About half the group is down and half is up...the index is now rallying up .43 at 267 and change. New highs for Energy Transfer Partners (ETP) and LIN Energy(LINE). ETP leads the way up 1 and change. LIN up 50 cents. Fractional plusses for Atlas Pipeline,Valero LP, Crosstex Energy LP and a few others.

Natural Resource Partners (NRP) is down 1 and change...no news there and a few others are down fractionally.

Heading to Boston tonight for a day of college shopping so blogging will be light until Thursday morning. I will try and post from time to time.

Tuesday, October 31, 2006

Sorry for the late first post today but i was running around this morning. Looks like we are higher so far today after a bit of a hesitant start. No corporate drivers this morning and we had one reiteration of Enbridge Energy Partners at underperform by RBC Capital Markets.

Yesterday's one day correction may have been just that. We'll see what lunchtime brings us.

Yesterday's one day correction may have been just that. We'll see what lunchtime brings us.

Monday, October 30, 2006

Lunchtime and MLPS are lower...some sharply. More ex-distributions going on and some selling as well. The index is down just shy of 2 points near 267. Crosstex LP (XTEX) is up nicely...75 cents and is one of the few winners. This one is ex-dis by 55 cents. Boardwalk Partners is up 50 cents after being up over 1 earlier and we have some others up by just pennies.

Downside we have Copano which is 75 cents ex-dis...stock down 1 and change. Natural Resource Partners (NRP) is down over 2 being ex-distribution and the Citigroup downgrade. Lots of fractional losers elsehwhere including Kinder Morgan Partners (KMP), Atlas Pipeline Partners (APL) on the lack of a distribution increase, Valero LP (VLI) is down 20 cents on a distribution increase but a cautious 4th quarter outlook.

Remember folks its end of the year for Mutual Funds so there are probably distortions all over the place today and tomorrow.

Downside we have Copano which is 75 cents ex-dis...stock down 1 and change. Natural Resource Partners (NRP) is down over 2 being ex-distribution and the Citigroup downgrade. Lots of fractional losers elsehwhere including Kinder Morgan Partners (KMP), Atlas Pipeline Partners (APL) on the lack of a distribution increase, Valero LP (VLI) is down 20 cents on a distribution increase but a cautious 4th quarter outlook.

Remember folks its end of the year for Mutual Funds so there are probably distortions all over the place today and tomorrow.

Valero LP earnings are out and i guess it depends on which way you look at them. 3rd quarter numbers were okay. We get a distribution increase of 3 cents. but the 4th quarter outlook is a bit murky. We'll see which way the martket takes it.

Hiland Holdings(HPGP) gets an outperform from Wachovia, a buy with a 26 dollar target from AG Edwards and an overweight from Lehman.

Hiland Holdings(HPGP) gets an outperform from Wachovia, a buy with a 26 dollar target from AG Edwards and an overweight from Lehman.

Good Monday Morning.

Thought we'd get Valero LP earnings before the open but they haven't posted so far. As soon they hit i'll blog with the numbers. Meanwhile earnings from Holly Partners are out and they are a little higher but nothing to write home about. Stock has done basically nothing for the year as it has gone sideways for the most part. Late Friday and while the market was still open Atlas Pipeline Partners (APL) announced its distribution and there was no increase which led the stock to sell off its highs on the disappointment. Atlas Holdings (AHD) announced a prorated distribution of 17 cents for the quarter...translates to 24 cents for a full quarter or 96 cents annual/

We have some brokerage house moves this morning on Hiland Partners (HLND as Lehman starts at overweight and Wachovia starts at outperform. Meanwhile Natural Resource Partners got cut to hold from buy at citi-group.

A bunch more MLPS are ex distribution today including Crosstex, Copano and some others so look for some impact again on the MLP Index as we sit near all time highs and a breakout on the weekly chart.

Ten year rates this morning are flat at 4.68% while the energy complex is selling off sharply this morning.Oil down 1 dollar and nat gas down as well.

Friday we saw some odd trading in Teppco (TPP) as the stock went ex-distribution and was up nearly 1 dollar on three times the volume.

No news this morning but we'll watch the trading today to see if this smells of takeover. Meanwhile the chart above looks like its in breakout mode.

Thought we'd get Valero LP earnings before the open but they haven't posted so far. As soon they hit i'll blog with the numbers. Meanwhile earnings from Holly Partners are out and they are a little higher but nothing to write home about. Stock has done basically nothing for the year as it has gone sideways for the most part. Late Friday and while the market was still open Atlas Pipeline Partners (APL) announced its distribution and there was no increase which led the stock to sell off its highs on the disappointment. Atlas Holdings (AHD) announced a prorated distribution of 17 cents for the quarter...translates to 24 cents for a full quarter or 96 cents annual/

We have some brokerage house moves this morning on Hiland Partners (HLND as Lehman starts at overweight and Wachovia starts at outperform. Meanwhile Natural Resource Partners got cut to hold from buy at citi-group.

A bunch more MLPS are ex distribution today including Crosstex, Copano and some others so look for some impact again on the MLP Index as we sit near all time highs and a breakout on the weekly chart.

Ten year rates this morning are flat at 4.68% while the energy complex is selling off sharply this morning.Oil down 1 dollar and nat gas down as well.

Friday we saw some odd trading in Teppco (TPP) as the stock went ex-distribution and was up nearly 1 dollar on three times the volume.

No news this morning but we'll watch the trading today to see if this smells of takeover. Meanwhile the chart above looks like its in breakout mode.

Good Monday Morning.

Thought we'd get Valero LP earnings before the open but they haven't posted so far. As soon they hit i'll blog with the numbers. Meanwhile earnings from Holly Partners are out and they are a little higher but nothing to write home about. Stock has done basically nothing for the year as it has gone sideways for the most part. Late Friday and while the market was still open Atlas Pipeline Partners (APL) announced its distribution and there was no increase which led the stock to sell off its highs on the disappointment. Atlas Holdings (AHD) announced a prorated distribution of 17 cents for the quarter...translates to 24 cents for a full quarter or 96 cents annual/

We have some brokerage house moves this morning on Hiland Partners (HLND as Lehman starts at overweight and Wachovia starts at outperform. Meanwhile Natural Resource Partners got cut to hold from buy at citi-group.

A bunch more MLPS are ex distribution today including Crosstex, Copano and some others so look for some impact again on the MLP Index as we sit near all time highs and a breakout on the weekly chart.

Ten year rates this morning are flat at 4.68% while the energy complex is selling off sharply this morning.Oil down 1 dollar and nat gas down as well.

Friday we saw some odd trading in Teppco (TPP) as the stock went ex-distribution and was up nearly 1 dollar on three times the volume.

No news this morning but we'll watch the trading today to see if this smells of takeover. Meanwhile the chart above looks like its in breakout mode.

Thought we'd get Valero LP earnings before the open but they haven't posted so far. As soon they hit i'll blog with the numbers. Meanwhile earnings from Holly Partners are out and they are a little higher but nothing to write home about. Stock has done basically nothing for the year as it has gone sideways for the most part. Late Friday and while the market was still open Atlas Pipeline Partners (APL) announced its distribution and there was no increase which led the stock to sell off its highs on the disappointment. Atlas Holdings (AHD) announced a prorated distribution of 17 cents for the quarter...translates to 24 cents for a full quarter or 96 cents annual/

We have some brokerage house moves this morning on Hiland Partners (HLND as Lehman starts at overweight and Wachovia starts at outperform. Meanwhile Natural Resource Partners got cut to hold from buy at citi-group.

A bunch more MLPS are ex distribution today including Crosstex, Copano and some others so look for some impact again on the MLP Index as we sit near all time highs and a breakout on the weekly chart.

Ten year rates this morning are flat at 4.68% while the energy complex is selling off sharply this morning.Oil down 1 dollar and nat gas down as well.

Friday we saw some odd trading in Teppco (TPP) as the stock went ex-distribution and was up nearly 1 dollar on three times the volume.

No news this morning but we'll watch the trading today to see if this smells of takeover. Meanwhile the chart above looks like its in breakout mode.

Friday, October 27, 2006

If it weren't for all the ex-distributions the MLP index would be up 2 points or more today. Teppco is ex-distribution and is up 1 and change...no news but a ton of volume here. Nearly 450,000 shares have changed hands...3 times normal volume. Something may be going on here. Most other MLPS are higher today even though the broad market is down. The weak GDP number is moving cash to high yielding instruments.

We are closing on a firm note. Will watch for last hour developements

We are closing on a firm note. Will watch for last hour developements

Lunchtime and there are many x-distributions that are impacting the MLP index which is down 70 cents after being down nearly 1.80 at one point. But allowing for that MLPS are higher and some sharply so. Teppco which is ex-distribution by 68 cents is up nearly 1 buck so yesterday's after market buyers were on to something. Markwest Energy has been on fire and is up another 55 cents. Buckeye Holdings raised its dividend and the stock is back to 16 bucks. Buckeye Partners meanwhile came out with earnings that were 3 cents shy but they boosted the distribution again.

Mutual Funds are closing the books for the year and they have to do it by Tuesday. So yesterday was last day for settlement on 10/31. Some volitility seems likely over the next few days as some of these get moved around.

Mutual Funds are closing the books for the year and they have to do it by Tuesday. So yesterday was last day for settlement on 10/31. Some volitility seems likely over the next few days as some of these get moved around.

Good Friday Morning.

First off in the news department Regency Partners announces a distribution increase which should make unit holders happy. Sometimes they buy the rumour sell the new, sometimes they don't. We'll see. Not much else corporate wise this morning. We do have Credit Suisse upgrading Enbridge (ENB) to outperform. Teppco (TPP) and Kinder Morgan Partners (KMP) both go ex-distribution today buy 68 and 81 cents respectively. 10 year rates plunging this morning on the weaker GDP number which will be supportive.

Copano LLC (CPNO) has had an incredible run to 60 dollars and why not. They've done everything right and have been boosting the distribution quarter to quarter at an amazing pace...now at 3.00 annual. Yesterday the stock broke 60 and then sellers came in and took the stock down 1.20 by days end.

If you are looking for an entry point i would place buy orders under the 34 day moving average on the chart...which is just below 55 (double nickles!). In strong uptrends i use the 34-55 day moving averages as good places to grab some shares...assuming they every get there. In these thinly traded stocks they can get there very fast and then bounce up from there very fast.

Meanwhile we have the AMZ MLP index sitting on the doorstep of a new alltime high.

This may be a logical place for a few day pause...but i think ultimately we are at the beginning of a multi-month upleg that should take us to 300 or so.

First off in the news department Regency Partners announces a distribution increase which should make unit holders happy. Sometimes they buy the rumour sell the new, sometimes they don't. We'll see. Not much else corporate wise this morning. We do have Credit Suisse upgrading Enbridge (ENB) to outperform. Teppco (TPP) and Kinder Morgan Partners (KMP) both go ex-distribution today buy 68 and 81 cents respectively. 10 year rates plunging this morning on the weaker GDP number which will be supportive.

Copano LLC (CPNO) has had an incredible run to 60 dollars and why not. They've done everything right and have been boosting the distribution quarter to quarter at an amazing pace...now at 3.00 annual. Yesterday the stock broke 60 and then sellers came in and took the stock down 1.20 by days end.

If you are looking for an entry point i would place buy orders under the 34 day moving average on the chart...which is just below 55 (double nickles!). In strong uptrends i use the 34-55 day moving averages as good places to grab some shares...assuming they every get there. In these thinly traded stocks they can get there very fast and then bounce up from there very fast.

Meanwhile we have the AMZ MLP index sitting on the doorstep of a new alltime high.

This may be a logical place for a few day pause...but i think ultimately we are at the beginning of a multi-month upleg that should take us to 300 or so.

Thursday, October 26, 2006

After hours news...Crosstex Energy will split its stock 3 for 1 as it nears 100 dollars a share. No date has been set other that to say that the split will come after the dividend is paid on November 15.

Looks like the weekly chart is on the verge of a breakout above 100 dollars. That could come tomorrow. Hopefully volume confirms.

Meanwhile the AMZ MLP INDEX closed over 270

It looks to me like we are at the beginning of a powerful upleg here. We're up nine out the last 10 days and its been straight up from 256 just 2 weeks ago. A pause could come at anytime but corrections here will be short and sharp.

Meanwhile some after hours trading in Teppco (TPP) as it jumps to 40 dollars. Normally i would not pay much attention to this except that while after hours volume is light...some bids with size are sitting 30 cents above the NY close. No news on this one after hours. We'll see what happens tomorrow.

Big moves today in Oneok LP up 1.75 and 1 point plus gains in Markwest Energy (MWE), Crosstex (XTXI) and Markwest Hydrocarbon (MWP) which boosted its quarterly dividend.

These are exciting times for our group so hang on as the ride contines.

Looks like the weekly chart is on the verge of a breakout above 100 dollars. That could come tomorrow. Hopefully volume confirms.

Meanwhile the AMZ MLP INDEX closed over 270

It looks to me like we are at the beginning of a powerful upleg here. We're up nine out the last 10 days and its been straight up from 256 just 2 weeks ago. A pause could come at anytime but corrections here will be short and sharp.

Meanwhile some after hours trading in Teppco (TPP) as it jumps to 40 dollars. Normally i would not pay much attention to this except that while after hours volume is light...some bids with size are sitting 30 cents above the NY close. No news on this one after hours. We'll see what happens tomorrow.

Big moves today in Oneok LP up 1.75 and 1 point plus gains in Markwest Energy (MWE), Crosstex (XTXI) and Markwest Hydrocarbon (MWP) which boosted its quarterly dividend.

These are exciting times for our group so hang on as the ride contines.

Some nice gainers on the board today. Copano (CPNO) is up 1 and change and over the 60 dollar mark! Markwest Energy was up 1 but is now off its high. Also up nicely and over 60 bucks is Oneok LP as it buys a storage facility. Business must be good!.

Magellan Midstream is down 80 cents...no news there. Valero LP and Kinder Morgan are down a touch. Mostly small fractional losses elsewhere. The AMZ MLP index poked through 270 this morning but its now down 55 cents.

Not much else happening as we digest gains just under new all time highs.

Magellan Midstream is down 80 cents...no news there. Valero LP and Kinder Morgan are down a touch. Mostly small fractional losses elsewhere. The AMZ MLP index poked through 270 this morning but its now down 55 cents.

Not much else happening as we digest gains just under new all time highs.

Good Thursday morning.

I got called into work this morning so this is just a quick post here. When i get home i'll post a full report. RBC Capital Markets cuts target on Sunoco Logistics to 44 bucks fwiw. Not much else that i can find so far but it looks like a firm start as we head for 270 on the MLP index and possibily all time closing highs!

I got called into work this morning so this is just a quick post here. When i get home i'll post a full report. RBC Capital Markets cuts target on Sunoco Logistics to 44 bucks fwiw. Not much else that i can find so far but it looks like a firm start as we head for 270 on the MLP index and possibily all time closing highs!

Wednesday, October 25, 2006

The fed meeting is done...no change..so we move on. The MLP index got to 269.80 but we've pulled back off that high. I think we'll have another run toward the high in the last hour. Oneok LP (OKS) has joined the losers list and is probably the downside weight.

Crosstex LP (XTEX) may be the next one on the verge of a breakout. We need a decisive close above 38 on volume. This could happen at any time (imho).

Crosstex LP (XTEX) may be the next one on the verge of a breakout. We need a decisive close above 38 on volume. This could happen at any time (imho).

We are solidly higher again this morning as the MLP index is up nearly 1 point and poised to attack 270. Plains All American (PAA) Sunoco Logisitcs (SXL) and LIN Energy (LINE) are strong fractional gainers. Penn Virginia (PVR) Boardwalk Partners (BWP) are also showing fractional gains.

Hiland Partners is down 1 and Martin Midstream is down fractionally but these guys trade on the thin side so a buy or two and suddely you could be unchanged.

LIN Energy (LIN) news last night of no new equity offering necessary and a 2.08 annual distribution rate for next quarter is driving the stock nicely higher. As viewed last night this one could run to 27-28 based on a 7% yield going foward.

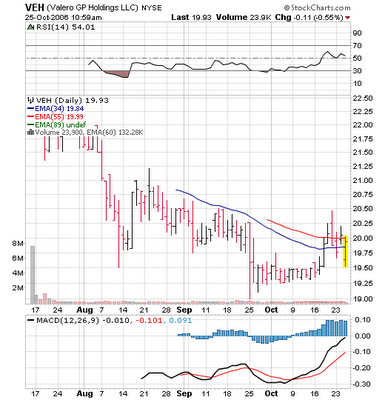

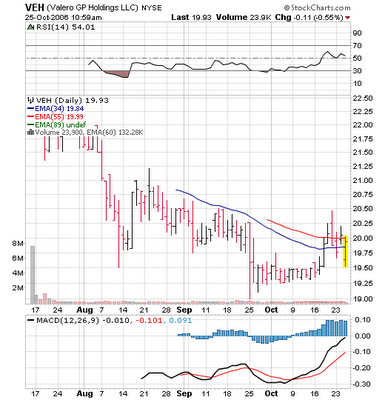

I would also like to address Valero GP (VEH) and Atlas Holdings (AHG). We've seen nice moves in the underlying LP's in the last week but the GP's haven't done much. I know there are stock overhang issues regarding Valero LP and probably a few others in the group. But I would think that the GP's will eventually catch up in terms of performance.

Hiland Partners is down 1 and Martin Midstream is down fractionally but these guys trade on the thin side so a buy or two and suddely you could be unchanged.

LIN Energy (LIN) news last night of no new equity offering necessary and a 2.08 annual distribution rate for next quarter is driving the stock nicely higher. As viewed last night this one could run to 27-28 based on a 7% yield going foward.

I would also like to address Valero GP (VEH) and Atlas Holdings (AHG). We've seen nice moves in the underlying LP's in the last week but the GP's haven't done much. I know there are stock overhang issues regarding Valero LP and probably a few others in the group. But I would think that the GP's will eventually catch up in terms of performance.

Good Wednesday Morning.

I posted last night's news...last night so scroll down to read. No breaking news this morning and no upgrades or downgrades. So we wait for more movement to 270. A correction could come at any time after 8 of 9 updays.

My wife is forcing me to hang up a mirror. Normally i would rather have a meat clever driven into my chest. I will post again with more info after we work through the opening gyrations.

I posted last night's news...last night so scroll down to read. No breaking news this morning and no upgrades or downgrades. So we wait for more movement to 270. A correction could come at any time after 8 of 9 updays.

My wife is forcing me to hang up a mirror. Normally i would rather have a meat clever driven into my chest. I will post again with more info after we work through the opening gyrations.

Tuesday, October 24, 2006

After hours news. LIN Energy (LINE) announces a priviate placement of equity and re-affirms that it will raise its distribution to 52 cents or 2.08 annual next quarter. Note that at today's price a 2.08 payout comes to a 9.04% annual rate. If the stock prices equals todays current yield of 7.80% gives you a stock price of about 27 dollars. The company also says it does not need to sell any more equity. I think this one goes higher. Btw as pointed out yesterday i am now long this stock.

Hiland Partners (HLND) and Hiland GP (HPGP) announce their distributions for the quarter and another increase for the LP. Also after the close another distribution increase for holders of Global Partners (GLP).

Another up close today as we near the breakout point of 270. We'll see what tomorrow brings.

Treading water with an upside global warming bias in MLPS this afternoon. Most MLPS are where they were at lunch time. The index is up .70 and holding its own. Not much else happening this afternoon. Quiet on the newsfront.

More political humor courtesy of the peoples cube dot com!

More political humor courtesy of the peoples cube dot com!

Nice upside this morning as the MLP index is now up nearly 1 point as we sit over 268. Nice gains in Markwest (MWE) Atlas Pipeline Partners (APL) which btw has decisively broken out to new all time highs. Also high Boardwalk Partners (BWP) which raised its distribution again late yesterday. Plains All American (PAA) raises its distribution this morning and the stock is up a fraction.

Nothing overly inspiring on the losers list...a few are down pennies but no news. Enterprise (EPD) is down 13 cents on its earnings. Energy stocks as a whole are firm this morning while the market seems to be digesting yesterday's gains.

Meanwhile more political humor thanks to the folks at the peoplescube.com

Nothing overly inspiring on the losers list...a few are down pennies but no news. Enterprise (EPD) is down 13 cents on its earnings. Energy stocks as a whole are firm this morning while the market seems to be digesting yesterday's gains.

Meanwhile more political humor thanks to the folks at the peoplescube.com

Good Morning.

Busy morning as we have news coming in from several companies. First lets begin with news leftover from last night. Sunoco Logisitcs reported earnings and another distribution increase. Also leftover from last night Crosstex Energy LP (XTEX) and Crosstex Energy (XTXI) which announced another distribution increase.

This morning we have earnings news from Enterprise Products Partners (EPD) and they are very good...record earnings!

Crude is down this morning but not by much and Natural gas is rebounding from yesterday's rather large loss. Stock futures are lower after yesterdays surge. The 10 year is flat at 4.83%. Fed meeting begins today; its a 2 day affair so no news until tomorrow at 2:15pm. Nothing so far in the upgrade downgrade department but i would like to point out that Oneok LP was downgraded yesterday by Howard Weil and the stock closed higher. Thats the second downgrade in a week and its led to 2 higher closes both times. This one I think is going higher over the long term.

Short term we are getting a bit extended here. If we get a pullback to the 34 day moving average it will be a good place to get in.

We are getting very close to the all-time high on the AMZ MLP index after another up close yesterday...making it 7 out of the last 8 days.This is the weekly chart for your enjoyment.

Will we go through 270 and make new all time highs? Stay tuned.

And finally this morning a little political humor courtesy of the peoples cube.com

Busy morning as we have news coming in from several companies. First lets begin with news leftover from last night. Sunoco Logisitcs reported earnings and another distribution increase. Also leftover from last night Crosstex Energy LP (XTEX) and Crosstex Energy (XTXI) which announced another distribution increase.

This morning we have earnings news from Enterprise Products Partners (EPD) and they are very good...record earnings!

Crude is down this morning but not by much and Natural gas is rebounding from yesterday's rather large loss. Stock futures are lower after yesterdays surge. The 10 year is flat at 4.83%. Fed meeting begins today; its a 2 day affair so no news until tomorrow at 2:15pm. Nothing so far in the upgrade downgrade department but i would like to point out that Oneok LP was downgraded yesterday by Howard Weil and the stock closed higher. Thats the second downgrade in a week and its led to 2 higher closes both times. This one I think is going higher over the long term.

Short term we are getting a bit extended here. If we get a pullback to the 34 day moving average it will be a good place to get in.

We are getting very close to the all-time high on the AMZ MLP index after another up close yesterday...making it 7 out of the last 8 days.This is the weekly chart for your enjoyment.

Will we go through 270 and make new all time highs? Stay tuned.

And finally this morning a little political humor courtesy of the peoples cube.com

Monday, October 23, 2006

Took a position in LIN Energy (LINE). I think the chart looks okay. The company seems to be doing all the right things including growing the distribution. Trying for a trade to 25.

Meanwhile MLPS continue to be determined to make it a nice up close. The index is up .75 and at the high of the day. Nice fractional gains as Markwest rears its head above 50. Nice fractional gains in a host of issues.

Sideways to higher at lunchtime with the MLP index up 20 cents. I think the strong overall market is keeping this group flat rather than down. Duke Midstream (DPM) leads the losers list down half a buck but it was a big gainer last week. Crosstex LP is down 44 cents though Morningstar mentions it in an arcticle today. Holly Partners is flat today even though they did increase their distribution by one cent! Plains All American (PAA) is down 50 cents as they do a priviate placement of securities...a billion dollars worth.

Atlas Pipeline Partners (APL) is up 50 cents as it nears all time highs. LIN Energy (LINE), Sunoco Logistics (SXL) and Markwest Energy (MWE) are all up 50 cents apiece.

Atlas Pipeline Partners (APL) is up 50 cents as it nears all time highs. LIN Energy (LINE), Sunoco Logistics (SXL) and Markwest Energy (MWE) are all up 50 cents apiece.

Good Monday morning and no better way to start your Monday with the daily chart above and the weekly chart below of the AMZ MLP INDEX!

We have been moving higher until Friday's small loss broke the winning streak at 6. Note we are nearing the very top on the weekly chart and I still think we are going to new all time highs in this upleg. Staying long and adding to positions on any weakness.

This should be a very active news week for earnings, distribution announcements and whatever else gets thrown our way. This morning Howard Weil downgrades Oneok LP to a hold from a buy. Other than that there is no corporate news. Crude Oil is down nearly $1.00 and testing its recent chart lows. Natural Gas however continues higher as it moves back over 7 dollars. 10 year rates have backed up to 4.82. I wouldn't want the 10 year to back up much further from here. If it did it might bring a halt to the rally.

One other thought. Prices of many in the group are near alltime highs. I wonder how many (or if any) companies will take the opportunity to do stock offerings.

Friday, October 20, 2006

Lunchtime on Wall street and we have everything off the lows of the day except for big energy stocks which are reacting to Crude Oil dropping $1 on the OPEC cut. MLPS have held up very well and have stayed in a tight range. The MLP index is down about 30 cents. The group as a whole is trading between 50 cents up to 50 cents down; none of the recent moves is corporate driven.

Looking for more of the same this afternoon but if the overall market rallies, look for MLPS to remain disconnected from the rest of energy and move up with any broad market move.

Looking for more of the same this afternoon but if the overall market rallies, look for MLPS to remain disconnected from the rest of energy and move up with any broad market move.

Good Friday Morning.

Up 6 days in a row on the AMZ MLP Index which is making a run toward its all time high. It might be time for just a little short term pullback but look for corrections to run its course very quickly.

You pretty much could have bought any MLP in the group. Even the laggards like Teppco (TPP) and Valero LP(VLI) among others have rallied.

Crosstex Energys (XTEX,XTXI)...the LP and the GP are ringing the opening bell at Nasdaq this morning.

Crosstex LP (XTEX) had been in a very tight range with an upside bias all week. 38 seems to be the breakout point here with the all time high at 43 and change (adjusted for distributions). This one should breakout soon on any positive news. Meanwhile Crosstex (XTXI) shrugged off a Wachovia downgrade two days ago and looks to make an assault on 100. It seems to me that both could clear their prospective tops together. I would like to see all breakouts done on volume to confirm.

No news this morning on the corporate front and no upgrades or downgrades at least so far. Crude oil is slightly higher this morning with nat gas down 17 cents after another big move yesterday. Stock futures down right now as earnings of dow stocks having an impact.

So its been 6 great days....lets shoot for 7.

Up 6 days in a row on the AMZ MLP Index which is making a run toward its all time high. It might be time for just a little short term pullback but look for corrections to run its course very quickly.

You pretty much could have bought any MLP in the group. Even the laggards like Teppco (TPP) and Valero LP(VLI) among others have rallied.

Crosstex Energys (XTEX,XTXI)...the LP and the GP are ringing the opening bell at Nasdaq this morning.

Crosstex LP (XTEX) had been in a very tight range with an upside bias all week. 38 seems to be the breakout point here with the all time high at 43 and change (adjusted for distributions). This one should breakout soon on any positive news. Meanwhile Crosstex (XTXI) shrugged off a Wachovia downgrade two days ago and looks to make an assault on 100. It seems to me that both could clear their prospective tops together. I would like to see all breakouts done on volume to confirm.

No news this morning on the corporate front and no upgrades or downgrades at least so far. Crude oil is slightly higher this morning with nat gas down 17 cents after another big move yesterday. Stock futures down right now as earnings of dow stocks having an impact.

So its been 6 great days....lets shoot for 7.

Thursday, October 19, 2006

Oneok LP (OKS) remains down 50 cents but Kinder Morgan Partners (KMP) has come all the way back to even and the MLP INDEX is now up 1.55 to 266.25 and within striking distance of its all time high. Lots of strong fractional gainers including MLPS that have not been raising distributions like Teppco which is actually closing in on the 40 dollar mark for the first time in ages. And Valero LP is challenging the 52 level again which is nice to see.

Atlas Pipeline Partners (APL) has broken out to new all-time highs this afternoon at 46.50 (adjusted for distributions..it once traded over 50 bucks but holders from a few years ago who bought that high are now finally even after distributions!). Atlas Holdings (AHD)...the GP of Atlas Pipeline has not done much since its ipo but i think this one should move up along with APL.

Kinder Morgan Partners(KMP) and Oneok LPOKS) are both having a large impact on the AMZ MLP index which is down a small fraction as of this posting...but most MLPS are actually higher with some big winners today. Copano(CPNO) and Natural Resource Partners(NRP) are both up nearly 1 point. Fractional plusses in Energy Transfer Partners(ETP), Valero LP(VLI), Regency Partners(RGNC) and a few others.

I have the link now for Energy Transfer Partners 800 million dollar financing in senior notes.

I have the link now for Energy Transfer Partners 800 million dollar financing in senior notes.

Good Thursday morning.

Its the day after Kinder Morgan Partners earnings and we have a Stifel Nicolaus downgrade of both KMP and Kinder Morgan Management (KMR) from buy to hold. Not sure if this will be a big deal when some of these smaller not well known houses does a ratings change but we put it out there for you anyway. We have some corporate news on Energy Transfer Partners (ETP) as the company priced some senior notes....800 million worth. No news link available yet but i will provide one when it comes. Still no earnings here and they are usually the first one out of the gate with numbers. Last night we had Copano (CPNO) doing another big distribution increase and they are now at 3 dollars annual payout going foward. My guess is given the stocks recent sawtooth move from 51 to 57 bucks the increase is priced in.

No other news this morning so we key on the MLP index chart

The daily here is in upside mode and taking a look at the weekly chart

the assault on 270 is underway and if we break through we could be on a new multi-month upleg that will take us perhaps to 300?

Its the day after Kinder Morgan Partners earnings and we have a Stifel Nicolaus downgrade of both KMP and Kinder Morgan Management (KMR) from buy to hold. Not sure if this will be a big deal when some of these smaller not well known houses does a ratings change but we put it out there for you anyway. We have some corporate news on Energy Transfer Partners (ETP) as the company priced some senior notes....800 million worth. No news link available yet but i will provide one when it comes. Still no earnings here and they are usually the first one out of the gate with numbers. Last night we had Copano (CPNO) doing another big distribution increase and they are now at 3 dollars annual payout going foward. My guess is given the stocks recent sawtooth move from 51 to 57 bucks the increase is priced in.

No other news this morning so we key on the MLP index chart

The daily here is in upside mode and taking a look at the weekly chart

the assault on 270 is underway and if we break through we could be on a new multi-month upleg that will take us perhaps to 300?

Wednesday, October 18, 2006

After the close Copano boosts its distribution to 75 cents from .675 cents....second big quarterly boost in a row. Also after the close Kinder Morgan Partners comes out with earnings and distribution numbers.

Higher close after going through several rounds of profit taking. We'll see what tomorrow brings.

Higher close after going through several rounds of profit taking. We'll see what tomorrow brings.

Had running around to do this afternoon so sorry for the lack of posts. We ran up...some profit taking in the middle and now running up to the days highs again. The MLP index is up 1.10 with lots of nice gains on the board. Oneok LP gets downgraded and the stock is higher on the day...which tells you that the market is not done taking this one higher. Atlas Pipeline Partners is sitting right on its all time high at 46.04 and attempting a breakout. Kinder Morgan Partners is up nearly 1 on 2 upgrades and ahead of earnings.

LIN Energy, Copano and Crosstex (XTXI) are down major fractions...Crosstex was downgraded but 90 cents off on a 96 dollar stock isn't much.

Watching for another last hour run to the upside.

LIN Energy, Copano and Crosstex (XTXI) are down major fractions...Crosstex was downgraded but 90 cents off on a 96 dollar stock isn't much.

Watching for another last hour run to the upside.

Good Morning.

Brokerage houses are on the horn in force this morning as a host of new coverage and upgrades and one or 2 downgrades of note. But overall the houses seem to be falling all over themselves as they talk up MLPS ahead of earnings. Lets start with MLP granddaddy Kinder Morgan Partners(KMP) which gets an upgrade from Wachovia to outperform from market perform and Credit Suisse starts at an outperform with a $54 target. This btw is being done ahead of earnings which are due out after the close today with a conference call to follow. Credit Suisse starts Enbridge Partners (EEP) with an outperform and a $56 dollar price target. organ Stanley starts Energy Transfer Partners (ETP) at overweight. Morgan Stanley and Credit Suisse both start Holly Energy Partners (HEP) at equal weight and neutral respectively.Moving down the list Credit Suisse also starts Plains All American (PAA) at a neutral. Morgan Stanley starts Regency Partners (RGNC) at an outperform. And finally Credit Suisse starts Valero LP at an outperform and puts a nice $62 price target.

We have 2 downgrades of note. Oneok LP is downgraded to market perform from outperform by Wachovia and they also downgrade Crosstex Energy (XTXI) to market perform from outperform. Both of these stocks have been leaders in the group.

The MLP Index looks like should continue to extend its gains as we brokeout above 262 yesterday in very impressive fashion finishing at the highs of the day. I had predicted weeks ago that we should challenge the 270 weekly top for a decisive breakout above that to new all-time highs. I still stand by that prediction. CPI due out at any moment which will set the tone today with 10 year rates. As long as it behaves get set for some nice upside...and its out and in line with estimates..0.2% up...headline down 0.5%. Its off to the races!

Brokerage houses are on the horn in force this morning as a host of new coverage and upgrades and one or 2 downgrades of note. But overall the houses seem to be falling all over themselves as they talk up MLPS ahead of earnings. Lets start with MLP granddaddy Kinder Morgan Partners(KMP) which gets an upgrade from Wachovia to outperform from market perform and Credit Suisse starts at an outperform with a $54 target. This btw is being done ahead of earnings which are due out after the close today with a conference call to follow. Credit Suisse starts Enbridge Partners (EEP) with an outperform and a $56 dollar price target. organ Stanley starts Energy Transfer Partners (ETP) at overweight. Morgan Stanley and Credit Suisse both start Holly Energy Partners (HEP) at equal weight and neutral respectively.Moving down the list Credit Suisse also starts Plains All American (PAA) at a neutral. Morgan Stanley starts Regency Partners (RGNC) at an outperform. And finally Credit Suisse starts Valero LP at an outperform and puts a nice $62 price target.

We have 2 downgrades of note. Oneok LP is downgraded to market perform from outperform by Wachovia and they also downgrade Crosstex Energy (XTXI) to market perform from outperform. Both of these stocks have been leaders in the group.

The MLP Index looks like should continue to extend its gains as we brokeout above 262 yesterday in very impressive fashion finishing at the highs of the day. I had predicted weeks ago that we should challenge the 270 weekly top for a decisive breakout above that to new all-time highs. I still stand by that prediction. CPI due out at any moment which will set the tone today with 10 year rates. As long as it behaves get set for some nice upside...and its out and in line with estimates..0.2% up...headline down 0.5%. Its off to the races!

Tuesday, October 17, 2006

Up 2.19 on the index at the close today as most MLPS close near their highs of the day. No after hours news as of yet but earlier today Natural Resource Partners boosted its distribution yet again for the 13th straight quarter and also announces a unit conversion.

Kinder Morgan Partners earnings due out tomorrow after the close with conference call to follow. Energy Transfer is usually the first MLP out with quarterly numbers but still no sign of them.

Kinder Morgan Partners earnings due out tomorrow after the close with conference call to follow. Energy Transfer is usually the first MLP out with quarterly numbers but still no sign of them.

Lunchtime and MLPS are mixed to higher even though stocks as a whole are selling off today...and 10 year rates plunging on the PPI number which i don't quite get since the core was bad but the headline number was excellent...and rates reacted by dropping sharply. Anyway the falling rates has put a floor under MLPS today. T C Pipelines (TCLP) is toda's biggest winner up nearly three quarters of a point. Valero LP (VLI)is also up nicely as is Teppco(TPP) and Ferrellgas (FGP).

Atlas Pipeline Partners (APL) is down after several days of nice upside and it bumps up against 46 on the charts which constitutes a breakout. Regency Partners (RGNC) and Markwest Energy (MWE) also down fractionally but nothing is news driven.

Atlas Pipeline Partners (APL) is down after several days of nice upside and it bumps up against 46 on the charts which constitutes a breakout. Regency Partners (RGNC) and Markwest Energy (MWE) also down fractionally but nothing is news driven.

Deutche Bank is on the horn this Tuesday morning on a couple of the GP's. It likes Valero GP and starts that one at a buy with a $24 target. It likes Buckeye Holdings a bit less and starts that one with a hold. It also like Teekay LNG Partners (TGP) with a buy and a $36 target. Meanwhile crude is up this morning and over the 60 dollar mark and nat gas just continues to soar; up another 38 cents today.

I thought that Energy Transfer Partners (ETP) would have earnings out this morning but so far nothing on the wire...maybe after the close. No other news items this morning but with earnings coming out in the next few weeks and distribution announcements as well i'd like to make this point. The non hurricane season this year may benefit in 2 ways. One is the obvious one that there was no damage to companies in our universe. But the other could be that repairs from last year may be getting done faster than forecast thanks to no interruptions. This was an issue with a few companies like Markwest Energy (MWE) for example. The market seems to be pricing in good numbers for the group so look for these stocks to continue their upside with of course buying opportunities (pullbacks) along the way.

Looks to me like the MLP Index is finally breaking out of its base and we could be at the beginning of a serious upleg here that could go on for quite awhile. At the very least we should see a serious retest of the all-time highs around 275.

The shorter term daily chart shows a breakout here above 262. More upside coming in my book. Also i posted yesterday about Crosstex LP (XTEX) and just wish to point out that Crosstex (XTXI) is rallying back to the 100 level.

There is a 3 for 1 split coming on this one. Meanwhile the Crosstex(XTEX) weekly chart below...

...clearing 37.50-38 and a close above 38 and this one could rally back to its old high.

I mentioned yesterday that I like Atlas Pipeline Partners (APL) and i bought more shares yesterday morning when the stock was down (lucky me!). I also took a position late yesterday in Atlas Holdings (AHD) as the GP has not done much since the IPO. In fact its under the price it came public at. But I don't think it will be for much longer once investors take notice.

PPI will be a market mover this morning so we wait for that and any other developments.

BTW one quick mention...KUDOS to CNBC SQUAWK BOX for the good job they did this morning on all the breaking news hitting them left and right. The squawk anchors are very good at what they do and make the show enjoying to watch. I AM A HUGE BECKY QUICK FAN! I think she is one of the best anchors on television.This is quite unlike the shows that follow which in my view should be watced only with the mute button close at hand! And don't get me started on the Maria Bartiromo show!

I thought that Energy Transfer Partners (ETP) would have earnings out this morning but so far nothing on the wire...maybe after the close. No other news items this morning but with earnings coming out in the next few weeks and distribution announcements as well i'd like to make this point. The non hurricane season this year may benefit in 2 ways. One is the obvious one that there was no damage to companies in our universe. But the other could be that repairs from last year may be getting done faster than forecast thanks to no interruptions. This was an issue with a few companies like Markwest Energy (MWE) for example. The market seems to be pricing in good numbers for the group so look for these stocks to continue their upside with of course buying opportunities (pullbacks) along the way.

Looks to me like the MLP Index is finally breaking out of its base and we could be at the beginning of a serious upleg here that could go on for quite awhile. At the very least we should see a serious retest of the all-time highs around 275.

The shorter term daily chart shows a breakout here above 262. More upside coming in my book. Also i posted yesterday about Crosstex LP (XTEX) and just wish to point out that Crosstex (XTXI) is rallying back to the 100 level.

There is a 3 for 1 split coming on this one. Meanwhile the Crosstex(XTEX) weekly chart below...

...clearing 37.50-38 and a close above 38 and this one could rally back to its old high.

I mentioned yesterday that I like Atlas Pipeline Partners (APL) and i bought more shares yesterday morning when the stock was down (lucky me!). I also took a position late yesterday in Atlas Holdings (AHD) as the GP has not done much since the IPO. In fact its under the price it came public at. But I don't think it will be for much longer once investors take notice.

PPI will be a market mover this morning so we wait for that and any other developments.

BTW one quick mention...KUDOS to CNBC SQUAWK BOX for the good job they did this morning on all the breaking news hitting them left and right. The squawk anchors are very good at what they do and make the show enjoying to watch. I AM A HUGE BECKY QUICK FAN! I think she is one of the best anchors on television.This is quite unlike the shows that follow which in my view should be watced only with the mute button close at hand! And don't get me started on the Maria Bartiromo show!

Monday, October 16, 2006

Last hour of the day...MLPS have been gaining strength all day long. Atlas Pipeline Partners (APL;) The stock hit 46 and is on the verge of breakout out above its all time high (adjusted for distributions).

Action has looked good all day. Also Markwest Hydrocarbon is nearing 31..up 15% since the middle of last week. I mentioned this morning that alot of charts look good.

Crosstex LP (XTEX) which has been in a sideways pattern for awhile. This one could be the next to break to the upside. Resistence at 37.50 BTW i am long both issues.

Action has looked good all day. Also Markwest Hydrocarbon is nearing 31..up 15% since the middle of last week. I mentioned this morning that alot of charts look good.

Crosstex LP (XTEX) which has been in a sideways pattern for awhile. This one could be the next to break to the upside. Resistence at 37.50 BTW i am long both issues.

Just after lunchtime...MLPS are strong again today. The index is now over 261 up a little over 1 on the day. And while there are no standout winners just about the whole group is up fractionally. On the downside. US Shipping down 69 cents on the sell rec by citigroup. And Global Partners is down 20 cents...no news there.

Nat gas is soaring today up 58 cents a t 6.25. Oil is up as well. Lets see if market strength pushes MLPS even higher this afternoon.

Nat gas is soaring today up 58 cents a t 6.25. Oil is up as well. Lets see if market strength pushes MLPS even higher this afternoon.

Good Monday Morning.

I spent the weekend rolling through charts and was actually strcuk by the fact that there were so many MLP charts that have either broken out or are on the verge of breaking out so lets start the day with a few of the better looking ones.

Copano LP (CPNO) just continues to dazzle in an uninterrupted uptrend that's been going on for months now. The action suggests another big distribution increase coming. The stock is very thinly traded as there are very few shares outstanding so bear that in mind if you put this one on your shopping list. 60 is certainly do-able before earnings.

Regency Partners has broken out as well and this one is a relative newcomer to the scene so its still cheap. I recomended this one at the beginning of the quarter and watched the stock jump 3 points at one point on 10/2/06. I had nothing to do with that. Somebody with deep pockets went shopping that same day.I think this one goes higher.

Markwest Hydrocarbon (MWP) is up 10% in the last 10 days and was also on my 4th quarter shopping list. This one is looking a touch extended but with Martkwest Energy doing well, this one i think also leads higher.

Another one that is on the verge of a major breakout is Atlas Pipeline Partners and a close over 46 (adjusted for distributions) puts this one at an all time high and a breakout also on the weekly chart. Now for some reason i can't seem it upload this chart from my computer. Its one of those mysteries i can't seem to solve. It works for all the others but not this one. But go here to stockcharts.com and you can make one your self. There are others that continune to look good like Oneok LP (OKS) and a few others. I'll blog on those later/

Now to Monday morning news where oil has just turned lower as i post. And here is a piece of news leftover from Friday as Teppco (TPP)has announced its distribution and its the same as last quarter which is why the stock price is about the same as last quarter. Also this morning Markwest Energy (MWE) does a priviate placement of notes.

Citigroup is on the horn this morning as it downgrades US Shipping (USS) to sell from hold. You don't see this too often in the MLP group. Nothing else on the upgrade/downgrade list so far.

Now to some weather related observations. As the hurricane season was discounted for an apocalyptic vision and when destruction did not come the energy markets sold off. Now we have the energy markets pretty much pricing in Florida like conditions across the United States this winter. Nat gas has been doing nothing but going down but i think we could be at a bottom. The media's short attention span of focus has been on El Nino but for the midwest and especially the northeast the pattern to wathc for is the north atlantic oscillation or NAO. It moves on a scale from +2 to -2 on average...sometimes peaking above or below those numbers. When the NAO is negative usually means below normal or sometimes even much below normal temperatures across the midwest and especially the northeast. Well kids its going negative for the next two weeks. And while that doesn't mean a cold winter, it does have a tendency to go negative and stay that way for weeks at a time. If this verifies look for an early and rough start to the winter in nat gas usage land. And the market has not priced this in.

If you wish to look at the national weather service longer range forecasts and see their climate forecasts bear in mind that the monthly and 3 month outlooks will be updated this week.

Friday, October 13, 2006

The whole group is strong today with the MLP index knocking on the door of 260 when just last week we were down in the 253 level. Except for Ferrellgas (FGP) which is down 1 on a stock offering and one or 2 others, we have lots of upside with fractional plusses across the board. Crude held 57 and is back to 59...big energy stocks telegraphed this when they did not go to new lows in the latest move.

Friday afternoons can be slow as people cut out early for the weekend...but we should finish on a strong note.

Friday afternoons can be slow as people cut out early for the weekend...but we should finish on a strong note.

Friday's are always the toughest days to blog because after 4 days of trading the brain gets a little soft by weeks end. Still it is a trading day and we begin with last night and news as Enterprise GP raises its distribution by over 8%! There is no news in the group this morning and nothing in the upgrade or downgrade world.

Most MLPS open higher and the MLP index is up .70 in the early going. Fractional gains in Crosstex LP(XTEX), Enterprise Products Partners(EPD), Atlas Pipeline Partners (APL), and a few others.

We'll post later after all the opening noise is worked out.

Most MLPS open higher and the MLP index is up .70 in the early going. Fractional gains in Crosstex LP(XTEX), Enterprise Products Partners(EPD), Atlas Pipeline Partners (APL), and a few others.

We'll post later after all the opening noise is worked out.

Thursday, October 12, 2006

The field has turned for home and we're at the sixteenth pole...and MLPS are driving higher...the index is up nearly a point and a half and we have some really good gains in many issues. Atlas Pipeline extends its gains from this morning up 1.20 and Markwest Hydrocarbon (MWP)is up 1.10 . Lots of fractional gains across the board.

Crosstex LP (XTEX) is the biggest loser and is off its lows...trying to rally back but still down 80 cents on the last trade..a few other losers but nothing is newsdriven and nothing thats more than pennies.

Crosstex LP (XTEX) is the biggest loser and is off its lows...trying to rally back but still down 80 cents on the last trade..a few other losers but nothing is newsdriven and nothing thats more than pennies.

Lunchtime on Wall Street and MLPS are moving right along and nicely higher. The MLP index is up nearly 1 at 257 and change. We have nice gains in Atlas Pipeline Partners (APL) and Natural Resource Partners (NRP) which are both up nearly 1 apiece; Atlas is benefiting from Citigroups buy recommendation. Also up nice fractions are Magellan Midstream Partners (MMP) and Valero LP (VLI).

Ferrellgas (FGP) is down on its news of record earnings and a stock offering. Also Crosstex LP (XTEX) is down about 40 cents...no news there.

XOI up 14 points...XNG up nearly 5. I guess the perception is that energy companies will still make tons of money even if oil is under 60 bucks. I can't figure out the logic in the nat gas as it is selling off today but the stocks are higher...unless its saying pretty much the same thing with regards to nat gas.

Ferrellgas (FGP) is down on its news of record earnings and a stock offering. Also Crosstex LP (XTEX) is down about 40 cents...no news there.

XOI up 14 points...XNG up nearly 5. I guess the perception is that energy companies will still make tons of money even if oil is under 60 bucks. I can't figure out the logic in the nat gas as it is selling off today but the stocks are higher...unless its saying pretty much the same thing with regards to nat gas.

Good Morning.

Some news this morning as we begin with Ferrellgas Partners (FGP) which announces record earnings this morning and a stock offering as well. This is one that i don't pay close attention to but one view of the stock chart above suggests that i should have.

Citigroup is on the horn this morning as it starts coverage of Atlas Pipeline Partners (APL) at a buy. Its chart has been in a tight range but it illustrates that holding this stock over the past year has been a pretty good thing.

Meanwhile crude continues to sell off and while it continues to head lower, energy stocks have stopped going down.

a href="http://photos1.blogger.com/blogger/6412/1286/1600/crude.2.png">

And note the natural gas stocks have held up far better than natural gas itself.

So where do we go from here. My head tells me that the oil inventory numbers today will cause crude to rally from here unless they are really really bad. I have a tendency to believe that the stocks are offering a positive divergence. Its less clear with nat gas because i've yet to figure out how that works, especially in regards to MLPS. Most mlps have little exposure to price and the ones that have some exposure seem to have a good handle on how to hedge correctly. So i think i boils down to 10 year rates which have been moving sharply higher back to 4.80%. So far the spike from 4.54% has had little impact on MLP prices. Stock futures are higher so we'll revisit after the open.

Wednesday, October 11, 2006

We are completely flat on the MLP AMZ index....and the tape is mixed but has a firm feel to it. Crosstex Energy LP (XTEX) continues to sawtooth its way higher now over the 37 level up 46 cents on the day. Small fractional gains in a host of issues but nothing to be dancing in the streets over. Same thing goes for issues on the losing side. Penn Virginia Resources (PVR) and Natural Resource Partners (NRP) are the bigger losers to the tune of 40 cents or so.

Crude oil now with a 57 handle. It seems that energy stocks continue to hold up nicely in here and as crude makes new lows..the XOI is well above its trading low. Bullish divergence if you ask me.

Crude oil now with a 57 handle. It seems that energy stocks continue to hold up nicely in here and as crude makes new lows..the XOI is well above its trading low. Bullish divergence if you ask me.

Good Morning!

We have weak stocks this morning and flat energy ahead of oil stats so we kick things off with leftover news from last night. LIN Energy (LINE) ups its distribution 7.5 %. This kicks off what should be a long list of distribution increases for this quarter. This morning we have Lehman Brothers upping Duke Midstream (DPM) to overweight and raises its price target to 31 from 30 dollars. Lets see if the market raises the stock price on this move. Nothing else happening in the news front this morning.

Yesterday's firm finish was nice to see considering oil sold off nearly 2 dollars and the XOI closed up 18 points. The AMZ MLP Index closed up nearly three quarters of a point. Lets see what the open brings.

We have weak stocks this morning and flat energy ahead of oil stats so we kick things off with leftover news from last night. LIN Energy (LINE) ups its distribution 7.5 %. This kicks off what should be a long list of distribution increases for this quarter. This morning we have Lehman Brothers upping Duke Midstream (DPM) to overweight and raises its price target to 31 from 30 dollars. Lets see if the market raises the stock price on this move. Nothing else happening in the news front this morning.

Yesterday's firm finish was nice to see considering oil sold off nearly 2 dollars and the XOI closed up 18 points. The AMZ MLP Index closed up nearly three quarters of a point. Lets see what the open brings.

Tuesday, October 10, 2006

After a hesitant start we have gains and this is happening while crude drops to 59 bucks..nat gas however remains higher. So MLPS are moving right along here with the index up .60 which is not bad. Hiland LP(HLND) is up 1 and we have fractional plusses in Crosstex LP (XTEX) Valero LP (VLI), LIN Energy (LINE) and Energy Tranfer Partners (ETP) which btw should have earnings coming out at anytime.

Williams Partners (WPZ) Sunoco Logistics (SXL) and Boardwalk Partners (BWP) are down fractionally but nothing big.

Williams Partners (WPZ) Sunoco Logistics (SXL) and Boardwalk Partners (BWP) are down fractionally but nothing big.

Good Morning.

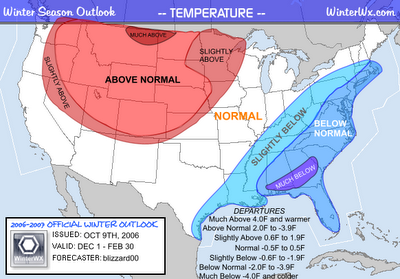

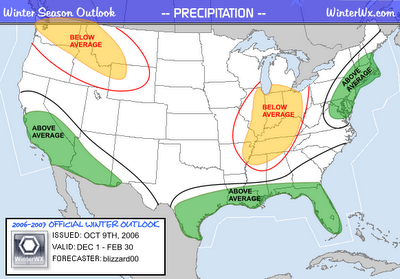

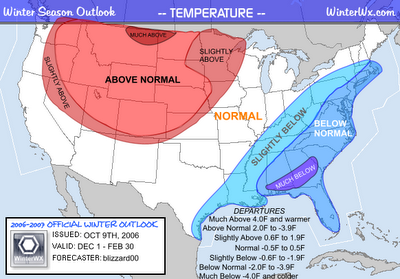

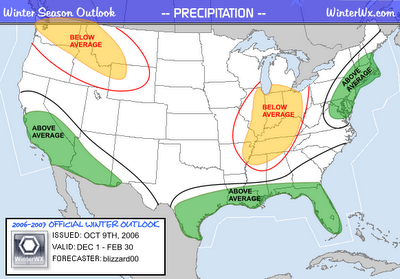

Sorry for the lack of posts yesterday but i was doing family stuff all day with the kiddies off from school. But its back to normal today so lets begin with crude which turned away from the highs yesterday at 12:30pm and its been straight down ever since...now with a 59 handle and down another 53 cents this morning. Natural gas has been in rally mode for days and continues higher this morning (although it also sold off yesterday). And speaking of nat gas and for that matter heating oil there is a winter forecast out that should perk your spirits if you are long. Its not the National Weather Service forecast but i have to tell you there is a lot here that i agree with. You can read the whole thing here or just read it off the maps provided.

Now in the interest of equal time this is the current National Weather Service forecast for the winter (December, January, February)

The stucture of this profile would be supported if we have a strong El Nino coupled with a positive NAO or "North Atlantic Oscillation". For those of you who don't live in the meteorology world the NAO is a weather pattern in the North Atlantic which forces cold air southward from the North Pole into the Eastern US. When the NAO is positive it favors warmer than normal temperatures in the East and Midwest...when it is negative it causes very cold and possibly snowy conditions. Please be advised that the Weather Service 3 month winter forecasts have not been very good over the past few years and this is not the final winter forecast which won't be out for a few weeks. Many other factors play a role in how winters evolve in the US. To trade on this is dangerous as this years apocolyptic hurricane forecasts have proven.

Some MLP news this morning as Duke Midstream (DPM)is on a shopping spree and it will be getting more assets from Duke Energy. The stock is approaching a breakout on the charts and this could be the news to take it over 29 on a volume spike.

No other news to speak of this morning and no upgrades or downgrades. I will point out that Goldman Sachs downgrades Exxon this morning which will probably weigh on the XOI index today.

Sorry for the lack of posts yesterday but i was doing family stuff all day with the kiddies off from school. But its back to normal today so lets begin with crude which turned away from the highs yesterday at 12:30pm and its been straight down ever since...now with a 59 handle and down another 53 cents this morning. Natural gas has been in rally mode for days and continues higher this morning (although it also sold off yesterday). And speaking of nat gas and for that matter heating oil there is a winter forecast out that should perk your spirits if you are long. Its not the National Weather Service forecast but i have to tell you there is a lot here that i agree with. You can read the whole thing here or just read it off the maps provided.

Now in the interest of equal time this is the current National Weather Service forecast for the winter (December, January, February)

The stucture of this profile would be supported if we have a strong El Nino coupled with a positive NAO or "North Atlantic Oscillation". For those of you who don't live in the meteorology world the NAO is a weather pattern in the North Atlantic which forces cold air southward from the North Pole into the Eastern US. When the NAO is positive it favors warmer than normal temperatures in the East and Midwest...when it is negative it causes very cold and possibly snowy conditions. Please be advised that the Weather Service 3 month winter forecasts have not been very good over the past few years and this is not the final winter forecast which won't be out for a few weeks. Many other factors play a role in how winters evolve in the US. To trade on this is dangerous as this years apocolyptic hurricane forecasts have proven.

Some MLP news this morning as Duke Midstream (DPM)is on a shopping spree and it will be getting more assets from Duke Energy. The stock is approaching a breakout on the charts and this could be the news to take it over 29 on a volume spike.

No other news to speak of this morning and no upgrades or downgrades. I will point out that Goldman Sachs downgrades Exxon this morning which will probably weigh on the XOI index today.

Monday, October 09, 2006

Good Morning and a Happy Columbus Day! Western Oppression began on this day 514 years ago. I for one will be celebrating with lots of Italian food!!!

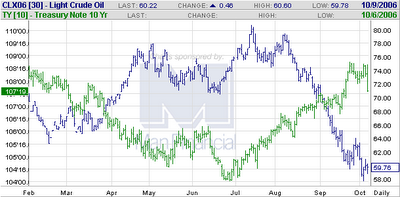

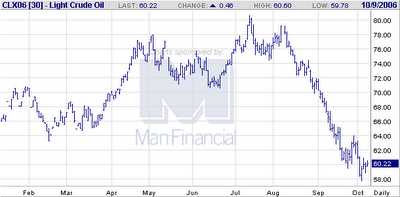

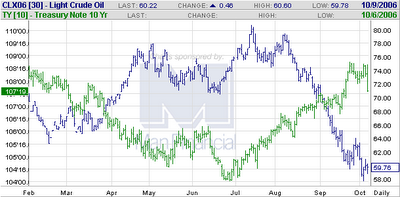

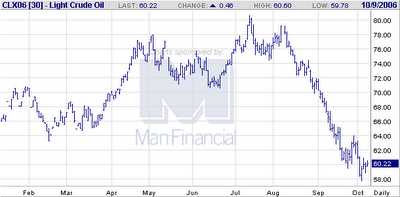

Okay lets begin this morning as any healthy person would...charts of crude and crude verses the 10 year.

Note that crude and rates are moving in opposite directions...rates bottomed in July...Crude topped in July. The message here is that the bond market is focusing on the lower inflationary implications of falling oil. The question is has crude or is crude bottoming here and are rates bottoming...at least short term? Food for thought. Opec is going to cut production or at least they claim they will be cutting production. Will this stablize prices? And do mlps trade along in their own way? North Korea tests a nuke and tensions tightnen in the far east. Lots to ponder this morning.

Meanwhile no corporate developements and no upgrades or downgrades either. So in this semi-holiday enviorment we have lots going on. Stocks will open lower in the overall market. We will of course see where that takes us.

I usually will post charts of leaders. I thought this morning i'd look at 2 laggards, Atlas Pipeline Partners (APL) and Valero LP (VLI).

Both have been in very tight ranges over the past year. I'm not sure what the problem is with Atlas Pipeline (APL) other than falling nat gas prices. The stock is well hedged here. So if nat gas stablizes or rises it could be a positive. Valero on the other hand has only done one distribution increase in the last 5 quarters. They need to start growing the payout again to get the stock price moving. The have been optimistic about this for the second half of the year. This quarter should resolve this one way or the other.

Okay lets begin this morning as any healthy person would...charts of crude and crude verses the 10 year.

Note that crude and rates are moving in opposite directions...rates bottomed in July...Crude topped in July. The message here is that the bond market is focusing on the lower inflationary implications of falling oil. The question is has crude or is crude bottoming here and are rates bottoming...at least short term? Food for thought. Opec is going to cut production or at least they claim they will be cutting production. Will this stablize prices? And do mlps trade along in their own way? North Korea tests a nuke and tensions tightnen in the far east. Lots to ponder this morning.

Meanwhile no corporate developements and no upgrades or downgrades either. So in this semi-holiday enviorment we have lots going on. Stocks will open lower in the overall market. We will of course see where that takes us.

I usually will post charts of leaders. I thought this morning i'd look at 2 laggards, Atlas Pipeline Partners (APL) and Valero LP (VLI).

Both have been in very tight ranges over the past year. I'm not sure what the problem is with Atlas Pipeline (APL) other than falling nat gas prices. The stock is well hedged here. So if nat gas stablizes or rises it could be a positive. Valero on the other hand has only done one distribution increase in the last 5 quarters. They need to start growing the payout again to get the stock price moving. The have been optimistic about this for the second half of the year. This quarter should resolve this one way or the other.

Subscribe to:

Posts (Atom)