Monday, December 31, 2007

Let me get back to fixing this mess.

Friday, December 28, 2007

Year end action continues and in that low volume selloff yesterday on the overall tape, MLPS rallied to the flat line in the last hour recovering from a point and half loss earlier. So i think the rally resumes today. We still have lots of year end distortions going on and Monday is the last day of trading for tax purposes. A few MLPS have not rallied yet such as Holly Partners (HEP), Penn Virginia Holdings (PVG) Constellation Partners (CEP) among others...and you can guess that i own all three although the PVG is one i have been buying over the last 2 days. So look for some catch up. I also bought Atlas Holdings (AHD) as this one will be yielding 6.5% going foward and is way off its high for the year which was around 46 so it has some headroom.

No news and no upgrades or downgrades. Stock futures are higher and bond yields are lower this morning. Energy is higher with oil over 97 bucks.

Thursday, December 27, 2007

On the losers list Williams Partners (WPZ) and Amerigas (APU) showing losses of 75 cents to 1 dollar. Inergy Holdings (NRGP) Quest Partners (QELP) Copano (CPNO) and Penn Virginia Holdings (PVG) are fractional losers.

Overall market down 130 on the dow but MLPS are holding up very well. Unless the market completely falls apart i would look for another MLP rally attempt this afternoon.

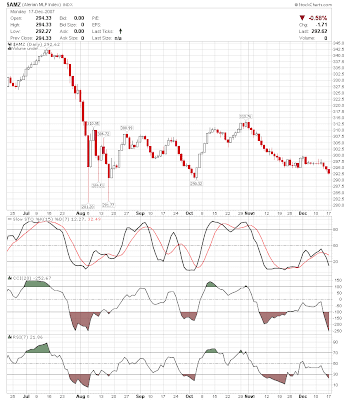

I figured it was time for a long and short term chart look just to set some perspective and you'll notice that in the longer term chart we have been in this corrective phase since August but look at the end of 2005 and its almost a carbon copy.

Back in '05 the rally began on 12/24 and it lasted into the mid Feburary, followed by a pause and then another leg. In total it was an over 30 point move from low to high or about 16%. Its never exactly the same but for laughs a perfect repeat performance would take us from the 290 low to possibly back to the old 342 high. Maybe a stretch but in the meantime we've turned and the path of least resistence is higher for now.

Short term the chart is bullish as we have come off a triple bottom and the first line to get through would be the 310-313 level on the index. Yesterday's action was impressive with the morning spend backing and filling and then the buyers arrived with both hands in the afternoon as we closed with an almost 3 point gain.

This morning we have some pressure due to geo political issues with the death of Bhutto in Pakistan. But we are in our own little world so after the open we should see the rally continue.

No news this morning and no upgrades or downgrades so bring on the open.

Wednesday, December 26, 2007

I'm sorry for the thin posts but i 'm on no sleep for the last 3 days as i have been working late night and early morning shifts which just kill me. So i can't seem to keep a thought in my head without it hurting badly. Tonight its back to normal sleep and i should be recharged and refreshed in the morning with a clearer perspective.

BTW some MLPS have not moved much yet and those include Atlas Pipeline Partners (APL) and Holly Partners (HEP). If we are re-playing 2005 Holly could have a big move in a hurry starting late Friday as tax loss selling abates. Not sure with Atlas but i added to my position today and i'm looking for this one to play catch up soon.

Welcome to all on this boxing day where i supppose many of us would prefer not to see anything resembling food after yesterday. And i hope everyones Christmas was a good one. We got a nice 5 point rally on Monday and we are now near 300 again on the MLP index and 10 points above the low of last week. Does it continue today? Sure as hell hope so. And while Monday's volume was not exactly inspiring all the year end pressure seems to have come off as i noticed on the tape that sellers seemed to have all but disappeared. There is lots of headroom here for mlps to run up before even coming close to being overbought. Take a look at DCP Midstream(DPM) which has rallied 8 points in the last 2 days once the sellers went away. Atlas Pipeline (APL) didn't start to move until Monday and Nustar (NS) is another one that has room to run. So i think we have the wind at our backs at least until year end. And today is the last day you can sell if you need your trade to settle in 2007.

No news that i can see so far. More later when i get home from work.

Friday, December 21, 2007

I'm starting to feel a little better as the mlp tape has a nicer feel to it. Certainly its better than anything we've seen in weeks.

Linn managed to get 40 cents of upside on the deal news (whoppee...duh!).

Never a dull moment around here and this really will be interesting for sure. We have Linn Energy (LINE) which is promising a 2.52 distribution on a 23.00 stock price and a going foward yield of 10.9% this morning announcing a deal of over 1/2 a billion bucks and its immediately accretive to cash flow. More importantly they specifically said there will be no issuance of equity which should make the market happy. Conference call this morning at 11am. The sarcasm in me wants to say "this should be good to knock off 2 or 3 points and take the stock down to 20" but always the optimist we may actually see this open (dare i say it) higher. It might be nice if they come out and re-iterate the 2.52 annual distribution for Q1. Or would that cause the stock to sell off? (i'm pissed off right now!)

Lots of MLPS had blocks of size move in the last seconds of trading yesterday which drove the index down to 289.89.

Its now or never here kids as we are at a critical place on the charts. We are back at the August and October closing lows but still above the intra-day lows set during the mlp crash on that one huge August down day. Either it turns in here and we repeat December 2005 when the bottom was made on Dec 23 or prepare for more pain. With the yield spread at nearly 300 basis points...higher than it was in December 05....the odds are certainly in our favor.

Effectively this is the last full trading day of the year. Next week its pretty much a week off for most people so i have to believe anyone who had to sell or move stock of size has already done so. Stock futures are strong; up 100 dow points. Energy is higher and bond rates are sitting at just over 4%.

Just letting you guys know after today i will not be blogging until sometime next Wednesday afternoon. Christmas makes for busy times around here and that includes 3 family dinners beginning sunday...3 masses where this tenor gets to sing...and i am working through all of this as well. So the blog gets a rest. Let me just extend to all of you readers and posters a very Merry Chirstmas. In my view wishing someone a Merry Christmas is to extend the highest blessings to you and your family regardless of your faith (or non-faith). Ian Rand use to say that when asked as an aethist what happens when you sneeze and someone says God Bless You. We've become a generic society. We don't take the time anymore to get to know people so we use these generic phrases when speaking. It keeps us at a safe distance from the outside world. Its time we take a look at the consequences of such action. Its not pretty. So have yourself a Merry Christmas, eat lots of food, be happy, and do at least one kind thing to someone you know and maybe to someone you don't know!

Thursday, December 20, 2007

Also if a recession is at hand could we have a repeat of 2000-2002 when MLPS rallied as everything else sold off? Does money flow out of everything else and head for high yielding defensive issues? The situation is not exactly the same as we had the tech bubble burst and we came out of a period then where unsexy stocks went nowhere for a long time.

I guess we'll find out soon enough.

The fat old bastard better have MLPS in his big red bag! Yesterday we went nowhere.

There are those who follow charts that might look at that triple bottom and say the end of this grueling period is here. Candlestick worshippers could look at that cross formation from yesterday as a bullish sign. We'll see. Nothing going on today corporate wise and no upgrades or downgrades so its year end stuff and options expiration that provides us with the main action today and tomorrow. Stock futures are strengthening this morning and it looks to me like the market wants to rally here. I went through the new lows list and did not see anything on there from yesterday so maybe some hope there. If this is like DEC 2005 then the bottom was either yesterday or today.

Wednesday, December 19, 2007

Looks like yesterday's reversal is trying to build this morning in the overall market albeit slowly. MLPS finished flat yesterday after being up 1 and then down 1. We have some news leftover from last night as Energy Transfer Equity (ETE) is announcing a 4 month distribution as they rework their fiscal calendar. Not much else going on this morning. New issue Quest Energy Partners (QELP) is getting outperform nods from Wachovia, RBC and Friedman Billings while Steifel Nicholas starts it with a buy.

I'm not going to read anything into yesterday's action and prefer now to let it all just play out. Day to day its torture sometimes watching all this but longer term...lots of gifts out there!

Tuesday, December 18, 2007

Semgroup Energy (SGLP)Partners is up 1 and change as the biggest winner. Looks like the list is split evenly between winners and losers. Hiland LP is down 1 and change as the biggest loser but on thin volume.

Fingers crossed that we made bottom.

Excuse me while i remain completely underwhelmed and head out to do pre Chirstmas stuff. I will check in later just for laughs!

I usually get very punchy after long stretches like this...and it comes close to a bottom when i don't want to watch anymore.

I was watching a few MLPS trade yesterday afternoon and i noticed some wholesale dumping of shares on some volume. It could be a climax in tax loss selling or perhaps not. Hard to say when the overall tape was under pressure. The MLP index is sitting now just a handful of ticks off the August lows in the 290 area.

Since November we've traded up on 8 days and down on 23. In terms of relative performance the big cap MLPS have fared much better then some of the newer issues and/or small caps. Still i have to believe the pressure comes off at anytime and when it does the bounce should be a nice one.

No upgrades or downgrades this morning and there are no corporate developements. I would expect things to be quiet on the news front until after the new year unless some stray equity offering comes along. over 2 billion is stock has hit the market this quarter which is a lot of pressure. Now with respect to the impact of the credit market issues we'll see if this move this morning by the European Central Bank this morning does something to bring risk takers back into the fold.

Headlines as they break. Stock futures are soaring this morning up 100 dow points. Energy is higher as well.

Monday, December 17, 2007

On the winning side Penn Virginia Holdings (PVG) is up 1.45 as the biggest winners. Otherwise the few winners on the list like Boardwalk (BWP) Holly Partners (HEP) and some others are only up small fractions.

I guess that is the case until proven otherwise. 10 trading days left in the year. I've given up trying to pick a bottom. 290 is the logical place on the chart

Trading is getting very thin out there so it won't take much to move prices in either direction. In 2005 where we had a selloff from July through December followed by a nice January rally MLPS bottomed around Dec 26th. I hope Citigroup is right since they are making the comparison that we could be seeing a repeat performance.

Two upgrades this morning with TEEKAY (TGP) getting an upgrade from FBR and Genesis (GEL) gets an upgrade from Wachovia. No other news this morning.

Friday, December 14, 2007

Morning headlines as Spectra Energy Partners is getting assets from Spectra Energy. Also new MLP Quest Energy Partners (QELP) affirmed its distribution in its 2008 capital budget.

We'll get a clue about this today after news last night that Omega Advisors bought Quantum's 4 million share stake. This yahoo message poster suggests that Omega has a long track record of being correct so we'll see. But consider this. Omega is getting 4 million shares that cost them about 23 bucks or so a share. If the Q1 2.52 distribution is correct they are getting a yield of about 11%. Would they have taken the stake if the 2.52 distribution were not going to happen? We've been saying all along that the market is telling us its either a screaming buy or that distribution is suspect and that a new position here could be a dice roll. The Omega purchase suggests the dice roll could have come up 7! Certainly the overhang of shares has just about played itself through as volume imploded yesterday and no visit to the new 52 week lows list.

If this is a typical Friday we won't see any major corporate headlines. Note Crosstex (XTEX) is doing a stock offering of under 2 million shares which by recent standards is small. No upgrades or downgrades so far but it's early.

Thursday, December 13, 2007

This may mean that all the selling is finally done! I hope! Also Crosstex LP announces an offering of shares. Also Eagle Rock (EROC) redid its financing which results in rates 100 basis points lower than previous and a 5 million dollar savings in interest.

The winners list has gotten a little longer with Energy Transfer Partners (ETP), Alliance Resource Holdings (AHGP) Constellation Partners (CEP) and Markwest (MWE,MWP) showing fractional gains.

The new lows list grew by a couple yesterday as Calumet (CLMT) Eagle Rock (EROC) Linn Energy (LINE) Williams Partners (WPZ) occupy space there. All but Linn Energy (LINE) so far today are on the list again. There are no news drivers this morning and no upgrades or downgrades so the year end selling continues. The MLP index is down 1.75 and sitting just above 295. The dow meanwhile is putting in a floor here and looks like it wants to go higher. Maybe we'll get some support later on...maybe not. The mood here is pretty dismal.

Very few stocks on the winner list. Linn Energy (LINE) is seeing a big drop in volume after yesterday's six million shares that crossed including one 4 million share block. I don't know if this means the overhang is over with. I've been fooled before. Nustar (NS) is down 1.21 as the biggest loser. Most MLPS are showing fractional losses.

Wednesday, December 12, 2007

New 52 week lows list includes Eagle Rock (EROC) and Linn Energy (LINE) which is now a 10% yield and yields over 11% for q1; both fractional losers today. Also down nearly 1 point are Hiland (HLND) and DCP Midstream (DPM).

Sunoco Logistics is up 1.20 and leads the winners list. Regency (RGNC) made another purchase today and the stock is up nearly 1 dollar. Fractional winners include Oneok (OKS) Crosstex (XTXI) and Boardwalk (BWP).

God knows how we will finish but i guess we have to bear in mind that the group still has lots of pressure on it and there are only 12 trading days left in the month after today.

I guess everyone is rushing to sell shares in equity offerings before the year ends and Energy Transfer Partners joins that party with a public offering of stock. The company however also issued guidance for 2008 which forecasts higher EBITA. Because the company is changing their fiscal year they are going to do a four month distribtuion to even things up. Reuters has a breakdown on the guidance increase.

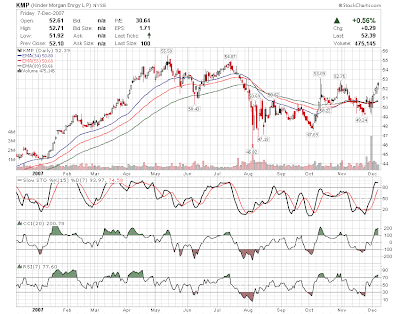

Meanwhile we are all recovering from yesterday's post fed collapse. MLPS closed flat on the index after being up most of the day. Actually the group performed quite well yesterday until the fed news and then the market wagged the dog. I think going into the meeting MLPS were acting like the fed action would have loosened up the siezed up credit markets and the gas came out of the bag when that didn't happen. Still the action yesterday especially in some issues like Kinder Morgan Partners (KMP) was very encouraging that the group sell off may finally be winding down. 13 trading days left for tax loss selling. And i have to think that Energy Transfer Partners (ETP) equity offering may be among the last offerings coming on. Once that is discounted we may finally get to move foward.

Stock futures are sharply higher this morning with the dow futures up about 100 points and S&P futures are up nearly 14 points so we are getting some bounce in here on news that the fed may have more tricks up its sleeve. Energy is a little higher.

Tuesday, December 11, 2007

fed announcement in about 35 minutes.

News this morning as Regency Partners (RGNC) buys some assets from GE which owns the Regency GP. They'll be paying for it by issuing some class D units so there is no immediate dilution. More shares may come to market down the road but at least not today. No other corporate developements so we can shift our attention to the Fed which will cut rates today by 25 basis points which looks like its baked into the cake and probably signal more cuts are coming down the road. MLPS have not moved at all in the last couple of weeks as the overall market as rallied nearly 900 points on the Dow. The selling pressure continues and as i have said before its probably a combination of year end selling, unabating stock supply coming to market, and the credit markets which are simply not functioning. Now perhaps if the fed moves bigger on the discount rate today to get the credit markets moving again we can remove what is probably the biggest headwind we are dealing with. In the meantime we just drip drip drip lower lower lower.

No upgrades or downgrades this morning. Stock futures are higher as is energy. Ought to be an interesting day.

Monday, December 10, 2007

Copano (CPNO) and Atlas Resource (ATN) are up just under 1 dollar apiece. Spectra (SEP) Atlas Holdings (AHD) and Energy Transfer Equity (ETE) are up fractionally as are Kinder Morgan Partners (KMP) and Martin Midstream (MMLP).

We'll look for a last hour push in the group. Meanwhile after today there are only 14 trading days left in 2007 for tax loss selling.

Sunday, December 09, 2007

Friday, December 07, 2007

Another day where the dow was up nearly 200 points. So we've had almost 400 points in 2 days and we are 800 points above the lows in August and November and MLPS are no where. My God even financial and housing stocks have been going up. How bad is that?

Stargas Partners (SGU) which pays no distribution and is in the heating oil business posts earnings this morning. This one is planning to pay a distribution next year based on its reorganixation a few years ago. Not sure how this report puts that prospect. No other news and no upgrades or downgrades.

My horse Farleyshelonwheels runs today in the first race at Aqueduct. Trainer says he's been kicking down the barn door wanting to run. Not sure of the competition but we are ready. Morning line is 4-1. I'll be at the race track for the 12:30 pm post.

Thursday, December 06, 2007

Williams successfully priced its offering of nearly 10 million shares so that's done. Also insiders are stepping up and buying Atlas Holdings (AHD) and DCP Midstream (DPM). Open market purchases are bullish. No news this morning and no upgrades or downgrades. Crude is down, nat gas is up, stock futures lower but not by much.

Here comes the open!

Wednesday, December 05, 2007

Meanwhile Williams (WPZ) Energy Transfer Partners (ETP) and Boardwalk (BWP) are the biggest drags down major fractions. Genesis Partners (GEL) is the biggest winner up 1 even though they are increasing their stock offering by 1 million shares. Oneok (OKS) is also a 1 point winner.

Index just slipped under 297. If i had to bet it closes lower.

Citigroup is upping Teekay LNG Partners (TGP) from hold to buy. Nothing else on the news front this morning. Stock futures are nicely higher and we should see a rally going into next week's fed meeting. Oil futures are higher on no OPEC cut.

Tuesday, December 04, 2007

Very few winners at lunchtime. Inergy Holdings (NRGP) is up 1.55 and Holly Partners (HEP) is up a small fraction. Legacy (LGCY) is up a few pennies along with Boardwalk (BWP) and Natural Resource Partners (NRP).

Ugly day and getting uglier but we are holding above 295.

Linn Energy (LINE) and Williams (WPZ) are down 1 point apiece. Lots of fractional losers. Meanwhile not many winners with Alliance Holdings (AHGP) up 75 cents as the biggest winner.

Oil down 1.43 and under 88 bucks now.

Which is nothing to sneeze at after the last few weeks of what seemed liked endless selling.

So do we have a triple bottom here on the charts? Well we always know those things in retrospect but at least some of the short term inidcators like rsi and the stocastics have turned positive. The first challenge is to get above those moving averages including the 200 day moving average which is above 305. We still have the headwinds of supply and it did not help that Williams Partners (WPZ) announced an offering of 9 million shares last night. But each day we are one day closer to year end and each day the headwinds are getting closer to being discounted.

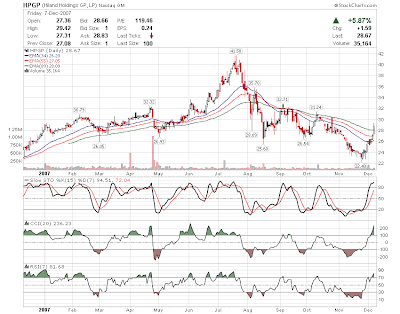

Wachovia this morning starts Sunoco Logistics(SXL) at market perform. No other news on the wire and no upgrades or downgrades. We have a filing at Hiland Holdings (HPGP) which shows one insider adding to his already large 10% stake with another open market purchase.

No other corporate developements this morning. Crude oil is down but off the lows this morning but natural gas is up a few ticks. Stock futures are lower as we head into the open. 10 year rates remain under 4%

BTW for those of you into charts and technicals here is a link to Barchart with some stats regarding the MLP index just to put things into perspective. Also Factiods has his November MLP summary up on his web site so take a look. Also one of this blogs regular readers has started his own blog so please visit and look around. Its always good to share ideas.

Monday, December 03, 2007

Action is looking bullish as we are seeing follow through to Friday's nice gain.

December begins and i guess it would be logical to assume that the recent factors putting pressure on the group will continue for a while longer. Tax loss selling probably will be a feature for the next few weeks. But there is light at the end of the tunnel and i suspect Citigroups call for a January reflex rally of 5% or more looks like a good possibility once all this short term bullshit comes off.

This morning we are lower by 1 point on the index.Hiland Holdings (HPGP), Williams (WPZ), and Alliance Resource (ARLP) are fractional winners. Brietburn (BBEP) and Markwest Hydrocarbon are 1 point plus losers and lead the way lower.

No news and no upgrades or downgrades. Oil and natural gas continue to sell off sharply. Stocks are a little lower.