CHART DAY!!!!

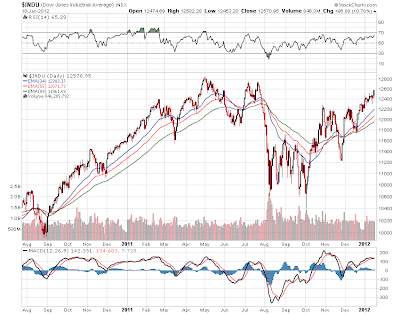

Late first post but this is what happens after a holiday weekend and you have to come back from a nice weekend with the deer in Pennsylvania. The market began by playing catch up to Europe which of course rallied after the S&P downgrades last Friday. The downgrades themselves are utterly meaningless to the markets and if I were S&P, Fitch, and Moody's, i would recognize that their downgrades continue to come pretty late in the game. The dow industrials ran up 150 but are now up about 100 points. The tick (net uptics/downtics) has been running negative much of the day so far so sellers are around here. Financials aren't rallying today for the most part thanks to Citigroup and its earnings (so called) so we watch the tape for signs of a top in the October rally. Each attempted top has been aborted and we have gone on the new highs but only marginally so. Except for the dow industrials and the mlp index we are barely above the October 24th high. So i figured lets put up some charts and see what they are telling us.

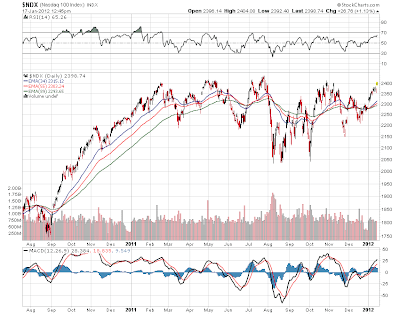

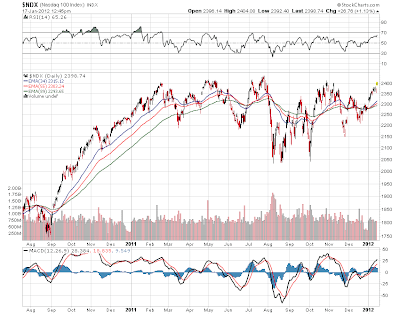

The nasdaq 100 is making its 5th attempt to break out above 2400. Either this is a monstrous top being formed or we will breakout decisively out of a long base that goes back to the beginning of 2011. The S&P 500 meanwhile hasn't even gotten back to its 2011 highs yet and it is struggling here at 1300 even.

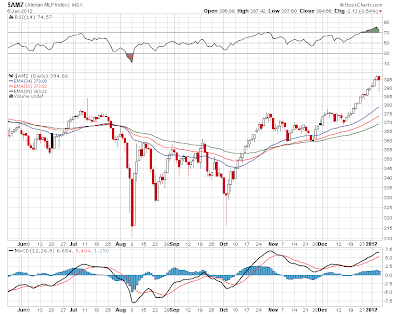

The MLP index meanwhile has taken out its 2011 high and remains in an uptrend although it is only break even since January 1st. Its attempt to rally to 400 has failed and it looks like its mounting another try. Its up 2 on the day today being led by Kinder Morgan (KMP) which is up 1 ahead of earnings.

The last chart i thought was pretty interesting and that is the index of nat gas stocks. Now to look at nat gas today it is down 5% and sits at an amazing $2.45. We have been told by so many experts how 3 dollars was the wall. Well guess what? We are closer to 2 than 3 thanks to endless supply and a non existent winter in the US this year. That base at 620 doesn't look likely to hold here if the commodity itself continues to circle the drain and demand overall continues to contract.

What are we to conclude from all this? Well for now it seems rather ambiguous. The market continues to rally overall in the face of Europe. The economic numbers here are not exactly ramping up. Energy stocks as a whole seemed to be rolling over as the same money gets moved around from group to group. MLPS continue to do okay. Earnings and distribution annoucements begin this week and increases are already priced in. Still 6% yield continues to attract cash against a 10 year at 1.85%. Short term the market appears to want to go higher, but at some point you have to ask yourself whether any of this is sustainable given what is going on out in the world. And i keep asking myself the same question. If the world is getting better, why oh why is the 10 year still under 2%? As for MLPS, our bull market here began in December of 2008 and has begun its 4th year. No sign of a top, at least not yet.

MLPS which have been pulling back over the last few days are a touch higher for now as 10 year rates push to 1.80 and look to challenge that 1.69 intraday low from last August. Meanwhile markets are setting up for what appears to be an outside reversal day. After opening 60 points higher the dow is now down 70 points on weak economic news. Chicago PMI is down to its lowest levels since last August and might be putting recession back on the table..

MLPS which have been pulling back over the last few days are a touch higher for now as 10 year rates push to 1.80 and look to challenge that 1.69 intraday low from last August. Meanwhile markets are setting up for what appears to be an outside reversal day. After opening 60 points higher the dow is now down 70 points on weak economic news. Chicago PMI is down to its lowest levels since last August and might be putting recession back on the table.. Still the dow chart says the uptrend is intact and the dow needs to crack below 12,000 to take out all the support levels we watch. So far now its just end of month profit taking and nothing more.

Still the dow chart says the uptrend is intact and the dow needs to crack below 12,000 to take out all the support levels we watch. So far now its just end of month profit taking and nothing more.