Monday, June 30, 2008

Energy Transfer (ETP) and Penn Virginia Holdings (PVG) are down nearly 1 point.Magellan (MMP) Plains All American (PAA) Nustar (NS) and Hiland Holdings (HPGP) are among the fractional losers.

In case you missed it crude oil dropped to 139 and change for about 12 seconds and then it was back up again shortly there after. Picking tops is a fools game as is picking bottoms. No greater fool than I!

SO GET READY!

And yes the scene is rather Macbeth=ish out there. The best that i can say about oil this morning is that Friday's print high of 142.99 has not been taken out yet but we are close and up over 2 dollars from Friday's close. It was(is) the worst June in the markets since the depression but as i pointed out to a friend last night its not as bad today as that June in the depression. MLPs about to retest the 275 low from January and we of course are always on alert for that elusive bottom.

Friday, June 27, 2008

The mlp index has just broken below 280 and is down 2 plus points. Oil is up and the markets continue to trade with every tick.

Actually when you look at the mlp list its the big boys again that are down fractions to a point. Let me point out for those of you holding Linn Energy (LINE) E V Partners (EVEP) and Constellation Energy Partners (CEP). You guys should be celebrating as each of these stocks is 6 to 8 points above its March lows and all 3 are either flat or slightly higher today. Also higher is Hiland Holdings and Inergy Holdings albeit on very limited volume.

Sunoco Logistics (SXL) Enbridge Energy Partners (EEP) and Energy Transfer Partners (ETP) lead the list of losers of 1 point or more.

USO and SPY continue to trade tick for tick.

Since it is end of quarter is it possible we are seeing run-ups in oil and nat gas specifically related to the trading of the 2 proxies that exist now...USO and UNG. Its an easy way for portfolio managers to show they own crude without actually having to hold the commodity. Just wondering here if whats happening here is a huge technically distortion as stocks are getting blown out from one side and being replaced by energy proxies on the other. Don't forget we have a proxy for coal (KOL) and a proxy for gold (GLD).

Food for thought...at much higher inflated prices of course!

142 this morning up 2.36 and the march higher continues. Its like Nasdaq in 1999! So after yesterday disaster we can look foward to another horror show today. Gasoline futures are at 3.55! Stock futures are a little lower at least to start. A bounce may come soon but if oil keeps going its going to get ugly again....whoops up 2.56 at 142.20!

Nothing on the news front this morning in MLP land . Western Gas (WES) gets an overweight from Lehman and a hold from Citigroup.

Unlike the trip down in March which was led by the mlps that were having private equity issues like Linn (LINE) Constellation Energy Partners (CEP)...those issues this time are no where near those lows. This time its the bigger boys like Kinder Morgan (KMP) Oneok (OKS) and the like taking gas. Bottom line its a bear market and until the oil bubble bursts the pressure will continue. The good news is we are not financials and we have the advantage of a nice yield check every quarter which lessens the pain. Its hard to be encouraging in here but you have to resist the temptation of looking at mlps in this prism and that their performance needs to be viewed relative to everything else. Okay we're not Potash but in the scope of things we're not nearly as bad off as so many others out there.

Stock futures are starting to weaken now...S&P down 3.40. The only thing left thats working is big energy and Ag stocks and the bottom of this selloff will not come until the last men standing finally rollover. So when you see Potash and the like drop 10-20 points...then you know the bottom may be near.

Thursday, June 26, 2008

I guess the first logical place for the MLP index to go would be to test that "v" bottom at 275 but if the overall market selloff keeps going that 262 low is not impossible.

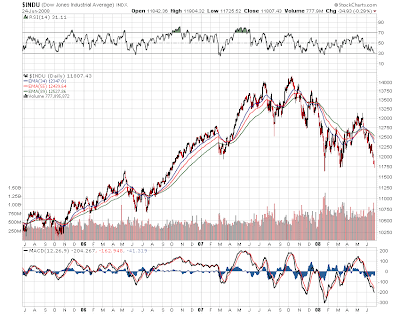

The dow chart is hideous and that "w" bottom in 2006 is probably the next logical level of support. That means a trip to 10,700 is not impossible and 10,200 is the next level of support beyond that.

The dow chart is hideous and that "w" bottom in 2006 is probably the next logical level of support. That means a trip to 10,700 is not impossible and 10,200 is the next level of support beyond that.

Crude meanwhile closed just above the top of this channel which technically is a breakout but i guess we'll know by tomorrow's action whether we head for points north of 140.

I don't know about you guys but frankly after today my hair hurts and my teeth itch!

Will watch for after hours developements. Oil close up 5 dollars just shy of 140 and we did make a new print high today. Looks like we can forget the island reversal and brace for 150 or higher.

The fed should have raised rates yesterday. But we probably would have wound up in the same place somehow.

A handful of winners. The Alliances (ARLP,AGHP) Atlas Resource (ATN) Exterran (EXLP) and Enbridge (EEP) all fractional winners.

Dow now down 240. Get ready for a bloody afternoon as all important lows are being challenged and taken out.

Just a thought.

Yesterday's fed meeting has become the focus of what happens when you say a lot of nothing to everyone. Now that everyone has slept on it we awake to a real mess this morning as stock futures which were weak going into the early morning trade have weakend even further. Remember a few days ago when i mentioned that the Hindenburg Omen had been triggered. That says that the probability of a 5% or more down move was high in the short term. And what better time than here at the end of the quarter where we might see this as a huge porfolio blow out.

Crude is up this morning but not by a whole lot for a change. We're still in that channel on the USO between 107 & 112 and no sign of a breakout or breakdown yet. The dollar is weak, gold is higher and nearing 900 again. MLPS are just going to follow the market at this point. No upgrades or downgrades and no corporate headlines.

Wednesday, June 25, 2008

MLPS off the lows as they rallied almost back to dead even as big energy rallied back as well but then came the sputtering and its back down about 1 point. Natural gas was down quite a bit today and under 13 bucks so nat gas mlp plays taking some hits. Constellation Energy Partners (CEP) is down fractionally. Linn Energy (LINE) is also down a fraction. Alliance Resource (ARLP) is down 2 plus points as the biggest loser.

No standout winners in the crowd either as we see a few mlps like Atlas Pipeline (APL) and Martin Midstream (MMLP) up small fractions.

Island reversal fans on Oil should note that we did not get one today however we are set up for one tomorrow if we get a gap down open and see selling accelerate from there. There is always hope.

Oil is down but well off its lows which took it down to the base of the channel on the chart which on the USO is at 106.75. That has got to break. No island reversal yet but we're setting up for it.

MLPS down wiht the index down a little less than 2 points as energy stocks are getting sold off on lower oil and nat gas. Dorcester Minerals (DMLP) and Alliance Resource (ARLP) are both down 2 points or more but they have had great runs in here.

More later after the fed.

Today's 2:15 ish decision and statement will be moving all the charts you see below. Not much to say about them that hasn't been said so many times. The dow chart looks like a horror show thats about to go from bad to worse. The 10 year rate chart is clearly in breakout mode. The dollar chart looks like a bottom and feels like a bottom. The Oil chart (USO) is in la la land. And of course our MLP chart which continues to mozey along on a path to nowhere

Citigroup is on the horn this morning as it upgrades Atlas Pipeline Partners (APL) to buy from hold. As i said a few days ago after the stock offering that the yield and price look attractive in here. Citigroup apparently agrees which may make you want to run for your lives. RBC leaves Global Partners (GLP) at market perform but lowers the price target.

Crude is down a little this morning while natural gas is down back with a 12 handle. Dollar a little higher ahead of the fed. I actually got up this morning at 4am and watch Jean Claude whats his name; head of the European Central Bank give his testimony before the meeting of the socialists. Rivetting testimony! How sad am i?

Tuesday, June 24, 2008

Dorchester Minerals LP (DMLP) is up another 75 cents to 35. Alliance Resource (ARLP) continues on its tear up 1. Nustar (NS) has moved back to near 50 and is up fractionally along with Calumet (CLMT) and Magellan (MMP) also fractionally higher.

Overall market went below the March low on the dow this morning when we were down 100 points. We're now up 25 on the day. So far just a dead cat bounce. Crude is down fractionally.

The answer to that question is...it depends. If the selloff in the markets gets serious as the day wears on then everything gets taken out although on a relative basis we should go down less. Thats my opinion. Crude at 138 this morning up another dollar and change. There are no corporate news drivers out there this morning and i think we are also seeing some end of quarter nonsense going on. Witness the run in energy stocks yesterday. I think people were falling all over themselves trying to get anything commodity driven into their portfolios. This use to happen on the last day of the quarter but they seem to be gaming the system early to avoid the eyes of regulators. To me it looks like we are going to new lows on the dow s&p etc etc. MLPS are 25 points above their lows as measured by the mlp index which was up 3 and some change yesterday to 289. Then of course there is the fed meeting and its not so much what they will do but what will they say in their statement.

Nothing on the upgrade downgrade list this morning. So unless something breaks we crawl to the open. Seatbelts fastened everyone.

Monday, June 23, 2008

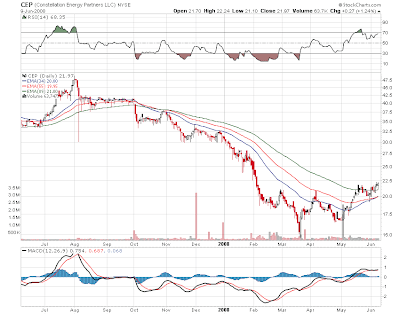

And frankly it looks much better to me. We have a nice double bottom..breakout from a cup and handle formation today as the stock is closing in on 23. Would like to see more volume but we'll take what comes. Moving averages have turned higher and crossing.

And frankly it looks much better to me. We have a nice double bottom..breakout from a cup and handle formation today as the stock is closing in on 23. Would like to see more volume but we'll take what comes. Moving averages have turned higher and crossing.

Fundamentally the company needs to boost the distribution in July or at least give some visibility about it. My bet here is it goes higher.

Still up 3 and change on the mlp index and near the highs of the day. Glory!

Dear Ben Bernake,

Be a lamb and raise the fed funds rate by 25 basis points.

yours

mlp holders

Sunoco Logistics (SXL) and Atlas Energy Resource (ATN) are down major fractions. Eagle Rock (EROC) is down 30 cents. A couple of others down samller fractions.

The dollar is very strong and driving down all commodities except for oil of course. Go figure.

Nustar was 47.70 when the famous idiot line was thrown...so far i'm up 2 points. Weeeee!!!!!!

Oil weakening, dollar stronger, stocks stronger as of this post.

We in MLP land where admittedly we suffer quietly with nice yields (unlike banks..no danger of distribution cuts) the chart sits a little better. which is sort of like comparing a second degree burn to a third degree. Still we are outperforming (going down less ) and thats a good thing. And if you are lucky enough to be holding any of the coal or resource mlps you are in a pretty good place.

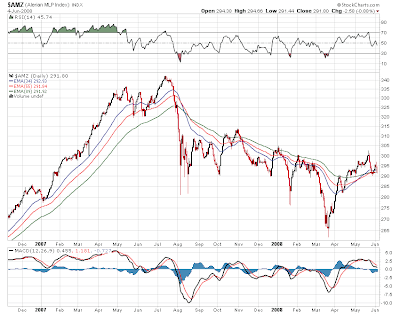

We in MLP land where admittedly we suffer quietly with nice yields (unlike banks..no danger of distribution cuts) the chart sits a little better. which is sort of like comparing a second degree burn to a third degree. Still we are outperforming (going down less ) and thats a good thing. And if you are lucky enough to be holding any of the coal or resource mlps you are in a pretty good place. I put the XOI chart of big oil to illustrate that big energy is showing signs of weakness lately and we may be following the stock market no matter what the energy complex does. Looks like a down close today for the XOI would point to lower prices for big energy stocks as a whole although admittedly the nat gas stocks are holding up better.

I put the XOI chart of big oil to illustrate that big energy is showing signs of weakness lately and we may be following the stock market no matter what the energy complex does. Looks like a down close today for the XOI would point to lower prices for big energy stocks as a whole although admittedly the nat gas stocks are holding up better. And lastly the USO which is a proxy for crude continues to trade above its breakout from 2 weeks ago. The potential for an island reversal continues but we're still waiting. BTW while i have been posting the dollar has strengthened considerably and crude oil which was up nearly 3 bucks at one point overnight is barely higher now by 55 cents. Hope springs eternal for a breakdown.

And lastly the USO which is a proxy for crude continues to trade above its breakout from 2 weeks ago. The potential for an island reversal continues but we're still waiting. BTW while i have been posting the dollar has strengthened considerably and crude oil which was up nearly 3 bucks at one point overnight is barely higher now by 55 cents. Hope springs eternal for a breakdown.

And can u imagine that even the mighty Saudi's can't seem to move the oil price. They have thrown everything at this including asking for tighter regulation and it does nothing. You can only watch in awe...like Nasdaq in 1999.

This morning MLP land is quiet and calm. No news..no upgrades or downgrades. 2 movers of note on Friday. E V Partners (EVEP) was down 2.50 on no news. Could have been some sort of option arbitrage or a position unwind. Nothing confirmed. Dorchester Minerals LP (DMLP) was up 3 dollars on nice volume and no news. Nothing that i could find here either other than perhaps a special distribution rumour.

Crude oil has just turned lower by 33 cents as gold is collapsing by 23 dollars. Maybe the key to all of this is a big dollar rally.

Friday, June 20, 2008

MLPs along with big energy are doing better than the rest of the market which means they are down less. The index is down just over 1 point as it has been for hours. Could be worse on a 220 point down day.

Watching the tape carefully.

Okay back to mlps Penn Virginia Holdings (PVG) Atlas Energy Resources (ATN) Enbridge Energy (EEP) Dorchester Minerals LP (DMLP) are fractional winners. On the losing side nothing outstanding; just small fractional losses on the board.

JPM just turned higher so watch for a rally attempt in here.

Some chatter last night about the Hindenburg signal being triggered which is a technical signal that doesn't happen too often but says that a 5% or more downside move is coming very soon. We'll see on that the tape does feel very weak

That dow chart looks pretty awful as it heads into the March lows. At least the MLP index is above those lows but we're not looking to hot either with this endless sideways movement plus or minus a few points of 290. But we're a long way from the March lows of 262.

Crude dropped 5 dollars yesterday but it remains in that island channel so the island reversal threat remains if we could ever get a gap down open below the channel and then some followthrough. Crude is up 87 cents this morning in the pre market and it was up yesterday until the China news hit just before the open. There is always hope. But remember that the direction of crude is not always the same as what the energy equity does.

<

This morning Citigroup starts Western Gas Partners (WES) at a hold. This new MLP has gotten a host of opinions all week long now that the quiet period is over. No other headlines so far but i will post before the open if anything hits.

Thursday, June 19, 2008

If oil is in for a selloff (and that is a big if) refiners are due for a nice bounce. In my never to be humble opinion of course. Went long some Tesoro (TSO) and Valero (VLO) july calls this morning.

Watch 132 on oil...if it breaks this afternoon look for a push at 130 where a break there could mean something more serious. If this co-incides with the stock market weakening this afternoon we could see energy take a beating. If you want to follow the USO the spot is around 107.30.

But then again i've been at this door many times in the last few weeks. Just when it looks like oil is about to crack..back come the buyers. Maybe the china news begins the process of letting the air out this bag.

And speaking of gasbags...Paulsen is pontification...lots of sound and fury...signifying not much.

Winners are a handful and nothing really impressive except for Atlas Pipeline Partners (APL) which is up 1 after completing its offering. Linn Energy (LINE) and Legacy (LGCY) are still benefiting from the Cramer Mad Money goose as they are up fractions. So are the Alliance's (ARLP,AHGP).

Crude down 2 bucks on China raising gasoline prices. If they can't at least prick the bubble on this news to start some sort of correction back to say......130 ( i don't ask for much) then in my view God must be long.

ATLAS PRICES OFFERING.

Legacy Reserves (LGCY) got a bit of a boost last night on Mad Money in the email segment which accounts for the 1.23 gain in that one in after hours yesterday. Nice to see someone is at least looking. Also this morning we have Atlas Pipeline Partners (APL) priceing its offering at 37.52. Stock is a little higher than that in the pre-market. At a 10% yield, the guidance boost, and the offering done , the downside here is probably limited. I picked up some additional shares in the pre market even as it sits with an ugly chart and a 52 week low. Just letting you guys know what i'm doing.

Not much else happening this morning. Stock futures are firming this morning and we may be going into options expiration/fed meeting next week with an excuse to rally. Oil is down a little this morning and nat gas continue to rally with a 13 handle. Dollar is stronger this morning which is a good thing. Nothing on the upgrade downgrade list so far this morning.

Headlines as they cross before the open.

Wednesday, June 18, 2008

Losers are extensive among the big caps. Oneok (OKS) is down 1.33 and is the biggest loser. Atlas Pipeline (APL) is down nearly 1. Plains All American (PAA) Williams (WPZ) and Energy Transfer Equity (ETE) among the strong fractional losers.

Here comes the last hour. Fasten seatbelts please.

THE CRAMER GOOSE

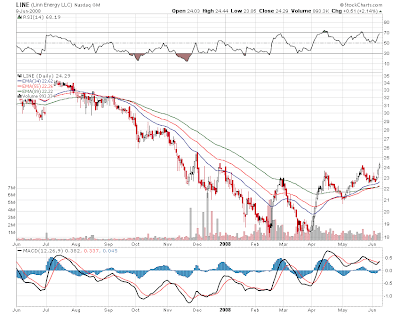

MLPS don't get mentioned too often on MAD MONEY but last night Jim Cramer did talk about it extensively and recommened the stock rather strongly. If you missed it here is the video from the CNBC website. The chart of Linn has bottomed and we have seen a nice recovery from the high teens to almost 25.

The stock traded activtely in afterhours yesterday right up until the 8pm close. Look for a good start here this morning.

Meanwhile we continue to wait for this island reversal pattern in crude oil to complete itself with a gap down open and followthrough. Hasn't happened yet but we continue to patiently wait.

Inventory numbers are due out today so they will be moving crude which is up this morning by 35 cents. Nat gas continues its rally and now has a 13 handle. Stock futures are weaker and this morning we have Royal Bank of Scotland (RBS) prediciting a 300 point decline in the S&P 500 from here as the world comes to an end. Love optimists!

Inventory numbers are due out today so they will be moving crude which is up this morning by 35 cents. Nat gas continues its rally and now has a 13 handle. Stock futures are weaker and this morning we have Royal Bank of Scotland (RBS) prediciting a 300 point decline in the S&P 500 from here as the world comes to an end. Love optimists!Western Gas LP (WES) which is a new MLP on the block is getting its first round of coverage by the brokerages. Credit Suisse says outperform, Citigroup says hold, UBS says neutral.

Atlas Pipeline Partners (APL) has broken down to a new low after raising guidance on Monday and announcing a 5 million share stock offering after the close yesterday to pay to unwind hedges. The stock dropped over 2 points to 38 in after hours yesterday. Why did the company wait 24 houts to announce the offering? Were they hoping for the stock to rise yesterday on the increased guidance on cash flow. That didn't happen as the stock was flat at best. Maybe the market smelled it out as it often does ahead of time and ultimately we would be at the same place anyway. Still it might have been better from a looks standpoint to do it all at once. Keeps the conspiracy theorists at bay. If any Atlas guys out there want to address this feel free to post in the comments section.

Tuesday, June 17, 2008

Penn Virginia Resources (PVR) makes another purchase of assets. Stock was a 42 cent winner today.

Losers are showing small losses with Atlas Pipeline (APL) Oneok (OKS) Alliance Resource (ARLP) and a few others losing 30 cents or less. Cheniere (CQP) is down 30 cents but thats a 3% loss there on 11 dollar MLP.

Overall market is weak with energy stocks as a whole showing some gains while oil is straddling the fence in here around 133 -34. Please break down already!

Crude down nearly 2 dollars at this time. The island reversal case is getting stronger but i don't want to speak too soon.

Of course in a perfect world i would be able to tell you the actual date time and downtick but sadly that is not the case. However we had an interesting day yesterday on crude oil which in NY trading opened on the high tick making a new all time print high of 139.89 and then sold off and closed just off the lows of the day. Note on the chart that the USO (Crude Oil proxy) has been trading outside the main channel ever since it gapped up 2 weeks ago on that one day spike to 139. If we can get a gap down open today we could complete an iisland reversal formation which is a very bearish pattern.

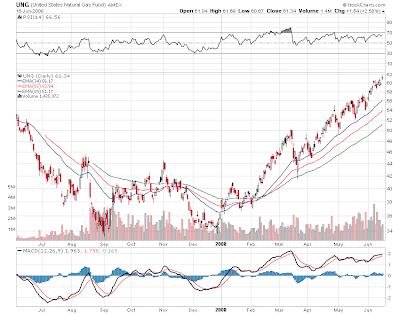

Meanwhile no sign of a top in the Natural Gas chart (UNG) which is still locked in a solid uptrend.

Meanwhile no sign of a top in the Natural Gas chart (UNG) which is still locked in a solid uptrend.

All of this action seems to be co-inciding with a potential double bottom formation in the Ultrashares Double short oil and gas (DUG) which follows the Dow Jones Oil and Gas index (DJUSEN). Sometimes the crude and the equities don't move in line but the signals are interesting.

And yesterday's news on Linn Energy where it sold some notes to pay down debt was met well by investors which took the stock up to 24.50 and the chart in my view continues to signal higher prices ahead.

And yesterday's news on Linn Energy where it sold some notes to pay down debt was met well by investors which took the stock up to 24.50 and the chart in my view continues to signal higher prices ahead.

The mlp index finished yesterday with just about a 2 point gain. We seem to be in this period of just boring sideways action with the occasional news item moving an issue here and there. We did get some news after the close yesterday on Atlas Pipeline Partners (APL) which is undoing some hedges and increasing estimates for distributable cash flow for the rest of the year. Since the company last year told us about possibly taking the distribution to 4 dollars annaul it would put the stock at a 10% yield. Should be a bullish driver. Magellan Midstream Partners (MMP) is settling a case with the EPA. The stock has languished lately as it settled above 36 yesterday.

Crude at this time is down 1 dollar as we approach the NY open. This could be the day we break the uptrend...short term that is. Stock futures are stronger this morning as it rallies on the back of Europe and ahead of Goldman Sachs and Producer Prices due out at 8:30am. This is an early post so i will be putting up any headlines as they break.

Monday, June 16, 2008

Losers are showing small drops of 30 cents or less except for Hiland Partners (HLND) which is down 81 cents but on only 2000 shares traded.

Crude has pulled back off the record print high but still showing a 2 dollar gain.

That sums it up really. The energy complex is higher even with the Saudi's saying they are going to boost production. What is the spin? Doubts they will be able to do it. So crude moves higher. Nat gas is strong this morning up 23 cents. We in MLP land continue to just get our tail wagged in one direction or the other as we straddle that 290 area. The dollar rally has stalled out this morning and that is really where the key to all this lies in my view.

News item this morning as Linn Energy is selling some senior notes in a private placement to continue reducing its debt. Also this morning Boardwalk Partners (BWP) has a 10 year commitment on its new pipeline. The company just completed a large 10 million share stock offering.

No other headlines and no upgrades or downgrades. Stock futures are a little weaker this morning. Crude has now popped up nearly 3 dollars and is approaching 138 a barrel. Could we spike over 140 today?

Friday, June 13, 2008

Its Friday and sunset racing at Belmont with post time at 3pm. So my vbf Stevie Applebee and I will head for the track to try and make some money. Meanwhile this morning a slightly hot CPI but the market i guess was looking for worse. Also of course food and energy don't count because so few of us eat or drive. The dollar is sharply higher again and that has put some pressure (i'm trying not to laugh here) oil which is down a dollar right now. MLPS were down yesterday to 288 on the index so its below 290 again. This time around the selling seems to be hitting mlps that were not hit as hard in March. Still pressure is pressure and the stronger stock market will give us an opening boost .

News this morning on Western Gas Partners (WES) which is a relatively new issue and it posts earnigns for the first time. No news on US Shipping (USS) which is running out of ticks here with the mlp down to 2.69 after losing another point and change yesterday. If you can't pay the distribution then your sharelholders say goodbye!

No upgrades or downgrades this morning. Back to the CPI; Rick Santelli on CNBC said about stripping out food an energy...my daughter would like her grade point average ex algebra! He is probably the best on CNBC.

Thursday, June 12, 2008

All of this course is playing havoc on the markets which have come off their high on stocks. MLPS are a little lower. Big energy is lower by 1% or so.

The shipping MLPS are getting hit hard again. US Shipping is under 3 now and down another buck and change; soon could be the only penny stock mlp! Teekay on its stock offering is also down 1. Plains All Americna (PAA) EV Partners (EVEP) Nustar (NS) Buckeye Holdings (BGH) Holly (HEP) and Oneok (OKS) all fractional losers.

On the winning side Alliance Resource (ARLP) is up another 2 dollars at 52 and change. You couldn't give this one away in the mid 30s a few months ago. Alliance Holdings (AHGP) is up 1. Buckeye (BPL) Eagle Rock (EROC) Natural Resource (NRP) and Constellation (CEP) are all small fractional winners.

Crude is now up nearly 1 and close to new all time highs again. Market continues to pull back away from the highs. You just get the feeling that crude oil wants to spike up to 200 don't you? And i wonder what that would do to stocks as awhole. Take a guess..it won't be pretty. But the market behavior i think is telling us that even the big energy stocks will go down from here along with everything else. And mlps will probably follow.

My bet today is that MLPS will follow the dollar higher and not follow crude oil and big energy stocks lower. Stock futures are stronger off that horror show yesterday in the overall market. MLPS closed flat yesterday and with the exception of a couple of issues most mlps didn't do much.

US Shipping (USS) finished the day down 3 dollars to just over 4 as it says it looks like the distribution will go bye bye and why hold an mlp if there is no payout. Also Teekay (TOO) picked yesterday to announce a stock offering after the close which accounts for the drop yesterday in that stock.

This morning we have no corporate headlines and no upgrades or downgrades. Crude is down nearly 3 dollars right now but thats off yesterday's 6 dollar gain. I guess we need to get used to these big multidollar swings.

It might be nice to see one of these guys do a deal or something since the news flow lately has been almost non existent.

Wednesday, June 11, 2008

Insider buys at Buckeye Partners (BPL) which has been hit lately with no news. MLP index is unchanged as of this post time as energy stocks are a little higher. Oil is a lot higher up 6 dollars on another bullish inventory report...or for that matter any excuse they can find rallies oil. The dow is down 150 and off its low of the day.

Alliance Resource Partners (ARLP leads the way up 1. Constellation (CEP Atlas Resource (ATN Energy Transfer (ETP) up fractions. Most mlps showing small moves in one direction or the other.

Since there isn't a stich of corporate news to trade on MLPS are getting tailwagged by the action in the rest of the energy stocks which were down 2% yesterday on their respective indexes. MLPS were down about 1% and are holding just above 290 although we got below that level yesterday

I'm not sure how tis will play. I think the bigger issue is whether the overall market heads down to the March lows for a retest or does energy sell off hard and we diverge from those bigger energy stocks. Of course this assume that crude goes down back below 120. I still think thats where we're going short term but who knows considering the mania in here.

The Dow Jones Oil and Gas index has pulled back to its moving average support and so far that is holding. The XOI index of big oil looks a little more suspect but that too has just moved back to its support lines. Watch the action in the equity to give out clues as to the overall direciton of crude.

The Dow Jones Oil and Gas index has pulled back to its moving average support and so far that is holding. The XOI index of big oil looks a little more suspect but that too has just moved back to its support lines. Watch the action in the equity to give out clues as to the overall direciton of crude.

So there you have it. A quiet start to stocks...oil up..no mlp news. Oil inventory numbers at 10:30am. Lots of fun ahead today.

Tuesday, June 10, 2008

MLPS down on the index by 2 and some change at just under 291. Energy stocks as a whole selling off today so it may be taking everything else with it. Winners list is thin. Most mlps down fractions to 1 point. Boardwalk (BWP) the biggest loser down 1 on the stock offering.

Another hot day in the city..90s one more time in NYC-land.

We continue to just muddle along here above 290 on the MLP index in what has been a long bottoming sideways process. And while the overall market is on its way to a March low retest we continue to hold above any breakdown point. Good sign.

Now while they are admittedly a long way off their highs i think we can take Constellation Energy Partners (CEP) and Linn Energy (LINE) off the "most hated mlp list" Check out the chart of Constellation which looks like it is breaking out of "cup and handle" formation which in the chart world is a very good thing! At least we are well above those teens we saw back a few months ago.

Now while they are admittedly a long way off their highs i think we can take Constellation Energy Partners (CEP) and Linn Energy (LINE) off the "most hated mlp list" Check out the chart of Constellation which looks like it is breaking out of "cup and handle" formation which in the chart world is a very good thing! At least we are well above those teens we saw back a few months ago. And Linn Energy (LINE) has very quietly made its way back above 24 and needs to clear 24.50 on volume which could push it back to the upper 20s in a hurry. Also here alot better than that trip into the teens.

And Linn Energy (LINE) has very quietly made its way back above 24 and needs to clear 24.50 on volume which could push it back to the upper 20s in a hurry. Also here alot better than that trip into the teens.

So we have the list of the 5 most hated mlps.

1. Calumet Specialty Products (CLMT)

2. US Shipping (USS)

3. Cheniere Energy Partners (CQP)

4. Nustar (NS)

5. Breitburn (BBEP)

Most hated does not necessarily mean these are bad investments longer term. In fact being on this list might be an indicator to put the mlp on your radar screens. For example Breitburn (BBEP) has quietly rallied back from its lows in the teens so it could be getting ready to drop off the list. Nustar was discussed last week as getting to a point where it may be all sold out. US Shipping and Cheniere i would avoid at this point because they have told us that the distribution may be at risk. Calumet (CLMT) is in the process of testing its bottom and it continues to suffer along with other refiners. If oil ever tops or heaven forbid actually goes down one day this one could benefit. Another one for the watch list.

Okay news items this morning as Boardwalk Partners (BWP) whose price has rallied lately from its lows of 21ish to 28 ish...has decided to come to market with a 10 million share offering. Stock was down 1 to 26 after hours yesterday. Also noted some small insider buys yesterday at DCP Midstream (DPM). Love those bullish open market purchases. Someone is putting money where his mouth is.

This morning oil is up (shocked), dollar is sharply higher (really shocked), nat gas is down a few pennies (just for laughs) and stock futures are down about 10 points on the S&P. No other headlines this morning and nothing yet on the upgrade downgrade list.

Monday, June 09, 2008

Penn Virginia Holdings (PVG) is up 1 and some change as the biggest winner. Atlas Resource (ATN) Linn Energy (LINE) Spectra Energy Partners (SEP) Targa Resources (NGLS) Alliance Resource (ARLP) among the fractional winners.

Boardwalk (BWP) Transmontiagne (TLP) Buckeye (BPL) and Boardwalk (BWP) among the fractional losers but nothing on volume or news.

92 degrees at noontime...heading for near 100!

And why shouldn't be after a rise as big as what a barrel cost about 6 yrs ago. But that is the market drive this morning along with Lehman so we follow along. MLPs last week actually held up well with everything going on. So we start Monday with a firm tone to the overall market and oil down 2 dollars...at least for now.

No news and no upgrades or downgrades for the individual MLP names. The open is coming so i'll wait for things to settle. Blogger issues this morning so i will post as long as its working.

100 degrees in NYC today making everyone miserable.

Friday, June 06, 2008

Nustar (NS), Magellan (MMP) Linn Energy (LINE) Boardwalk (BWP) Hiland (HLND) Plains All American (PAA) and Constellation (CEP) all fractional winners among others. Constellation (CEP) is breaking out of a cup and handle formation and is doing it on volume.

Losers are relatively contained so far but if this market sell off gets out of hand this afternoon i think we might see the selling spread into the energy stocks which in some instances has begun. So eyes are on the tape.

First off the MLP index yesterday closed up 2 points and some change which was okay but pales in comparison to the nearly 4% gain in energy stocks as a whole.

But the big story this morning is the parabolic move in oil which began yesterday when Oil was around 121. It has been nearly straight up since then as we closed yesterday around 128 for a 6 dollar gain. And it was the biggest one day dollar gain ever.

But the big story this morning is the parabolic move in oil which began yesterday when Oil was around 121. It has been nearly straight up since then as we closed yesterday around 128 for a 6 dollar gain. And it was the biggest one day dollar gain ever. And it continues this morning as crude adds another 3 dollars as of this post in European trading to 131. No news that i could find. Its not the dollar as its a little higher this morning. No supply disruption in the news. Its just totally insane. The chart shows a bounce right at support and the trendline but a 10 dollar rally in a matter of hours? This just has to be the last gasp in here. Is it a contratrend rally against the decline from 135 to 120 or are we still in this mega uptrend with no top in sight. I am still of the opinion that 135 was "the" top last week. But the action from yesterday makes you wonder whether it was just "a" top and not necessarily "the" top.

And it continues this morning as crude adds another 3 dollars as of this post in European trading to 131. No news that i could find. Its not the dollar as its a little higher this morning. No supply disruption in the news. Its just totally insane. The chart shows a bounce right at support and the trendline but a 10 dollar rally in a matter of hours? This just has to be the last gasp in here. Is it a contratrend rally against the decline from 135 to 120 or are we still in this mega uptrend with no top in sight. I am still of the opinion that 135 was "the" top last week. But the action from yesterday makes you wonder whether it was just "a" top and not necessarily "the" top.

This is an early post this morning so i will put up headlines as they cross. This is a busy day around here as i begin handicapping the race card for Belmont Day and will Big Brown become the first triple crown winner since Affirmed in 1978.

In case you missed it below is Big Brown's preakness win where he walked home to capture the second leg of the triple crown.

Now the only horse that maybe has a shot in here is Casino Drive off of this win in the Peter Pan at Belmont a few weeks ago.

If Casino Drive wins it will be the 3rd horse in a row to win the Belmont that is out of the same mare which is incredible from the breeding perspective. Jazil, Rags to Riches(filly), and Casino Drive are all half brothers and sister and share the same mother Better Than Honor. The pedigree is there for a mile and half, no question. But Casino Drive is very lightly raced, has never run 2 turns, and has problems with big crowds in Japan. And he will have 120k people out there screaming in 90 degree heat.

I think trading oil is easier!

Thursday, June 05, 2008

Dow up 130 but some financials hemmoraging or flat at best. Last hour as always a fascinating time.

Magellan Midstream had some fire issues at its Kansas City terminal but that seems to be resolved. I'm not sure if thats the reason why Magellan Holdings (MGG) took a hit the other day. Sometimes this stuff moves on this news and sometimes it doesn't. That takes care of the morning news as the corporate offices remain rather quiet in MLP land. A deal might be nice but otherwise its pretty quiet. UBS this morning starts coverage on Genesis LP (GEL) at...get ready folks....neutral.

Yesterday the MLP index took at hit as the XOI (big oil) dropped over 3%. As noted last night a few issues took 1 point plus hits but not everything in the group was down. The mlp index continues to base along. 290 is a critical place as always.. There is a firm tone in the futures this morning so i think we should see a firm beginning in the group.

Now as per crude using the USO we are at a place where you could have bought before and made money. First support here at 98 which in my view is not going to hold and we could be headed down to the lower moving averages at 90 or so which would correspond to 110 crude. Maybe not all in one day mind you and intraday rallies continue to remain probable.

Now as per crude using the USO we are at a place where you could have bought before and made money. First support here at 98 which in my view is not going to hold and we could be headed down to the lower moving averages at 90 or so which would correspond to 110 crude. Maybe not all in one day mind you and intraday rallies continue to remain probable. I posted last night that the Nustar charts are beginning to look interesting to me. Nustar (NS) and Nustar Holdings (NSH) are carving out what looks like a triple bottom and if oil comes off it would stand to reason that margins here could widen. Looks like Nustar has endured the same problems that Valero (VLO) and the other refiners have had to deal with.

I posted last night that the Nustar charts are beginning to look interesting to me. Nustar (NS) and Nustar Holdings (NSH) are carving out what looks like a triple bottom and if oil comes off it would stand to reason that margins here could widen. Looks like Nustar has endured the same problems that Valero (VLO) and the other refiners have had to deal with.

Constellation Energy Partners (CEP) came up to an important breakout point yesterday which is around 22 and got turned back but the selling was light and on miniscule volume. The chart to me looks like its going to breakout soon and a close over 22 on volume could set us up for a run to 25-27 in a hurry...no guarantees but i am long and it looks like the sellers are done here.

Constellation Energy Partners (CEP) came up to an important breakout point yesterday which is around 22 and got turned back but the selling was light and on miniscule volume. The chart to me looks like its going to breakout soon and a close over 22 on volume could set us up for a run to 25-27 in a hurry...no guarantees but i am long and it looks like the sellers are done here.

Wednesday, June 04, 2008

Well truthfully they all are interesting days; even during those watching paint dry moments. Crude Oil is straddling 124 with inventory numbers out at 10:30am. The overall market has been teetering on the edge with financials and their problems. Energy stocks have been selling off as we noted yesterday with a number of intraday reversals which are only relevant with followthrough. MLPS have actually been up over the last 2 days with relative outperformance. So as I said it should be another interesting day.

No corporate developements and no upgrades or downgrades on the list this morning. Natgas is down 10 cents and holding a 12 handle. So fasten seatbelts kids.

Tuesday, June 03, 2008

Also its encouraging with all the Lehman issues that MLPS are holding up far better than during the Bear Sterns collapse.

I discovered that my DUG position has effectively hedged the MLP portfolio so far. I am in the money now on my position and i'm looking for a run to 32-33 where i will sell. No guarantees but that is the plan of action as of this posting.

Bruce...you posted about Magellan Holdings which was down 1 (4%) today on no news. I couldn't find anything so it may be just one of those days. Nothing on Magellan Midstream (MMP) either.

Dow now down on the day. We'll see what the afternoon brings for us but 300 is a lot closer right now than 290.

Nat gas is leading the way here and is holding up other energy. MLP index up .50 in the early going here. Alliance (ARLP) is down 1 on profit taking after yesteday's 3 point + gain.

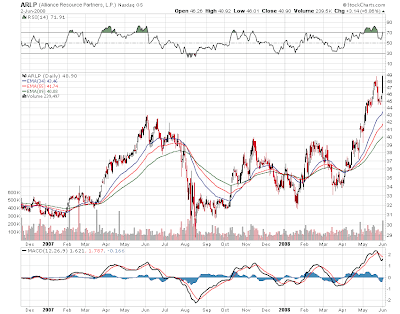

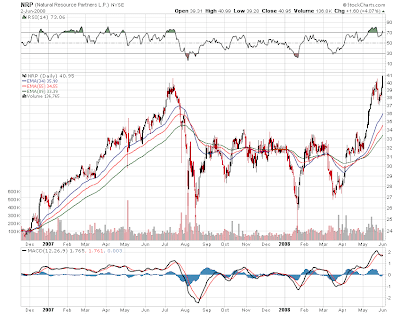

Coal has been the buzz word in MLP land lately as the 2 mlp proxies that have worked the best are Alliance Resource Partenrs (ARLP) and Natural Resource Partners (NRP) which are on the 52 week high list and have rip roaring chart patterns.

Alliance Resource Partners (ARLP) was up over 3 points yesterday on no news other than the fact that coal stocks were up sharply across the board. The momentum continues but just be careful as the pullbacks can be sharp and painful when they happen.

Alliance Resource Partners (ARLP) was up over 3 points yesterday on no news other than the fact that coal stocks were up sharply across the board. The momentum continues but just be careful as the pullbacks can be sharp and painful when they happen. And yesterday was an intersting day for the whole group as the overall market was under pressure from the financials...big energy was flat...and mlps were up nearly 1%. So we had a strong day of relative outperformance. For you unbelievers out there it can happen. Again notice that MLP chart seems to be moving in line with the breakout in the 10 year as rates rise.

And yesterday was an intersting day for the whole group as the overall market was under pressure from the financials...big energy was flat...and mlps were up nearly 1%. So we had a strong day of relative outperformance. For you unbelievers out there it can happen. Again notice that MLP chart seems to be moving in line with the breakout in the 10 year as rates rise.

All of this is dollar linked and the UUP is the Powershares Dollar Bullish and here we have a bottom forming and trying to breakout of its base. All of this is linked an i am inclined to have a bullish view for MLPS (more than usual) going into the summer. Barring a complete market collapse or a complete collapse in energy stocks (not necessarily the commodities)..i think we may get some nice relative outperformance in here. It might be considered a counter intuitive move in view of rising rates.

Monday, June 02, 2008

We seem to be led by the strengthening dollar and rising rates and not the collapsing financials. Maybe its a brave new world. But a close above 300 the index would encourage me...a 310 close and we'll be dancing in the streets.

Losers list today include Legacy Partners (LGCY) Penn Virginia Holdings (PVG) Hiland Holdings (HPGP) Energy Transfer Equity (ETE) all down fractionally. No big losers on the board today.

Keep an eye on the tape this afternoon because if the overall market weakness gets worse we could see it spread to the energy group which as already pulled back from the days highs.

There seems to be a view that this could be a big week with some markets teetering on the edge of making big moves. Probably the one chart that is the most ambiguous is the MLP index chart which continues to move in a sideways channel. The 290 level which has been support except for those few weeks of turmoil last March seems to be holding in here. Also the index seems to be moving in tandem with dollar strength and with the rise in rates. I know that the second one seems counter intuitive but when you lay the short term 10 year chart over the MLP index...they seem to be moving in line. Something to watch.

Meanwhile the dow jones index of oil and gas stocks is looking to do something as it moves with oil..which is down 1.50 this morning and under 126. Last week's low is near 125 and if that goes i think we could see a very fast and hard sell off.

The chart of USO which is a crude proxy could correct to 98 which i think would be close to 120 on the crude contract...i'm making a rough guess here.

The UNG which is the nat gas proxy and has been in an unrelenting uptrend would probably sell off if the rest of energy sells off hard. Also bear in mind that there is a difference between how the commodities trade and how the stocks trade as they do diverge on some days. But i would think that at least today they should trade in line.

Also bear in mind that there is a difference between how the commodities trade and how the stocks trade as they do diverge on some days. But i would think that at least today they should trade in line.

No corporate developements and no upgrades or downgrades this morning at least so far. Stock futures are down as financials are getting hit. Energy is lower across the board.