Friday, September 29, 2006

We have higher prices in MLPS today....not by alot but definitely an upside bias. No doubt also that end of quarter noise continues. Copano (CPNO) and Regency Partners (RGNC) are up major fractions today on some volume. Also Crosstex LP (XTXI) is up 46 cents. Losers are few and losses are contained...under 25 cents. No news driving the group today.

I just want to start off this morning with this absolutely seemingly endless dow record high close coverage. CNBC PLEASE.....STOP IT ALREADY! Okay...i've said it.

Now to the business of MLPS which are up slightly this morning at the open. The index is up 9 cents and they seem to be holding their own. Copano (CPNO) is up another 50 cents and back to the 53 level. Crosstex LP (XTEX) is also up 50 cents this morning. Volume on each one is not that impressive. No news and no upgrades or downgrades this morning.

Its the last day of the quarter and there's always nonsense especially in the last 30 minutes. I've noticed alot of shares getting moved around in a few MLPS this week and i would not be surprised to see a spike rally in a few of these issues late in the day. The question is which MLPS?

Now to the business of MLPS which are up slightly this morning at the open. The index is up 9 cents and they seem to be holding their own. Copano (CPNO) is up another 50 cents and back to the 53 level. Crosstex LP (XTEX) is also up 50 cents this morning. Volume on each one is not that impressive. No news and no upgrades or downgrades this morning.

Its the last day of the quarter and there's always nonsense especially in the last 30 minutes. I've noticed alot of shares getting moved around in a few MLPS this week and i would not be surprised to see a spike rally in a few of these issues late in the day. The question is which MLPS?

Thursday, September 28, 2006

Blogger today has been very difficult for some reason. Trying again here with the AMZ MLP index up 1 with Copano Energy (CPNO) and Natural Resource Partners (NRP) up 1 each. And we also have some nice fractional plusses in a host of issues including Plains All American (PAA) and Martin Midstream Partners (MMLP). Holly Partners(HEP) dropped below 36 this morning but is coming back now up 24 cents to 36.63. In the past the stock has always bounced back from this level to 40 rather quickly.

A few issues lower including Crosstex LP down double nickles (55 cents)..no news there. Watch for the end of quarter nonsense to move prices around through tomorrows close.

A few issues lower including Crosstex LP down double nickles (55 cents)..no news there. Watch for the end of quarter nonsense to move prices around through tomorrows close.

MLPS moving nicely higher today as the index is up over 1 point to 256 and change. 1 point winners today include Copano (CPNO) and Markwest Energy (MWE) with fractional plusses in a host of others including Willams Partners (WPZ) Sunoco Logsitcis (SXL) and Markwest Energy (MWE). A few losers in the group but nothing serious so far.

Sitting here watching the HPQ congressional hearings and watching everybody plead the 5th ammendment. Its like watching Godfather 2!

Sitting here watching the HPQ congressional hearings and watching everybody plead the 5th ammendment. Its like watching Godfather 2!

MLPS moving nicely higher today as the index is up over 1 point to 256 and change. 1 point winners today include Copano (CPNO) and Markwest Energy (MWE) with fractional plusses in a host of others including Willams Partners (WPZ) Sunoco Logsitcis (SXL) and Markwest Energy (MWE). A few losers in the group but nothing serious so far.

Sitting here watching the HPQ congressional hearings and watching everybody plead the 5th ammendment. Its like watching Godfather 2!

Sitting here watching the HPQ congressional hearings and watching everybody plead the 5th ammendment. Its like watching Godfather 2!

Two of the better looking charts of the last few months and they still look good. Markwest Energy LP above and Markwest below...and i think they both have more upside. Markwest Energy gets its price target raised this morning by RBC Capital Markets.

And this is how we start the second to last day in the quarter. Crude is flat this morning and nat gas is higher on the new front contract. No corporate developements. MLPS closed right near its high of the day yesterday and we look foward to some followthrough today.

Note the end of quarter usually provides us with all kinds of odd trading patterns in a few issues. I think your seeing it in Crosstex LP, Holly Partners and a few others. Which means if you see these climb late tomorrow on short covering, don't be surpirsed.

Wednesday, September 27, 2006

A couple of sidenotes. Hat tip to Keith...Crosstex (XTXI) was downgraded to equal weight from overweight. Stock down 1 and change. Otherwise MLPS are moving higher...the index is up 1.02.Hiland LP (HLND) is todays big winner up 1. Also up 1, Markwest (MWP)...hat tip to Keith again...and Markwest Energy (MWE) over yesterday's deal announcement. Plains All American (PAA), Boardwalk Partners (BWP) and Kinder Morgan Partners (KMP) all up nice fractions.

Crude oil is back over 62 bucks but nat gas is collapsing down to 4.17! Amazing that a year ago Nat gas hit 15 bucks!

Crude oil is back over 62 bucks but nat gas is collapsing down to 4.17! Amazing that a year ago Nat gas hit 15 bucks!

MLPS opened higher and the AMZ MLP index is up .82 so far today. 10 year rates droppped on the durable goods number and then upticked on better new homes sales data. So the overall market is higher. Oil and energy stocks as a whole are higher so a good day so far.

Enterprise (EPE) down 22 cents on the Lehman downgrade. Otherwise nice fractional gains in Markwest Energy(MWE), Energy Transfer Equity(ETP), Penn Virginia Resources(PVR) and Sunoco Logistics.(SXL)

Enterprise (EPE) down 22 cents on the Lehman downgrade. Otherwise nice fractional gains in Markwest Energy(MWE), Energy Transfer Equity(ETP), Penn Virginia Resources(PVR) and Sunoco Logistics.(SXL)

Good Wednesday morning!

We have a quiet morning on the corporate news front but we do have Lehman Brothers cutting Enterprise Holdings (EPE) to equal weight from outperform. And thats it!

Crude Oil is higher this morning, Nat gas is slightly higher. Crude oil stats out at 10:30am so that will be a market mover. Durable goods was soft and the 10 year yield is dropping again. End of quarter nonsense continues so who knows where we'll be going today. New highs on the dow getting very close.

Not much else to write about this morning so i'll wait for the open and post around 10am

We have a quiet morning on the corporate news front but we do have Lehman Brothers cutting Enterprise Holdings (EPE) to equal weight from outperform. And thats it!

Crude Oil is higher this morning, Nat gas is slightly higher. Crude oil stats out at 10:30am so that will be a market mover. Durable goods was soft and the 10 year yield is dropping again. End of quarter nonsense continues so who knows where we'll be going today. New highs on the dow getting very close.

Not much else to write about this morning so i'll wait for the open and post around 10am

Tuesday, September 26, 2006

Nice upside today in MLPS...the index is up over 1 point. And we have nice gains in many issues. Energy Transfer Equity continues in breakout mode...now at 29.50. Markwest is up 50 cents on its deal news this morning and Energy Transfer Partners is up 70 cents.

These days its the coal exposed MLPS that continue to move lower. Alliance Resource Partners (ALRP) and its GP (AHGP) have been selling off in recent days...the GP is still down today but the LP is higher. Natural Resourec Partners (NRP) is down 10 points in recent weeks and still shows no sign of a significant bounce.

These days its the coal exposed MLPS that continue to move lower. Alliance Resource Partners (ALRP) and its GP (AHGP) have been selling off in recent days...the GP is still down today but the LP is higher. Natural Resourec Partners (NRP) is down 10 points in recent weeks and still shows no sign of a significant bounce.

Good Morning

Markwest Energy (MWE) leads the way with news this morning as it will be developing midstream assets for Woodford Shale. Its a 4 year deal and should be a stock mover.

Other than that its very quiet this morning with no corporate news and no upgrades or downgrades. Crude Oil is down 50 cents but holding above 60 dollars. Nat gas which was down earlier is now higher. The 10 year is holding at 4.56%; the spread between the 10 year and MLP yields has widened considerably. At some point MLPS have to diverge from the rest of energy but who knows when that will happen. Its never easy!

Crosstex LP (XTEX) jumped 1 in the last 10 minutes of trading yesterday. Not sure why other than perhaps some end of quarter nonsense. Look for more of that in some other issues today.

Looking at Crosstex (XTXI). It might be under pressure because it has been such a big winner this year...profit taking for end of quarter. Right now just watching.

The chart pattern itself is perhaps a little less positive looking than it was. So for now no trading recommendations....just keeping a watchful eye on things.

Markwest Energy (MWE) leads the way with news this morning as it will be developing midstream assets for Woodford Shale. Its a 4 year deal and should be a stock mover.

Other than that its very quiet this morning with no corporate news and no upgrades or downgrades. Crude Oil is down 50 cents but holding above 60 dollars. Nat gas which was down earlier is now higher. The 10 year is holding at 4.56%; the spread between the 10 year and MLP yields has widened considerably. At some point MLPS have to diverge from the rest of energy but who knows when that will happen. Its never easy!

Crosstex LP (XTEX) jumped 1 in the last 10 minutes of trading yesterday. Not sure why other than perhaps some end of quarter nonsense. Look for more of that in some other issues today.

Looking at Crosstex (XTXI). It might be under pressure because it has been such a big winner this year...profit taking for end of quarter. Right now just watching.

The chart pattern itself is perhaps a little less positive looking than it was. So for now no trading recommendations....just keeping a watchful eye on things.

Monday, September 25, 2006

Days like today can make you want to pull your hair out. MLPS just sort of sitting there...off the lows but no rush to the flat line. Just sort of holding their own at mostly lower prices.

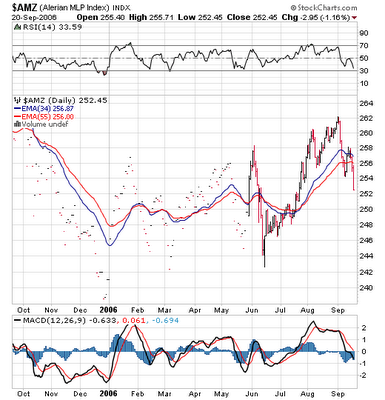

MLP index down 1. Notice on the weekly chart, the down moves of the last week are still within the context of the basing pattern. Ultimately i think we see new highs but i guess we have more sideways work to do.

Days like today can make you want to pull your hair out. MLPS just sort of sitting there...off the lows but no rush to the flat line. Just sort of holding their own at mostly lower prices.

MLP index down 1. Notice on the weekly chart, the down moves of the last week are still within the context of the basing pattern. Ultimately i think we see new highs but i guess we have more sideways work to do.

Issues with blogger all day long today so hopefully this gets through. Crude and the XOI have made their stand today. XOI was down 20 now up 3 and crude is up 1.35. MLPS also off their lows but still down. The index was down 2 points...now down .80 so its going in the right direction.

Energy Transfer Equity(ETE) is today's big winner up 61 cents and over 29 bucks on its boost in the distribution. Also higher are Energy Transfer Partners (ETP), Calumet Partners (CLMT) and Inergy (NRGY).

Energy Transfer Equity(ETE) is today's big winner up 61 cents and over 29 bucks on its boost in the distribution. Also higher are Energy Transfer Partners (ETP), Calumet Partners (CLMT) and Inergy (NRGY).

Issues with blogger all day long today so hopefully this gets through. Crude and the XOI have made their stand today. XOI was down 20 now up 3 and crude is up 1.35. MLPS also off their lows but still down. The index was down 2 points...now down .80 so its going in the right direction.

Energy Transfer Equity(ETE) is today's big winner up 61 cents and over 29 bucks on its boost in the distribution. Also higher are Energy Transfer Partners (ETP), Calumet Partners (CLMT) and Inergy (NRGY).

Energy Transfer Equity(ETE) is today's big winner up 61 cents and over 29 bucks on its boost in the distribution. Also higher are Energy Transfer Partners (ETP), Calumet Partners (CLMT) and Inergy (NRGY).

Approaching lunchtime and MLPS are still married to other energy stocks and getting sold off. The AMZ MLP index is down another 1.60. Lots of fractional losers with Natural Resource Partners (NRP), Penn Virginia(PVR), and Copano (CPNO) among the largest losers although all are off their lows. Meanwhile Crude Oil is desperatley trying to hold 60 bucks while nat gas is down another 14 cents.

The XOI is in a place where it should bottom. Ten year rates continue to fall to 4.55%

The XOI is in a place where it should bottom. Ten year rates continue to fall to 4.55%

Here is the link to Energy Transfer Equity's distribution increase. Somehow i didn't get it on my first morning post.

Meanwhile MLPS remained attached at the hip of all things energy and they are down as a whole; mostly fractional losses out there. Natural Resource Partners is back with a 48 handle...down 1 earlier but now down a bit less. Copano (CPNO) was down 1 and change but thats off its low as well. A few winners but not by much. Mostly pennies higher. The AMZ MLP index is down 1.50.

The XOI is at a place where it could bottom or reverse. Watch crude to see if it holds 60.

Meanwhile MLPS remained attached at the hip of all things energy and they are down as a whole; mostly fractional losses out there. Natural Resource Partners is back with a 48 handle...down 1 earlier but now down a bit less. Copano (CPNO) was down 1 and change but thats off its low as well. A few winners but not by much. Mostly pennies higher. The AMZ MLP index is down 1.50.

The XOI is at a place where it could bottom or reverse. Watch crude to see if it holds 60.

Good Morning.

Over the weekend gasoline prices in my nieghborhood went from 2.63 a gallon on Friday afternoon to 2.39 a gallon Sunday night! And crude oil is now under 60 bucks as we have a 59 handle on it. Nat gas is down another 16 cents to $4.70. We also have a collapsing 10 year yield at 4.57% this morning as we head for 4.50. So that enviornment hasn't changed from last week. There are a number of issues here including when or if MLPS will disconnect from the rest of the Energy group...whether end of quarter selling in this group has already all been done...and will Energy prices start bottoming?

No surprise really from Energy Tranfer Equity(ETE), the general partner of Energy Transfer Partners (ETP) makes a big distribution announcement this morning. Will they sell on the good news or continue to rally on the breakout in the chart pattern.? No other breaking corporate news this morning and no upgrades or downgrades.

Over the weekend gasoline prices in my nieghborhood went from 2.63 a gallon on Friday afternoon to 2.39 a gallon Sunday night! And crude oil is now under 60 bucks as we have a 59 handle on it. Nat gas is down another 16 cents to $4.70. We also have a collapsing 10 year yield at 4.57% this morning as we head for 4.50. So that enviornment hasn't changed from last week. There are a number of issues here including when or if MLPS will disconnect from the rest of the Energy group...whether end of quarter selling in this group has already all been done...and will Energy prices start bottoming?

No surprise really from Energy Tranfer Equity(ETE), the general partner of Energy Transfer Partners (ETP) makes a big distribution announcement this morning. Will they sell on the good news or continue to rally on the breakout in the chart pattern.? No other breaking corporate news this morning and no upgrades or downgrades.

Friday, September 22, 2006

Many thanks to a poster on my TCLP trade. He writes as follows.

"Wow that is one of the dumbest things I have ever heard. TCLP is not a unitholder of OKS. TCLP owns a 50% interest in the NB Pipeline, whilst the other 50% is owned by OKS. TCLP used to own 30%, but increased their ownership of the NB system when OKE bought TRP's interest in NBPs GP. Duh. Anyway. The NB received an unfavorable rate case. This impacts TCLP more than OKS because as a percentage of assets/cashflows the NB system is much bigger relative to TCLP than OKS. Therefore, bad news at NB is worse for TCLP while good news for OKS not related to NB has no impact on TCLP. Wow."

And he is absolutely correct...it was dumb of me and i apologize for not looking at this more carefully. From a trade standpoint it worked out okay since i was able to buy near Thursday's low and actually made some money. But I may not be so lucky next time.

One of the odd things about TCLP is that the stock price actually didn't drop until nearly 2 days after the news was out. Somebody dumped with both hands late Wednesday afternoon to drive the stock from 32 down to near 30 thursday morning.

Lesson learned here!

"Wow that is one of the dumbest things I have ever heard. TCLP is not a unitholder of OKS. TCLP owns a 50% interest in the NB Pipeline, whilst the other 50% is owned by OKS. TCLP used to own 30%, but increased their ownership of the NB system when OKE bought TRP's interest in NBPs GP. Duh. Anyway. The NB received an unfavorable rate case. This impacts TCLP more than OKS because as a percentage of assets/cashflows the NB system is much bigger relative to TCLP than OKS. Therefore, bad news at NB is worse for TCLP while good news for OKS not related to NB has no impact on TCLP. Wow."

And he is absolutely correct...it was dumb of me and i apologize for not looking at this more carefully. From a trade standpoint it worked out okay since i was able to buy near Thursday's low and actually made some money. But I may not be so lucky next time.

One of the odd things about TCLP is that the stock price actually didn't drop until nearly 2 days after the news was out. Somebody dumped with both hands late Wednesday afternoon to drive the stock from 32 down to near 30 thursday morning.

Lesson learned here!

I keep waiting for this dis-connect to occur between big energy and mlps and they (mlps) are down but holding up better than the XOI index which continues to try and stand near 1040. Oneok LP is up 1.60 which is probably giving the MLP Index an upward bias. And speaking of Oneok I though i'd get cute and by its biggest shareholder TCLP hoping that it would bounce with OKS. So far...how wrong was I?

Waiting for the last hour as we head into the weekend.

Waiting for the last hour as we head into the weekend.

This morning we have a modest rally in Crude Oil as it heads back to 62 dollars. 10 year rates which yesterday collapsed to 4.648 percent are down again in European trading...hovering near 4.60%. If the tape of the stock market is beginnning to focus on a recession possibility look for MLPS to rally as high yields relative to the 10 year attract investors. During the 2000-2002 timeframe when stocks were imploding this group nearly doubled in value.

No corporate developements this morning and no upgrades or downgrades.

Oneok LP should see a nice pop higher this morning after boosting earnings estimates last night substantially. See last nights post below for more details.

No corporate developements this morning and no upgrades or downgrades.

Oneok LP should see a nice pop higher this morning after boosting earnings estimates last night substantially. See last nights post below for more details.

Thursday, September 21, 2006

After market news...Oneok LP boosts guidance significantly this quarter and for the rest of the year. The news estimates are well above the high end of the previous ones. Should be good for a couple of points tomorrow.

TCLP owns a big chunk of Oneok and could also be a mover tomorrow. I went long this one today.

10 year rates plunging and oil is rising slightly so MLPS are moving higher...decoupling from the overall market which is down 75 points on the dow. The AMZ MLP index is up 1.22 and off its high of the day. Natural Resource Partners (NRP) is up 1.50 as it finally rallies after days of declines from 10 points higher. Also higher Teppco (TPP) which is up a solid fraction and Energy Transfer Partners (ETP) which gave a big boost to its distribution. Crosstex Energy LP (XTEX) is up fractionally but had a run to 37.78 this morning before pulling back. Thankfully i had an order up at 37 and was able to sell and buy back here at 36.

Oneok LP(OKS) appears to be rallying back from its sharp down open. TCLP which is also the symbol owns a big chunk of Oneok LP sold off this morning but hasn't quite come back yet. So i bought some this morning hoping that i get a bounce. We shall see.

Oneok LP(OKS) appears to be rallying back from its sharp down open. TCLP which is also the symbol owns a big chunk of Oneok LP sold off this morning but hasn't quite come back yet. So i bought some this morning hoping that i get a bounce. We shall see.

10 year rates plunging and oil is rising slightly so MLPS are moving higher...decoupling from the overall market which is down 75 points on the dow. The AMZ MLP index is up 1.22 and off its high of the day. Natural Resource Partners (NRP) is up 1.50 as it finally rallies after days of declines from 10 points higher. Also higher Teppco (TPP) which is up a solid fraction and Energy Transfer Partners (ETP) which gave a big boost to its distribution. Crosstex Energy LP (XTEX) is up fractionally but had a run to 37.78 this morning before pulling back. Thankfully i had an order up at 37 and was able to sell and buy back here at 36.

Oneok LP(OKS) appears to be rallying back from its sharp down open. TCLP which is also the symbol owns a big chunk of Oneok LP sold off this morning but hasn't quite come back yet. So i bought some this morning hoping that i get a bounce. We shall see.

Oneok LP(OKS) appears to be rallying back from its sharp down open. TCLP which is also the symbol owns a big chunk of Oneok LP sold off this morning but hasn't quite come back yet. So i bought some this morning hoping that i get a bounce. We shall see.

Good Morning!

So I was watching Jim Cramer yesterday on "The Maria Bartiromo Show" and he made an interesting point that energy is dead money until the end of the quarter since after the recent decline no one is going to want to have energy on the books at the end of the quarter. This leads me to believe that while in general we may continue to see pressure...there could be a trading rally coming soon or perhaps a bull market bottom come October. MLPS should be disconnecting from all this as the 10 year rate continues to move lower. But when your in a shoot first ask questions later enviornment you go down with everyone else.

Some news on a few issues this morning. First off Boardwalk Partners is doing a 5 million share stock offering. Also in the news this morning is a big distribution boost from Energy Transfer Partners which boosts its payout to 3 bucks annual. Also last night they announced a pipeline expansion project.

No upgrades or downgrades this morning so lets see if MLPS can start to trade away from the rest of energy.

Wednesday, September 20, 2006

The fed has done nothing which was expected so now we continue with MLPS down. Big caps continue to feed on the MLP index which is down 2.64 points. The XOI tried to make a stand at 1040 but it seems now that we have given up the ghost. Looking for a move to challenge the 1000 level.

Meanwhile i've been trading in and out of Regency Partners (RGNC) which continues to look like a breakout possibility but then just as it runs to 25 it pulls back to 23. So we sit here in this endless trading range but i still think this one has a shot for an upside resolution. I also took a position in Martin Midstream Partners (MMLP) for a trade.

Meanwhile i've been trading in and out of Regency Partners (RGNC) which continues to look like a breakout possibility but then just as it runs to 25 it pulls back to 23. So we sit here in this endless trading range but i still think this one has a shot for an upside resolution. I also took a position in Martin Midstream Partners (MMLP) for a trade.

Big cap MLPS are taking the index lower again as the overall market rallies. Energy Transfer Partners (ETP) is down 1 and change. Is it because its anticipating a stock offering because of the new aquisition? No news on it. Energy Transfer Equity is flat to up a few pennies.

Some breaking news this morning on Crosstex Energy LP (XTEX) as they say they are restating earings for the first 2 quarters. The stock has been down, then up, and now its down 75 cents. The company says no restatement required for Crosstex Energy (XTXI). Meanwhile Plains All American Pipeline (PAA) says its earnings will meet the high end of expectations. The stock was up 50 cents initially but now its flat on the day. Oneok LP (OKS).is down another 60 cents with no additional news there. Copano Energy (CPNO) is down 1.35. No news there. I put the chart up on Copano yesterday as a breakout possibility but i was leary on this one because of the lack of volume.

The XOI is desperately trying to hold the 1040 area as it is now down 5 points after being up a couple earlier. Volitility is the name of the game these days. Crude Oil is holding 60 bucks at least so far today.

Some breaking news this morning on Crosstex Energy LP (XTEX) as they say they are restating earings for the first 2 quarters. The stock has been down, then up, and now its down 75 cents. The company says no restatement required for Crosstex Energy (XTXI). Meanwhile Plains All American Pipeline (PAA) says its earnings will meet the high end of expectations. The stock was up 50 cents initially but now its flat on the day. Oneok LP (OKS).is down another 60 cents with no additional news there. Copano Energy (CPNO) is down 1.35. No news there. I put the chart up on Copano yesterday as a breakout possibility but i was leary on this one because of the lack of volume.

The XOI is desperately trying to hold the 1040 area as it is now down 5 points after being up a couple earlier. Volitility is the name of the game these days. Crude Oil is holding 60 bucks at least so far today.

Big cap MLPS are taking the index lower again as the overall market rallies. Energy Transfer Partners (ETP) is down 1 and change. Is it because its anticipating a stock offering because of the new aquisition? No news on it. Energy Transfer Equity is flat to up a few pennies.

Some breaking news this morning on Crosstex Energy LP (XTEX) as they say they are restating earings for the first 2 quarters. The stock has been down, then up, and now its down 75 cents. The company says no restatement required for Crosstex Energy (XTXI). Meanwhile Plains All American Pipeline (PAA) says its earnings will meet the high end of expectations. The stock was up 50 cents initially but now its flat on the day. Oneok LP (OKS).is down another 60 cents with no additional news there. Copano Energy (CPNO) is down 1.35. No news there. I put the chart up on Copano yesterday as a breakout possibility but i was leary on this one because of the lack of volume.

The XOI is desperately trying to hold the 1040 area as it is now down 5 points after being up a couple earlier. Volitility is the name of the game these days. Crude Oil is holding 60 bucks at least so far today.

Some breaking news this morning on Crosstex Energy LP (XTEX) as they say they are restating earings for the first 2 quarters. The stock has been down, then up, and now its down 75 cents. The company says no restatement required for Crosstex Energy (XTXI). Meanwhile Plains All American Pipeline (PAA) says its earnings will meet the high end of expectations. The stock was up 50 cents initially but now its flat on the day. Oneok LP (OKS).is down another 60 cents with no additional news there. Copano Energy (CPNO) is down 1.35. No news there. I put the chart up on Copano yesterday as a breakout possibility but i was leary on this one because of the lack of volume.

The XOI is desperately trying to hold the 1040 area as it is now down 5 points after being up a couple earlier. Volitility is the name of the game these days. Crude Oil is holding 60 bucks at least so far today.

Good Morning. Starting off today with the charts i could not post yesterday. To update Energy Transfer Equity was one of the few stocks in the group that closed higher yesterday on volume as it is in breakout mode. Could see a run to 30 or so.

Now back to this morning where oil is rapidly approaching 60 dollars and could see a 5 handle on it later today. Stock futures are higher and 10 year rates are favorable so its a question of whether MLPS can detach from energy.

We have some corporate news leftover from last night. Valero LP(VLI) is buying a refinery in Louisiana which will immediately add to cash flow. This might be a sign that Valero is on track for the 3rd quarter and could boost the distribution; which is key on getting the stock price to breakout of this 49-52 range its been in. Also Hiland LP (HLND)priced the ipo of its general partner last night...offering fewer shares at the mid range. This should free up HLND for a short term rally. No upgrades or dowgrades this morning so far.

So we begin another day. I successfully day traded Crosstex (XTXI) and Natural Resource Partners (NRP) yesterday and will be looking for opportunities again. Back to the XOI chart above; it is trying to hold at this 1040 level but a drop to 1000 or even piercing it is not out of the question.

Tuesday, September 19, 2006

MLPS start the day lower being weighed down by a 1.50 loss for Oneok Partners. Some news last night after the close seems to be the driver here as the company settled a rate case and agreed to a 5% rate reduction, and this morning we had a shelf filing to sell additional securites. Natural Resource Partners is also down another 75 cents after losing 2 yesteday as it continues to feel the sting of a downgrade.This has the MLP index down 75 cents which is off the days lows.

The XOI index is trying to bottom here but I wonder if it will hold. Certainly an arguement can be made for a run back to 1000 on the XOI where some support exists.

Meanwhile here are charts that are showing potential breakouts to the upside. Energy Transfer Equity seems to be in breakout mode an a move to 30 seems in the cards.

Also a the top of its chart is Copano Energy although i'm less confident on this one since its been holding this area for awhile and there has been no big upsurge in volume.

So overall a negative start but nothing catastropic. The 10 year yield drop today on good PPI numbers bodes a positive for a better close.

I'm having problems posting charts so as soon as that problem is rectified i will add charts

The XOI index is trying to bottom here but I wonder if it will hold. Certainly an arguement can be made for a run back to 1000 on the XOI where some support exists.

Meanwhile here are charts that are showing potential breakouts to the upside. Energy Transfer Equity seems to be in breakout mode an a move to 30 seems in the cards.

Also a the top of its chart is Copano Energy although i'm less confident on this one since its been holding this area for awhile and there has been no big upsurge in volume.

So overall a negative start but nothing catastropic. The 10 year yield drop today on good PPI numbers bodes a positive for a better close.

I'm having problems posting charts so as soon as that problem is rectified i will add charts

Monday, September 18, 2006

Its one of those days where the AMZ MLP index is being weighed down by the big caps like Oneok LP, Energy Transfer Partners, Natural Resource Partners and a few others which are down solid fractions. The index was down nearly 1 but not has rallied back to being down about 30 cents. Most MLPS are actually higher today. News that the BP Pipeline shutdown will continue until perhaps mid 2008 caused shippers and anyone involved in shipping or moving energy products to turn higher. General Marine (GMR) and Martin Midstream Partners (MMLP) are both up major fractions after being flat to down earlier. XOI now up 22 points.

Not much else happening as we reacting to what the rest of energy is doing. 10 year rates higher today but off the highs.

Not much else happening as we reacting to what the rest of energy is doing. 10 year rates higher today but off the highs.

Good Monday Morning.

Boy is it quiet this morning...no news and only one move in upgrade downgrade land where Buckeye Holdings is started at buy from our friends at Key Banc. So we watch this morning as everything that was down last week (Oil, Nat Gas, Gold etc) is up and visa versa (Bonds and Stocks initially). MLPS are higher this morning as the MLP index is up 12 cents (whoppee!). Holly Energy Partners, Sunoco Logistics, and Regency Partners are up nice fractions. Natural Resource Partners (NRP) is down 70 cents after being down 1 and change Friday on an anal-ist downgrade.

So we seem to be in pre-fed mode and the usual nonsense that goes with that. We'll check in later this morning to see if we have added to gains or changed direction.

Boy is it quiet this morning...no news and only one move in upgrade downgrade land where Buckeye Holdings is started at buy from our friends at Key Banc. So we watch this morning as everything that was down last week (Oil, Nat Gas, Gold etc) is up and visa versa (Bonds and Stocks initially). MLPS are higher this morning as the MLP index is up 12 cents (whoppee!). Holly Energy Partners, Sunoco Logistics, and Regency Partners are up nice fractions. Natural Resource Partners (NRP) is down 70 cents after being down 1 and change Friday on an anal-ist downgrade.

So we seem to be in pre-fed mode and the usual nonsense that goes with that. We'll check in later this morning to see if we have added to gains or changed direction.

Friday, September 15, 2006

Oil closes flat...the 10 year closes flat...the Big oil stocks are down slightly...and MLPS are basically flat going into the last hour. Not much happening really...most MLPS opened where they opened this morning and have spent the day near those levels. Lets see what happens as we get to the close and the S&P 500 gets rebalanced.

We have cross-currents in the market place. Crude oil is down with a 62 handle...Nat gas was down to 4.70 before turning around to 4.94. The XOI is down but not by much and the ten year yield is down. So all of this and you have MLPS mixed with the AMZ MLP index pretty much at the flat line or a few pennies lower.

Energy Transfer Partners and Energy Transfer Equity are the 2 big winners today on its purchase of Transwestern. ETP is up 50 cents...and ETE is up nearly 1. Natural Resource Partners is down 1 and change on the A G Edwards downgrade.

Energy Transfer Partners and Energy Transfer Equity are the 2 big winners today on its purchase of Transwestern. ETP is up 50 cents...and ETE is up nearly 1. Natural Resource Partners is down 1 and change on the A G Edwards downgrade.

We have some breaking news this morning as Energy Transfer Partners (ETP) is buying Transwestern Pipeline. This is a big deal...a 1.4 billion dollar purchase and immediately accretive to shareholders.

CPI numbers were benign..0.2%. Ten year rates down to 4.76 and dropping. Stock futures have turned nicely higher.

CPI numbers were benign..0.2%. Ten year rates down to 4.76 and dropping. Stock futures have turned nicely higher.

Good Friday Morning! The big economic number this morning is the CPI so we wait for 8:30am to see what 10 year rates will do.Meanwhile we have Philip Berleger on CNBC who is predicting a collapse in Oil prices and gasoline prices. Interesting persepective in describing the hedge funds that have sold puts to oil and gas companies that hedge their production...that they will now have to cover those puts by selling futures making for a downward spirial. I find it interesting how quickly sentiment has become so extremely bearish on energy. So lets see what the XOI index is telling

Looks to me like 1000 on the XOI is a key level that has to hold in my view. If that breaks then the stocks are telling you that the bull move of the last several years is over with. So how does it impact MLPS? Well one needs to remember that while traders will blindly sell (or not buy) all things energy when prices are dropping there is a point where MLPs will seperate and go their own way. Note the AMZ MLP index had diverged

MLPS are far more influenced by moves in the 10 year rate then moves in crude and natural gas and notice that MLPS have rallied back the last 2 days. We'll see how this plays out today.

We have a downgrade this morning from buy to hold from Natural Resource Partners (NRP) thanks to A G Edwards. Nothing else so far on the wire this morning and no corporate developements.

Looks to me like 1000 on the XOI is a key level that has to hold in my view. If that breaks then the stocks are telling you that the bull move of the last several years is over with. So how does it impact MLPS? Well one needs to remember that while traders will blindly sell (or not buy) all things energy when prices are dropping there is a point where MLPs will seperate and go their own way. Note the AMZ MLP index had diverged

MLPS are far more influenced by moves in the 10 year rate then moves in crude and natural gas and notice that MLPS have rallied back the last 2 days. We'll see how this plays out today.

We have a downgrade this morning from buy to hold from Natural Resource Partners (NRP) thanks to A G Edwards. Nothing else so far on the wire this morning and no corporate developements.

Thursday, September 14, 2006

We have big oil and gas selling off hard again so for those stocks it was a one day bounce. But MLPS are mixed to higher, the index is off its high but still up about 30 cents as we head into the last half hour. Buckeye Partners is the biggest winnner up 40 cents. Atlas Holdings is down 60 cents as the biggest loser. Everyone else is somewhere in between.

MLPS are mostly higher..The AMZ MLP index is up 60 cents so far today. Natural gas is at 2 year lows at 5 bucks...a far cry from nearly 15 last year at this time after the hurricane mess. Some of the stocks that were down yesterday are playing catch up today as Energy Transfer Equity (ETE) is up 22 cents, Regency Partners (RGNC) is up 15 cents (i profiled these in my previous post), Buckeye LP (BPL) and Atlas Pipeline Partners are todays biggest winners with fractional gains between 30 and 50 cents.

Meanwhile what goes with Crosstex LP? The chart below is inconclusive. I have noticed lots of shares getting moved around in the last week or so...especially here around 35.75. Not sure what this all means but will continue to be positive on the stock...and long it as well.

Meanwhile what goes with Crosstex LP? The chart below is inconclusive. I have noticed lots of shares getting moved around in the last week or so...especially here around 35.75. Not sure what this all means but will continue to be positive on the stock...and long it as well.

Good Morning.

On the assumption that we've made a bottom on Monday, reversal Tuesday and rallied Wednesday..will we resume the uptrend today that began in the AMZ MLP index back in late June?

I guess the first goal is to take out the 258 level and get back above the 34 day moving average. I still think that with the favorable rate enviornment we should challenge or even breakthrough the 275 all time high level.

Meanwhile some individual stocks to look at today. We'll start with Regency Partners (RGNC) which i thought was getting ready to take off a few weeks ago. The stock held the 89 day moving average although it was it bit annoying that the stock did not rally yesterday with the rest of the group. Still the stock seems to be performing in line with the group and i still think this one could break above 25 on the next up-leg.

Energy Transfer Equity continues to stil just under its breakout point and also did nothing yesterday. A dividend increase announcement should come any day and if it is not priced it, we could see this head for 30.

Please note that interest of disclosure i am long RGNC and ETE.

This morning its quiet in MLP land...no breaking news and no upgrades or downgrades to speak of. Crude is higher for the second straight day 10 year rates flat at 4.76%.

Wednesday, September 13, 2006

Solid gains across the boards at lunchtime. The AMZ MLP index is up 1.75 and we have a large slew of fractional gains. Those of you who grabbed Crosstex at 86 or less on Monday; you should be happy today as we're up 3 to over 90 bucks! Nice trade if you pulled it off.

Just a few losers on the list and all for pennies on minimal volume and nothing news driven.

Just a few losers on the list and all for pennies on minimal volume and nothing news driven.

Good Wednesday Morning! Looks like the signs that the Energy stock selloff ran its course (at least for now) when Oil dropped nearly 2 bucks but the XOI closed down only slightly. The MLP index turned higher late in the day yesterday and with rates droppping on the long end ....to me it looks like the correction is over. The daily chart is a little hard to read because of the tight range its been in for the last year.

The weekly chart to me is a bit clearer. To me it shows that we could be on the verge of another upleg if we break above 275 on volume. 255 provides support just above the moving averages that i use.

In news developements this morning we see nothing much. Some coverage action as Wachovia starts Valero Holdings (VEH) at outperform and Valero LP (VLI) at market perform. Magellan Holdings got an upgrade to buy from hold at Merrill Lynch.

Looks like a good start...lets see how it carries.

Tuesday, September 12, 2006

Hard for the energy group to make a stand when oil is down another buck and change as 65 bucks didn't hold and the rest of the market is moving higher. Still the AMZ MLP index is down just 13 cents while the XOI index of big energy is down 10. Oneok LP is the biggest winner today as its back over 55 dollars after a drop to 54 yesterday. Calumet (CLMT) and Energy Transfer Partners (ETP) are the biggest losers but only by 25 cents each.

Crude now down 1.80 with a 63 handle. XOI should be down much more than 9 points. Could a near term bottom be at hand..or are we headed to XOI 1000? MLPS need energy stocks to stablize so they can react to the positive rate enviornment.

Crude now down 1.80 with a 63 handle. XOI should be down much more than 9 points. Could a near term bottom be at hand..or are we headed to XOI 1000? MLPS need energy stocks to stablize so they can react to the positive rate enviornment.

Good Morning.

Starting the morning with some news from last night from Atlas Pipeline Partners (APL) and new hedges. Note as you read through the list you will find that these guys continue to hedge prices above today's...which is a good thing if prices for raw products hold here or drop further. I will go through the hedges and see if there are any issues.

Looks like we're dead cat bouncing this morning which is nice and so far holding on to or adding to initial gains...which is also nice. No breaking news. We have coverage started on Atlas Holdings (AHG) by Wachovia at an outperform. Stock up 54 cents on light volume. XOI and XNG indexes are higher so lets see if a bottom is in.

Crosstex (XTXI) is up 93 cents so far...was the bottom yesterday at 82?

Starting the morning with some news from last night from Atlas Pipeline Partners (APL) and new hedges. Note as you read through the list you will find that these guys continue to hedge prices above today's...which is a good thing if prices for raw products hold here or drop further. I will go through the hedges and see if there are any issues.

Looks like we're dead cat bouncing this morning which is nice and so far holding on to or adding to initial gains...which is also nice. No breaking news. We have coverage started on Atlas Holdings (AHG) by Wachovia at an outperform. Stock up 54 cents on light volume. XOI and XNG indexes are higher so lets see if a bottom is in.

Crosstex (XTXI) is up 93 cents so far...was the bottom yesterday at 82?

Monday, September 11, 2006

Crosstex (XTXI) drops to 82 this morning at the open...i decide to get cute and buy 300 shares before the open on the stock split news...just a small position...and got my head handed to me. Stock is around 85 right now. I will be adding to shares as this sell-off continues. Sometimes i never learn!

Meanwhile its down after 1 hour and 20 minutes of trading...AMZ MLP index down 1.20 and there are sizeable fractional losses. Oneok got a boost from Howard Wiel to buy but the stock is down anyway. Hardly a winner to be found as the XOI is down nearly 30 points or 3% which is taking anything energy down with it.

Meanwhile its down after 1 hour and 20 minutes of trading...AMZ MLP index down 1.20 and there are sizeable fractional losses. Oneok got a boost from Howard Wiel to buy but the stock is down anyway. Hardly a winner to be found as the XOI is down nearly 30 points or 3% which is taking anything energy down with it.

Sunday, September 10, 2006

What better way to start your day with the MLP index which on this weekly chart looks like its setting up for a blast through the 270-275 level even though we did experience a sharp correction late this week. I still think we are getting ready to move to new highs on this index in the next 3 to 6 months.

We have are charts here of Crosstex Energy (XTXI) with the daily chart above and the weekly chart sitting below

For those of you interested in trading this or establishing new long positions i think we are near a zone where new longs can buy. I think the 144 day moving average is about to be tested on the daily and the 34 week moving average to be tested on the weekly...so that puts the buy zone between 83.50 and 85. This stock can spike down very quickly to these levels and i will be laying several buy orders in this zone Monday morning. I prefer hard down opens to buy into. This is for the nimble among you and I know i run the risk of being wrong or missing it all together. But this is the world we live in.

Note here the extremely sad looking XOI daily chart which has broken down. Looks like we are near some sort of uptrend line where we could make a stand here...otherwise it might be a fast trip down to 1000. However look at the weekly chart below and it is far more constructive. In fact on the weekly chart we may be close to a bottom assuming its uptrend lines hold. Also you may have noticed how bearish everyone has become on Oil and Gas...especially Nat gas. All of a sudden gasoline is going to drop to under 2 bucks a gallon? Maybe...and then again...maybe not. The negative sentiment to me signals this ain't over yet.

The 10 year chart below has turned positive for MLPS and provides a tail wind of support despite the overall energy stock selloff. Look for the overall downtrend in rates to continue as the economy slows. If you go back to what MLPS did during the 2000-2001 recession..the index nearly doubled in price.

Anyway...happy reading and more to come as we head into Monday.

Friday, September 08, 2006

Its mostly down for MLPS so far today. Calumet Products Partners (CLMT) is today's biggest winner up a mjor fraction while National Resource(NRP) and Penn Virginia (PVR) are the biggest losers down major fractions. Everyone else is somewhere in between. Howard Weil starts Copano (CPNO) at a buy and the stock is up a small fraction. Its been in a tight one point range for weeks now. Breakout i think to the upside coming soon imho. Crosstex (XTXI) is under 87 bucks..getting extremely close to my buy area...hopefully a spike down to 85 will occur so i can pick up some shares.

Friday morning in MLP land and we are seeing a flat start to trading. Some of yesteday's losers are bouncing at the open, others showing small losses with the index down 25 cents. No news this morning but A.G. Edwards starts coverage on Valero Holdings with a buy and a 25 dollar target.

Crosstex (XTXI) at 88 this morning...still waiting for that one sell spike down.

Crosstex (XTXI) at 88 this morning...still waiting for that one sell spike down.

Thursday, September 07, 2006

Noticed while watching the tape this afternoon that they finally got around to selling a few of the recent better performers. Regency Partners (RGNC) ran to 25 this morning up 1.23 before selling off to basically flat on the day. And Crosstex LP dropped at the same time to 35.50 down 1. Both stocks sold off together which i thought was odd...perhaps somebody liquidating both positions at the same time? Used the opportunity to pick up RGNC for a trade...I am still long XTEX at higher prices but i've bought and sold it so many times recently i can hold it without sweating.

AMZ MLP index was down 2 points but has come off its lows slightly as energy stocks have stabilized somewhat...XOI was -11 earlier but was back to even as of 2pm.

AMZ MLP index was down 2 points but has come off its lows slightly as energy stocks have stabilized somewhat...XOI was -11 earlier but was back to even as of 2pm.

Here is the chart for Energy Transfer Equity (ETE) which I accidently left off my morning post.

A sea of red has taken over with the MLP index down 1.36 as of this writing. Crude stocks came in about as expected and nat gas showed higher builds. There was an inital small sell off in oil stocks and gas stocks...we'll see if there is any follow through. Sometimes stock anticipate these numbers

A sea of red has taken over with the MLP index down 1.36 as of this writing. Crude stocks came in about as expected and nat gas showed higher builds. There was an inital small sell off in oil stocks and gas stocks...we'll see if there is any follow through. Sometimes stock anticipate these numbers

Good Morning.

Letting the opening noise work its way through and no clear trend yet. Most MLPS opened lower with the AMZ MLP index down about 50 cents. Oil stocks also opened lower but the XOI has turned higher at this time. 10 year yield up a touch at 4.82% and there are no corporate developements to speak of.

Anytime now we should get distribution/dividend announcements for Energy Transfer Partners (ETP) and Energy Transfer Equity (ETE). Yesterday's UBS downgrade of ETP only knocked out 30 cents from the price on a day when the group was down hard. ETE looks like its trying to start another up leg to perhaps the 30 level.

Wednesday, September 06, 2006

An ugly day overall in MLP land. Fractional losses across the board with the bigger caps down harder like Enterprise (EPD) and Valero LP (VLI) down nearly 1 each. The AMZ MLP index is down 2.75 to 258 and change. The smaller cap MLPS are doing a little better and Copano (CPNO) is actually one of the few winners..up 26 cents. Big cap oil and gas down hard today with the XOI down nearly 3%

Good Morning! Blogger problems this morning so we have an initial late post. Inergy(NRGY) announced its boosting earnings for the quarter and the stock is up slightly (13 cents). Energy Transfer Partners (ETP) got downgrade by UBS from buy to hold and it its down slightly (24 cents). Overall MLPS are lower this morning pressured by lower oil and gas prices and a higher 10 year yield which is back over 4.80%. Board changes at Valero LP as it heads for complete seperation from Valero (VLO). Stock down about 30 cents. Enterprise Products Partners (EPD) is down 1.13 this morning but I don't see any news or headlines as to why.

Winners are few..Regency was up 26 cents but now is flat...and just a few issues are up small fractions.

Winners are few..Regency was up 26 cents but now is flat...and just a few issues are up small fractions.

Tuesday, September 05, 2006

Just one of those tight range type of days...can't seem to get going in either direction. As the late Ed Hart of CNBC/FNN use to say...a lot of tension on the tape building. Meanwhile MLPS are in the same tight range with everything else as we head into the close. Not much has changed since the last post. Just want to point out that a distribution announcement from Energy Transfer Partners (ETP) and Energy Transfer Equity (ETE) should be coming out any day now....might be the catylist for more upside in these 2 issues which have done quite well so far this year.

Kind of a strange day; probably because we're not quite back at full strength in the market place. There is a frenzy over the Gulf and Mexico discovery with Chevron up 2 and Devon Energy (DVN) up nearly 10 bucks. MLPS mixed to lower today with the AMZ MLP index down 50 cents. Martin Midstream (MMLP) Crosstex LP (XTEX) and Regency Partners (RGNC) are fractional winners. Valero LP is down 80 cents on the Sanders Morris downgrade and Crosstex (XTXI) is also down about 1.

Not sure what to make of this Crosstex (XTXI) chart which on the whole looks positive to me but i can't help but think we'll see one spike down to the mid 80s before a rally takes this over 100 bucks. Patience and nimbleness is required. I have some buy orders from 88 down.

Not sure what to make of this Crosstex (XTXI) chart which on the whole looks positive to me but i can't help but think we'll see one spike down to the mid 80s before a rally takes this over 100 bucks. Patience and nimbleness is required. I have some buy orders from 88 down.

Good Monday Morning after Labor Day...as things get back to normal lets look at a few things going on over the last 24 hours.

The Crude oil and nat gas charts below tell the story as they dropped yesterday in European trading and everything is sort of catching up today. News of the potential big oil and gas find in the Gulf of Mexico is pressuring prices. No hurricanes or tropical storms in the oil and gas region and a lot of supply and we're seeing new 10 week lows.

Meanwhile a few developments in MLP land this morning as Global Partners (GLP) has completed its aquisition of a terminal that will add to cash flow...and Inergy (NRGY) which has been busy lately buying up properties just bought another one.

In the land of upgrades and downgrades...Valero LP was downgraded to hold from buy at Sanders Morris and that is costing the stock 60 cents this morning. Not much else is happening. The AMZ MLP index is up 20 cents so far. 10 year yields are rising a couple of basis points but nothing overally tragic.

The Crude oil and nat gas charts below tell the story as they dropped yesterday in European trading and everything is sort of catching up today. News of the potential big oil and gas find in the Gulf of Mexico is pressuring prices. No hurricanes or tropical storms in the oil and gas region and a lot of supply and we're seeing new 10 week lows.

Meanwhile a few developments in MLP land this morning as Global Partners (GLP) has completed its aquisition of a terminal that will add to cash flow...and Inergy (NRGY) which has been busy lately buying up properties just bought another one.

In the land of upgrades and downgrades...Valero LP was downgraded to hold from buy at Sanders Morris and that is costing the stock 60 cents this morning. Not much else is happening. The AMZ MLP index is up 20 cents so far. 10 year yields are rising a couple of basis points but nothing overally tragic.

Subscribe to:

Posts (Atom)