CROSSTEX CUTS!

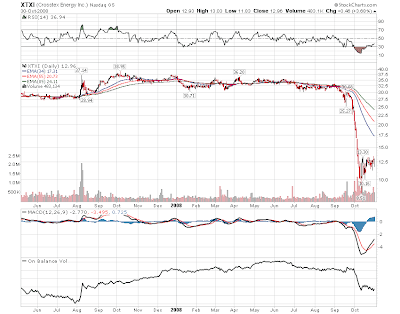

This is going to be an interesting day for MLPS on a couple of levels. Aside from the day to day push and pull from the market we have the dreaded distribution cut. Crosstex Energy LP (XTEX) and Crosstex Energy (XTXI) are cutting the payouts. XTEX goes from 63 cents to 50 cents and XTXI from 38 to 32 cents. The company says its implimenting a strategy to increase liquidity and it will also sell non strategic assets. The company says hurricanes impacting the second half by 25 million. No surprise when you look at the charts as they have fallen off the cliff but what hasn't.

The question for me is the market reaction. How much of all this is already priced in? We saw what happened to Atlas Pipeline (APL) when Citigroup downgraded the other day on the idea of a distribution cut down the road. Before the cut Crosstex was yielding over 17% and the new yield is down around 13%. In normal credit market times we could say its priced in. So the reaction here could be a good lead indicator of how much distribution cuts are already priced into mlp prices.

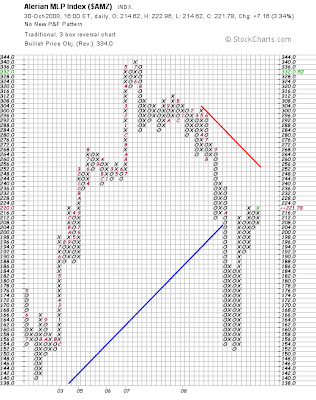

Last night i took a look at Point and Figure charts on a few mlps and got a surprise. A few of them have turned bullish including the MLP index which has an upside target of 330! And among the bullish chart patterns...Constellation Energy Partners (CEP) which has an upside target of 19! Oh glory...let me start spending my money now!

Boardwalk Partners (BWP) has been in an uptrend off its lows and the company has gone to Loews Corp (not the home depot competitor...the other one) and getting money for stock. The company has done this before. Was it easier for Boardwalk to go back to the Loews well instead of the banks given credit market conditions?

Nothing on the upgrade downgrade list yet. Stock futures are lower this morning coming off a nice gain yesterday. Crude and energy is selling off as 60 dollars is the next wall. Interesting developement in that energy is having trouble moving higher with stock prices. We'll watch that closely. It's probably the stronger dollar which continues to gain.

No comments:

Post a Comment