Mlps rally in the face of negatives in other places and as we head into the last hour we are nursing a 4 point gain on the index. Atlas Energy Resources (ATN) is the biggest loser today down over 1 point. Penn Virginia Resources (PVR) and Penn Virginia Holdings (PVG) are down 50 cents apiece. Otherwise most mlps are moving higher. Oneok (OKS) leads the winners list up 2. Regency (RGNC) which is part owned by General Electric is boosting its ownership in Haynseville. Those gas fields are the nation's fastest growing. The stock is up 1.50. Energy Transfer (ETP) Alliance Resource (ARLP) Nustar (NS) Plains All American (PAA) and Spectra (SEP) are up 1 point or more.

Mlps rally in the face of negatives in other places and as we head into the last hour we are nursing a 4 point gain on the index. Atlas Energy Resources (ATN) is the biggest loser today down over 1 point. Penn Virginia Resources (PVR) and Penn Virginia Holdings (PVG) are down 50 cents apiece. Otherwise most mlps are moving higher. Oneok (OKS) leads the winners list up 2. Regency (RGNC) which is part owned by General Electric is boosting its ownership in Haynseville. Those gas fields are the nation's fastest growing. The stock is up 1.50. Energy Transfer (ETP) Alliance Resource (ARLP) Nustar (NS) Plains All American (PAA) and Spectra (SEP) are up 1 point or more.

Friday, February 27, 2009

Mlps rally in the face of negatives in other places and as we head into the last hour we are nursing a 4 point gain on the index. Atlas Energy Resources (ATN) is the biggest loser today down over 1 point. Penn Virginia Resources (PVR) and Penn Virginia Holdings (PVG) are down 50 cents apiece. Otherwise most mlps are moving higher. Oneok (OKS) leads the winners list up 2. Regency (RGNC) which is part owned by General Electric is boosting its ownership in Haynseville. Those gas fields are the nation's fastest growing. The stock is up 1.50. Energy Transfer (ETP) Alliance Resource (ARLP) Nustar (NS) Plains All American (PAA) and Spectra (SEP) are up 1 point or more.

Mlps rally in the face of negatives in other places and as we head into the last hour we are nursing a 4 point gain on the index. Atlas Energy Resources (ATN) is the biggest loser today down over 1 point. Penn Virginia Resources (PVR) and Penn Virginia Holdings (PVG) are down 50 cents apiece. Otherwise most mlps are moving higher. Oneok (OKS) leads the winners list up 2. Regency (RGNC) which is part owned by General Electric is boosting its ownership in Haynseville. Those gas fields are the nation's fastest growing. The stock is up 1.50. Energy Transfer (ETP) Alliance Resource (ARLP) Nustar (NS) Plains All American (PAA) and Spectra (SEP) are up 1 point or more.

Thursday, February 26, 2009

Sorry for the extremely late first post as i have been out all day dealing with stuff. Dow was up 125 this morning and looked like it was on its way to a nice gain but then a reversal again and we are down 80 points. The mlp index on the other hand has been holding on to a nice 3.50 gain although its off the highs of the day. Looks like Shelia Bear's comments that healthy banks should cut paytouts caused the selloff to pick up steam. Kinder Morgan is putting a heavy drag on the index down 2.59. No news driving this. Is another stock offering coming?

Linn earnings (LINE) this morning and the stock is up 1. Exterran Partners (EXLP) is up fractionally on its earnings. Both companies seem upbeat about 2009. Sunoco Logistics (SXL) is up 2 and change as the biggest winner. Holly Partners (HEP) is down a little over 1 point and is the biggest loser.

I was wondering with the Obama budget and the probability that taxes are going up for the 250k+ earnings; perhaps its making MLPS appear attractive at these prices. Doesn't hurt that crude is rallying sharply for the second straight day up over 2 dollars.

Wednesday, February 25, 2009

Btw for the gamblers among you. Hiland Partners (HLND) and Hiland Holdings (HPGP) have offers on the table of 9.50 and 3.20 respectively. Both stocks right now are trading about 1/3 below those offers assuming the takeover is completed the stocks have some upside ahead for them. But of course these days that is a pretty big assumption. That offer to go priviate was made back in January. Food for thought and no guarantees from the management. Just putting it out there. And beware that we could get a situation like what happened with Buckeye Holdings (BGH) which saw their 17.50 offer pulled off the table.

MLPS have turned higher again as markets have come well off the lows which were down about 200 points. Targa(NGLS) and Genesis(GEL) are up fractionally on earnings. Quicksilver (KGS) is down a little on earnings. Buckeye (BPL) Nustar (NS) TC Pipelines (TCLP) are all up 1 point or more. The index is up 1.25 and nearing 183.

Today's action will be interesting to say the least as we come off a solid day yesterday that undid the losses of the day before. Did you follow all that? Charts are inconclusive in my view. Good sign was that the S&P held the intraday lows of November, the nasdaq never came close to making new lows. And the mlp index is back over 180 and is back up on the year. We had a nearly 10 point swing yesterday from bottom to top and the MLP index closed near the highs of the day.

News this morning on 3 mlps. Quicksilver Gas (KGS) Genesis (GEL) and Targa Resources (NGLS). Genesis has this relatively positive view going foward.

Grant Sims, CEO said, “Our results for the quarter reflect the ability of our increasingly integrated businesses, and the dedication of our employees, to deliver solid financial results in a challenging economic environment. The underlying cash flows from our businesses are not materially, directly impacted by commodity price fluctuations and the demand, in the aggregate, for our assets, products and services appears to be reasonably solid.”

Sims added, “While we anticipate the challenging environment will continue for the foreseeable future, we believe we are as well positioned as anyone to weather the uncertainty confronting almost every business enterprise. With the continuing financial performance of our existing businesses, the healthy coverage of our current distributions, $195.5 million in cash and existing debt commitments, and no need, other than opportunistically, to access the capital markets, we hope to be able to take advantage of both organic and/or attractive acquisition opportunities that we believe are likely to develop in 2009. Our goal is unchanged, and that is to create long-term value for all of our stakeholders.”

The outlooks have been important in driving prices lately. Targa Resources has commodity price exposure but they say things are okay with them.

``Our fourth quarter results reflect the underlying strength of our assets and hedge program. Despite the continued declines in commodity prices and processing margins, our coverage remained solid in the fourth quarter. We believe that our healthy coverage ratio, strong liquidity and hedge program currently allow us to fund our operations primarily from internal cash flow as we continue to assess the durations and ultimate impacts of the decline in commodity prices and the disruption in the capital markets. We will continue to execute with a focus on cost control and discipline regarding capital expenditures while we monitor developments in our markets and areas of operation,'' said Rene Joyce, Chief Executive Officer of the Partnership's general partner and of Targa Resources, Inc. (``Targa'').

No press release yet for Quicksilver.

Crude is up this morning ahead of inventory numbers. Stock futures were lower but they have slowly clawed their way back to the flat line. It might be nice to put 2 up days in a row in here. Bernake putting the brakes on bank natioanlization seems to have put a floor underneath us but will that floor hold?

Tuesday, February 24, 2009

Nice rally after the morning bottom when we were down over 4 points. Now up well over 5 with the dow up over 200. Most mlps have turned higher and some of the big caps which were down 1 plus this morning are now up 1 and 2 points apiece. At least they've stopped going down and we've undone yesterday's losses. And we are back up for the year again! Glory!

Lovely opening isn't as the mlp index went into freefall shortly after the open and sits down over 4 points. Oneok LP (OKS) is leading the way among the mlp big caps down over 2 points. Energy Transfer Partners (ETP) is also down over 2 points and both stocks weigh heavily in the index. Nustar (NS) another heavyweight is down a point and a half. Its pretty ugly and if the market sells off hard today we will be leading the way down. Well at least we no longer have to worry about being up on the year.

Lovely opening isn't as the mlp index went into freefall shortly after the open and sits down over 4 points. Oneok LP (OKS) is leading the way among the mlp big caps down over 2 points. Energy Transfer Partners (ETP) is also down over 2 points and both stocks weigh heavily in the index. Nustar (NS) another heavyweight is down a point and a half. Its pretty ugly and if the market sells off hard today we will be leading the way down. Well at least we no longer have to worry about being up on the year.We need a laugh and what better way than this website and video of the painfully ridiculous end to the NYU protests. My God have protests degenerated into outright silliness on our campuses. The 60s protesters must be laughing hysterically!

Yesterday's undercutting of the November lows i guess is no surprise considering the market continues to be driven by the lack of any kind of clear vision by the Messiah and his disciples. And the charts tell us that another down leg may have begun.

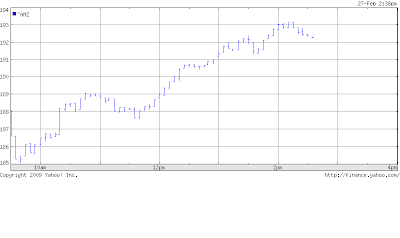

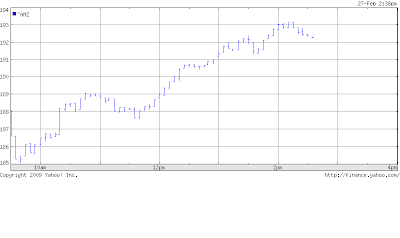

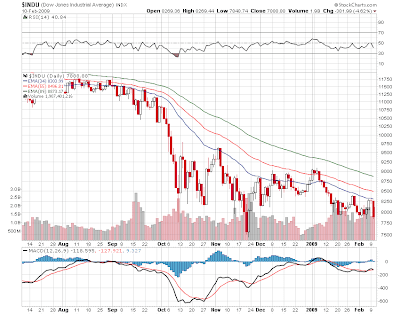

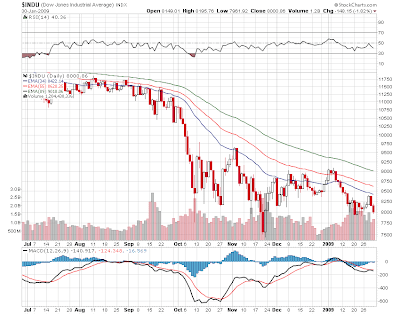

Of course we have been harping on the outperformance of the MLP index against the S&P so here are chart views of the last 5 days and the last 3 months.

Notice the last 5 days the MLP index has been outperforming on the downside. However the three month period takes us back to the day of the November low in the mlp index and the S&P. The MLP index is 24 points above its low so its up over 16% during this stretch while the S&P is now down after yesterday's breakdown. The next thing to watch for is what MLPS do in the next rally (assuming of course we ever get one) and i'm not talking about a one day bounce but something along the lines of a rally of a few weeks. Don't worry. I will wake you up IF that happens.

No news drivers this morning except for Oneoks (OKS)earnings which they had told us about last week. The driver is the market as a whole.

Monday, February 23, 2009

RETEST HAS FAILED...DOW DOWN 250 S&[ BREAKS NOVEMBER LOW! MLPS DOWN NEARLY 9 POINTS AND IS NOW FLAT ON THE YEAR. ( at least we got a payout this month that gives you a 3 to 5 percent real return depeneding on your yield).

GLORY!

The retest continues. It has been suggested this morning from one of our posters that the test has failed. He may be right. I'm holding on that it could still hold. The S&P got just under its November low by about a point or so and as of this post it is back above it at 752. Needless to say the market is demoralizing and the mlp index is in fact losing ground here faster than the rest of the market. It is now up for the year by less than 2%. Dow down 127 and back over 7200! Whoopee!

The largest mlps are leading the way downward like Nustar(NS) Oneok (OKS)Enterprise (EPD) Plains All American (PAA)Kinder Morgan (KMP)etc all down between 1 and 2 points. Oneok is down 2.50.

With the world coming to an end with every tick it makes the tape very hard to watch. White House insists a priviately held banking system is the way to go and that has caused the market to firm up in the last few minutes. Down 115 on the dow and off the lows of minus 160. Rallies are where you find them.

Friday i was driving around upstate NY looking at colleges for my daughter, all of which i can't afford. I was checking in on my phone on the status of a collapsing market and the late day bounce off the lows. It left the Dow Industrials sitting on the edge of a cliff. The mlp index is down 4 days in a row and was off over 10 points at point Friday before bouncing back to 185 which left it in a 6 point loss. 152 is the MLP closing low and we are still up on the year but that gain has been reduced to under 5%.

Monday morning brings no corporate news. Energy complex showing some gains this morning as stock futures are stronger. Overnight news that the government might take a common equity stake in Citigroup rather than go down the nationalization road is causing some short covering but its nothing more than that.

In case you missed it over the weekend Stuart Varney of Fox Business News had this encounter with an ACORN member. Thanks to Flopping Aces and the transcript is also available there. It speaks volumes about where we are headed here. That tea party that Rick Santelli called for is getting bigger and bigger.

Friday, February 20, 2009

I'm on the road today as i have some college shopping to do. Of course given the times we live in i'm going to expect the government to pay for it. Meantime its a down open as the markets are in full retest mode for the Dow and getting closer for the S&P and Nasdaq. MLP index still well above its November lows down near 150. And MLPS are still up for the year based on the index.

I should be back late this afternoon.

Thursday, February 19, 2009

Markets opened higher went lower ..went higher..went lower...etc etc. Its going nowhere fast but there are one or 2 bright spots. MLPS were up a couple and now down 1 on the index. Williams (WPZ) is down 1.43 and Martin Midstream is down 1.75 as the 2 biggest losers. Calumet Specialty Products had good earnings yesterday but closed down with the group. Its up 1.17 as the biggest winner.

Back to Rick Santelli. Bring on the revolution. He is absolutely 100% right on everything including having to take a shower once an hour if he had to work in Washington!

Williams Partners (WPZ) puts up earnigns and tells us 2009 is not going to be as good as 2008 (shocker) and they are reducing their outlook. The market told us that a long time ago. No other news this morning on the board and no upgrades or downgrades so far. Stock futures are up this morning. Maybe we are all sold out. Crude is rising above 35 bucks which is a good thing in my view.

Some items of interest. Free Barrons piece on Gold which you might want to read since it is the only thing that has been working lately. Stock futures this morning are rallying away from the overnight lows. Bottoms are frustrating processes and this one sure has been frustrating. MLPS at least still remain up 10% on the year. 16 mlps sell for under 10 dollars right now. At the November lows 24 sold for under 10 bucks. Now that doesn't mean you should run out and buy the 16 since they may be under 10 bucks for a reason. Atlas Holdings btw now has a 1 handle!

Wednesday, February 18, 2009

Yesterday's close on the dow closed right on the November closing low. And the mlp index remains miles above its November low. Doesn't take away from just how ugly things were yesterday with being down nearly 300 on the dow and 7 on the mlp index.

Calumet Specialty Products (CLMT) puts up good earnings and notes that they are in compliance with all loan covenants. Good news there and the company says its benefiting from the oil price drop. Glad someone is!

No other corporate news this morning and no upgrades or downgrades. So we now watch the intraday dow lows around 7390 on the dow and the S&P lows which are around 750. We have a ways to go on that. Crude is up this morning as it holds just above 35 bucks. Dollar is a little higher this morning.

Tuesday, February 17, 2009

Holly Partners (HEP) Transmontaigne (TLP) Nustar (NS) Boardwalk (BWP) and Suburban Propane (SPH) lead the lsoers down 1 point or more. Winners number all of 3 with Plains All American (PAA) Oneok (OKS) Exterran (EXLP) up small fractions.

Lets hope this "the" bottom for the overall market because if it isn't then there will be weeping and gnashing of teeth!

Charts show us we are in a much better place while the overall market is retesting the November climax lows (among many other climax lows) and there will be a positive divergence as the S&P needs to get down below 780 to match those lows. The dow is pretty much already there.

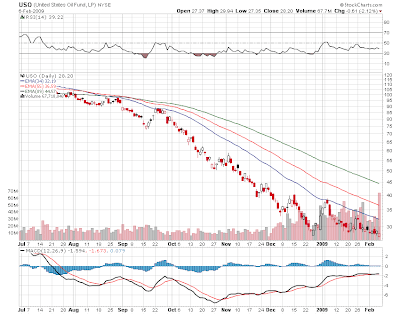

Crude is down 2 dollars right now at around 35 bucks while Brent remains high at 44. Gasoline remains high as offshore oil is selling 9 bucks higher and its from imported oil that gasoline is made from and not the high grade West texas intermediate which apparently we have tons of but not enough pipeline to get it to market. And you can't build pipelines if you can't get money!

Holly Partners (HEP) is posting earnings numbers this morning. This mlp has been among the better performing mlps out there. Also we have a gas deal between Southern Union and Enterprise Products Partners (EPD). No other corporate developements this morning and no upgrades or downgrades. Stock futures are at the lows of the morning now at -20 on the S&P.

Not a pretty way to come back from a holiday weekend.

Friday, February 13, 2009

Not much else happening this afternoon. Bond market closed early so i guess we head into the weekend here with a firm tone in MLP land.

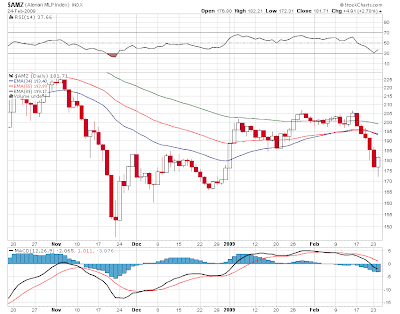

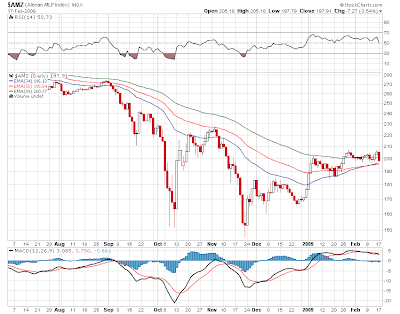

Yesterday's 4 point mlp index gain in the face of the dow's reversal in the last half hour was actually a pretty stunning move. Even when the down went to new lows on the day after 3pm..it was down about 230 or so...the mlp index never went negative. The mlp chart is showing the 34 day moving average making a cross of the 55 day and it appears to me that we are about to adventure to a new 2009 high. The real test in my view will come when we get to the 220 level. And btw the mlp index is now back to outperforming the S&P 500 for every time period out to 10 years. Of course the mix of mlps you hold makes a huge difference and if you are in the likes of Crosstex (XTEX) Atlas Pipeline (APL) for example...your position right now may be far worse. If you are in Kinder Morgan (KMP) Nustar (NS) and Buckeye (BPL) your position is far better. If you are in Sunoco Logistics (SXL) your position is stellar. Or perhaps and more likely you have a mix of both bad and good and you are performing...like the index...average!

Yesterday's 4 point mlp index gain in the face of the dow's reversal in the last half hour was actually a pretty stunning move. Even when the down went to new lows on the day after 3pm..it was down about 230 or so...the mlp index never went negative. The mlp chart is showing the 34 day moving average making a cross of the 55 day and it appears to me that we are about to adventure to a new 2009 high. The real test in my view will come when we get to the 220 level. And btw the mlp index is now back to outperforming the S&P 500 for every time period out to 10 years. Of course the mix of mlps you hold makes a huge difference and if you are in the likes of Crosstex (XTEX) Atlas Pipeline (APL) for example...your position right now may be far worse. If you are in Kinder Morgan (KMP) Nustar (NS) and Buckeye (BPL) your position is far better. If you are in Sunoco Logistics (SXL) your position is stellar. Or perhaps and more likely you have a mix of both bad and good and you are performing...like the index...average!Its Friday ahead of a 3 day weekend and also your distribution checks will be arriving. Spend them well and help the economy. No news headlines this morning. No upgrades or downgrades. And have you noticed btw how we've been seeing a host of downgrades on mlps right as mlps as a whole continue to slowly improve and vastly outperform the market? "Anal"-ists!

Stock futures are firm. Energy futures are firm. And btw is crude oil ever going to rally again? Gasoline remains way out of whack relative to crude. Is crude going to catch up or is gasoline going to drop?

Finally you must add Iowahawk to your list of must see political satire blogs. I found it yesterday and its absolutely hilarious! Do visit and give it a read. It will be added to the blogroll on the sidebar.

Thursday, February 12, 2009

Plains All American (PAA) closed up 2 and change..and Magellan (MMP)Holly Partners (HEP) and Martin Midstream (MMLP) closed up 1 to 1.50 leading the winners.

Nice day overall for our group. Tortoise Energy Infrastructure (TYG) announced a distribtuion of 54 cents which is a 2 cent cut from last quarter however the company says it sees distributions no lower than 54 cents for future quarters and that could be a positive driver here. The stock has rallied from a low of 9 to 22 and change today. No after hours trades so far.

Good signs in here!

The tape action is extremely encouraging in my view and we could be setting up for a nice afternoon reversal in my view. At least i'm hoping thats the case but for those that will be looking for bottom testing there are all kinds of non confirmations showing up. We'll keep our eyes open as the day wears on.

DCP Midstream is dealing with an explosion at one of its plants in Texas which it has shutdown for the time being. No indications on the extent of the damage or the impact but the stock lost 50 cents or about 5% yesterday. We also had earnings yesterday from Plains All American (PAA) as they put up another soild quarter. No hints in the press release about 2009 although the company does mention challenging conditions which we all know is the case. Also we have earnings from Penn Virginia Holdings (PVG) and Penn Virginia Resources (PVR). Noticed in the 2009 guidance that coal volumes are forecast to be the same but nat gas volumes are forecast higher from 2008 although we are dealing with lower prices. Also the company mentions the difficulties accessing the capital markets. Nothing new here.

Well it looks like with respect to the dow anyway that we are heading for a retest of the November lows. Futures are calling for a down open of about 90 or so points. Right now if we get down to those levels many of the broader averages will not confirm. Certainly mlps won't confirm as they need to lose 25% of their value in order to get down to the November lows on the index. Thats down around 150. We are still up 23 points on the mlp index for 2009 so far.

Crude Oil is down this morning as the front month contract is around 35 bucks. Gasoline continues to trade completely out of whack to crude and matches up to oil at around 50 bucks. The back month crude contracts are trading at much higher levels. Something has to give somewhere in here. Gasoline is up another 2 cents this morning.

Thankfully we don't have to sit through any congressional hearings today so we don't have to watch and listen to those Washington gasbags. Another day of listening to these sanctimonious scatterbrains and i will probably lose my mind.

Wednesday, February 11, 2009

Most mlps entering the lunch hour either flat or higher. The index is up just under 1 point. The dow is higher by 60 or so points as we go into the lunch hour. So at least so far the lows and the trendlines are holding. The three month chart above shows about 5% relative outperformace between the mlp index and the s&p index and that outperformance has accelerated since January 1st.

No outstanding movers in either direction so far except for Oneok (OKS) which is down 1.37 and Genesis (GEL) which is up 87 cents. Everything else seems to be moving fractionally.

Yesterdays action as bad as it was still is above the so called base we've been building on the dow industrials. And as far as the MLP index is concerned we are still doing quite well. The index is up 23 points or up over 13% since January 1st. The dow is down about 9% in that time frame so thats a 22% outperformance. And we have a distribution payout coming in a few days and thats priced in so add another 3 to 5% depeneding on your holdings to calculate total return.

Its one of those morning s where we don't have any corporate news items yet but Plains All American (PAA) will be posting earnings after the close. Crude is up a little this morning as we see oil pretty much trading with stocks and the economy. Gasoline continues to trade higher and is completely out of whack with the crude price. I don't know if that is signaling a bottom in crude but gasoline continues to move higher. Something has to give somewhere.

I of course occasionally put up blogs or web sites that i suggest you visit and here is another one to bookmark on your list. Its Jay DeDapper.com. Jay is a terrific reporter and has a nose for politics that i think you will find interesting. He also will be added to the blog roll! This morning he has perspective on treasury along with some great stuff on news items of the last few days. Go there!

Tuesday, February 10, 2009

thanks to Althouse for this.

And in case you missed it!!!

Sorry for the late first post but had my hands filled with crap this morning. After a slightly down open and an up open for MLPS, stocks have taken gas big time with the dow down 330 points and just off the lows of the day around 7900. Some of this is buy the rumor sell the news but its also buy the rumor, sell the news, and then sell some more. MLPS are down with the index off a little more than 2 points which so far, considering the rest of the tape...is not that bad. The plan had little in details and nothing since the announcement has brought about any kind of solace about it. It could get ugly in the late afternoon.

Some mlps are up today as Transmontaigne (TLP) is up almost 50 cents and leads a short list of winners. None of the big cap mlps however are showing any plus signs. On the otherhand there are no one point losers but many mlps are down fractions to, in some cases, major fractions. Frankly we've seen much worse days in mlp land so perhaps the overall improvement in credit markets have put a floor underneath our particular asset class.

Maxine Waters is attempting to sound intelligent by saying she doesn't understand anything that the fed has done with regards to saving certain institutions. Isn't that fabulous. Also watching the Messiah's press conference last night, it was not comforting to hear that government was the only thing that could save us from a "catastrophy". Maxine does have a new hair style as she pontificates on CNBC.

Crude rallied this morning but now is down 77 cents as stocks swoon. Looks like a retest of those 7400 lows is going to occur very soon.

Lots of news stories on the treasury plan here along with blog reactions.

Monday, February 09, 2009

Nustar (NS) and Suburban Propane (SPH) are fractional losers on the wachovia downgrades but other than that the MLP index has been up a little..down a little and then going sideways a little. Transmontaigne (TLP) and Holly (HEP) are up major fractions and lead the winners list. Actually most mlps are either flat or a little bit higher on the day and they outnumber the mlps that are down..and those are down just relatively small fractions.

IS IT A BASE OR A PLATFORM?

This morning Wachovia has taken out the knife and is cutting Suburban Propane (SPH) and Nustar (NS) both to market perform from outperform. And technically they are correct as both mlps are trading at 6 month highs and Suburban Propane is trading near a 52 week high. So if we take them to market perform and the market goes higher from here then these mlps will continue to go up! You got that...its a cut but not really! Such absolute convoluted bullshit really and since these guys are the smartest folks in the room you are most certainly going to follow their every move. As Patricia Heaton used to call Ray Romano on Everybody Loves Raymond...IDIOT! In this case its plural..IDIOTS!

We are a little chart happy this morning as we have 4 of them to look at. Above we have the MLP index and the Dow Industrails. We are in outperformance mode for the most part; at least as measured since January 1st with the mlp index up over 25 points or nearly 15% plus a distribution thats about toe be paid vs the dow which is down for the year. And while day to day we see some days where we are down less...or some days when we are up less. Overall i think the outperformance continues as long as 10 year rates continue to rise.

The mlp outperformance is occuring even though the Dow Jones Oil and Gas index of big energy stocks has gone nowhere. Crude looks like its trying to bottom. If big energy stocks can get on the ball and break out of the base that will probably give mlps an additional tailwind. We have a lot of things converging this week including the governments bailout announcements so keep your seatbelts securely fastened.

Boardwalk Partners (BWP) puts up earnings this morning. What is interesting about Boardwalk is that it was among the first mlps to fall when it ran into cost overrun problems and the stock price started to fall long before other mlps. And now after the banking crisis it has emerged as one of the better performers. It helps to have Loews Corp and the Tisch family as a sugar daddy as they hold sizeable stakes and have provided financing.

Not much else happening this morning. The energy complex is higher this morning which helps. Btw got heating oil delievered this week at 1.79 a gallon. Can't remember last time heating oil was this cheap.

Friday, February 06, 2009

Capital Products Partners (CPLP) and Enbridge Partners (EEP) are the two biggest losers down major fractions. No news on either one.

The unemployment numbers were horrible and there was no surprise there. So focus is on a potential package next week that will be helpful long term. So the shorts are covering today. Energy stocks are dragging at little at the open which is holding MLPS near the flat line at the start but my guess is if the buying spreads out..we'll get it in gear and move up with the rest of the tape.

Oneok Partners (OKS) is down 2 dollars at the open as they provided guidance for 2009 that was a bit underwhelming due to market conditions. Tudor Pickering downgrades the stock as well. Kinder Morgan (KMP) is down 50 cents at the open which providing addtional drag on the index. Nothing much else going on from a corporate standpoint.

The energy complex is lower with oil under 40 bucks again and that is providing additional pressure.

Thursday, February 05, 2009

Plains All American (PAA) leads the way up 1 and some change. Buckeye Partners (BPL) is up 1 and is nearing a six month high. Buckeye Holdings (BGH) is up nearly 1. Energy Transfer (ETP) Genesis (GEL) Oneok (OKS) Teppco (TPP) Inergy LP (NRGY) among the nice fractional winners today.

Exterran (EXLP) is listed down 75 cents but 46 cents of that is ex-distribution. E V Partners (EVEP) Martin Midstream (MMLP) Inergy Holdings (NRGP) are fractional losers. Duncan (DEP) is down fractioanlly on the Citigroup downgrade.

Looks like we could finish well today. Waiting for that fabulous last hour.

The dow continues to straddle the floor around 8000 and there is an intraday low down in the 7400s. So this retest continues and the implications are serious here. If we break down below this low decisively then the market is telegraphing a serious recession/depression thats going to last for a long time. So we continue to watch and MLP continue to show relative outperformance which is a positive for mlp holders and followers.

Eagle Rock (EROC) puts up its distribution amount for the quarter and its 41 cents for unti holders. Crosstex (XTEX) has elected its chairman. The company has seen its stock go from 40 to 4 in this bear market. We'll see if he can turn things around there. And Citigroup is downgrading Duncan Partners (DEP) to hold from buy. Duncan has been among the better performers in mlp land. Neglected to mention yesterday that RBS upgraded Cheniere Energy (LNG) to buy from hold which was good for a 10% up move in this under 5 dollar stock.

Not much else happening this morning. The energy complex is a little higher this morning but not far from the flat line. Stock futures are a little lower this morning but not far from the flat line. A horrible unemployment number is due tomorrow and i would think traders will be getting ahead of that number today.

Wednesday, February 04, 2009

Teppco (TPP) among the biggest losers on the board down nearly 1 point and its been down every day since going ex-distibution. The companies earnigns yesterday and a cautious outlook weighing here.

Don't want to read too much into this but Hiland Partners is at 9.24 up 25 cents today and close to the 9.50 offer thats on the table by Harold Hamm. Also we continue to see improvements in the credit markets as rates rise on the long end and even the 3 month bill is yielding something north of .25%! Doesn't hurt. Also...the broader market averages are doing quite well today.

NOW THATS POSITIVE INERGY!

Amd the charts don't look half either as the stocks are nearing 6 month highs and a couple of weeks of good action will put them at 52 week highs. But first things first it was a very good quarter and the company says things for 2009 are looking better than before. Stocks go ex-distribution tomorrow(2/5). So we at least start the day with some good news. It is actually my largest holding and that has helped considerably in having my accounts come off their lows. Still a long way to go however.

Not much else going on so far this morning. Stock futures are a touch softer but commodities seem to be rallying this morning with the energy complex up. The dollar is up as well this morning.

Gotta take my daughter to school along with dealing with a snowfall overnight. More later.

Tuesday, February 03, 2009

Magellan (MMP) announced record earnings this morning and the stock is up just under 1 point. And if Magellan does well so does Magellan Holdings (MGG) which also posts higher earnings. Its unchanged after being down earlier. Also up 1 or more Alliance Resource (ARLP) and K-Sea (KSP) Buckeye (BPL) and Buckeye Holdings (BGH) are fractional winners on their earnings.

Teppco (TPP) is down 1 on earnings news and Plains All American is down 1 and change. No news on that one. Ferrellgas (FGP) is down a little less than 1 point on its secondary offering.

Overall the way the dow has behaved lately it feels like its building some sort of a longer term bottom. But being in this bear market has left me pretty shell shocked to call anything with confidence. Still we are seeing volume drying up on this selloff below 8000 and while the financials are still taking gas...some groups are beginning to poke their heads above water...or at least they are rising from the depths and the light from the surface above is within reach.

Are mlps improving as 10 year yields rise. If these were normal times a rise in yields would be an issue but these are not normal times. The rise in yields in the 10 year are signalling an easing in credit tightness. That seems to be benefiting MLPS as we are the only group of stocks that i could find showing a gain since January 1st...we're up over 14% while the S&P is down 10 percent. So i'm looking for mlps to continue to lead the way higher as long as yields continue to rise.

We have earnings distribution numbers for Buckeye Partners and we see another boost in the payout. Same holds for Buckeye Holdings (BGH). This morning we have earnings from Teppco (TPP) and Magellan (MMP) is due out before the open. Holly Partners (HEP) which has been one of the better performers lately puts up earnings numbers this morning. Nothing doing on the upgrade downgrade list so far this morning.

One of the things we should be watching over the next few days is what happens after we go ex-distribution. It would of course be nice to see mlps hold their price levels after the payout support disappears for another 3 months. Note that Hiland Partners (HLND) and Hiland Holdings (HPGP) go ex-dis this morning and they have a buyout offer on the table above these levels so i would expect these 2 to not drop much after their payouts. We'll see about the others.

Sunoco Logistics (SXL) remains among the best mlp performers as it sits just under a 52 week high. And actually as i look at the longer term chart..its only a couple of points away from an all time high!

Monday, February 02, 2009

Flat finish on the MLP index and still holding the 200 line while the dow came off its lows and closed down 64 but broader averages were higher which is good.

Ferrellgas (FGP) announces a public offering of shares after the close. Also we have distribution annoucnes from Teekay LNG Partners of 57 cents and also one from Teekay Offshore (TOO) which announces a 45 cent payout.

Not much else happening today but it is good to see continued outperformance. Be sure btw to visit the Yahoo MLP group (membership required) for the latest uploaded reports. "Pass and Shoot: added some stuff today so check it out.

BREAKDOWN OR REBOUND?

Its either a platform or a diving board and we seem to be ready to retest the depths of the November lows with stock futures sharply lower this morning. MLPS will follow along but the group has outperformed and remains up 10% on the year and this is a reflection in the small improvements that we have seen in credit markets. But there is pressure this morning as commodities take it on the chin. Crude is at 40 dollars down 1 and change. It doesn't look like a pretty start.

Its either a platform or a diving board and we seem to be ready to retest the depths of the November lows with stock futures sharply lower this morning. MLPS will follow along but the group has outperformed and remains up 10% on the year and this is a reflection in the small improvements that we have seen in credit markets. But there is pressure this morning as commodities take it on the chin. Crude is at 40 dollars down 1 and change. It doesn't look like a pretty start.This morning we have earnings from Duncan Partners (DEP) and Enterprise Products Partners (EPD) and Dan Duncan has both those companies moving right along gunning on all engines. Not much else happening from a corporate standpoint this morning. Ex distributions are getting underway and they will be mostly done by week's end.

Here comes the open....fingers crossed and seatbelts fastened.