POST HOLIDAY RALLY TIME!

Often times holiday weekend provide not only the necessary extra day rest but sometimes things happen that gives markets a reason to run. With Europe kicking the Greek problem further down the road and rumors of more money for Ireland is helping to ease euro debt woes, markets are running this morning and the dow futures are up over 100 points.

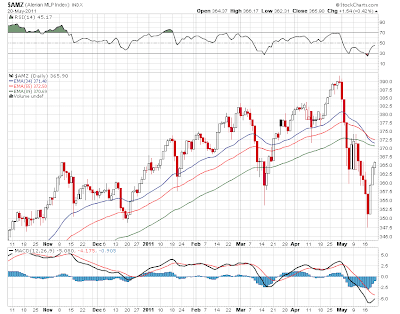

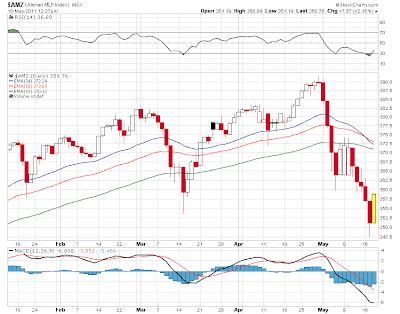

The dow chart actually held the support lines quite well and it looks like its time for another run to recovery highs is about to begin. 12,800 is the new top to watch when we get there. Meanwhile mlps have given up their leadership role and the 370 remains the short term resistence that will be watched very carefully when we get there. And we could get there in a hurry today given the strong open.

The dow chart actually held the support lines quite well and it looks like its time for another run to recovery highs is about to begin. 12,800 is the new top to watch when we get there. Meanwhile mlps have given up their leadership role and the 370 remains the short term resistence that will be watched very carefully when we get there. And we could get there in a hurry today given the strong open. One tail wind for nat gas based mlps is nat gas itself which has caught a bid and is up 2% pre open. The chart shows nat gas once again successfully holding its bottom and its another ride up to the top of the trading range. 5 dollar nat gas is not impossible during this run.

One tail wind for nat gas based mlps is nat gas itself which has caught a bid and is up 2% pre open. The chart shows nat gas once again successfully holding its bottom and its another ride up to the top of the trading range. 5 dollar nat gas is not impossible during this run. Today is the last day of the month of May so end of month has a bullish edge to it. No news on individual mlps so far this morning and no upgrades or downgrades. Crude oil is rallying this morning and back over 102 bucks. Nat gas as we said is 2% higher. The dollar is down and rates are a little higher.

Today is the last day of the month of May so end of month has a bullish edge to it. No news on individual mlps so far this morning and no upgrades or downgrades. Crude oil is rallying this morning and back over 102 bucks. Nat gas as we said is 2% higher. The dollar is down and rates are a little higher.