Thursday, May 31, 2007

COULD BE!

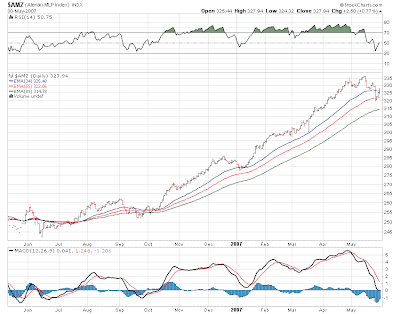

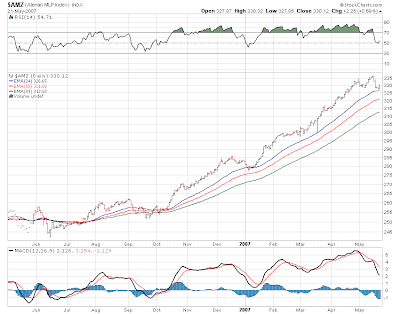

The 319 ish low from last week is holding and the bounce from there gained steam yesterday with a 2.54 gain and a close near 328. Technically this puts us above the 34 day moving average and the next hurdle to clear is the 331-332 level.

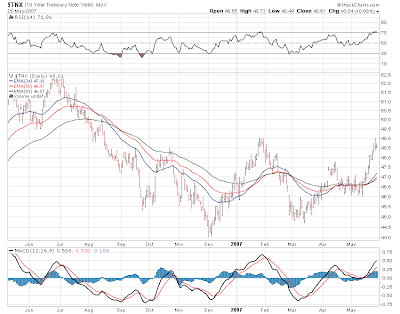

To me whether we clear it or not will depend on whether that 4.90 level holds on the 10 year note.We are sitting just below that now and i suppose the employment numbers will be the determining factor over whether we break through that level or get turned back yet again.

But for today a firm stock market at record highs for the dow and s&p will probably carry us higher again.

Its quiet this morning on the corporate news front. Steifel Nicholas is telling us we should be buying Trans Montaigne (TLP) which closed yesterday at 35.86. Nothing else on the upgrade downgrade list so far but the morning is young.

Wednesday, May 30, 2007

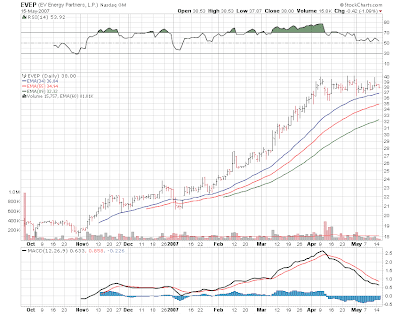

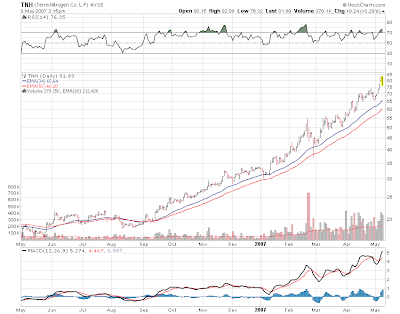

Winners today include Legacy (LGCY), Energy Transfer Partners (ETP), Boardwalk (BWP) Atlas Pipeline (APL) and Terra Nitrogen (TNH) among others.

If the AMZ index closes above 326.38 it would put it back above my first support line...which would suggest a run back to the 336 high at least.

We'll start with the last one first. After the close yesterday Plains All American raised its guidance for the year which should make shareholders happy. Nothing in the premarket yet but i would expect this one to trade higher. This type of news seldom spreads to the rest of the group but it doesn't hurt. The main news driver this morning in the broad market is the selloff of 6% in China as they raise taxes on transactions to slow that market down. This will play its way through the first half hour and then the market will go its own way. MLPS did well yesterday closing over 325 and at the high for the day. Whether the rally continues or not will depend on the 10 year which is seeing its yield dropping a little this morning but 4.90 looms large as an upside breakout point. Watch the Dow Jones Utility average as an indicator of where we will be going in the short term.

No other corporate developements this morning and no upgrades or downgrades either. So bring on the open and lets get the day underway.

Tuesday, May 29, 2007

Losers list is thinning out and most are off their lows but Constellation Energy Partners (CEP) is down 1.80 and Hiland LP (HPGP) is down 70 cents as the 2 biggest losers.

Some losers on the list. Constellation Partners (CEP) is down 1.50. And we have Buckeye Partners (BPL) and Buckeye Holdings (BGH) down fractions. A few others like Holly Partners (HEP),Williams Partners (WPZ) and Nustar Holdings (NSH) losing fractionally as well.

Nice to see the bottom hold in here so we can increase the chances that the pullback was just that in a bull market move for this group. The jury is still out however.

If you want a reason for the recent correction you need look no further that the behavior of the 10 year bond verses the MLP index and you will note the upleg in the 10 year rate of the last few weeks in co-inciding with the reversal at 336 on the MLP index and the trip down here to 322. Friday's bounce off Thusday's nearly 3% drop left some MLPS behind but 1st day bounces often times don't carry everybody along.

Note that the 19 year is now resting just under the 4.90 breakout point. Lots of economic and fed data this week so we should get a decisive picture of where rates will go. And if 4.90 is taken out there really isn't any reason why the 10 year rate couldn't rally back to 5.25% which is the high from last July. No doubt in my mind that this correction in MLPS will deepen considerably if 4.90 is taken out.

Friday, May 25, 2007

Holding firm but dow utilities are down 5 points again.

A nearly 3% selloff yesterday was messy but so far today we are bouncing. The 55 day moving average seems to be holding up around 321. Atlas Resource (ATN)is up 1 as is Atlas America(ATLS). Holly Partners(HEP) is up nearly a point as well. And many of yesterday's bigger losers are up fractionally. The MLP index is up 1 and change around 322.

Not bouncing...E V Partners which is down 1 and Boardwalk Partners which is been dropping for the last 6 weeks is down another 50 cents. Buckeye Partners (BPL) Calumet Products Partners (CLMT) and Plains All American are losing fractions.

Look for trading to slow to a crawl this afternoon as they make for the exits ahead of the 3 day weekend. No news of conseqence this morning and no upgrades or downgrades to report.

Thursday, May 24, 2007

Okay so if we are shopping for bargains and assuming this is just a bull market correction...we can certainly look at some potential bargains at the open tomorrow. I bought some Magellan today and also but some Buckeye Holdings. Tomorrow morning i will be looking at Calumet, Atlas Resource which sold off to 34 today, along with a few others. I'm hoping for a big down open to wash out the sellers and then wait for the rebound. Of course the best laid plans of mice and men and who knows whether the correction has run its course or not. But for sure there are some MLPS out there that have corrected nicely off their 52 week highs and are much better buys now then they were just 2 or 3 weeks ago.

If you were looking for cheaper prices...you have a slew to choose from today. Down 7.70 on the MLP index. Next support level for me is the 89 day movning average which is down around 313.

One the winning side Penn Virginia Holdings (PVG) is up 50 cents and Hiland GP is also holding on to a 50 cent gain for some reason. Hiland LP (HLND) is down only 35 cents and volume has been a bit more brisk than usual. Not sure what if anything is going on here.

DREAMING OF THE WEEKEND!

Its Thursday morning and 80s loom today with sunshine in nyc...90 tomorrow and a good weekend so i'm sure minds will be on the exit doors as trading slows to a crawl by tomorrow. No news this morning and no upgrades or downgrades so far so we'll look for followthrough to yesterday's reversal and 2 point loss. Support levels lie just under us in the 325-27 range so we could be there quickly.

I'm working this morning so i will repost later this morning when i get home.

Wednesday, May 23, 2007

On the downside Constellation Partners (CEP) is down nearly 2 points. Terra Nitrogen (TNH) E V Partners(EVEP), Breitburn (BBEP), Markwest Hydrocarbon (MWP) and Teppco (TPP) are down 1 point or more.

Oil numbers were just another excuse to buy as crude is up at 66 bucks and energy stocks are generally higher. More excitment as the day wears on.

After 6pm last night Deutsche Bank told us that i cut 2 mlps from buy to hold and those 2 were Magellan Midstream Partners (MMP) Breitburn LP (BBEP) Nustar (NS) and Nustar Holdings (NSH). Well this morning it is upgrading Calumet Specialty Products (CLMT) from hold to buy and it is also raising Buckeye Holdings (BGH) from hold to buy. So we have 5 companies in our group likely to move this morning...2 up...2 down. Meanwhile stock futures over all are up a strong 6 points on the S&P so we will see a push through 1527 in the first 1/2hour. This puts a bid under MLPS this morning so we should have a higher open as well.

Energy markets are higher this morning after yesterday's selloff. No corporate headlines this morning at least so far but this is an early post for me.

Tuesday, May 22, 2007

Same losers as before with Terra Nitrogen (TNH) and Inergy Holdings (NRGP) losing 1 point or more.. Holly LP (HEP),Regency (RGNC), K-Sea (KSP) and Constellation Partners (CEP) are fractional losers.

Terra Nitrogen(TNH) is down 1 as is Inergy Holdings (NRGP) as the latter absorbs an equity offering. Maybe now the stock can trade with more liqudity instead of by appointment only and with 2 point bid and ask spreads. Holly Partners (HEP) and Trans Montaigne(TLP) are fractional losers.

MLPS HOLDING FIRM

After the close last night Duke Midstream buys up more assets and they're doing it with a private placement so no new equity coming out here. Stock has been one of the out performers in MLP land so look for more upside today. Meanwhile yesterday's 2 point gain in the MLP index stopped the downward drip we've been since last week.

There is so much underlying strength in here that MLPS just can't go down much before new buyers arrive. So yesteday's 2 point gain puts the index back over 330. While i thought we would head down into the moving average support levels starting at 326.65 the recent action looks like we may be having a trading range correction and just go sideways. Its all about evolution in here so we'll see what today brings. I guess i wouldn't be surprised to go back to 336 again.

Not much else happening this morning so far in the news department and no upgrades or downgrades the report...at least for now.

My guess is look for follow through upside on Atlas Resource (ATN) and Atlas America (ATLS) after there big deal news yesterday...if they pull back at the open..it might be worth buying for a trade.

Monday, May 21, 2007

Linn Energy is down 60 cents...no news here. Trans Montainge, EV Partners and Boardwalk Partners are on the losers list with fractional losses around 50 cents or so.

Sunday, May 20, 2007

MAKES A BIG PURCHASE

Not often we get a deal on Sunday night but we have one as Atlas Energy Resources (ATN) is buying 1 billion in assests...doing a private placement of equity and promising a big distribution increase for 2008! The distribution now is 1.72 and they are forecasting a rise of 2.20 to 2.40 per unit so at a 5% yield at $2.20 annual the stock prices should get into the 40s by next year.

Looks like a Monday morning big mover! Although one has to wonder whether word began leaking out on Friday since the stock closed up 1 ahead of the weekend.

And with a new week beginning i think we need to look at what is going on with MLPs as compared to the 10 year. We haven't been paying much attention to this in the last few months since the group has been on a bull tear and rates have done nothing. But notice that last week's sell off is co-inciding with a move up in the 10 year yield and that chart is looking to move higher toward the 4.90 area.

Now as long as 4.90 holds the correction in MLPS should remain contained to the moving average support lines. We're almost there on the 34 day at 326.44 and 320 and 312 loom right below there. But if 4.90% gets taken out and we are suddenly facing a move back to 5% or 5.25% we could be in for a serious pullback...perhaps to the 300 level as that is where the 34 week moving average sits on the weekly chart.

Note that the upmove in rates if it is real may be a reason to set off a broader market correction which is being forever predicted but never happening. Eventually broken clocks are right twice a day.

No other corporate developements this morning and no upgrades or downgrades at least so far.

Saturday, May 19, 2007

Meanwhile a couple of notes. Those of you who follow Richard Kinder of Kinder Morgan fame should read this piece about the KMI deal....an interesting read.

I have been looking at some charts of the 10 year note and it may be pointing to a further correction in our group. I'll have more on this Monday morning.

Friday, May 18, 2007

Ladies day at Pimlico....going with Winning Point in the Black Eyed Susan...race 12.

"Have you or any of your readers made sense out of the EVEP and LINE 1Q earnings reports and conference calls. I am particularly puzzled about the implications of the hedge losses. Thanks."

Those of you with any info please share it in the comments section. Just click and post. It would be a great help

Still the week's moves Terra Nitrogen excluded have been rather orderly. And there was some buying noted late yesterday in some of the small and mid size MLPS. So this morning we have news from Trans Montaigne (TLP) as they have priced their offering which by the way barely moved the stock lower which is unusual. Says a lot here for demand. Martin Midstream saw the same thing happen as it completed its offering earlier in the week.

Thursday, May 17, 2007

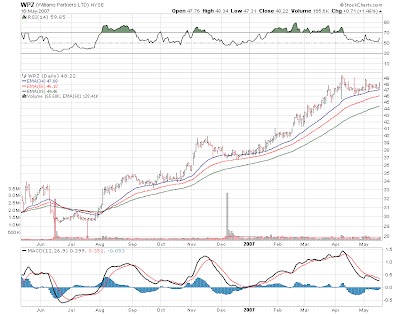

Losers include Holly Partners(HEP) Hiland LP (HLND) Duke Midstream (DPM) and Williams (WPZ) all showing losses of 50 cents or less.

Going to be an interesting day as i sense a bull bear battle here.

Its a pretty simple proposition here. We're down 8 points from Monday morning when we crossed 336...straight down in fact since then. We're sitting at 328 and high change before the open this morning.And we should head lower today right into the supporting moving averages that i like to use...34..55..89..144 etc.

On the daily chart its pretty clear. Relative strength has broken down. MACD is in sell mode. So this will be the first time since the end of 2006 that we will visit those moving averages. Note that down bar in the middle of March is a data error.

Wednesday, May 16, 2007

Tonight I will be taking a look at some of these charts and lets see if can't come up with some sort of shopping list. I can tell you this...Magellan has a habit of dropping to the 55 day moving average every few months..that is sitting at 46.11 and the 89 day moving average takes us down under 45...might be worth a look tomorrow if it gets there. Breitbart LP (BBEP) is at 33...down from 37. If it drops a little more i might get interested.

Meanwhile Terra Nitrogen bounced nicely today...up nearly 5 on the day. I was able to make some nice trades and clear some money which is good.

Terra Nitrogen (TNH) is up 2 and change as the biggest winner as it rebounds but it is an exception here. The few winners are up less than half a point and most of those are up just pennies.

Losers of a point or more including Sunoco Logistics (SXL), Genesis LP (GEL) and Enbridge Energy Partners (EEP) is down 2 and change. Lots of fractional losers on the board including Kinder Morgan (KMP), Markwest (MWE), Oneok LP (OKS) and a host of others.

Terra Nitrogen(TNH) is up 1 and off its high of the day. Duke Midstream (DPM) is also a one point winner. Hiland LP (HLND) E V Partners (EVEP) are up fractionally. A few others are up small amounts.

The new wall appears to be 336 which is were the selloff began yesterday and we know start today just under 333 after dropping nearly 3 points yesterday. A lot of the big MLPS pulled back with 1 point or more losses in Teppco(TPP) and Oneok(OKS) for example although the two heavyweights in the index; Kinder Morgan(KMP) and Enterprise Products Partners (EPD) did drop by much. And of course the correction to beat all corrections may have hit bottom yesterday as Terra Nitrogen LP (TNH) went straight down from 99 to 77 without blinking an eye. A bounce is certainly due and the stock is up 2 points in the pre-market. At 77 it has a yield in the mid 7% range which is on the high end for the group. So assuming there is nothing else going on here other than a violent round of profit taking...a bounce to the upper 80s is in order. I hope so since i have been building a position for this since early

yesterday.

E V Partners came out with earnings after the close yesterday. There has been a tendency for the big movers to sell off on their earnings news like Linn Energy which dropped 2 and change yesterday.

Energy is a little softer this morning at the open which doesn't mean much. No upgrades or downgrades. Stock futures are a touch higher in the pre-open.

Tuesday, May 15, 2007

Alliance Resource (ARLP,AHGP) are up about 50 cents as this afternoon's biggest winners. Still no sign of a bounce in TNH.

MLP index is now down 1 point.

Tuesday morning news drivers include earnings from 2 more MLPS, Linn Energy(LINN) and Regency Partners (RGNC) and the market has opened up both stocks higher this morning. The MLP index opens higher by .70 this morning and we have the usual round of fractional gains to start things off. Terra Nitrogen has been in free fall since hitting 99.88 yesterday and is now nearly 17 points below that at 81. You would think this were Amazon.bomb...or something.

Global Partners(GLP) got the downgrade this morning as Lehman goes to equal weight from overweight and RBC leaves Hiland (HLND)at sector perform but takes the stock's target down 2 bucks. Stock is up anyway. The market is now selling off on the earnings news for Linn and Regency...Linn is down and Regency has gone flat. Terra Nitrogen (TNH) is down 7 now at 78 and change.

I'm a little late with the opening post today as i had errands this morning but updates to follow.

Monday, May 14, 2007

Lunchtime brings higher prices in MLPS with the index over 336 and up 60 cents on the day. We have 1 point gains in Constellation (CEP)and Inergy Holdings (NRGP) and a round of fractional gains in Magellan Midstream (MMP), Oneok LP (OKS) Suburban Propane (SPH) and a few others.

Nustar Holdings (NSH) is down 1 as the biggest loser. Some of last weeks bigger winners are giving back a bit today Like Duke Midstream (DPM) Genesis LP (GEL) and Martin Midstream (MMLP).

Back to nailing boards onto the deck....Alarms are set on my laptop for when price levels are taken out so i am nearby watching.

Monday morning and its quiet in MLP land as we have no headlines and no upgrades or downgrades so far. Transmontaigne (TLP) was down Friday as they are doing a stock offering this week, expected to come to market Thursday. That's pretty much it on the morning news front.

With earnings just about done on MLPS and distribution checks hitting mailboxes in the next few days not much is left on the table so we turn to market forces this morning as the primary drivers. Stock futures are a little softer while the energy complex starts the morning firm.

The charts are still quite positive here...no signs of a top in either the short term daily chart or in the weekly chart. Still looks like it wants to go higher. Fridays close over 335 gives us another new alltime high.

At the beginning of this chart is the point of the prior breakout at 190 which topped 14 months later at 270 for a 50% move so if the moves are similar (big assumption) it means the rally lasts until December and tops around 400 on the MLP index.

Friday, May 11, 2007

Trans Montaigne (TLP) and Nustar GP (NSH) are both down over a point but no specific news for either one.

Looks like a firm finish today as we head into another weekend. Distribution checks will be arriving on Monday...lucky us!

We are at Friday in an active week with lots of earnings news and Dan Duncan deals with Energy Transfer Equity and Teppco so today we seem to be taking a breather in the news department. There are no headlines of importance this morning. RBC Capital Markets is raising its target price on Markwest Energy(MWE) from 30 to 39 bucks...the stock sits above 36. Credit Suisse starts Cheniere LP (CQP) at a neutral.

So what do we make of yesterday where the overall market sold off 1% and MLPS closed flat. Well from a relative strenght basis we're still attracting buyers on any attempt at weakness which is a good sign. I thought last week we would correct to the 34 day moving average at 323 which did not happen. All it took was for Dan Duncan with his equity stake purchases earlier in the week signaling to the market that in his view the group still looks attractive.

PPI numbers this morning were market friendly so futures are firming...oil and gasoline are higher...nat gas a little lower. So we await the open and i will post with any breaking headlines.

Thursday, May 10, 2007

The losers list is a little longer than the winners list. Hiland (HLND) and Hiland GP (HPGP) are both 1 point losers right now as the conference call did nothing to move the stock out of its hole. Linn Energy (LINN), Suburban Propane (SPH) and a few others are also losing major fractions.

Coming into the afternoon as Europe closes so lets see if the market stablizes or heads lower and pulls everything with it.

Well it took one good push and we're back at a new all time high close in MLP land. Enterprise Products Partners (EPD) has a 14% weighting in the index and with an 80 cent up move yesterday, it gave a big push to the mlp index.

So we've given up forecasting a correction and will just let it happen when it happens.

Meanwhile earnings news this morning from Crosstex Energy (XTEX) and now we know why there was no distribution boost as the DCF coverage ratio was a .86 which is not good. However the company did say that cash flow was diverted to completing projects and that they exepct cash flow to grow "rapidly" in future quarters. This should be all priced in but i'm never a good guesser at these things...and I admit that i do have an optimistic bent. But at least in the press release i don't see anything that wasn't already known or that i had already figured out.

Also Duke Midstream posted earniings numbers last night that looked impressive. The company has completed its recent purchase and so far we see no signs of them coming to market with an equity sale. The stock continues to climb and sits above 43. Stargas announces earnings as it continues to move foward.

Nothing yet in upgrades or downgrades but it is early. Stock futures are a little soft this morning which really means nothing these days...energy prices are higher this morning...10 year rates hold flat.

Watch the Hiland Partners (HLND) conference call this morning as a potential stock mover if they indicate that distribution growth will resume after no raise this quarter.

Wednesday, May 09, 2007

Meanwhile the 2 Hilands (HPGP,HLND) are both down 1 point and small change on its earnings and guidance which i thought was pretty good. Not much volume however. Markwest (MWE), Trans Montaigne (TLP) and a few others are down fractionally.

Inergy Holdings (NRGP) press release on earnings is now out. So is the earnings release for Constellation Energy Partners (CEP).

Enterprise Products Partners (EPD) is up 1 in the premarket as is Inergy LP (NRGY).

RBC Capital raises its target price to 35 bucks on Genesis LP (GEL) and keeps it at an outperform.

Every so often someone emails or posts in the commment section about an MLP that i had no idea about. This one came to me yestereday and all i can say about it is...why did you not find this sooner!

Terra Nitrogen LP is the greatest MLP story never told. Its up 4 fold since last summer and has a nearly 8% yield. Here is the company profile from Yahoo.

Terra Nitrogen Company, L.P., through its subsidiary, Terra Nitrogen, Limited Partnership, engages in the production and distribution of nitrogen fertilizer products for use in agricultural and industrial markets. Its nitrogen product includes anhydrous ammonia, a form of nitrogen fertilizer and the feedstock for the production of other nitrogen fertilizers, such as urea ammonium nitrate solutions (UAN). Terra also produces UAN by combining urea solution and ammonium nitrate solution. Terra Nitrogen GP, Inc. serves as the general partner of the company. It sells its products primarily in the Central and Southern Plains and Corn Belt regions of the United States. Terra�s customers include dealers, national farm retail chains, distributors, and other fertilizer producers and traders. The company was founded in 1991 and is based in Sioux City, Iowa.

Not bad for a "shitty" company.

Okay now for morning news and we have earnings from last night as Copano (CPNO) posted numbers. This morning Inergy Holdings reports earnigns as their numbers rise. Constellation Energy Partners (CEP) also puts up numbers for the quarter. Headlines only on the other 2 and as links arrive to the news stories i will post them.

No upgrades or downgrades this morning so far. MLPS look like they may mount an assault on Last Monday's top rather than trade down to support lines. Yesterday's announcment of Mr Duncan taking stakes in ETE and TPP is certainly a statement that someone thinks these companies are good investments for the long haul...and that some of them may still be cheap.

Stock futures are a little soft ahead of the fed today...energy complex is mixed this morning but moves are small on either side of unchanged.

Tuesday, May 08, 2007

Holly Partners(HEP), Martin Midstream (MMLP) and Copano(CPNO) are all down a point or more as the 3 biggest losers today.

Martin Midstream is down 1 on earnings and is the biggest loser. Some small fractional losers on the board but no other real standouts so far.

Yesterday i posted about how nice it would be to wake up to a deal. Well Dan Duncan must of heard me and bless his heart, always the accomodating soul Dan has taken stakes in two of them. He has taken a 4% stake in Teppco (TPP) and a 17% stake in Energy Transfer Equity (ETE) which holds a large block of Energy Transfer Partners (ETP). All of this will have a positive impact on Enterprise Products Partners (EPD) which will see higher distributions down the road. Bullish moves for all of the above and this could be a group mover.

We also had earnings news last night as Martin Midstream Partners (MMLP) puts up quarterly numbers. US Shipping also put up its numbers and announced its distribution. Trans Montaigne (TLP) which wins the award as the MLP with the most fabulous name...put up its earnings and announces a 10,000 unit buyback. Markwest Energy posted quarterly earnings. Markwest Hydrocarbon(MWP) also announced earnigns but the stock was down nearly 3 dollars ahead of the news last night so we'll find out this morning what has or has not been priced in on a stock that has more than doubled in the last 6 months.

Wachovia which has been busy cutting MLPS in the last few weeks is doing the oppposite today as it raises Eagle Rock Partners (EROC) to outperform from market perform. And by the way i was wondering yesterday why both Crosstex's (XTEX,XTXI) were up sharply...well it turns out XTEX got a goose from Morningstar while XTXI got a goose on Fox News Saturday. Thanks to readers Max and "vonhayek-schumpeter" to readers who posted the information in the comments section.....something i encourage all of you to do since sharing information is always a good thing.

Energy is mixed this morning with oil slighty higher and gas slightly lower. Stock futures are a little soft this morning so there will be a weaker influence at the open. More news as headlines break but i will be interested to see if the Dan Duncan stake purchases light a fire under the entire group. Yesteday took us back over 330. I think i'm going to throw in the towel with regards to predicting a correction in this group and just let things play out. It just seems there is too much money looking to buy in on any sort of pullback...even if its less than 2%.

Monday, May 07, 2007

Losers today Markwest Hydrocarbon down 2.55 and Hiland Holdings (HPGP) is down nearly 1. Fractional losses in Altas Resource (ATN), Penn Virginia Holdings (PVG), Global Partners (GLP) and a few others.

Maybe one Monday morning we'll wake up to one to a deal in the MLP space with so and so taking out such and such at a 10 dollar premium so that there will be much rejoying and dancing in the streets...but today ain't that day. Its quiet this morning as we have no headlines. The bulk of the group has gone ex-distribution so that is behind us and the checks will be in the mail in the next few days. And there are no upgrades or downgrades to speak of so far so I guess we will trade off the overall market trend...which this morning looks flat. The energy complex is a little weaker so not much to move us there.

Actually we have headlines crossing now that Linn Energy is buying up more assets that will be accretive but unlike other prior buys the company is not pre-announcing any distribution increase.

The MLP index daily chart is correcting but the good news is that if it doesn't get out of hand we should pull down to the 322-323 area and find support there. And that is only 5-6 points below where we are now or a little less than 2%. And the weekly chart remains in a bullish uptrend so i am not worried for the time being.

Finally this morning this horse is going to win the triple crown this year. Street Sense is the real deal off that incredible performanc in the Derby.

this horse is going to win the triple crown this year. Street Sense is the real deal off that incredible performanc in the Derby.

Saturday, May 05, 2007

Friday, May 04, 2007

MLPS TRYING TO HOLD 330 LEVEL

CITIGROUP CUTS NATURAL RESOURCE

Another week passes and MLPS continue to resist a drop although when you look at the daily chart it seems like its time for at least a pullback. The 34 day moving average is sitting just below 322 and it wouldn't take much to get there. The reversal from the 334-335 level continues to impact trading but after the nearly 3 point drop Tuesday the group has tried to make a stand at 330. Also note that we have been dealing with lots of ex-distributions which have been imacting the index.

Thursday, May 03, 2007

Not much has really changed since lunchtime but the last hour often can make or break a day.

Not sure what to make of the trading so far...MLPS sure trying hard to hold on.

Natural Resource Partners has now posted earnings as well.

Nothing additional on the upgrade downgrade list so far.

We'll start off the morning with some leftover news from last night as Penn Virginia GP (PVG)announces higher earnings and a higher distribution. And of course we also have earnings numbers from Penn Virginia Resources LP (PVR).

A few MLP charts are in corrective mode. Magellan Midstream was 53 and change Monday morning before turning south and now sits just under 48.

It certainly looks like this one which has been climbing for almost a year is taking another one of its usual dips into its moviing average support lines. If you are searching for an entry point on this one we may be getting close to the zone. This morning Lehman Brothers cuts the stock from overweight to equal weight. This follows the Citigroup cut on Tuesday from buy to hold. Also this morning Friedman Billings drops coverage on Atlas Pipeline Partners (APL).

More MLPS going ex-distribution this morning including Willams Partners(WPZ), Boardwalk Partners(BWP), Buckeye (BPL) among others. The MLP index yesterday tried to rally and closed fractionally higher. The MLP index islooking at support around 321 and some change. I think today's trading should tell us whether we are headed down toward the moving averages.

I am back to normal today so i will be posting at my usual regular rate.

Wednesday, May 02, 2007

Markwest Hydrocarbon(MWP) is up 2 and change and Sunoco Logistics (SXL) is up 1 and change as the 2 big winners today. General Marine (GMR)is down 1 on an earnings miss while Hiland GP (HPGP) is down 70 cents and Magellan Midstream down 60 cents are the 2 biggest losers.

Btw...i love Street Sense for the Derby Saturday and he has the talent to pull off the elusive triple crown...of course in my never to be humble opinion of course.

So if this is indeed the long awaited correction what do we buy? My view would be to stick with those MLPS that have been growing their distributions from quarter to quarter but on the other had if you believe that the hic-cups that have occured in Crosstex (XTEX,XTXI) Hiland LP (HLND) and Atlas Pipeline (APL) are just single quarter events...we'll they have already had their blow-ups so this could be an opportunity to pick up MLPS that...if they resume distribution growth later this year...could emerge as the next round of leadership.

This morning we have a downgrade of NuStar GP Holdings as AG Edwards takes it from buy to hold...and after a 50% move it sort of makes sense i guess. Steifel Nicholas is starting Cheniere LP at a buy.

Some news from last night. General Marine (GMR) came out with earnings which looked soft. The stock traded down 2 bucks in after hours so we'll see if that carries over today.

Tuesday, May 01, 2007

Its been so long since we've seen a down day like this i've forgotten what it looked like and how to trade it.

Okay so yesterday afternoon we had a pretty sharp intra-day reversal as the MLP index was up 2.40 and then fell below the flat line to a slight down close. Now this probably was related to end of month activity and some profit taking or profit booking. But this was the first time we saw anything resembling a reversal in many many months. Could this be a sign that we may have finally reached a short term top? Well the short answer is "who knows" Bottom reversals usually work pretty well but top reversals are a little harder to figure. First off it was just one day and donwside follow-through would need to show up on the tape today. And again please bear in mind we're talking about short term noise here. But i will say that the upside move we've enjoyed has con-incided with the market rally. Yield compression has taken us where there isn't as much yield support as we're use to. So if a broad market sell-off were to occur we would probably follow along at least for awhile. But for now we watch and wait to see what developes. Stock futures are higher this morning and energy is firm...10 year rates supportive.

Holly Partners has gone parabolic and we have earnings out this morning. We'll see if the numbers are priced in. Lehman Brothers (I am not sure which one) is downgrading Nustar from overweight to equal weight which is their version of buy to hold i guess. The morning is young but this is all i have for now on this front.

By the way some of the pullbacks yesterday were quite dramatic. Take Magellan Midstream (MMP) which traded above 53 at one point yesterday up 2 and change...then dropped after 2pm to 49.66...down 1 and change...and closed down about 20 cents. Its not often you see a nearly 4 point range in one day on an MLP.