Friday, June 30, 2006

Sorry for the late post today...just got back from work.

The overall market is doing a very good job of digesting gains from yesterday...MLPS are not doing much as a whole but there are some individual movers and news items today. First off Markwest priced its offering last night at 39.75 and the stock is rallying off that today up 1 and change. I think the selling yesterday was way overdone but they had to drop the price low enough to attract support. Atlas Pipeline Partners (APL) is re-doing their revolving line of credit. Valero LP is boosting shares in the the ipo of its GP...stock is down 20 cents. National Resource Partners (NRP) closes its deal on recent purchases.

Tape has that end of quarter feel so look for some wierd action by days end.

The overall market is doing a very good job of digesting gains from yesterday...MLPS are not doing much as a whole but there are some individual movers and news items today. First off Markwest priced its offering last night at 39.75 and the stock is rallying off that today up 1 and change. I think the selling yesterday was way overdone but they had to drop the price low enough to attract support. Atlas Pipeline Partners (APL) is re-doing their revolving line of credit. Valero LP is boosting shares in the the ipo of its GP...stock is down 20 cents. National Resource Partners (NRP) closes its deal on recent purchases.

Tape has that end of quarter feel so look for some wierd action by days end.

Thursday, June 29, 2006

MLPS are slightly higher on the whole as we continue to see end of quarter pre-fed gyrations. No important corporate developements this afternoon so we wait for the fed decision which is coming shortly.

I have been hinting at a possible end of quarter price spike that may occur and i have posted 2 stocks that might be eligible. Holly Partners(HEP) which has not done much in the last 3 months has last day of quarter spikes in the last 3 quarters. And the move has been 2 points or so. Markwest Energy (MWE)is another which while in this agonizing downtrend has had end of quarter spikes of several points. The trick is to sell shares by days end tomorrow and not hold on until Monday unless you are brave. I also think Valero LP(VLI) and Atlas Pipeline Partners (APL)could see moves. This again is for nimble traders among you.

Meanwhile we are now 4 days into a 3 million share offering of Markwest Energy LP (MWE). They must be pricing it one share at a time!

Good Thursday morning.

Its all about the fed today so after the open i imagine we'll just trade sideways before the 25 basis point increase. Then its end of quarter pressures for tomorrow, the russell rebalancing and then the long holiday weekend. No corporate news that i could find and no upgrades or downgrades....although there are some upgrades today of the more popular energy stocks. MLPS were mostly lower yesterday so we'll see what today brings. Teppco priced its 5.5 million offering at 35.50 a share. Meanwhile Markwest's offering has been out there since last Friday afternoon. Maybe they'll get around to letting us know the price here...perhaps sometime before the decade is out. The investor relations department here is absolutely useless.

I am working again this morning so i'll have a more comprehensive post when i get home in a few hours.

Its all about the fed today so after the open i imagine we'll just trade sideways before the 25 basis point increase. Then its end of quarter pressures for tomorrow, the russell rebalancing and then the long holiday weekend. No corporate news that i could find and no upgrades or downgrades....although there are some upgrades today of the more popular energy stocks. MLPS were mostly lower yesterday so we'll see what today brings. Teppco priced its 5.5 million offering at 35.50 a share. Meanwhile Markwest's offering has been out there since last Friday afternoon. Maybe they'll get around to letting us know the price here...perhaps sometime before the decade is out. The investor relations department here is absolutely useless.

I am working again this morning so i'll have a more comprehensive post when i get home in a few hours.

Wednesday, June 28, 2006

I can't figure out what is going on with Valero LP other than end of quarter blowouts. Hope that's all it is. Meanwhile the AMZ MLP index is down 1 and change...my guess is VLI is one of the highweights in this index but overall looking at the group of stocks the action is mixed.

Last hour action...overall tape is firm especially the energy stocks. 10 year at 5.24%.

Last hour action...overall tape is firm especially the energy stocks. 10 year at 5.24%.

The fed meeting is underway so get set for tremendous tension to build on the tape until the release at 2:15pm. So while the main tape gets pulled back and forth, energy is moving higher and taking some MLPS with it. The AMZ MLP index is down however by a small fraction. Atlas Pipeline and Oneok LP lead the losers list down fractions. Also down are Valero LP, Pacific Energy Partners and a few others.

Meanwhile Markwest Energy is up another fraction today along with Crosstex LP, Energy Transfer Partners and Boardwalk Partners.

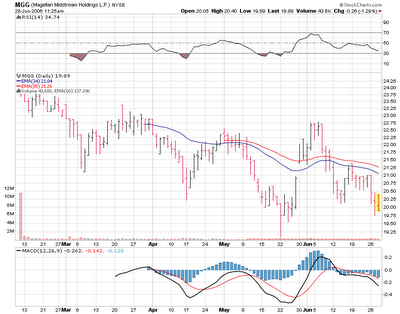

Magellan Holdings is down under 20 bucks again and note the chart above is not exactly pretty. However put this one on the radar screen for a possible move on Friday when the end of quarter nonsense possibly sends this one skyward for a nice 1 day trade...imho of course!

Tuesday, June 27, 2006

Oil and gas stocks as a whole are higher while the market is selling off. MLPS are slightly lower as a group with the index is down .42 or .17% so its near the flat line for practical purposes. Markwest is higher by 40 cents is the biggest winner. Hiland LP and Teppco are both down about 1. Fractional losers include Oneok LP, Alliance Resource and a few others. Most of the losses are 20 cents or less.

Dow down 88 points...lets see what happens when Mr Paulson is done speaking.

Dow down 88 points...lets see what happens when Mr Paulson is done speaking.

Its Tuesday morning and Oil and Natural Gas are higher in overnight and early morning trading. No news and no upgrades or downgrades. Today is the last day of trading for settlement in Q2.

Not much else happening so I'll be on headline watch. Teppco announced a 5 million share offering last night. So far a bid at 36.50 in the pre-market. No stock offered and no trades so far.

Not much else happening so I'll be on headline watch. Teppco announced a 5 million share offering last night. So far a bid at 36.50 in the pre-market. No stock offered and no trades so far.

Monday, June 26, 2006

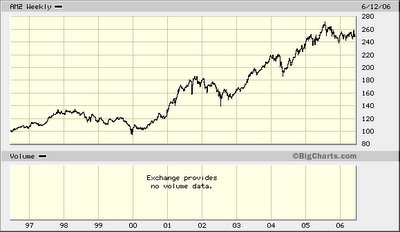

Solid close today in most MLPS...The AMZ MLP index was up 1 to 249.11. Weekly dow chart above still looks to have the uptrend intact.

After the close news with Teppco as they announce a 5 million share offering...the stock was down 50 cents today and will be down more tomorrow on the dilution. No other breaking headlines.

Still a bit of split day as the AMZ MLP index is basically unchanged. Markwest is up 1 and change at 41.95 as it prices its offering of 3 million shares. Looks like this was long discounted by the market over the last 8 weeks. Emergy Transfer is up a fraction along with a few others. Down today Crosstex LP which dropped 1.70 at one point but has now rallied back to -40 cents. Copano is also lower by 70 cents, Teppco and Sunoco Logistics are down major fractions.

I've mentioned that the end of quarter brings about some weird price action. Last end of quarter Markwest LP (MWE) jumped nearly 3 points in the last 20 minutes of trading. Crosstex LP (XTEX) did the same. My guess is there has been a lot of naked shorting of some of these and the end of quarter brings with it short covering into a thin float so the stocks move sharply. I would expect similar moves in the stocks mentioned above. Also Atlas Pipeline (APL)might bounce and Valero LP(VLI) might be eligible as one that might have room to move. Regency Partners (RGNC).

Markwest leads the way higher among MLPS today as the overhang of the offering is now priced in. Stock up 80 cents as the offering is absorbed. The group is mixed overall with most moves fractional in nature.

Magellan Holdings is the biggest loser as it drops to near 20 again. Fractional losers include Buckeye Partners, Plains All American and Sunoco Logistics.

There are some end of quarter distortions going on and as we get close to friday i will post a list of stocks i think might see some end of quarter buying but these are for quick trades and you will probably need to be out by the close of trading at 4pm. More on this as we get closer.

Magellan Holdings is the biggest loser as it drops to near 20 again. Fractional losers include Buckeye Partners, Plains All American and Sunoco Logistics.

There are some end of quarter distortions going on and as we get close to friday i will post a list of stocks i think might see some end of quarter buying but these are for quick trades and you will probably need to be out by the close of trading at 4pm. More on this as we get closer.

Good morning!

Monday morning on the last week of June of the last week of the second quarter with 2 days before a 2 day fed meeting where we know what they're going to do but not what they're going to say. So with that kind of a backdrop we will probably push and pull in both directions.

Markwest Energy finally announced its offering of 3 million units Friday afternoon at 3:45pm. I still think this has been an overhang on the stock since April and now that its finally done...once the stock hits the market, the stock may actually move up in response.

No other corporate news and no upgrades or downgrades this morning.

Monday morning on the last week of June of the last week of the second quarter with 2 days before a 2 day fed meeting where we know what they're going to do but not what they're going to say. So with that kind of a backdrop we will probably push and pull in both directions.

Markwest Energy finally announced its offering of 3 million units Friday afternoon at 3:45pm. I still think this has been an overhang on the stock since April and now that its finally done...once the stock hits the market, the stock may actually move up in response.

No other corporate news and no upgrades or downgrades this morning.

Friday, June 23, 2006

Lots of green on the screen except that i think everything would be higher in MLP land but for the 10 year pushing 5.25%. Most issues are fractionally higher. A few losers mostly 15 cents or less...Markwest leads the way there as its downtrend continunes.

Heading for the racetrack this afternoon so i'll post this evening.

Heading for the racetrack this afternoon so i'll post this evening.

Good Morning...its Friday...horray.

By the way hello to all you Moneyblog readers who have joined us here. We welcome you and please share your thoughts in the comments section at any time.

Interesting morning with the huge deal as Anandarko buying Western Gas and Kerr McGee at huge premiums to yesterday's close. I mention this because sometimes these deals can put a bid underneath the group so we'll know shortly if thats the case. In corporate news last night Inergy LP priced its offering at 24.90 per share which is where we're trading in the pre-market action.

Nothing going on in the upgrade downgrade department so far. Crosstex (XTXI) has some stock to buy in the pre-market above yesterday's 89.30 close. Otherwise no pre-market action.

Meanwhile we have the Markwest Energy saga....lovely chart iabove sn't it! This from a company that has increased its distribution 5 cents in the last quarter; beat earnings estimates and is likely to raise the distribution again. Problem here is that the company has a hideous communication problem with its shareholders. We learned of a pipe extention from an Enbridge Energy release. Now this may not be a big deal but you know what...it might be nice if they would just tell us so. Then there is the pending offering of 3 million shares which the company announced they were going to do once they got their filings done with the SEC...in fact those filings were released a few days ago. What is taking so long??? You could of course call the company and try to talk to invester relations. But i'm still waiting for a call back from one i placed 3 months ago to answer a simple question. Let me just point out that the stock chart says you have a credibility issue here. How about some better communication with your shareholders?

Food for thought.

Thursday, June 22, 2006

Some market firming in the last hour in what as been a very boring day. MLP's are lying between down 50 cents and up 50 cents. Just a very boring day.

Next week is the fed meeting and we know what they're going to do. Then we can look foward to end of quarter and if it plays like the last one we could see some interesting moves in a few of these that i think are being oversold. Last end of quarter we saw a 2 point rise in Markwest Energy (MWE) for example in the last 15 minutes of trading. Crosstex LP also saw a nice move. This is for short term traders only and one must be very nimble. More on this next week as we get closer to the end of month.

Next week is the fed meeting and we know what they're going to do. Then we can look foward to end of quarter and if it plays like the last one we could see some interesting moves in a few of these that i think are being oversold. Last end of quarter we saw a 2 point rise in Markwest Energy (MWE) for example in the last 15 minutes of trading. Crosstex LP also saw a nice move. This is for short term traders only and one must be very nimble. More on this next week as we get closer to the end of month.

Good Morning!

We have an upgrade this morning; actually coverage started as Lehman Brothers starts Copano Energy (CPNO). Note yesterday afternoon's post where i recommended CPNO for short term traders...good timing on my part!

No news this morning but we did have news last night from LIN Energy which makes a purchase and announces an annual distribution increase.

Overall market looks flat right now for the open. Nat gas inventories out later this morning. Crude oil is up this morning as well.

We have an upgrade this morning; actually coverage started as Lehman Brothers starts Copano Energy (CPNO). Note yesterday afternoon's post where i recommended CPNO for short term traders...good timing on my part!

No news this morning but we did have news last night from LIN Energy which makes a purchase and announces an annual distribution increase.

Overall market looks flat right now for the open. Nat gas inventories out later this morning. Crude oil is up this morning as well.

Wednesday, June 21, 2006

A couple of charts. I still think Regency Partners is poised to breakout to the 24-26 area shortly. Chart looks very good and should rally soon...if it could get a piece of news to move it along. Also note Crosstex (XTXI) daily is on a sell while the weekly is still in buy mode. Looks like we're building another base in here.

Note stocastic on RGNC is about to go to buy again.

Good day in the overall market and while MLPS are up nicely...there isn't really a whole lot of volume. I've been watching the trading and frankly its been rather boring. A large group of fractional plusses. Penn Virginia Resources and National Resource Partners are the biggest winners both up about a point.

Markwest LP and Oneok LP both down fractions but its more from lack of interest than genuine selling.

Markwest LP and Oneok LP both down fractions but its more from lack of interest than genuine selling.

Good Morning!

First off my blog will now be appearing on The Money Blogs sponsored by Trading Markets. The link is going to take the RSS feed from here so i'll be blogging at the usual place. If you are coming to the blogspot link; just continue to do so...or you can use the new link and get to other money related blogs and info. There is nothing there yet but it should be hooked up soon.

Meanwhile there is no news this morning to speak of and no upgrades or downgrades either. Inergy LP is doing another stock offerning of 3 million plus shares to pay off debt. Meanwhile we have those wonderful investor relations people from Markwest Energy (MWE) who could not issue a press release regarding Enbridge and the Gulf of Mexico Pipeline but at 7pm last night they issued this release about changing the date of their investor conference. I guess the IR people and the night cleaning crew are one in the same!

On the watch for the open this morning.

First off my blog will now be appearing on The Money Blogs sponsored by Trading Markets. The link is going to take the RSS feed from here so i'll be blogging at the usual place. If you are coming to the blogspot link; just continue to do so...or you can use the new link and get to other money related blogs and info. There is nothing there yet but it should be hooked up soon.

Meanwhile there is no news this morning to speak of and no upgrades or downgrades either. Inergy LP is doing another stock offerning of 3 million plus shares to pay off debt. Meanwhile we have those wonderful investor relations people from Markwest Energy (MWE) who could not issue a press release regarding Enbridge and the Gulf of Mexico Pipeline but at 7pm last night they issued this release about changing the date of their investor conference. I guess the IR people and the night cleaning crew are one in the same!

On the watch for the open this morning.

Tuesday, June 20, 2006

After hours news...Energy Transfer Partners is making a special distribution from a lawsuit settlement. 3.25 cents boys and girls. ETP is up 30 cents in after hours trading from the 4pm close.

Markwest which announced an offering 2 months ago but was waiting for the SEC filings and approval..well the filings were made today. I'm wondering that since the stock has been sideways to down since April that the secondary hold up has been the hangover that keeps this stock from getting back to 45. So once this thing is priced you might get a relief rally.

Markwest which announced an offering 2 months ago but was waiting for the SEC filings and approval..well the filings were made today. I'm wondering that since the stock has been sideways to down since April that the secondary hold up has been the hangover that keeps this stock from getting back to 45. So once this thing is priced you might get a relief rally.

A very green screen this morning as we head into the lunch hour. Market rally following through inot MLPS... although the MLP index is up a strong fraction and has not back the 2 points it lost yesterday. Still the group is quite firm here with strong fractional plusses in a host of issues including Duke Midstream, Valero LP, Crosstex LP, Penn Virginia Resources and a few others. Markwest is up 35 cents on the pipeline news with Enbridge.

A few issues are down but not by much; mainly those that weren't big losers yesterday.

A few issues are down but not by much; mainly those that weren't big losers yesterday.

Good Morning.

Starting this morning with some Enbridge news (ENB) which is also linked to Markwest Energy Holders as they extend Gulf of Mexico coverage. The news comes via Enbridge and not from Markwest who are notorious for being terrible with information. Looks like things have not gotten better in the PR department.

No other news this morning and no upgrades or downgrades at least so far. MLPs are opening a little firmer this morning.

Starting this morning with some Enbridge news (ENB) which is also linked to Markwest Energy Holders as they extend Gulf of Mexico coverage. The news comes via Enbridge and not from Markwest who are notorious for being terrible with information. Looks like things have not gotten better in the PR department.

No other news this morning and no upgrades or downgrades at least so far. MLPs are opening a little firmer this morning.

Monday, June 19, 2006

Went to home depot to buy a mailbox and come back to a sell-off. Dow down 100 pts; XOI down 35. MLPS extending their losses with Copano down 1 and change and Crosstex (XTXI) down over 2. And we have a slew of fractional losses across the board.

With sell-offs come opportunities and you may have another chance to buy XTXI in the lower 80s again if the market drops and retests the lows at 10700 in the next few days.

With sell-offs come opportunities and you may have another chance to buy XTXI in the lower 80s again if the market drops and retests the lows at 10700 in the next few days.

Looks like we are taking our cues from the XOI index which is down 25 points...over 2 percent. Most MLPS are down but none of is individually news driven. The AMZ/MLP index is down nearly 2 points or a little less than 1 percent. Lots of fractional losses...Buckeye Partners is down 75 cents...the biggest losers. Only a handful of winners today; mainly up pennies.

Good Morning!

Its Monday and its very quiet this morning as there is no news, no upgrades, no downgrades, no nothing. The energy complex is lower this morning and it looks like the rally continues in the overall market. Friday was a very good day for MLPS as the index was up 3 points. We should see the rally continue and some of the laggards in the bounce might play catch up.

Its Monday and its very quiet this morning as there is no news, no upgrades, no downgrades, no nothing. The energy complex is lower this morning and it looks like the rally continues in the overall market. Friday was a very good day for MLPS as the index was up 3 points. We should see the rally continue and some of the laggards in the bounce might play catch up.

Good Morning!

Its Monday and its very quiet this morning as there is no news, no upgrades, no downgrades, no nothing. The energy complex is lower this morning and it looks like the rally continues in the overall market. Friday was a very good day for MLPS as the index was up 3 points. We should see the rally continue and some of the laggards in the bounce might play catch up.

Its Monday and its very quiet this morning as there is no news, no upgrades, no downgrades, no nothing. The energy complex is lower this morning and it looks like the rally continues in the overall market. Friday was a very good day for MLPS as the index was up 3 points. We should see the rally continue and some of the laggards in the bounce might play catch up.

Friday, June 16, 2006

The MLP index is up 2 and change today as MLPS are mostly higher. Penn Virginia leads the way with a strong fractional gain along with Crosstex (XTXI), Buckeye LP, Sunoco Logisitics, Copano, Magellan Midstream and a few others.

A handful are down but mostly 20 cents or less.

Overall market lower but not by much which is a good thing after the knid of week we've had.

A handful are down but mostly 20 cents or less.

Overall market lower but not by much which is a good thing after the knid of week we've had.

Good Friday morning!

What a week and its finally coming to a close. I would think they will pull em back and forth today but i could be wrong. The open looks soft. Yesterday Merrill Lynch restarted Teppco (TPP) at a buy and today it restarts Kinder Morgan Partners (KMP) at a buy as well. No other news items this morning so here comes the open.

A block of 22000 shares of XTXI was posted this morning at 89.60. Don't know when it was done.

What a week and its finally coming to a close. I would think they will pull em back and forth today but i could be wrong. The open looks soft. Yesterday Merrill Lynch restarted Teppco (TPP) at a buy and today it restarts Kinder Morgan Partners (KMP) at a buy as well. No other news items this morning so here comes the open.

A block of 22000 shares of XTXI was posted this morning at 89.60. Don't know when it was done.

Thursday, June 15, 2006

If you like charts i posted the dow industrials daily and weekly chart. On the daily this rally should carry to the downtrend moving averages around 11100 ish...I would expect to see some selling to come in at that level. Note that on the weekly chart the 89 day expotential moving average has held in the overall uptrend and it has held again at least so far. 10,700 on the dow now becomes the new base level which needs to be watched.

As per moving averages i use fibinocci numbers 34,55,89,144,233 day. They seem to work well most of the time.

Excellent day as we head into the close. First the losers list because its small. Markwest Energy is down...im guessing they must be close to doing their stock offering. Otherwise we are getting a nice snapback in many of these. If you were lucky enough to grab Crosstex at 83-84 its now near 90....up 4...Crosstex LP is up 1 as is Sunoco Logistics, Kinder Morgan with a host of big fractional winners.

Still no news on the corporate front.

Still no news on the corporate front.

Well the rally ran its logical course of 200 or so points on the dow. Now the trick is to see how much selling comes into it. Meanwhile the MLP index is actually down 0.44 but most MLPS are nicely higher so I can't understand that one. The ones that are down are not the big cap MLPS if this is a cap weighted index. Crosstex (XTXI) is up 4 1/4 and a slew of fractional plusses in Energy Transfer, Crosstex LP, Sunoco Logistics and a few others. Calumet LP is down 1 and change responding to its 4 million share offering.

Good Morning!

So we're coming off yesterday's dead cat bounce so this morning it looks like the dead cat has some spring in its step at least at the open today. The rally has the right to go another 100 points or so and should carry some of yesterday's laggards. We continue to operate in a news vacumm so MLPS will probably move with the overall tape. No upgrades or downgrades so far this morning.

So we're coming off yesterday's dead cat bounce so this morning it looks like the dead cat has some spring in its step at least at the open today. The rally has the right to go another 100 points or so and should carry some of yesterday's laggards. We continue to operate in a news vacumm so MLPS will probably move with the overall tape. No upgrades or downgrades so far this morning.

Wednesday, June 14, 2006

Lots of green on the screen (so far) as the dead cat bounce continues. Baige book at 2pm should dictate the last hour nonsense and whether we'll get an up close. The MLP index is up 1.26. Oneok LP leads the way up nearly 1 and we have fractional plusses in most other issues.

Losers today include Sunoco Logisitcs, Calumet Partners on a stock offering of 4 million shares, Williams Partners and Penn Virgina resources.

Losers today include Sunoco Logisitcs, Calumet Partners on a stock offering of 4 million shares, Williams Partners and Penn Virgina resources.

Good Morning!

CPI was not good but the market may have already figured that out since futures are higher although well off its highs. Nat gas is up this morning and crude and gold aren't falling which is good news is suppose. No news this morning on the corporate front so its another day where we move with the rest of the market.

Missed a downgrade yesterday as Raymond James cut Plains All American. RBC Capital Markets ups its target on Plains this morning from 46 to 51 dollars.

CPI was not good but the market may have already figured that out since futures are higher although well off its highs. Nat gas is up this morning and crude and gold aren't falling which is good news is suppose. No news this morning on the corporate front so its another day where we move with the rest of the market.

Missed a downgrade yesterday as Raymond James cut Plains All American. RBC Capital Markets ups its target on Plains this morning from 46 to 51 dollars.

Tuesday, June 13, 2006

After today's sorry close I think the market is poised to do something big tomorrow. The only question is direction. We are so oversold that a 200 point relief rally could occur at anytime. On the other had if the CPI is bad tomorrow it could produce a huge selloff. Actually i would love a down open and and up close but i'll take any positive action as i think we all would.

Lots of bargains out there. Fingers crossed for tomorrow.

Lots of bargains out there. Fingers crossed for tomorrow.

No fun blogging when everything is going down like this. My God you know its bad when everything is going down and Intel is up 35 cents!. MLP index at the lows of the day down 3.72 or 1.5%. Holly is up a couple of pennies otherwise everything else is down fractions to a point. Calumet Products Partners is down 1 and change and is the biggest loser so far today.

The whole group is down save for Holly Partners which is up a few pennies. The MLP index is down a little over 1 percent.The dow which has been going back and forth is down again but has not taken out the days low but we'll wait for the last hour for that.

Absent of any news we seem to be at the mercy of the downtrend.

Absent of any news we seem to be at the mercy of the downtrend.

Good Morning!

Its perhaps a little less ugly this morning than it was but the tape is heavy. And since we don't have any drivers this morning in corporate news or upgrades I guess we trade with everyone else. At some point we should see a sharp snapback rally but who knows when that gets underway.

The group is down but not as much as the rest of the market which is a small consolation. Meanwhile above are the 1 year and 10 year charts of the MLP index (AMZ) and note the period on the 10 year from 2000-2002 when we had the big market sell-off and the last recession. MLPS did very well especially in 01-02.

Monday, June 12, 2006

Selloff spreading again..dow -73. Just Pacific Energy, Teppco and Crosstex remain higher and Pacific Energy is well off its 2 point plus gain from earlier. Since its price is now tied to Plains Price...when PAA goes down...PPX goes down too. Plains is down 1.47 at 3:30pm. Most MLPS now making new lows on the day. Getting ugly again!

The MLP index is down just under 1% at 249 and change.

The MLP index is down just under 1% at 249 and change.

Its been sideways with a downward bias since the open...nothing catastrophic but oh so boring. One news headline on Atlas Pipeline Partners as the IPO price range for Atlas Pipeline Holdings is set for 23 to 25 dollars a share. In this market enviornment it will be interesting to see if they get it.

Williams Partners is down 1 and change on a debt and equity offering.

Finally above is the Crosstex (XTXI) as it looks like the price is correcting....looking for a drop into the lower 80s as a logical entry point.

Good Morning!

Sorry for the late start but we have a takeover this morning of Pacific Energy Partners (PPX) by Plains All American (PAA) in a stock swap which has given a nice pop in PPX + 2 and change and a 50 cent gain in PAO. Plains says its yearly distribution will be 3.2o. Valero LP is up 50 cents perhaps in some speculation that they may buy something soon (my guess here) and i would think that this would light a fire under others in the group but the market tone which is tentative at best probably holding them back. But lets see how the day evolves. The group is mixed at best right now. Williams Partners is down 1 and change Natural Resource Partners is down 76 cents...they are the 2 biggest losers.

No other drivers this morning at least so far.

Friday, June 09, 2006

Thunderstorms in the Western Caribbean are trying to organize into the seasons first tropical depression. The latest here from the National Hurricane Center.

Short term traders might want to look a Crosstex (XTXI) as perhaps needing a correction here. 83-85 is solid support imho and may be a good place to accumulate shares. It has to get there first but the chart looks a little toppy short term.

Yesterday's laggards are playing catch-up; yesterdays leaders are extending their gains...and some of them are nice gains like Valero LP, Plains All American, and Crosstex LP...all up major fractions while the rest are up between 25 and 50 cents...Hiland is down 80 cents on just a few trades and Kinder Morgan Partners and National Resource Partners are down pennies right now.

Still like Regency Partners to resume its uptrend as it sits near its breakout point at 23. Crosstex LP ran to near 38 on Tuesday before the market sell-off took hold. I think it could run back there fairly quickly!

Good Friday morning.

What a week and its ending today....the overall market will probably extend its rally that began yesterday so lets see how far it goes. MLPS turned late in the afternoon but many still closed lower so look for them to play catch up today. Oil and nat gas are up this morning so we have support underneath them. No upgrades or downgrades so far. Last night we had corporate news about a new pipeline to be built with three companies involved. No corporate developements this morning.

What a week and its ending today....the overall market will probably extend its rally that began yesterday so lets see how far it goes. MLPS turned late in the afternoon but many still closed lower so look for them to play catch up today. Oil and nat gas are up this morning so we have support underneath them. No upgrades or downgrades so far. Last night we had corporate news about a new pipeline to be built with three companies involved. No corporate developements this morning.

Thursday, June 08, 2006

Blogger was down all afternoon again so i could not post. Well we had a nice rally back to even and while most MLPS closed lower they finished off their lows and some turned higher by days end. Usually in selling climaxes like these MLPs being the last group to sell off; it can take a day or two for some to recover. Crosstex LP (XTEX) and Buckeye (BPL) for instance should play catch up tomorrow. In day trades I caught the lows in Exxon and Energy Transfer Partners and made nice trades there. Copano was my big winner today as the stock jumped 1 point within minutes after buying it. So it wound up being a pretty good day for me.

Should see some followthrough tomorrow. I went long for short term swing trades in Crosstex LP, Regency Partners, Valero LP and Oneok LP.

Should see some followthrough tomorrow. I went long for short term swing trades in Crosstex LP, Regency Partners, Valero LP and Oneok LP.

Forever the optimist it is unusual to see just about every MLP down this morning and the overall market is getting sold off but i will be so bold to predict that by days end there could be green on the screen. First off is the fact that there is lots of selling going on now and that could bring about a washout. Secondly since they move the big boys first....some buying has arrived in Exxon Mobil as it is off its 58.10 low...now its 58.42. Okay so its only 32 cents off the low but the buying ususally starts there and then spreads. And the fact that MLPS are getting sold usually comes at the end of a market sell-off and not the beginning.

Of course these could be famous last words but i am forever hopeful. Dow now back at 10,900.

Of course these could be famous last words but i am forever hopeful. Dow now back at 10,900.

Good Morning!

Blogger was down late yesterday afternoon so i could not post about the air coming out of the market as it got very ugly at the end of the day. Meanwhile overnight we have the big cheese of iraqi terrorism biting the dust which is a major step foward. Meanwhile we also have Iran saying they will come to the table but the guy is a loon so who knows. This has put pressure on the oil market as crude is down another dollar this morning and Exxon Mobil is down 57 cents. Stock futures are down this morning which might be a good thing as I would like to see a nice plunge early on volume to wash out the sellers and then maybe we can put a floor in. Natural Gas is higher after yesterday's debacle in that market.

Meanwhile no news and no upgrades and downgrades so far so we trade with the overall tape.

Blogger was down late yesterday afternoon so i could not post about the air coming out of the market as it got very ugly at the end of the day. Meanwhile overnight we have the big cheese of iraqi terrorism biting the dust which is a major step foward. Meanwhile we also have Iran saying they will come to the table but the guy is a loon so who knows. This has put pressure on the oil market as crude is down another dollar this morning and Exxon Mobil is down 57 cents. Stock futures are down this morning which might be a good thing as I would like to see a nice plunge early on volume to wash out the sellers and then maybe we can put a floor in. Natural Gas is higher after yesterday's debacle in that market.

Meanwhile no news and no upgrades and downgrades so far so we trade with the overall tape.

Wednesday, June 07, 2006

Well after a tepid open with a little weakness we've managed to gain some traction. MLPS are mixed to higher for the most part. Looks like the ones that were up yesterday are soft today and versa visa ( or should i say visa versa). Penn Virgina and Boardwalk Partners are up fractionally...while most others are hugging near or just above the flat line.

Fractional losers today in Oneok LP, Plains All American and several others including Crosstex. And speaking of these three imho if you are looking to established long positions this may be a good place for these 3. Crosstex LP ran to nearly 38 yesterday and a pullback here to 35.50-36 area looks like a good place to go long. Oneok LP also i believe giving you an opportunity here. I still think Regency Partners has the chart on the verge of a breakout....all imho of course!

Fractional losers today in Oneok LP, Plains All American and several others including Crosstex. And speaking of these three imho if you are looking to established long positions this may be a good place for these 3. Crosstex LP ran to nearly 38 yesterday and a pullback here to 35.50-36 area looks like a good place to go long. Oneok LP also i believe giving you an opportunity here. I still think Regency Partners has the chart on the verge of a breakout....all imho of course!

Btw i forgot to mention my favorite right now and thats Valero LP. I think this one has potential to do quite well in the next 6 months and perhaps get back to 52 week highs...54 is the first hurdle....distribution growing again...insider buying...and a good outlook from the last quarterly earnings report. I am long for disclosure purposes.

Good Morning!

After yesterday's last 30 minute rally we'll see if we made some sort of tradeable bottom in the overall market. Futures are higher this morning so at least the market opens higher. MLPS have held up very well in this correction and while some have sold off, some have also rallied, some have broken out to new highs...some have made higher lows from 3 weeks ago. So this tells me certainly from a relative strength standpoint that we are in very good shape.

No news this morning and no upgrades or downgrades so i guess we trade with the overall market trend.

I have included some charts of MLPS that i think could do very well over the next few weeks. I really like Regency Partners(RGNC) and Oneok LP(OKS) amoung others. Meanwhile in the one that got away department...how about this chart of Calumet Products Partners (CLMT).

Tuesday, June 06, 2006

Ugly day again today as MLPS are mostly lower but there are a few winners. The Crosstex pair are up ( or "is up"), Williams Energy and Penn Virginia Resources are also fractionally higher. Holly Partners has a fractional gain as well

The rest of the group showing fractional losses with Martin Midstream down 80 cents along with Plains All American and Sunoco Logistics.

The index is now on the tickers above.

The rest of the group showing fractional losses with Martin Midstream down 80 cents along with Plains All American and Sunoco Logistics.

The index is now on the tickers above.

Good Tuesday morning!

First off I have added the Master Limited Partnerships Index (^amz) on the tickers for your investing pleasure!. It was down with everything else yesterday but by far less than the overall market. Meanwhile a small bounce at the open is likely and i think we could see more follow through selling once we work through the initial bounce. I predict that if we break below 11000 K there could be some wholesale dumping even in our group....in which case have shopping carts ready for cheap shares. Some the ones that have been showing good relative strength include Energy Transfer Partners and the GP...Energy Transfer Equity. Crosstex LP was up 1 yesterday...Crosstex GP has been rallying all through this decline and I would love to see a pullback to the lower 80s to pounce on shares. But one must be nimble here. Oneok LP looks like it wants to breakout out above 50.

Meanwhile no news and no upgrades or downgrades this morning at least so far.

First off I have added the Master Limited Partnerships Index (^amz) on the tickers for your investing pleasure!. It was down with everything else yesterday but by far less than the overall market. Meanwhile a small bounce at the open is likely and i think we could see more follow through selling once we work through the initial bounce. I predict that if we break below 11000 K there could be some wholesale dumping even in our group....in which case have shopping carts ready for cheap shares. Some the ones that have been showing good relative strength include Energy Transfer Partners and the GP...Energy Transfer Equity. Crosstex LP was up 1 yesterday...Crosstex GP has been rallying all through this decline and I would love to see a pullback to the lower 80s to pounce on shares. But one must be nimble here. Oneok LP looks like it wants to breakout out above 50.

Meanwhile no news and no upgrades or downgrades this morning at least so far.

Monday, June 05, 2006

Selling has accelerated as the down is now -127 and at the lows of the day. MLPs are not down by much however as the MLP index is off a small fraction here. Fed chairmen headlines hitting the tape adding to volitility. Meanwhile a few more MLPs have turned lower here but still nothing that sets off any alarm bells. DOW -134 as we type. I still think 11000 will be violated.

Good Monday Morning.

First off apologies for being away since Friday morning. Had to run down to Monmouth Park to watch my horse race... and then got the privlege of driving home on 2 of the worst highways in NYC during rush hour in torrential downpours. It has taken days for me to recover and the horse lost.

Friday was a good day as most MLP'S finished nicely higher and near their highs of the day. This morning we have threats from Iran and crude is sharply highier...up over 1 and change...Natural Gas has continued its Hurricane season rally so i guess we should see more upside unless the overall stock market completely falls apart which it is not doing so far this morning.

No corporate developments and no upgrades or downgrades so far today.

First off apologies for being away since Friday morning. Had to run down to Monmouth Park to watch my horse race... and then got the privlege of driving home on 2 of the worst highways in NYC during rush hour in torrential downpours. It has taken days for me to recover and the horse lost.

Friday was a good day as most MLP'S finished nicely higher and near their highs of the day. This morning we have threats from Iran and crude is sharply highier...up over 1 and change...Natural Gas has continued its Hurricane season rally so i guess we should see more upside unless the overall stock market completely falls apart which it is not doing so far this morning.

No corporate developments and no upgrades or downgrades so far today.

Friday, June 02, 2006

Good Morning!

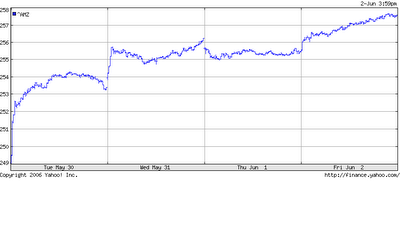

Okay its Friday and the employment numbers are out and the market likes them so we should rally out of the gate. MLPS have had a great week . The MLP INDEX starts the day at 255.46 and we have 2 charts for you. This week MLPS have outperformed the S&P nicely. The index was down yesterday probably because Kinder Morgan (KMP) was down on profit taking from Tuesday's run-up. I will be posting the index on a daily basis and pass quotes along. The yahoo symbol is "^amz"

No news and no upgrades or downgrades this morning. Crude oil is up, Ten year rates are plunging to 5.04%.

Thursday, June 01, 2006

A few MLPS are giving back pennies today from yesterday's gains but at least half the group is higher going into this afternoon. Buckeye Partners which was tasting 41 just a few days ago is now back to near 44 so a nice move there. Fractional gains in Natural Resource Partners, Atlas Pipeline, Plains All American(52 week high) Duke Midstream and Copano.

I'm long Regency Partners and the chart formation suggests a breakout to the upside could be coming soon. I trade in and out of this one while its been sitting in the 21.50-22.80 area. A piece of news could be the trigger here.

Meanwhile Crosstex (XTXI) has hit my trading target of 92 and i'm content to take profits here. Crosstex LP (XTEX) has been hovering between 34-35 and might be worth a look as it might play a little catch up here. Just my humble opinion of course.

Hey everybody...someone is paying attention to us. We will now have an INDEX on the NYSE!!!!! It will trade under the symbol AMZ! And of course i will blog about it.

No additional headlines and nothing in the upgrade/dpwmgrade arena so far!

No additional headlines and nothing in the upgrade/dpwmgrade arena so far!

Good Thursday morning...

A good week so far so lets see if we can make it 3 in a row. We begin with some news from last night. Recent LLC IPO LIN Energy (LINE) filed its annual report complete with its restatement of financials. It also got a Nasdaq notice of delisting because of the late paperwork filing. This is all reflecting news released back last April so how much if any impact it will have remains to be seen. My guess is most of this stuff is probably priced in.

Its the first day of Hurricane season so get ready for the endless panic that this season will bring. Of course the enviornmental moonbats are demanding the heads of NOAA and the National Hurricane Center resign because they dare to go against the religous dogma that global warming has become. God forbid science should be free to reach scientific conclusions without politics and God forbid that we should make policy based on good science and not on people who tend to chant slogans and have an ability to shout very loud.

A good week so far so lets see if we can make it 3 in a row. We begin with some news from last night. Recent LLC IPO LIN Energy (LINE) filed its annual report complete with its restatement of financials. It also got a Nasdaq notice of delisting because of the late paperwork filing. This is all reflecting news released back last April so how much if any impact it will have remains to be seen. My guess is most of this stuff is probably priced in.

Its the first day of Hurricane season so get ready for the endless panic that this season will bring. Of course the enviornmental moonbats are demanding the heads of NOAA and the National Hurricane Center resign because they dare to go against the religous dogma that global warming has become. God forbid science should be free to reach scientific conclusions without politics and God forbid that we should make policy based on good science and not on people who tend to chant slogans and have an ability to shout very loud.

Subscribe to:

Posts (Atom)