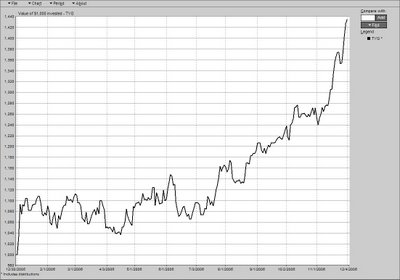

Mike G sent me this chart of Tortiose Energy Infrastructure (TYG) which is MLP trust that trades on the NYSE and it holds a broad universe of MLPS. Note that since January 1st it's up nearly 40%! Mike makes these observations.

A quick look at this total return chart says we are out of control to the upside right now.

Some people say MLP's are weak in Decembers. I have not done data on that, but sure was last year. Rising interest rates on the 10 year might make some think about finding high yields and push MLP's, maybe it has already happened. The actual number on the chart is +43% according to MSN.

Then he follows up with this observation.

And on the flip side:

While many of us are doing quite well in MLP's.

Look where many others put their savings.

I use FMAGX and FBGRX two no load, low fee large cap funds that do better than their competitor high expense funds and load funds.

These two funds have about $65B in holdings or a bit more than $200 for every man woman and child in the US.

For 5 calendar years, 2001-2006 they produced +0.9% and -8.7% returns if we ignore their expenses.

Include dividends and capital gains in all cases. The Dow was about even for the period.

For this year to date they produced +3.0% and +3.1%.

These pick from the pool of Dow stocks and Dow like stocks. The Dow is about +12% for the year.

So these highly paid stock pickers pick stocks that underperform the pool from which they pick.

I have no chance of picking stocks and beating the professionals. Those pros do not play in the MLP pool. Thank goodness.

Amen to that. I'm not sure that Tortiose is the best proxy to use for MLPS if only because i have found that the trusts don't often move in line with the MLPS they hold. The last NAV i ahve for TYG is from October 3rd at 29.09 per share. Also the recent run in these MLP trusts began as some have suggested when Canada redid its tax structure on the Canadian Royalty Trusts or CANROYS where they revoked their tax free status beginning in 2011. Take a look at Kayne Anderson (KYN) which has had a strong run in the last few weeks. But I think Mike's point of where you could have been invested and the returns over the last 5 years tells us that we are in a good place...and its good to be in a place where the professional rif-raf does not frequent.

Some news this morning on Inergy (NRGY,NRGP) as earnings are out. The company beat estimates by a penny and re-affirms 2007 guidance.

1 comment:

Nov 30 nav for TYG=31.79.

I think you'll find the nav of TYG tracks the AMZ very closely. The premium or discount to NAV does fluctuate but 1)has usually been at a premium, and 2)is now at the highest premium I've seen, so its probably not a great buy now.

TYY which holds mostly the same socks as TYG is at 27.10 with a Nov 30 nav of 26.79 so its a much smaller premium, although it has sold mostly at discounts until recently. TYY also has a much smaller embedded capital gain than TYG, and its dividends should be 100 return of capital for longer than TYG's. TYG advisors has said that TYG's distribution could be as much as 20% qualified dividends and only 80% return of capital.

Until there is an etf for the AMZ or Citi MLP index these with all their faults are the way to go for a diverse portfolio and no state income tax returns to worry about.

Post a Comment