THE PANIC OF 2008

FEAR

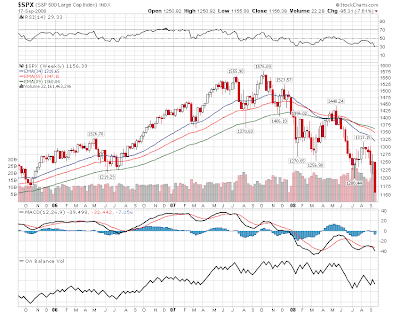

Not since January of 1941 did interest rates go to zero. But they did today. The demand for safety was so great that 1 and 3 month bills actually went to a negative interest rate for a brief time. In other words you would have to pay over 100 to get back 100 in 3 months. The Ted spread which is the Eurodollar/treasure spread went higher today than it did in the 1987 crash. Fear is everywhere. The world is in turmoil. Someday you can tell the story of the panic of 2008. MLP yields today rose to their highest levels we've ever seen and the spreads are at panic extremes. The volitility index or the VIX (chart above) is breaking out above the prior highs in the last year which marked bottoms for trading rallies. No sign of a bottom yet in this collapse. I guess a big scare would take us below 10000 on the dow. S&P support is down around 1100. The mlp index chart would say there is some support around 220 and major support around 200. I think we go to 10k on the dow we'll see 200 on the mlp index.

News tonight from Breitburn (BBEP) which reports limited exposure to Lehman hedges. Kinder Morgan Partners (KMP) also reports some exposure the Lehman hedges. No story to link to yet. Oneok LP (OKS) says no Lehman exposure and no significant hurricane Ike damage.

5 comments:

Sen. Dodd claims the Federal Reserve has the Authority to set up debt fund ( ALA Resolution Trust, Co.). Perhaps this might help clear some of the Level 3 assets off of banks balance sheets.

------------------------------

Dodd Says the Fed Has Authority to Set Up Debt Fund (Update2)

By Viola Gienger

Sept. 17 (Bloomberg) -- Senate Banking Committee Chairman Christopher Dodd said the Federal Reserve can act as an ``effective Resolution Trust Fund'' to buy and dispose of bad debt stemming from the subprime mortgage crisis.

``The Fed has the authority to move in this area,'' Dodd told reporters in Washington today.

Creating a separate agency to take on bad debt, akin to the Resolution Trust Corp. set up in 1989 to absorb losses from savings and loan associations, would take about a year, he said. Instead, the Fed should use its own authority to act.

``Debating whether or not you're going to set up some new agency or bureaucracy in government is a nice point, but I don't think we have the luxury of waiting another year,'' Dodd said.

Establishing a new government bureaucracy might distract officials from addressing housing as the underlying cause of the financial crisis, Dodd said. Congress in July enacted legislation creating a Federal Housing Administration program to insure as much as $300 billion in refinanced mortgages for 400,000 borrowers at risk of losing their homes.

Implementing regulations based on that legislation will help, as will lower mortgage rates and the government's takeover of Fannie Mae and Freddie Mac earlier this month, Dodd said.

``But candidly, I want to do a lot more than 400,000 units,'' he said. ``And we have the opportunity to do more than that.''

Dodd met yesterday with Federal Reserve Chairman Ben Bernanke and Treasury Secretary Henry Paulson and said Bernanke agreed that the subprime mortgage collapse remains the core of the broader crisis.

Longer Term

For the longer term, Dodd said he is ``willing to entertain'' the idea of a separate agency.

House Financial Services Committee Chairman Barney Frank, who proposed creating an RTC-like agency to take on bad loans on Sept. 15, said there is ``growing agreement among a lot of people that that is exactly what we need to be doing.''

Frank, a Massachusetts Democrat, plans to hold a hearing on the issue on Sept. 24, he said today in an interview on Bloomberg Television.

To contact the reporter on this story: Viola Gienger in Washington at vgienger@bloomberg.net.

IMHO much of the financial crisis problems can be attributed to the two politicians mentioned in this article.

Both Dodd and Frank have pushed and pushed banks, savings & loans, mortgage companies and other lenders to lend to people considered high risk. Those who do not put any marbles in the game, getting their downpayments from sources other than their own money. Thus making it no skin off their backs to walk away when the mortgage resets to a higher rate.

Just what did these two Bone-Heads think would happen!! As long as they and others of their ilk socialize financing of houses for people who cannot really afford them, this mess will slowly drag on and on.

Many in Congress who supported Fannie and Freddie need to take very very long looks in the mirror to see who the problem really is.

If their ever was a case for term limits this is one.

Ron

Texas

I think the resposibility for the mortgage mess is bi-partisan.

Sure Dodd and Frank ( and Cuomo HUD director under Clinton ) are culpable, but Greenspan, the rating agencies, Bush ( lack of early leadership), Wall Street and others of both parties are responsible. The repeal of Glass-Stegal didn't help either.

What we need now is not to point fingers, but solutions.

HS

Who gives a shit about who allowed the mess to happen. Our govt is a frickin joke. Do you ever actually listen to a senator or congressmen discuss anything related to financial matters, they are just clueless, they all take money from lobbyists and special interests. Congress has lost its mandate as a voice of the people.

It seems to me that the spreads group into the 7-9% for large cap limited credit risk MLPs and at 10%+ for the smaller cap more liquidity issues MLPs.

Has our host gone thru the smaller cap higher yielding MLPs to determine which are actually in good credit shape (capex covered, longer term debt) and are therefore providing higher yields but with decent safety?

Post a Comment