ETP BUYS SUN!

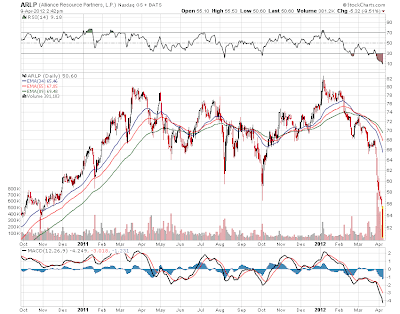

Short headline but right to the point this morning.Energy Transfer Partners (ETP) which has been a chronic underperformer in the mlp group made a big purchase today as it takes out Sunoco (SUN) for 50 bucks a share..1/2 in cash and 1/2 in stock. Both stocks are up on the news with SUN up nearly 8 bucks and Energy Transfer is up 1.60. Energy Transfer Equity (ETE) is up 1.92. The move diversifies ETP holdings and might be a driver in the stock price going foward especially in the NGL and logistics markets which have been quite strong. In face ETP is approaching a 52 week high and may challenge the top it made early in 2011.

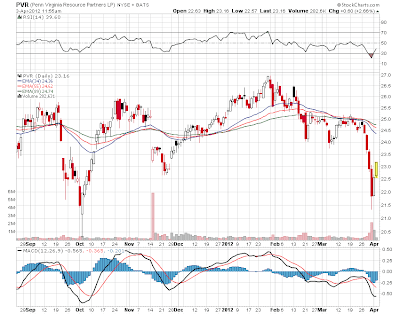

MLP meanwhile as a whole continue to hold their own in here although still off their highs. Markets are down today but the group is up 1.75 as of this posting. Earnings news from Holly Partners (HEP) and its one cent distribution hike was pretty much in line. So far except for Nustar (NS) which took a hit on its earnings, the corporate numbers have been typical of the group and distribution increases have been priced in.

410 on the mlp chart remains the near term challenge and 380 is the near term support. Neither side seems willing to give at this point so we will follow the overall tape and see where it takes us. We are into May where significant tops were built a year ago. So far it appears we may be following a similar path.