Still under perfect bullish conditions in MLP land this monday morning in the broad sense as we start this morning at all time highs on the index. News this morning on Energy Transfer Partners and Energy Transfer Equity (ETE). First off Dow Jones is reporting from a report from the Financial Times that the company is being investigated on some energy swaps it did on the intercontinental exchange.

We have the anal-ists doing a few moves this morning. New issue Eagle Rock Partners(EROC) is getting its cheerleaders now that the quiet period is done. UBS starts at a neutral and AG Edwards starts at a buy. Also AG Edwards raises its target price on Energy Transfer Partners from 55 to 62 dollars. stiefel Nicholaus raises its target on Inergy (NRGY) from 30 to 32 dollars.

I thought i'd pick out a few laggards this morning and came across these 2 charts. Natural Resource Partners(NRP) and Alliance Resource Partners(ARLP).

These charts are identical. In fact both companies have nearly identical market caps of about 1.25 billion. Both companies deal with coal. Non MLP coal companies like Arch Coal (ACI) and Peabody (BTU) have been in a decline since last spring but at least from a chart stand point they may have put in some sort of trading bottom in September. I would think at some point in this rate decline that the 10 year rate squeeze alone should force these higher. If the coal companies start to rally theseMLP laggards could move to the front of the line.

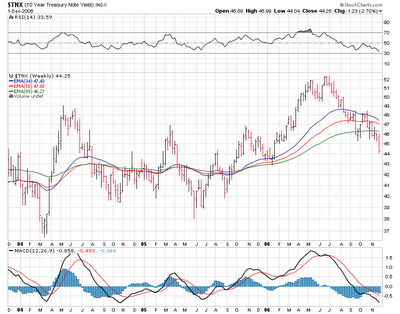

Two more charts for you viewing pleasure..the 10 year and the MLP index.

10 YEAR rates peaked in June-July while MLPS restested the bottom of its base in June and July. Rates have declined 75 basis points since the peak. MLPS have rallied nearly 10% since its July bottom. If the rate decline shows no signs yet of ending...i think MLPS have more upside. Continue to use corrections however fast and sharp to add to positions....imho of course.

No comments:

Post a Comment