END OF QUARTER OR SOMETHING MORE?

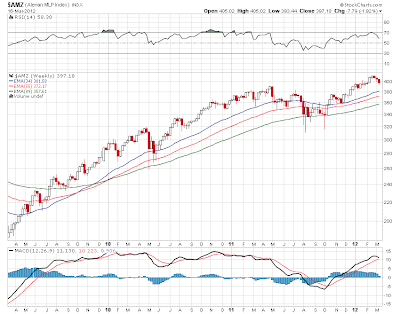

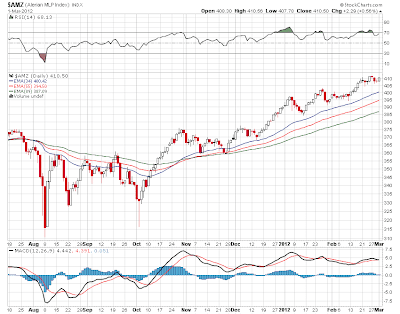

We have been talking about the recent pressure on mlps and it continues today as the index is down just a little less than 5 points. Support and trendlines have been taken out and now what remains is the 200 day moving average which is down around 380. What is of particular interest today is the collapse (again ) in nat gas which is causing coal stocks to implode and in particular Alliance Resource Partners(ARLP).

We have been talking about the recent pressure on mlps and it continues today as the index is down just a little less than 5 points. Support and trendlines have been taken out and now what remains is the 200 day moving average which is down around 380. What is of particular interest today is the collapse (again ) in nat gas which is causing coal stocks to implode and in particular Alliance Resource Partners(ARLP). We are seeing a rush out of this one today, down nearly 6 points at one point today and just off the lows as of this post. It seems overdone to me on this issue and it could be just a matter of running out of an mlp that reached 80 just 2 months ago coupled with end of quarter portfolio purging.

We are seeing a rush out of this one today, down nearly 6 points at one point today and just off the lows as of this post. It seems overdone to me on this issue and it could be just a matter of running out of an mlp that reached 80 just 2 months ago coupled with end of quarter portfolio purging.Nat gas is the other story today as it is down hard and has broken below its January low. This means 2 dollars is the next stop and we could see some panic selling and the possibility for a selling climax once the one handle becomes reality.