What better way to start your day with the MLP index which on this weekly chart looks like its setting up for a blast through the 270-275 level even though we did experience a sharp correction late this week. I still think we are getting ready to move to new highs on this index in the next 3 to 6 months.

We have are charts here of Crosstex Energy (XTXI) with the daily chart above and the weekly chart sitting below

For those of you interested in trading this or establishing new long positions i think we are near a zone where new longs can buy. I think the 144 day moving average is about to be tested on the daily and the 34 week moving average to be tested on the weekly...so that puts the buy zone between 83.50 and 85. This stock can spike down very quickly to these levels and i will be laying several buy orders in this zone Monday morning. I prefer hard down opens to buy into. This is for the nimble among you and I know i run the risk of being wrong or missing it all together. But this is the world we live in.

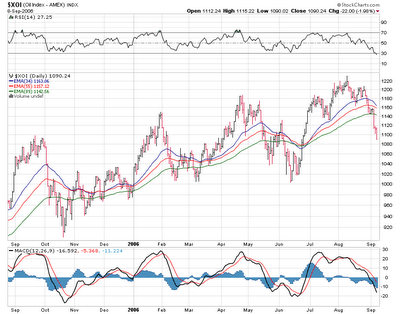

Note here the extremely sad looking XOI daily chart which has broken down. Looks like we are near some sort of uptrend line where we could make a stand here...otherwise it might be a fast trip down to 1000. However look at the weekly chart below and it is far more constructive. In fact on the weekly chart we may be close to a bottom assuming its uptrend lines hold. Also you may have noticed how bearish everyone has become on Oil and Gas...especially Nat gas. All of a sudden gasoline is going to drop to under 2 bucks a gallon? Maybe...and then again...maybe not. The negative sentiment to me signals this ain't over yet.

The 10 year chart below has turned positive for MLPS and provides a tail wind of support despite the overall energy stock selloff. Look for the overall downtrend in rates to continue as the economy slows. If you go back to what MLPS did during the 2000-2001 recession..the index nearly doubled in price.

Anyway...happy reading and more to come as we head into Monday.

2 comments:

Natural gas is down 22% in 3 weeks. Just wondering what impact that will have on margins for gas gathers and processors like Crosstex. I think the 10 year bond yield matters more for equity valuation and these guys do hedge somewhat but I am long a lot of these (RGNC, LINE, WPZ, DPM, CPNO XTEX, ETP).

The 10 year does indeed matter more and i know for example Atlas Pipeline Partners hedged last year to effect an 8.00 nat gas price. Crosstex if i remember correctly bought (sep 2006?) puts at 14 dollar nat gas last year. So these guys seem to know what they are doing. Look at the period from Sept to Dec last year when Nat gas spiked higher and MLPS moved lower as a good indicator that rates do matter far more. BTW i'm also long RGNC,CPNO,XTEX,ETE,APL,VLI

Post a Comment