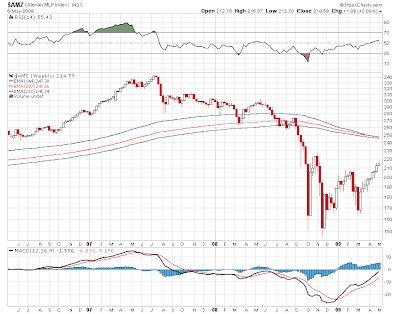

Thought it was time to take a look at the Dow chart and the MLP chart but this time we are looking at them on a weekly basis and i changed the moving averages to 144,200 and 233. Notice just how far below the 200 week moving average we are!

Also a bit disturbing is the fact that the moving averages are laying on top of each other and beginning to cross to the downside! 200 weeks is almost 4 years! And think about the fact that this rally has taken us back very little when you look at the chart in its entire context. There is still so much headroom that the dow can get to over 10,000 and we would still be below the those longer term averages. We need to keep this in mind. If this rally should end and the selling resume i won't be a big surprise. But we will leave that for another day. For now prices still want to go higher. The same holds true for the mlp index but we only have to get back to the 240 level which is 15% higher from here.

Earnings this morning from Holly Partners (HEP) which just completely its stock offering and we also have earnings from Exterran Partners (EXLP). There are other earnings due out this morning and after the close. Also last nights earnings news posts are on the twitter bar on the side.

Crude is up 1.60 this morning and nearing 58 dollars. That breakout above 55 was important and now buyers are adjusting to a new trading range. Looks like we should make a run for 60 bucks short term. Stock futures are higher this morning ahead of retail sales and stress test results which are due out later today.

Wednesday, May 06, 2009

The mlp index is basically unchanged after opening lower and trading down over 2 points. As mlps go ex-distribution they sell off in the morning as yield holders cash out and then start to rally back. Take DCP Midstream for example which went ex-distribution. It traded down from 17.69 at the open to 15.91 and has now made it back to 17. Stand there with a catchers mitt and you could get lucky.

Atlas Energy Resources (ATN) and Atlas Holdings (AHD) are up 1 apiece and for the latter its a huge percentage gain. Inergy (NRGY) is down but off its lows on distribution and earnings. Magellan (MMP) is down just under 1 point on earnings.Holly Partners (HEP) continues to absorb its equity offering and its down fractionally.

Other winners today include Enbridge (EEP) Alliance (ARLP) Boardwalk (BWP) Exterran (EXLP) all of which showing nice fractional gains.

Crude is up 2 dollars and over 56 bucks as it breaks out above the 50-55 range its been in lately.

Atlas Energy Resources (ATN) and Atlas Holdings (AHD) are up 1 apiece and for the latter its a huge percentage gain. Inergy (NRGY) is down but off its lows on distribution and earnings. Magellan (MMP) is down just under 1 point on earnings.Holly Partners (HEP) continues to absorb its equity offering and its down fractionally.

Other winners today include Enbridge (EEP) Alliance (ARLP) Boardwalk (BWP) Exterran (EXLP) all of which showing nice fractional gains.

Crude is up 2 dollars and over 56 bucks as it breaks out above the 50-55 range its been in lately.

INERGY REPORTS RECORD EARNINGS (AGAIN)

We have a number of news items this morning Inergy Holdings and Inergy Partners (NRGP,NRGY) have put up another quarter of record earnings. Stock has been in rally mode going into today's news and it is ex distribtuion today. Briefing.com has it a 3 cent miss and a revenue miss but that doesn't always play out in our group. Calumet Specialty Products reports earnings today and everything appears in line including the compliance of all debt covenants. Magellan Midstream Partners reports earnings and the company says it sees the possiblity of increase distributions in 2010. And we have a slew of ex-distributions today which is a nice thing.

Its been a busy morning in the rest of the market and if you weren't awake earlier stock futures were sharply lower on a NY Times Bank America story about having to raise capital which apparently had errors in it. So the markets were sharply lower and then turned around and rallied when corrections were made. Bank of America needs 35 billion of common stock and not additional capital from the outside. It does not have to raise 35 billion of fresh new dollars. Anyway the markets like this and we are up.

Crude oil has just broken through the 55 dollar level and is up 1 and change. Inventory numbers due out later today. We are less than 30 minutes from a higher open.

Tuesday, May 05, 2009

IT HAS ARRIVED!

We have been waiting for it but now we have an exchange traded note on the mlp index! Glory! So if you can't decide what mlp to buy...buy them all!

Tape getting a little heavier as we head into noontime. MLPS are lower on the index although the list is mixed. Holly Partners (HEP) is down over 2 on its stock offering. Inergy Holdings (NRGP) is up nearly 1 point is the biggest gainer i could find. Crude is a little weaker. The index is down less than 2 points after being up 1 point this morning.

HOLLY STOCK OFFERING OTHERWISE MLPS OPEN FIRM AGAIN

One of the issues you should look out for in this rally phase is the likelyhood that mlps will take the opportunity with the rise in share prices to put some more equity on the table for sale. Usually but not always they wait for the ex-distribution date to do it and that is what Holly Partners (HEP) did last night with a small-ish 2 million share offering. The stock ran to 31 yesterday and has doubled off the lows so the company is selling 2 million shares. Keep that in mind over the next few days if you are making new purchases. Plains All American (PAA) and Energy Transfer (ETP) are among the ones who already have come to the table in the last few weeks.

The mlp index opens up 1 point this morning with the overall market having a very firm feel to it even though a short sharp correction could come at anytime. MLPS that have been trading in the 2 dollar range continue to rally as Crosstex (XTEX,XTXI) were up 50% just yesterday and are up again this morning nearing the 4 dollar mark. No news driver that i can see.

Monday, May 04, 2009

Markets racing ahead with the dow up nearly 200 and energy stocks doing very well. The mlp index is now up 3 points and is at the high of the day! Crosstex Energy LP (XTEX) and Crosstex (XTXI) are huge percentage winners today both up 1 and a fraction and joining an expanding list of 1 point plus winners. No news that i could find.

Over 215 and up 2.68 on the mlp index with energy stocks roaring foward today and the dow up 175. Holly Partners (HEP) Buckeye (BPL) Alliance Resource (ARLP) and Inergy Holdings (NRGP) all up 1 point or more. A mile long list of fractional winners today. And we have a few big percentage winners like Crosstex (XTEX) and Constellation Energy Partners (APL).

Only a few sit on the losers list. Linn Energy (LINE) is showing down 60 cents but it is ex distribution today and Nasdaq doesn't always do a good job of adjusting the change from the prior session so it is essentially flat on the day.

220 on the mlp index is certainly within reach now with this market and energy tail wind.

Only a few sit on the losers list. Linn Energy (LINE) is showing down 60 cents but it is ex distribution today and Nasdaq doesn't always do a good job of adjusting the change from the prior session so it is essentially flat on the day.

220 on the mlp index is certainly within reach now with this market and energy tail wind.

MORNING OPEN LOOKS FIRM AS

MLPS PREPARE TO PAYOUT!

This week we will see the majority of MLPS go ex distribuitions so checks will be in the mail shortly headed for your mailbox on May 15th! Markets look okay this morning in the pre open with stock futures higher by about 4 S&P points. MLPS probably will take their cue from energy stocks as a whole and they took the lead Friday.

For the first time since back in August of 2007 the mlp index is trading clearly above the moving averages. The 34 day moving average has completely its cross and is now in an uptrend. Notice below however the weekly charts are no where close to doing this as they are in a downtrend. The mlp index has crossed above the 89 week moving average and repair jobs have to start somewhere. The dow chart on a weekly basis still looks fairly sad.

Finally for comparison purposes take a look at the High Yield index and notice that if you overlay it over the mlp index daily chart they match up almost tick for tick. So as credit markets slowly improve, mlps will continue to firm or at least outperform.

No news on the mlp front this morning and nothing on the upgrade downgrade list so far. Crude is a little lower in the front month but the back months are firm. Dollar is a touch better this morning but not by too much. From 176 to 212 the mlp index is up over 20% since January 1st and with this distribution it puts total return somewhere north of 25%. This compares to the dow which is still lower on the year. At least we are in a relatively good place to be!

No news on the mlp front this morning and nothing on the upgrade downgrade list so far. Crude is a little lower in the front month but the back months are firm. Dollar is a touch better this morning but not by too much. From 176 to 212 the mlp index is up over 20% since January 1st and with this distribution it puts total return somewhere north of 25%. This compares to the dow which is still lower on the year. At least we are in a relatively good place to be!

Friday, May 01, 2009

Energy is taking the lead today as crude is up nearly 2 dollars and energy stocks are leading the market today. The dow is essentially flat while mlps have gotten back 2 points of yesteday's loss.

Nustar (NS) leads the way up 1.50. Lots of fractional gains on the list. Breitburn (BBEP) is up 50 cents as they get a letter from their biggest shareholder Quicksilver Gas (KGS) saying they should pay down their debt and not cut the distribution. Just a handful of losers including Kinder Morgan (KMP) and Oneok LP (OKS) which are down small fractions.

Nustar (NS) leads the way up 1.50. Lots of fractional gains on the list. Breitburn (BBEP) is up 50 cents as they get a letter from their biggest shareholder Quicksilver Gas (KGS) saying they should pay down their debt and not cut the distribution. Just a handful of losers including Kinder Morgan (KMP) and Oneok LP (OKS) which are down small fractions.

EARNINGS NEWS, BREITBURN GETS A LETTER,

EX DISTRIBUTIONS, AND MORE!

EX DISTRIBUTIONS, AND MORE!

First we will go over the news from last night as we had earnings and distribution news from Buckeye Partners (BPL) and Buckeye Holdings (BGH) which also lifted the payout. Payout news also from Exterran Partners (EXLP) which kept things even from last quarter. Enbridge Energy Partners (EEP) put up earnings and distribution news last night. And this morning we have K-Sea Transportation (KSP) which reports earnings and keeps the distribution even. So lots of company news to chew through this morning. We also have Quicksilver Gas (KGS) sending a letter to Breitburn basically telling them they are pissed off that they cut the distribution and that they should do clean up their act or they will seek representation on the board. The SEC filing is here and i will post the news release of the letter when it appears. It moved on Dow Jones around 7:15 am. I also found this on gurufocus.com about Breitburn.

We had a 3 point loss on the MLP index as energy stocks took gas yesterday as a whole but the group action was pretty mixed. Some of the largest weighted mlps took hits yesterday but the broader mlp list was flat to higher. A pull back was due anyway as we were up 5 days in a row and 6 out of the last 7. I still think we will head to 220-230 before this rally leg is done.

Stock futures are higher this morning as we continue to struggle to get through 8250 on the dow. Maybe we'll make it through today. Lots of ex-distributions this morning so look for the normal price adjustments. Crude is flat at 51 bucks.

The picture above is of Rachel Alexandra who is the star of the Kentucky Oaks which is the race of the day. Tomorrow is the Derby and I Want Revenge will be the favorite but i am taking a flyer on 50-1 Summer Bird! You only live once.!

We had a 3 point loss on the MLP index as energy stocks took gas yesterday as a whole but the group action was pretty mixed. Some of the largest weighted mlps took hits yesterday but the broader mlp list was flat to higher. A pull back was due anyway as we were up 5 days in a row and 6 out of the last 7. I still think we will head to 220-230 before this rally leg is done.

Stock futures are higher this morning as we continue to struggle to get through 8250 on the dow. Maybe we'll make it through today. Lots of ex-distributions this morning so look for the normal price adjustments. Crude is flat at 51 bucks.

The picture above is of Rachel Alexandra who is the star of the Kentucky Oaks which is the race of the day. Tomorrow is the Derby and I Want Revenge will be the favorite but i am taking a flyer on 50-1 Summer Bird! You only live once.!

Subscribe to:

Posts (Atom)