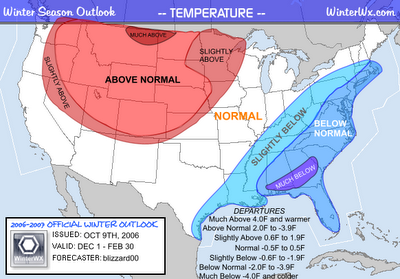

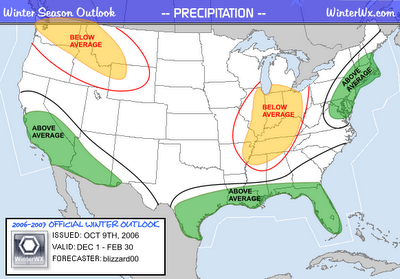

Sorry for the lack of posts yesterday but i was doing family stuff all day with the kiddies off from school. But its back to normal today so lets begin with crude which turned away from the highs yesterday at 12:30pm and its been straight down ever since...now with a 59 handle and down another 53 cents this morning. Natural gas has been in rally mode for days and continues higher this morning (although it also sold off yesterday). And speaking of nat gas and for that matter heating oil there is a winter forecast out that should perk your spirits if you are long. Its not the National Weather Service forecast but i have to tell you there is a lot here that i agree with. You can read the whole thing here or just read it off the maps provided.

Now in the interest of equal time this is the current National Weather Service forecast for the winter (December, January, February)

The stucture of this profile would be supported if we have a strong El Nino coupled with a positive NAO or "North Atlantic Oscillation". For those of you who don't live in the meteorology world the NAO is a weather pattern in the North Atlantic which forces cold air southward from the North Pole into the Eastern US. When the NAO is positive it favors warmer than normal temperatures in the East and Midwest...when it is negative it causes very cold and possibly snowy conditions. Please be advised that the Weather Service 3 month winter forecasts have not been very good over the past few years and this is not the final winter forecast which won't be out for a few weeks. Many other factors play a role in how winters evolve in the US. To trade on this is dangerous as this years apocolyptic hurricane forecasts have proven.

Some MLP news this morning as Duke Midstream (DPM)is on a shopping spree and it will be getting more assets from Duke Energy. The stock is approaching a breakout on the charts and this could be the news to take it over 29 on a volume spike.

No other news to speak of this morning and no upgrades or downgrades. I will point out that Goldman Sachs downgrades Exxon this morning which will probably weigh on the XOI index today.

No comments:

Post a Comment