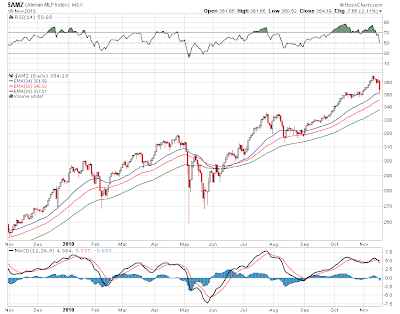

CORRECTION MODE!

We have finally made our way and rather quickly down to the 34 day moving average and we bounced off of that, closing off the lows of the day. The question becomes whether this is a one or 2 day affair or is there more work to do. Markets are a bit jittery with all going on in Europe, bailouts, China, etc etc etc. Or it may have just been a much need pause and another buying opportunity. The key remains rates and it would be wise to watch long bonds for clues as to where this is all going. Yesterday bond yields soard to 4.40 and closed at 4.25. There was a flight to quality that began in the bond sector yesterday so some may come out today. Still even with the dow down nearly 200 and MLPS down nearly 8, the damage was pretty much in control.

MLPS are quiet this morning on the news front however Harbinger announces they have a 9.6% interest in Crosstex (XTXI) and have approached the board about control. Could be the reason why the stock has been relatively active in the last week.

Stock futures are a little higher and so are yields. Crude is down this morning but nat gas is up. BTW the weather pattern after thanksgiving looks very cold in the northeast and midwest going into December. This could be a bullish tailwind for nat gas which i believe is putting in a significant tradable bottom.

2 comments:

Interesting call on natural gas. I hope you are right. It seems that higher gas prices would be bullis for MLP', except for those that rely too heavily on spread between Gas and NGL's.

I've been setting Stop/Losses 5

% below this year's highs on my MLPS. I got stopped out of BPL yesterday. I don't want to ride them all the way down like I did in 2008. Of course, I could always get whipsawed. I think the entire world financial system is in deep doo doo. 48 of 50 states are technically bankrupt. This is all going to end very badly.

Post a Comment