Saturday, December 31, 2005

Its the general view among many on the message boards that Teppco will be taken over by Dan Duncan and folded into Enterprise Products Partners (EDP). Check out these slew of messages on the yahoo board for Teppco for other opninons. No one seems to be discussing this on the Enterprise board . I planted a seed there so lets see what it yields.

One could say that the appointment of an "acting" CEO could be a sign since recent other corporate moves involved moving EPD people into the Teppco heirarchy. Folding Teppco into Enterprise probably makes sense for Duncan. I'll be curious to see market reaction to this on Tuesday morning. If there were a takeover please remember that Enterprise's takeover of Gulfterra was done at almost no premium to the trading price. If this merger were to occur my guess is a stock swap and i am dreaming of 1.67 -1.75 shares of Enterprise for each Teppco share ($40-42 bucks).

Of course this could all be one big fantasy here but as always....food for thought.

Friday, December 30, 2005

Lots of near end noise and some early session dumping in Crosstex (XTEX) which plunged to 32 at the open and is now back to unch...HILAND which was +2 and change yesterday has given 1 and change back...otherwise its just year ending with a firmness in most issues. Plains All American is down near its low.

Unless there is an earthshattering development...HAPPY NEW YEAR!!!

Thursday, December 29, 2005

Also note the blog roll i've added a new insider site which has lots of info about insider trading. Take a look.

No news this morning so i guess its more of the same. Year end distortions continue but only 2 days left of this nonsense.

Lots of Bargains in MLP land with yields over 8% in some that are growing their distribution like Atlas Pipeline Partners (APL) and not Teppco (TPP).

Watching the tape as always.

Wednesday, December 28, 2005

Mostly lower again today with some bouncing here and there. Looks like some organized year end dumping by somebody. Yesterday it was ATLAS PIPELINE and ENBRIDGE ENERGY PARTNERS...both were down 1 or more yesterday and they're up today. Today they're shooting Holly Partners down 1 and change...and Tortoise Energy down 1 even.

Teppco is up as we speak...trying to break a 10 day losing streak.

No corporate news....3 trading days including today left for final tax loss selling. Yesterday was last day for 2005 settlement if thats important to some traders.

Tuesday, December 27, 2005

When will the ugliness stop??? BTW no corporate news to speak of.

Ten year yield chart is breaking down which should put a solid floor in these things but i've been chanting this for weeks now and the market is not listening.

Teppco looks very sad. Beginning to believe that a distribution cut is in the offing!

Sorry for the late going but had torun around this morning. Everything energy is collapsing so MLPS are following suit even though the 10 year is supportive and breaking under 4.40%. Teppco is down 1 and change and really breaking down badly....if this area goes...I think its a distribution cut being telegraphed and we're headed for 26-28. Atlas is down 1 and change. Big fractional losses across the board. Markwest is actually up a few pennies; Energy Transfer and Buckeye also seem to be holding up well.

Saturday, December 24, 2005

Friday, December 23, 2005

Another one of my favorites!

Please note that i have updated the blog roll. I've added a link to CLOSED END FUNDS. It is a very useful sight with info on how CEF's work. Please visit. Also visit this blog on CEF's. I am adding this to the blogroll as well.

Sharing with you one of my favorite cartoons!

Good Morning. Friday before Christmas Weekend.....Trading should be rangebound today...no news...no nothing so far. Tax loss selling should be abating now as we're past peek volume for the month. There was some firming late in the day yesterday in MLPS....lets see if the trend continues.

Thursday, December 22, 2005

Teppco down 11 cents...a year from now at 11 cents a day...it will be at zero!

Wednesday, December 21, 2005

Losing 2+ is Markwest and its down 6 points in the last few days....still no news here. Mixed in the group today...moves mostly small fractions. At least we're one day closer to the end of tax loss selling.

Fractional moves dominate most moves are small. No real news.

Late night in Manhattan again last night with a Handels Messiah Singalong at Avery Fischer Hall...lots of fun...very tired. And i know all the unused ways into Manhattan and had minimal trouble with traffic!

Okay so Valero and Teppco are up this morning but the day is young. No news today. I think it stays this way until Jan 2 2006...so take your tax losses while you can if you have them.

Tuesday, December 20, 2005

And Valero LP also can't get out of its own way and that one is near its August 2004 low in the 49 area. Yesterday's late afternoon Deuthce upgrade was a waste. 4.47 on the 10 year. Oil and Gas majors are higher.

Also Energy Transfer Partners has increased the size of its GP IPO though no story link is available as of this posting. Will post link when available.

Late in the day yesterday we had Valero LP being upgraded by Deutche Securities and Energy Transfer downgraded by Deutche Securities. No impact on ETP but it did cause a few upticks in VLI.

Pre-Christmas/Transit Strike trading so it looks to be more of the same stuff. No news this morning so we may just be appointment only from here on until after new years day.

Monday, December 19, 2005

Still new lows in Teppco and Valero LP as tax loss selling or just plain selling continues. Markwest is down 1.31 with no news. In fact except for a few of the closed end funds which are up a few pennies...everything is down today.

Sorry for the late posting this morning but i had another funeral to go to...its been a December to remember here as 8 people i know have died. I hope this is the last for awhile.

Looks like end of year mode has begun...Tax related selling has taken Teppco and Valero to new 18 month lows. Markwest Energy is down 1 and change to under 45. Seeing small fractional moves elsewhere with no corporate news.

Friday, December 16, 2005

Good morning. Went to see La Boheme at THE MET at Lincoln Center last night. It was my first opera. The main character dies at the end...the audience dies far sooner!

There has been a general thesis being put out there by MLP observers that rising interest rates have hurt prices in the last 3 months. I would contend that while prices have been hurt the cause may have been more the huge amount of stock offerings and the market correctly anticipating this...rather than any rise in long rates. My reason for this is plainly and simply long rates not only have not really risen in the last year but are still below the April 2004 peak at 4.90%. Short rates have climbed and i think you could argue that risk free 4% is attracting some shorter term money away. The yield spread which shrunk to under 2 at one point in July have now risen to over 3 in some cases like APL and MMLP.

I bring this up mainly because the 10 year yield has been falling since reaching 4.64 a few weeks ago and if you look at the chart we be ready for 10 year rates to drop which of course is supportive to MLP prices. Add to this is the improving technical action in the group and i think (in my never to be humble opinion of course) that the correction in these stocks is over and its time to buy! Again look for the strongest looking charts...

Yields are falling this morning...futures are higher...crude is lower. No news or upgrades/downgrades so far this morning. Waiting for the open.

Thursday, December 15, 2005

No news from late last night and this morning and no upgrades or downgrades so i figured i let them open up first and trade for a hour. Huge nat gas draw down has put a bid under gas stocks after selling off in the first hour.

MLPS are either side of unchanged this morning all the moves small and fractional. 4.49 on the 10 year. Looking for these stocks to rally later today.

Wednesday, December 14, 2005

Actually a good day today. The best looking charts were up the strongest today. Plains All American is +1.15 on its upgrade. Energy Transfer is up 60 cents and so is Pacific Energy Partners. Magellan Midtream over 33 again up 21 cents. Also fractional gains in Atlas Pipeline and Markwest. Northern Borders Partners at 42.99 now as it bounced off its low. Duke Midstream Partners the new IPO has quietly moved up to 25 from 23 in the last few days.

Lets start the morning with an upgrade of Plains All American Pipeline by RBC Capital Markets to outperform from sector perform. Then there is news from Teppco about its credit line and also from Energy Transfer Partners.

No other news this morning so far.

Tuesday, December 13, 2005

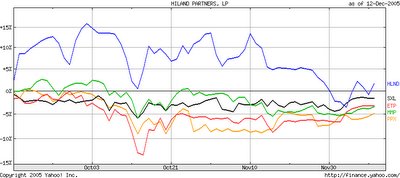

Posted chart above of 4 MLPS and 1 GP. Energy Transfer is the best performer in this group and NRP the worst over the last 3 months. ETP is -3% the rest are down about -9 to -13 %. APL had a stock offering; the others did not.

Now the chart at the top are what i consider to be the 5 outperformers during this correction and perhaps should be looked at seriously as the next group leaders. Note all are down less than 5% and Hiland LP is actually up slightly...and they had a stock offering along with Pacific Energy.

Food for thought.

Copano (CPNO) seeing some stock sales...-1.46 with no news. Penn Virginia Resources (PVR) down a buck with no news.

Broken clocks i suppose are right twice a day.

Monday, December 12, 2005

Watching the after market for news. Morningstar had some nice things to say about Northern Borders Partners, TCLP which owns a stake in NBP and Amerigas.

when one sells an MLP, does one refer to the first K-1 for adjusted cost basis? I've held NBP for a few years and suppose original K-1 is included with that tax year file (that I bought it) but not sure. Think the MLP would help with guidance in that event?

Any answers appreciated in comment section

Outside our space but a big deal with Conoco Philips and Burlington if finalized. This along with firm energy this morning might light a fire under all things energy. We'll see. Meanwhile its getting closer to Holiday (or should i say CHRISTMAS) and individual company news is non existant this morning. But it is early.

Sunday, December 11, 2005

First off the the weather pattern over the eastern us looks cold to bitter cold at times....there looks to be an arctic dump coming for the week of Dec 18-24....at least thats what most weather models are indicating. This coming week will start cold and below normal in the northeast and then trend to near nomal by week's end. This should continue to put upward pressure on oil and gas prices.

In the news a massive explosion at a British oil depot.

Lastest from the BBC at the above link.

I think MLPS are bottoming here and could rally into year end. Buy only the ones with best charts like ETP and PSX among a few others and i would still avoid Teppco and Northern Borders Partners until their charts show at least some signs of bottoming. BTW for the first time the universe of closed end MLPS are selling at discounts to their net asset values after trading at premimums of as high as 6% above NAV. Check FEN FMO TYG KYN.

Crude oil is up this evening by 46 cents and Natural Gas is up as well by a nickle. More cold air arriving. Cactus Jack has as always an informative post on the yahoo boards. Give it read.

Friday, December 09, 2005

I am no getting stronger in my opinion that we have bottomed in here and that this is a good place to either add to positions or pick up new positions in the stronger MLP charts as shown yesterday...(see archive). Valero LP looked like it did its climactic plunge to 51.40...now higher and 1 dollar off the low. Copano (CPNO) is up 75 cents. On the downside Crosstex (XTXI) is down 1. Everyone else is somewere in between.

Thursday, December 08, 2005

And now an example of a hideously looking chart...the daily chart of Northern Borders Partners as the price is now nearing at 15 month low. Check out the weekly chart at the top here and the round trip that stock holders have been on. Since we're approaching an 8 percent yield its hard to imagine this go much lower than 40...but with no prospects for a distribution increase this looks like dead money at best.

More plus signs and watching the tape in the last 30 minutes MLPS they seem to firm into the close. Ranges very tight today on many in the group and IM(never to be)HO i think this is a good place to pick up bargains. Energy Transfer has one of the best looking charts in the group and Hiland LP for those who want to be a bit more speculative. Again no guarantees from the management here but i think there is light at the end of this rather long corrective tunnel!

Above are some of the better looking charts.

http://www.raymondjamesecm.com/industry_1300_main.asp?indid=71

thats the raymond james link and its also on the links column

Wednesday, December 07, 2005

When corrections are underway they can be painful and grinding and just not fun. But it is wise during this time to perhaps find the ones that are outperforming so when the next upleg begins you might have the next leaders. In the interest of disclosure I own all three. But of all the charts of MLPS...and if you are a chart reader. These three look so much better than the others.

Energy Transfer Partners (ETP) probably is the best looking as it seems to be emerging out of a basing pattern. The other two (Magellan Midstream MMP, and Sunoco Logistics SXL) still look like they are working through their bases. These three do not have that "still in a downtrend look that so many in the group have.

Anyway Food for thought.

Somewhat of a firm finish for most of the group yesterday so lets see if it carries over today. Meanwhile on the news front Energy Transfer Partnerss announces a series of aquisitions but they sound on the small side.

No other news to speak of this morning so far. Energy complex is firm as winter continues.

I'm adding this link to the links column. Its to Raymond James and its MLP monthly report. Its a good read on a regular basis.

Tuesday, December 06, 2005

Down fractions include Holly Partners which opened down 1.50 and is now down 70 cents. Also down are Tortiose Energy(TYG) and Northern Borders Partners (NBP).

Moodys downgrades Markwest's unsecured debt but its a headline and i'm not sure if its the GP or the LP.

Lets see if we can keep a firm tone into the close.

BTW i don't now how i missed this but Duke's LP came public last Friday.

News from Teppco this morning. They're presenting today at a Wachovia Oil and Gas Conference...they reinterated their guidance for 05'. No big deal here. Atlas Pipeline Partners announcing a priviate placing of senior notes. No other breaking news this morning.

Crude and energy complex is lower this morning but not by much.

Monday, December 05, 2005

Energy Transfer Partners is 75 cents higher on the distribution and guidance boost. Elsehwhere the picture is mixed with small fractional moves in either direction. The energy complex is off its high of the day. No other corporate news.

Not much else happening. 10 year at 4.55...Crude and Nat gas still higher...dow -40.

GOOD MORNING! We begin this monday morning with news from Energy Transfer Partners who is raising the distribution by a nickle (10%) to 55 cents a share and increase earnings guidance as well. Should be worth some upside here. No other news so far this morning.

Energy Complex is rallying this morning especially Natural Gas.

Above is the daily chart for crude verses the 10 year price...Since Hurricane Katrina they have been in lock step...falling crude/rising yields. This chart implies crude will impact the economy as prices rise above 60 dollars.

This is the natural gas chart vs the 10 year. Here its been rising gas/rising yield. The implication here is that rising gas prices will raise yields and be inflationary.

The daily chart on oil/10 year shows how much in lockstep they have been since August.

Seems like the market has discoverd that now we will indeed have a winter as cold air has spread out across much of the eastern two thirds of the US. As per MLPS i am cautiously predictiing that a bottom is being put in place here as volume looks to be drying up in the last several days with some individual selling climaxes occuring. But the charts of most of the group look pretty awful and we need to see these guys to move above their 34 day moving averages. No sign of this yet.

Friday, December 02, 2005

Hopefully these things are all sold out...some of the action has the look of a selling climax but bottom picking has not been my strong suit. Unemployment numbers will move the 10 year today. 10 year's initial response to numbers is an easing of yield back toward 4.50%

Inergy GP is out with record earnings after you strip out the numbers. No other news this morning on the corporate front.

Thursday, December 01, 2005

Big energy is firm...XOI +15 points.

Most of these guys cut their losses yesterday by closing time. Its getting to the point where these stocks are severely oversold; yields are approaching 8% in some instances. Atlas Pipeline which has been growing its distribution at a 16% annual clip is yielding 7.8% which is higher than Northern Borders Partners who has not raised its distribution in several years. And some of these like Valero LP is selling for less than it did in MAY 2004 when the 10 year spiked to 4.95%.

I think money flows right now are out of energy and into technology and MLPS are being sold as a source of those funds. And they don't seem to be attracting new money. But the 10 year spread being over 3 points...we are at the top of historical range.

No news on the corporate front this morning.