Friday, March 30, 2007

Last hour of the first quarter...who knows what will happen!

Frankly neither chart thrills me at the moment for different reasons. Linn's chart looks okay but i wonder whether i may go lower in the short term. I don't want to buy too early and i'll wait to see what developes. If it where to get down to the 89 day moving average or lower it think it may be back up the truck time.

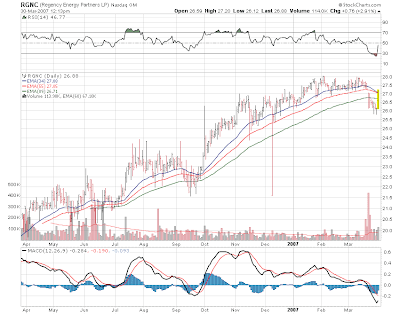

Regency is rallying today but sold off last week on a Citigroup downgrade. Now usually those moves don't mean much to me unless it were from A G Edwards...they have a good track record with MLPS....but the chart isn't screaming at me to buy it and i'm not one to buy on a news driven day like this one. So i will also let this one play out as well.

One thing i've learned with these is that opportunities always seem to present themselves eventually and patience is rewarded most of the time.

REGENCY EARNINGS ARRIVE

AND OTHER RUMBLINGS!

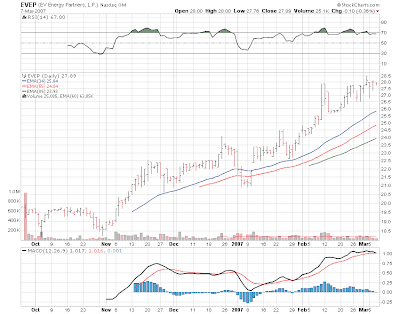

Friday morning brings earnings from Regency Partners (RGNC). The company was downgraded last week by one of the brokerages and did pre-announce earnings issues about a month ago. We'll see if its all priced in. Meanwhile we come to the end of a magnificent 1st quarter where the S&P 500 is essentially flat and the MLP index is up 11% with total return probably closer to 13%. And some individual issues are showing really solid gains of 20-30% or more like Linn Energy(LINN) and E V Partners (EVEP) for example.

So far no upgrades or downgrades.

Thursday, March 29, 2007

MLPS FIRMED YESTERDAY

END OF QUARTER APPROACHES

Linn Energy waited until the wee hours of the morning to finally put out the press release of its earnings. Its long and confusing and frankly i'll wait for another story to break it down to the nitty gritty. We also had distribution news from Energy Transfer Equity (ETE). This morning there are no headlines so far. Crosstex LP (XTEX) is having an anal-ist meeting today and the stock has rallied in the last week into the meeting. They better have some good things to say or at least be optimistic about future distribution increases to drive the stock back to its highs.

No upgrades or downgrades so far this morning . Crude is a little lower this morning after hitting 64 dollars a barrel yesterday. I'll update this post as the morning wears on.

Wednesday, March 28, 2007

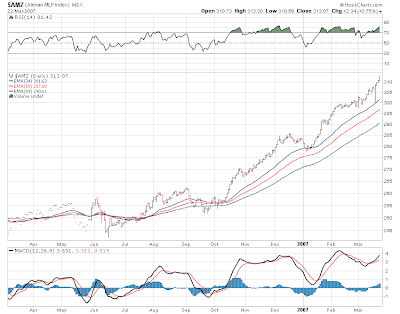

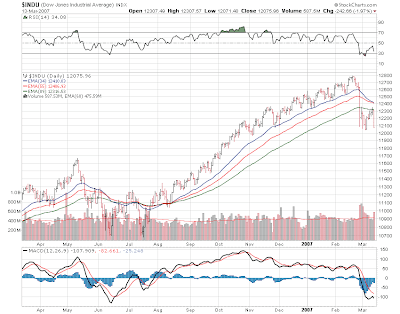

Hard to argue with this chart which demonstrates how much this group has outperformed the S&P 500....up over 10% in q1 vs a flat s&p. And don't forget the fabulous yield near 6% on average verses the S&P yield of 1 and change%. I'm wondering what kind of end of quarter distortions will occur tomorrow and Friday.

Trans Montaigne got cut to hold by UBS and its down 70 cents right now. Lehman starts Duncan Partners (DEP) at equal weight and its down 30 cents. Oneok LP (OKS) announces a new pipeline project. Stock is up 30 cents. Tortoise Energy Infrastructure (TYG) priced a 400,000 plus share offering this morning. Stock is down a fraction after being down a dollar yesterday. Linn Energy (LINE) earnings are out after the close today.

Berneke is speaking before the disgusting senators who used pork to buy votes at the expense of the soilders. Should be an interesting afternoon.

CRUDE UP SHARPLY ON IRAN WORRIES

MLPS DOWN 2 IN A ROW...CORRECTION (FINALLY?)!

Crude oil is up sharply this morning at over 64 a barrel as supply fears and Iran are driving prices. Stock futures are reflecting this as they are down about 5 points on the S&P in the pre-open. I would think that at least at the open selling should impact MLPS. Yesterday the group finished a little lower with a small loss on the MLP Index. Support on the chart sits around 300-305 area and the last time MLPS corrected down to the moving average support lines that i use (34,55,89,144). The last time we had a correction in the group was back at the end of last quarter and we are now at the end of the first quarter. It doesn't always happen the same way but sometimes it does.

Last night Legacy Reserves (LGCY) announced its hedging program into next year. It also revised earnings from last year due to some accounting errors regarding swaps.

I will be adding to this post as the morning wears on.

Tuesday, March 27, 2007

Overall there hasn't been much movement since this morning as the market overall has been holding minus 60 on the dow.

ENERGY TRANSFER BOOSTS DISTRIBUTION

Tuesday morning has us facing the harsh reality that...well...mlps just don't go up every day. The index had its first down session in the last 6.

No damage to the uptrend yet and we would need several days of selling to confirm any tyoe of short term correction. Pullbacks to the moving averages would be logical entry points and the weekly chart below is still in a strong upward thrust.

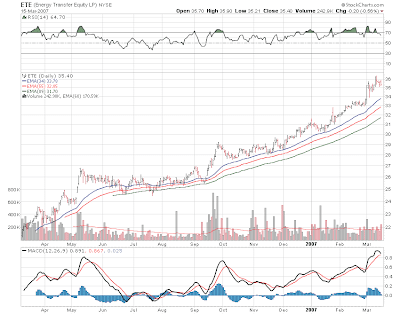

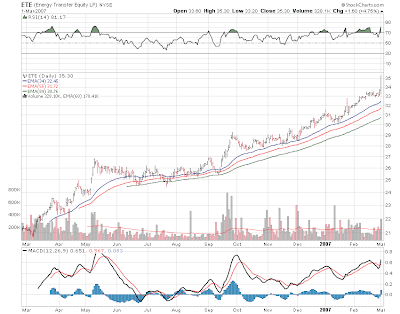

Last nights news from Energy Transfer Partners (ETP) should send shouts of joy from its unit holders as they have boosted their distribution for the umpteenth time in a row. And of course this will bode quite well for Energy Transfer Equity (ETE)when it announces shortly.

Last week Boardwalk Partners (BWP) did an 8 million share stock offering and notice the stock behaved as it should by pulling back right into its moving averages. It should move sideways for awhile as the offering is absorbed but the stock is acting well and it should resume its uptrend with the rest of the group.

Duke Midstream (DPM) is pulling back ever since it hit 40 and got downgraded by Citigroup last week. It has been bouncing off its 34 day moving average. The company did make an asset purchase a few weeks ago and did say it would sell equity to finance it. I'm watching this one for a trading opportunity but i'm a little leary until they announce whether they will do a stock offering or not.

Monday, March 26, 2007

Energy stocks turned higher and closed at the high of the day and the markets came back from a 120 point loss this morning to nearly unchanged. The undertone here is bullish. The question is whether MLPS are going to correct ot the support lines or was this just a one day pullback. More on this tomorrow. No news to speak of after the close.

Profit taking has set in on Global Partners (GLP) which ran to 35.70 before dropping below 33 and its down a point and change as the biggest loser. Enterprise (EPD) is a big component of the MLP index and its the main drag down 70 cents as of this posting. If the index closes higher today it will make 6 days in a row...if it doesn't it should be no shock since it can't go up every day.

MLPS SET FOR ANOTHER ALL TIME HIGH RUN

CROSSTEX PLACES PRIVIATELY!

Monday morning brings another higher open in the crude complex this morning with oil nearing 63 bucks a barrel. Nat gas is also a few pennies higher. Friday's big MLP rally came on the back of the move in anything energy so that seems to be the new short term driver. In the news this morning Crosstex Energy (XTEX) does a priviate placement of senior notes. Other than that its all quiet with respect to corporate news. No upgrades or downgrades so far.

I am working this morning so this is a quick post until i can get home and go through everything.rza

Friday, March 23, 2007

Enjoy the weekend with a very profitable week behind us. We should start looking for a correction soon in this astounding move from last October but we'll let the charts tell us if and when.

Thursday, March 22, 2007

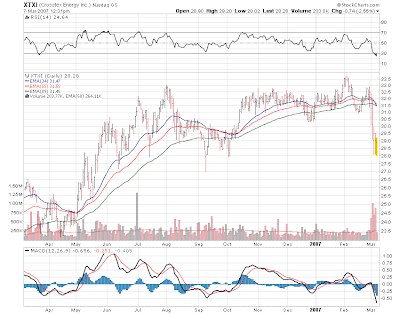

Friday has arrived and we are shooting for our 5th up day in a row. There is no corporate news to move the group along this morning. We do have Goldman Sachs upgrading Crosstex Energy (XTXI) to a buy from a neutral. The stock has been trying to hold the 28 level as support and that appears to have been successful so far. Looks like the Goldman goose should bring this one up a bit today. AG Edwards is downgrading Penn Virginia Holdings GP(PVG) from buy to hold. Goldman also reiterates its buy on Buckeye Holdings (BGH) and raises its price target there by 2 dollars to 25 dollars.It is reiterating its neutral stance on Enterprise Holdings (EPE) and Valero GP (VEH) although it is raising its price targets on both issues.

Here are the daily and weekly chart of the AMZ MLP index. I would just like to point out something first on the daily chart.

Notice that it has been 3 months since we last touched the 34 day moving average. That bar down a few days ago is an error. We did not trade near 300 this week at any time. So I think we should at least begin to prepare for some sort of short term correction in the group that could come at any time. I want to emphasize however that i believe that it would be just that...a short term correction similar to the late December early January move.

Meanwhile the weekly chart shows no sign of a top which is why i would not be concerned about any pullback and that it would be another buying opportunity.

Crude is down this morning after yesterday's big rally. 10 year rates are sitting at 4.59% this morning after moving higher yesterday. Stock futures are flat pre-open. So sit back and lets work through the open.

Not many losers although Atlas Pipeline (APL) is down 50 cents. No news on this one. Looks like energy is carrying the group higher today as 10 year rates are soaring back to 4.60%

A day after the fed induced stock market rally and we sit this morning at new all time highs. MLPS are quiet on the news front this morning and quiet on the upgrades and downgrades. I can't even find any news from last night to blog about so. The energy complex is higher this morning and stock futures are higher. So i guess at least we start the day extending yesterday's gains. Usuallly in big stock market moves like yesterday we tend to lag a bit as money moves into more aggressive issues first. But yesterday's gains came with all time highs in the utilities so no reason to for our rally not to continue.

You just can't argue with this chart.

Wednesday, March 21, 2007

Blogging is a little light today as i had to run around in Manhattan for awhile.

Wednesday morning begins with the MLP index just under the 310 level and at new all time highs. The day after day upsurge just keeps rolling on and frankly a few days of downside would be welcome for those of us who wish to add to positions or start new ones. Nonetheless the rally that began last October shows no signs of abating.

Crosstex LP (XTEX) announced last night that it will be holding its annual anal-ist conference late next week. This will probably seen as a positive since its earnings report has put the stock on the defensive. I suppose they would have cancelled it if they did not have some positive things to say for later in the year and next year. A relatively new ipo is Legacy Reserves (LGCY) and they came out with lower earnings last night but they also are buying up some assets that will be immediately accretive to earnings and will also bring a higher distribution but the company does not say by how much.

Citigroup is downgrading Duke Midstream (DPM) from a buy to a hold. It is also downgrading Regency Energy (RGNC) from buy to a hold. Friedman Billings is reiterating Legacy Reserves (LGCY) as a buy and is raising the price target to $29 from $27 dollars.

The fed will be center stage today so trading will probably come to a grinding halt around around or just after lunchtime.

Tuesday, March 20, 2007

A few losers but not many today. List is pretty much the same as earlier although most of the issues are off their lows of the day.

For whatever reason Goldman Sachs needed to remind us about how it feels on all the MLP's it follows. It was neutral before today on Enbridige Energy Partners(EEP), Energy Transfer Partners (ETP), Magellan Midstream (MMP) Oneok Partners (OKS) Plains All American (PAA) Suburban Propane (SPH) Sunoco Logistics and TC Pipelines (TCLP). It is still neutral on all of the above. It does like Enterprise Products Partners (EPD) and reiterated a buy there. It had sells on Teppco (TPP) and Ferrellagas (FGP) and reiterates those. AG Edwards reiterates a buy on Trans Montaigne (TLP).

Prices are higher as the index nears the 310 level up 1.40 on the day so far. Lots of winners all up major fractions to a point. Losers are few. Martin Midstream got a downgrade from RBC Capital Markets and Boardwalk is doing its stock offering and they are both down major fractions but off their lows. Btw a correction from earlier as the fed is having a 2 day meeting so no results until tomorrow.

Meanwhile the chart looks like a coiled spring ready to blow higher. 33-34 is the range and support lies just below in the 32-33 range. It might be time to go shopping here again imho of course.

Another all time high with a 1.49 gain in the MLP index and focus is on the fed today so i thinkwe'll just plod along as we have been lately until 2:15pm and then we'll get it out of the way. Meanwhile this is really worthwhile as i posted it last night. Its a panel discussion on MLPS that took place at the MLP Investor Conference 2 weeks ago. Find some time to listen to it. It is most informative and very bullish long term. Also you can listen to the individual company presentations.

Crude is higher this morning and stock futures are playing either side of unchanged at this time. The open approaches.

Monday, March 19, 2007

Still waiting on earnings from Linn Energy. Will post when they hit the wire.

Btw lately mlps that have done stock offerings have seen their stocks sell-off only slightly as demand for yield here appears to be very strong. Check Buckeye Partners (BPL) which did an offering in the last 2 weeks and the stock price is holding close to 50.

Trans Montaigne (TLP) is down 67 cents on Fridays earnings report. Also General Marine (GMR) and Williams Parnters (WPZ) are down fractions. Much of the other losers are under 25 cents.

EARNINGS NEWS ON LINE AND TLP

AND GLOBAL PARTNERS MAKES A BUY!

A new week begins and we sit near all time highs but the market has some support this morning so we should at least open higher. Still no sign of any topping action in either the daily or weekly chart. The rally has been unrelenting since October with just that small crorrection at the end of December 06. I continue to believe that MLPS continue to benefit from yield compression on the 10 year rate%. So if the market selloff resumes at some point we remain a flight to quality destination.

Earnings are due from Linn Energy (LINE) and they are forecast to post 39 cents for the quarter. The stock looks like its getting ready to breakout again and remember they have already preannounced an increase to 2.07 annual for this quarter.

Meanwhile after the close Friday Trans Montaigne (TLP) announced earnings which have all kinds of distortions due to aquisitions. Remember they also have already prenanounced a distribution increase schedule for the rest of the year.

The upgrade downgrade list this morning is empty so nothing we can trade on there. BTW the UBS downgrade of Energy Transfer Equity(ETE) resulted in a 50 cent gain and a new all time high on ETE Friday. So much for their opinion.

The energy complex is lower this morning with crude down about 40 cents but energy stocks will probaly get more impact from the overall market performance than the weakness in crude.

So we wait for the open! Breaking news from Global Partners (GLP) as they make a purchase from Exxon and announce how they are going to pay for it.

Friday, March 16, 2007

Digging out of heavy sleet up here so i'll just wait for the March sun this weekend to get rid of this stuff. In the meantime why not start your weekend off with a little Stevie Applebee who is blogging today about insurance companies and other timely subjects. Venting is what Stevie does best.

Brietburn Energy Partners (BBEP) is the biggest loser as A G Edwards downgrades from buy to hold. This one has had quite a move since its ipo....its down about 50 cents. Oneok LP (OKS) Williams (WPZ) and E V Partners (EVEP) all fractional losers.

CPI basically in line market flatish to slightly lower on the futures right now. No other nwes and no other upgrades or downgrades.

Friday is finally here and the CPI number awaits this morning and that will be a market mover. We in MLP land start the day at new all time highs as our defensive nature continues to attract money.

UBS has downgraded Energy Transfer Equity from buy to neutral. The chart has been nothing short of stellar. A pullback to the moving averages would provide an entry point imho.

You can now access this blog at Masterlimitedpartnerships.net so bookmark it for those times when blogger.com has issues.

This is an early post and i will be adding to it.

Thursday, March 15, 2007

It should be working shortly....and its a little easier to remember!

Nice close near the highs of the day up 1.83 on the index. Lots of winners with strong fractional gains in Sunoco Logisitcs (SXL) Buckeye Partners (BPL) Valero LP (VLI) Boardwalk Partners (BWP), Atlas Pipeline (APL), Oneok LP(OKS) Inergy LP (NRGY) and EV Partners (EVEP) among others.

My eyes are on the tape for any after market developements.

Earnings due out tomorrow for Trans Montaigne (TLP) which has already pre-announced a distribution increase. Should be a stock mover imho.

Martkets showing a firm tone this afternoon which could mean they'll run em at the end of the day which would confirm yesterday's V bottom.

JUST OFF ALL TIME HIGHS.

Wednesday, March 14, 2007

A few of the bigger cap MLPS are down fractionally and that is weighing on the index. Hiland LP (HLND) is up 1..14 as the biggest winner today. Natural Resource (NRP) and (HORRAY!) both Crosstex's (XTEX,XTXI) are fractional winners.

Seatbelts fastened for the last hour!

Good Wednesday Morning! And thanks for the kind words from yesterday. My dad had to have a couple of stents put in and all is fine. He's home today and as good as new. Had to endure a hospital with no wi-fi and driving in rush hour traffic in nyc both ways which i'm not use to.

Anyway i did manage to keep my eyes on the sell-off yesterday which did not spread to MLPS until the last hour when the index went from being up 2 points to just flat on the day...and at the days lows.

The chart still looks fine but remember if the market sell-off continues or gets worse it will spread to us. The good news is that when that happens its almost always at the end of the market move. We're the last group to be sold.

This morning we have Goldman downgrading Holly Partners (HEP) and AG Edwards starting Duncan Partners (DEP) at a neutral.

Meanwhile if the sell-off continues it might be a chance to pick up a few bargains and LINE may be one of them. It looks like from the chart that this tight sideways correction should be coming to an end soon and ultimately should break to the upside...imho.

Futures for stocks are generally weak. Energy is up slightly this morning while 10 year rates are falling again in a flight to quality.

Tuesday, March 13, 2007

Monday, March 12, 2007

The losers list is dwindling down to a few issues.

Crosstex Energy (XTEX) looks like its re-resting its lows from 2 weeks ago and volume is drying up here so thats a good sign. The stock is down 80 cents. Martin Midstream (MMLP)and Energy Transfer Equity (ETE)..big winners last week are down 80 cents each. The rest of the losers list showing minor losses and nothing news driven.

Monday morning begins with with the energy complex selling off with Crude down 65 cents and Natural Gas breaking under 7 dollars as (guess what) winter is ending and 70 degree weather is heading for NYC for midweek. Also no additional cuts coming from OPEC so there is some pressure on prices this morning. Stock futures are a calling for a slighty higher to flat open and the 10 year gets underway at 4.58%. So with that backdrop we have no corporate news this morning.

Last week we had the Master Limited Partnership Conference in NYC. Reader Keith who happily posts in the comment section is sharing with us a link to all the reports on your favorite MLP. Lots of information here on many of the widely known MLPS and some of the newer ones. Big thanks to Keith for taking the time to post the link.

Anal-ists are busy this morning upgraing and downgrading. RBC Capital is reiterating an outperform on Copano )CPNO) and is raising its price target to 69 dollars from 64 dollars. Duncan Partners (DEP) is getting multiple nods this morning. Wachovia starts at outperform. Citigroup starts at buy and UBS starts at a neutral. UBS starts Boardwalk Partners (BWP) at a neutral.

I'm going to start searching and looking for related video links and posting them. So this morning on CNBC.COM the outlook for crude and energy,

Also we have this review of last week's markets.

And this perspective on what's going on today.

Iam going to be searching around You tube and CNBC to try and find the best of this stuff and i will post when i do.

Saturday, March 10, 2007

Friday, March 09, 2007

As always a few losers as Inergy Holdings (NRGP) is down 1.19 as the biggest loser. Some of the gainers of the last few days shedding small fractions.

Friday has arrived and its been a very interesting week. So lets cap it off this morning with earnings from Ferellagas (FGP) which look good...margins were good...and the company backs 2007 earnings forecast.

The chart is not the most inspiring in the group but there is a chance this could break above 23. might be nice if they decide to grow their distribution.

Speaking of growing distribution I want to go back to the 2 companies that announced deals yesterday. EV Partners and Duke Midstream. Both companies aquired assets of size and EV preannounced another distribution increase for the second quarter to be paid in August 07...although no specific amount was given. Duke Midstream bought assets from Anadarko Petroleum and gave a positive view but nothing specific. Now look at the day charts of both.

It took nearly 3 hours for money to come in and move Duke Midstream. It took less time for the reaction in E V Partners but you still had a good hour to pick up the stock fractionally higher from Wednesday's close before it had a big runup to 31. Amazing that this group has so few people paying attention to it that it can take so much time to run up a stock on good news. I'm sure that liquidity plays a big role as no one wants to run a big block at the market and drive up the price you want to pay but the stocks do eventually get to where they are supposed to go. As per the press release for Duke Midstream it is planning to finance the deal with an equity sale so be advised that a secondary may be coming here. EV Partners says it will finance the deal with its current credit facility.

Not much else going on this morning in corporate news and no upgrades or downgrade to speak of so its all about the employment numbers this morning and whether the market will continue its snapback rally out of a V-shaped bottom

We'll find out soon enough but if the numbers are very bad then we'll probably break down below last week's low and head under 12K (hopefully not in one day)...if the numbers are good then we take out resistance and start a run back toward the top of the chart. As Bette Davis said in ALL ABOUT EVE..."Fasten your seatbelts...its going to be a bumpy night!"

Just a few side notes...i've added the yahoo bar with news headlines. Just click on the MLP on the list to display headlines or just put in your favorite symbol. Also i will begin looking for relevant video clips for energy and stocks in our group. CNBC has this money and energy preview

Thursday, March 08, 2007

Losers are comprised of recent big winners like Martin Midstream (MMLP), Holly Partners (HEP), Williams Partners WPZ) and a few others...down fractions. It looks like the usual rotation that occurs in the group.

The index is right at 302.

We begin this morning with EV Partners (EVEP) which is buying new assets and it will be pre-announcing a distribution increase for the second quarter of 2007! They have in the past pre-announced its quarter 1 distribution increase from its current already pre-announced q1 distribution of 46 cents which is 6 cents higher that the 2006 q4 distribution of 40 cents! If you follow all that the stock should trade higher today. The company did not say what the new increase will be.

Also on a shopping spree this morning is Duke Midstream (DPM) which is buying assets from Andarko Petroleum.

Wednesday, March 07, 2007

Took a position in the last hour in Trans Montaigne(TLP) and Suburban Propane(SPH) for trading purposes. TLP broke out yesterday and should move higher from here while SPH is correcting into support after its breakout a few weeks ago. It seemed logical from here.

MLP RALLY YESTERDAYON FALLING 10 YEAR

WHERE TO FROM HERE?

Lets begin with the top headline as TransMontaigne (TLP) (I JUST LOVE THAT NAME!) pre-announces significant distribution growth...a 7 cent increase in q1 and another 3 coming down the road. The stock closed up 1 and change yesterday.

Nice looking chart as we broke out of a long base. So at yeserdays close the stock yields 5.6% which means the market has placed a premium on this when with respect to the rest of the group. It also means that this one is growing its distribution among the fastest in the group. Higher prices ahead imho.

Tuesday, March 06, 2007

We'll see if the last hour brings more strength or profit taking.

Copano earnings hit the tape after the close last night and the company continues to roll right along. Remember a 2-1 split is coming soon. Martin Midstream Partners (MMLP) also put out earnings numbers last night and they seem to look good as well. No clues on these 2 in the premarket.

No headlines to speak of this morning and no upgrades or downgrades. So a strong tape is our lead this morning. We'll see shortly if we move with everything else or correct from last week's mlp flight to quality.

Monday, March 05, 2007

Inergy Holdings which was up 1 and change Friday is up 1 and change to 44 and at new all time highs. Also Holly Partners is ripping higher by another point and another all time high. Most issues however are still down as the index is off 1.75. Hiland Partners (HLND) Plains All American (PAA) and Natural Resource Partners (NRP) are down about 1 point each. General Partners are losing fractions today as they correct from last weeks big gains but nothing of major consequence.

Monday morning sees the potential for a 100 point down open and the dow falling below 12000 so we could see some downside gap opens before some upside takes hold. Energy is down this morning across the board which might take big energy down but the selloff has priority and MLPS will react much more to the fall in the 10 year. This morning the rate sits at 4.48%. General Partners (GP's) did extremely well last week with new all time highs for Valero GP(VEH) and Energy Transfer Equity (ETE) and why not. You get yields in the 4 to 5% range and the market is beginning to pay attention.

Crosstex LP was one of the few MLP losers last week on so-so earnings...the prospect for a slowing of distribution growth (temporarily according to the company) and a host of downgrades. The stock use to yield in the mid 5% range which is inline with with the faster distribution growers in the group. But now the market has raised the yield to the mid to high 6% range which puts it more in line with the slower or nongrowers. I think the stock is probably fairly valued now between 34 and 36 and Credit Suisse this morning, which had the stock at underperform upgrades the stock to neutral. Considering that they were the only house at underperform in the last few months, their move has some value. Stock bidding higher in the premarket this morning by 50 cents. Being downgraded this morning is Atlas Pipeline Holdings by Wachovia from outperform to market perform. Stock has down well as it has moved from the low 20s to 26 or so.

It's always important to keep an eye and where you are so i give you 2 charts...one chart is nice looking and the other not so nice. Which one would you rather own?

Markwest Energy (MWE) has just come out with earnings which shows a doubling of distributable cash flow (DCF) and prospects going foward look very good. Copano Earnings (CPNO) will be out after the close today.

Friday, March 02, 2007

Both Crosstex LP (XTEX) AND Crosstex (XTXI) are getting slammed as the LP is cut from buy to hold at Wachovia, Raymond James, and Sanders Morris...so with that XTEX is down 2.60 but off the low and XTXI is also down 2 and change. A host of issues showing fractional losses.

There are a few winners today like Holly Partners (HEP) which is up 1 and change and General Marine is also up 1 and change. E V Partners is up 60 cents...and then we have a few winners showing gains of 25 cents or less.

Nervous times here as we head into a weekend. Last hour could be a mess!

Yesterday was an astounding day really for MLPS and their General Partners (GP's). The index opended down nearly 3 points and then staged a huge rally and closed up 2 on the day and at new all time highs. And there were big moves in the general partners of Valero (VEH)

and Energy Transfer Equity (ETE)

which were both up 1 point or more. And why not since they both have yields in the 5% or so range and who wouldn't take a 5% annual payout in an enviornment like this? So when someone asks you how are you braving this correction show them this chart.

And then respond by saying...What correction? Of course they are probably looking at this chart and asking themselves why i did not sell last week.

Now before we get too cocky here at some point if this selloff gets out of hand they will get around and start selling our group as well because when they have sold everything else and the market is still going down they will start selling the winners. But i don't think we're at that point yet. Also the good news is when they finally get around to taking down MLPS and their GP's it will be very close to the overall market bottom. They sell us at the end of a down move...not the beginning of one.

More selling will start today as stock futures are down about 60 points on the dow and 9 points on the S&P futures. Crude oil is flat to down slightly and bonds are up in flight to quality as the 10 year rate is down to 4.53%. So continue the same strategy of letting opening downswings as opportunities to pick of shares on the cheap.

No news this morning on the corporate front and no upgrades or downgrades. Markwest Energy LP (MWE) split 2-1 yesterday so don't panic...the stock was not cut in half.

Thursday, March 01, 2007

Crosstex (XTXI) has worked its way back to unchanged but Crosstex LP (XTEX) is down nearly 3 points and not far from the days low.

Crosstex (XTEX,XTXI) taking hits today with the LP taking it worse...down 2 points and change as a slowing distribution growth doesn't have holders happy...and they could do better elsewhere i suppose in the meantime. Crosstex (XTXI) was down over 2 points but has gotten most of that back at this time. Holly Partners (HEP) is the biggest loser other than Crosstex down 60 cents. Kinder Morgan(KMP), Alliance Resource(ARLP), and Energy Transfer Partners(ETP) are leading the way on the winners side with nice fractional gains.

While the overall market went back and forth yesterday in a 100 point range and closed well off its highs...and oil and energy stocks actually closed lower on the day, MLPS moved higher and finished just a few ticks from the high of the day and made up just about everything they lost on Tuesday( which was far less than the rest of the market). Yesterday's market bounce was anemic at best and stocks are starting the day weaker. If we are beginning a slow grinding sell off remember we are one of the defensive bond proxies that money will flow to. I see no reason to back off from a bullish position. In fact drama in the overall market will lead to 1 point or more swings in MLPS and laying orders a dollar or so under the market can lead to scooping up bargains.

Crosstex Energy (XTEX,XTXI) is out with earnings this morning and there are all kinds of distortions. The company did say it sees distribution growth slowing temporarily in 2007 and has suggested a distribution range for XTEX between 2.24 and 2.34 a share. At 56 cents right now we're at 2.24...so i guess by q 4 we'll be near .585 a share. The company trades at a 6% yield as of yesterdays close. For the GP XTXI the dividend is 88 cents right now and it sees the dividend between 88 cents and 98 cents in 2007.

Just want to point out that there has been some insider buying recently at Enterprise Products Partners(EPD) and 2 insiders have bought shares in Teppco (TPP). Also insiders have been actively buying Martin Midstream Partners (MMLP) for several months now.

Magellan Midstream (MMP) has audited its 2006 earnings and has issued a filing about this. The change is due to an accounting change. And for you options lovers the CBOE begins trading options this morning on Valero Holdings (VEH).

Nothing in upgrades or downgrades this morning. Stock futures are down 115 points on the DOW so it looks like we're headed back down to Tuesday's low and if you ask me i think we take it out and go lower. Again watch for any flight to quality and use patience to your advantage. Crude oil is a little higher this morning...nat gas a little lower.