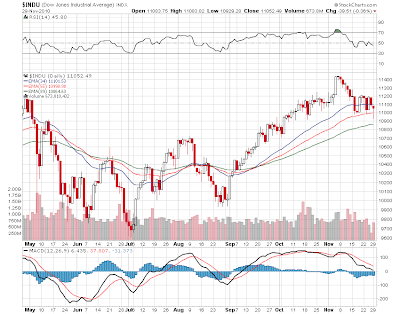

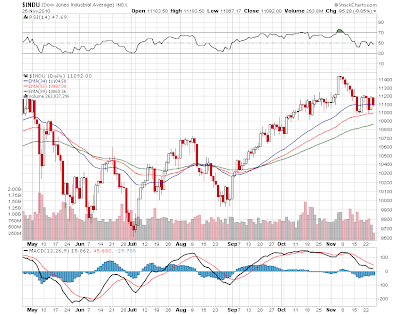

FROM 2010 TO 2011!

The year closes out with a font style change so let me know what you think. All fonts must change just like in life. Okay lets get serious. This is the last day of trading and who knows what happens due to all the year end noise. But through the noise im going to stick my neck out on the chopping block. The 2 trends i think are going to remain intact as we head into January are Nat gas and Interest rates.

The nat gas chart as measured by UNG may have finally bottomed and i think we are headed for a breakout in the next few weeks. We have favorable weather (cold as far as the eye can see after this weekend) and rising commodities in general which natgas has not participated in. And there are some favorable trends emerging in the industry which might at least keep the endless supply from getting more endless.

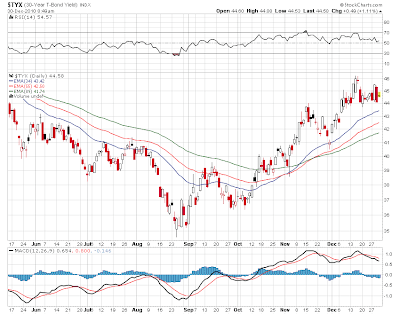

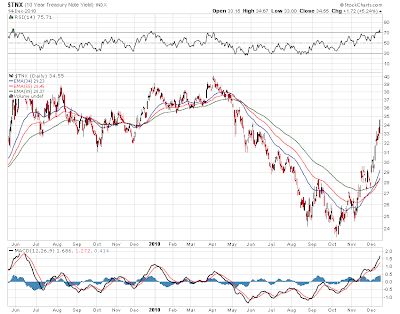

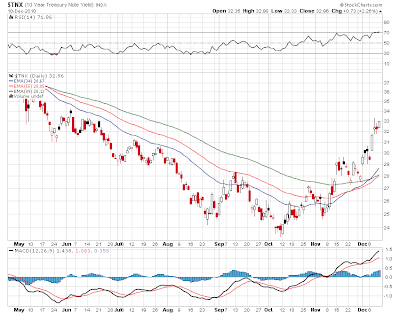

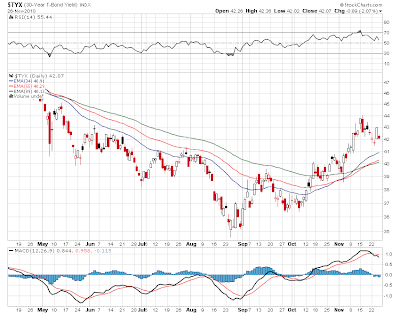

The nat gas chart as measured by UNG may have finally bottomed and i think we are headed for a breakout in the next few weeks. We have favorable weather (cold as far as the eye can see after this weekend) and rising commodities in general which natgas has not participated in. And there are some favorable trends emerging in the industry which might at least keep the endless supply from getting more endless. And the other trend is interest rates which are in an uptrend on the long end and i see no reason for that to change in the next few months as this stairstep rally continues. We are completing another stair here and i think we are preparing for the next leg up.

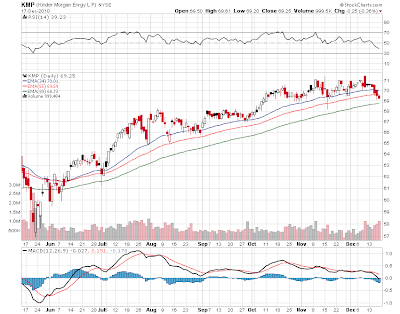

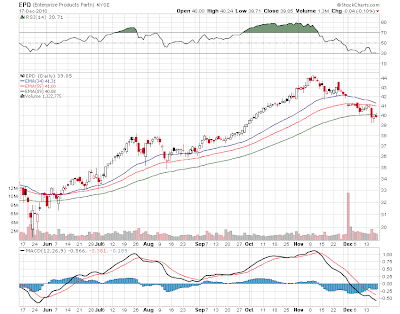

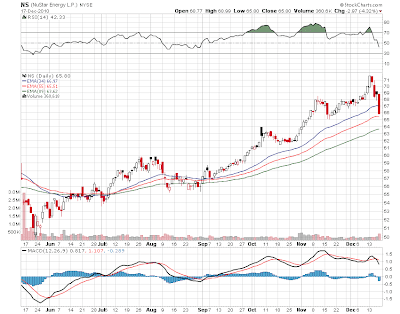

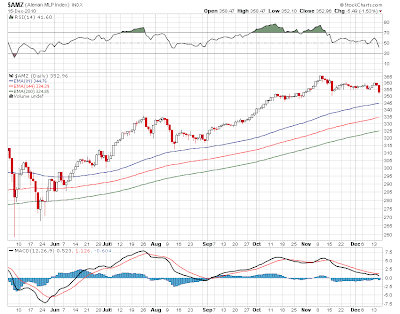

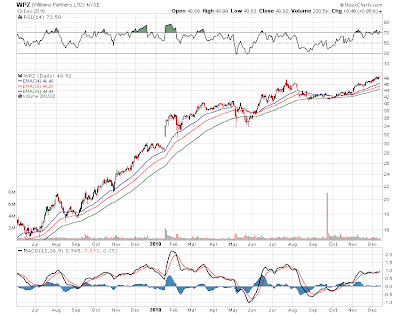

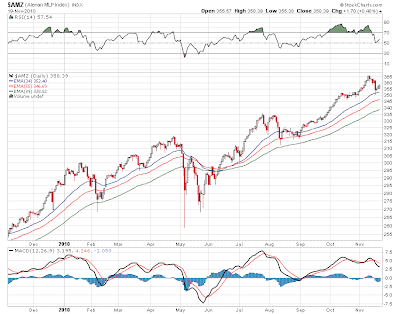

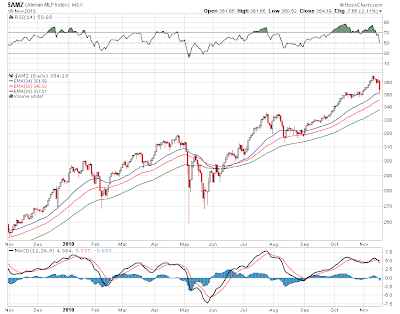

And the other trend is interest rates which are in an uptrend on the long end and i see no reason for that to change in the next few months as this stairstep rally continues. We are completing another stair here and i think we are preparing for the next leg up.And for MLPS we have one tailwind and one headwind. I have no pearls of wisdom here other than we are still in a tight trading range.

We have been in that tight range since the beginning of November and we are drifting near the top of the range. It would not surprise me to see us have one of those last hour runs that takes us to a new all time high close. But frankly i would wait until late next week to determine whether that has any meaning.

We have been in that tight range since the beginning of November and we are drifting near the top of the range. It would not surprise me to see us have one of those last hour runs that takes us to a new all time high close. But frankly i would wait until late next week to determine whether that has any meaning.MLPS open flat to a little lower this morning. No news in the group and no upgrades or downgrade. The overall market is a little lower and no outstanding movers so far in the group.