Wednesday, December 30, 2009

THE YEAR WINDS DOWN!

Its just today and tomorrow boys and girls and MLPS will go down as having a spectacular year as they led us out of the abyss. Now we are focused on the last of the year end distortions and the push and pull we've seen in the last 2 weeks. My gut feeling is that we may see a bit of selling into the close tomorrow in the group. But who knows really. Remember on options expiration this month we had that last half hour collapse due to rebalancing and we got it all back the next day. Maybe all the year end stuff was taken care of already.

No news and no upgrades or downgrades that i can find. So its more of the same for today. Energy numbers at 10:30am and that will drive oil. Nat gas is down a little as it hoves under 6 bucks. Bonds are flat and S&P futures are a little lower.

Tuesday, December 29, 2009

YEAR END DISTORTIONS CONTINUE!

Its really hard to separate whats real and what isnt this time of year as we have all sorts of push and pull going on. Some people are booking profits. Some people are repositioning themselves for 2010 and the next leg; whichever way that is. Some people are playing the year end bounce. And some are doing all of the above. Yesterday we saw a little profit taking in MLPS with the index down a point and off its lows. Again its hard to discern what if anything it means and given the almost straight up move we've had in December; a down day should be no surprise.

This morning we have a slight positive bias in stock futures. No news in MLP land and no upgrades or downgrades although Wunderlich is taking Energy and Income Fund (FEN) which trades on the Amex down to a hold from a buy. The fund is an mlp fund and trades like a stock.

Not much else to say really in this holiday trading enviornment as 2009 winds down to the last few trading days. At some point i would think we will see a little volatility as the last bets are put down before the ball drops.

Monday, December 28, 2009

5 POINTS AWAY FROM A DOUBLE!

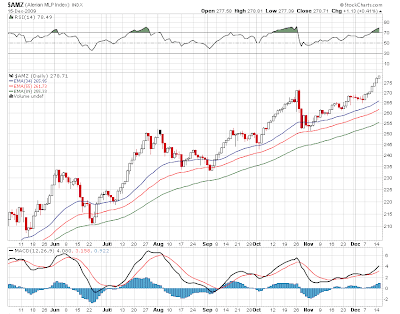

Welcome back and here we are in the last week of trading. We are 122 points above the Dec 24th rally low and we are up just about 100% from the 2008 low at 146! By far MLPS have been the best performing group and if you were nimble enough to avoid the disasters in the group and stayed with the big boys...then congratulations you are probably back where you started in 2007 and perhaps more counting distributions.

Welcome back and here we are in the last week of trading. We are 122 points above the Dec 24th rally low and we are up just about 100% from the 2008 low at 146! By far MLPS have been the best performing group and if you were nimble enough to avoid the disasters in the group and stayed with the big boys...then congratulations you are probably back where you started in 2007 and perhaps more counting distributions. Now of course we look ahead and wonder what next year brings. Frankly im getting a bit nervous in here not just due to the length of the rally but the chart of the 10 year yield below as represented by the TBT which is the 10 year yield ETF. It looks to me that we are breaking out of a base and yields could be headed higher. The mlp/10 year yield spread has tightened and it will probably tighten further as yields rise. MLP distributions are due to rise next month with the payout announcements come which is a positive. Right now we're seeing a rush to year end winners and a grab for yield. Im just thinking that after this massive rally in our little group, no would would be faulted for taking some money off the table.

Now of course we look ahead and wonder what next year brings. Frankly im getting a bit nervous in here not just due to the length of the rally but the chart of the 10 year yield below as represented by the TBT which is the 10 year yield ETF. It looks to me that we are breaking out of a base and yields could be headed higher. The mlp/10 year yield spread has tightened and it will probably tighten further as yields rise. MLP distributions are due to rise next month with the payout announcements come which is a positive. Right now we're seeing a rush to year end winners and a grab for yield. Im just thinking that after this massive rally in our little group, no would would be faulted for taking some money off the table.Not much on the news front this morning and i would expect quiet times this week as we head into New Years Day. Nothing on the upgrade downgrade list. Crude is up and nat gas is up 3% in the pre market. 10 year yields are higher in the premarket.

Thursday, December 24, 2009

Wednesday, December 23, 2009

And on and on it goes. Except for that one day re balancing act last Friday we have been going straight up for 3 weeks. The mlp index is up nearly 3 right now and we have solid gains across the board and many mlps are back to levels not seen since before the collapse. Great way to end the year!

Linn Energy (LINE) Sunoco Logistics (SXL) Nustar (NS) and Suburban Propane (SPH) are all up solidly with Linn the big winner today up 1.27. Atlas Holdings (AHD) is down 70 cents today after a 2 dollar gain yesterday.

Linn Energy (LINE) Sunoco Logistics (SXL) Nustar (NS) and Suburban Propane (SPH) are all up solidly with Linn the big winner today up 1.27. Atlas Holdings (AHD) is down 70 cents today after a 2 dollar gain yesterday.

ROLLING ALONG IN RALLYLAND!

First off sorry about no posts yesterday as i had another work day. But it was just another rally day in the land of MLPS as we continue to march along to higher highs and i guess 300 is the next important level to challenge on the MLP index. There seems to be a rush to get in to anything high yield and even the single digit mlps are getting into the act. Atlas Holdings (AHD) got a Citigroup upgrade and the stock price jumped 40% from 5 to 7 yesterday. It shouldnt be any different today as stock futures ahead of the open are higher and everything looks supportive so far. Crude is up, nat gas is down ahead of the open.

I will add to this post as headlines break.

Monday, December 21, 2009

If the mlp index is up over 6 it would be no surprise given the moves in some issues. 15 mlps are up 90 cents or more and we have Inergy Holdings (NRGP) with a nearly 2 point gain along with Alliance Resource Partners (ARLP) and Sunoco Logistics (SXL). Its hard to know what exactly is going on since we had that rebalancing last Friday.

Still all and all and excellent day in mlp land as we hade into the close.

Still all and all and excellent day in mlp land as we hade into the close.

If you were wondering why the big selloff late Friday wonder no longer as the mlp was rebalanced as K-Sea (KSP) went out and Holly Partners (HEP) went in. Those distortions continue this morning as the index is unchanged but almost every mlp is up and many are up sharply this morning making back much of their Friday losses. All the major mlps are up strong fractions and some over a point including Oneok (OKS) Inergy (NRGP) and Suburban Propane (SPH). Looks like a good day ahead.

THE DAY AFTER THE BIG REVERSAL!

It was only a matter of time after being up 9 days in a row and a move from 265 to 283, mlps sold off sharply in the last hour on Friday. Now we did have triple witch expiration which probably played some havoc here in some fashion along with year end factors and likely a few other things going on. But a correction was due and no big surprise. It continues to be in the context of this stair step advance we have been in since last Decemeber. And we are coming up on the one year anniversary of the 176 bullback from which this rally began. Markets are firm this morning so we'll see soon enough if this was just a one day decline or if we need to touch the 34 day moving average again around 268.

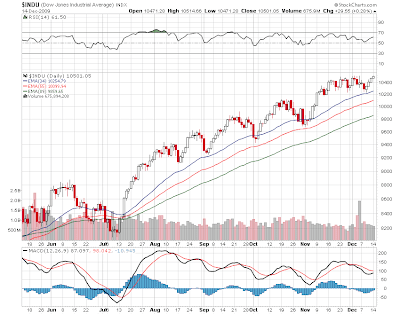

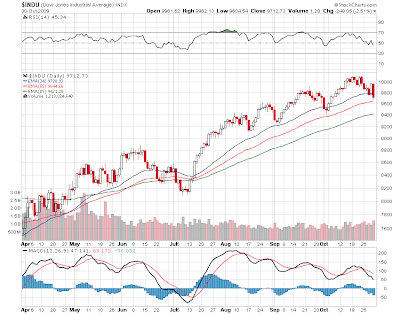

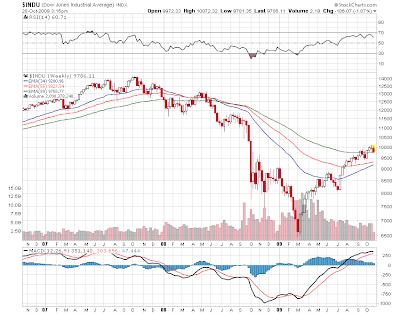

The overall tape as measured by the dow touched its 34 day moving average on Friday and bounced. Markets are firm this morning and it looks like we will have a positive bias to the overall tape for this week into Christmas. No mlp headlines this morning so far and no upgrades or downgrades.

Sorry for no posts last Friday as i had my hands full working hours while i can. Plus we had a huge snowstorm this weekend here and i have 25 inches of snow to dig out of. All this winter weather has nat gas roaring and nearing the 6 dollar mark. Crude is up a touch this morning as well. Rushing around as Christmas approaches; always a busy time!!!

Thursday, December 17, 2009

MLPS have been heading higher as the overall market remains lower. The index is touching 281 right now and the outperformance continues on a relative basis. Inergy Holdings (NRGP) is up 1,03 and is at an all time high. Sunoco Logistics (SXL) is up 55 cents and is also at an all time higher. Some of the beaten down mlps like Crosstex (XTEX) and Atlas Pipeline (APL) are up strong on a percentage basis. Almost looks like the January effect coming early in here.

Some fractional losers but nothing that gets the heart racing in panic. Nat gas is very strong and adding additional support here. The dollar is ripping higher on the euro and the dow is now at the lows of the day down about 130.

Some fractional losers but nothing that gets the heart racing in panic. Nat gas is very strong and adding additional support here. The dollar is ripping higher on the euro and the dow is now at the lows of the day down about 130.

A CORRECTION DUE SOON?

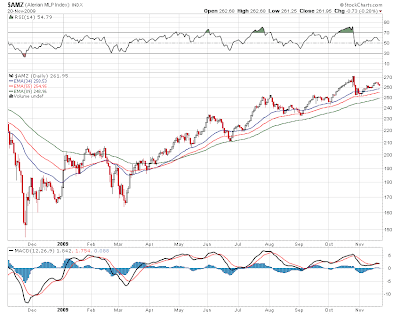

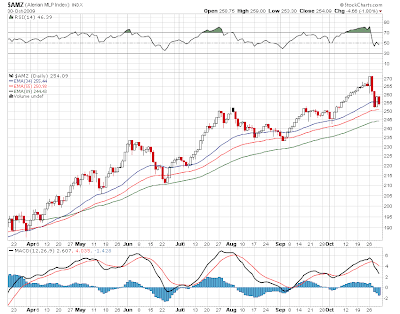

Eight up days in a row and a break of 280 which came with relative ease. But we have to ask ourselves a question here and that is when will there be some sort of a pull back. When we look at the chart we can notice a couple of things. One is that this is the longest stretch in the March rally without a pullback to the 34 day moving average which sits at 266. Also we are 15 points above that average. On the other hand the MACD indicator just went to a buy and is no where near overbought yet. Clearly money continues to pour into the group so if and when a correction comes it will be sharp and swift.

This morning we have Oppenheimer cutting Spectra Energy (SEP) to market perform from outperform. Not much else happening this morning in on the corporate news side. Crude is down but nat gas is up. Nat gas has inventory numbers later this morning and they will probably show a drawdown as cold weather across the US dominates for the next few weeks. Big rally in the dollar this morning which has stock futures lower.

Wednesday, December 16, 2009

WILL TODAY BE EIGHT/280?

Shooting for 8 up days in a row and 280 on the mlp index. This has occured in the face of crude just ending a 9 day losing streak and nat gas rallying to 11 month highs! Nat gas is off just a touch this morning and crude is higher ahead of 10:30am inventory numbers. MLPS are getting chased by year enders starved for yield. And dont forget mlps are up 57% year to date and a total return closer to 67%! And if you were in the right mlps you could easily be back to pre 2008 levels! What collapse?

Shooting for 8 up days in a row and 280 on the mlp index. This has occured in the face of crude just ending a 9 day losing streak and nat gas rallying to 11 month highs! Nat gas is off just a touch this morning and crude is higher ahead of 10:30am inventory numbers. MLPS are getting chased by year enders starved for yield. And dont forget mlps are up 57% year to date and a total return closer to 67%! And if you were in the right mlps you could easily be back to pre 2008 levels! What collapse?Okay this morning we have no breaking headlines in MLP land and no upgrades or downgrades. Stocks are opening higher as we chew through data and the fed decision later today.

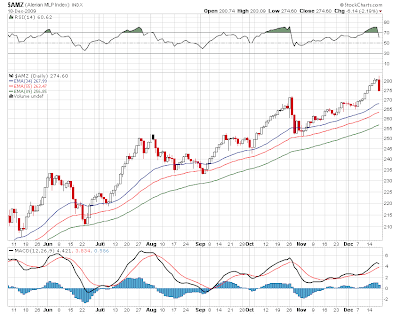

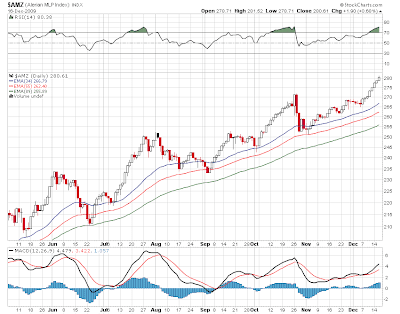

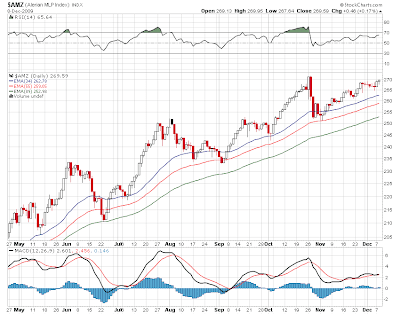

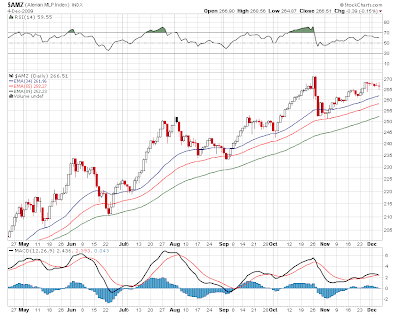

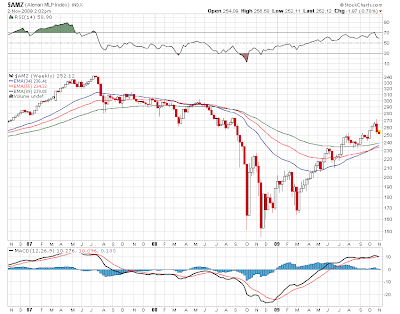

And here is the MLP weekly chart where the moving averages continue to cross and it appears on this chart that 300 on the index is not out of the question.

And here is the MLP weekly chart where the moving averages continue to cross and it appears on this chart that 300 on the index is not out of the question.

Tuesday, December 15, 2009

MLPS continue to move right along and are at the highs of the day up 1.20 and nearing 279 on the index. Fractional gains continue and many mlps have added to morning gains. Support coming from rising energy particularly nat gas which is up sharply and the need for yield. Ever since that broad Barrons piece a few weeks ago its been nothing but higher for the group as a whole.

MLPS doing well today as the nat gas rally is very supportive. The index is up about 1 point and over 278 in a flat market. Most mlps are flat to fractionally higher. Teekay Offshore (TOO) and Williams Partners (WPZ) lead the way higher with 50 cent plus gains. Genesis (GEL) Ferellgas (FGP) and TC Pipelines (TCLP) are showing small losses among the thin list of losers.

The march upward continues.

The march upward continues.

ANOTHER LEG UP!

Our upleg in this leadership position continues. In fact if you look at the dow chart below vs the mlp chart above we have been clearly outperforming and that is taking more and more mlps back toward not only 52 week highs but all time highs. Notice on the dow chart that we've touched the 34 day moving average and bounced right off so 2 steps foward 1 back continues with no signs of a change in this pattern.

Our upleg in this leadership position continues. In fact if you look at the dow chart below vs the mlp chart above we have been clearly outperforming and that is taking more and more mlps back toward not only 52 week highs but all time highs. Notice on the dow chart that we've touched the 34 day moving average and bounced right off so 2 steps foward 1 back continues with no signs of a change in this pattern. Nat gas is up another 12 cents this morning which is beginning to help some of those mlps that have been teetering on the edge and have never climbed out of the abyss. No corporate headlines this morning and no upgrades or downgrades. The dollar is rallying as interest rates rise. Inflation numbers were a little hot this morning. Crude is up as it tries to get back over 70 bucks.

Nat gas is up another 12 cents this morning which is beginning to help some of those mlps that have been teetering on the edge and have never climbed out of the abyss. No corporate headlines this morning and no upgrades or downgrades. The dollar is rallying as interest rates rise. Inflation numbers were a little hot this morning. Crude is up as it tries to get back over 70 bucks.We get ready for the open. A short correction in mlps is in order and 265 is the logical place to go if we sell off....and right now thats a big if!

Monday, December 14, 2009

A gain of 2.60 on the mlp index as we are approaching 280! Amazing really when you think about where we were a year ago. Fractional to 1 point gains in many mlps. Oneok (OKS) and Inergy Holdings (NRGP) are the big winners today.

Inergy LP (NRGY) is down on a downgrade but only by 30 cents. Only a couple of issues are lower and mostly by pennies.

Market overall looks firm but not exactly running away higher. Nat gas is the word of the day as those stocks are moving sharply higher in response to Exxon Mobil buying XTO. This should keep natural gas mlps firm.

Inergy LP (NRGY) is down on a downgrade but only by 30 cents. Only a couple of issues are lower and mostly by pennies.

Market overall looks firm but not exactly running away higher. Nat gas is the word of the day as those stocks are moving sharply higher in response to Exxon Mobil buying XTO. This should keep natural gas mlps firm.

XTO Energy (XTO) getting bought by Exxon (XOM) has put a bid under all things energy so look for a sharply higher open in the whole group and MLPS should lead nicely.

Standing by for a higher open.

Standing by for a higher open.

ONE YEAR..100 MLP POINTS

We are approaching a 100 point gain on the mlp index from 1 year ago. In fact if you take it back to the 146 intraday low and we're talking 130 points or just about a double in the index and then add to that 4 distributions. So we not only continue to lead but the index itself is probably back at a place where we can say that the bear market damage has been pretty much undone. However there are a number of MLPS that have not rallied at all and if you held those or still do, its much more difficult to see this view as fact. Still we have many mlps at or near all time highs...not just recovery highs!

We are approaching a 100 point gain on the mlp index from 1 year ago. In fact if you take it back to the 146 intraday low and we're talking 130 points or just about a double in the index and then add to that 4 distributions. So we not only continue to lead but the index itself is probably back at a place where we can say that the bear market damage has been pretty much undone. However there are a number of MLPS that have not rallied at all and if you held those or still do, its much more difficult to see this view as fact. Still we have many mlps at or near all time highs...not just recovery highs!This morning we have Wunderlich cutting Inergy LP (NRGY) to a hold from a buy. Inergy and Inergy Holdings (NRGP) are sitting at all time highs. No other news on the wires this morning. Stock futures are higher ahead of the open. Oil is down under 70 bucks and this stock rally continues in the face of falling crude and a rising dollar. Nat Gas is up again this morning as the US is facing some very cold weather at the end of the week and next weekend especailly in the eastern states.

Sorry for the lack of posts the last few days as i have been working double shifts with minimal computer access. Add to that a few Christmas parties and..well you get the picture. Back to normal this week.

Thursday, December 10, 2009

MLPS AT THE 270 WALL!

Thought it was time to look at the MLP weekly chart and notice that through all of this rally that began a about a year aog, it is only now that the moving average lines are crossing and sloping higher which is a good thing. The 34 week moving average is now positive for the first time since mid 2007 and the 55 and 89 week moving averages are about to cross. These are all good things and bode well for 2010. Now a correction down to the moving averages themselves could occur at anytime but if that happens, as long as they hold then we are still bullish on the group.

El Paso Partners (EPB) hits the wires this morning with positive 2010 guidance. Also this morning earnings from Ferellgas Partners (FGP) which beat by 6 cents. Conference call to follow this morning. Those are the corporate drivers this morning. No other news items and no upgrades or downgrades

Stock futures are higher this morning and it looks like we may begin another one of those 2 steps up in this 2 up 1 down pattern. We continue to have trouble around 10,500 but with mlps now at 270 and leading, we could be poised for another upside breakout in our group. Note i have been cautious up in here lately and there are seasonal factors at play. But since the Barrons piece Monday favoring MLPS among other things, we continue to enjoy good relative strength.

One of the year end trades to watch for is the tax loss selling that is evident in the single digit MLPS that have issues. These could be setting up for big bounces once tax loss selling is done. Once that pressure comes off we could see some nice moves in those MLPS that have option like prices. I;ve been building a position in Crosstex (XTXI) in trying to play this seasonal bounce but remember you have to be in the right one and there are never any guarantees in these sorts of things.

Wednesday, December 09, 2009

MLPS CONTINUE FIRM AS MARKETS STRUGGLE

We just sit above the uptrending support lines for the markets and mlps but mlps continue relative outperformance here as the index is at new highs for the move. MLPS in fact have been up the last 2 days with the overall market down. The broad Barrons piece over the weekend favoring yield instruments like mlps continues to influence buyers and my guess is that will continue for awhile longer.

Not much happening this morning. No breaking corporate headlines and nothing on the upgrade downgrade list so far. Nat gas has rallied nicely since late last week as very cold weather is set to move in to the US for probably the rest of this month. This could be the first real rally in nat gas that can hold and that could give support to nat gas mlps. Crude is up this morning after breaking below 75.

The month of December has alot of cross currents at work which makes trading difficult. I would expect this push and pull to continue. Watch those support lines as they have held since March. A break of them would spell trouble.

Tuesday, December 08, 2009

DOW OPENS DOWN 100 AND MLPS DOWN 1.

Im still a little concerned with all the struggling the markets have been doing up here in this 10,500 dow..mlp 269 though admittedly yesterdays mlp performance was pretty good. This morning the markets are soft and so are mlps. We have some news. Calumet Specialty Partners (CLMT) is doing what other mlps have done with a double digit stock price...a stock offering. It is down 1 today on the news. Deutche Bank cuts Teekay Offshore (TOO) to a hold from buy. The stock is down 43 cents today. There is an mlp conference today so there might be some news when some companies make their presentations so we should pay attention during the day. Nustar (NS) among other is making noise today.

Nat gas is exrending its rally today as the recognition of winter is descending on that market while crude is down. Energy stocks as a whole are under pressure today. So it looks like a soft day ahead and barring any tragic mis-steps it should be contained.

Monday, December 07, 2009

MLP index up 2 points right now with the dow up 30. Nat gas is up 8% as cold weather spreads across the US and maybe the buffoons in Copenhagen might not do anything on so called global warming. Lots of stories available here to fill you up on climate change.

Magellan Midstream leads the winners list up 75 cents and at another new high. Oneok (OKS) Suburban Propane (SPH) and EV Partners (EVEP) among the list of fractional winners. Losers are few with small moves except for Inergy Holdings (NRGP) which is down 1. But that one has been a big winner and is just off all time highs.

Push and pull continues. Interesting that the dollar is up and gold is down hard and equities are not selling off.

Magellan Midstream leads the winners list up 75 cents and at another new high. Oneok (OKS) Suburban Propane (SPH) and EV Partners (EVEP) among the list of fractional winners. Losers are few with small moves except for Inergy Holdings (NRGP) which is down 1. But that one has been a big winner and is just off all time highs.

Push and pull continues. Interesting that the dollar is up and gold is down hard and equities are not selling off.

MONDAY MORNING AFTER THE BIG NUMBER!

Doulble shifts kept me busy last Friday so i apologize for the lack of posts. We saw the markets rally big on the better than forecast employment numbers, sell off midday and finish firm. Lots of push and pull back and forth here. MLPS having a tough time breaking out above 267 and the longer it takes, the more concern i have that this rally may have run its course. For now however until we see a clear reversal of trend and a break of those uptrend lines the path of least resistence remains higher.

This morning we are seeing markets starting off flat or a little lower. MLPS are getting pushed and pulled around by all sorts of forces. There is a broad front page piece in Barrons that it may be time to swap out of bonds and into preferred shares, utilities, and mlps. You need to be a subscriber to read the piece. Otherwise there is no news this morning on the corporate side. Breitburn(BBEP) has been involved in a lawsuit with Quicksilver (KGS) which will probably come to trial next year. Quicksilver announced today that its dropping its lawsuit against Breitburn directors.

In the energy complex this morning crude is down but nat gas is up 4% as colder than normal weather takes hold in the northeast and midwest and it will likely hold in place for the rest of this month. Stock futures are flat. Gold is down another 25 bucks after Fridays 60 dollar plus implosion as the dollar rallies and that rally is extending itself today.

Thursday, December 03, 2009

ANOTHER DAY OF WATCHING PAINT DRY!

Not much happened yesterday other than a slight pullback. Crude took a 2 buck hit yesterday which put some pressure but the group itself was mixed for the most part. Now this morning Crude is back up a little under half a buck as we wait for nat gas numbers. Stock futures are a little higher to start the day.

Inergy LP (NRGY) is up 1.50 on premarket trades and the bids are there as well. I dont see any newsdrivers but its acting like an upgrade from a major brokerage (are there any of those left standing????) or something. Otherwise its a pretty quiet news morning with year end trading dominating the push and pulls in the group. Found this on Magellan Midstream (MMP) which has been hitting 52 week highs lately. Nothing new being mentioned; just a quick read.

I guess its all about tomorrow's employment numbers and i doubt anyone is expecting anything good which leaves the door open for another leg up.

Wednesday, December 02, 2009

DRAW A LINE AT 270!

I dont want to keep making much ado about the 270 level on the mlp index but it would be nice if we can finally clear it. We have been having some trouble making headway and thats because MLPS themselves have been taking advantage of the rally you see on this chart to sell new equity. Regency Partners (RGNC) is the latest to join the parade as it puts 10 million units on the market this morning. The stock is down 1 in the pre market. Also Regency will be at the RBC MLP conference on December 18th and has put up a slide presentation for your viewing.

I dont want to keep making much ado about the 270 level on the mlp index but it would be nice if we can finally clear it. We have been having some trouble making headway and thats because MLPS themselves have been taking advantage of the rally you see on this chart to sell new equity. Regency Partners (RGNC) is the latest to join the parade as it puts 10 million units on the market this morning. The stock is down 1 in the pre market. Also Regency will be at the RBC MLP conference on December 18th and has put up a slide presentation for your viewing.We have a downgrade this morning of Boardwalk Partners (BWP) based on valuation. The stock is cut to marketperform. Not much happening so far this morning on the news front. The energy markets are lower this morning. Stock futures are a little lower after yesterdays gains. Gold is over 1200 an ounce this morning.

I just want to go back to the 270 level issue. 270 was an important wall where back in 05-06 we spent time building a base before launching that final assault to the 340 all time high top. So this is a logical place to find resistence. Year end issues are also beginning to play here with a push and pull in both directions. Of course we shall watch the situation carefully.

Tuesday, December 01, 2009

Markets are moving right along to dow 10500 while mlps are going nowhere today and thats mainly due to the Kinder Morgan (KMP) 1 point of downside drag.

Fractional gains on the board for a number of issues with the list split about in half. Downside movers have them confined mostly to small fractions. Duncan Partners (DEP) is down 40 cents is the biggest loser other than the above mentioned KMP. On the other side Calumet Specialty Products (CLMT) and Buckeye Partners (BPL) lead the winners list with gains of 50 cents or more. Williams Partners (WPZ) continues to rip the cover off the ball up another 85 cents at 29, Was a 26 handle just last Friday.

Last hour on the first trading day of the month approaches.

Fractional gains on the board for a number of issues with the list split about in half. Downside movers have them confined mostly to small fractions. Duncan Partners (DEP) is down 40 cents is the biggest loser other than the above mentioned KMP. On the other side Calumet Specialty Products (CLMT) and Buckeye Partners (BPL) lead the winners list with gains of 50 cents or more. Williams Partners (WPZ) continues to rip the cover off the ball up another 85 cents at 29, Was a 26 handle just last Friday.

Last hour on the first trading day of the month approaches.

KINDER MORGAN DOES (ANOTHER) OFFERING!

Kinder Morgan (KMP) will be a bit of a drag this morning on the MLP index as they are doing a publick offering of 4.5 million shares as indicated by this 8k filing. Kinder does these offerings a little more frequently then other mlps but any investor who rode the ride in this one would be sitting at all time highs right now and enjoyed fabulous payouts along the way. The stock is giving back 1.50 in the pre market this morning.

Linn Energy (LINE) has a deal on the table this morning as its buying a 150 million in assets. The release says the assets are a good strategic buy with 20 years of potential reserves. The stock is bid a little higher in the premarket.

Not much happened yesterday other than the push and pull in both directions. Clearly the Dubai story has had minimal impact so far and unless there is another shoe to drop there markets are going to continue to trade in the stairstep uptrend. Stock futures are higher this morning by nearly 9 S&P points. Crude is higher nat gas is lower and the dollar is losing ground today against the Euro and Pound...all of which lately has been good for US equities.

Back to mlps if the market trends continue through year end 2 forces will be at work here. One will be the year end buying pressure of stocks of this top performing group..up over 50% plus distributions vs those who might like to book those profits before 12/31/09. My guess is in the bullish uptrend the former will overpower the latter. MLPS look to clear 270 on the index but Kinder Morgan (KMP) will definitely be a drag today on the index.

Monday, November 30, 2009

A little higher and then a little lower which is where we are now after lunch. The mlp index is down about .70 after being up about the same. Williams (WPZ) continues however to move nicely higher and has been in a solid uptrend since its earnings. TC Pipelines (TCLP) and Oneok LP (OKS) are the leading losers down about the same..75 or so. No news drivers on this last day of the month.

MONDAY AFTER THANKSGIVING AND DUBAI!

Took the day off from blogging Friday but did have my eye on things. MLPS came off Friday only a small fraction in the end which considering the market and the news backdrop was an excellent performance. Nat gas was up sharply and that may have leant a hand but crude was off over 3 bucks. The overall market looked like it was going to crack after the first selling wave but it held its own as the Dubai news took hold. Funny thing was that news hit the tape mid morning Wednesday but nobody seemed to pay attention until Europe sold off the next day.

Earnings news from Inergy LP and Inergy Holdings (NRGY,NRGP) and they are record earnings with 2010 guidance to be discussed this morning in a conference call. No other headlines this morning and nothing on the upgrade downgrade list. Stock futures were higher overnight, then turned lower and are now turning higher again. Crude is flat and nat gas is down about 17 cents after Fridays big gain of 35 cents. General feeling to me is Dubai right now is just another buying opportunity. Until the uptrend line is broken in this 2 up 1 down pattern we're in, there is no reason to change strategy. Last day of the month and then the last month of the year begins with its usually round of year end distortions. Looks like we will be opening a little higher.

Wednesday, November 25, 2009

HAPPY THANKSGIVING TO ALL!

I figured i would leave you a little early today as we will open higher and then probably spend the rest of the day going sideways as many head for the exits early. From the markets perspective we are at a much better place then we were a year ago...which is nice. Better is if you are in a better place personally then you were a year ago. Take time to give thanks. From my perspective a neighbor and longtime friend has seen her battle with stage 4 colon cancer come to an end.....WITH A CLEAN BILL OF HEALTH! CANCER FREE!! So good things are happening folks. Safe and Happy Thanksgiving to you and your family. I leave you with the great Charles Chaplin and this clip which i think says alot.!

Tuesday, November 24, 2009

MLPS are moving in their own world and rallying in here as we are up almost 2 points on the index and heading for that 265 wall. The overall market is a little lower and crude is lower. They seem to be leading the way for other energy which is consolidating from yesterday.

Kinder Morgan (KMP) Buckeye (BPL) and Williams Partners (WPZ) among the biggest fractional gainers this afternoon.

An interesting day.

Kinder Morgan (KMP) Buckeye (BPL) and Williams Partners (WPZ) among the biggest fractional gainers this afternoon.

An interesting day.

Whoops...just noticed Morgan Keegan upgraded Kinder Morgan to outperform from market perform this morning and the stock is up fractionally. The company also updated its guidance.

BUSY BUSY BUSY!

Sorry guys but i had to run to pick my daughter up from college for Thanksgiving and its off to the dentist to get my teeth cleaned. In between checking into flat markets, flat mlps for the most part, no news and no upgrades or downgrades.

I will be back for some afternoon musings once my teeth are done! Its not this bad.

Monday, November 23, 2009

Its worth 18 cents to Constellation Energy Partners (CEP) unit holders but the President and CEO is doing some insider buying as per this filing.

Off the highs and in mlp land we we're up over 265 where we touched the high of the first thrust a few weeks ago and we've come off that. So lets watch 265 as an important point here. Im wondering whether we might be setting up for a short term reversal in here. Just a feeling.

Buckeye (BPL) Oneok (OKS) and Natural Resource Partners (NRP) lead a long list of fractional winners while TC Pipelines (TCLP) is down 75 cents. They are coming off last week's stock offering so there is some overhead supply there as there is for Nustar (NS) Holly Partners (HEP) and some others. Also we'er in light volume Thanksgiving mode.

Dow up 129 as of this post and off the up 170 from earlier.

Buckeye (BPL) Oneok (OKS) and Natural Resource Partners (NRP) lead a long list of fractional winners while TC Pipelines (TCLP) is down 75 cents. They are coming off last week's stock offering so there is some overhead supply there as there is for Nustar (NS) Holly Partners (HEP) and some others. Also we'er in light volume Thanksgiving mode.

Dow up 129 as of this post and off the up 170 from earlier.

THANKSGIVING WEEK BEGINS HIGHER!

Going back 1 year ago to the beginning of Thanksgiving week finds us only about 30 points higher on the mlp index. Thats because the final horror of the 145 low on the index did not occur for another couple of weeks. Everyone here should remember the abyss we sank into to reach that final climax bottom and it certainly was not physically or emotionally pleasant.

Going back 1 year ago to the beginning of Thanksgiving week finds us only about 30 points higher on the mlp index. Thats because the final horror of the 145 low on the index did not occur for another couple of weeks. Everyone here should remember the abyss we sank into to reach that final climax bottom and it certainly was not physically or emotionally pleasant.So here we sit a year later at 262 and some change. The market has been in rally mode since March. MLPS have been rallying for almost 11 months going back to last December. Lots to be happy about even if we arent exactly back to the promised land.

Im not expecting much to happen this week to our companies in the mlp universe. No news this morning and nothing on the upgrade downgrade list. Energy is up this morning as the dollar is down so it looks like another one of these strong Monday's is setting up pre open.

Friday, November 20, 2009

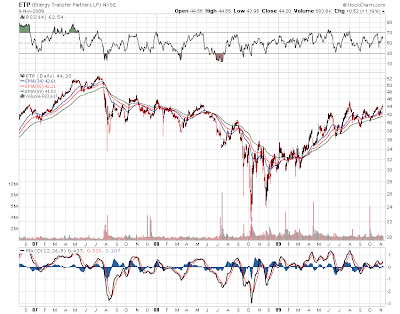

COPANO AND ENERGY TRANSFER PARTNERS???

This was the chatter yesterday fueled by a Bloomberg story that ETP had approached Markwest (MWE) and Crosstex (XTEX) and got turned away and is now talking to Copano (CPNO). The discussion continues on the Yahoo board. Considering ETP has a stock with currency value as do some others; frankly i'm surprised we havent seen some marriages in the space. Perhaps thats coming in 2010.

Okay its Friday and the dow opens down a little. MLPS are down by a point on the index at the open. No news and no upgrades or downgrades in the group.

Thursday, November 19, 2009

Yahoo message board has rumours about Energy Transfer Partners (ETP) buying Copano (CPNO). Copano ran to 20 on the story.

Exterran Partners (EXLP) is up 40 cents and leads a short list of winners today as the mlp index is down 2 points with the dow down about 140. While most mlps are lower they are only frationally so and there are no 1 point plus losers as of this post. The only exception is DCP Midstream (DPM) which is doing a stock offerning. The market may be down but there appears to be no sense of urgency here. Just more of the same 2 up 1 down. Crude is down 2 dollars and nat gas is off a penny after inventory numbers for nat gas continue to move along in bearish fashion.

MLPS continue to hold up well in these selloffs. Lets see if buyers show up after 2pm, BTW for you nat gas lovers the makers of the UNG contract which continues to whither in the world of cantango is issuing a new ETF which is trading that tries a different approach. Thanks to Max for the heads up. The question is will it work?

MLPS continue to hold up well in these selloffs. Lets see if buyers show up after 2pm, BTW for you nat gas lovers the makers of the UNG contract which continues to whither in the world of cantango is issuing a new ETF which is trading that tries a different approach. Thanks to Max for the heads up. The question is will it work?

PULLBACK TIME?

When you look at the dow chart and see the pattern we've put in place for the past couple of months it seems we go up in the first half of the month and then pull back to the rising moving averages in the second half of the month. So a trip down to 10,000-10,100 is possible in this pattern which takes us back to support. The difference this month is that we do have the seasonal tail wind which could make things different.

MLPS on the other hand have not done much in this rally leg partly because of offerings and the ex-distribution distortions. We went above 265 yesterday and got turned back. 260 ish support is a days trade below us here so the theme here is we've got to watch this carefully. Speaking of which Steve mused the other day in the comments about where we were a year ago. Well here's my post from a year ago today.

MLPS on the other hand have not done much in this rally leg partly because of offerings and the ex-distribution distortions. We went above 265 yesterday and got turned back. 260 ish support is a days trade below us here so the theme here is we've got to watch this carefully. Speaking of which Steve mused the other day in the comments about where we were a year ago. Well here's my post from a year ago today.Another stock offering hit the tape after the close last night as DCP Midstream (DPM) is selling some shares with the stonger stock price. Stock is down a buck and some change in the premarket. Regeny Partners (RGNC) is expanding its gas operations in Haynesville. Those are the 2 driving headlines this morning. Quiet on the upgrade downgrade list.

Stock futures are down this morning by 8 S&P points but off the low of minus 10. The dollar is a little higher and crude a little lower ahead of the open.

Wednesday, November 18, 2009

RALLY GOES ON!

Support lines are at 258 on the mlp index and 10,000 on the dow as the 2 steps foward one step back dance continues. Seasonal factors are strong here and we have options expiration which looks like it has a positive bias. So we start the morning higher ahead of cpi. Crude oil has a bit of a bid in it this morning as it nears 80 dollars again. Inventory numbers loom at 10:30am.

Nothing specific on the upgrade downgrade list. Just noticed HSBC is starting some of the major coal plays like Arch and Peabody at an overweight. No corporate headlines driving any individual mlps this morning. There was a renegade 4 point upside trade on Magellan Midstream (MMP) in after hours but that looks to be nothing other than some fool overpaying. No news there.

Sorry for the lack of posts. Worked a 22 hour day yesterday and was so overtired i could barely make it up the stairs last night. Back to normal today.

Monday, November 16, 2009

The dow is up 155 and over 10,400. MLPS are up 2.66 and at the highs for the day. We are above 264 and the high for this move is 266ish so we are at one of those critical areas here. Ignore the 270 on the chart as that came on the Teppco takeover by Enterprise (EPD) and there was some quote errors on the chart.

Sunoco Logistics (SXL) came alive today and leads the winners list up 1 and some change.Transmontaigne (TLP) is showing a 1 point gain as well. Plain All American (PAA) is up 70 cents as the third best performer so far today. Most mlps showing solid fractional gains. Just a few underwater and nothing being driven by news.

Everything is going up today. If you have noticed take a look at silver which is up over a dollar today. Havent seen moves like that since the Hunt Brother's tried to corner the market in 1980 when silver hit 50 bucks.

Sunoco Logistics (SXL) came alive today and leads the winners list up 1 and some change.Transmontaigne (TLP) is showing a 1 point gain as well. Plain All American (PAA) is up 70 cents as the third best performer so far today. Most mlps showing solid fractional gains. Just a few underwater and nothing being driven by news.

Everything is going up today. If you have noticed take a look at silver which is up over a dollar today. Havent seen moves like that since the Hunt Brother's tried to corner the market in 1980 when silver hit 50 bucks.

Im going to be linking to the website Oil Price dot com...and suggest strongly for all you energy watchers that you do the same. This looks to be a very valuable site for all things in the energy complex. Lots of journalism here and it seems to cover the lot.

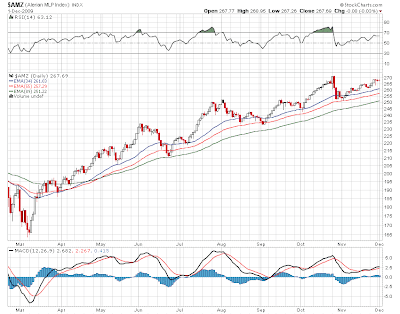

NEW WEEK BRINGS A HIGHER OPEN

Thought i would put up some 1 year charts just to see where we were just before Thanksgiving in 2008. Note that we were in the midst of a waterfall decline which bottomed on the MLP index at 145 and some change. I remember feeling doom at that point. That was the final bottom for mlps. The overall market however did not accomadate us for another 5 months when the dow went to new lows and just about everything else did not. Now here we are 70 or so percent up from those disastrous levels. And where will we be a year from now? Who knows? For now the dance continues higher with 2 steps foward one step back pattern. MLPS have not broken out to another new high but that could be resolved pretty easily. On the otherhand at this point we should keep an eye here in case we are at a point where the market will keep going while mlps start to lag behind..in other words the opposite of what evolved from this time last year. Not prediciting this yet but this 270 level on the mlp index is something we should watch.

Nothing on the news front and nothing on the upgrade downgrade front. It looks like the potential for another strong Monday at least here at the open with S&P futures up 10 points. Energy is up including nat gas. The dollar is down and gold is up. So everything is on autopilot until proven otherwise.

Friday, November 13, 2009

TC PIPELINES DOES AN OFFERING

One positive thing about these equity offerings we're seeing is that they are coming from a position of strength for alot of mlps. Rising equity prices means a strong currency for them so they are using that to raise money. In normal times it has paid off to add to positions during such times as they then move to higher highs. Lets hope we continue on the road back to normal times. T C Pipelines becomes the latest to offer shares and the stock is down 2 dollars in the pre market.

MLPS behaved well yesterday as the market took 92 points of gas. Sometimes we play catch up to the primary trend the second day and energy is softer this morning. Energy stocks got hit pretty hard yesterday which makes the outperformance a bit more meaningful. Stocks look a little higher at the open. Its Friday and usually Fridays tend to be a little slower than other days. Crude is down and so is nat gas. Nothing much else going on. Dollar is nwo down agains the euro and pound so that might provide a driver if the dollar sells off.

TC Pipelines btw just now priced its offering at 38 dollars.

Thursday, November 12, 2009

MLPS holding up pretty well today partly because Nustar (NS) is up almost 50 cents so that is skewing the index higher. Its down roughly half a point and most mlps are seeing relatively small moves; this inspite of the fact that energy is falling and energy stocks are taking a hit today. So i guess a stronger dollar is attracting yield; at least that is the theme for today.

Dow down 90 plus points and near the lows of the day. No surprise after 7 straight up days.

Dow down 90 plus points and near the lows of the day. No surprise after 7 straight up days.

2 STEPS FOWARD 1 STEP BACK DANCE CONTINUES!

The trade has been to buy the pullbacks into the moving averages and it has been incredibly successful since the March bottom. It seems we are in another one of those up legs. MLPS are distorted on the charts here thanks to the Teppco takeout, ex distributions, and so on but 265 is the level to watch on this move. MLPS have not broken out to a new rally high like the dow has and this is fine for now. I like to give things a few days to play out the wrinkles. But i think we need to pay attention here in case we are beginning to build some sort of trading top. Remember btw that MLPS are up from 176 to 260 on the index which is a 48 % gain and lets add 4 distributions to that and you have a total return running at around 55-60% or so. And that is well above the returns of other averages.

Suburban Propane (SPH) reported earnings this morning which were down and below estimates citing weak demand. One trade in the premarket down 2 plus but it was a panic seller letting go of 300 shares and the bid is above the last trade. Wunderlich is upgrading Transmontaigne (TLP) to buy from hold. It is also raising its price target on Kayne Anderson (KYN) which is an mlp fund.

Elsewhere stock futures are a touch softer. We have oil and nat gas down ahead of the open. Inventory numbers are out later this morning and that will drive the oil complex today. The open approacheth!!

Wednesday, November 11, 2009

Just a sideways kind of day with an upside bias. MLPs really not doing much in this holiday atmosphere. Fractional moves dictate the pace as we head into early afternoon. Markwest (MWE) is down 75 cents as it is still reeling a bit from its earnings report. Inergy Holdings (NRGP) leads the winners list up about 50 cents on the day. Its pretty much at all time highs.

HOLIDAY LOOKS HIGHER!

Nice when a holiday falls in the middle of the week! So with banks closeed today we'll have perhaps more subdued activity with an upside bias. MLPS closed lower yesterday with the Nustar (NS) and Energy Transfer Partners (ETP) drag on the index.

No news and no upgrades or downgrades so far. Energy is higher this morning. Pancakes for breakfast. More later.

Tuesday, November 10, 2009

Nustar (NS) down 2.50 and Energy Transfer Partners (ETP) down pretty much make up the bulk of the mlp index's 1.50 pt loss right now. Small fractional moves are the character of the moves today. All this while the overall market continues to digest yesterday's 200 pt gain. Markwest Energy (MWE) is down 1.40 on earnings which might have been a touch light. Martin Midstream (MMLP) and Magellan (MMP) are up over 50 cents each as the 2 biggest gainers.

CNBC pushing the sucker's rally meme' which frankly is boring and repetative. Debate the obvious question and waste more time. Watch it with the volume turned down after Squawk Box is done at 9am.

CNBC pushing the sucker's rally meme' which frankly is boring and repetative. Debate the obvious question and waste more time. Watch it with the volume turned down after Squawk Box is done at 9am.

2 BIG DRAGS ON THE MLP INDEX TODAY!

Today will be known as distortion day as we have 2 big drags on the index. Nustar Energy (NS) announced a 5 million unit offering after the close yesterday so we're seeing a nearly 3 dollar loss in the pre-market.

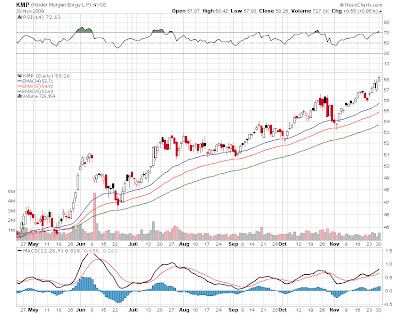

This is a long term daily chart which looks like it is on the verge of a major breakout here above 57. Certainly the offering sets it back a bit but i would point out that buying the discounted price of offerrings lately has been a very good move. Take Holly Partners (HEP) which did an offering months ago with the stock at 27 and it ran to 40. Now its done another one. So if you believe in the longevitiy of the rally this 3 point loss today is probably a good entry point longer term.

This is a long term daily chart which looks like it is on the verge of a major breakout here above 57. Certainly the offering sets it back a bit but i would point out that buying the discounted price of offerrings lately has been a very good move. Take Holly Partners (HEP) which did an offering months ago with the stock at 27 and it ran to 40. Now its done another one. So if you believe in the longevitiy of the rally this 3 point loss today is probably a good entry point longer term. Earnings may be the issue here as Energy Transfer Partners (ETP) put up its quarterly numbers last night. The stock is down 2.20 in the premarket. Not sure what traders are focusing on in here. The company reported a loss vs a forecast gain but there is so much noise in these numbers. Distributable cash flow we now is the metric by which we live. I was looking for the metric in the press release. All i could find was this paragraph.

Earnings may be the issue here as Energy Transfer Partners (ETP) put up its quarterly numbers last night. The stock is down 2.20 in the premarket. Not sure what traders are focusing on in here. The company reported a loss vs a forecast gain but there is so much noise in these numbers. Distributable cash flow we now is the metric by which we live. I was looking for the metric in the press release. All i could find was this paragraph.(1) Based on the declared distribution rate of $0.89375 per Common Unit, distributions to be paid for the three months ended September 30, 2009, are $249.5 million in total, which exceeds net income for the period by $177.0 million. Accordingly, the distributions to be paid to the General Partner, including incentive distributions, further exceeded the net income for the three months ended September 30, 2009, and as a result, a net loss was allocated to the Limited Partners for the period.

Maybe that's where traders are looking but it still doesn't answer my question.

The upgrade downgrade list is empty so far this morning. Stock futures are just a shade lower ahead of the open. Small moves are the story this morning in all the relevant markets. The distribution cycle is just about over now as i think all mlps have gone ex-distribution. The checks will be arriving in a few days just in time for Christmas.

Monday, November 09, 2009

A nice 3 1/2 point gain on the mlp index as markets continue to soar. The dow is up 160 right now. Strong fractional plus signs across the board. Inergy Holdings (NRGP) is up 1.65 and is today's biggest winner. Buckeye Holdings (BGH) Nustar (NS) Oneok (OKS) Plains All American (PAA) all showing sizeable gains and lead the way higher. Buckeye (BPL) is losing about 30 cents as it is ex distribution today.

In case you missed it, the best race horse in the world wins the Breeders Cup Classic.

In case you missed it, the best race horse in the world wins the Breeders Cup Classic.

THE NEXT LEG UP?

After Friday's reversal off the nasty employment numbers the market is waking up to sharply higher futures by almost 90 points on the industrials. So the question is are we on another upleg? The answer will come if we get above 10,200 on a closing basis so we will keep our eyes on that. MLPS bidding higher in the premarket.

We have some earnings this morning to chew through. E V Partners puts up its quarterly numbers which include a 30% production increase and some additional hedges going foward. Regency Partners in its earnings guides to lower end of guidance. Transmontaigne (TLP) earnings came a few pennies shy of estimates but that matters little in this group. And finally Quicksilver Gas (KGS) also announces quarterly results. No moves in the premarket on these issues.

Other markets this morning we have crude higher and nat gas lower. Overseas markets are doing well. The dollar is falling and gold has broken out above 1100 bucks. So we should be moving right along, higher at the open.

Note that the library of links continues to grow as I continue to list mlp web sites on the blog roll. This should make it easier for you if you want to investigate an mlp for future investment by saving you a few steps and a trip to google. Should have them all on there before too long.

Friday, November 06, 2009

Spectra Energy earnings have hit the wires. So has the employment number which was not pretty. Looks like a down open.

CROSSTEX EARNINGS AND MORE

THE DAY AFTER THE BIG RALLY!

THE DAY AFTER THE BIG RALLY!

First off sorry for no posts yesterday but i had my hands full at work and suddenly the time slipped away. 200 dow points and nearly 3 points on the mlp index was nice. Charts are suggesting we could break out today on the dow assuming the employment numbers behave. Lost of talk of a head and shoulders top forming on the daily chart of the dow but we had that talk 2 months ago and that was about 1000 points ago.

News this morning from Crosstex (XTEX) as they post earnings and they say they are pleased with the progress of paying down debt. No sign of a distribution returning anytime soon for Constellation Energy (CEP) as they put up numbers they call solid. DCP Midstream (DPM) put their earnings up last night after the close. Spectra Energy Partners (SEP) are due out this morning.

Stock futures are up a little head of the employment numbers while energy is a little lower. The dollar gets attention today and its a little higher against the euro ahead of the open. The scope of yesterday's move leads one the suspect someone got wind of the employment number but we wont go down that particular road.

Wednesday, November 04, 2009

RALLY MOOD THIS MORNING

Markets are in rally mode and rally mood this morning as futures on the S&P are up over 8 points. Fed meeting and announcement at 2:15pm and everyone will be disecting the press release for any clues. 9700 is holding quite well and we may see the markets begin to move away from this short term bottom. Still no sign of a top.

The ex distribution cycle continues this morning with Sunoco Logistics (SXL) among others trading sans dis. Earnings news also on the frontline this morning with Linn Energy (LINE) putting up numbers and the stock looks a little lower at the open. Also we have earnings from El Paso Partners (EPB). Targa Natural Resources (NGLS) earnings news with some guidance and Calumet Specialty Products (CLMT) tells us in their earnings that they are good with their covenants.

Crude is higher, nat gas lower this morning and we have commodities moving higher this morning with gold knocking on the door at 1100. Here comes the open and what looks like a strong start.

Just a reminder i continue to add links to mlps on the blog roll for your mlp shopping convienence. And also i would like to point you to this blog posted by one of our members here. AVI gives us his market perspective and its always good to get ideas from others. Its also on the blogroll.

Tuesday, November 03, 2009

HOLLY DOING A STOCK OFFERING.

I was wondering just yesterday when this was coming and sure enough they announced yesterday after the close. Holly Energy Partners (HEP) is doing another offering. Its the second one this year; 1.9 million units coming to market. The stock is down over 2 bucks before the open. Last time they did an offering the stock was around 27 and since then we've seen it run to 41. The bull trend means this could be an opportunity. Usually stock offerings tend to make the particular mlp and underperformer for a week or so.

I was wondering just yesterday when this was coming and sure enough they announced yesterday after the close. Holly Energy Partners (HEP) is doing another offering. Its the second one this year; 1.9 million units coming to market. The stock is down over 2 bucks before the open. Last time they did an offering the stock was around 27 and since then we've seen it run to 41. The bull trend means this could be an opportunity. Usually stock offerings tend to make the particular mlp and underperformer for a week or so.Ex distributions continue. This morning its Nustar (NS) by over a buck. We still have a few more to get through but the bulk should be done by the end of the week. Not much else on the news front this morning. No upgrades or downgrades so far. The dollar is stronger and that means lower oil and lower stocks but we have this big Buffett deal buying Burlington Northern (BNI) at a huge premium to yesterday's close. So the open looks soft but there might be a firm undertone not much lower than here.

Monday, November 02, 2009

Notice on the weekly chart that a trip down to 235-240 would take us to where all those moving averages are crossing. Not out of the question and it still means we can be bullish longer term; as long as that level holds.

The index is now down 2 points and the dow is down 20. Not looking pretty for the last hour. Also note some large cap mlps have not gone ex distribution yet and that is probably holding some mlps up in price like Nustar and Sunoco Logistics just to name 2.

Volitlity rearing its ugly head right now and the dow has gone from plus 140 to down 2 right now. MLPS were up over 2 on the index and are now barely higher. Watching the tape today you can feel the push and pull in both directions so the close today is important.

Williams Partners (WPZ) and Martin Midstream (MMLP) were both up one or more earlier but have since pulled back. They remain up major fractions. Capital Products Partners(CPLP) got downgrade this morning by Deutche Bank to hold from buy as Deutche is predicting a distribution cut.

While i type this post the mlp index has just gone negative but the dow has turned positive again. The volitility index on the S&P has turned higher and is back up over 30. Enjoy the rollercoaster.

Williams Partners (WPZ) and Martin Midstream (MMLP) were both up one or more earlier but have since pulled back. They remain up major fractions. Capital Products Partners(CPLP) got downgrade this morning by Deutche Bank to hold from buy as Deutche is predicting a distribution cut.

While i type this post the mlp index has just gone negative but the dow has turned positive again. The volitility index on the S&P has turned higher and is back up over 30. Enjoy the rollercoaster.

Buckeye Partners (BPL) is out with earnings and a distribution increase.

Some isolated premarket trades in E V Partners (EVEP) down 2 and Plains All American (PAA) down 1 but no news drivers and i dont see them on any downgrade list. At least not yet.

Some isolated premarket trades in E V Partners (EVEP) down 2 and Plains All American (PAA) down 1 but no news drivers and i dont see them on any downgrade list. At least not yet.

AFTER FRIDAY...WE LOOK AHEAD!

Monday morning in a new month and its Novemeber which usually begins a seasonally strong period. Now notice that even after Friday's big sell off we have not taken out any important support in my view and the uptrend line of those rising moving averages remains intact for both the dow and the mlp index. So really the jury is still out on what is really happening here. Friday was the last day of the year for mutual funds so you can imagine a number of fund managers running to the sell window all at the same time.

Buckeye Partners (BPL) and Buckeye Holdings (BGH) are set to report earnings this morning around 8am No other headlines on the wire this morning. Nothing yet on the upgrade downgrade list. The round of ex-distributions continue this week along with addtional earnings news so we post headlines as they cross. Stock futures are higher this morning ahead of the open as is the energy complex.

Friday, October 30, 2009

ANOTHER UPLEG BEGINS?

I went to a 4 month chart view here of the dow industrials and mlps and you can see very clearly the scope of this uptrend and what has happened every time we have come down to the 34 day moving average. Now i am going to put out a small warning flag here. It may or may not mean anything but so far the trend is holding. We need to decisively take out 10,200 on the dow and keep on going. So the real test will come on this rally that began yesterday. The trade remains in tact as far as buying these corrections. On the positive side (and you can see this better on the S&P 500 chart)

There was a spike in volume on Wednesday when the market fell. Yesterday we got it all back and more which suggests Wednesday was signficant technical reversal day. Watch that level on the downside down the road. Looking for some followthrough today or at least nothing worse than sideways.

Okay MLPS this morning seeing some upgrades as Citigroup upgrades Williams (WPZ) to buy from hold. Steifel Nicholas starts both Nustar (NS) and Energy Transfer Partners (ETP) at a buy. No news developlements. Stock futures are softer ahead of the open as is the energy complex except for nat gas which is higher.

Thursday, October 29, 2009

More than half way back from yesterday's losses as mlps extend their gains and the index is now up over 5 points. Everything is up pretty much with quite a few mlps with strong fractional to 1 point plus gains. Market rally is very strong so the verdict so far is this was another trip down to the trendline that has now been reversed. Next wall will be what happens when we get back to 10,100 on the dow and 265 on the mlp index.

The rally has a bit of steam as far as MLPs go and we are up well over 3 points on the day so far. K-Sea is down another 2 and change and trades with an 11 handle. A 50% haircut in 2 days. Other than that almost the entire group is showing gains. Enterprise (EPD) on the Citigroup upgrade is up nearly 1 and so is Alliance Resource (ARLP) on RBC listing them as outperform. Williams (WMZ) is up 1.49 on very good earnings and is the days biggest winner.

The dow is up around 70 points and holding. There have been a few attempts to get it up over 100 but nothing successful so far. I would like to see some mommentum build between 11am and noon so i can feel better about what they might try to do after 1pm.

Nat gas numbers are out and nat gas has turned higher as energy moves higher with stocks and the lower dollar.

The dow is up around 70 points and holding. There have been a few attempts to get it up over 100 but nothing successful so far. I would like to see some mommentum build between 11am and noon so i can feel better about what they might try to do after 1pm.

Nat gas numbers are out and nat gas has turned higher as energy moves higher with stocks and the lower dollar.

9 POINTS DOWN...NOW WHAT?

After yesterday's 9 point MLP debacle, which btw was only a bit more than the 8 point debacle in K Sea Transportation Partners (KSP) we are already sitting today on the chart at a place where rallies have ensued taking us to higher highs going back at least 6 months on this chart. So until proven otherwise from a trading standpoint you have to look around in here after this rapid 6% correction in mlps and add to positions. However is it different this time? Oh if we only knew the answer to that one. The 55 day moving average sits at 250 and some small change and if we go lower at the open we could be right there. A trip to the 89 day moving average took place at the end of June and thats at 244. Another day like yesterday and we're right there. We can probably get that low and still be well within the contruct of the uptrend.

How is all of this going to break? Well in true bull markets it will get resolved with higher highs. We need however to ask ourselves after a move from 176 to 267 on the mlp index in 10 months is a meaningful correction finally at hand? Wouldnt be a big surprise. We noted a few weeks ago that 270 was going to be an extremely difficult wall to get through. Still it is amazing that sentiment in the overall tape got so bearish so fast. And that bearish sentiment is a very good thing to fuel another leg up. As always though they never make these decisions easy.

Okay this morning we begin the ex distribution parade with Holly Partners (HEP) and Markwest (MWE) leading the way. Holly Partners puts up earnings this morning which look pretty good. Williams Partners (WPZ) also announces earnings and announes an improved cash flow outlook going into next year. The news overall from most mlps appears to be brighter than where we were a year ago.

We have some anal-ist moves. Wells Fargo appears to see something in K-Sea's (KSP) distribution cut and outlook yesterday that...well to be perfectly frank..just didnt sound quite right. And so...brilliant minds that they are we see a downgrade from Outperform to Underperform. What would we do withoout these guys? And this morning RBC Capital Markets starts Alliance Resource Partners (ARLP) at Outperform. We can only hoe they are right since we are long this one! I decided to do highlight them in color! Lack of sleep does this to the mind.

Other broader market drivers this morning we have stronger stock futures ahead of data. Energy is a little higher except for nat gas. European markets are a little softer. The dollar is a little softer also ahead of data...gold and silver are higher.

Okay do note that i have been adding MLP web sites to the blog roll a few at a time. Just scroll down to MLP BLOGS AND MORE and i am listing them alphabetically. My goal is to have them all on here for you so you can source them all from one page which would make life just a little bit easier.

Wednesday, October 28, 2009

Closing in on an 8 point loss with EV Partners (EVEP) the biggest loser outside of K-Sea which by now we all know about. EV is down 2 on the oppenheimer downgrade. This is biggest one day drop we've seen since the great demise. Still only back to the trendlines and if we look at the weekly charts we are coming into a very important zone for most of the indexes. The moving averages have only now started to turn and attempting to cross over into a positive slope for the longer term. We are at a critical juncture here.

A 6 point loss on the MLP index and we are at support.

K-Sea Transportation (KSP) is down 8 points on the distribution cut and hints of more trouble down the road. Teekay Shipping (TOO) is down in sympthay by 1.50. Oneok LP (OKS) E V Partners (EVEP) and Alliance (ARLP) are down 1 plus each. Down nearly 1 include Sunoco Logistics (SXL) Energy Transfer Equity (ETE) and Plains All American (PAA).

Nustar (NS) is the big winner today up 25 cents as it continues to ride the upbeat company comments yesterday with earnings. If mlps and the market start another upleg this one could lead the way.

1050 on the S&P getting all the attention so watch it carefully. Perhaps everyone is selling ahead of the gdp number tomorrow and unless its really bad...every may have sold ahead of it and the market will rally. That has been the pattern these last several months. So we watch carefully.

K-Sea Transportation (KSP) is down 8 points on the distribution cut and hints of more trouble down the road. Teekay Shipping (TOO) is down in sympthay by 1.50. Oneok LP (OKS) E V Partners (EVEP) and Alliance (ARLP) are down 1 plus each. Down nearly 1 include Sunoco Logistics (SXL) Energy Transfer Equity (ETE) and Plains All American (PAA).

Nustar (NS) is the big winner today up 25 cents as it continues to ride the upbeat company comments yesterday with earnings. If mlps and the market start another upleg this one could lead the way.

1050 on the S&P getting all the attention so watch it carefully. Perhaps everyone is selling ahead of the gdp number tomorrow and unless its really bad...every may have sold ahead of it and the market will rally. That has been the pattern these last several months. So we watch carefully.

Subscribe to:

Posts (Atom)