ARE WE BEGINNING TO LAG THE RALLY?

Steve posted

that idea yesterday in the comments section. Lets discuss.

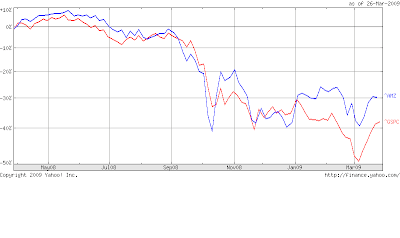

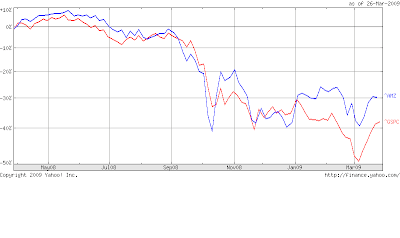

Something is definitely not right in MLP land again. The relative outperformance we saw the first 2+ months of the year has stopped and we have begun to lag the averages. Either the averages have gotten fluffy and we are keeping to a base line, or something less sanguine is afoot.

Steve is concerned with the relative underperformance and this week we have seen the mlp index go nowhere while the s&p is up 6%. Certainly disheartening when you consider the rest of the market. On the other hand mlps have been an outstanding outperformer in the last 3 months with a nearly 20% relative outperformance and total return for 2009 of about +15%. Should we worried by this weeks action? Perhaps we should be a bit concerned. One never wants to see underperformance. But could there be some other reasons why this is happening. I propose 2 ideas. One is that a number of mlps that actually have a price attached to them..that is higher than 15 bucks have done offerings. The latest was Buckeye (BPL) yesterday which was down 2 points on its latest stock offering. And based on the l

ast rebalancing of the mlp index BPL has an over 3% weighting. Plains All American (PAA) and Inergy (NRGY) have also done stock offerings and the 2 have a combined weighting of over 8%. So certainly we can say these stock offerings have caused a distortion.

What could also be at play here is end of quarter and it could be that we are up so much for the year; players are moving out of mlps and into other things that have a long way to catch up. Ultimately that game plays itself out in a few days and we will be left with the basic question unanswered. Steve goes on to say...

I'm going to be really disappointed if in the next market downdraft we find that we are giving it all back - or worse, leading the market down. If we have topped out and are rolling over, we may lead on the downside.Should we be worried? Well we should always be worried. But there are enough positives out there including a firmness in the crude price to give us a little bit of space. All will be resolved in the fullness of time but Steve correctly points out that we should be on watch.

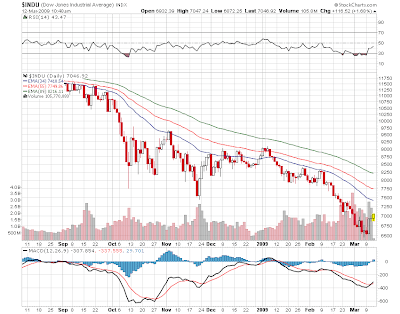

Well we have arrived at the end of the week and the end of the quarter is next Tuesday. So i would look for markets to correct the move but with a firm tone. 875-900 is a doable target on the S&P and 205 on the MLP would be logical. Stefil Nicholas is cutting Alliance Holdings (AHGP) and Alliance Partners (ARLP) from buy to hold. Crude is down about a buck this morning and stock futures are down 10 points on the S&P as we see profit taking after the big moves this week.