NATGAS BOTTOM? MARKETS ON EDGE!

Heading for a long vacation for all of 4th of July Week so posting will be minimal the next 10 days. Its been pretty minimal as it as lately as work schedules and family issues have been a bit overwhelming. So let me get to a few issues here going on.

Nat gas is staging a rally off what appears to be a significant bottom back in late April. What is very important is that we have broken out above 2.75 so we may be headed back to 3 bucks which for years was the old line in the sand. At least it appears that the nat gas market may try and get above that. Meanwhile take a look at the nat gas mlp etf and notice that this bottom in price has not rallied these stocks. In fact the reverse is true. This is something we need to pay attention to. Something else is going on here and it could be that maybe these companies have so reflexively hedged themselves for falling nat gas prices for years that maybe they are going to get caught short at least at this particular turning point. I guess we might get some idea on this come late July when earnings come out.

Meanwhile the dow and MLP chart are not inspiring. The mlp index seems to be getting ready for another trip down to 350 And the dow chart is moving in tandem.

These are not inspiring charts and i think the summer could bring us turmoil as Europe unravels. But its end of month, end of quarter, and end of half year and at least for the next few days we could see the usually nonsense of money getting moved around from A to B and then back to A.

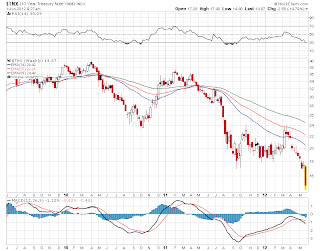

Frankly its hard to see how markets can rally when you have a bond chart that looks like this. Those looking for a hopeful summer might be better off looking for it at the shore.