ENERGY STOCKS JUST KEEP ON GOING!

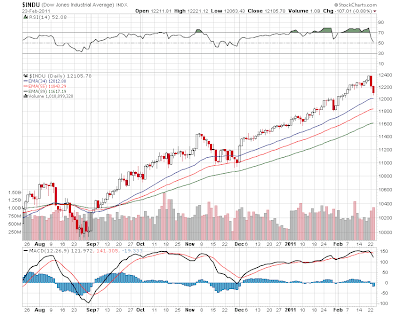

This has been a rather unusual "correction" if thats what you want to call it and it reminds me a bit of the summer of 2008 when oil zoomed to $150. Energy stocks were rallying at least for awhile before the overall market doom took everything down including crude. The last few days we have seen big spikes up in energy equity prices as a whole while the rest of the market has been going down. Note the dow chart has 2 down days in a row (gasp!) and we haven't even come close to threatening the uptrend that has been in place since last August.

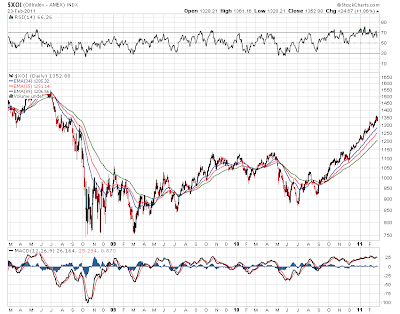

The XOI chart is an index of big oil and you can see that big energy stocks really didn't do much in 2009 and it was not until last September that they emerged from their bottom and they have been playing catch up ever since. It wasn't that many months ago that Exxon (XOM) was below 60. Now we see MLPS holding up pretty well in all this so far.

No sign of any breakdown here yet and i would look at 350 on the MLP index as a place where i would get nervous about the uptrend. One big difference between now and 2008 is that the market is telling us that the economy 6 to 9 months from now will be still humming along but not contracting. That is probably the single big difference between today and the last oil price spike.

And there is no Lehman Brothers waiting to be unwound and the MLP disaster (145 on the index at the absolute low) that came with it.

No big deal to wake up to on the MLP front this morning after yesterday's Duncan/Enterprise merger deal. We do have earnings however from El Paso Partners (EPB) and they were very good as the company highlights significant growth in distributable cash flow. Baird is raising Legacy Partners (LGCY) starting it with an outperform and a 33 dollar price target. One mlp that has done well is Calumet Specialty Products (CLMT) as it continues its climb up from the depths of the 2008 bear market. Its moved from 19 to 24 in the last 2 months. The company was hit pretty hard the last time oil spiked and they were one of the first mlps to cut the payout. But they seem to be managing price risk so far this time around and the company is doing a public offering (like the rest of mlp land lately) to take advantage of the higher equity price. The stock is down 1.60 in premarket trading.

Overall stock futures are down this morning and they seem to be trading on crude oil's every tick. As i started writing crude was over 100 bucks and we are at 101 and some change as i type. Still stock futures have come well off their lows as of this moment. Bond yields are lower in a bit of flight to quality. Nat gas of course is down and right on its lows. Crude is now selling for 30 times nat gas which is once again at an historical (or hysterical ) extreme. If whole nations going up in flames can't move this commodity i'm afraid nothing will. And its too soon for hurricane season. I wonder if at some point today there will be a serious rally attempt. They tried yesterday but it didn't work as the market sold off in the last 20 minutes to a 100 point dow lows. MLPS have an energy tail wind but that can only carry you so far. Still they are doing quite well in the midst of this (so far contained) 2 day sell off. Bulls in my opinion still remain in control.

And there is no Lehman Brothers waiting to be unwound and the MLP disaster (145 on the index at the absolute low) that came with it.

No big deal to wake up to on the MLP front this morning after yesterday's Duncan/Enterprise merger deal. We do have earnings however from El Paso Partners (EPB) and they were very good as the company highlights significant growth in distributable cash flow. Baird is raising Legacy Partners (LGCY) starting it with an outperform and a 33 dollar price target. One mlp that has done well is Calumet Specialty Products (CLMT) as it continues its climb up from the depths of the 2008 bear market. Its moved from 19 to 24 in the last 2 months. The company was hit pretty hard the last time oil spiked and they were one of the first mlps to cut the payout. But they seem to be managing price risk so far this time around and the company is doing a public offering (like the rest of mlp land lately) to take advantage of the higher equity price. The stock is down 1.60 in premarket trading.

Overall stock futures are down this morning and they seem to be trading on crude oil's every tick. As i started writing crude was over 100 bucks and we are at 101 and some change as i type. Still stock futures have come well off their lows as of this moment. Bond yields are lower in a bit of flight to quality. Nat gas of course is down and right on its lows. Crude is now selling for 30 times nat gas which is once again at an historical (or hysterical ) extreme. If whole nations going up in flames can't move this commodity i'm afraid nothing will. And its too soon for hurricane season. I wonder if at some point today there will be a serious rally attempt. They tried yesterday but it didn't work as the market sold off in the last 20 minutes to a 100 point dow lows. MLPS have an energy tail wind but that can only carry you so far. Still they are doing quite well in the midst of this (so far contained) 2 day sell off. Bulls in my opinion still remain in control.

No comments:

Post a Comment