MLPS KEEP ON GOING!

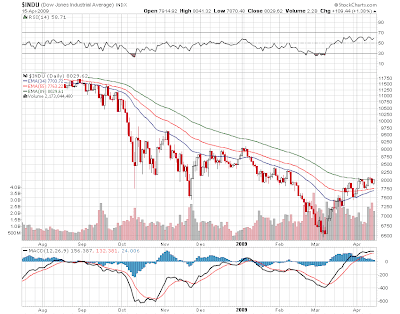

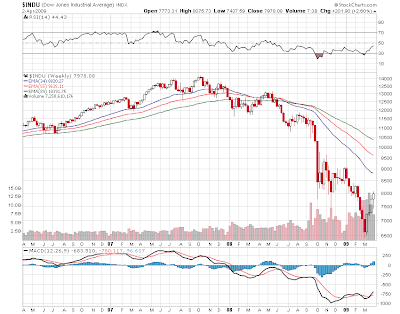

The dow is at a short term resistence area as the 8250 area has turned the market back in the last few weeks. The selloffs however from there have been extremely shallow and this morning with stock futures pointing to a sharply higher open that resistence will be seriously challenged. Chartist will be screaming "inverse head and shoulders bottom" and 9000 may be the next challenge which takes us back to the beginning of the year.

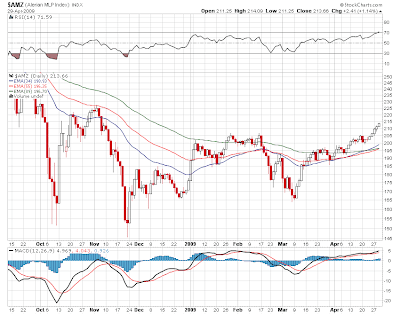

Those of us who reside in MLP land however have emerged from this base or whatever you want to call it and we have already broken out so our next challenge is the November 1st 2008 high which is around 230! Since we started the year at 176 and are now at 213 for a 21% gain since January 1st and if you add in now 2 distributions you have a total return of about 26%! Glory!

Earnings news will be driving a few mlps this morning like Sunoco Logistics which posted last night and its record earnings for them. This morning its Williams Partners (WPZ) which posts earnings but the press release is not available yet. Last night we had some negative news from Eagle Rock (EROC) which slashes its distribution to 0.025 cents from 41 cents in order to improve liquidity. We have some pre market trades down 1.33 to 5 bucks. Okay we now have the press release from Williams along with 2009 guidance. Oneok LP (OKS) posted numbers and guidance last night and look for Nustar(NS) to post sometime this morning.

Alliance Resource (ARLP) which has been among the better performers has been cut by Citigroup to hold from buy. These downgrades right now don't matter too much if at all. As always they are playing behind the eight ball. Crude Oil is up this morning as it moves with equity and sooner or later that short term top around 55 bucks will be challenged; hopefully sooner. Energy stocks may lead today depending on what Exxon says when their earnings come out shortly.

Keep an eye on twitter on the sidebar as i will be posting short messages their when i can't make a full blog post. Used it from Belmont yesterday! And you can of course follow me on twitter if you like. Click on the link on the sidebar. Got my daughters confirmation this morning so i will post when i can.

I should have dones this long ago but i started adding tags to make for quick references should you need to go back and look something up.