Saturday, December 31, 2005

Its the general view among many on the message boards that Teppco will be taken over by Dan Duncan and folded into Enterprise Products Partners (EDP). Check out these slew of messages on the yahoo board for Teppco for other opninons. No one seems to be discussing this on the Enterprise board . I planted a seed there so lets see what it yields.

One could say that the appointment of an "acting" CEO could be a sign since recent other corporate moves involved moving EPD people into the Teppco heirarchy. Folding Teppco into Enterprise probably makes sense for Duncan. I'll be curious to see market reaction to this on Tuesday morning. If there were a takeover please remember that Enterprise's takeover of Gulfterra was done at almost no premium to the trading price. If this merger were to occur my guess is a stock swap and i am dreaming of 1.67 -1.75 shares of Enterprise for each Teppco share ($40-42 bucks).

Of course this could all be one big fantasy here but as always....food for thought.

Friday, December 30, 2005

Lots of near end noise and some early session dumping in Crosstex (XTEX) which plunged to 32 at the open and is now back to unch...HILAND which was +2 and change yesterday has given 1 and change back...otherwise its just year ending with a firmness in most issues. Plains All American is down near its low.

Unless there is an earthshattering development...HAPPY NEW YEAR!!!

Thursday, December 29, 2005

Also note the blog roll i've added a new insider site which has lots of info about insider trading. Take a look.

No news this morning so i guess its more of the same. Year end distortions continue but only 2 days left of this nonsense.

Lots of Bargains in MLP land with yields over 8% in some that are growing their distribution like Atlas Pipeline Partners (APL) and not Teppco (TPP).

Watching the tape as always.

Wednesday, December 28, 2005

Mostly lower again today with some bouncing here and there. Looks like some organized year end dumping by somebody. Yesterday it was ATLAS PIPELINE and ENBRIDGE ENERGY PARTNERS...both were down 1 or more yesterday and they're up today. Today they're shooting Holly Partners down 1 and change...and Tortoise Energy down 1 even.

Teppco is up as we speak...trying to break a 10 day losing streak.

No corporate news....3 trading days including today left for final tax loss selling. Yesterday was last day for 2005 settlement if thats important to some traders.

Tuesday, December 27, 2005

When will the ugliness stop??? BTW no corporate news to speak of.

Ten year yield chart is breaking down which should put a solid floor in these things but i've been chanting this for weeks now and the market is not listening.

Teppco looks very sad. Beginning to believe that a distribution cut is in the offing!

Sorry for the late going but had torun around this morning. Everything energy is collapsing so MLPS are following suit even though the 10 year is supportive and breaking under 4.40%. Teppco is down 1 and change and really breaking down badly....if this area goes...I think its a distribution cut being telegraphed and we're headed for 26-28. Atlas is down 1 and change. Big fractional losses across the board. Markwest is actually up a few pennies; Energy Transfer and Buckeye also seem to be holding up well.

Saturday, December 24, 2005

Friday, December 23, 2005

Another one of my favorites!

Please note that i have updated the blog roll. I've added a link to CLOSED END FUNDS. It is a very useful sight with info on how CEF's work. Please visit. Also visit this blog on CEF's. I am adding this to the blogroll as well.

Sharing with you one of my favorite cartoons!

Good Morning. Friday before Christmas Weekend.....Trading should be rangebound today...no news...no nothing so far. Tax loss selling should be abating now as we're past peek volume for the month. There was some firming late in the day yesterday in MLPS....lets see if the trend continues.

Thursday, December 22, 2005

Teppco down 11 cents...a year from now at 11 cents a day...it will be at zero!

Wednesday, December 21, 2005

Losing 2+ is Markwest and its down 6 points in the last few days....still no news here. Mixed in the group today...moves mostly small fractions. At least we're one day closer to the end of tax loss selling.

Fractional moves dominate most moves are small. No real news.

Late night in Manhattan again last night with a Handels Messiah Singalong at Avery Fischer Hall...lots of fun...very tired. And i know all the unused ways into Manhattan and had minimal trouble with traffic!

Okay so Valero and Teppco are up this morning but the day is young. No news today. I think it stays this way until Jan 2 2006...so take your tax losses while you can if you have them.

Tuesday, December 20, 2005

And Valero LP also can't get out of its own way and that one is near its August 2004 low in the 49 area. Yesterday's late afternoon Deuthce upgrade was a waste. 4.47 on the 10 year. Oil and Gas majors are higher.

Also Energy Transfer Partners has increased the size of its GP IPO though no story link is available as of this posting. Will post link when available.

Late in the day yesterday we had Valero LP being upgraded by Deutche Securities and Energy Transfer downgraded by Deutche Securities. No impact on ETP but it did cause a few upticks in VLI.

Pre-Christmas/Transit Strike trading so it looks to be more of the same stuff. No news this morning so we may just be appointment only from here on until after new years day.

Monday, December 19, 2005

Still new lows in Teppco and Valero LP as tax loss selling or just plain selling continues. Markwest is down 1.31 with no news. In fact except for a few of the closed end funds which are up a few pennies...everything is down today.

Sorry for the late posting this morning but i had another funeral to go to...its been a December to remember here as 8 people i know have died. I hope this is the last for awhile.

Looks like end of year mode has begun...Tax related selling has taken Teppco and Valero to new 18 month lows. Markwest Energy is down 1 and change to under 45. Seeing small fractional moves elsewhere with no corporate news.

Friday, December 16, 2005

Good morning. Went to see La Boheme at THE MET at Lincoln Center last night. It was my first opera. The main character dies at the end...the audience dies far sooner!

There has been a general thesis being put out there by MLP observers that rising interest rates have hurt prices in the last 3 months. I would contend that while prices have been hurt the cause may have been more the huge amount of stock offerings and the market correctly anticipating this...rather than any rise in long rates. My reason for this is plainly and simply long rates not only have not really risen in the last year but are still below the April 2004 peak at 4.90%. Short rates have climbed and i think you could argue that risk free 4% is attracting some shorter term money away. The yield spread which shrunk to under 2 at one point in July have now risen to over 3 in some cases like APL and MMLP.

I bring this up mainly because the 10 year yield has been falling since reaching 4.64 a few weeks ago and if you look at the chart we be ready for 10 year rates to drop which of course is supportive to MLP prices. Add to this is the improving technical action in the group and i think (in my never to be humble opinion of course) that the correction in these stocks is over and its time to buy! Again look for the strongest looking charts...

Yields are falling this morning...futures are higher...crude is lower. No news or upgrades/downgrades so far this morning. Waiting for the open.

Thursday, December 15, 2005

No news from late last night and this morning and no upgrades or downgrades so i figured i let them open up first and trade for a hour. Huge nat gas draw down has put a bid under gas stocks after selling off in the first hour.

MLPS are either side of unchanged this morning all the moves small and fractional. 4.49 on the 10 year. Looking for these stocks to rally later today.

Wednesday, December 14, 2005

Actually a good day today. The best looking charts were up the strongest today. Plains All American is +1.15 on its upgrade. Energy Transfer is up 60 cents and so is Pacific Energy Partners. Magellan Midtream over 33 again up 21 cents. Also fractional gains in Atlas Pipeline and Markwest. Northern Borders Partners at 42.99 now as it bounced off its low. Duke Midstream Partners the new IPO has quietly moved up to 25 from 23 in the last few days.

Lets start the morning with an upgrade of Plains All American Pipeline by RBC Capital Markets to outperform from sector perform. Then there is news from Teppco about its credit line and also from Energy Transfer Partners.

No other news this morning so far.

Tuesday, December 13, 2005

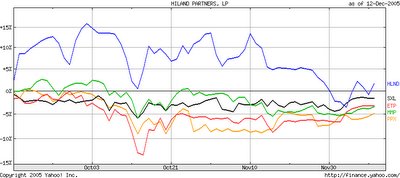

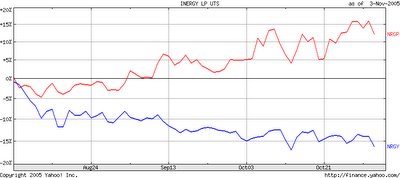

Posted chart above of 4 MLPS and 1 GP. Energy Transfer is the best performer in this group and NRP the worst over the last 3 months. ETP is -3% the rest are down about -9 to -13 %. APL had a stock offering; the others did not.

Now the chart at the top are what i consider to be the 5 outperformers during this correction and perhaps should be looked at seriously as the next group leaders. Note all are down less than 5% and Hiland LP is actually up slightly...and they had a stock offering along with Pacific Energy.

Food for thought.

Copano (CPNO) seeing some stock sales...-1.46 with no news. Penn Virginia Resources (PVR) down a buck with no news.

Broken clocks i suppose are right twice a day.

Monday, December 12, 2005

Watching the after market for news. Morningstar had some nice things to say about Northern Borders Partners, TCLP which owns a stake in NBP and Amerigas.

when one sells an MLP, does one refer to the first K-1 for adjusted cost basis? I've held NBP for a few years and suppose original K-1 is included with that tax year file (that I bought it) but not sure. Think the MLP would help with guidance in that event?

Any answers appreciated in comment section

Outside our space but a big deal with Conoco Philips and Burlington if finalized. This along with firm energy this morning might light a fire under all things energy. We'll see. Meanwhile its getting closer to Holiday (or should i say CHRISTMAS) and individual company news is non existant this morning. But it is early.

Sunday, December 11, 2005

First off the the weather pattern over the eastern us looks cold to bitter cold at times....there looks to be an arctic dump coming for the week of Dec 18-24....at least thats what most weather models are indicating. This coming week will start cold and below normal in the northeast and then trend to near nomal by week's end. This should continue to put upward pressure on oil and gas prices.

In the news a massive explosion at a British oil depot.

Lastest from the BBC at the above link.

I think MLPS are bottoming here and could rally into year end. Buy only the ones with best charts like ETP and PSX among a few others and i would still avoid Teppco and Northern Borders Partners until their charts show at least some signs of bottoming. BTW for the first time the universe of closed end MLPS are selling at discounts to their net asset values after trading at premimums of as high as 6% above NAV. Check FEN FMO TYG KYN.

Crude oil is up this evening by 46 cents and Natural Gas is up as well by a nickle. More cold air arriving. Cactus Jack has as always an informative post on the yahoo boards. Give it read.

Friday, December 09, 2005

I am no getting stronger in my opinion that we have bottomed in here and that this is a good place to either add to positions or pick up new positions in the stronger MLP charts as shown yesterday...(see archive). Valero LP looked like it did its climactic plunge to 51.40...now higher and 1 dollar off the low. Copano (CPNO) is up 75 cents. On the downside Crosstex (XTXI) is down 1. Everyone else is somewere in between.

Thursday, December 08, 2005

And now an example of a hideously looking chart...the daily chart of Northern Borders Partners as the price is now nearing at 15 month low. Check out the weekly chart at the top here and the round trip that stock holders have been on. Since we're approaching an 8 percent yield its hard to imagine this go much lower than 40...but with no prospects for a distribution increase this looks like dead money at best.

More plus signs and watching the tape in the last 30 minutes MLPS they seem to firm into the close. Ranges very tight today on many in the group and IM(never to be)HO i think this is a good place to pick up bargains. Energy Transfer has one of the best looking charts in the group and Hiland LP for those who want to be a bit more speculative. Again no guarantees from the management here but i think there is light at the end of this rather long corrective tunnel!

Above are some of the better looking charts.

http://www.raymondjamesecm.com/industry_1300_main.asp?indid=71

thats the raymond james link and its also on the links column

Wednesday, December 07, 2005

When corrections are underway they can be painful and grinding and just not fun. But it is wise during this time to perhaps find the ones that are outperforming so when the next upleg begins you might have the next leaders. In the interest of disclosure I own all three. But of all the charts of MLPS...and if you are a chart reader. These three look so much better than the others.

Energy Transfer Partners (ETP) probably is the best looking as it seems to be emerging out of a basing pattern. The other two (Magellan Midstream MMP, and Sunoco Logistics SXL) still look like they are working through their bases. These three do not have that "still in a downtrend look that so many in the group have.

Anyway Food for thought.

Somewhat of a firm finish for most of the group yesterday so lets see if it carries over today. Meanwhile on the news front Energy Transfer Partnerss announces a series of aquisitions but they sound on the small side.

No other news to speak of this morning so far. Energy complex is firm as winter continues.

I'm adding this link to the links column. Its to Raymond James and its MLP monthly report. Its a good read on a regular basis.

Tuesday, December 06, 2005

Down fractions include Holly Partners which opened down 1.50 and is now down 70 cents. Also down are Tortiose Energy(TYG) and Northern Borders Partners (NBP).

Moodys downgrades Markwest's unsecured debt but its a headline and i'm not sure if its the GP or the LP.

Lets see if we can keep a firm tone into the close.

BTW i don't now how i missed this but Duke's LP came public last Friday.

News from Teppco this morning. They're presenting today at a Wachovia Oil and Gas Conference...they reinterated their guidance for 05'. No big deal here. Atlas Pipeline Partners announcing a priviate placing of senior notes. No other breaking news this morning.

Crude and energy complex is lower this morning but not by much.

Monday, December 05, 2005

Energy Transfer Partners is 75 cents higher on the distribution and guidance boost. Elsehwhere the picture is mixed with small fractional moves in either direction. The energy complex is off its high of the day. No other corporate news.

Not much else happening. 10 year at 4.55...Crude and Nat gas still higher...dow -40.

GOOD MORNING! We begin this monday morning with news from Energy Transfer Partners who is raising the distribution by a nickle (10%) to 55 cents a share and increase earnings guidance as well. Should be worth some upside here. No other news so far this morning.

Energy Complex is rallying this morning especially Natural Gas.

Above is the daily chart for crude verses the 10 year price...Since Hurricane Katrina they have been in lock step...falling crude/rising yields. This chart implies crude will impact the economy as prices rise above 60 dollars.

This is the natural gas chart vs the 10 year. Here its been rising gas/rising yield. The implication here is that rising gas prices will raise yields and be inflationary.

The daily chart on oil/10 year shows how much in lockstep they have been since August.

Seems like the market has discoverd that now we will indeed have a winter as cold air has spread out across much of the eastern two thirds of the US. As per MLPS i am cautiously predictiing that a bottom is being put in place here as volume looks to be drying up in the last several days with some individual selling climaxes occuring. But the charts of most of the group look pretty awful and we need to see these guys to move above their 34 day moving averages. No sign of this yet.

Friday, December 02, 2005

Hopefully these things are all sold out...some of the action has the look of a selling climax but bottom picking has not been my strong suit. Unemployment numbers will move the 10 year today. 10 year's initial response to numbers is an easing of yield back toward 4.50%

Inergy GP is out with record earnings after you strip out the numbers. No other news this morning on the corporate front.

Thursday, December 01, 2005

Big energy is firm...XOI +15 points.

Most of these guys cut their losses yesterday by closing time. Its getting to the point where these stocks are severely oversold; yields are approaching 8% in some instances. Atlas Pipeline which has been growing its distribution at a 16% annual clip is yielding 7.8% which is higher than Northern Borders Partners who has not raised its distribution in several years. And some of these like Valero LP is selling for less than it did in MAY 2004 when the 10 year spiked to 4.95%.

I think money flows right now are out of energy and into technology and MLPS are being sold as a source of those funds. And they don't seem to be attracting new money. But the 10 year spread being over 3 points...we are at the top of historical range.

No news on the corporate front this morning.

Wednesday, November 30, 2005

Since there is not one iota of corporate news this morning... i waited until now for the first post of the day. Ten year yield dropping this morning to 4.46%. And while the energy market sold off on winter being cancelled...i will reinterate the weather pattern turns colder beginning Friday and remains so for the next 10-14 days.

Enterprise Products Partners priced an offerning last night at 25.54.

Watching and waiting for the open. Martin Midstream Partners has been firming on increasing volume for some reason or another.

Tuesday, November 29, 2005

MLPS continue to do nothing for the most part. Enterprise has some news about expanding its LNG storage. Ten year is back up to 4.48 yield. Energy is lower while big energy stocks are a little lower.

I need to get my head together here...will post a roundup this evening.

Monday, November 28, 2005

MLPS are mostly lower but not by alot. Not much news out there other than the Lehman notes on Crosstex (outperform)...Crosstex up 60 cents...and Martin Midstream which is up 17 cents.

Meanwhile the ten year is at 4.41 and MLPS are mixed. Lehman's overweight of Crosstex is good for 38 cents so far. Otherwise moves are fractional and small in both directions.

We start this monday with an upgrade. Lehman Brothers starts coverage on Crosstex LP and humbly recommends an overweight position! Pre market bids are above Friday's close. No other news this morning...the 10 year is at 4.44%

Lets see if MLPS put in a solid trading low in mid november and if last weeks tepid rally can gain some steam.

Weather trends look colder in the northeast and midwest after midweek.

Wednesday, November 23, 2005

Wednesday before thanksgiving so its an early getaway today for most traders. I guess all of the days moves should be done by lunch time and then its just back and forth after that. No news to speak of this morning. Treasuries flat at 4.42 on the ten year. Energy complex a touch lower this morning. Weather pattern no longer looks very cold over the next 2 weeks...once we get past Friday.

Waiting for the open.

Tuesday, November 22, 2005

As mentioned earlier Atlas Pipeline Partners priced its offering at 42. And a big 5000 market purchase of Hiland Partners by an insider. This was reported after the close.

Sorry the blogging has been on the light side this week with Thanksgiving and some personal stuff. Looks like everything tomorrow will be in the first 45 minutes and then its nothing of consequence until Monday. Thats just a prediction.

Here is a list of MLP yields as of 11/10 thanks to Utility Stock Blog

Doesn't look like i missed much anyway...looks mixed on the tape. Majors are higher with XOI +17 and back over 1k. Atlas Pipeline Partners priced its offering at 42.

Cactus Jack suggested 42.75 as an entry point for Northern Borders Partners. Its almost there now.

Monday, November 21, 2005

Holiday shortened week so my guess is trading that is more appointment only in nature but there is some leftover news from Friday that will move some MLPS.

Lets start off with Atlas Pipeline Partners which 3 news items late Friday. First off its a stock sale of 2.7 million shares. Also rhey will be selling some senior notes. And finally Atlas America is considering a restructering involving APL.

This morning the energy complex is higher. Weather prospects are positive as very cold air is heading for the great lakes, northeast and mid atlantic. And the pattern overall looks cold for the next 2 weeks.

Friday, November 18, 2005

No real news to speak off...an upgrade for Enbridge Energy Partners (EEP) from underperform to market perform thanks to the brilliance of Wachovia. Otherwise the group is trading mixed this morning with mostly fractional moves in each direction. Magellan Midstream and Plains Pipeline are giving back yesterday's gains...others higher by 1/2 pt or less.

Ten year has that 4.5 handle on it.

Thursday, November 17, 2005

Okay to play catch up...citigroup upgrades Pacific Energy Partners to buy this morning. Another insider purchase this time at Martin Midstream Partners (MMLP). Please note that the only ones i regard as signficant is the open market purchases which is someone buying with their own cash at market prices.

Otheriwise it was a good day for MLPS for a change...just about the entire group was up soild fractions...Markwest was up 1.48. Will report on any late breaking news.

Wednesday, November 16, 2005

First off we have news from last night that will be impacting. Crosstex LP priced its equity offering at 33.25. Also on the equity pricing front we have Hiland LP pricing its offering last night at 41.77.

Also i may have missed this but Energy Transfer Partners came out with earnings on Monday night. My apologies for not catching it.

Ten year is continuing to move away slowly from the 4.67 high from last week...now at 4.53 on a decent CPI number. No other news breaking this morning on MLPS

Tuesday, November 15, 2005

Also Enbridge Energy Partners (EEP) announces a stock offering.

Another Insider purchase report this time from Holly Partners. At least its encouraging to see some folks stepping up to the plate here. Its an open market purchase which i think is the most important kind of insider buy. No exercise of option or company giving someone shares. This is going out and buying something at full price with your own money.

Markwest is down 2...Valero and Hiland down between 1 and 2 pts...fractional losses of .25 to .75 cents on average for the rest of them.

Distributions should be appearing in your accounts so this at least allieviate some of the pain.

Atlas Pipe Line (APL) 7.4%

Martin Midstream (MMLP) 7.10%

Energy Transfer (ETP) 5.9%

Teppco Partners (TPP) 6.9%

Valero LP (VLI) 6.2%

Magellan Midstream (MMP) 6.5%

Sunoco Logistics (SXL) 7.0%

I sampled just a few but there was a time last june where the spread between the ten year yield and the distribution yield on these was near or just under 2 pts...now we seem to rallying the spread back to nearly 3 points in some cases. The distribution growth has probably prevented the sell off from being worse. Atlas catches my eye with a 7.4% yield and distributions growing at a very fast rate.

Meanwhile among the losers Markwest Energy Partners (MWE) is down 1.66, Hiland (HLND) is down 1.49 Valero LP(VLI) -1.09 ...lots of fractional losers on the board. XOI is +10 and XNG is +6 though the complex is mostly lower this afternoon. Crosstex is holding 33.75 on its news of an offering of 3.5 million shares.

Maybe the happiness fairy will help us out of this rut!

Some news from last night. At least now we know why Crosstex LP has been in a downtrend. They're selling more shares. Now this should put pressure on the stock this morning but i will point out 2 things. First off the stock may have anticipated this already and that could limit downside. And secondly Hiland LP announced its sale 2 weeks agao and the stock traded down from 43 to 41 and now its at 45. Lets hope! So far no pre market trading...bid and ask even with the close.

Earnings news and its good news from Pacific Energy Partners. Numbers were good and raising 05 view. (whats left of it.)

Energy complex is lower this morning but let me caution that a much colder weather pattern is evolving for the northeast and great lakes and it could be downright frigid for thanksgiving.

PPI number was very good....core down .3. Ten year yawning.

Monday, November 14, 2005

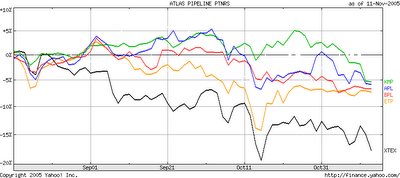

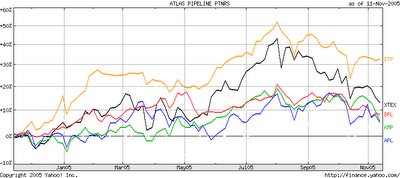

Corrections are never fun and this chart is proof. The first chart compares 5 MLPS and their performance in the last 52 weeks. Note that in this subset that all 5 stocks are up with KMP and APL near the bottom and XTEX AND ETP at the top.

Corrections are never fun and this chart is proof. The first chart compares 5 MLPS and their performance in the last 52 weeks. Note that in this subset that all 5 stocks are up with KMP and APL near the bottom and XTEX AND ETP at the top.Notice that in the last 3 months Kinder Morgan has outperformed the other four with Crosstex down the most. So the biggest gainers year over year are experiencing the sharpest pullbacks in here while there is a flight to quality into KMP. It seems to be a grinding correction in here from the July highs.

Meanwhile most MLPS remaining slightly higher and off the morning highs. No news to speak of on any in the group.

Good Monday Morning to all.

Lets start the day with news of a Yorktown sale of Crosstex Energy (XTXI). For those of you unfamilar with Yorktown they are a large holder of Crosstex Energy and will periodically dispose of shares. This time it was 1/2 a million shares as per the filing. No other earthshattering news this morning on the MLP front.

The energy complex is higher this morning which could be a bounce from an oversold condition. I promised last week i would blog about weather prospects over the next few weeks. I'll post about this later today. Meanwhile Hurricane season ain't done yet.

A couple of week's ago a friend of mine's horse broke his maiden at the Meadowlands. Here is the picture at the winner's circle. I'm the one smiling!

Friday, November 11, 2005

Meanwhile the 10 year yield has hit a wall at 4.60 short term. Double top at least for now. Maybe a trip down to 4.40 yield into year end?

A better looking chart in Atlas Pipeline...not a picasso but better than what follows!

A better looking chart in Atlas Pipeline...not a picasso but better than what follows! Kinder Morgan chart looks like its broken down in here and at a 5/1/2 month low. Its been straight down since selling new shares in the 51.25 area.

Kinder Morgan chart looks like its broken down in here and at a 5/1/2 month low. Its been straight down since selling new shares in the 51.25 area.

Well we're past the open and we can hear the collective yawn. Most moves are small and favor the downside. Crosstex (XTXI) showing $1.88 loss at the open but this is one of the stocks where 3 or 4 buys can have it back to unchanged. No news to trade on.

Kinder Morgan Partners down another 70 cents and trading at a 5 1/2 month low here.

From last night news of a public offering of Magellan's GP. Magellan Midstream has been a good performer over the last 2 years. Something to look foward to since GPS have done well asa group.

For Hiland Partners holders a conference call is scheduled for this morning. Also Martin Midstream partners announced a closing of its Prism deal

Bond market is closed today for Veterans Day so no trading in the 10 year. Energy complex continues to decline this morning. Look for trading to be light for the most and by appointment only!

Over the weekend i shall try to blog about future weather conditions, the winter ahead, and update the blogroll of links.

Thursday, November 10, 2005

The two big losers are Kinder Morgan Partners - 1.26 and Crosstex (XTXI) -1.50. No news on either front. Copano - 1.22, no news either. Markwest still has not opened as it places stock privately.

Big oil and gas stocks getting hit very hard this morning. XOI down 27, XNG -9.

Natgas numbers due at any moment.

News from after the close last night. We'll start with Pacific Energy Partners who was supposed to come out with earnings. but announced a delay. This would normally cause consternation amongst holders but apparently they found some money they did not know they had! They should call General Motors!

Martin Midstream Partners which usually trades by appointment only reported record earnings. Should provide some upside.

Earnings news from Hiland Partners which was 6 cents better than first call and they announce an expansion.

Markwest Energy announces a private placement of shares at 44.21

No upgrades or downgrades so far.

Wednesday, November 09, 2005

Hotel Bombs going off in Jordan...civil war in France...riots elsewhere. Ugh!

Copano (CPNO) down 75 cents as they sell the earnings news. Inventory numbers bearish overall but i find that oil stocks don't often react the way you expect them too. Right now the group is weak (XOI -12). Crude down 61 cents.

Oil executives testifying before the senate circus. If anything earthshattering is said...i shall report. But don't hold your breath.

We'll start with last nights news on Copano and earnings. Numbers look good. Pacific Energy Partners earnings due out after the close.

No breaking news this morning and no upgrades or downgrades. Ten year yield up slightly while the energy complex is lower.

Tuesday, November 08, 2005

We begin the morning with earnings from Crosstex Energy LP (XTEX). You have to cut through charges one time gains etc etc. I think the most important figure to look at is distributable cash flow or DCF. Here is the relevant paragraph.

"The Partnership's Distributable Cash Flow for the quarter was $17.9 million, 3.50 times the amount required to cover its Minimum Quarterly Distribution of $0.25 per unit, and 1.54 times the amount required to cover its distribution of $0.49 per unit. As previously disclosed, the Partnership sold certain idle equipment for $9.0 million in 2005, and during the third quarter, the Partnership received the final $5.4 million of funds for the sale, which is included in Distributable Cash Flow for the quarter. The $11.5 million charge for the mark-to-market value of the puts did not affect Distributable Cash Flow. Excluding proceeds from the sale, Distributable Cash Flow for the quarter increased $2.1 million, or 20.2 percent, over Distributable Cash Flow of $10.4 million in the 2004 third quarter. Distributable Cash Flow is a non-GAAP financial measure and is explained in greater detail under "Non-GAAP Financial Information." Also, in the tables at the end of this release is a reconciliation of this measure to net income."

So we'll how the market reacts to this. I don't think there was any real surprise here. The conference call is at 11am eastern time and you can access it here.

No other new upgrades or downgrades so far.

Monday, November 07, 2005

Friday, November 04, 2005

Some MLPS have firmed up this afternoon after selling down this morning. Atlas Pipeline Partners has come back to the flat line...while Buckeye is higher and so are a few others.

Breaking news...an insider purchase of 4000 shares on the open market for Teppco!!!!

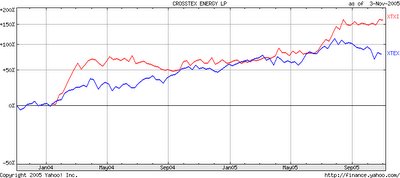

I've put up the above charts to illistrate that we may be in a period where General Partners are out performing the limited partnerships. This is especially true of Crosstex where the GP XTXI has sharply outperformed the LP XTEX. This outperformance seems to have become exaggerated since 10 years began to climb toward 4.75. While these outperformances can continue i wouuld suspect that GPS moving sharply higher should carry the LPS along for the ride at some point.

Last hour!

10 year at 4.67% and as long as that continues to rise it will put an upside cap on prices. But distributions are growing at a fast rate which probably takes the edge off.

Hiland (HLND) should be pricing its offering perhaps today.

Thursday, November 03, 2005

Kinder Morgan priced shares at 51.75 and its down 1 from there. Northern Borders rose initially on earnings but now is down a nickle.

Last hour underway.

Opening was on the firm side for most MLPS....Northern Borders up a fraction on the earnings. TCLP which owns a ton of Norther Borders is +1 and change.

Kinder Morgan is selling more shares (again) and its down 80 cents. Crosstex Energy (XTXI) is breaking out to a new high and could be the beginning of another upleg into the 70s.

A bunch of ex-dis MLPS this morning including Atlas, Buckeye, Sunoco Logistics, and Valero among others. No news this morning of any consequence. Teppco filed and 8k for an investors conference...I scanned through it and saw nothing new but if you wish you can scan for yourselves. If I missed something let me know.

Last nights Northern Borders issued its earnings and its seems its more of the same. While they raised guidance for the rest of this year they also set guidiance for next year which at first glance is lower than 05.

"Our results for 2006 are expected to be fairly consistent with 2005 from a base business perspective excluding non-recurring items," Cordes continued. "We anticipate net income to be in the range of $2.50 per unit to $2.60 per unit and distributable cash flow to be in the range of $3.65 per unit to $3.85 per unit."

It seems to me that they are playing the game of laying low expectations on the base earnings, this way they can raise guidance as they go along like they did this year. Most important is the DCF of 3.65-3.85 a unit which means that at least the 3.20 distribution is safe. Any upward revisions in DCF might mean (heaven forbid i say it!) a distribution increase? At least with these guys i'm in prove it to me mode. At a 45 closing price yield is at 7%. With the rising 10 year yield this and Teppco continue to look like dead money. I might get interested here if the yield returns to 8 % which means a price down near 40 dollars.

On to some side but related issues. Supposing you are at work or perhaps a smart dinner party surrounded buy those who say we need a windfall profits tax on oil and gas companies because they are so evil. Well thanks to Instapundit he provides a link to give you the necessary points to counteract socialist drivel!

Also if you haven't been to The Oil Drum lately we recommend that you check out recent posts regarding energy consumption.

Also from the strandpoint of political speech please read this blog..and call or email your congressman about protecting the right to blog.

Breaking news on Enbridge with great earnings and a 15% dividend increase! Is it possible that Cramer is right on this one???

Watching the open...

Wednesday, November 02, 2005

Northern Borders Partners earnings due after the close today. Stock down 1 ahead of the numbers. Its on the dead money list along with Teppco.

We'll start the day with an offering to sell....Hiland Partners has filed to sell 1.5 million shares. We'll see where this takes us. No other news so far this morning. The energy complex is lower with crude oil keeping a 59 handle. The fed hike has come and gone so we're quiet on that front for awhile.

Last night Crosstex said they've completed there purchase from El Paso.

No upgrades or downgrades so far this morning.

Tuesday, November 01, 2005

Kinda slow today...had some errands to run this morning so the blogging had to take a backseat so lets catch up.

First off MLPS selling off a touch today but not by alot. Some news on Valero LP with its earnings this morning and a distribution announcement which is static from the last quarter. Still chewing through the Kaneb Pipeline buy...

Holly partners still up 50 cents on followthrough from yesterday's good earnings.

Not much else happening here....losses are mostly under 50 cents. Take a look by the way at some of the closed end MLP funds...some are selling at discounts. First Energy Income trust (FEN) had a closing NAV 0f 23.34 yesterday and trades today at 20.95....2.39 discount is almost 12 percent!

Monday, October 31, 2005

Lots of distortions today with end of month and mutual fund end of year activity closing today. Lets see if there is some followthrough tomorrow.

Looking for Atlas Pipeline to extend its rally this week off its great earnings and the new 81 cents distribution. At 3.24 a share going foward APL's foward yield is 6.89 percent....2.30 ish above the 10 year. So i beleive one could argue that MLPS can rise as long as distributions rise at a faster rate then the 10 year to keep the yield in line.

No upgrades or downgrades so far.

Some early after midnight blogging. First a recap from Friday. Cramer on Mad Money gave a ringing endorsment to Enbridge Energy (ENB) and its prospects. Stock climbed to 31 in after hours trading. We'll see if it holds on Monday regular trading. Crude is down slightly from its friday close in Sunday night electronic trading.

Please note that Monday is the last day of the fiscal year for mutual funds. I believe most of the selling and repositioning has been done earlier in the month so we could see some odd moves later in the day.

I will of course be blogging on action later this morning. Checking weekend arcticles and will post the appropriate links.

Friday, October 28, 2005

Otherwise there is a firm tone overall to the group.

Some nice numbers by Atlas and Buckeye last night...should be moving today.

Thursday, October 27, 2005

By the way....try not to focus on the first call number because it often is not a clean number and you are never sure whether your comparing apples to apples or apples to oranges.

A bunch of MLPS go ex-dis this morning...Kinder Morgan (KMP), Northern Borders (NBP), Enbridge Energy (EEP) and Teppco (TTP) and Pacific Energy Partners (PPX). Teppco will also be reacting to last nights earnings which did not exactly make one want to jump for joy. Looks like its more of the same for this company and continued underperformance.

Magellan Midstream reports earnings before the open and they look good while Atlas Pipeline will report earnings after the close along with a distribution announcement.

Plains All American reports its numbers and they look good too!

Energy complex higher this morning....stocks slightly lower.

Wednesday, October 26, 2005

How much of this is baked in i'm not sure...no after hour action....so far

Traded in and out and in again on Martin Midstream....made some nice change on the spreads. No news though the overall market seems to be giving up the ghost late in the day.

Good Morning,

Energy complex a little softer this morning after yesterday's big rally. MLPS did well yesterday in spite of the 10 year breaking above 4.50 yield. Distributions are growing almost across the board in the group and in some cases...like INERGY LP raising it by 20%! And thats year over year.

Some pre-market bids on Sunoco Logistics (SXL) above yesterday's close. Sometimes thats indicative of an upgrade of some sort...but no news has appeared yet.

10 year yields open sharply higher at 4.57%...looks like yields are headed for 4.75%...MLPS may have priced that all in during the correction....I still think as long as yields stay below 4.90% that the group can rally but perhaps the top will be contained.

This just in....the brains at RBC Capital Markets...who 2 days ago reinterated an underperform on SXL have now upgraded the stock to sector perform. I guess they saw something in yesterday's earnings and/or the double distribution increase.

Tuesday, October 25, 2005

My MLPS portfolio has gotten back everything it lost in the last 2 weeks or so.

No news this morning but you have to be encouraged by the slew of distribution increases showing up. In case you missed it Sunoco Logistics just raised its distribution for the second time in the same quarter! I expect more good news to flow from the sector as well as good earnings in spite of the hurricanes.

No upgrades or downgrades so far.

Monday, October 24, 2005

Also another increase in distribution for Martin Midstream Partners. Looks like the trend in this group in spite of all the hurricanes is these companies are having great quarters.

Eyes on the tape for the remainder of the afternoon.

Good Morning.

Needed some quiet time over the weekend so i retreated from blogging. Batteries recharged!

Some leftover news from friday. Atlas Pipeline Partners coming out with earnings Friday...we should get the distribution announcement by weeks end. Also look for earnings after the close today from Sunoco Logistics. And we got a distribution hile from Pacific Energy Partners.

No news so far this morning. Lets see if the firm tone continues this week. 10 year at 4.40.

Note on the chart above that the 10 year/crude link may be breaking down here....Lets see where this goes. But its more important for the 10 year yield to fall away from 4.50 then whether crude holds 60 dollars or not. Crude now with a 59 handle.

Finally this just in...Wachovia cuts Enbridge Energy Partners to underperform from market perform.

Friday, October 21, 2005

Bigger oils are dead cat bouncing this morning even with crude at or under the $60 level.

No corporate news or upgrades/downgrades to speak of.

Thursday, October 20, 2005

MLPS seem to be holding above last weeks lows which is a good thing. Rates being contained at 4.50 on the 10 year plus distribution increases seem to be holding things here.

Magellan Midstream joins the chorus of distribution increases.

Watching the last two hours...expect it to move with the overall market.

Good Morning

Lets start with Kinder Morgan Partners which beat estimates by 4 cents...raised its distribution by a penny and said its outllook was good. It was able to have a great quarter in spite of 2 major hurricanes. This and Energy Transfer's raising guidance yesterday i think bode quite well for the group.

Also yesterday Atlas Pipeline Partners building a new nat gas plant. Still waiting for a distribution announcement.

Crosstex Energy (XTEX) is raising its distribution by 2 cents to .49 from .47. and on XTXI to .46 from .43...great news there!

Wilma still in the northwest carribbean and off its peak intensity. Also of importance is that cold canadian air will be spreading across the eastern third of the US over the weekend...driving temperatures lower east of the Mississippi...a reminder that winter is coming.

Crude is down a bit this morning; nat gas numbers out later this morning.

Wednesday, October 19, 2005

A little bit of corporate news to share this morning. Energy Transfer partners raises guidance for next year and raises distribution as well....to .525 next quarter. Good news to holders there.

Crosstex says its raised 105 million for its el paso purchase. Its a priviate placement of units that convert to common after the november distribution (they will not recieve the dis)...I like priviate placements!!!!

Hurricane Wilma...the strongest hurricane ever recorded in the Atlantic Basin...which of course is George Bush's fault!

10 year yield at 4.50 is holding....down to 4.42 this morning...bullish for MLPS.

Tuesday, October 18, 2005

Wilma forecast is for it to emerge out of the caribbean and turn it to the northeast across south florida...which of course means no impact to rigs and nat gas.

Energy Transfer started at a buy...Duetche Bank...Valero LP and Buckeye started at holds.

New Hurricane Center info on WILMA due out in the next hour.

Good Morning.

Another morning starts with energy selling off a bit. Right now Wilma is strengthening but odds favor a track into the SE Gulf on a Northeast track to south Florida. But i'm still waiting for this southward drift to end and apparently it has!

No corporate news or upgrades or downgrades. Thanks to a poster who informed about Lehmans upgrade yesterday of Plains All American Pipeline which seemed to escape reporting on Dow Jones and other wires.

10 year yield at 4.50 this morning on PPI news...we're at the top of the breakout point above 4.50 yield (Chart of weekly 10 year above). Note that the real breakout on yields will occur if we take out that 4.75-4.90 top from April 2004.