FRIDAY FIRMNESS!

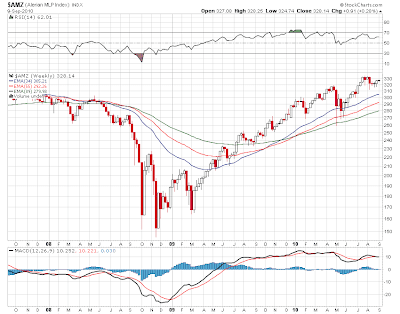

Thought it might be time to take a look at the weekly chart of MLPS and it appears that we are very early in this rally phase. Notice the we went down and touched weekly support back in May and notice also that the 200 week moving average crossed over at the beginning of this year. And we could be at the verge of another upleg in here but i think that comes with the overall market moving up. The tape has been firm since bouncing off the bottom at 9900 so the wind is at our back.

And key to all this is rates. The 30 year looks like its put in some sort of bottom in the rush to safety a few weeks ago. Now we're bouncing up a bit and maybe the 30 year could get back to a 4 handle in the short term. The longer term depends on the economy and whether the fed is sucessful at reflation.

This morning rates open higher by about 4 basis points which is happening with higher stock futures and higher energy and a lower dollar. MLPS are quiet this morning. No upgrades or downgrades and no corporate headlines. We were up 2 points on the mlp index and getting closer to that 335 high which is the next breakout point. The launching pad diving board pattern is looking more and more like a launching pad as we get in line performance with the overall market.

This morning rates open higher by about 4 basis points which is happening with higher stock futures and higher energy and a lower dollar. MLPS are quiet this morning. No upgrades or downgrades and no corporate headlines. We were up 2 points on the mlp index and getting closer to that 335 high which is the next breakout point. The launching pad diving board pattern is looking more and more like a launching pad as we get in line performance with the overall market.

No comments:

Post a Comment