THE ROYALE WEDDING!

a blog dedicated to the discussion of MASTER LIMITED PARTNERSHIPS and the day to day news related to the group...along with perhaps a few other things...as long as the conversation is kept civil. Although i have no problem telling you what i am doing regarding my trades...PLEASE DON'T ASK ME WHAT YOU SHOULD DO REGARDING WHETHER TO BUY, SELL OR SHORT!!! i am not in the stock business.

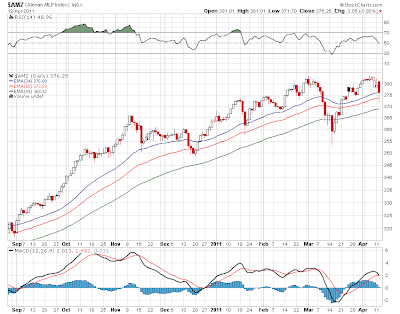

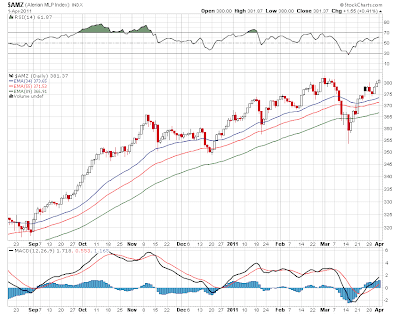

350 still holds on the downside and 382-383 is the upside wall. So we march on to the open. Sorry about no posts yesterday. Holy Week, Easter, and a wedding to prepare for!!!

350 still holds on the downside and 382-383 is the upside wall. So we march on to the open. Sorry about no posts yesterday. Holy Week, Easter, and a wedding to prepare for!!!

The last week or so have seen some failed rally attempts to new all time highs as well as failed breakdown attempts through support. So essentially we have been going sideways. Overall markets have tried the same thing this week in what for now has been a rather orderly correction. We're getting ready for the usual slew of distribution announcements that are coming. As usual with mlps its buy the rumor sell the news and the payout hikes seem always to be baked into the cake. Atlas Pipeline Partners (APL) broke out to a new highs yesterday.

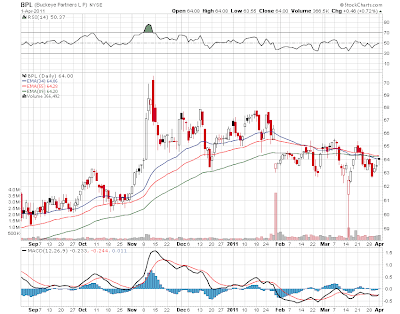

The last week or so have seen some failed rally attempts to new all time highs as well as failed breakdown attempts through support. So essentially we have been going sideways. Overall markets have tried the same thing this week in what for now has been a rather orderly correction. We're getting ready for the usual slew of distribution announcements that are coming. As usual with mlps its buy the rumor sell the news and the payout hikes seem always to be baked into the cake. Atlas Pipeline Partners (APL) broke out to a new highs yesterday. The latest upleg seems to co-incide with the Eagle Rock Energy Partners asset purchase from a few days ago. Not sure why unless its a reminder to the markets that Atlas Pipeline is still undervalued. They are going to hike its payout faster than most mlps and that is driving prices higher. Others in the group are coming out of the cloud of a secondary as Buckeye Partners (BPL) did one yesterday at 59.41. This stock has not done well at all in the last year when compared to others.

The latest upleg seems to co-incide with the Eagle Rock Energy Partners asset purchase from a few days ago. Not sure why unless its a reminder to the markets that Atlas Pipeline is still undervalued. They are going to hike its payout faster than most mlps and that is driving prices higher. Others in the group are coming out of the cloud of a secondary as Buckeye Partners (BPL) did one yesterday at 59.41. This stock has not done well at all in the last year when compared to others. The stock touched 70 back in November and its been down since thanks to its selling shares with its takeover of Buckeye Holdings even though it was not dilutive. Now that its done its offering UBS this morning upgrades Buckeye to a buy from neutral and the stock is bid up this morning in the pre market.

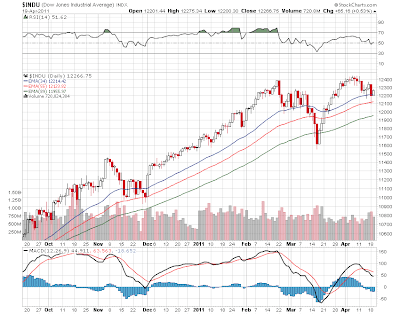

The stock touched 70 back in November and its been down since thanks to its selling shares with its takeover of Buckeye Holdings even though it was not dilutive. Now that its done its offering UBS this morning upgrades Buckeye to a buy from neutral and the stock is bid up this morning in the pre market. 365 on the MLP index is an important inflection point and ultimately 350 is "the" support level in my view. But no worries about seeing either one of those levels today (at least based on this morning's open) as stock futures are up 80 points on the dow which gets back most of yesterday's lows. Crude sold off hard yesterday but its up this morning as is nat gas now after being lower earlier. And interest rates are up on stronger than forecast retail sales ex gasoline. MLPS are within striking distance of getting back to all time highs but we seem to be failing when we get there. Let the morning trades begin!

365 on the MLP index is an important inflection point and ultimately 350 is "the" support level in my view. But no worries about seeing either one of those levels today (at least based on this morning's open) as stock futures are up 80 points on the dow which gets back most of yesterday's lows. Crude sold off hard yesterday but its up this morning as is nat gas now after being lower earlier. And interest rates are up on stronger than forecast retail sales ex gasoline. MLPS are within striking distance of getting back to all time highs but we seem to be failing when we get there. Let the morning trades begin!

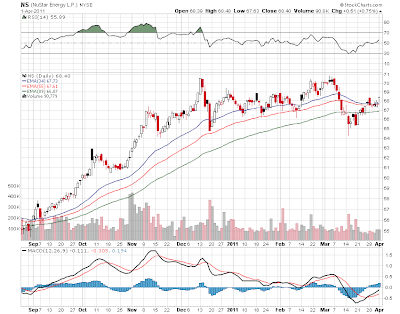

Buckeye Partners (BPL) has done nothing but trend downward since it hit 70 back in early November. Since then it bought out Buckeye Holdings (BGH) along with selling shares related to the takeover. At some point all that will get digested and this mlp could move to the front of the line among the leaders. All of this assumes that the mlp uptrend continues in the second quarter.

Buckeye Partners (BPL) has done nothing but trend downward since it hit 70 back in early November. Since then it bought out Buckeye Holdings (BGH) along with selling shares related to the takeover. At some point all that will get digested and this mlp could move to the front of the line among the leaders. All of this assumes that the mlp uptrend continues in the second quarter.