And that search is not necessarily going to be easy given the stellar results of last quarter. The MLP index went from 257.72 on the close of trading at 9/29 to 282.93 on 12/29 for a 25.21 gain or 10% plus a healthy October distribution.

So where do we go from here? Well i have argued that nothing much has changed. The same factors of stable energy prices...a stable to falling 10 year...and a bullmove in the overall market should continue to provide a tail wind for MLPS. Add to that the prospect for more distribution increases this quarter means more yield compression. The problem will be what to buy since many of these have had big moves. Some ideas to follow.

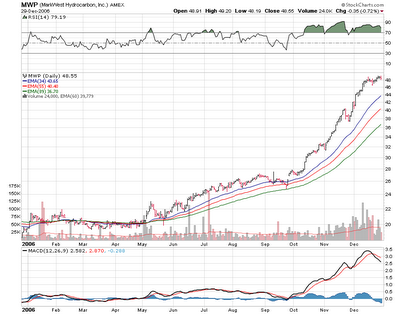

Lets return to this morning for just a minute here. We do have a large downgrade for Markwest Hydrocarbon as Lehman Brothers goes from Overweight to underweight.

This was one of my picks last quarter when it was 28 on 9/29 so the gain here was huge. The chart would suggest a pullback of sorts here at least to the moving averages so a quick drop to 44 might be a place to start nibbling since i think this one has more upside down the road. No other news and no other upgrades or downgrades so far.

One MLP that has not moved in the last quarter is Alliance Resource Partners (ARLP) and Alliance Holdings (AHGP) which is the general partner. These 2 stocks have been weak mainly because pull up any coal stock and they've gone nowhere but down in the past several months following nat gas.

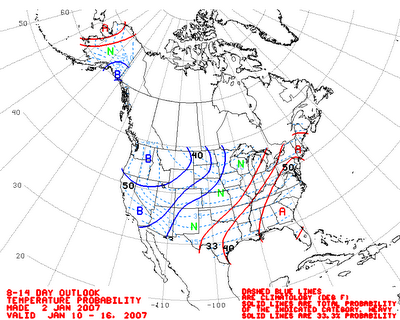

I've been bringing up these 2 lately and i think their moves will hinge on a turn in the weather. And that turn in my humble meteorological opinion is coming.

Now while you would look at this forecast and say that it still shows warm in the east and cold in the west and that's true but remember this is over a 6 day period from Jan 10-16 which will average out to this forecast but the beginning of the period will be much warmer and the cold air will be spreading eastward bringing near or below normal temps for the east and midwest just beyond this forecast period. The models have been consistent in showing a winter pattern finally getting established across the US. which will have impact on the second half of this month.

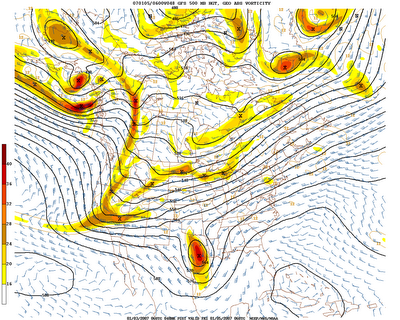

Now for a little meteorology lesson. The above map is pretty much what the jet stream pattern across the US looks like today. Basically you could read it like a west to east road map. Assuming nothing changes you would just follow the lines to show where your air is coming from. In this instance the pacific is the main feeder of air and not the arctic. Winds are blowing across a relatively warm pacific across California and the west and straight across the us to the east coast....result is no air flowing from Canada or the Arctic and you get above normal temperatures certainly everywhere east of the rockies.

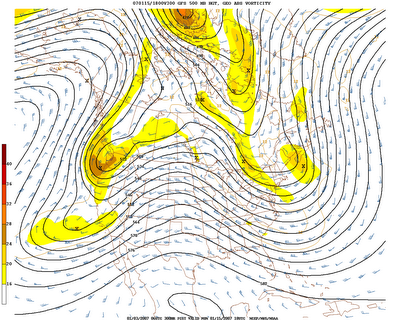

Now in this view which is a forecast for the jet stream late next week notice the huge difference. The Air in the east is getting its flow now from Canada and their is actually some feed from Northern Canada. Assuming a static atmosphere this results in at least normal temperatures in the midwest and east and below normal temperatures are even likely. The big question is if this is a temporary change that lasts a few days or a few weeks and then reverts back to the pattern of late October to early January which has been very warm everywhere. Right now my bet is that once the pattern makes the change its going to stick around at least for a few weeks. I will be looking for clues to see if this has longer term ramifications. All of this will at least have some impact on the energy markets especially nat gas. And if nat gas goes up coal will be pushed higher as well.

Also on the agenda this morning will be how MLPS react now that we're in a new tax year. This may provide opportunites in Lin Energy (LINE) and Regency Partners (RGNC) where sellers could be dumping shares on these winners in a new tax year. If that happens it may be a chance to get in...especially LINE which if it drops near or under 30 again...one could back the truck up.

So lots to ponder here as the open approaches.

2 comments:

Any info on NOA a recent IPO

Looks to me that very cold air will invade the eastern half of the country beginning late next week. And, my sense is that it stays for quite some time, and that Feb. will be much colder than normal. We sure need that to come to pass!!

Post a Comment