Sunday, December 31, 2006

Saturday, December 30, 2006

HAPPY NEW YEAR...2006 WAS A GREAT YEAR FOR US...LETS HOPE 2007 IS EVEN BETTER....AND OF COURSE MOST IMPORTANTLY THAT ITS A GREAT 2007 FOR EVERYONE THAT IS IN YOUR LIFE!!!!

I have to openly thank all of you...and those of you who posted messages to me in the prior post a special thank you. I love comments and i only wish more of you would post your opinions of my opinions. Please don't be shy!!!!

I am beginning to wonder about early 2007 and would like to point out that winter has been non-existent so far in the heat using regions. But there are meteorological signs that i am becoming increasingly confident about that this ridiculous pattern we've been in is about the change after the first week of January. What i am not sure of is how its all going to play out specically but it is going to change. And if that is the case look for upside in natural gas prices and coal. I've been accumulation Alliance Resource and the GP looking for an upside move on 2 stocks that have not done much while the rest of MLPS have rallied. More on this and other trading ideas before the open Wednesday.

Incidently those of you who have been looking for an entry point in Linn Energy....here is a suggestion. If you want to buy cheaper than Friday's close...ladder some buy orders 2 points or more below the prior close and keep your fingers crossed. I'm hoping there will be some post new years tax gain wholesale dumping of last years ipo winners on the first day or 2 of trading. Regency (RGNC) might be another one to look at...Calumet (CLMT) is also a possibility. More coming probably on Tuesday!

I am beginning to wonder about early 2007 and would like to point out that winter has been non-existent so far in the heat using regions. But there are meteorological signs that i am becoming increasingly confident about that this ridiculous pattern we've been in is about the change after the first week of January. What i am not sure of is how its all going to play out specically but it is going to change. And if that is the case look for upside in natural gas prices and coal. I've been accumulation Alliance Resource and the GP looking for an upside move on 2 stocks that have not done much while the rest of MLPS have rallied. More on this and other trading ideas before the open Wednesday.

Incidently those of you who have been looking for an entry point in Linn Energy....here is a suggestion. If you want to buy cheaper than Friday's close...ladder some buy orders 2 points or more below the prior close and keep your fingers crossed. I'm hoping there will be some post new years tax gain wholesale dumping of last years ipo winners on the first day or 2 of trading. Regency (RGNC) might be another one to look at...Calumet (CLMT) is also a possibility. More coming probably on Tuesday!

Friday, December 29, 2006

We have slow year end trading but i suspect that we'll see action picking up after 2:30pm...i think the tax loss selling if any is done and then its portfolio rebalancing which could make for some swings. I was able to grab my Arch Coal Calls (ACIAG) at a nickel apiece for a purely speculative move. We'll see how this plays.

LAST DAY OF 2006...A VERY GOOD YEAR FOR MLPS..

The AMZ MLP index began the year at 241.04 and sits this morning at 283.66 or a nearly 20% gain not including those handsome distributions...so total return for the year based on the index is 25% or higher as we continue to outperform just about every other standard market measure. We did well this year for sure and at least peaking ahead into 2007 there is no reason why the outperformance can't continue in the face of steady to falling 10 year rates coupled with distribution increases.

Meanwhile this morning there is absolutely no corporate news and no upgrades or downgrades to deal with. So the question for the day is what effect year end mark ups and mark downs will have on closing prices and if there is any money to be made on year end distortions. I will be watching carefully and will post anything noteworthy.

Thursday, December 28, 2006

MLP index is higher by half a point at lunchtime. Most issues are moving between plus and minus 30 cents and that has not varied too much all day. Valero LP (VLI) and Hiland GP (HPHP) are the upside exceptions as they are both up 1 dollar each. On the losing side Natural Resource Partners is down 75 cents. No news driving the group today although rates on the 10 year are back above 4.70%.

I will watch for any action this afternoon. Still looking for an options buy in Arch Coal for a purely speculative play here. Waiting for confirmation from weather models but their are signs of a weather pattern shift after January 10th that could lead to actual winter time weather moving into gas eating areas of the midwest and northeast. We'll see.

I will watch for any action this afternoon. Still looking for an options buy in Arch Coal for a purely speculative play here. Waiting for confirmation from weather models but their are signs of a weather pattern shift after January 10th that could lead to actual winter time weather moving into gas eating areas of the midwest and northeast. We'll see.

APPROACHING YEAR END...MLPS SET TO GO OUT NEAR ALL TIME HIGHS!

Good Thursday Morning!

Its the day before the last trading day of the year. MLPS have been a big winner this quarter and this year...outperforming just about every measure around. So with 2 trading days i'm thinking upside pressure will be there as they mark everything up to make things look even better. This morning it is news free from a corporate standpoint and no upgrades or downgrades.

I mentioned yesterday Alliance Resource Partners (ARLP) and Alliance Holdings GP (AHGP)as possible rally candidates once tax loss selling was done. Judging by yesterday's action it looks like they may have put in their bottoms and that the bounce may be starting. Looking for follow through upside here today.

Not much else to blog about today pre-open so i'll let the cards play themselves out and repost after 10am

Good Thursday Morning!

Its the day before the last trading day of the year. MLPS have been a big winner this quarter and this year...outperforming just about every measure around. So with 2 trading days i'm thinking upside pressure will be there as they mark everything up to make things look even better. This morning it is news free from a corporate standpoint and no upgrades or downgrades.

I mentioned yesterday Alliance Resource Partners (ARLP) and Alliance Holdings GP (AHGP)as possible rally candidates once tax loss selling was done. Judging by yesterday's action it looks like they may have put in their bottoms and that the bounce may be starting. Looking for follow through upside here today.

Not much else to blog about today pre-open so i'll let the cards play themselves out and repost after 10am

Wednesday, December 27, 2006

Light volume and after the inital moves were pretty much treading water although at much higher levels. The index is up over 1 point and we have nice gains in Natural Resource Partners (NRP), Hiland Partners (HLND), T C Pipelines (TCLP), Markwest (MWP), Oneok LP (OKS), and a few others.

Calumet Partners (CLMT) is down 1.11 as the biggest loser. Martin Midstream Partners (MMLP) is down 59 cents. A few other losers but the losses are limited to 25 cents or less.

Calumet Partners (CLMT) is down 1.11 as the biggest loser. Martin Midstream Partners (MMLP) is down 59 cents. A few other losers but the losses are limited to 25 cents or less.

Good Morning!

One of those quiet mornings to start in the world of corporate news but i did find this story via dow jones from the Houston Chronical on Energy Transfer Partners about price fixing during Hurricane Katrina as the company is under investigation. We'll see if this has any impact. Meanwhile in upgrade/downgrade land nothing is going on. Energy is lower in both oil and natural gas. Nat gas is down another 20 cents and we're back to a five handle. No cold air in sight, probably through the middle of January and possibly through the end of January.

More end of year stuff will effect trading. It looks to me like we're going to rally into Friday. As for trading opportunities i'm still waiting for entry points for a few issues.

I think the IPO winners like Linn Energy(LINN) and Regency (RGNC) for example might have a selloffs next week but when they come they will be fast and furious so you need to be ready. Again i recommend using moving averages like the 34,55,and 89 day expotential moving averages as logical places to put buy orders. Laddering is always best. There might be a few other issues that could see similar action. On the other hand i think the coal MLP Alliance Resource Partners (ALRP) and Alliance Holdings GP (AHGP)

Notice that the AHGP chart looks like it is has formed a nice base and i think once tax loss selling is done we could see a nice trading rally in both these issues.

One of those quiet mornings to start in the world of corporate news but i did find this story via dow jones from the Houston Chronical on Energy Transfer Partners about price fixing during Hurricane Katrina as the company is under investigation. We'll see if this has any impact. Meanwhile in upgrade/downgrade land nothing is going on. Energy is lower in both oil and natural gas. Nat gas is down another 20 cents and we're back to a five handle. No cold air in sight, probably through the middle of January and possibly through the end of January.

More end of year stuff will effect trading. It looks to me like we're going to rally into Friday. As for trading opportunities i'm still waiting for entry points for a few issues.

I think the IPO winners like Linn Energy(LINN) and Regency (RGNC) for example might have a selloffs next week but when they come they will be fast and furious so you need to be ready. Again i recommend using moving averages like the 34,55,and 89 day expotential moving averages as logical places to put buy orders. Laddering is always best. There might be a few other issues that could see similar action. On the other hand i think the coal MLP Alliance Resource Partners (ALRP) and Alliance Holdings GP (AHGP)

Notice that the AHGP chart looks like it is has formed a nice base and i think once tax loss selling is done we could see a nice trading rally in both these issues.

Tuesday, December 26, 2006

While the selloff in the energy complex accellerates some weakness has spread into MLPS as the index is now down 23 cents. More losers than winners and a few in the group that were positive have turned negative...but nothing stands out to painfully. Crosstex LP (XTEX) is the biggest loser down 54 cents while TC Piplines is up nearly a dollar on top of last Friday's 2 dollar gain.

With year end tax selling and all the other nonsense going on i'm looking to see what could be a candidate for a tax selling bounce when its all said and done. Alliance Resource Partners (ARLP) has been in a trading range and has showed some weakness recently. Alliance Holdings (AHGP) also is down from 26 to 19 and change and could be a bounce prospect.

And while not an MLP i am thinking of buying some Arch Coal (ACI) options...the January 35 call is on my radar but i won't pull the trigger unless they drop to a nickle. Then i may take a dice roll. As always no guarantees from the management but we keep trying!

With year end tax selling and all the other nonsense going on i'm looking to see what could be a candidate for a tax selling bounce when its all said and done. Alliance Resource Partners (ARLP) has been in a trading range and has showed some weakness recently. Alliance Holdings (AHGP) also is down from 26 to 19 and change and could be a bounce prospect.

And while not an MLP i am thinking of buying some Arch Coal (ACI) options...the January 35 call is on my radar but i won't pull the trigger unless they drop to a nickle. Then i may take a dice roll. As always no guarantees from the management but we keep trying!

Good morning and i hope everyone's Christmas was a great one. I'm coming off a double shift and am so tired i can't hit the keys on the keyboard right. Nonetheless MLP's are higher as the index is up over 1 point and we have lots of nice gains in a host of issues. We do have some moves in the upgrade downgrade department as Lehman starts Constellation Partners (CEP) at overweight but the stock moved last week in anticipation and is down a few pennies today. Key Banc cuts Linn Energy to buy from agressive buy. If it drops to the 30 level i'm backing the truck up again.

Oil was higher and now trades lower...nat gas getting hit hard down 40 cents. All kinds of year end nonsense going on over the next few days which may offer some trading opportunities. I'll post a few things to watch for once i get my head together.

Oil was higher and now trades lower...nat gas getting hit hard down 40 cents. All kinds of year end nonsense going on over the next few days which may offer some trading opportunities. I'll post a few things to watch for once i get my head together.

Sunday, December 24, 2006

In those days a decree went out from Caesar Augustus 2 that the whole world should be enrolled. This was the first enrollment, when Quirinius was governor of Syria. So all went to be enrolled, each to his own town.

And Joseph too went up from Galilee from the town of Nazareth to Judea, to the city of David that is called Bethlehem, because he was of the house and family of David, to be enrolled with Mary, his betrothed, who was with child.

While they were there, the time came for her to have her child,

and she gave birth to her firstborn son. 3 She wrapped him in swaddling clothes and laid him in a manger, because there was no room for them in the inn.

Now there were shepherds in that region living in the fields and keeping the night watch over their flock. The angel of the Lord appeared to them and the glory of the Lord shone around them, and they were struck with great fear.

The angel said to them, "Do not be afraid; for behold, I proclaim to you good news of great joy that will be for all the people. For today in the city of David a savior has been born for you who is Messiah and Lord.

And this will be a sign for you: you will find an infant wrapped in swaddling clothes and lying in a manger." And suddenly there was a multitude of the heavenly host with the angel, praising God and saying: "Glory to God in the highest and on earth peace to those on whom his favor rests."

When the angels went away from them to heaven, the shepherds said to one another, "Let us go, then, to Bethlehem to see this thing that has taken place, which the Lord has made known to us." So they went in haste and found Mary and Joseph, and the infant lying in the manger.

When they saw this, they made known the message that had been told them about this child. All who heard it were amazed by what had been told them by the shepherds. And Mary kept all these things, reflecting on them in her heart. Then the shepherds returned, glorifying and praising God for all they had heard and seen, just as it had been told to them.

TO ALL MY READERS AND VISITORS TO THIS BLOG...A VERY MERRY CHRISTMAS TO YOU AND YOUR FAMILIES...ENJOY THIS WONDERFUL TIME OF YEAR!

Friday, December 22, 2006

TCLP leads the way higher up 1.73 as it buys a stake in another company as reported earlier. MLPS are up with the index higher by 1 full point. Most of the gains are fractional in nature as trading continues to slow. There are some losers today including Linn Energy (LINN) which was down 70 cents...profit taking after its big move. The rest of the losers list holding losses of 15 cents or less.

Good Friday morning and a happy last day of trading before Christmas. We actually have some news this morning as TC Pipelines (TCLP) is buying a stake in another company which is immediately accretive to earnings. Nothing else news wise and no upgrades or downgrades. So i suspect that everything will get wrapped up early trading wise and then we'll just tread water the rest of the way.

Weatherwise btw it looks like the pattern will turn somewhat colder late next week and beyond which will probably impact the energy markets as we get closer to the timeframe.

So i'll probably post one or two more times today and then shut down until next Tuesday when the year end games begin.

Thursday, December 21, 2006

Mostly lower prices this afternoon with the market and energy both down. Calumet (CLMT) is down 80 cents as Raymond James cuts the stock to market perform. There are no other corporate drivers today. Weakness is orderly and the pace of trading continues to slow to a trickle. Thats why my blogging has slowed to a trickle today.

Good Morning!

I would suspect that trading today will continue to slow to a crawl. 5 trading days left in the year so look for some year end nonsense. For those of you looking for opportunities to buy Linn Energy (LINE) or Regency Partners (RGNC) or any of a number of MLP IPO'S that came to market this year, maybe you'll get your shot on January 2nd when selling and booking profits go on the books for 2007.

Meanwhile I would like to point out a couple of charts that may have entered correction mode. Energy Transfer Partners (ETP)and Duke Midstream look to be in pullback mode here.

If you have been waiting for pullbacks in these two issues look at the moving averages as logical entry points.

No corporate developemts this morning and no upgrades or downgrades so far.

Wednesday, December 20, 2006

The pace of trading has slowed today. Not much has happened since the open. The index is losing ground down .75 and there are some noteable losers like Duke Midstream which is down.80 and Hiland LP which is down 1 and change. Calumet got the downgrade but it looks like most of the selling was done late yesterday. The stock is actually flat today.

I'm putting up trains and fixing the house so i will post again after the close.

I'm putting up trains and fixing the house so i will post again after the close.

DEUTCHE DOWNGRADES THIS MORNING....ENERGY UP THIS MORNING...KINDER BUYOUT APPROVED!

Two downgrades are on the wire this morning as Deutche Securites cuts Calumet Products Partners (CLMT) and Plains All American (PAA). In the case of Plains it lowers its price target to 50 dollars. No target specified for Calumet. It seemed like these Deutche downgrade rumours hit the tape yesterday as Calumet dropped 2 points after 2:30pm and never really recovered.

Notice this one has been on fire and in a fabulous uninterrupted uptrend. A trip back down to the moving averages here seems logical.

Also Energy Transfer Equity (ETE) took a hit in the last 15 minutes and sunk back to near 30 before getting most of it back near the close. Someone posted in the comments section yesterday about seeing a Deutche Downgrade but I have not seen any confirmation of that...nor is their anything on the wire about it this morning so far.

The Kinder Morgan (KMI) deal has been approved by shareholders. Look for the deal to close sometime in the first quarter of 2007. No other news items on the tape so far this morning.

The MLP index closed down two days in a row for the first time in quite awhile. And yesterday's weak close came after being up over 1 point earlier in the day.

Is this a top short term? We won't really know until the correction is well underway and at some point this straight up move of the last few months needs to rest. I want to emphasize that we're talking very short term here.If the index corrects to the moving averages...and thats a big if...it will provide another opportunity to add to positions at lower prices.

Two downgrades are on the wire this morning as Deutche Securites cuts Calumet Products Partners (CLMT) and Plains All American (PAA). In the case of Plains it lowers its price target to 50 dollars. No target specified for Calumet. It seemed like these Deutche downgrade rumours hit the tape yesterday as Calumet dropped 2 points after 2:30pm and never really recovered.

Notice this one has been on fire and in a fabulous uninterrupted uptrend. A trip back down to the moving averages here seems logical.

Also Energy Transfer Equity (ETE) took a hit in the last 15 minutes and sunk back to near 30 before getting most of it back near the close. Someone posted in the comments section yesterday about seeing a Deutche Downgrade but I have not seen any confirmation of that...nor is their anything on the wire about it this morning so far.

The Kinder Morgan (KMI) deal has been approved by shareholders. Look for the deal to close sometime in the first quarter of 2007. No other news items on the tape so far this morning.

The MLP index closed down two days in a row for the first time in quite awhile. And yesterday's weak close came after being up over 1 point earlier in the day.

Is this a top short term? We won't really know until the correction is well underway and at some point this straight up move of the last few months needs to rest. I want to emphasize that we're talking very short term here.If the index corrects to the moving averages...and thats a big if...it will provide another opportunity to add to positions at lower prices.

Tuesday, December 19, 2006

The rebound in energy carrying MLPS up today. And there are some nice movers out there as well. Linn Energy has run to 34 and is just under that now, up 1.27 as of this posting at 33 and change. Valero GP (VEH) is running up 1.37 at 22.99 after finishing the secondary. Solid fractional gains in Crosstex LP (XTEX), Natural Resource Partners (NRP), Holly Partners (HEP) and Valero LP (VLI).

Buckeye Partners (BPL) and Calumet Partners (CLMT) are today's biggest losers down 65 cents and 1 dollar respectivly. Everyone else is somewhere in between.

The top ticker is back working again.

Buckeye Partners (BPL) and Calumet Partners (CLMT) are today's biggest losers down 65 cents and 1 dollar respectivly. Everyone else is somewhere in between.

The top ticker is back working again.

LINN ENERGY CONTINUES TO RUN....DISTRIBUTION ANNOUNCEMENTS...A SECONDARY IS DONE...AND BIG KUDOS TO FACTOIDS!!!

Its a busy morning in MLP land so lets begin with Linn Energy (LINE) which has run from 22 to 32 lately. Well look for some more upside today as we have AG Edwards upgrading the stock from hold to buy. The only question in my mind here is whether this is priced in short term. Another big runner in the last few days has been Natural Resource Partners(NRP) which is even more impressive since anything coal lately has been falling. Anyway they announce another small purchase of reserves last night. We'll see if this pushes the stock toward 60...or not. Teppco is on the wire this morning as it is going to be expanding a refinery.

Anyone wanting to go long on Valero Holdings (VEH) has been waiting for the sale of stock from former parent Valero (VLO). Well that's now done as the offering priced last night at 21.62 per share. The stock is active in the premarket this morning with 220,000 shares traded, last at 21.82 up 20 cents from yesterday's close.

Energy Transfer Partners has announced its distribution increase this morning. The increase is .075 annual or .018750 for the quarter. Which leads me to giving big kudos to "FACTOIDS" who MLP followers know all to well on some of the assorted message boards on the internet. Here's a thread that he started on the yahoo ETP message boards that is really worth reading. He breaks down the math on ETP and indicated that a 2 cent distribution increase was the most likely outcome from this quarter and that higher numbers were clearly unrealistic and in fact unsustainable. Its is well worth the time to read through this. Also visit factoids site, the link to which is near the top of the blogroll or just link right here.

We may be at the point with Energy Transfer Partners where its just too large to grow at rates sustained in the past few years.

No indication yet on the distribution for Energy Transfer Equity (ETE) which is poised to see its distribution grow at a faster rate due to recent deals and where it is with respect to distribution rights and splits. BTW in the interest of disclosure i am long ETE. And speaking of message boards (shameless self promotion.) please don't forget i have set up a board for MLP stocks on google with the link here or on the side bar above the blogroll.

The ten year yield is back to 4.60 but no real reaction to the messed up PPI number whch was way above expectation but had some ridiculous car price increase distortion. And it counters the prior months number which was equally ridiculous on the downside. Crude and natural gas are selling off this morning but big energy stocks look a bit on the flat side in the pre market.

The open approaches and we wait patiently to see whether yesterday's 1.50 mlp index drop was a one day correction or something that spreads out over a couple of days. If it spreads out...buying opportunity.

Monday, December 18, 2006

The energy sell off has proven too strong and MLPS have given up the ghost as measured by the index which is down 1.50 and at the lows of the day. Coal stocks are getting hit hard and that's impacting Alliance Resources which is down 1 and change near 34 and at the low of the day. But Natural Resource Partners is still up over 1 point as last Thursday's deal plus upgrades by citigroup and wachovia continue to have positive impact.

Rallying off the lows as the AMZ index has cut its losses in half...down just .70 at this posting. A few of the ones hovering around unchanged or with small losses have turned positive like Kinder Morgan Partners (KMP) for example now up a few pennies. Some of the leaders from earlier have pulled a bit off their highs but some of the bigger losers have pulled off their lows.

Right after my last post the AMZ MLP index dropped to nearly a 1.50 loss...now down 1 point even. More losers in the group then winners but for now it looks like some of the recent winners getting more buying..Calumet Product Partners up another 1 and change...and Natural Resource Partners (NRP) is up 1 and change as well...its up 5 points since Thursday's close. Not much else change since my prior post but big energy is down with the XOI down 27 points. So that seems to be having more pull today on MLPS then the flat 10 year yield and the generally higher stock marke.

With big energy on the XOI down 16 points...an Exxon downgrade responsible for some of that....MLPS are taking a bit of a breather with the index down a few pennies. Still we have some winners today with Transmontaigne (TLP) and Natural Resource Partners (NRP) up nearly a point each. Linn Energy (LINE), Oneok LP (OKS), new issue Constellation Energy Partners (CEP) showing nice fractional gains.

Crosstex (XTXI) split 3-1 today and its down 1. Regency Partners (RGNC) is a fractional loser as is Duke Midstream (DPM). Alliance Resource Partners (ARLP) was down 1 and change but that may have some options expiration distortions associated with it since it ran up on the close Friday to 35.50 and it looks like it gave it all back this morning.

I am trying to think back to the days of the IPOS in the late nineties and i recall certain trading patterns that occured at the end of the year. Since we have a few MLP winners of the recent new issues we could see some buying opportunities develope as some of these shares get thrown out the window after January 1st. More on this in the next 2 weeks.

Crosstex (XTXI) split 3-1 today and its down 1. Regency Partners (RGNC) is a fractional loser as is Duke Midstream (DPM). Alliance Resource Partners (ARLP) was down 1 and change but that may have some options expiration distortions associated with it since it ran up on the close Friday to 35.50 and it looks like it gave it all back this morning.

I am trying to think back to the days of the IPOS in the late nineties and i recall certain trading patterns that occured at the end of the year. Since we have a few MLP winners of the recent new issues we could see some buying opportunities develope as some of these shares get thrown out the window after January 1st. More on this in the next 2 weeks.

Good Morning and Merry Christmas.

Its the last week of serious trading for the year so i'm not expecting too much to happen in the news department. Sometime this week we should hear from Energy Transfer (ETP,ETE) with regards to the quarterly distributions.They will go ex-dis around Dec 29th or in very early January based on past history. No headlines this morning but Wachovia is chiming in on Natural Resource Partners (NRP) upgrading them to outperform from market perform. Let's see if they get more upside after a nearly 4 point gain on Friday. Also Valero Holdings (VEH) in the secondary that seems to go on forever is supposed to come to market today so we can finally get that out of the way.

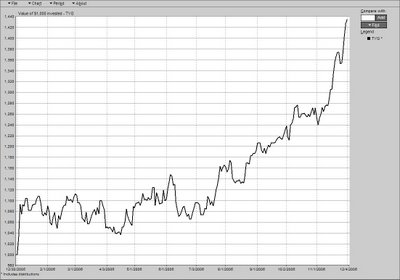

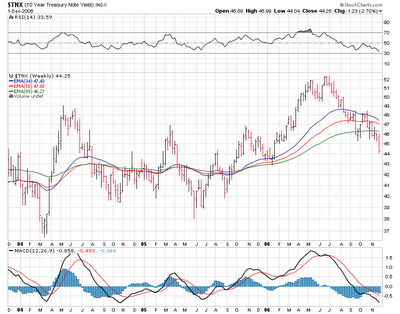

The AMZ weekly chart still shows no sign of a top. We've gone almost straight up from 253 to 285 since the end of September for a nearly 13 percent gain (not including the october distributions). Still no sign of top

And why should there be...since the 10 year rate chart which topped at 5.25% in July has been in a downtrend ever since. And there is no sign of a bottom here. Just as the rates topped about 2 months before the rally began, my guess is that MLPs won't top out on this move until rates bottom out. And who knows when that will be but I think we are still at the beginning of a long multi-month up cycle.

And since this is my blog...and i basically will blog on what is on my mind. I'm a practicing Catholic. I make no apologies...its me! I think religion is a personal issue and while i enjoy discussing concepts regarding all faiths i truly respect everyone's choice..or even the choice to be an aethist! I am no bible thumper by any means. But i have to say that when you go to your own church and your fellow church goers won't use the word christmas...i've had enough! Its really pissing me off! So i'm doing my own little thing on my own little blog to express my disdain for all this happy holidays bullshit!

Friday, December 15, 2006

Natural Resource Partners (NRP) gave you a chance at the open when 10,000 shares at 54.00. Its now up 3 and change and 56 and a fraction. Kinder Morgan Partners 60 cent gain is giving the index most of its .75 gain so far today. Most MLPS are trading between plus 25 cents and minus 25 cents.

While i did not get lucky with NRP...i did lay an order for Crosstex (XTEX) at 38.13 and got filled! Stock now at 38.69 and hoping for a trade back to 40.

While i did not get lucky with NRP...i did lay an order for Crosstex (XTEX) at 38.13 and got filled! Stock now at 38.69 and hoping for a trade back to 40.

LOOKS LIKE A BIG DAY FOR NATURAL RESOURCE PARTNERS....WAITING FOR C.P.I....AND STAR GAS CUTS ITS LOSSES!

Natural Resource Partners (NRP)and its GP (NSP) along with the other coal mlp Alliance Resource Partners (ARLP)and its GP (AHGP) have not really participated in the MLP rally as they react to coal and the downtrend its been in for most of this year. Well Natural Resource Partners is looking at some nice upside today as it announced a major deal last night picking up more coal reserves. In addition Citi-group upgrades the stock to buy from hold and raises its target from 55 to 60 bucks citing this deal. Two other coal stocks...Consol Energy (CNX) and Arch Coal (ACI) getting mentioned by Banc of America this morning..neutral on CNX and a buy on ACI.

Its been my policy in general not to blog about those MLPS which are either too small or are in financial difficulty but i am making an exception this morning. Remember Star Gas Partners (SGU) which went from 20 to 1...restructured and now sits around $2.50 per unit? They deal with home heating oil. It doesn't pay a distribution but it reported earnings today as its loss narrows. I mention this as a pure Las Vegas diceroll play...like buying a call option...but if this company does get its act together and starts paying a distribution again in 2008 which btw was its projection when it restructured...then it might be worth a play. But this is again like putting money on the roulette wheel. I just throw it out there for you. Do your research!!!!

Outside of the NRP citigroup upgrade its quiet in the group this morning and their are no other corporate headlines at lease so far.

F.Y.I. Crosstex (XTXI) will split 3 for 1 and will begin trading at the split adjusted price on Monday 12/18.

Having some chart trouble this mornin. I'll post some charts a.s.a.p.

Natural Resource Partners (NRP)and its GP (NSP) along with the other coal mlp Alliance Resource Partners (ARLP)and its GP (AHGP) have not really participated in the MLP rally as they react to coal and the downtrend its been in for most of this year. Well Natural Resource Partners is looking at some nice upside today as it announced a major deal last night picking up more coal reserves. In addition Citi-group upgrades the stock to buy from hold and raises its target from 55 to 60 bucks citing this deal. Two other coal stocks...Consol Energy (CNX) and Arch Coal (ACI) getting mentioned by Banc of America this morning..neutral on CNX and a buy on ACI.

Its been my policy in general not to blog about those MLPS which are either too small or are in financial difficulty but i am making an exception this morning. Remember Star Gas Partners (SGU) which went from 20 to 1...restructured and now sits around $2.50 per unit? They deal with home heating oil. It doesn't pay a distribution but it reported earnings today as its loss narrows. I mention this as a pure Las Vegas diceroll play...like buying a call option...but if this company does get its act together and starts paying a distribution again in 2008 which btw was its projection when it restructured...then it might be worth a play. But this is again like putting money on the roulette wheel. I just throw it out there for you. Do your research!!!!

Outside of the NRP citigroup upgrade its quiet in the group this morning and their are no other corporate headlines at lease so far.

F.Y.I. Crosstex (XTXI) will split 3 for 1 and will begin trading at the split adjusted price on Monday 12/18.

Having some chart trouble this mornin. I'll post some charts a.s.a.p.

Thursday, December 14, 2006

After hours developements with Natural Resource Partners picking up some large coal assets. Stock closed down today but it should be a mover tomorrow. Kinder Morgan Partners (KMP) sees accellerating growth and a 6% distribution increase for next year. KMP closed flat on the day and there are no after hours trades so far. Hiland will be developing midstream assets for Woodford in 2007. Stock closed flat on the day.

MLPs as measured by the index pulled back near the close but there were some nice moves today. Linn Energy was today's big winner up a buck and a half to 31.65 on its deal announced last night. Its priced to yield 6.5% right now and 7.2% based on its new pre-announced Q1 distribution of 2.28 annual. So its only slightly undervalued imho right here...and about 15-20% under valued for 2007 Q1 distributions. Any weakness here should continued to be used to back up the mack truck...imho of course!

Energy Transfer Equity busted out of a tight range in the last 30 minutes and finished at a new 52 week high. Should be moving to 31-32 shortly as distribution announcement should come out any time now.

Crosstex (XTXI) splits 3-1 tomorrow. Might be some sellers at the open with this one. If they take it down hard i may pick some up.

MLPs as measured by the index pulled back near the close but there were some nice moves today. Linn Energy was today's big winner up a buck and a half to 31.65 on its deal announced last night. Its priced to yield 6.5% right now and 7.2% based on its new pre-announced Q1 distribution of 2.28 annual. So its only slightly undervalued imho right here...and about 15-20% under valued for 2007 Q1 distributions. Any weakness here should continued to be used to back up the mack truck...imho of course!

Energy Transfer Equity busted out of a tight range in the last 30 minutes and finished at a new 52 week high. Should be moving to 31-32 shortly as distribution announcement should come out any time now.

Crosstex (XTXI) splits 3-1 tomorrow. Might be some sellers at the open with this one. If they take it down hard i may pick some up.

Upside continue at lunchtime. Linn Energy is up 1 and change and leading the way. Crosstex (XTXI) is also up 1 and change as it will soon split 3 for 1. Strong fractional gains again in Plains All American (PAA), Sunoco Logistics (SXL).Teppco (TPP) is nearing 42 dollars today up 16 cents.

Valero LP(VLI) and Alliance Resournce Parnters (ARLP) are down 30 cents apiece as the 2 biggest losers today. Tortoise Energy (TYG) the mlp trust is down nearly 1 dollar. No news there.

Valero LP(VLI) and Alliance Resournce Parnters (ARLP) are down 30 cents apiece as the 2 biggest losers today. Tortoise Energy (TYG) the mlp trust is down nearly 1 dollar. No news there.

LINN ENERGY DOES IT AGAIN....ENERGY COMPLEX UP THIS MORNING....IS THERE A TOP IN SIGHT?

Good thursday morning and lets address the last item first...at least for now the answer is no. Now on to Linn Energy which has once again done a deal where they are pre-announcing the distribution. For this quarter we're going to $2.08...for Q1 07 we're going to 2.28 annual. So based on a yield in the low 6% range...this one should be headed now for the middle 30s by April. So all things being equal lets see if the market misses this one again...in which case shares should be bought with both hands at these prices.

It's hard to argue with this chart. If the spike of the last few days is a result of this deal and its priced in we could get a buying opportunity here. We'll see how it plays out.

Meanwhile no other news so far this morning. No upgrades or downgrades either. So we'll let the open play out and go from there.

Good thursday morning and lets address the last item first...at least for now the answer is no. Now on to Linn Energy which has once again done a deal where they are pre-announcing the distribution. For this quarter we're going to $2.08...for Q1 07 we're going to 2.28 annual. So based on a yield in the low 6% range...this one should be headed now for the middle 30s by April. So all things being equal lets see if the market misses this one again...in which case shares should be bought with both hands at these prices.

It's hard to argue with this chart. If the spike of the last few days is a result of this deal and its priced in we could get a buying opportunity here. We'll see how it plays out.

Meanwhile no other news so far this morning. No upgrades or downgrades either. So we'll let the open play out and go from there.

Wednesday, December 13, 2006

Some profit taking as the index is still up but by under half a point. Crosstex(XTEX) ran to 40 and now is selling off a bit at 38.69...down on the day. LIN Energy (LINE)which was down earlier is now up nearly 1 point and is sitting above 30 dollars! Hiland Parnters(HLND) is today's biggest winner up 1.07. Ferrellgas is now down 1 as today's biggest loser.

Valero Holdings (VEH) is really holding this 20.90 level pretty well. As long as Valero LP can hold its own I think the GP will play some catch up in the next few weeks. Coal MLPS are down today...Natural Resource Partners (NRP) is down .65 and Alliance Resource Partners (ARLP) is down a smaller fraction.

Valero Holdings (VEH) is really holding this 20.90 level pretty well. As long as Valero LP can hold its own I think the GP will play some catch up in the next few weeks. Coal MLPS are down today...Natural Resource Partners (NRP) is down .65 and Alliance Resource Partners (ARLP) is down a smaller fraction.

A one point gain on the MLP index and we continue to live in new all time high territory. Among the newsmakers this morning Valero LP is down 1.39 and off the lows of the day on lowering its earnings forecast. Valero GP(VEH) is absorbing the secondary very well down 40 cents. Ferrellgas (FGP) and Suburban Propane (SPH) are down major fractions on the Citigroup downgrades. A nine cent gain for Amerigas (APU) on the Citigroup upgrade. Eagle Rock (EROC) is up 50 cents on the Wachovia outperform.

Elsewere Crosstex went to 40 before pulling back...still up on the day. The big boys of Oneok LP (OKS), Plains All American (PAA), Sunoco Logisitcs (SXL) are up major fractions; smaller gains among the rest of the group.

New issue Atlas Holdings (ATN) priced at 21...opened at 21.80 and is sitting right now at 22.40. Not a bad opening day here.

Elsewere Crosstex went to 40 before pulling back...still up on the day. The big boys of Oneok LP (OKS), Plains All American (PAA), Sunoco Logisitcs (SXL) are up major fractions; smaller gains among the rest of the group.

New issue Atlas Holdings (ATN) priced at 21...opened at 21.80 and is sitting right now at 22.40. Not a bad opening day here.

There's lots to discuss this morning so lets do so on the GOOGLE MLP DISCUSSION BOARD. All are welcome! Its a place where we can meet...just us MLP investors!

Tuesday, December 12, 2006

VALERO LP LOWERS EARNINGS OUTLOOK FOR Q4 AND '07 Q1...CITIGROUP ON THE HORN THIS MORNING...AND MORE!

Busy morning to start this Wednesday as we have after hours news on Valero LP (VLI)and Valero GP(VEH). First off on the GP the secondary offering began last night...17 million shares being offered...again to remind you non dilutive. 4 million shares have already been placed to the GP president. Valero LP (VLI) is lowering earnings guidance for the first quarter of 2007 due to continued problems with re-starts and turnarounds.

On the horn this morning is Citigroup as it shuffles around some ratings on the propane LP's It is upgrading Amerigas (APU) from a sell to a hold....downgrades Ferrellgas LP(FGP) to sell from hold..and it cuts Suburban Propane(SPH) to hold from buy. On Ferrellgas Citigroup says they downgraded the stock because the company has not grown the distribution in 10 years (so they wait until now to downgrade when they could have put their customers in other LP'S?) . The downgrade on Suburban is due to valuation. The Amerigas upgrade is because it says the company will be able to grow the distribution. Also Wachovia (pronounced WACH-OVER-YA in Brooklyn) starts new issue Eagle Rock Partners (EROC) at outperform.

On the "more" front we have a new ipot hat begins trading today which is Atlas Energy Resources (ATN) which priced at 21 bucks a share last night which was at the top of the range. This one could have a pop at the open and we will watch carefully. It will only have 6 million shares floating around in public hands(17%) while Atlas America will hold on to the rest.

Oil markets are slightly lower this morning while natural gas is 17 cents higher. 10 year rates are lower this morning and stock futures are higher. So the backdrop this morning is okay. The Valero LP announcement will have some impact on the mlp index since it has nearly a 4% weighting. Also Crosstex LP (XTEX) broke back above the 39 level on the close yesterday up 1 and change on the day and we'll be looking for followthrough here. 42 on volume would mean an upside breakout for this one which has been moving sideways for a long time now.

And finally this morning just a little christmas humour!

Busy morning to start this Wednesday as we have after hours news on Valero LP (VLI)and Valero GP(VEH). First off on the GP the secondary offering began last night...17 million shares being offered...again to remind you non dilutive. 4 million shares have already been placed to the GP president. Valero LP (VLI) is lowering earnings guidance for the first quarter of 2007 due to continued problems with re-starts and turnarounds.

On the horn this morning is Citigroup as it shuffles around some ratings on the propane LP's It is upgrading Amerigas (APU) from a sell to a hold....downgrades Ferrellgas LP(FGP) to sell from hold..and it cuts Suburban Propane(SPH) to hold from buy. On Ferrellgas Citigroup says they downgraded the stock because the company has not grown the distribution in 10 years (so they wait until now to downgrade when they could have put their customers in other LP'S?) . The downgrade on Suburban is due to valuation. The Amerigas upgrade is because it says the company will be able to grow the distribution. Also Wachovia (pronounced WACH-OVER-YA in Brooklyn) starts new issue Eagle Rock Partners (EROC) at outperform.

On the "more" front we have a new ipot hat begins trading today which is Atlas Energy Resources (ATN) which priced at 21 bucks a share last night which was at the top of the range. This one could have a pop at the open and we will watch carefully. It will only have 6 million shares floating around in public hands(17%) while Atlas America will hold on to the rest.

Oil markets are slightly lower this morning while natural gas is 17 cents higher. 10 year rates are lower this morning and stock futures are higher. So the backdrop this morning is okay. The Valero LP announcement will have some impact on the mlp index since it has nearly a 4% weighting. Also Crosstex LP (XTEX) broke back above the 39 level on the close yesterday up 1 and change on the day and we'll be looking for followthrough here. 42 on volume would mean an upside breakout for this one which has been moving sideways for a long time now.

And finally this morning just a little christmas humour!

The fed spoke...basically said nothing we did not already know...the bonds rally with yields down to 4.49 and the MLPS head higher with the index now up over 1 point. Teppco (TPP) is up over 41 bucks as the big winner today. The winners list has gotten a little longer but mostly fractional winners on the board. Losers are contained with no really big standout loser.

On a fed day and with no corporate news the index is higher by point .56 being led by Penn Virginia Resources (PVR) Valero LP (VLI) Sunoco Logistics (SXL) and new issue Eagle Rock (EROC) all fractional winners. No standouts on the losing side today...looks like the list is split 50-50 vs up and down.

No surprises expected by the fed so look for uneventful trading until that gets out of the way.

No surprises expected by the fed so look for uneventful trading until that gets out of the way.

ALL QUIET ON THE MLP FRONT THIS MORNING...ALMOST TOO QUIET!

Its one of those mornings where i am actively looking around for something...anything to to write about but sadly...slightly higher oil...flat 10 year and slightly lower stock futures. So under that backdrop i guess it should be more of the same. We closed at another all time high on the MLP index yesterday. Still no sign of a top and i guess as the downtrend in the 10 year continues there will be no top until rates bottom.

I want to revisit LIN Energy as it nears the 30 dollar mark. This i believe was a perfect example of what happens in the MLP group because we are small, somewhat isolated and boring. Back in October the company pre-announced that the distribution for January 07 would rise to 2.07. With the unit price at 22 bucks it was nearly a 10% yield. At a 6-7% group yield the stock should trade closer to 30 bucks. So why was the stock trading so low relative to yield? I think this was a perfect example of what happens in this group. We're not followed...we're not traded very much..no one is interested. As a result opportunities are laid at our doorstep and it leaves us to ask "what is wrong with this picture?" " what is the market seeing that i'm missing?" The answer is to the second question is exactly the reverse...it is what am i seeing that the market is missing. In LIN's case it was missing this ridiculous yield relative to the market. And as a result you had a stock that took 6 weeks to get from 22 to 29. Sometimes you need to have the strength of your convictions.

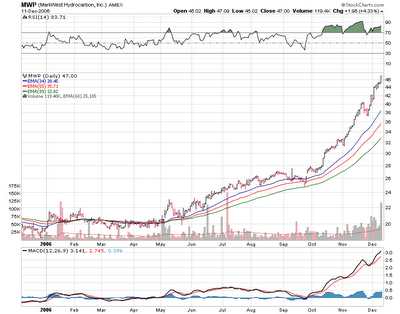

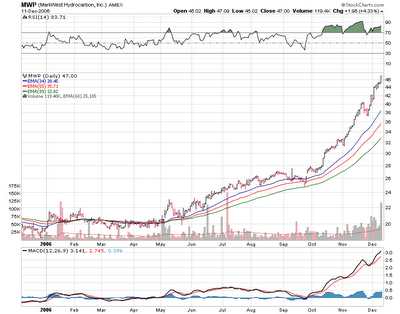

And what about Markwest Hydrocarbon..another one that was not doing much but this one has become a market darling now and has been like a runaway train. One can only watch in awe...and while it put this one on the radar on October 1 when the stock was at 27...never in my wildest dreams did i think we'd get a 20 point upside move.

By the way a reminder...keep an eye on the GPs as they have underperformed the LP's for awhile now. I would think at some point some of these will start outperforming. Valero Holdings (VEH), Atlas Holdings(AHD), and Energy Transfer Equity(ETE) are may favorites and i'm long all three right now. Look for a distribution announcement from Energy Transfer Partners and ETE any day now as they like to go ex-distribution before year end based on past ex-distribution dates.

Its one of those mornings where i am actively looking around for something...anything to to write about but sadly...slightly higher oil...flat 10 year and slightly lower stock futures. So under that backdrop i guess it should be more of the same. We closed at another all time high on the MLP index yesterday. Still no sign of a top and i guess as the downtrend in the 10 year continues there will be no top until rates bottom.

I want to revisit LIN Energy as it nears the 30 dollar mark. This i believe was a perfect example of what happens in the MLP group because we are small, somewhat isolated and boring. Back in October the company pre-announced that the distribution for January 07 would rise to 2.07. With the unit price at 22 bucks it was nearly a 10% yield. At a 6-7% group yield the stock should trade closer to 30 bucks. So why was the stock trading so low relative to yield? I think this was a perfect example of what happens in this group. We're not followed...we're not traded very much..no one is interested. As a result opportunities are laid at our doorstep and it leaves us to ask "what is wrong with this picture?" " what is the market seeing that i'm missing?" The answer is to the second question is exactly the reverse...it is what am i seeing that the market is missing. In LIN's case it was missing this ridiculous yield relative to the market. And as a result you had a stock that took 6 weeks to get from 22 to 29. Sometimes you need to have the strength of your convictions.

And what about Markwest Hydrocarbon..another one that was not doing much but this one has become a market darling now and has been like a runaway train. One can only watch in awe...and while it put this one on the radar on October 1 when the stock was at 27...never in my wildest dreams did i think we'd get a 20 point upside move.

By the way a reminder...keep an eye on the GPs as they have underperformed the LP's for awhile now. I would think at some point some of these will start outperforming. Valero Holdings (VEH), Atlas Holdings(AHD), and Energy Transfer Equity(ETE) are may favorites and i'm long all three right now. Look for a distribution announcement from Energy Transfer Partners and ETE any day now as they like to go ex-distribution before year end based on past ex-distribution dates.

Monday, December 11, 2006

Gains continue to get extended this afternoon. The MLP index is up 1.40. Markwest (MWP) is up 1.65 and over 45 bucks. LIN Energy (LINE) is up 1.50 and off its high of the day. Strong fractional plus signs in many other issues.

Alliance Resource Partners(ALRP) is down a fraction as is Regency Partners (RGNC) and Ferrellgas (FGP), again no news drivers this afternoon.

Some of the General Partners (GP's) have been quietly moving higher. Atlas Holdings is back to 23 and Valero Holdings (VEH) is over 21 and holding as it waits for the Valero (VLO) secondary which i think should be done anytime now. Remember that the secondary is not dilutive here, just Valero (VLO) divesting its holdings.

Alliance Resource Partners(ALRP) is down a fraction as is Regency Partners (RGNC) and Ferrellgas (FGP), again no news drivers this afternoon.

Some of the General Partners (GP's) have been quietly moving higher. Atlas Holdings is back to 23 and Valero Holdings (VEH) is over 21 and holding as it waits for the Valero (VLO) secondary which i think should be done anytime now. Remember that the secondary is not dilutive here, just Valero (VLO) divesting its holdings.

Onward and upward again...up 1.04 and in new all time high territory for the MLP index and we have strong gains in LIN Energy (LINE) up 1.69 at 29.44 and close to my 30 dollar target. Tortiose Energy (TYG) is up 1.25 and Oneok LP (OKS) is up nearly 1 point. Lots of fractional gains in a host of issues.

Not much downside. Kinder Morgan (KMP) is flat. Regency(RGNC) is down 40 cents..no news there. And the other losers are shedding pennies and nothing news driven.

Not much downside. Kinder Morgan (KMP) is flat. Regency(RGNC) is down 40 cents..no news there. And the other losers are shedding pennies and nothing news driven.

MONDAY MORNING...A FEW NEWS ITEMS...LOWER ENERGY PRICES...AND NO COLD AIR!

Good Monday morning to all and hope your weekend was a good one. Warmer weather has moved into most of the eastern US and look for this to last for the next 10 days before we turn colder right around Christmas weekend. So with weather taking a break there is no weather spark for the energy markets. Meanwhile we have a news item on Plains All American as the government may go after them for an oil spill last year. The item is on Dow Jones and there is no link as of yet that i could find. No other headlines this morning and no upgrades or downgrades so far

Still no sign of a top on the MLP index so we'll see what today brings.

DAILY CHART ABOVE...WEEKLY CHART BELOW.

So off we go into the open. I will post if any headlines cross.

Good Monday morning to all and hope your weekend was a good one. Warmer weather has moved into most of the eastern US and look for this to last for the next 10 days before we turn colder right around Christmas weekend. So with weather taking a break there is no weather spark for the energy markets. Meanwhile we have a news item on Plains All American as the government may go after them for an oil spill last year. The item is on Dow Jones and there is no link as of yet that i could find. No other headlines this morning and no upgrades or downgrades so far

Still no sign of a top on the MLP index so we'll see what today brings.

DAILY CHART ABOVE...WEEKLY CHART BELOW.

So off we go into the open. I will post if any headlines cross.

Friday, December 08, 2006

This morning at the open Regency Partners dropped nearly 5 points to 21.88 and quickly rebounded to 26 and change. No news. Somebody dropped a big block of shares. Thats the only thing I saw. So if you laddered an order under the moving averages you got a gift.

Meanwhile mostly higher prices on MLPS this afternoon. Nothing particularly stands out so we may be in Friday slow mode for the rest of the day.

Meanwhile mostly higher prices on MLPS this afternoon. Nothing particularly stands out so we may be in Friday slow mode for the rest of the day.

ITS FRIDAY...EMPLOYMENT NUMBERS RISING ENERGY PRICES.... OTHERWISE ITS QUIET OUT THERE.

18 degrees in NYC this morning but once this cold air pulls out there is no cold air to speak of for the next 10 days. Nonetheless energy is up sharply this morning as oil is up over 1 dollar on production cuts...nat gas slightly higher and stock futures higher as well. No corporate developements and no upgrades or downgrades.

The MLP index had a down day yesterday, a rare event lately as this daily chart shows its been straight up

A pullback of some sort is in order but as i mentioned earlier this week when you are in a bull trend trying to buy in is very difficult and trying to figure out when the pullback comes is even harder. If you are looking to take new positions but just can't bring yourself to pull the trigger i would suggest looking at the 34 or 55 day moving averages as logical entry points in pullbacks. Its not a full proof system by anymeans. In the case of Markwest Hydrocarbon which has been in runaway upside for the last 2 months buying in at lower prices has been nearly impossible. Still there are opportunities that could pop up quickly.

I'm putting these up as examples and not necessarily recomendations although i will tell you that i'm looking to get back into both RGNC and LINE for a trade. Regency has been in a sideways to higher pattern for awhile and has had an orderly correction. If you look at the chart this is a stock that on occasion likes to trade down to the 34 to 55 day moving average. I would lay buy orders in between those 2 areas...and ladder the prices. In otherwords buy some at say 26.01...some more at 25.81...and some more at 25.51. Notice i don't use round numbers because everyone else does.

Markwest above is not for the faint of heart as its almost parabolic. Same strategy applies here. If it pulls back to the upper 30s i would be interested.

LIN Energy had a down day yesterday. A trip to the 25.50 area and i would back up the truck on this one. However its uptrend is not only strong but its preannounced January distribution of 2.07 annual says this one should be trading near or over 30 based on the yield alone. So i may buy if it drops to the mid 26 area instead of waiting for a trip down to the 34 day moving average.

Again these are just examples and not recommendations that come with any guarantee. The open is coming..the 10 year rate is now flat and stock futures have sold off.

18 degrees in NYC this morning but once this cold air pulls out there is no cold air to speak of for the next 10 days. Nonetheless energy is up sharply this morning as oil is up over 1 dollar on production cuts...nat gas slightly higher and stock futures higher as well. No corporate developements and no upgrades or downgrades.

The MLP index had a down day yesterday, a rare event lately as this daily chart shows its been straight up

A pullback of some sort is in order but as i mentioned earlier this week when you are in a bull trend trying to buy in is very difficult and trying to figure out when the pullback comes is even harder. If you are looking to take new positions but just can't bring yourself to pull the trigger i would suggest looking at the 34 or 55 day moving averages as logical entry points in pullbacks. Its not a full proof system by anymeans. In the case of Markwest Hydrocarbon which has been in runaway upside for the last 2 months buying in at lower prices has been nearly impossible. Still there are opportunities that could pop up quickly.

I'm putting these up as examples and not necessarily recomendations although i will tell you that i'm looking to get back into both RGNC and LINE for a trade. Regency has been in a sideways to higher pattern for awhile and has had an orderly correction. If you look at the chart this is a stock that on occasion likes to trade down to the 34 to 55 day moving average. I would lay buy orders in between those 2 areas...and ladder the prices. In otherwords buy some at say 26.01...some more at 25.81...and some more at 25.51. Notice i don't use round numbers because everyone else does.

Markwest above is not for the faint of heart as its almost parabolic. Same strategy applies here. If it pulls back to the upper 30s i would be interested.

LIN Energy had a down day yesterday. A trip to the 25.50 area and i would back up the truck on this one. However its uptrend is not only strong but its preannounced January distribution of 2.07 annual says this one should be trading near or over 30 based on the yield alone. So i may buy if it drops to the mid 26 area instead of waiting for a trip down to the 34 day moving average.

Again these are just examples and not recommendations that come with any guarantee. The open is coming..the 10 year rate is now flat and stock futures have sold off.

Thursday, December 07, 2006

Looks like we're backing and filling today in MLP land as most are lower but the index is down about 50 cents. Atlas Pipeline Partners (APL) is a big gainer today up 75 cents to $49. Enterprise (EPD) and Kinder Morgan Partners (KMP) are both up slightly which is what is holding up the index.

Some of the bigger winnners lately are down today like Duke Midstream (DPM) and Plains All American (PAA) which a both down 50 to 75 cents. Ferrellgas (FGP) is a strong fractional loser on earnings today.

Nat gas numbers were bullish and the nat gas market which was down earlier is up by one cent. Weather will not be favorable for nat gas for the next 10 days as much of the country goes above normal once tonights cold blast in the northeast pulls out this weekend.

Some of the bigger winnners lately are down today like Duke Midstream (DPM) and Plains All American (PAA) which a both down 50 to 75 cents. Ferrellgas (FGP) is a strong fractional loser on earnings today.

Nat gas numbers were bullish and the nat gas market which was down earlier is up by one cent. Weather will not be favorable for nat gas for the next 10 days as much of the country goes above normal once tonights cold blast in the northeast pulls out this weekend.

FERRELLGAS PARTNERS EARNINGS THIS MORING...

STILL NO SIGN OF A TOP IN MLP'S.

Another all time high close on the index yesterday although there was some profit taking in the last hour and a half that took the index from+2 to a less than 3/4 pt gain. This morning Ferrellgas (FGP) came out with earnings that beat estimates. We'll see how it plays. Meanwhile no upgrades or downgrades this morning...the 10 year is holding at 4.48% with tomorrow's employment numbers looming. Until proven other wise the tone is positive although a correction could come at any time.

Energy Transfer Equity broke out to new highs yesterday on volume. Clearing 30 is important and i think this one could be in the mid 30s by the end of q1 of 2007 imho.

No upgrades or downgrades this morning so far.

STILL NO SIGN OF A TOP IN MLP'S.

Another all time high close on the index yesterday although there was some profit taking in the last hour and a half that took the index from+2 to a less than 3/4 pt gain. This morning Ferrellgas (FGP) came out with earnings that beat estimates. We'll see how it plays. Meanwhile no upgrades or downgrades this morning...the 10 year is holding at 4.48% with tomorrow's employment numbers looming. Until proven other wise the tone is positive although a correction could come at any time.

Energy Transfer Equity broke out to new highs yesterday on volume. Clearing 30 is important and i think this one could be in the mid 30s by the end of q1 of 2007 imho.

No upgrades or downgrades this morning so far.

Wednesday, December 06, 2006

Up nearly 2 points and we continue to just add to gains. Energy Transfer Equity (ETE) has now broken through 30 dollars on volume. Strong fractional gains across the board. Not much change in who the winners are from the last post. Losers are still the same but they have come off their lows.

ETE breaking above 30 is signifcant and could be on its way to 33-34in the next several weeks imho.

ETE breaking above 30 is signifcant and could be on its way to 33-34in the next several weeks imho.

Well no pullback this morning...its ripping upside again as the index is up 1.60. Most of that is Enterprise Products Partners (EPD) which is up 60 cents but most MLPS are higher and the few losers aren't down by much except for Martin Midstream (MMLP) which giving back half of yesterday's one point gain. Many strong fractional gains including Sunoco Logistics (SXL) Atlas Pipeline Partners (APL), Plains All American (PAA), Valero LP (VLI) among others.

Energy numbers from the DOE were bullish. Let the ride continue.

Energy numbers from the DOE were bullish. Let the ride continue.

UBS DOWNGRADES MAGELLAN MIDSTREAM...

IS A PULLBACK COMING FOR MLPS?

Good Wednesday Morning.

I don't think we've had 2 down days in a row in this group since we broke out above the 270 level on the MLP Index which sits this morning ant another new all time high. At some point some sort of pullback is in order. Will it begin today? tomorrow? Wish I had the answer to that one. The rate squeeze continues as 10 year rates sit near 4.40%. Bill Gross of Pimco revised his forecast on the 10 year to where rates could fall to...are you ready for this...a 2 handle in 2007 and that the federal reserve will need to start cutting rates soon as the economy slows. If we keep a 3 point spread on MLPS this would mean yields on MLPS would drop to the low 5's and in some instances for the rapid growers...into the 4's! Forecasts however are just that so who knows where we wind up.

Now back to the question of a pullback.

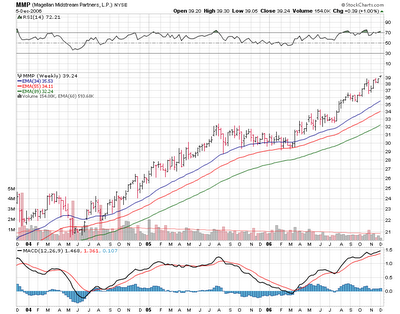

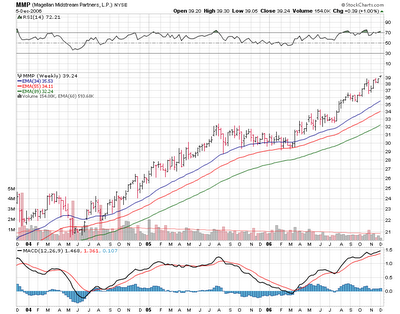

The daily chart above looks like its in run-away train mode while the weekly chart below is still showing us that we have just emerged from a base. The upleg from May 2004 to July 2005 (15 months of upside) was primarily driven by rising energy prices and risiing distributions with rising 10 year yields.

This leg has gone from the 252 September bottom to just under 282 this morning...a nice move and the drivers now are stable to lower energy prices...lower interest rates and up until now...rising distributions. I believe any corrections are just that...and should be used to add to positions.

Meanwhile this morning UBS Securities downgrades Magellan Midstream Partners (MMP) from buy to hold.

The units have been an excellent performer. A pullback here would be logical.

Good Wednesday Morning.

I don't think we've had 2 down days in a row in this group since we broke out above the 270 level on the MLP Index which sits this morning ant another new all time high. At some point some sort of pullback is in order. Will it begin today? tomorrow? Wish I had the answer to that one. The rate squeeze continues as 10 year rates sit near 4.40%. Bill Gross of Pimco revised his forecast on the 10 year to where rates could fall to...are you ready for this...a 2 handle in 2007 and that the federal reserve will need to start cutting rates soon as the economy slows. If we keep a 3 point spread on MLPS this would mean yields on MLPS would drop to the low 5's and in some instances for the rapid growers...into the 4's! Forecasts however are just that so who knows where we wind up.

Now back to the question of a pullback.

The daily chart above looks like its in run-away train mode while the weekly chart below is still showing us that we have just emerged from a base. The upleg from May 2004 to July 2005 (15 months of upside) was primarily driven by rising energy prices and risiing distributions with rising 10 year yields.

This leg has gone from the 252 September bottom to just under 282 this morning...a nice move and the drivers now are stable to lower energy prices...lower interest rates and up until now...rising distributions. I believe any corrections are just that...and should be used to add to positions.

Meanwhile this morning UBS Securities downgrades Magellan Midstream Partners (MMP) from buy to hold.

The units have been an excellent performer. A pullback here would be logical.

No other breaking headlines this morning and no upgrades or downgrades.

On the Master Limited Partnership discussion group this morning we have lots of talk surrounding Energy Trasnfer Equity (ETE) for those of you interested. Also some posts on the Duke Midstream board about the Barron's arcticle this weekend.

Tuesday, December 05, 2006

Secondary prospectus for Valero GP on the wire this evening. Looks like William Greenly takes a priviate placement of 4.7 million shares...17 million shares held by Valero (VLO). Remember this is not a dilutive stock offering. Nothing else in the after hours so far.

One day someone is going to figure out that Valero Holdings is gradually become very undervalued as Valero LP is breaking out today to new highs. The "secondary" of former parent Valero(VLO) of 27 million shares remains the overhang. Once this is done...this one should play catch up. Meanwhile LIN Energy (LINE) has broken out to nearly 28 today. Regency (RGNC) is also on the verge of another upleg. Afternoon action remains very bullish. Looking foward to the last hour.

A solid morning with higher prices pretty much across the board. The MLP index is up 1 and small change but off the highs of the day. Markwest Energy (MWE) leads the way up 1 and Oneok LP (OKS)was up 1 and over 65 for awhile...small pullback to a strong fractional gain. And we have fractional plusses in Plains All American (PAA), Valero LP (VLI) and Natural Resource Partners (NRP).

Williams Partners (WPZ) is a fractional loser today along with Energy Transfer Equity (ETE) and one or 2 others...nothing really news driven.

Williams Partners (WPZ) is a fractional loser today along with Energy Transfer Equity (ETE) and one or 2 others...nothing really news driven.

CRUDE BACK UP THIS MORNING...ANOTHER MLP INDEX ALL TIME HIGH....NO SIGN OF A TOP YET!

We start the day with higher crude prices this morning as we get back most of yesterdays 1 dollar loss. Nat gas holding its own after yesterday's "winter is over before it started" drop. Ten year rates are flat at 4.43% and MLPS will probably open higher again.

Meanwhile the upside continues and based on the weekly chart i still see no sign of a top here but i think at some point we need a shakeout. Still the momentum in this group remains very strong so rather than to try and pinpoint when a shakeout will occur...i'll just let it happen when it happens and just let the upside continue to run its course.

This morning we have some more anal-ist moves as Goldman starts Eagle Rock Partners (EROC) at a neutral. And it ain't much but Friedman Billings raises its target price on Natural Resource Partners from $76 to $77 dollars. Actually HSBC is busy on the coal stocks as it starts Arch Coal and Peabody Energy at overweights so lets see if attention on coal today moves NRP and also Alliance Resource Partners (ARLP). No other corporate developements so far this morning.

We start the day with higher crude prices this morning as we get back most of yesterdays 1 dollar loss. Nat gas holding its own after yesterday's "winter is over before it started" drop. Ten year rates are flat at 4.43% and MLPS will probably open higher again.

Meanwhile the upside continues and based on the weekly chart i still see no sign of a top here but i think at some point we need a shakeout. Still the momentum in this group remains very strong so rather than to try and pinpoint when a shakeout will occur...i'll just let it happen when it happens and just let the upside continue to run its course.

This morning we have some more anal-ist moves as Goldman starts Eagle Rock Partners (EROC) at a neutral. And it ain't much but Friedman Billings raises its target price on Natural Resource Partners from $76 to $77 dollars. Actually HSBC is busy on the coal stocks as it starts Arch Coal and Peabody Energy at overweights so lets see if attention on coal today moves NRP and also Alliance Resource Partners (ARLP). No other corporate developements so far this morning.

Monday, December 04, 2006

Back to near the highs of the day after a mid-morning pullback. A majority of MLPS are higher with Oneok (OKS) up 1 and strong fractional gains in Plains All Amereican(PAA), LIN Energy(LINE), Global Partners(GLP) and Calument Products Partners (CLMT). On the downside Holly Partners (HEP) is down 50 cents. Duke Midstream(DPM) is off its lows down .19 as is Kinder Morgan Partners (KMP).

It just keeps going...the MLP index opens up and is over 280 now...+1.05 higher as of this posting. Nice solid gains in many issues. Oneok LP which was up 2 and change Friday up another 1 and change this morning..Inergy Group Holdings is up 1.69. Markwest Hydrocarbon is up nearly 1 point. Fractional plusses litter the group.

A few losers. Duke Midstream is down 56 cents. There is this post on the MLP DISCUSSION BOARD about a Barron's piece this weekend concerning another Duke Energy MLP spin-off coming soon. I have not read the piece yet but i will try to get my hands on it. If anyone has a link to it please post it in the comments section. A few other fractional losers. The MLP Trusts this morning are down like Kayne Anderson (KYN) and Tortoise Energy Infrastructure (TYG) showing fractional losses at this point.

A few losers. Duke Midstream is down 56 cents. There is this post on the MLP DISCUSSION BOARD about a Barron's piece this weekend concerning another Duke Energy MLP spin-off coming soon. I have not read the piece yet but i will try to get my hands on it. If anyone has a link to it please post it in the comments section. A few other fractional losers. The MLP Trusts this morning are down like Kayne Anderson (KYN) and Tortoise Energy Infrastructure (TYG) showing fractional losses at this point.

Mike G sent me this chart of Tortiose Energy Infrastructure (TYG) which is MLP trust that trades on the NYSE and it holds a broad universe of MLPS. Note that since January 1st it's up nearly 40%! Mike makes these observations.

A quick look at this total return chart says we are out of control to the upside right now.

Some people say MLP's are weak in Decembers. I have not done data on that, but sure was last year. Rising interest rates on the 10 year might make some think about finding high yields and push MLP's, maybe it has already happened. The actual number on the chart is +43% according to MSN.

Then he follows up with this observation.

And on the flip side:

While many of us are doing quite well in MLP's.

Look where many others put their savings.

I use FMAGX and FBGRX two no load, low fee large cap funds that do better than their competitor high expense funds and load funds.

These two funds have about $65B in holdings or a bit more than $200 for every man woman and child in the US.

For 5 calendar years, 2001-2006 they produced +0.9% and -8.7% returns if we ignore their expenses.

Include dividends and capital gains in all cases. The Dow was about even for the period.

For this year to date they produced +3.0% and +3.1%.

These pick from the pool of Dow stocks and Dow like stocks. The Dow is about +12% for the year.

So these highly paid stock pickers pick stocks that underperform the pool from which they pick.

I have no chance of picking stocks and beating the professionals. Those pros do not play in the MLP pool. Thank goodness.

Amen to that. I'm not sure that Tortiose is the best proxy to use for MLPS if only because i have found that the trusts don't often move in line with the MLPS they hold. The last NAV i ahve for TYG is from October 3rd at 29.09 per share. Also the recent run in these MLP trusts began as some have suggested when Canada redid its tax structure on the Canadian Royalty Trusts or CANROYS where they revoked their tax free status beginning in 2011. Take a look at Kayne Anderson (KYN) which has had a strong run in the last few weeks. But I think Mike's point of where you could have been invested and the returns over the last 5 years tells us that we are in a good place...and its good to be in a place where the professional rif-raf does not frequent.

Some news this morning on Inergy (NRGY,NRGP) as earnings are out. The company beat estimates by a penny and re-affirms 2007 guidance.

MONDAY MORNING..."ANAL-ISTS" BUSY. ENERGY LOWER...10 YEAR HEADING FOR 4.25%

Still under perfect bullish conditions in MLP land this monday morning in the broad sense as we start this morning at all time highs on the index. News this morning on Energy Transfer Partners and Energy Transfer Equity (ETE). First off Dow Jones is reporting from a report from the Financial Times that the company is being investigated on some energy swaps it did on the intercontinental exchange.

We have the anal-ists doing a few moves this morning. New issue Eagle Rock Partners(EROC) is getting its cheerleaders now that the quiet period is done. UBS starts at a neutral and AG Edwards starts at a buy. Also AG Edwards raises its target price on Energy Transfer Partners from 55 to 62 dollars. stiefel Nicholaus raises its target on Inergy (NRGY) from 30 to 32 dollars.

I thought i'd pick out a few laggards this morning and came across these 2 charts. Natural Resource Partners(NRP) and Alliance Resource Partners(ARLP).

These charts are identical. In fact both companies have nearly identical market caps of about 1.25 billion. Both companies deal with coal. Non MLP coal companies like Arch Coal (ACI) and Peabody (BTU) have been in a decline since last spring but at least from a chart stand point they may have put in some sort of trading bottom in September. I would think at some point in this rate decline that the 10 year rate squeeze alone should force these higher. If the coal companies start to rally theseMLP laggards could move to the front of the line.

Two more charts for you viewing pleasure..the 10 year and the MLP index.

10 YEAR rates peaked in June-July while MLPS restested the bottom of its base in June and July. Rates have declined 75 basis points since the peak. MLPS have rallied nearly 10% since its July bottom. If the rate decline shows no signs yet of ending...i think MLPS have more upside. Continue to use corrections however fast and sharp to add to positions....imho of course.

Still under perfect bullish conditions in MLP land this monday morning in the broad sense as we start this morning at all time highs on the index. News this morning on Energy Transfer Partners and Energy Transfer Equity (ETE). First off Dow Jones is reporting from a report from the Financial Times that the company is being investigated on some energy swaps it did on the intercontinental exchange.

We have the anal-ists doing a few moves this morning. New issue Eagle Rock Partners(EROC) is getting its cheerleaders now that the quiet period is done. UBS starts at a neutral and AG Edwards starts at a buy. Also AG Edwards raises its target price on Energy Transfer Partners from 55 to 62 dollars. stiefel Nicholaus raises its target on Inergy (NRGY) from 30 to 32 dollars.

I thought i'd pick out a few laggards this morning and came across these 2 charts. Natural Resource Partners(NRP) and Alliance Resource Partners(ARLP).