ARE WE BEGINNING TO LAG THE RALLY?

Steve posted that idea yesterday in the comments section. Lets discuss.

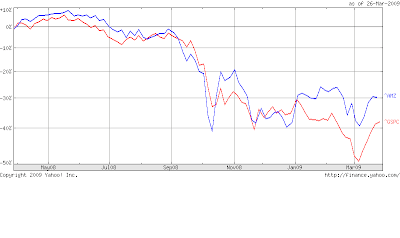

Something is definitely not right in MLP land again. The relative outperformance we saw the first 2+ months of the year has stopped and we have begun to lag the averages. Either the averages have gotten fluffy and we are keeping to a base line, or something less sanguine is afoot.

Steve is concerned with the relative underperformance and this week we have seen the mlp index go nowhere while the s&p is up 6%. Certainly disheartening when you consider the rest of the market. On the other hand mlps have been an outstanding outperformer in the last 3 months with a nearly 20% relative outperformance and total return for 2009 of about +15%. Should we worried by this weeks action? Perhaps we should be a bit concerned. One never wants to see underperformance. But could there be some other reasons why this is happening. I propose 2 ideas. One is that a number of mlps that actually have a price attached to them..that is higher than 15 bucks have done offerings. The latest was Buckeye (BPL) yesterday which was down 2 points on its latest stock offering. And based on the last rebalancing of the mlp index BPL has an over 3% weighting. Plains All American (PAA) and Inergy (NRGY) have also done stock offerings and the 2 have a combined weighting of over 8%. So certainly we can say these stock offerings have caused a distortion.

What could also be at play here is end of quarter and it could be that we are up so much for the year; players are moving out of mlps and into other things that have a long way to catch up. Ultimately that game plays itself out in a few days and we will be left with the basic question unanswered. Steve goes on to say...

I'm going to be really disappointed if in the next market downdraft we find that we are giving it all back - or worse, leading the market down. If we have topped out and are rolling over, we may lead on the downside.

Should we be worried? Well we should always be worried. But there are enough positives out there including a firmness in the crude price to give us a little bit of space. All will be resolved in the fullness of time but Steve correctly points out that we should be on watch.

Well we have arrived at the end of the week and the end of the quarter is next Tuesday. So i would look for markets to correct the move but with a firm tone. 875-900 is a doable target on the S&P and 205 on the MLP would be logical. Stefil Nicholas is cutting Alliance Holdings (AHGP) and Alliance Partners (ARLP) from buy to hold. Crude is down about a buck this morning and stock futures are down 10 points on the S&P as we see profit taking after the big moves this week.

4 comments:

This is the kind of market that makes one reach deep down for a true sense of "long-term." Here's what I mean: As a business owner, I am constantly analyzing sales/revenue/profit trends in my company and anytime I see a departure from our projections over, say, a month, I take note and dig for the cause. During the 21-years of running the company, I can tell you that this practice has served me well because when I've spotted declines, there is almost always an identifiable cause. Sometimes the cause is something over which we have influence and knowing about it allows us to take steps to alter the direction. Sometimes the cause is outside our influence (macro-economics, seasonality, etc.), in which case we just ride out the storm.

As investors in publically traded companies, we have little real influence over the direction of the companies we own and even less access to the information upon which boards make their decisions. We're pushing strings and trying to put fog in a bottle. At the end of the day, all we can really do is size up events after they occur as indicators of future events.

I look at the MLP universe the same way I look at my own business. These bad boys are here to stay because they are integral components of integral industries. Long term, I have no doubt they'll perform as hoped. Short term, on the other hand, is anybody's call. So to me, the short term (gut wrenching) gyrations are macro events about which I have no influence and the only decision I can make is whether to hold 'em or fold 'em. In my case, I would no more be likely to sell them then I would be to sell my company based on similar conditions.

That said, I appreciate Steve's observations of relative underperformance during the past few weeks because there is no room for complacency in this man's war...

Lee

P.S. Sorry for the ramble...

I think Lee hits it pretty much dead-nuts on. I also own rental real estate and at one point owned a LOT of it. My overarching concern with those investments is/was cashflow. If I had sufficient income to pay the mortgages I was happy. Unlike the stock market, real estate is usually a very illiquid way to invest money. More important, you cannot determine the value of your holdings with an instant click of the mouse.

As I began to unwind my real estate investments a few years back, I moved the post-tax proceeds into MLPs. I have adopted the same philosophy -- I want income. I have zero control over what the market decides my holdings are worth at any point in time. What I do know is that I own businesses that are pumping out cash every quarter as faithfully as an ATM. In many cases the payout has gone up every quarter without fail. All this without the hassle of bitchy tenants. In fact, my new `tenants' are bending over backwards to make me happy. The market can do what it wants, but it cannot ignore a cash machine forever. And forever is my anticipated holding time.

I'm not overly concerned with day to day fluctuations in stock prices. What I'm concerned about are trends in stock price that ultimately reveal fundamental issues. Last year when stock prices declined precipitously, it signaled that a lot of people were very concerned about the stability of distributions and in several issues that concern was dead-on. Eg, XTEX, CEP, and several others whose payouts were cut.

Like Mike, I liquidated all my real estate holdings in 2004 and 2005 and invested all of the proceeds in MLPS and energy trusts. While the income from the Trusts has been severely cut, the income from the MLPs is largely still there, although somewhat diminished.

What concerns me is that another sharp downward trend in MLP prices might signal another round of distribution cuts. Distributions are the ONLY reason to own an MLP and once they are eliminated (XTEX) or even cut severely (CEP) prices go to zip.

That is what I am concerned about.

steve

Steve, one other way to look at this is if those mlps that have been cut to penny stock levels ever get their growth back and return to pay distributions down the road; those mlps could be big winners. Of course figuring out which ones (if any) is the rub.

Post a Comment