Friday, July 30, 2010

MLP index bottomed at 319.71 and is now virtually unchanged as the market has come well off its lows. Atlas Pipeline Partners (APL) continues to extend its gains on the week and is now 17.50. Alliance Resource (ARLP) is the other leader today. Enbridge Energy Partners (EEP) opened down 3 but is now unchanged.

Enbridge Energy Partners (EEP) continues to deal with the Lakehead pipeline leak and the consequences. The stock is not ex distribution today. Its down another buck and change in the pre market. Don't see any new headlines this morning. Theex distribution on this one is next Tuesday 8/3.

Stock futures continue to sink lower down 12.

Stock futures continue to sink lower down 12.

Breitburn Energy (BBEP) just announces a distribution and here is a nice surprise. They are upping by a penny! Exterran Partners (EXLP) also announces its payout. No change there. And Wunderlich raises Sunoco Logistics.(SXL) target price to 75. The stock is at 75. So are they telling us the stock is going to head down to 70?

PULLBACK CONTINUES!

A couple of observartions. First off it was clear we were so extended and a pullback to the moving averages was expected and not really a surprise. The second is that the pullback is comint at a time when the 10year is trying to carve out a short term bottom in yield. I found it particularly interesting that yesterday's fed speak by St Louis head Bullard about the dangers of deflation, that the fed may need to buy long term bonds to prevent Japan here, did nothing to spur on another downleg in yield.

And this morning the GDP is out and its telling us that the economic recovery is terrible (no surprise) but within expectations. Its wise for we mlp holders to keep an eye here on these recent developements. So far however its nothing more than a pullback being exaggerated by ex distributions.

And this morning the GDP is out and its telling us that the economic recovery is terrible (no surprise) but within expectations. Its wise for we mlp holders to keep an eye here on these recent developements. So far however its nothing more than a pullback being exaggerated by ex distributions.Stock futures are down almost 100 after GDP. The metals are up. Crude and energy are down. No corporate headlines and no upgrades or downgrades.

Atlas Pipeline (APL) have to be happy as their mlp has come alive with a 5 point gain so far this week on the possibility of the distribution coming back soon. Attention now shifts to Crosstex (XTEX,XTXI) to see if they will say the same thing. Last quarter the company did tell us that they had distributable cash flow and that they were doing the right things to increase that number. They will let us know soon with earnings next Friday.

Thursday, July 29, 2010

MLP INDEX DOWN 3 AS CORRECTION CONTINUES!

317 is the natural place to go here and we're at 323 so we can get there in short order and i would be buying in that support zone. Enbridge Energy Partners (EEP) is a 3 point loser today leading the list lower. Sunoco Logistics (SXL) Williams Partners (WPZ) and Copano (CPNO) are all down 1 or more. Williams put up pretty good earnings this morning. Holly Partners put up earnings numbers which were in line pretty much. Stock is down a few ticks right now. And Linn Energy (LINE) is over 30 bucks on earnings this morning.

Atlas Pipeline Partners (APL) suggesting that it could resume the payout next quarter has given this one a reason to move higher and its up another 50 cents today after being up 4 yesterday. This one probably now can be bought on any pullbacks. The resumption of the distribution has moved the speculation to Crosstex Energy (XTEX,XTXI) as to whether they may announce the same thing soon. Those stocks are also up today in a down MLP tape.

Not sure what is going on with Enbridge (EEP) other than they are cleaning up that 2000 gallon spill in Lake Michigan. People continue to shoot first and ask questions later.

The dow has done a 100 point turnaround and is now down 50 or so and at the lows of the day.

Wednesday, July 28, 2010

MLP index down 2.52 and at the lows of the morning so far. Its been a slow grind down and right now as i have said..2 things are at play. One is the view that long term rates have finally bottomed and the ex distribution cycle. 316 is where the 34 day moving average lies and is a logical downside target here short term.

BTW Crosstex Energy (XTEX,XTXI) are both up over 3% in sympathy to Atlas Pipeline (APL) which is up 4. I guess the hope is that Crosstex will tell us that sometime soon or when they announce earnings in early August.

BTW Crosstex Energy (XTEX,XTXI) are both up over 3% in sympathy to Atlas Pipeline (APL) which is up 4. I guess the hope is that Crosstex will tell us that sometime soon or when they announce earnings in early August.

UBS cuts Spectra Energy Partners (SEP) to a sell from hold. Stock is down about 30 cents. Atlas Pipeline Partners (APL) up 3 and change on the prospect of a solid distribution coming back in q4. Atlas Holdings (AHD) is up 1 and change as well. Alliance Resource Partners (AHGP) is up 10% in 2 days since earnings hit the tape Monday morning....up another 1 and change as well this morning.

The mlp index is down 1 and change under pressure from Kinder Morgan (KMP) going ex distribtuion along with Oneok (OKS). Look for more of this over the next several days. Overall market is down just a touch this morning.

The mlp index is down 1 and change under pressure from Kinder Morgan (KMP) going ex distribtuion along with Oneok (OKS). Look for more of this over the next several days. Overall market is down just a touch this morning.

ATLAS PIPELINE SELLS AND

(MAYBE) WILL DISTRIBUTE!

(MAYBE) WILL DISTRIBUTE!

Atlas Pipeline Partners (APL) will be a mover this morning and possibly in a big way as it is selling assets to Enbridge Energy Partners(EEP), but more importantly the company says that it is in position to resume distributions in Q4. The company is also giving 2011 projections of distributable cash flow of $1.80 to $2.60 so being conservative...we could be looking at a quarterly distribution from 40 cents to 55 cents per unit. No trades yet in the pre market but its nice to see an old favorite coming back to the land of payouts. And as everyone knows with MLPS its all about distributions. Also this morning Eagle Rock is exercising its rights to buy its GP.

We are coming off a 6 point mlp index loss and this morning we are going to see technical pressure as Kinder Morgan (KMP) and Oneok (OKS) go ex distribution. Also we are seeing 10 year rates back over 3 and i think this has begun spooking some of the late money that has moved in here. Nothing tragic mind you but the unrelenting push higher that began a few weeks ago seems to have run its course just shy of all time highs.

Stock futures are a little higher now after being flat most of the night. The dollar is lower and rates are ticking a shade higher pre open. Crude is a little lower and nat gas is a little higher. Headlines as they break. Noticing some stock for sale on Spectra Energy Partners (SEP) but no news headlines that i see.

Tuesday, July 27, 2010

MLPS DOWN OVER 6 POINTS

When your flat or up 17 days in a row and your extended far from the 34 day moving average i think a pullback is a no-brainer. I would have thought it might have waited for the round of ex-distributions which starts in the next few days but no matter. They are starting it now. Enbridge Energy Partners (EEP ) is down over 2 dollars on the Lakehead Pipeline leak in Lake Michigan. In the wake of BP its shoot now ask questions later. Crosstex (XTEX,XTXI) is expanding its presence in Barnett Shale. XTEX is flat but XTXI is up over 30 cents or 5% on the day. Alliance Resource (ARLP) Nustar (NS) Plains All American (PAA) and a number of the big boys are down 1 point or more as we head into afternoon trading.

When your flat or up 17 days in a row and your extended far from the 34 day moving average i think a pullback is a no-brainer. I would have thought it might have waited for the round of ex-distributions which starts in the next few days but no matter. They are starting it now. Enbridge Energy Partners (EEP ) is down over 2 dollars on the Lakehead Pipeline leak in Lake Michigan. In the wake of BP its shoot now ask questions later. Crosstex (XTEX,XTXI) is expanding its presence in Barnett Shale. XTEX is flat but XTXI is up over 30 cents or 5% on the day. Alliance Resource (ARLP) Nustar (NS) Plains All American (PAA) and a number of the big boys are down 1 point or more as we head into afternoon trading.Markets overall holding basically flat to a little lower right now.

Monday, July 26, 2010

By the way...except for the -.06 close a few days ago the MLP index has been up 15 out of the last 16 days which is a pretty astounding accomplishment. We're getting a bit extended in here short term so, again, i think we may see a sharp correction coming in here..co-inciding with the mass ex distribution cycle about to hit. But there is stll time to ring the bell at 340.02!

MONDAY MORNING EARNINGS PARADE!

Alliance Resource Partners (ARLP) leads a long list of earnings this morning with a record performance all the way around and a solid distribution boost. Alliance GP Holdings (AHGP) of course benefits and hikes the payout as well. Boardwalk Partners (BWP) puts up its numbers which look good as well but the stock is trading down nearly 1 in the premarket. Holders will also get a .005 cent increase in the distribution. Don't spend the extra 1/2 cent all in one place. Enterprise Products Partners (EPD) is doing what it always does well which is grow earnings and payouts. And what Enterprise does..Duncan Partners (DEP) also follows and their earnings look very good as well. Inergy Partners (NRGY) gives us its 35th consecutive quarterly distribution increase which is remarkable really...8 years! Inergy Holdings (NRGP) which split 3-1 also boots by a penny and a half. No story yet though just a headline.

Stock futures this morning just a shade lower at the start. Its a quiet Monday morning in July. The dollar is down this morning and gold is up. Rates are flat this morning at lease so far. MLPS have 340 and all time highs in their sights but there are only a few days before the ex-distribution cycle begins. Also i posted last night 2 story links that are must reads esepecially about the new MLPL which is the leveraged ETN and the risks involved.

Sunday, July 25, 2010

Interesting read from Investors daily about the new leveraged 2x etn for MLPS. It gives one pause about investing in it. Worth the time to read through especially for those of you considering it. Also Daily Markets has this piece about mlps that probably repeats everything we already no but the newbies in the group should read it.

Stock futures are basically flat in early trading as Asia gets underway.

Stock futures are basically flat in early trading as Asia gets underway.

Friday, July 23, 2010

HEADING INTO THE WEEKEND FIRM!

Starting out the morning with silightly higher stock futures which is a good thing. Yesterday's action in mlps was a bit subduded compared to the overall market but it's hard to draw conclusions from one day's action. If you combine the 2 day action of mlps (remember the day before the dow was down over 100 but mlps closed flat) nothing has changed yet in the overall trend. I think its important to keep your eye on the 10 year and whether we are near an are where rates can't go much lower; unless of course the economy is going to "take more gas" (not literally) for the rest of the year. Let us watch what happens to mlps on days where rates move higher. There is probably a place where if rates climb back to, will cause money to flow away from yield. We are not anywhere near there yet and it may be somewhere around 4%. And of course it will be most important to watch what happens to mlps next week when the ex distribution cycle begins and what impact the new etfs and etns have, particularly the MLPL which is 2x the mlp index.

Okay its a quiet Friday morning with no upgrades or downgrades and no corporate developements. Here is a list of yesterday's news stories all on one page for your convenience. All the bs this morning is swirling around this euro stress test show on their banks. The dollar is up a little against the euro and rates are moving higher this morning on this news at 2.97%.

Thursday, July 22, 2010

RELATIVE STRENGTH CONTINUES!

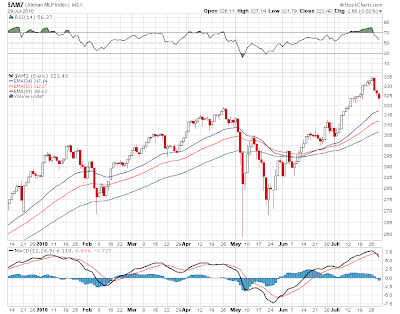

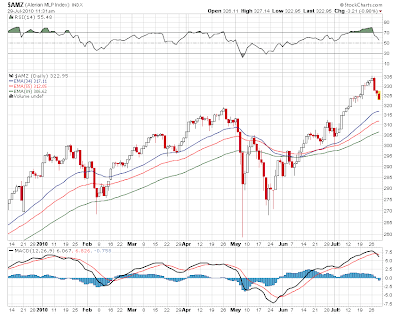

Futures are sharply higher this morning pretty much undoing the Bernake damage yesterday. The market wants to go higher and its good to see the reversal on the face of yesterday's testimony. But lets take a look this morning at the mlp chart and notice that the uptrend continues as we march on the road to 340. But we are getting a bit extended from the support below and if you look along the uptrend, there have been a number of these sharp 1 or 2 day drops that come down to support and bounce right off. Im thinking that we could get one of those drops come next week when we get that mass ex distribution exodus that almost always happens. This distribution cycle is coming with the addition of 5 etf's/etns that have become part of the trading world. Would not be at all surprised if we see a pretty sharp down move but meanwhile 340 and all time highs loom large and its quite possible we'll see that first. Im also wondering if on a big rally day if we get one that we might see some sort of huge pile on.

Moving along this morning we have nothing much corporate wise going on and nothing on the upgrade downgrade list so far. Europe is up on good economic news, rates are flat and energy is up so far.

Love the fact that i can post from my phone now with relative ease so i will be putting short posts up from time to time during the day. Makes my life easier!!!

Wednesday, July 21, 2010

Opened higher..then went 2 points lower...and now back to even with the dow up 10. Waiting for the fed speak at 2pm.

Atlas Pipeline Partners (APL) must be up 76 cents because Apple Computer (AAPL) is up 9 dollars after earnings. There is no other reason for the 7% up move in the stock but it is todays big mlp winner. Most mlps are moving fractionally in either direction. Some pull backs in Oneok Partners (OKS) and Sunoco Logistics (SXL) but they have recently made all time highs.

Atlas Pipeline Partners (APL) must be up 76 cents because Apple Computer (AAPL) is up 9 dollars after earnings. There is no other reason for the 7% up move in the stock but it is todays big mlp winner. Most mlps are moving fractionally in either direction. Some pull backs in Oneok Partners (OKS) and Sunoco Logistics (SXL) but they have recently made all time highs.

GETTING READY TO RING A BELL!

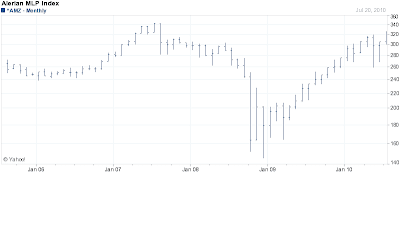

The week of July 16th 2007 is the anniversay of note. 3 years ago around this time the mlp index hit an all time high of 340.11. It has been quite the trip as we went from there to starring into the abyss in early November 2008 when we hit 152.06 on a closing basis and fell to 145 intraday. Now here we are at 330.40 on the mlp index..up over 4 yesterday. We are 3% away from all time highs and if we adjust for distributions which have only been growing through all of this for many of the mlp majors, we are already there. Its a nice place to be!

And now of course we have officially become "trendy" as this Forbes arcticle points out. We have gone from no ETN's or ETF's to 5 now out there. I have stated repeatedly that this is a double edged sword. As long as the spread between MLPS and treasuries remains around 400 basis points, mlps will continue to attract money. That spread only gets supported by the usual distribution hikes that have been coming along quarter after quarter. As long as the music continues to play we can continue to walk around the chairs. 340 is the obvious next stop here and its been a wonderful trip up. Play on but remember with the advent of popularity comes perhaps volatility when any correction comes. And it might be volatility like we saw back in 2008 with 15 and 20 point down days on the index. No sign of that happening now so let us play!

And now of course we have officially become "trendy" as this Forbes arcticle points out. We have gone from no ETN's or ETF's to 5 now out there. I have stated repeatedly that this is a double edged sword. As long as the spread between MLPS and treasuries remains around 400 basis points, mlps will continue to attract money. That spread only gets supported by the usual distribution hikes that have been coming along quarter after quarter. As long as the music continues to play we can continue to walk around the chairs. 340 is the obvious next stop here and its been a wonderful trip up. Play on but remember with the advent of popularity comes perhaps volatility when any correction comes. And it might be volatility like we saw back in 2008 with 15 and 20 point down days on the index. No sign of that happening now so let us play!Markets as I indicated yesterday were gearing for a strong finish and it worked out that way. The dow looks like it has built a complex bottom in here so we will have an additional tail wind for awhile. No corporate news so far this morning and no upgrades or downgrades. Stock futures are a little higher pre open. Energy is up and rates are flat.

Tuesday, July 20, 2010

THE RUN TO ALL TIME HIGHS!

Up well over 2 points here after a down open as the overall market wants to go higher. Nice gains among most mlps with Williams Partners (WPZ) up over 46 and a t new all time highs...up 1.33 as of this post. Oneok Partners (OKS) has broken above 70 and is also up 1 and change. The 10 year under 3% continues to drive money to yield. Enjoy the ride.

Double shift today so im sneaking in this post. Looking for a strong run into the close.

Monday, July 19, 2010

A run to 326 and small change and then a pull back as the market went negative and now we are a touch higher again. The mlp index is basically unch at lunchtime. No big moves in either direction. Inergy Holdings (NRGP) Enbridge Energy Partners (EEP) and Oneok LP (OKS) all about 5o cents higher and hovering around 52 week and all time highs in some cases. Nustar (NS) Kinder Morgan (KMP) and Sunoco Logistics (SXL) among the fractional losers. The list is split about 50-50.

MARKET MLP DIVERGENCE GROWS!

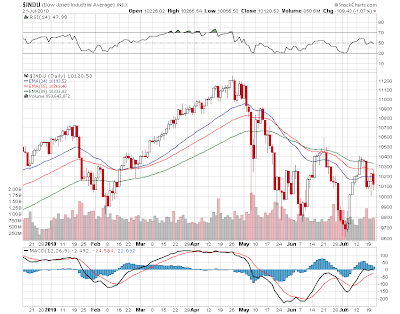

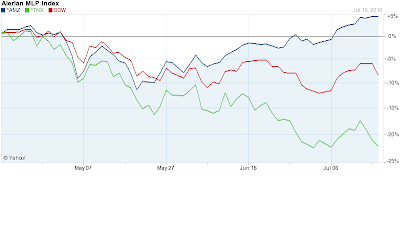

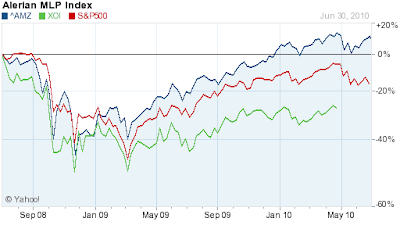

Back home from vaca so its back to something resembling normalcy. Not normal is what we continue to see going on in MLP land and frankly while i think outperformance is great, i am becoming a bit concerned overall as to what this chart is trying to tell us. This is a three month chart of MLPS VS YIELD VS THE DOW and i think in the years i've been blogging i have never quite seen something like this. The mlp index is up nearly 5 percent in the last 3 months while the dow is down nearly 10 which is a 15% outperformance. Notice that all this has occured as 10 year yields have collapsed below 3 which is of course the opposite of what conventional wisdom told us was going to happen (dollar going to zero..rates going to the moon). Now outperformance is fine but i would feel a whole lot better if the overall market were at least flat rather than down. Clearly money continues to flow to yield and MLPS offer 6-8% of yield vs 2.9% on the 10 year and near 0 on short term instruments. I am beginning to worry how much fast money is going in here and i am also worrying about all these new etf's and 2x leverage etf's in mlp land that work fine as things go up but one day when things go down...they may go down very fast.

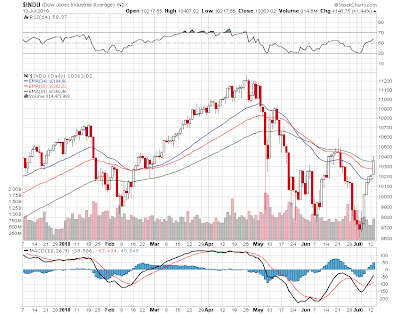

Back home from vaca so its back to something resembling normalcy. Not normal is what we continue to see going on in MLP land and frankly while i think outperformance is great, i am becoming a bit concerned overall as to what this chart is trying to tell us. This is a three month chart of MLPS VS YIELD VS THE DOW and i think in the years i've been blogging i have never quite seen something like this. The mlp index is up nearly 5 percent in the last 3 months while the dow is down nearly 10 which is a 15% outperformance. Notice that all this has occured as 10 year yields have collapsed below 3 which is of course the opposite of what conventional wisdom told us was going to happen (dollar going to zero..rates going to the moon). Now outperformance is fine but i would feel a whole lot better if the overall market were at least flat rather than down. Clearly money continues to flow to yield and MLPS offer 6-8% of yield vs 2.9% on the 10 year and near 0 on short term instruments. I am beginning to worry how much fast money is going in here and i am also worrying about all these new etf's and 2x leverage etf's in mlp land that work fine as things go up but one day when things go down...they may go down very fast. This 2 year chart is very telling. Is it any accident that over this time frame that the overall market is down..mlps are up 20% and yields are down 20%? And what happens when the day comes that rates actually turn up? While these are questions to ponder lets get back to the very short term. MLPS are coming into the next distribution cycle and thats probably a big reason why MLPS are continuing to catch a bid in here and will probably continue to do so until the ex distribution cycle begins.

This 2 year chart is very telling. Is it any accident that over this time frame that the overall market is down..mlps are up 20% and yields are down 20%? And what happens when the day comes that rates actually turn up? While these are questions to ponder lets get back to the very short term. MLPS are coming into the next distribution cycle and thats probably a big reason why MLPS are continuing to catch a bid in here and will probably continue to do so until the ex distribution cycle begins.Linn Energy (LINE) is in the news this morning as it is buying up more assets in East Texas and they are doing it with internally generating cash flow. Nothing else on the corporate front. Stock futures are higher but off the highs of the morning. The dollar is down, rates are flat, energy is basically flat and trading on either side of unchanged.

So lots to ponder this morning. Friday we say the dow down 260 and the mlp index basically unchanged. It was also option expiration. The open looms large as always.

Friday, July 16, 2010

ANOTHER UP WEEK COMES TO AN END!

I know my posts this week have been rather limiting thanks to my vacation but this comes to an end today and its back to nomal come Monday. The distribtution annoucements have begun with several mlps upping payouts and of course this is no surprise. The 10 year is below 3% this morning so the drive of money to yield continues. No reason why we won't see new all time highs on the mlp index in the next few weeks. I would only caution however that with this move has come the arrivial of all these etfs. When the day comes that selling is the thing to do, the volitility in these things may be something taking us back to the Lehman unwind. But for now its up with minor interrruptions until further notice.

Just noticed stock futures turned a little lower this morning ahead of the open afer trading a little higher. Nothing major here. Good tape action yesterday with the dow down over 100 and then a rally back to a small loss at the close. No corporate developements this morning and no upgrades or downgrades.

Wednesday, July 14, 2010

NEW BREAKOUT HIGH FOR THE MOVE..

340 IS NEXT ON THE MLP EXPRESS TRAIN!

340 IS NEXT ON THE MLP EXPRESS TRAIN!

Sorry for no posts yesterday but we had no wireless service in the house which is in the Redneck Riveria. Then this morning after going crazy all day i realized it was just a matter of resetting the wireless router (Duh!) so im back on this morning. So my apologies. The MLP index is clearly telling us that with the overall market now rallying out of W bottom we have a shot for all time highs in a few weeks.

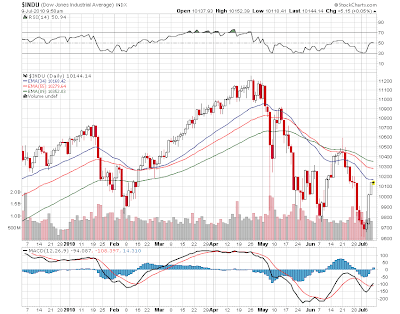

The dow chart looks constructive here and the move has been very powerful from the lows of 2 weeks ago. We're above support. So the wind is at our backs probably through earnings and distribution announcements.

The dow chart looks constructive here and the move has been very powerful from the lows of 2 weeks ago. We're above support. So the wind is at our backs probably through earnings and distribution announcements. The open looms in a few. We're on central time here so my body clock is a bit off. Going to swim laps. Looks like a slightly lower open off June retail sales and a sideways day would be no shock here after 7 up days in a row. MLPS could continue pushing higher regardless so let the games begin and im off to swim laps. By the way no kidding aside it is beautiful here. Check out the link above.

The open looms in a few. We're on central time here so my body clock is a bit off. Going to swim laps. Looks like a slightly lower open off June retail sales and a sideways day would be no shock here after 7 up days in a row. MLPS could continue pushing higher regardless so let the games begin and im off to swim laps. By the way no kidding aside it is beautiful here. Check out the link above.

Monday, July 12, 2010

MLP INDEX AIMING FOR 320!

That is our short term goal and we last were there when the Dow was at 11200. Here were are with the dow 1000 points lower and we're in the same place. So basically the dow is 10 % with the mlp index basically flat in the last couple of months. Since it appears that the market wants to rally in here it looks like we're headed for a breakout and then a challenge of all time index highs at 340. Remember when we were there last somewhere back in 2007. And through all that time we had 12 payouts or so to pad the pockets. If you were in the right mlps after all that we went through in 2008...you are ahead of the game. And how many of your non mlp friends can say that?

The dow is back up right now and the mlp index is up about 1 point. Most mlps are fractionally higher. Sunoco Logistics (SXL) and Inergy Holdings (NRGP) are at all time highs today along with Williams Partners (WPZ). You can add those three to Apple Computer (AAPL) and all time highs are a nice place to be.

On vacation this week in Panama City where its been great and oil free. Will post from time to time when im taking a break from the beach.

Friday, July 09, 2010

STRANGE TIMES INDEED!

A look at these 2 charts indeed tells 2 different stories. On the one hand the dow industrials is in a downtrend of lower highs although this week we've seen a nice rally and maybe we can get above support in time. Meanwhile MLPS continue to just roar along and why not. When the yield spread with the strongest mlps is over 4 basis points to the 10 year it becomes a magnet for money. The mlp chart is getting close to 320; where the dow was over 11k. Now the dow is over 10% lower from that rally high and we are right back at the door. Relative outperformance continues and no sign of any change in momentum or trend.

We are just under 318 this morning up another point and small change. No news and no upgrades or downgrades that i could find so far. The heat here in the east got to me the other day and so i apologize for no posts yesterday. It was tough enough just to get out of bed!

Wednesday, July 07, 2010

NOW WE HAVE TWICE AS NICE!

Figures that now that we have run well beyond 2008 levels UBS comes out with an MLP etn which tracks 2x the move in the mlp index and pays out 2x. But remember boys and girls 2x the move works in both directions and all this added leverage in the marketplace and that means we will see moves that we normally don't see in this group. Too bad we didn't have this at AMZ 150 or else we would have a quadruple from the lows in your portfolio. In time we will probably have options to hedge the hedge. Please note there are no K-1's here so the payouts pass as ordinary income. So do consider the tax implications.

The index is up over 5 today as the market finally rallies strong from being deeply oversold. 320 is in view for mlps as long as rates stay in the abyss under 3-3.25% on the 10 year and the bounce in the market is something other than a one day wonder. Lots of mlps are up 1 or more like Nustar (NS) Alliance Resource (ARLP) Calumet Specialty Products (CLMT) and Williams Partners (WPZ).

Tuesday, July 06, 2010

Ran to almost a 5 point gain and the dow up 160 but now sellers have taken over and markets are well off the highs of the day. The dow is up just 57 and mlps up 2.60. Alliance Resource (ARLP) leads the winners list up 1. Also up strongly are Kinder Morgan (KMP) Williams (WPZ) and EV Energy Partners (EVEP). Most mlps are fractionally higher. Calumet Specialty Products (CLMT) is down 50 cents as the noteable loser though there is no news here to speak of.

It will be demoralizing if markets can't sustain an up close given the start we've had.

It will be demoralizing if markets can't sustain an up close given the start we've had.

POST HOLIDAY FIRM WITH BEARS EVERYWHERE!

Hope everyone's 4th of July weekend went well. We come back to what should be a slow trading week and a heatwave in the northeast . Over the weekend the press was about as bearish as you could be. There was this on CNBC.com that its the depression all over again if you believe the charts. This of course sets the blogosphere ablaze with all sorts of commentary. Then there is Paul Krugman of the NY Times who blames republicans for everything. One must be clean before reading Krugman so be sure to bathe.

In the end seeing all this gloom and doom around in the press leads me to believe that the markets may fool everyone and rally in here. But lets make no mistake there are big big issues out there and lots of headwinds to deal with.

We here in the land of MLPS however seem to be in a different world of sorts as money continues to move to yield. MLPS are not that far from new post 2008 bear market highs. This morning with stock futures we're set for a higher open. News from Kinder Morgan(KMP) and Copano (CPNO) as they will be managing energy for SM Energy. Both stocks are bid up ahead of the open. No other corporate developements and no upgrades or downgrades so far this morning.

We here in the land of MLPS however seem to be in a different world of sorts as money continues to move to yield. MLPS are not that far from new post 2008 bear market highs. This morning with stock futures we're set for a higher open. News from Kinder Morgan(KMP) and Copano (CPNO) as they will be managing energy for SM Energy. Both stocks are bid up ahead of the open. No other corporate developements and no upgrades or downgrades so far this morning.Markets are firm this morning in Europe. The dollar is down against the euro which is good for stocks. Yields are a little higher this morning in the face of the world not having ended over the weekend.

Thursday, July 01, 2010

MLPS selling off with everything else as we have hideous economic stats. Dow down 85. MLPS down 4. The 10 year is at 2.89%, and isn't in wonderful how wrong (myself included) the conventional wisdom is about rates that had no where to go but up...and here we are at new lows in yield! Brilliant what a depression and a deflation can do.

NEW QUARTER BEGINS...

AND YOU CAN THANK THE ASSHOLE!

AND YOU CAN THANK THE ASSHOLE!

Okay the new quarter starts today and i guess we will get the answer to the question i've been posting for over a week now. Was the end of quarter run into bonds and mlps and the end of quarter selling in everything else part of something bigger or part of the big pile-on. Yields on the 10 year are down to 2.95% which puts mlps at a very wide spread...almost 4 points. Now by 2008 standards when spreads went to the moon this is low but it is above the normal long term range. And since i think what's going on here is much different (no Lehman unwind), it is possible that mlps could go higher while the rest of the market goes nowhere or down. And mlps are rising while energy stocks in general hit new lows almost daily. We have BP to thank for that to some degree but that group going down does not say good things about the economy.

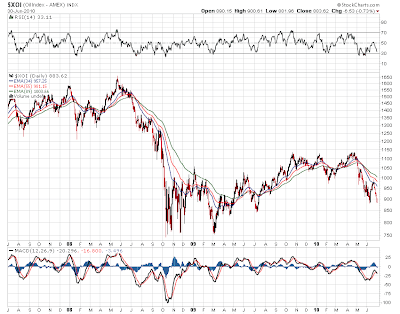

The XOI index of big energy stocks is not down to its 2008 or 2009 lows but it's not that far away. Frankly i'm amazed that MLPS have been able to stage almost unheard of outperformance while the rest of energy is getting shunned. But when you do nothing other than throw off cash in a deflationary enviornment; that apparently is an asset that somebody wants.

The XOI index of big energy stocks is not down to its 2008 or 2009 lows but it's not that far away. Frankly i'm amazed that MLPS have been able to stage almost unheard of outperformance while the rest of energy is getting shunned. But when you do nothing other than throw off cash in a deflationary enviornment; that apparently is an asset that somebody wants.

The one and 2 year chart comparisons here say it all. How long can this divergence go on? I guess as long as less than 3% isnt enough for some people...it may go on for quite a while. Still i have to wonder that if the market overall goes into some sort of deflationary implosing..how long before mlps do the same thing. Food for thought.

The one and 2 year chart comparisons here say it all. How long can this divergence go on? I guess as long as less than 3% isnt enough for some people...it may go on for quite a while. Still i have to wonder that if the market overall goes into some sort of deflationary implosing..how long before mlps do the same thing. Food for thought.Okay new quarter brings lower futures after yesterday's 100 point loss on the dow. Everyone is screaming about the S&P breaking 1040. Nat gas numbers are out later this morning. Rates are flat ahead of the open. No corporate developements this morning so far and i don't expect any ahead of the holiday weekend. MLPS closed up 1 yesterday after being up nearly 4 earlier. Going to be an interesting day.

I guess it had to happen eventually but after 6 years of blogging, i've gotten popular enough that im getting this....so as a result i have to activate the moderation option. If you guys want to give the man a friendly thank-you just click on this and tell whoever it is to go hawk his stuff elsewhere. Sorry about having to put a monitor into the playground. If this is an isolated incident i will take it off.

Subscribe to:

Posts (Atom)