VIEW FROM THE JUNKYARD!

Weekends come and go and these days those are the only 2 days we don't lose money. Sunday at mass we offer prayers for the economy! Sunday family gatherings include discussions of government conspiracy; of those magical 5 guys in a room smoking cigars who intentionally drove oil prices to 140 and then with equal intent drove them back down to 60. Suck are weekends these days. Monday mornings come with futures showing 200 point down opens.

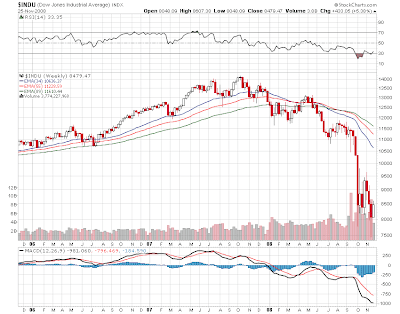

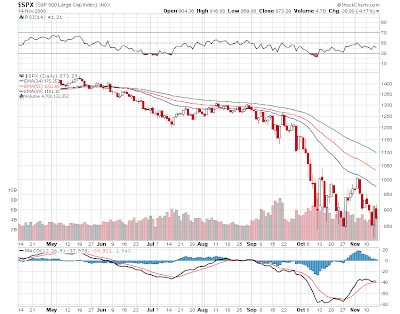

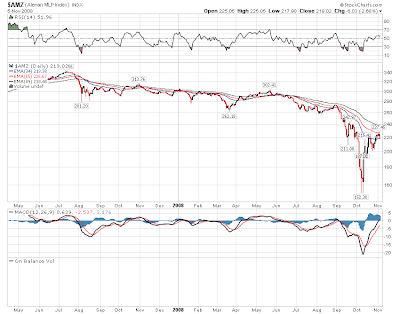

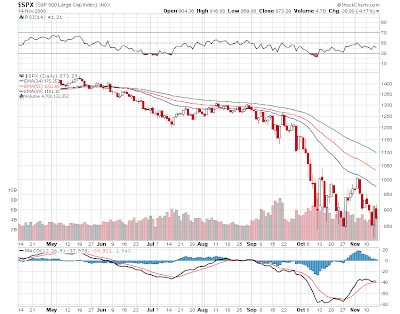

We're trying to carve out a trading bottom in here but it seems like we are destined to sweat out another trip down into the abyss first. We have to hold in here because if we break here then the markets are telegraphing that we are headed for a severe economic recession that will last for a long time. Maybe we will cascade into that elusive final capitulation...or not...who knows.

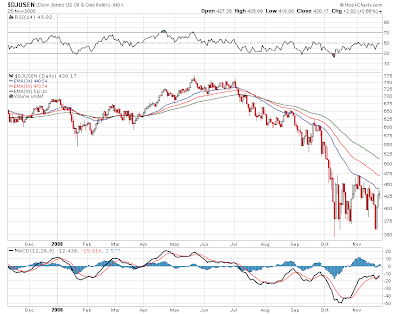

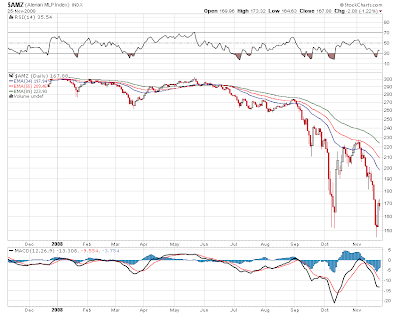

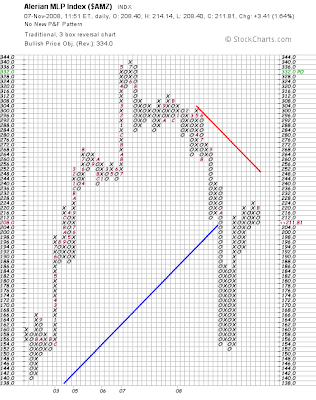

Rick Santelli on Friday evening put up a chart of junk bond yields sitting somewhere just under 20%. And then it hit me. That is what MLPS have become. Most are now trading at "junk" status and a few are yielding at "garbage" status.

Candlestick fans can see that doji hammer from last Thursday which is a bullish formation. It has not been undone by Friday's mess as we finished with just a 1 point loss.

News this morning as Crosstex LP (XTEX) and Crosstex (XTXI)

announce a sale of a non strategic asset. When you need to raise money...everything becomes "non strategic".

No other corporate developemests so far and nothing yet on the upgrade downgrade list.

Over the weekend i posted some changes. From here on if you want to post on the blog you will need to log in with some sort of id. All opinions are welcome and encouraged to be shared. But there is no reason here to hide behind a door in order to speak freely. This may result in few posters which will be disappointing but so be it!

Cold weather here in the Northeast for the whole week ahead and into next weekend. Should be supportive for nat gas and perhaps heating oil. Might be a driver for crude down the road but the cracking economy continues to be the primary driver of energy prices.