Sunday, February 28, 2010

NEW WEEK BRINGS LOTS OF QUESTIONS

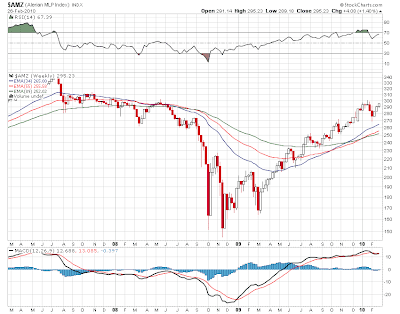

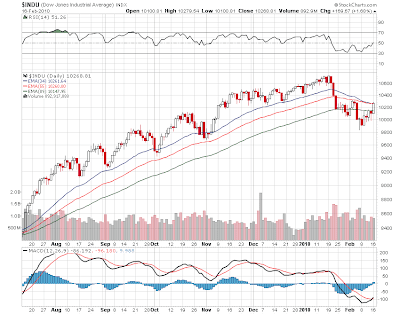

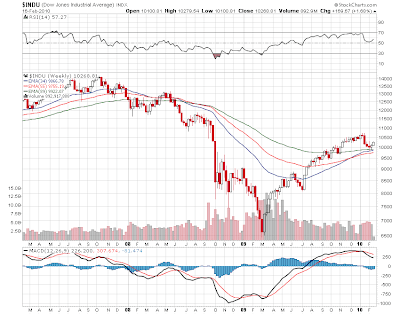

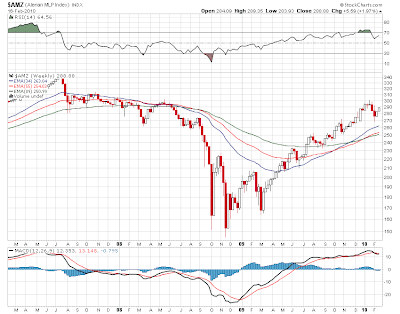

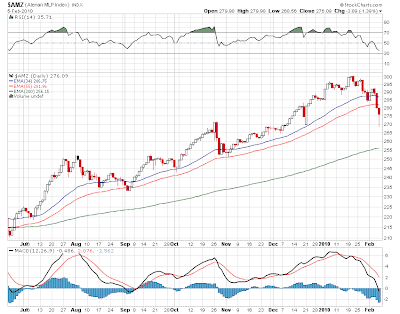

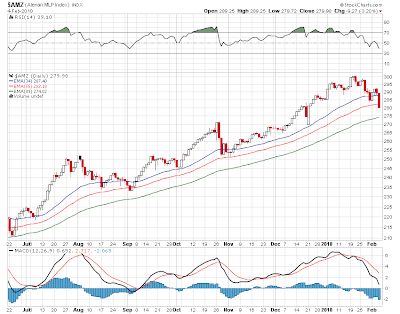

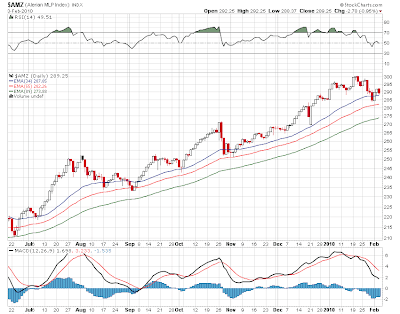

The mlp index had a very good week last week while the overall market churned back and forth. Notice the MLP index seems destined to challenge that 300 rally high reached a few weeks ago. Im still concerned about whether that will become the top of a trading range so we will watch the assault on that level this week and see where it takes us. MLPS continue to clearly outperform the overall market which began almost 15 months ago. Meanwhile it seems to me that the dow chart is looking like it has a more formidable challenge as its chart is looking more and more like that of a trading range bounded by 9800 at the bottom and 10,700 at the top. Moving average support is holding here for now. This is going to be a very important week indeed.

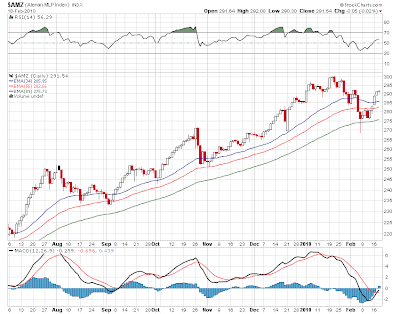

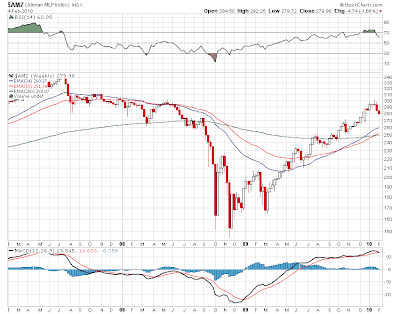

Back to the MLP index above is the weekly chart which is sitting above support but note that 300 is a wall that goes back to the 2007-2008 time frame so there is alot of money here that has a chance to get back even if they sell. So headwinds are around. Not insurmontable but it will be something to deal with.

Back to the MLP index above is the weekly chart which is sitting above support but note that 300 is a wall that goes back to the 2007-2008 time frame so there is alot of money here that has a chance to get back even if they sell. So headwinds are around. Not insurmontable but it will be something to deal with.Overnight stock futures were higher along with crude oil. The dollar is holding against the euro at least as of this post. I am posting early since i have a busy day ahead. Some weekend news notes. There is this item from Reuters on the upcoming IPO from Chesapeake (CHK) of Chesapeake Midstream LP. This will be another one of these LP's that has lots of support form the parent company. Powerful parents can be very supportive of the offspring according to this piece. Of course this assumes that the parent stays well. And there are some who accuse the parent of robbing the shareholders blind. Both pieces are worth the read. Seeking Alpha had this piece on Breitburn Energy (BBEP) a few weeks ago. There is some bullish opinion being expressed here.

The earnings parade is dying down but Martin Midstream Partners (MMLP) will announce earnings this week on Thursday. There may be one or two others that might not have announced but the bulk of them are done.

Taxtime is approaching and K-1s are arriving or have already been posted. Here is a link with some info regarding certain issues. Its a helpful beginning to coming to grips with how to deal with Uncle Sam.

Thursday, February 25, 2010

Considering the kind of day the market is having MLPS are doing very well. The index is down just .70 and gaining. While most mlps are down Holly Partners (HEP) is the biggest loser at minus 40 cents while Buckeye Holdings (BGH) is up 30 cents.

I would not expect mlps to hold if the rest of the market implodes this afternoon but should the market firm i would not be surprised if mlps lead the way higher.

I would not expect mlps to hold if the rest of the market implodes this afternoon but should the market firm i would not be surprised if mlps lead the way higher.

MORE EARNINGS NEWS!

Exterran Partners (EXLP) is out with earnings this morning along with Exterran Holdings (EXH). Both are on the same press release. Im noticing that the LP has a bid this morning at the close while the GP looks like it will open lower. But markets there are pretty thin so i dont want to read too much into this. Also Linn Energy (LINE) has numbers out as well along with an outlook for 2010. One trade in the premarket even with yesterday's close but its just 100 shares. And as i post another trade of 200 shares down 30 cents from yesterday. No real clue there.

MLPS closed a little higher yesterday after milling around for much of the day. Markets are soft this morning and we have data due out shortly. No sign of interest rates spiking up anytime soon in the short term which is supportive for MLPS. Stock futures and energy futures are down and the dollar is up Nat gas numbers out later this morning.

The pace of trading lately has been pretty slow especially when you look at volume. For now the push and pull continue here between 9800 and 10,700.

Wednesday, February 24, 2010

Atlas Pipeline Partners (APL) has extended its gain to a full point now as the MLP index, which was up one than down one is now up a few pennies. The dow is up just shy of 100 points.

Nustar (NS) and Inergy Holdings (NRGP) are showing nice fractional gains among the other winners whose plus signs right now are a bit smaller. But the losers list is dwindling down with Alliance Resource (ARLP) the biggest loser with coal stocks a bit weak.

Tape looks firm so looking for gains to get extended this afternoon. Preparing for another big snowstorm here for late tonight and into the weekend. Oh Joy!

Nustar (NS) and Inergy Holdings (NRGP) are showing nice fractional gains among the other winners whose plus signs right now are a bit smaller. But the losers list is dwindling down with Alliance Resource (ARLP) the biggest loser with coal stocks a bit weak.

Tape looks firm so looking for gains to get extended this afternoon. Preparing for another big snowstorm here for late tonight and into the weekend. Oh Joy!

EARNINGS FROM ATLAS AND ONEOK!

Two MLPS that went in different directions over the last few years and the results are certainly telling if you look at the stock price and where its been. Atlas Pipeling Partners (APL) put up earnings yesterday and the company basically said the repair job is working. There is no indication when the distribtution is coming back but the market thinks sooner rather than later. The stock is up today and over 12 bucks but sells for about 1/4 of what it use to.

Meanwhile if you bought Oneok LP (OKS) before the market implosing in 2008 you would be right where you started plus payouts. Strong solid earnings reported here and an upgrade by Citigroup. The question going foward is do you bet on the solid and steady or take a gamble that Atlas will someday be making a payout again. With the risk there is reward. Your choice!

MLPS this morning are higher by about 1 point on the index. Atlas Pipeline Partners (APL) is up 62 cents and is today's biggest winner. The list is split 50-50 between winners and losers and pretty much between plus 30 and minus 30 cents. Atlas Pipeline Holdings (AHD) is the biggest loser today down 37 cents. They also put up their numbers which of course are tide with the above Atlas. No reason to hold it if they aren't paying you to do it.

Markets are up as Bernake speaks and Congress listens.

Monday, February 22, 2010

TRADING RANGE DEVELOPING

Given that this bull market or bear market rally or cyclical bull within a secular bear or whatever you want to call it is coming up on its one year birthday i think its time to consider whether we are beginning the process of building some sort of top that may establish a longer term trading range. Granted i have no clue whether im going to be right about this but it's clear to me that the uptrend that began last March has changed character a bit since the dow hit 10700 a few weeks ago. We made the drop to the logical bottom at 9800 which was where the 200 day moving average was and now we are moving back to the top of the range at 10700. Lots of money can be made if we become trapped in a 900 point range for awhile. Once we get back to near 10700 we'll see if the market has the force to take it through there. So standby for the approaching test.

MLPs on the other hand are approaching there 300 high and its less clear to me whether our little group will go into a 270-300 trading range or if they can continue higher. Clearly a break above 300 can mean a ride to new all time highs as measured by the index (340). The outperformance continues and shows no sign of abating.

We have earnings this morning from Constellation Energy Partners (CEP) and the bottom line here is no distribution through at least Q4 of 2010. With no distirbution it makes it pretty much dead money here at best. The company does say its focused on the continued reduction of debt levels.

Premarket indicators are firm. Stock futures are higher. Rates are flat to a little higher. Energy is higher except for nat gas and the dollar is stronger. So it looks like we will start with buyers in control. Nothing going on as far as the upgrade downgrade list.

A couple of links here as Investment News writes a nice little piece on MLPS. And we have this on Seeking Alpha which is about an index approach to mlps. And the index is called the Cushing 30 .

Friday, February 19, 2010

IMPACT OF DISCOUNT RATE HIKE?

By now unless you've been in a hole you all know the fed raised the discount rate last night. Now the discount rate used to be far more important years ago but the focus will be on the symbolism. Given the bullish psychology in the markets my guess is the rate hike will be viewed as being done because credit markets no longer need emergency support, and not the beginning of a long series of rate hikes to slow the economy. Futures were down overnight but they have cut their losses in half so the open this morning does not look too bad.

Meanwhile the MLP index seems to be heading for a challenge of the recent high around 300. The MACD is in buy mode and frankly the trades for months have been pretty easy to see. I continue to regard 300 as criticial to this uptrend. If we dont break through then we could be entering a trading range which will be bordered by 270 to 300. And that wont be too bad.

Some leftover news from last night from Energy Transfer Partners (ETP) which posted earnings. Also putting up earnings is Energy Transfer (ETE). Im not sure if this is a reaction to earnings but Morgan Keegan is downgrading Energy Transfer Equity (ETE) to market perform from outperform. Market reaction lately is for mlps to sell off on earnings no matter how good they are( for the most part this has been true). There are no headlines on the corporate side to speak of this morning.

CPI is the driver this morning on the data front. Bond yields are back up to 3.80 on the 10 year. Btw i have been long the TBT (double short 10 year) so as yields rise the TBT rises and i've been selling calls against it which makes for nice returns. Back to the CPI its a market friendly number this morning so we're seeing an immediate reaction of stocks cutting losses and yields falling off the highs of the day. The dollar is up but off its high of the day. Energy is a little lower and we have nat gas numbers coming out later this morning.

Thursday, February 18, 2010

Sort of a watching paint dry kind of day so far. The mlp index is down 1 point. Most mlps are trading flat or a little lower in a tight range. Looks like a consolidation taking place in most issues. Oneok (OKS) the biggest loser down 55 cents right now. Gainers are mostly 25 cents or less. Earnings news driving small losses in TCLP and The Williams's.

EARNINGS, OFFERINGS AND UPGRADES

Busy morning out there with lots going on so lets get the ball rolling with earnings from Williams LP (WPZ) as opposed to Williams LP (WMZ) which also posts earnings this morning and the info is on the same press release. Also Williams (all three including the parent) announced yesterday that they have completed their transaction that will boost future distribution growth. Also putting up earnings is TC Pipelines (TCLP). BTW there has been a tendency for individual mlps to sell off a bit on earnings on a buy the rumor sell the news type action. In the land of upgrades downgrades Barclays leaves Enbridge Energy Partners (EEP) at equal weight but raises the target price to 52 bucks. And finally we have a secondary offering from Boardwalk Partners (BWP) and the stock is down 1 and some change this morning.

MLPS closed up 2 points yesterday and back over 290 as the march to the 300 recent high continues. Stock futures have sold off a bit on PPI and the jobless claims number. Bonds are rallying a bit this morning on this news. Looks like a lower open but nothing tragic ahead for us. The dollar is rallying sharply this morning.

Wednesday, February 17, 2010

CALUMET EARNINGS AND THE RUN TO 300!

Yesterday's nearly 6 point gain on the mlp index gives rise to the idea that we have made a short term bottom last week in the 270-275 area. We touched the support lines in the rising moving averages and it appears that the mlp index wants to challenge the top of the range at 300. It could be that a trading range is emerging here between 270 and 300 where MLPS can consolidate. We'll see. But with the dow up 170 yesterday the big mo is there for the rally to continue.

The dow chart appears to be trying to do the same thing which means a run to the top of the range would take us back to 10700. MACD indicators have turned to the buy side so the charts certainly are supportive.

The weekly charts below show how the Dow traded right into its rising weekly moving averages. So far everything that has occured has been pretty logical. The mlp index weekly chart did not reach its rising moving averages since the group has been so much stronger relative to anything else. Still no sign of a breakdown of that outperformance that began 14 months ago.

Calumet Specialty Products (CLMT) is on the news docket this morning with earnings. The company has comeback off its lows and has even boosted its distirbution this quarter for the first time since cutting back in 2008. Also we have an MLP IPO coming as Chesapeake (CHK) is planning an ipo of its midstream assets. Sign of a healthy mlp market but we should keep are eyes on this in case things are getting a bit too frothy.

Stock futures are higher this morning so we may get some followthrough at the open. Energy is higher with oil also showing strength after yesterday's 2 dollar plus gain. So it looks like a higher start.

Tuesday, February 16, 2010

We're up nearly 5 points on the mlp index with the dow up 120. Nustar (NS) is the biggest winner today up 1.60 and we have 1 point plus gains in Inergy Holdings (NRGP) Sunoco Logistics (SXL), Kinder Morgan (KMP) Holly Partners (HEP) and Williams Partners (WPZ). And of course we have a whole slew of mlps which are showing strong fractional gains.

Suburban Propane (SPH) one of the few losers on the board down just 30 cents. The only other losers are Captial Products Partners (CPLP) Quest Partners (QELP) and K-Sea (KSP) and all have distribution issues which accounts for this.

Markets are in rally mode in here so no reason that it wont continue this afternoon.

Suburban Propane (SPH) one of the few losers on the board down just 30 cents. The only other losers are Captial Products Partners (CPLP) Quest Partners (QELP) and K-Sea (KSP) and all have distribution issues which accounts for this.

Markets are in rally mode in here so no reason that it wont continue this afternoon.

DAY AFTER LONG WEEKEND

MLPS OPEN UP SHARPLY!

MLPS OPEN UP SHARPLY!

Hope everyone had a great 3 day weekend..and hopefully snow free as I shovel out another 3 inches that fell overnight. MLPS making that prospect better this morning with the index up 3 points (one point per inch!). and every mlp on the list is higher this morning which is nice. Nustar (NS) Sunoco Logistics (SXL) and Plains All Ameerican (PAA) are all up 1 or more in the early going. No news drivers on the corporate side. I dont see anything of consequence on the upgrade downgrade list but i do notice big oil stocks like Chevron and Hess among others getting upgrades which is moving energy stocks this morning in general.

Notice the MLP index chart is about to cross on the MACD which is tech speak for a buy signal. The support levels are holding and now the 300 level becomes extremely important to break through. Otherwise we have a potential double top here and that may mean the unrelenting uptrend that began December 24, 2008 is coming to an end. But thats still 15 points of upside to get there to make the test which means the path of least resistence in the short term is higher.

Notice the MLP index chart is about to cross on the MACD which is tech speak for a buy signal. The support levels are holding and now the 300 level becomes extremely important to break through. Otherwise we have a potential double top here and that may mean the unrelenting uptrend that began December 24, 2008 is coming to an end. But thats still 15 points of upside to get there to make the test which means the path of least resistence in the short term is higher.

Friday, February 12, 2010

Dow down 150 ish at the low and mlps down nearly 2 but there has been a big turnaround and mlps are now flat with the dow down 40. Nasdaq is positive.

5 minutes before the open a rush of buy orders hit the tape and Alliance Resource Partners (ARLP) opened up 2 and change at 42. It had the look of an upgrade but i did not see anything on the tape. Stock is up 1 and is the biggest mlp winner today. Natural Resource (NRP) Penn Virginia Resource (PVR) and Martin Midstream (MMLP) among the fractional winners.

Not many losers of note. Boardwalk (BWP) is down 35 cents and Nustar (NS) is down about 30 cents..among the dwindling list of losers.

Big rebalancing going on today with the S&P 500 as Bershire B stock gets added in so managers have to sell other things to get that all straightened out. So we are dealing with some distortions on top of the news. Crude down but nat gas up on respective inventory figures.

5 minutes before the open a rush of buy orders hit the tape and Alliance Resource Partners (ARLP) opened up 2 and change at 42. It had the look of an upgrade but i did not see anything on the tape. Stock is up 1 and is the biggest mlp winner today. Natural Resource (NRP) Penn Virginia Resource (PVR) and Martin Midstream (MMLP) among the fractional winners.

Not many losers of note. Boardwalk (BWP) is down 35 cents and Nustar (NS) is down about 30 cents..among the dwindling list of losers.

Big rebalancing going on today with the S&P 500 as Bershire B stock gets added in so managers have to sell other things to get that all straightened out. So we are dealing with some distortions on top of the news. Crude down but nat gas up on respective inventory figures.

THE CHECK IS IN THE MAIL!

The holiday weekend looms ahead and some pressure meets us this Friday morning. China raised reserve requirements which has spurred a dollar rally and taken stock futures from up a little to down 7 on the S&P. Thats the driver right now and probably means we may spend the day looking over our shoulder. Balance that with prospects for the Greece rescue and you have some who won't go into the weekend short. We'll see which side wins out today but for now we're looking a lower open and then we'll go from there.

Meanwhile except for a couple of MLPS they are all ex dis and you money should be arriving into your account or mailbox come Tuesday. MLPS did well yesterday with a 3 point gain and we're back over 280. Last week's climax bottom under 270 intra day is holding so far while the dow 9800 level holds intraday as well. Key levels out there for us to watch!

No news drivers this morning and nothing on the upgrade downgrade list. Energy numbers will be out today delayed by the snowstorm. So inventory for crude and nat gas will be market moving. Global markets are mixed. Bonds are higher this morning with the 10 year at 3.70.

Thursday, February 11, 2010

MLP index is up 2.50 with the dow up 80 now. Looks like a tradeable bottom has formed here. 1 point plusses in Penn Virginia Resources (PVR) which had good earnings and is up 1.60. Also up 1 or nearly so include Penn Virginia Holdings (PVG) Alliance Resource Partners (ARLP) Holly Energy Partners (HEP), Inergy Holdings (NRGP) Natural Resource Partners (NRP) and Williams Partners (WPZ). Most other mlps showing nice fractional gains.

Buckeye Partners (BPL) is down a fraction and so is Enbridge Energy Partners (EEP). A few others are losing pennies but no tragedies there.

Buckeye Partners (BPL) is down a fraction and so is Enbridge Energy Partners (EEP). A few others are losing pennies but no tragedies there.

THE BIG BLIZZARD!

Second burial of the year for me and the third or fourth for some people nearby left me out of the loop yesterday as MLPS dropped 3 points on the index. It appears the overall market is in corrective mode here and mlps are holding up better but we are getting into a rather important area here and we really dont wont to see these trendlines give way.

Still we are oversold and if we are going to bounce we need to hold last Friday's intraday low otherwise we could be looking at something far more serious.

This morning we have earnings news from Holly Partners (HEP) which reports record Q4 and year earnings. How much is baked into the price remains to be seen however. Plains All American (PAA) came in with another solid quarter after the close yesterday. They told us so in their release so it must be true. We'll see what the market says. Penn Virginia Resources (PVR) put up records earnings (PVG) and Penn Virginia Resources (PVR) put up record earnings last night which makes sense since one is the general partner of the other. And in other non earnings news Enbridge Energy (EEP) tells us they are planning to expand their pipeline further in Haynesville.

UBS is upgrading Buckeye Holdings (BGH) and raising its target price. Not much else going on as markets are waiting for whatever the eurozone is going to do about Greece and everything else.

Sorry about yesterday but I was in the land of double shifts.

Tuesday, February 09, 2010

Up about three on the MLP index at 1pm and around 281. The dow was up over 200 but there is a bit of volitility in here but overall a strong day on the tape.

Alliance Resource (ARLP) Buckeye Partners (BPL) and Kinder Morgan (KMP) all up 1 point or more. Exterran (EXLP) Plains All American (PAA) and Penn Virginia Resource (PVR) all up major fractions.

EV Partners (EVEP) is down a little less than 1 on its offering. RBC upgrades the stock to outperform and raises the target price.

Alliance Resource (ARLP) Buckeye Partners (BPL) and Kinder Morgan (KMP) all up 1 point or more. Exterran (EXLP) Plains All American (PAA) and Penn Virginia Resource (PVR) all up major fractions.

EV Partners (EVEP) is down a little less than 1 on its offering. RBC upgrades the stock to outperform and raises the target price.

MORE OFFERINGS BUT MARKETS STRONG PRE-OPEN

E.V Partners (EVEP) was looking at a 32 dollar stock price before the market correction but high 20s was enough for a public offering of shares which priced this morning at 28.08. That is really the only headline in MLP land as markets are focusing on the Greece problem getting resolved to some degree. So it looks like a nice rebound to start and we need to see if it has any followthrough to take us back over 10k and keeping us there.

Barclays is raising its price target on Buckeye (BPL) to 55 bucks with the stock at 54. Now there is a really brave move. Not much else happening. Some premarket trades in Breitburn (BBEP) above yesterday's close as the company brings back the payout. Not much else happening this morning. Crude is up and so is gold. Nat gas is a little lower.

Yesterday's action could still be part of the short term bottom process at 9800. We need to put together a couple of nice days. The wild card remains all this soverign risk news and how it plays.

Monday, February 08, 2010

Boarwalk Partners (BPL) beats on earnings and ups the payout. Also big news for Breitburn (BBEP) as they settle the lawsuit and resume the distribtion beginning next quarter! The stock is up 1.80 to just under 15.

MLP index up over 3 points as the bounce from Friday continues to extend itself. Markets are now higher as well after a brief morning selloff. Boardwalk and Buckeye lead the way with 1 point plus gains. Most mlps are up fractions to a point. Not many on the losing side of note.

MLP index up over 3 points as the bounce from Friday continues to extend itself. Markets are now higher as well after a brief morning selloff. Boardwalk and Buckeye lead the way with 1 point plus gains. Most mlps are up fractions to a point. Not many on the losing side of note.

AFTER THE REVERSAL

Friday's trading has every look of a short term climax bottom as we were staring into the abyss at 1:30pm with the dow down 170 and then came the violent turnaround that took the dow s&p and nasdaq to a higher close. Notice that while the short term uptrend has the look of being broken, the dow came down to the 2o0 day expotential moving average and bounced right off of it. The issue is whether we can get back above the uptrend line around 10,400 or so. Right now the market is in prove it to me mode.

Friday's trading has every look of a short term climax bottom as we were staring into the abyss at 1:30pm with the dow down 170 and then came the violent turnaround that took the dow s&p and nasdaq to a higher close. Notice that while the short term uptrend has the look of being broken, the dow came down to the 2o0 day expotential moving average and bounced right off of it. The issue is whether we can get back above the uptrend line around 10,400 or so. Right now the market is in prove it to me mode. The reversal wasnt lost on mlps but the average has been such an outperformer that it needed to get to 255 to reach its 200 day and it was no where close. It actually closed above the 89 day moving average uptrend line so to me the uptrend remains in our group. I will feel better if we can get back above 280.

The reversal wasnt lost on mlps but the average has been such an outperformer that it needed to get to 255 to reach its 200 day and it was no where close. It actually closed above the 89 day moving average uptrend line so to me the uptrend remains in our group. I will feel better if we can get back above 280.Meanwhile this morning its quiet on the news front. Nothing on the upgrade downgrade list either. Stock futures are flat, energy higher, and gold higher ahead of the open. Nat gas is showing a ncie gain this morning. So im looking for followthrough to Friday to confirm the climax bottom and the end to this short term correction.

Another snowstorm looms for the northeast and mid atlantic states. Shovels are ready.

Friday, February 05, 2010

The mlp index is down over 10 points and off the lows of the day!!! Its just a wholesale selloff in the group and not totally a surprise on the magnitude since there was some fast money in there just for distributions which are now pretty much through the ex distribution cycle. So there is no reason to hold them if you have to wait 3 months for the next payout. Lots of 1 and 2 point losses in there as the dow is now in free fall off 155.

Enbridge Energy (EEP) Oneok (OKS) and Buckeye Partners (BPL) all down 2 points or more. And the list of mlps down 1 or more is long and deep. Atlas Energy Resources (ATN) is up 4 cents and is the lone winner.

Crude is down 3 dollars to 70. The dow is now sitting just about on its 200 day moving average so at some point there should be a rally attempt. I averaged into the triple long energy etf (ERX) in the last hour at a price of 31. They have 2 hours to bring em back enough for me to make a few dollars.

Remember if you are using this selloff to add to positions its best to ladder in and let the market come to you in terms of price.

Enbridge Energy (EEP) Oneok (OKS) and Buckeye Partners (BPL) all down 2 points or more. And the list of mlps down 1 or more is long and deep. Atlas Energy Resources (ATN) is up 4 cents and is the lone winner.

Crude is down 3 dollars to 70. The dow is now sitting just about on its 200 day moving average so at some point there should be a rally attempt. I averaged into the triple long energy etf (ERX) in the last hour at a price of 31. They have 2 hours to bring em back enough for me to make a few dollars.

Remember if you are using this selloff to add to positions its best to ladder in and let the market come to you in terms of price.

APPROACHING IMPORTANT SUPPORT

When the downdraft began we thought 9800 was a good place for the dow to head for and even though i did not post the chart with the 200 day moving average; guess what? The 200 day moving average is right at 9800 on the dow. So lots of attention will be paid if we hold that level. Meanwhile in MLP land yesterday's 9 point clobbering takes us under 280 and under the 55 day moving average so the 89 is looming large for us. The 200 day is way down around 260 so that seems a bit of a reach unless the bottom completely falls out. Btw on the weekly chart 260 is where all the moving averages

That area to me provides considerable support technically. The weekly chart is bordering on a sell when you look at the MACD. Employment numbers at 8:30am will provide gas as stock futures are sinking ahead of the number.

That area to me provides considerable support technically. The weekly chart is bordering on a sell when you look at the MACD. Employment numbers at 8:30am will provide gas as stock futures are sinking ahead of the number.Buckeye Partners (BPL) puts up good earnings and an 11 cent beat. Buckeye Holdings (BGH) is putting up its earnings and ups the payout. Copano also is posting earnings this morning. Wunderlich is upgrading Inergy (NRGY) to buy from hold.

For those of you looking to build positions in this sell off..since one can only guess the bottom; i would suggest laddering in with buy orders under the market. This way at least you avoid that awful feeling you get when you pull the trigger and then realize that you could have done it at much better prices as markets pull back. A down open looms large unless the employment numbers surprise. The market is focused on all this soverign debt issue going on in Europe and elsewhere and that could be a driving force for awhile.

Thursday, February 04, 2010

Down over 9 points at the low at 279.70 on the mlp index but now we've come off that at 281 as the dow is now dowm a little less than 200 points. Losses across the board with some leaders like Williams Partners (WPZ) down over 2. Suburban Propane is down 3 and change as the biggest loser on earnings but off the minus 5 from earlier.

Last hour approaching.

Last hour approaching.

EARNINGS PARADE CONTINUES

Suburban Propane has been an excellent performer in this market as it has been making its way higher and it is in new all time high territory. This morning we have earnings from the company and they missed a bit on the revenue side according to those who watch these things. Still the company continues to grow the distribution which in the end is the bottom line in MLP land. And they did it despite decreasing volumes due to weather conditions as per the press release.

Not much else happening this morning as we look ahead to a soft open. S&P futures showing us down 10 points ahead of the open as the market responds to jobless claims that continue to run soft. No change from the ECB or Bank of England on rates. The dollar is rallying which is putting pressure on gold and crude. Nat gas is flat ahead of numbers and the weather outlook continues to look cold for the next week at least. Morgan Keegan is beginning coverage on Spectra Energy (SEP) with an outperform.

Not much else happening this morning as we look ahead to a soft open. S&P futures showing us down 10 points ahead of the open as the market responds to jobless claims that continue to run soft. No change from the ECB or Bank of England on rates. The dollar is rallying which is putting pressure on gold and crude. Nat gas is flat ahead of numbers and the weather outlook continues to look cold for the next week at least. Morgan Keegan is beginning coverage on Spectra Energy (SEP) with an outperform. Take a look at the mlp index and we have once again touched the the support lines that have held us for months. And each touch of the support lines has brought us to higher highs. So on the idea that the trend is our friend, the uptrend remains intact.

Take a look at the mlp index and we have once again touched the the support lines that have held us for months. And each touch of the support lines has brought us to higher highs. So on the idea that the trend is our friend, the uptrend remains intact.

Wednesday, February 03, 2010

Martin Midstream (MMLP) is down 2 and is the biggest loser today as the mlp index gives back all of yesterday's gains and more..down over 3. Most mlps down fractions to a point.

Crosstex (XTEX) continues to successfully price debt in the markets and the stock is up a little to today's downdraft. Magellan posted earnings this morning. Record profits and record distributable cash flow and the stock is up three cents!

Overall market pulling back today after 2 nice up days. No surprise.

Crosstex (XTEX) continues to successfully price debt in the markets and the stock is up a little to today's downdraft. Magellan posted earnings this morning. Record profits and record distributable cash flow and the stock is up three cents!

Overall market pulling back today after 2 nice up days. No surprise.

MORE OFFERINGS AND EX-DISTRIBTUIONS

The cycle continues and Nustar (NS) goes ex distribution as does Alliance Resource Partners (ARLP) and Holly Partners (HEP) so we have that going on. And we also have yet another equity offering on the table. Martin Midstream Partners (MMLP) is coming to the well with over a million shares. Also this morning earnings from Magellan Midstream (MMP) should be hitting the tape at any time.

Action was good yesterday as Friday's selloff is now pretty much reversed. So i guess we will be looking around for some sort of upside tailwind as markets are a little soft this morning ahead of the often. But remember we've 2 days of 100 point plus gains so a little softness at the open is clearly understandable. No other headlines on the tape this morning and no upgrades or downgrades so far. 10 year rates are rising this morning after the ADP number which means the jobs number Friday will get lots of attention.

Magellan news link as soon as it posts.

Tuesday, February 02, 2010

Take out the 2 point plus losses in Sunoco and Oneok and you have a pretty good day in mlp land. The index is now fractionally higher after initially being down 1 and some change. Inergy Holdings (NRGP) is the big winner up nearly 2 and closing in on the 70 level again. Its at 69 now. Fractional plusses are on the board for Natural Resource (NRP) Alliance GP (AHGP) and Holly Partners (HEP).

Nustar (NS) is down 40 cents as it continues to pull back after last Friday's earnings which looked okay in my book. Buckeye (BPL) Martin Midstream (MMLP) and Western Gas (WES) showing some fractional losses right now.

Market looks firm in here as yesterday's rally gets extended.

Nustar (NS) is down 40 cents as it continues to pull back after last Friday's earnings which looked okay in my book. Buckeye (BPL) Martin Midstream (MMLP) and Western Gas (WES) showing some fractional losses right now.

Market looks firm in here as yesterday's rally gets extended.

TIME FOR AN OFFERING!

Two of the bigger mlps will have an impact on the mlp index today as Oneok (OKS) and Sunoco Logistics (SXL) are going to the market well to get some money by selling equity. And when your mlp has enjoyed a big move its best to take advantage of your currency. Oneok (OKS) is doing a 5 million share offering while Sunoco Logistics (SXL) is doing a 2.2 million share offering. Both mlps are down over 2 dollars in the premarket so that is going to be coming out of the mlp index at the open. Yesterday the index closed up 5 points which reversed most of last Friday's selloff.

Not much else on the tape this morning as markets are looking at a slightly higher open. Energy is up with oil back over 75 bucks. Nat gas is up a nickle as wintertime continues in the east with no break in site and a couple of snowstorm threats looming. Barclays is downgrading K-Sea (KSP) to equal weight after last week's negative distirbution announcement.

Not much else on the screen this morning. We're still running through the payout cycle so more mlps go ex-distribution in the next few days. Checks will be in the mail shortly.

Monday, February 01, 2010

UPTREND REMAINS INTACT!

There are no hard and fast rules when it comes to these sorts of things but when we look at both of these charts it looks like the uptrends are still holding although the Dow Industrial chart appears to be on the verge of breaking down. Now these are short term charts we're looking at and the weekly charts remain in better shape for now. The MLP index chart looks pretty good overall and we are at support now. The 55 day moving average has held on the last 3 trips down to that level; each of which was followed with a higher high. 300 is the top of the wall so far. Fridays sell off looked like it could have been some end of month type of action since it seemed a bit out of proportion to the rest of the tape and the selling came in around 2pm; reminded me of the selloff we had on options expiration day back in December and we got it all back the following Monday.

Earnings news this morning via Dan Duncan and Duncan Partners(DEP) and Enterprise Product Partners (EPD) which are probably priced in to a large degree. We still have a few mlps waiting for ex-distribution and that will come this week. No other earnings news. Markets are waiting for Exxon Mobil (XOM) which may drive energy stocks to some degree. Nothing on the upgrade downgrade list so far.

Stock futures are higher this morning ahead of the open as markets search for a meaningful bounce. 10000 is right underneath us and so far it is holding.

BTW sorry for the lack of posts late last week but i was in the land of double shifts with no computer access and its hard to blog from a blackberry! Back to normal working conditions this week.

Subscribe to:

Posts (Atom)