Tuesday, September 30, 2008

Going into the close with nearly a 6 point gain on the MLP index but the volume today is low. I wish i could be more enthused about this but right now i'm demoralized with everyone else. Yet somehow i managed to pull off 5 nice day trades in the group.

There are a lot of end of quarter moves going on and the Jewish holiday of Rosh Hashannah causing less than normal volume. Kinder Morgan leads the way higher up 2 points. Still some losers on the list like Inergy (NRGY) which is down 1 and Calumet (CLMT) which is down about 80 cents.

And now of course after yesterday's 777 point debacle and the 15 point drop in the MLP index we see today setting up for a bounce at the open which frankly doesn't thrill me because it gives a strong bid for people to sell into. We are setting up to get about 1/2 of yesterday's loss but who knows if it holds.

News this morning on Constellation Energy Partners (CEP) which is exploring strategic alternatives in leiu of the merger of Constellation (CEG) with Mid American Energy. Stock is catching a bid on the news in the pre-market. No other news this morning. No upgrades or downgrades in MLP land.

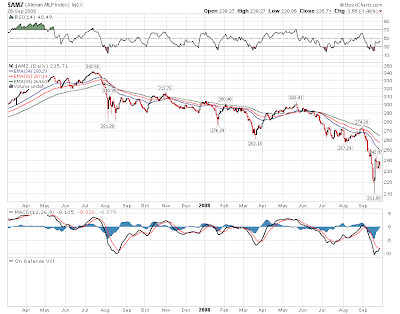

220 seems to be the line in the sand for us right now. We'll dead cat bounce with everything else this morning and then we will see if the sellers are done or if we are about to go further down into the abyss.

Monday, September 29, 2008

Could we please please please get some adults in the room? And maybe there was more to Pelosi's speech than meets the eye.

It has gone beyond MLPS a long time ago. The House of Representatives has pretty much tossed the entire US off the Empire State Building and we are rapidly approaching the pavement. These vile reps in Congress who have no clue how markets work have effectively sentenced us to a vicious recession. So now we will let the markets tell Washington what we think of them. See you at 9000! No point at looking at charts; they are pretty much meaningless now.

Legacy Partners (LGCY) was the only winner today up 6 cents. otherwise the damage in mlp land was extensive. The index closed @ 220 down 15 which was off the lows of the day @ 217.

Kinder Morgan (KMP) was down 4 as the biggest loser.

My bank is JP Morgan Chase and the mood in my branch was pretty somber today. I don't know why because the way its going they will be the only bank left!

On a serious note i hope all of you out there are okay. It certainly hasn't been easy and it may get a lot harder over the next few days. If need be...take a deep breath..drink lots of liquor...watch some football tonight. Just take a step back and relax. This too shall pass...so long as we don't pass out first.

I suppose its comforting to know that your portfolio is goind down along with the solvency of several other nations. If you are going to go...you might as well go big and take as many people with you as you can!

Gasbags vote at 1pm

The mlp index is down 4 points with the dow down 203. Wachovia is toast this morning so that seems to be driving mood.

Charts aren't exactly getting one's heart racing. The gasbags in Washington have completed the deal. The question for MLPS is whether pressure comes off the credit markets to take some of the pressure off MLPS. Also we have the locusts decending on Wachovia this morning with the stock trading with a 3 handle down from Friday's close around 10 bucks.

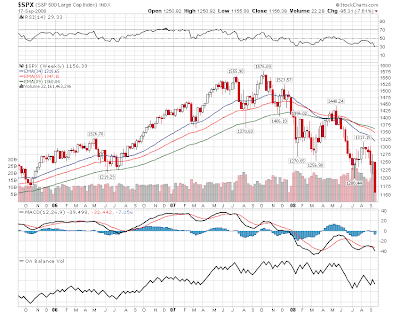

What is interesting on the charts to me is they had every opportunity last week to take 'em down 1000 points and down to 10k on the DOW. Didn't happen. Also note that on balance volume which is a running total of up volume minus down volume is actually increasing in here. So as grim as things look this morning on the dow and s&p futures i haven't given up hope yet.

Here is a bit of news on Ferrellgas (FGP) which puts up in line earnings and says they expect record EBITDA for 2009. I'm sure the market will yawn because that's the way things are these days. No other earnings and no upgrades or downgrades.

Crude and Natgas are on the decline this morning by large amounts...crude off nearly 4 bucks and gasoline is down 10 cents. This weekend i took a delivery of heating oil at 3.75 a gallon. This plus my new Peerless Boiler and hopefully my oil bills go down this winter. BTW winter forecasts will be due out soon and i'm sure we'll have market reactions to that.

It doesn't help that Europe is falling apart with bailouts for Britian's largest mortgage lender and bailout for Fortis. Of course the European central bankers continue to sip their espressos and planning their holiday in the South of France. Heaven forbid they should ease.

So that's pretty much it in a nutshell this morning. But lets not give up hope just yet. What else is there?

Sunday, September 28, 2008

I wonder if Bernake is ready to cut 50 basis points here after this deal is done?

Saturday, September 27, 2008

If you need a reason for why all this is happening, this video explains it in a fairly basic way. Spread it around.

Meanwhile i'm beginning to wonder whether we are setting up for another market melt up. The unintended consequence of not being able to short financials is that the crowd has instead shorted the S&P 500 futures contract and there has been a huge spike in the short interest there. If those short positions all run for cover at the same time we could see a couple of big up days. Add to that end of quarter and the climax of the government bailout plan and we could see some wild action next week. IMHO of course.

Friday, September 26, 2008

A few more issues have turned higher like Constellation Energy Partners (CEP) which is up 27 cents. Genesis (GEL) Markwest (MWE) and Global (GLP) showing small gains. Amerigas (APU) still leads the short winners list up 70 cents.

The dow is now higher! The MLP index was down over 8 points at the low of the day and has cut that now to a 6 point loss. Amerigas (APU) is up nearly 1 for some reason. Markwest (MWE) is a small winner. 1 and 2 point losers include Plains All American (PAA) Hiland Partners (HLND) Inergy Holdings (NRGP), Enbridge (EEP) Energy Transfer (ETP) etc etc etc.

It took 41 minutes to give back all of yesterday's gain on the mlp index which is no surprise but the overall market is holding up well in here. Market reacting to every press conference...every headline. Oil down 3 dollars right now so energy stocks under pressure from the complex but again its all about the markets.

Meanwhile you have to catch this battle this morning between Rick, Steve, and Jack on CNBC. The video will appear on this page. I'll post the direct link when it shows up.

Art Cashin says we are on the verge of a wholesale panic in here.

Everything hinges on the deal. For those of you following all of this we recommend newsflashr and also memorandum web sites.. Bookmark these sites folks. They are great for getting stories from multiple sources, blogs, etc etc etc. And this morning we are looking at the kind of day where every headline from the land of windbags (DC) will move prices. So hang on folks for a wild day. All this going and we have the death of Washington Mutual as the feds finish them off. Could be the reason for the additional credit market spread. And the Wamu collapse might give some congressman some cover for the bailout plan. I wonder whether the feds moved in on Wamu in order to raise the pressure to pass the bailout.

All the daily action on the chart still has not generated a buy on the MACD. But we are getting close.

All the daily action on the chart still has not generated a buy on the MACD. But we are getting close.

The S&P 500 chart is looking bottomy and the On balance volume continues to move higher. And you have to believe these children will eventually come back to the table and make the deal.

Haven't paid much attention to the one MLP that is into Agriculture but Terra Industries (TRA) which is the GP of Terra Nitrogen (TNH) is being downgraded today by Citigroup. Nothing much else happening today.

Yesterday we say a couple of the MLP funds take hits as Tortoise Energy (TYG) did a public offering of shares. First Income Fund (FEN) and Kayne Anderson (KYN) also sold off by 1 plus points. It could be end of quarter related as i noticed some odd action in some mlps yesterday. Of course maybe the upside yesterday was end of quarter related?

Thursday, September 25, 2008

I'll post later after i digest all of this.

I'll check in when i can later this morning. Meanwhile carry on without me in the comments area.

Wednesday, September 24, 2008

Okay in the meantime the markets have been going nowhere fast trading in an extremely tight range. MLPS are a little higher. Inergy GP and Inergy LP are up fractionally on the 2009 earnings guidance. Most mlp are showing fractional gains..nothing noteworthy really.

On the downside also fractional losses on uninspired volume. I guess we need to wait for these guys to get done. The general felling i get is that something will pass at worst over the weekend.

From day to day the roller coaster continues to be mind boggling and frankly nauseating so lets shift the focus briefly from the markets to Inergy LP which is issuing guidance for 2009 this morning ahead of its anal-ist meeting at 9am. What i don't know is if that guidance is being raised, lowered or they are just affirming prior guidance or if this is new guidance. I will try and find out. Meanwhile we have firm energy this morning with crude up 2 and nat gas up a dime or so.

Warren Buffett is on CNBC right now. He says that he would not have taken the Goldman stake now if he wasn't sure about the bailout passing. And he says that last week's near collapse was real and that we were on the edge of the abyss. So on that happy note we have firmer stock futures although off their highs. No other news this morning on the corporate front. Nothing on the upgrade downgrade list.

Finally another government agency is in need of money. They get less funds then defence which is just plain absurd given its importance to our survival.

Tuesday, September 23, 2008

1. FDR WAS NOT PRESIDENT IN 1929 WHEN THE MARKET CRASHED

2. TV WASN'T AROUND YET

Watch CBS Videos Online

Don't you feel more confident that the fate of the financial world lies with Congress?

Sunoco Logistics leads the losers down 2.30 at this point. 1 point minus signs in Markwest (MWE) Amerigas (APU) Nustar (NS) Buckeye (BPL) Atlas Resource (ATN) and Enbridge (EEP).

A few issues showing fractional plus signs but nothing stands out in the mess. Dow up only 13 points right now.

It seems like the one long day that started last week continues as we wait for so many uncertainties to work themselves out. Some like the final bailout bill from Congress will be resolved in the very short term. The final outcome will take months and years to play out. Yesterday we added the 30 dollar oil short squeeze on the expiring October contract. I don't know what was funnier..the short squeeze or the idiots in the main stream media who ran with the oil headline with no understanding of the technicals that caused it. Oil begins the day at 107 on the Novemeber futures contract. Any bets on headlines that oil dropped 20 dollars today? Don't hold your breath. And btw CNBC did a great job yesterday pointing out exactly what was happening at settlement.

This morning we have no corporate news and no upgrades or downgrades so every mlp tick today will be tied to the overall market. Crude is down 2 dollars this morning. Nat gas is a little higher. Stocks are lower. Today has the potential for another reversal day but things are so volatile that i really have low confidence on trying to trade this mess.

Monday, September 22, 2008

MLPS firm with the index up nearly 1 point. The Dow is down about 200 points as the dollar gets smashed. Considering the huge gains in MLPS since Thursday lunchtime...we're holding up pretty well in my view. Hiland Partners is up nearly 3 points and remains the biggest winner today.

Constellation Partners (CEP) has turned higher after a little pull back this morning.

Dow down a little less than 200 and big energy is lower so its nice to see relative outperformance.

When you look at this chart the answer clearly is no. Even with Friday's huge gain of almost 9%, which btw was the biggest one day gain every for mlps...the chart overall is still in sell mode. The damage this month has been so extensive that a huge bounce on Friday did not even wipe out the losses for the week, let alone for the month.

However you have to start a bottom from somewhere and 210 seems as good a place as any. And at least the trip back to 240 puts us right at the 2005 base. And that is a far better place to live at then 30 points or more below.

How will we know if things have changed? Well one day at a time. First off followthrough today might be nice to see. Also the technicals on the chart (MACD for one) are still in sell mode. Moving averages suggest we could go to 255 in the context of this big bounce before being rebuked. Now in my world we go to 255 and then pullback into that 240ish long term base and hold it. That would be a good outcome. But i am always the optimistic dreamer. And of course the overall market will be having its say on stock prices. But at least from the standpoint of mlps the extreme pressure seems to be off for now.

Energy prices are rallying this morning on the back of a falling dollar so that gives a bit of a tail wind. No corporate developements and no upgrades or downgrades so far. Reuters had this mlp summary piece over the weekend. Stock futures are lower by 100 or so dow points but off the lows of the morning.

I hope you all had a nice weekend away from all this stuff. I needed to recharge my brain after all that action. A few of you hit the tip jar last week..thank you very much. You bought me a nice cigar and beer and i enjoyed it very much while watching football. Also some of you have been indulging in Mystic Monk Coffee (link on the side). In these troubled times coffee what better way to escape then to enjoy java roasted by Monks in Wyoming!!!!

Friday, September 19, 2008

Thursday, September 18, 2008

Over 240 on the mlp index up over 18 points which is amazing really. Dow up 400. Most mlps are up 2 points or more and there is plenty of headroom. We just can't do it all in one day.

I'm tired!

Genesis Energy (GEL) is a huge percentage gainer up over 3 points at 15 and change..a 25% gain! Plains All American (PAA) Nustar (NS) and Energy Transfer Partners (ETP) are up between 3 and 4 points leading the index.

Global Partners (GLP) is the smallest winner up a nickle and Alliance Resource (ARLP) is down a nickle as the biggest loser.

300 DOW points and 45 S&P points. Even some mlps are catching a bid in the premarket. Linn Energy has traded at 16.19 up $1.39. Constellation Energy Partners (CEP) is bidding 10.45 which is 45 cents above the close. There are a few more examples of that this morning so we're headed higher today. No corporate news and no upgrades or downgrades. So its really all about the market and what we get out of it. Energy is mixed this morning with crude higher and nat gas lower. If we can't get at least a 3 or 4% gain out of this...we should just hang it up!

I will post headlines as news breaks.

However given that we may get a favorable resolution that could at least un-jam the credit markets...mlps stand to benefit greatly from this. Yield spreads are beyond ridiculous. The spread could get cut in 1/2 in some of these issues and that still will be well above normal. No thats not going to happen all in one day but i think a multi-percentage gain is due for tomorrow and we might at least see a few smiles by Friday's close.

Look for GP's to play catch up tomorrow as they did not turn around until late in the day and of course some of the laggards today like Markwest (MWE) and Oneok (OKS) and even Kinder Morgan (KMP) will play catch up.

One note on Constellation Energy Partners (CEP). I'm long this one and given all the news today and a the re-affirmed distribution this evening...this one yields 22%. It could double from here in the next year and still yield 11%. EV Partners at 18 is going to 3 dollars on the distribution. Thats a whopping 16% on that one. My point is if market conditions improve significantly MLPS could move up in a hurry.

Up 18 points and over 240 on the mlp index and in this "V" off the bottom rally we are back to the bottom of the 2005 base. Glory!

Everything is up....most mlps are up 2 points or more. And yet there is so much headroom that this really needs to go much further. But one day at a time.

So its 1pm Friday SEPTEMBER 19TH 2008

Wednesday, September 17, 2008

Rallying back now to minus 7 as the market is staging a serious attempt here to bottom. BTW it was 13 months ago on options expiration when the fed shocked everyone including all the short sellers by doing an emergency rate cut 2 days after the meeting and destroyed many short sellers. Tomorrow is options expiration. Maybe a co-ordinated world wide central bank rate cut?

Constellation Energy Partners (CEP) is up nearly 1 dollar as Warren Buffet's company comes to the rescue of Constellation (CEG) and therefore he gets our stake. What does this mean??? Even CEP can't ignore the Warren influence.

While i type the mlp index is down 1.50 and sinking rapidly. The odds of 190-200 on the mlp index is increasing. What's another 10% anyway?

Some of the smaller guys in the index getting a bounce like Williams (WPZ) up 1, Exterran (EXLP) is up 1 as well. But they are all coming off their highs.

Looking for more selling to come in this afternoon. Crude was up 5 and is now flat. The dow was up 200..now up 100. But sometimes off big sell off we get a surge and then a pullback so don't give up hope yet. But it is looking pretty grimm.

Central Banks around the world have been active this morning as they inject the money (de monet') in order to stablize markets so we have stock futures up this morning but they have pulled back off the highs as news of Morgan Stanley is in talks with Wachovia. Now if you ask me, why would the feds even allow this. Suddenly Morgan Stanley's balance sheet will part of Wachovia's balance sheet. And who will be responsible for this if Wachovia goes down? The tax payer and the Fed. Maybe that's why Morgan Stanley's stock is 2 dollars lower.

Now on to mlps. Energy stocks are catching a bid this morning with crude up 5 dollars to 101 this morning. A dead cat bounce is certainly in order but remember we are tied to the market and especially the fear spreads we're seeing in Libor and in treasuries. When you have negative interest rates...you loan money to the government and pay them for taking your money...things are really in a mess.

Watch what happens to Constellation Energy (CEG) and if it gets taken over. Might provide some clarity to Constellation Partners (CEP) and that stake that CEG holds. Yields in mlp land are making all time highs. You have to pay 15 to 20% in order to get someone to take risk. These are extremes we may never see again folks in our lifetime. But we won't know that until we get through the market crisis and that still needs lots of time to get through. No other corporate developements and no upgrades or downgrades.

Please be sure to read last night's post on Fear. Enjoy the dead cat bounce!

Amerigas (APU) was up 1.65 and Hiland Holdings (HPGP) also up 1.20...biggest winners on this sad day. No news on either one.

Dow closes down 450 and it got to minus 166 around 3:10 pm before the bottom fell out. Thank God oil and gas rallied or believe it or not it could have been worse; although when you are already in a corpse like state how much worse could it be?

MLP index down 8 points. Martin Midstream (MMLP) which did not rally yesterday and Amerigas (APU) are up fractionally. Otherwise its a horror show. Nustar (NS) and Plains All American (PAA) down 3. 2 point minus signs in Enbridge (EEP) Holly (HEP) Transmontaigne (TLP). Oneok (OKS) Suburban Propane(SPH) Hiland (HLND)EV Partners (EVEP) Penn Virginia Holdings (PVG)Inergy Holdings (NRGP)Legacy (LGCY) Atlas Pipeline (APL) Magellan (MMP) and others. Eagle Rock (EROC) is up on its deal by a few pennies.

A poll to distract you for a few seconds. In view of what has transpired this question seems appropriate.

Stock futures selling off down 100 dow points but the energy complex remains higher.

I wish it were Friday. These last 2 days have seemed like a lifetime. But we're at halfway day so lets see whats on the plate this morning. We had Eagle Rock (EROC) do a deal with Kayne Anderson. In this enviornment that they can do a deal at all is a positive. And as the market rally MLPS came back from well off their lows from -13 to -4 which is a pretty good run. Couldn't get over the flat line but I would suspect they will catch up this morning as they do tend to lag. Also crude and nat gas are rallying this morning and i think what you saw in the energy complex selling the last few days was related to forced selling especially by the liquidation of Lehman.

Please note if you missed it yesterday as I spoke to Tonya R. Cultice Director, Investor Relations for Constellation Energy Partners LLC who got back to me and here are some answers.Constellation Energy Partners (CEP) has no counterparty risk to Lehman.The company has recommended the distribution to the board as indicated on the last quarter earnings press release and nothing has changed on that regard. The distribution announcement will come sometime in late October.No news yet on what if anything Constellation Energy (CEG) will do with their stake in CEP.

Speaking of CEG the wagons were being surrounded yesterday by short sellers as that stock went from 45 to 14 in a matter of minutes thanks to having to pay up to insure their bonds. Stock came back to 33 down 14 on the day. One of the uncertainties for CEP is what happens to CEG's stake in CEP. I.R. indicated that CEP will do what is in the best interests of their unit holders in this regard as they work with CEG. (I hope you were able to follow this).

Western Gas (WES) gets a buy recommendation from Stanford Research this morning. Stock futures are a little weaker this morning but not imploding. Another day on the roller coaster looks like a pretty good bet.

Tuesday, September 16, 2008

Constellation Energy Partners (CEP) has no counterparty risk to Lehman.

The company has recommended the distribution to the board as indicated on the last quarter earnings press release and nothing has changed on that regard. The distribution announcement will come sometime in late October.

No news yet on what if anything Constellation Energy (CEG) will do with their stake in CEP.

IR was extremely forthcoming with answering questions which we all appreciate.

I can't tell you the slew of curse words that are just bursting to get out here!

MLP index rallied 10 points off its low. Not all mlps turned around but some did. I would think you will see others follow tomorrow to catch up.

Flood them with emails.

Constellation Energy Partners (CEP) is yielding 27% right now. I have emailed IR for information.

No mlps are showing any plus signs at this time.

In some respects but not all this has been worse for me than the bursting of the internet bubble!

We broke down yesterday with everything else. Its about markets and not about mlps today and of course it all revolves around AIG. One note from yesterday is that Eagle Rock Energy Partners (EROC) has been under some Lehman pressure (note the Lehman filing yesterday in a late night post)...now we have this 13g filing that came up this morning from New Mountain Vantage GP as we see the shares that this group owns in EROC. I'm not sure i completely understand whether this means they've added shares or took the Lehman shares that crossed on Thursday. I'll keep reading it until it sinks in. If one of you figures it out please post in comments.

No news on the corporate front here and no upgrades or downgrades...not that anything outside of a buyout would mean anything today. No real chart support on the MLP index until you get down to around 200...if that happens it comes with a 1000 point or more down day. So its all AIG!

Monday, September 15, 2008

There were a few insider buys today but frankly i make bigger share purchases then they did.

I think the last hour will tell us. If the overall market takes out the days lows it could be disaster. If we can somehow hold above the days lows and we get a catylist then there is still time to bring this back.

Paulson about to pontificate.

Holding on in here.

Lots of one point plus losses out there on the list. I guess from here its up to the rest of the market.

Some pre-market action. Linn Energy (LINE) is down 60 cents. Calumet (CLMT) is down 1.33 on insignficant volume. S&P futures off the lows now...down 40 points.

And it won't be pretty either like this old bridge collapse newsreel. This is what's going to be like today with the markets. The dow ils likely to open with a 10k handle and the years lows are likely to be taken out today as we head for 10,250. Who knows. we might be there by days end...or sooner.

And there is no way we seperate ourselves from this. We're going down. Last weeks 243 low should get tested pretty quickly if not taken out at the open. This is one of those events where trying to figure things out is pretty much a useless ordeal.

The only thing that could at least limit the damage this morning is a fed rate cut. But i wonder if even that prospect would be the equivilant of trying to stop a bleeding artery with a paper towel.

Stock futures are falling off a cliff. And on the energy side of the equation we're seeing huge drops in the energy complex this morning as well. Crude down nearly 5 bucks. Gasoline down nearly 20 cents...Hurricane Ike didn't disrupt the system as feared.

MLPS are already showing stock for sale below Friday's close. We'll find out soon enough what the impact will be to the Lehman held mlps which i posted about yesterday. Those of you following all this in depth should check out Memmorandum.com which will limk you to latest news developemets and other blogs where all this is being discussed.

Try to remain calm as the building burns. Think clearly about making decisions in all this turmoil. Its easy to make a mistake on a day like this.

Sunday, September 14, 2008

So many questions...so much uncertainty.

Meanwhile the big question is what happens to the MLP stakes that Lehman holds and how much pressure does that put on already pressured prices. Lehman has stakes in Eagle Rock Energy Partners (EROC), Constellation Energy Partners (CEP) Crosstex Energy LP (XTEX) among others. Feel free to speculate before we go broke!

Friday, September 12, 2008

We are entitled to a substantial dead cat bounce in here. Forget a rally for a moment. If we don't see signs of stablizinng in here today then as bad as things have been....they are about to get far worse.

Lets see...down 8 days in a row. From 274.28 to 242.93 or a loss of 31.35 points or about 12%. Aren't you glad you didn't buy tech stocks, financials, and any other group because you have this relatively stable collection of distribution paying stocks? Don't you feel better everytime you look at your portfolio value and enjoy the fact that its just shrinking away. One of my accounts is down 25% just this week! God i feel happy!

Beautiful chart isn't it. And bear in mind kids that 240 is important support that goes back to 2005 and if that goes there is virtually nothing underneath to hold us to the 190 level which takes us back to 2003 or so. Now i think that a break of 240 would mean there is some sort of catastrophic event looming among one of the big boys. I'm not saying that's going to happen. I'm actually saying that i find it really hard to fathom that area of support breaking without something major to tie it to.

Now to Lehman. Eagle Rock Energy Partners (EROC) at one point traded down to almost 10 bucks and down 2 and change before recovering. Lehman owns a huge block of Eagle Rock (EROC). Volume was over 3 million shares or 30 times normal. Was Lehman selling? If they were they would have to file with the SEC as a large stake holder. No filing so far.

RBC is actually raising the target price on Copano (CPNO) to 51 bucks or nearly a double from here. Good luck. Energy is higher this morning as IKE heads straight for rigs and refineries. Not much else going on this morning. No other corporate developements.

Finally this is the cry being heard throughout mlp land.

Thursday, September 11, 2008

So soon the "Lehman has been selling" mantra that we've seen posted here and on the comments board will be tested once and for all.

Anybody see an uptick? I forgot what they look like.

BTW if 240 breaks on the chart there is no support undernearth until 220 or even 190! Can you imagine what MLPS would like like another 20% down from here? And Wachovia had the nerve to say.."its not as bad as it looks!" I would hate to think what their definition of "bad" is.

Crosstex Energy is now at 22 and change. Did you ever believe it could get to that price. Was it last there in 2004? We are at least back to 2005 levels in here. Coal MLPS taking harder hits with most of those down 1 or more.

Oh my GOD IN HEAVEN we have uptick to minus 4.97!

Martin Midstream Partners (MMLP) is up 87 cents on the company clarifying its at no risk from the family lawsuit. Other than a few issues ticking up a couple of pennies its just an endless decline. Eagle Rock (EROC) was driven down to nearly 10 dollars this morning on no news and heavy volume..its back to around 11.40 and still down 1 and some change among the biggest losers.

The horror show continues...no signs of when intermission begins!

MARKETS IN TURMOIL

Natural gas is rallying this morning probably due to Hurricane Ike strengthening and taking a northward jog which brings it closer to the rigs in the NW Gulf of Mexico. But on the otherside of that equation we have crude down a little this morning so its not reacting. In fact 100 bucks is just a handful of ticks below us. And we have stock futures down hard in the pre open as we near 11,000 and an eventual breakdown there. Lehman is still out there justing waiting to head to zero. Its all lovely.

Wednesday, September 10, 2008

MLP index closes down a few ticks. in a tug of war day. Energy and commodity stocks did a dead cat bounce today. Martin Midstream (MMLP) closed down 4 and change as the biggest loser. Regency (RGNC) lost 2 and change. Coal MLPS were all up 1 point or more as the biggest winners.

In the event that a judgment is rendered against MRMC in the above-described litigation and such judgment is deemed to have a material adverse effect on the Partnership, the lenders under the Partnership's credit facility would be entitled to declare an event of default under such facility and all amounts outstanding thereunder to be immediately due and payable. In addition, if as a result of the above-described litigation, either Ruben Martin or Scott Martin ceases to be the President and Chief Executive Officer of MRMC and no successor acceptable to the lenders is appointed within the time period specified in the credit agreement, then such lenders would also be entitled to declare an event of default under such facility. Furthermore, any circumstance that might be deemed to have a material adverse effect on the Partnership,

including any circumstance that might be deemed to have a material adverse effect on MRMC, even though not a technical event of default under the Partnership's credit facility, could result in the Partnership being unable to access additional borrowings thereunder.

Maybe the Martin's should think back to a time when they got along like they did here against a formidable advesary.

BTW if you click and nothing happens on mystic monk you need to hold the control key (CTRL) at the same time...or turn off pop up blocker.

So lets look at where yields are with some of the mlps.

So lets look at where yields are with some of the mlps.

Oneok Partners 57.77....7.2%

Kinder Morgan Partners (KMP) 53.86.....7.35%

Nustar (NS) 48.71...8.08%

Energy Transfer Partners (ETP) 40.26...8.88%

Atlas Pipeline Partners (APL) 29.09...13.2%

E V Partners (EVEP) 20.63....13.57%*

Constellation Energy Partners (CEP) 10.12.....22.23%

*E V Partners has already announced an increase to 3 dollars annual for Q3 which puts the yield at 14.54%

Late yesterday Regency Partners (RGNC) announced a major expansion of a pipeline to accomodate Haynesville Shale production. There is also a 7 million share stake being sold by an affiliate.

Nothing on the upgrade downgrade list this morning as if that makes a difference anyway. Stock futures rallied ahead of Lehman and now have come well off their highs...from +12 on the S&P to +2. Crude is a little higher as Opec is cutting production but that's also coming off yesterday's 4 dollar selloff. Oil numbers out later could be the driver to take prices under 100. Hurricane Ike is likely to pass south of the rigs. The market hasn't cared anyway. Nat gas is a little lower this morning. The dollar is higher and other commodities like gold are lower this morning.

Over 1400 hits on the blog yesterday so it looks like we are approaching another extreme in the mlp selloff. As i said earlier...a dead cat bounce could come at anytime.

Tuesday, September 09, 2008

Lehman is in a death spiral right now under 8 bucks and just spinning out of control.

I got into mlps to get away from tech and everything else. I wanted some stability. I didn't want a dot com stock again.

Bear markets destroy and destroy everything and everyone.

Crude collapse to 102 sending everything energy out the window. MLP index down 9.19 and has reached the point and figure chart bearish downside target of 252..and of course we will overshoot this.

Constellation Partners (CEP) is down to 10.20 and yields 22%

Looks like we are going to breakdown from here as the we are at the absolute bottom of what looked like a base and has turned into another diving board. We're down 3 points and nearing 257. The point and figure chart target is 253

Looks like we are going to breakdown from here as the we are at the absolute bottom of what looked like a base and has turned into another diving board. We're down 3 points and nearing 257. The point and figure chart target is 253 Alliance Resource (ARLP) is down 2 dollars and leads the coal mlps on the losers list. Constellation (CEP) now has a 10 handle down 80 cents. Resource MLPS getting hosed. Atlas Pipeline (APL), Williams (WPZ) and Markwest (MWE) all down major fractions.

Alliance Resource (ARLP) is down 2 dollars and leads the coal mlps on the losers list. Constellation (CEP) now has a 10 handle down 80 cents. Resource MLPS getting hosed. Atlas Pipeline (APL), Williams (WPZ) and Markwest (MWE) all down major fractions.Nothing but minus signs. I don't know what its going to take really. Lets look at the following combinations.

We finished yesterday just over 260 and down. Now while the dow was up 300 points it was not as good as it looked when you check advance decline and up and down volume. However we are seeing stock futures stronger today so lets see if the buying can spread out to other groups.

In corporate news this morning E V Partners (EVEP) closed on its recent purchase. They go to a 75 cent distribution in October or 3 dollars annual which is a 13.6% yield. To which i respond who cares because the market sure doesn't. Morgan Keegan is starting coverage on Crosstex (XTEX) at market perform and Regency (RGNC) at outperform.

Stock futures are up this morning as oil falls below 105. Hurricane Ike continues to see its forecast track shift southward and the latest shift would take the hurricane only on the southernmost edge of the rigs in the Gulf of Mexico. Natural gas is crashing down 31 cents and getting close to the 7.00 level. So look for pressure on energy stocks at the open. If you are not sure what that means to MLPS's go back and find the combination listed.

I am adding a new financial blog to the blog roll. Jeflin's Investment blog looks like a good place for info. He has a list of all the banks that went under so far along with some good perspective. Check it out please.

Constellation Energy Partners (CEP) traded down to 11.28 yesterday and at that price we have a yield of 19.58%. So at that price...assuming the distribution isn't cut...the stock essentially pays for itself in roughly 15 quarters of distribution. So by July of 2012 you own the stock for free! But there is something wrong here because while the market does occasionally get things wrong, its normally not to this extreme. The company said back in July that it has already asked the board to recommend a q3 distribution at the same level. I'm sorry but the market is telling us that something is wrong here. Maybe its the announcment of the parent shopping around its stake and no one wants the uncertainty. Add a bear market enviornment and you get to this extreme price measure. I wish this would resolve itself one way or the other. You can tell i'm long.

Finally this morning a few of you posted in comments yesterday that i have capitulated and thrown in the towel and therefore we have made bottom. Believe me when i tell you i want to be the contrary indicator. I want to have that power. Whatever works. However while my hair hurts and my teeth itch, and the daily agony of watching my portfolio value shrink, i always hold on the that shred of hope. As to the waving of the white flag....please note below.