4 BOOS!

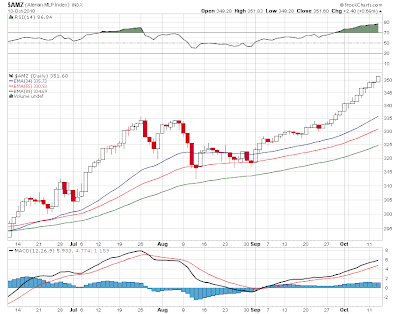

Sorry for the late post today but had a few things going on. Apparently no one wants to go home short into the weekend so stocks are making a run here in the last 2o minutes or so after doing much of nothing all day. Dow is up 15 points. MLPS are gaining as end of month pressures mean buyers are stepping up and we're over 352 on the index up over 2 points and a new all time high close is possible here.

Meanwhile 2 closes of significance to the number 4. The 30 year yield closed right at exactly 4 percent giving us something to ponder. I still think given all we know that long rates may continue to move higher in the short term as everything about QE2 has been discounted. Meanwhile it seems that everyone is touting the buy the rumor sell the fact mantra as far as the election goes. Given the very tight trading range we've been in for the last 6 trading days, I wonder whether the surprise Wednesday morning will be a rally no matter what happens. Same goes for the QE 2 announcement by the fed which has already been leaked out.

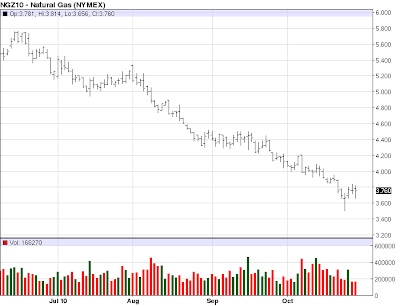

The second 4 in all this is nat gas which staged a huge reversal yesterday and the rally continues to day as we close above 4 bucks for the first time in quite awhile (allowing for contract rollovers etc) and this could be significant with colder weather forecast nextweek in the midwest and northeast. It may be time for a nice ride up. I dont trust the nat gas market but it is something to pay attention to.

So we head into the weekend firm and with much to ponder. The ex distribution cycle continues and ends next week as the last of the mlp holders lock their payouts. Next week could be exciting.