WORLD DID NOT END OVER THE WEEKEND!

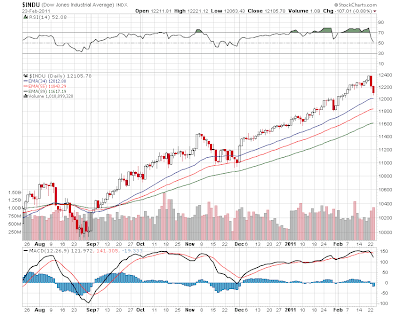

Given all the turmoil in the middle east i suppose it might be a surprise to some that the world did not end over the weekend. Markets seemd okay with going into the weekend on a firm note and since we're still here this morning, we are seeing prices firming in the futures. So looking at the dow chart, the rising moving averages and uptrend lines it appears that this melt up rally continues until something stronger than nations being set ablaze rattles the market. This is the 10th time since 1980 that oil prices have risen 10% in 2 days and in each case the market fell an average of 9% in the following 6 months. I hate to say this but..maybe this time its different...at least in the short term since markets just refuse to go down

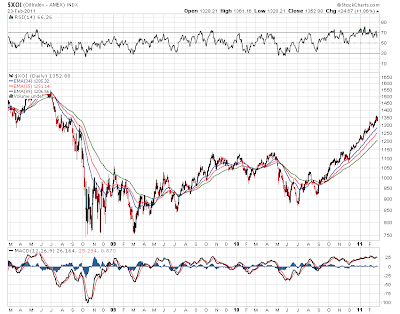

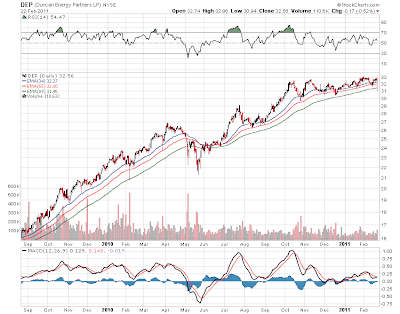

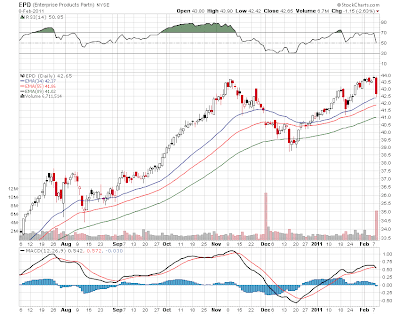

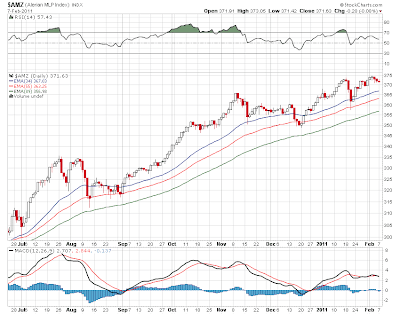

MLPS on Friday just ran from the get-g0 and closed at 380.35 up over 4 points and at a new all time high. I guess we are staring at the 400 level as the obvious place to go with market tailwind. The chart is breaking out here and relative strength is rising. Add to that market tailwinds and tailwinds in energystocks and you have a perfect recipe for a continued rise. Rising rates (in general) are being ignored. Inflation concerns are being ignored as well. So let the ride continue.

MLPS on Friday just ran from the get-g0 and closed at 380.35 up over 4 points and at a new all time high. I guess we are staring at the 400 level as the obvious place to go with market tailwind. The chart is breaking out here and relative strength is rising. Add to that market tailwinds and tailwinds in energystocks and you have a perfect recipe for a continued rise. Rising rates (in general) are being ignored. Inflation concerns are being ignored as well. So let the ride continue.This morning MLPS might have a little pressure from Kinder Morgan Partners (KMP) as the did an 8k filing saying they may offer to sell more shares from time to time. Not a surprise since the come to market every 6 months or so to sell stock so they are likely to do it again to take advantage of the high stock price. Markwest Energy (MWE) is going to announce earnings after the close today. Linn Energy (LINE) is annoucing 2 deals this morning and they are also doing a public offering of shares which will go toward paying for the new assets. The offering is rather large, 14 million shares worth are going to hit the tape. The stock has not traded yet but looks down under 39 this morning.

Lots of economic data due out this week including employment numbers on Friday so rates will be watched closely. Stock futures are at the highs now of the morning up 40 dow points. Crude was over 99 bucks overnight but has pulled back. Nat gas, shocking as this is, actually rallied strongly off the the long bottom it appears to be building. I guess selling for 1/25th the price of oil is attractive to some players. We will look for some followthrough today.