DAN DUNCAN DIES

It is truly no exaggeration to say that Dan Duncan was the Warren Buffett of MLPS. He took 10,000 bucks and 2 trucks 20 years ago and turned it into a 30 billion dollar operation. The richest man in Houston died yesterday of natural causes at the age of 77. There are a number of stories on this. This one from the Houston Chronicle gives a good local spin to it. And the WSJ has its story as well. Both are worth the reads. The man was a class act. RIP. Other stories are here on on neat google page. As for the stock reactions this morning Enterprise (EPD) is down a nickle on its last premarket trade and no trades yet on Duncan Partners (DEP). The company release says there are no changes planned in the day to day running of the company.

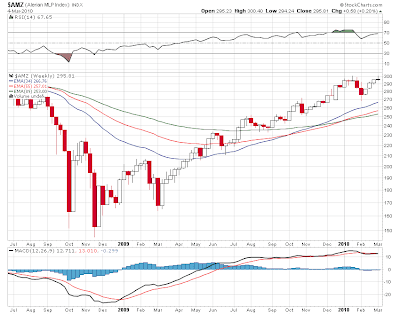

MLPS closed right on the 300 line yesterday with a 3 point gain. So its back to the top here. Atlas Pipeline Partners (APL) updates its hedge positions this morning. No other news on the wires and no upgrades or downgrades. Stock futures are flat this morning with crude up a little and nat gas down and continuing to drop away from the 4 dollar level. End of month and end of quarter nonsense continues with the tape showing a general upward bias.