A little bit off subject but perhaps not. Google missed earnings and by no small margin either. Google down sharply (50+ points) in after hours and anything tech is getting taken out and shot.

So what does this have to do with MLPS...not much really except to say that if the bloom is off the Google rose and the tape is more defensive we could see money flowing to MLPS tomorrow...just food for thought.

Also in tonights state of the onion address...President Bush will touch on America's addiction to oil which might drive money to some alternative energy stocks like Fuel Cel (FCEL) for example.

Tuesday, January 31, 2006

The FED raised rates....said they may raise again...Market selling off.

MLPS remain pretty much where they were before the fed announcement. Amerigas (APU) announces its quarterly distribution. Also Copano Energy (CPNO) priced some senior notes in a private placement. Will post the link when i see it.

10 year at 4.54%

MLPS remain pretty much where they were before the fed announcement. Amerigas (APU) announces its quarterly distribution. Also Copano Energy (CPNO) priced some senior notes in a private placement. Will post the link when i see it.

10 year at 4.54%

Too bad it only happens 4 times a year but when they go X-DISTRIBUTION you can get a lot of distortions and with a little luck make some quick money. For example Crosstex went x-dis today and opened down at 34.72..off 1.41 and then almost immediately bounced up 1 dollar from there. The over the counter MLPS tend to be a little more volitile and sometimes on x-dis day there are sellers at the open that sell into a vacuum...Nimble traders only and not for the faint of heart.

Nothing unusual this morning though Holly Partners is a big winner +1.15 this morning. I've noticed with these stocks that sometimes it takes a day or two for the earnings message tocome across. Look at Energy Transfer which had great earnings...pre-announced raising estimates and distributions and it took awhile for the news to catch on!.

Nothing unusual this morning though Holly Partners is a big winner +1.15 this morning. I've noticed with these stocks that sometimes it takes a day or two for the earnings message tocome across. Look at Energy Transfer which had great earnings...pre-announced raising estimates and distributions and it took awhile for the news to catch on!.

Good Morning!

Quiet morning out there with no news. We have the fed...the state of the onion address..the opec meeting which just ended..no cuts in production.

Lets see if we can recover some of Valero LP's losses yesterday. In the conference call the compnay said that earnigns would improve in the 2nd half and distribution increases could resume at the time.

on news watch...will blog with breaking bulletins.

Quiet morning out there with no news. We have the fed...the state of the onion address..the opec meeting which just ended..no cuts in production.

Lets see if we can recover some of Valero LP's losses yesterday. In the conference call the compnay said that earnigns would improve in the 2nd half and distribution increases could resume at the time.

on news watch...will blog with breaking bulletins.

Monday, January 30, 2006

After the close Enbridge news...first off an expansion of its Texas gas unit. Also we have earnings and distributions.

Valero LP conference call underway. Will post any info i can get my hands on.

Valero LP conference call underway. Will post any info i can get my hands on.

An afternoon of sideways trading. The clobbering continues at Valero LP however as it is now down nearly 3 at $50.90. They better have something nice to say during the conference call after the close. No news on Energy Transfer but its up 87 cents. Holly Partners sold off midday off its high but its now re-rallying up 60 cents. Buckeye Partners up 33 cents.

Teppco is down 63 cents and Copano is down 60 cents...no news

Teppco is down 63 cents and Copano is down 60 cents...no news

An afternoon of sideways trading. The clobbering continues at Valero LP however as it is now down nearly 3 at $50.90. They better have something nice to say during the conference call after the close. No news on Energy Transfer but its up 87 cents. Holly Partners sold off midday off its high but its now re-rallying up 60 cents. Buckeye Partners up 33 cents.

Teppco is down 63 cents and Copano is down 60 cents...no news

Teppco is down 63 cents and Copano is down 60 cents...no news

Valero really getting clobbered -2.62 (VLI) but VLO is +2.75.

10 year at 4.54%. We might be getting the same thing that happened here that happened at the last meeting where the 10 year yield rose into the meeting and the dropped sharply afterward.

Holly traded up 1 and change but has been selling off since 11am...now just up 25 cents on better earnings.

XOI surging to 1141

10 year at 4.54%. We might be getting the same thing that happened here that happened at the last meeting where the 10 year yield rose into the meeting and the dropped sharply afterward.

Holly traded up 1 and change but has been selling off since 11am...now just up 25 cents on better earnings.

XOI surging to 1141

Boy they did not like Valero LP's numbers this morning. The market for quite awhile has given VLI slack on the static distribution but looks like some are tossing in the towel...stock down 1.75 and is about to break through 52.

They liked the Holly numbers but the pre-market trade was a fluke. Stock is up 65 cents however.

Most MLPS are fractionally higher...Exxon's huge numbers lifting up all things energy...the 10 year yield is at 4.53% but so far not having impact.

They liked the Holly numbers but the pre-market trade was a fluke. Stock is up 65 cents however.

Most MLPS are fractionally higher...Exxon's huge numbers lifting up all things energy...the 10 year yield is at 4.53% but so far not having impact.

Cactus Jack on the yahoo Northern Borders Partners board provides this link to a good read on energy. Thanks CJ!

Valero LP has just reported earnings....Company says numbers were below expectations with bigger impacts from problems last fall. Distribution also announced; no change. Company says its sees issues in the first half of 2005 but a better 2nd half. Conference call later today. You will need a passcode to access it and thats provided here...scroll down to the bottom paragraphs. Stock traded 100 shares at 54 after the news.

Exxon is extending its gains this morning in the pre-market up $1.76 to 63.05!

Exxon is extending its gains this morning in the pre-market up $1.76 to 63.05!

Good morning!

We begin this morning with international news from Iran. Now be careful beacuse its a New York Times story but they say Iran is allowing nuke inspectors in to look at a hole in the ground. Also OPEC is meeting to add to all the political jitters.

Meanwhile Exxon (XOM) has reported quarterly earnings and they are huge. The stock is up $1.51 in the pre market.

Now in MLP news...Holly Partners reported earnings this morning and has traded 1000 shares in the pre market at 40.91 which is +1.71 above the Fridaly close. S&P had said that this quarters numbers might have some hurrciane inpact in them but they don't say anything in the press release. So i assume the trade is an indication that the numbers were better than expected.

No other headlines so far this morning....but i am on blog watch.

We begin this morning with international news from Iran. Now be careful beacuse its a New York Times story but they say Iran is allowing nuke inspectors in to look at a hole in the ground. Also OPEC is meeting to add to all the political jitters.

Meanwhile Exxon (XOM) has reported quarterly earnings and they are huge. The stock is up $1.51 in the pre market.

Now in MLP news...Holly Partners reported earnings this morning and has traded 1000 shares in the pre market at 40.91 which is +1.71 above the Fridaly close. S&P had said that this quarters numbers might have some hurrciane inpact in them but they don't say anything in the press release. So i assume the trade is an indication that the numbers were better than expected.

No other headlines so far this morning....but i am on blog watch.

Sunday, January 29, 2006

Good Morning!

A rare Sunday Morning post but the always inciteful Cactus Jack has posted his usual Saturday night observations on the Northern Borders Partners yahoo messageboard. Its recommended reading! He has 2 notes...one on the geopolitcal thing with Iran and the other on the bigger role that Africa is playing in our energy needs.

Also the Guardian has a piece today on the prospects for 90 dollar oil thanks to Iran.

I will be trying to pay closer attention to Iran headlines in the coming weeks since they will be market movers.

A rare Sunday Morning post but the always inciteful Cactus Jack has posted his usual Saturday night observations on the Northern Borders Partners yahoo messageboard. Its recommended reading! He has 2 notes...one on the geopolitcal thing with Iran and the other on the bigger role that Africa is playing in our energy needs.

Also the Guardian has a piece today on the prospects for 90 dollar oil thanks to Iran.

I will be trying to pay closer attention to Iran headlines in the coming weeks since they will be market movers.

Saturday, January 28, 2006

I am really trying to get a handle on blogging and feeds and all the rest that goes along with it. Grasping everything is difficult but i have added a few things this week including chicklets above the blog roll so you can add my blog to your favorite news/blog reader. Also the blog roll is increasing and i encourage you to visit the blogs listed as many have lots of links to related and unrelated investing information.

Monday morning earnings from Holly Partners will be out and look for the usual slew of ex-distribution trading of MLPS as the checks for the next payouts get written and sent!

Any ideas or suggestions are welcomed. Please feel free to post comments or email me!

Monday morning earnings from Holly Partners will be out and look for the usual slew of ex-distribution trading of MLPS as the checks for the next payouts get written and sent!

Any ideas or suggestions are welcomed. Please feel free to post comments or email me!

Friday, January 27, 2006

Probably because of the defensive nature of MLPS we find that they tend to go sideways or down on big stock market up days....and today is one of those days...any losses seemed to be contained...any gains however seemed to be capped.

Barring any shocking developements in the next few minutes...we'll blog later.

Barring any shocking developements in the next few minutes...we'll blog later.

Some breaking news on Holly Partners this afternoon as the company increases the distribution again.

Buckeye Partners released earnings and also increased its distribution again.

Both stocks have rallied off their lows of the day.

Buckeye Partners released earnings and also increased its distribution again.

Both stocks have rallied off their lows of the day.

Back in full swing now...did not miss much but a couple of standouts. Crosstex (XTXI) is continuing skyward now near 81 up 1.58 on no news. Holly Partners meanwhile is down nearly 1 on no news either.

Otherwise the group is mixed. Oil stocks have broken out as they attempt a close over 1100 on the XOI....it appears it will be successful today. No corporate news to speak of in any of the companies in the the MLP group...no upgrades or downgrades. Energy Transfer is up 33 cents after the company yesterday upped its numbers for 2006.

On Teppco and the on again off again merger speculation regarding Enterprise Partners (EPD). Stock is ex-distribution today and is behaving quite well. I think if the merger idea is a true no-go the stock should have imploded but its not doing that. Again if the company's outlook is good come quarter reporting time next week and they say something about growing the distribution again....you could see buyers come in and support this.

On the watch and will report as things develope.

Otherwise the group is mixed. Oil stocks have broken out as they attempt a close over 1100 on the XOI....it appears it will be successful today. No corporate news to speak of in any of the companies in the the MLP group...no upgrades or downgrades. Energy Transfer is up 33 cents after the company yesterday upped its numbers for 2006.

On Teppco and the on again off again merger speculation regarding Enterprise Partners (EPD). Stock is ex-distribution today and is behaving quite well. I think if the merger idea is a true no-go the stock should have imploded but its not doing that. Again if the company's outlook is good come quarter reporting time next week and they say something about growing the distribution again....you could see buyers come in and support this.

On the watch and will report as things develope.

Thursday, January 26, 2006

MLPS have a habit of posting news late in the evening so i will be watching. Meanwhile here is a link to comments regarding Enterprise Products Partners and why they won't be buying Teppco anytime soon. And then link here to see more opinions. Thanks to Factoids2002 for the info!!!

Meanwhile Tortoise Energy Infrastrure Holders (TYG) will be happy to know that their 2005 distributions were all 100% return of capital!. Same holds true for Tortoise Energy Corp (TYY).

Most of the group finished lower today...probably pressured by rising 10 year rates. A few winners however like Sunoco Logistics up 53 cents...Energy Transfer up 43 cents and Valero managed a close over 54. Teppco ex-dis tomorrow so look for an open near 37.70.

Meanwhile Tortoise Energy Infrastrure Holders (TYG) will be happy to know that their 2005 distributions were all 100% return of capital!. Same holds true for Tortoise Energy Corp (TYY).

Most of the group finished lower today...probably pressured by rising 10 year rates. A few winners however like Sunoco Logistics up 53 cents...Energy Transfer up 43 cents and Valero managed a close over 54. Teppco ex-dis tomorrow so look for an open near 37.70.

Wasn't good today as my horse ran 6th....looks like she needed a race. Oh well there is always next time.

Meanwhile i certainly did not miss much as the group for the most part is lower with the 10 year at 4.52% putting pressure. Magellan Midstream is spending money on capital improvements but the stock is down 40 cents plus its ex-distribution today by 56 cents. Energy Transfer is up 50 cents on a boost in outlook from the company. Otherwise its mostly fractional losses across the board with just the odd gainer.

Meanwhile i certainly did not miss much as the group for the most part is lower with the 10 year at 4.52% putting pressure. Magellan Midstream is spending money on capital improvements but the stock is down 40 cents plus its ex-distribution today by 56 cents. Energy Transfer is up 50 cents on a boost in outlook from the company. Otherwise its mostly fractional losses across the board with just the odd gainer.

My Horse Vroom Hilda is running today in the first race at Aqueduct here in New York...she is 4-1 morning line second choice so i will be busy at the racetrack after the open. Blogging will be light until about 3pm. Wish me luck.

Btw the 10 year at 4.50 seems to be holding so far this morning but the day is young!

Good Morning!

First some news from last night as Markwest Energy announces its distribution...no increase from last quarter.

Also this morning Teppco is selling some assets to Enerterprise Products Partners. Meanwhile Enterprise is busy in the news department this morning not only with the above story but they also issued earnigns and inks a deal with En Cana Corp (ECA) to process gas.

Energy Transfer Partners which has been moving sideways for weeks may have an upward catylist today as they increase the EBITA for 2006 and recommending a boost of the distribution to $2.30 annual.

Stock Futures are strong this morning up 7 points...the ten year which put some pressure on MLPS yesterday is at 4.49%. Crude sold off yesterday and is flat to slightly higher this morning as nat gas is flat to lower.

First some news from last night as Markwest Energy announces its distribution...no increase from last quarter.

Also this morning Teppco is selling some assets to Enerterprise Products Partners. Meanwhile Enterprise is busy in the news department this morning not only with the above story but they also issued earnigns and inks a deal with En Cana Corp (ECA) to process gas.

Energy Transfer Partners which has been moving sideways for weeks may have an upward catylist today as they increase the EBITA for 2006 and recommending a boost of the distribution to $2.30 annual.

Stock Futures are strong this morning up 7 points...the ten year which put some pressure on MLPS yesterday is at 4.49%. Crude sold off yesterday and is flat to slightly higher this morning as nat gas is flat to lower.

Wednesday, January 25, 2006

A sideways day again for the most part. The majors are selling off after a strong open this morning on the XOI..1100 is being formidable..but MLPS are holding up well despite the big oil and gas selloff and rising 10 year yields to 4.46%

No standouts on the downside but Tortoise and Kayne are each down 50 cents today.

No standouts on the downside but Tortoise and Kayne are each down 50 cents today.

Mixed to higher in most MLPS....Sunoco Logistics (SXL) was down over 1 but has recovered (buy the rumour sell the news) to only down a fraction. Up nicely this morning is Magellan Midstream (MMP) after earnings and conference call yesterday. Hiland LP (HLND) up 50 cents on its 22% distribution boost to 60 cents/2.40 annual. Oil stocks up sharply but Nat gas stocks flat to lower this morning..Atlas America (ATLS) down 1 and change...was down 3 earlier.

I've noticed that sometimes it takes a day or so for MLPS to digest earnings and distribution announcements. Unless there is some earth shattering news they seem to take a day off to digest the earnings and then move higher the day after. Now that i've observed this you can be sure it will no longer work!

I've noticed that sometimes it takes a day or so for MLPS to digest earnings and distribution announcements. Unless there is some earth shattering news they seem to take a day off to digest the earnings and then move higher the day after. Now that i've observed this you can be sure it will no longer work!

Good Morning!

Some news from last night to catch up....First off is Hiland Partners and a huge boost in the distribution. Also we have earnings news last night from Sunoco Logistics and a modest distribution increase. Also from INERGY (NRGY) comes an aquisition and a distribution increase.

No news this morning so far. Stock futures are stronger this morning...oil and nat gas futures are lower.

Nice to see this stream of distribution increases and some sizeable ones by MLPS...should continue to be very supportive to prices overall.

Some news from last night to catch up....First off is Hiland Partners and a huge boost in the distribution. Also we have earnings news last night from Sunoco Logistics and a modest distribution increase. Also from INERGY (NRGY) comes an aquisition and a distribution increase.

No news this morning so far. Stock futures are stronger this morning...oil and nat gas futures are lower.

Nice to see this stream of distribution increases and some sizeable ones by MLPS...should continue to be very supportive to prices overall.

Tuesday, January 24, 2006

Most MLPS this afternoon not doing to much. A few exceptions..Atlas Pipeline, Copano, Magellan Midstream and Sunoco Logistics showing fractional plus moves. Crosstex LP is down on its distribution boost...probably buy the rumor sell the news action while Crosstex (XTXI) is up a fraction on its big dividend boost. Plains All American is 25 cents higher on its distribution increase. Kinder Morgan is also up 44 cents...no news there.

Holly Partners is the biggest loser i could find down 50 cents...no news there.

Holly Partners is the biggest loser i could find down 50 cents...no news there.

Some news this morning on Magellan Midstream Partners. They released earnings last night at 9:05pm (someone was working late). This morning they announced they are reducing the number of shares in the upcoming ipo of the General Partner but the offering price is set higher.

More breaking news on distributions. Plains All American is raising there payout by 2% quarter to quarter...Crosstex LP ups there by a couple of pennies but the common sharesholders (XTXI) get a big boost!

No other news this morning so far...overall market tone looks firm.

More breaking news on distributions. Plains All American is raising there payout by 2% quarter to quarter...Crosstex LP ups there by a couple of pennies but the common sharesholders (XTXI) get a big boost!

No other news this morning so far...overall market tone looks firm.

Monday, January 23, 2006

Boy talk about a late news release ( or an early one for Tuesday) Magellan Midstream is out with earnings. They look good.

Kinda sideways today...some higher some lower...no real reaction to any anal-ist moves save for Pacific Energy which is up 58 cents...partly on the credit suisse coverage at outperform and more so for the nice distribution boost announced after the close friday.

Overall market taking some selling right now with the dow barely hanging on.

Overall market taking some selling right now with the dow barely hanging on.

The anal-ists are busy this morning; Here's the rundown

Valero LP started at OUTPERFORM by Credit Suisse

Pacific Energy Partners at OUTPERFORM by Credit Suisse

Holly Partners and Sunoco Logistics started at Neutral.

Buckeye Partners started at UNDERPERFORM

Also KEY BANC starts Duke Midstream (DPM) at BUY!

Also late news on Friday from Pacific Energy Partners as they boosted their distribution.

Valero LP started at OUTPERFORM by Credit Suisse

Pacific Energy Partners at OUTPERFORM by Credit Suisse

Holly Partners and Sunoco Logistics started at Neutral.

Buckeye Partners started at UNDERPERFORM

Also KEY BANC starts Duke Midstream (DPM) at BUY!

Also late news on Friday from Pacific Energy Partners as they boosted their distribution.

Good Morning!

Oil and Nat Gas down this morning with stock futures up on a rebound attempt after Friday's debacle. MLPS are in the news free zone this morning but they performed quite well on Friday so we'll see if that relative outperformance continues today!

Finally...my horse Vroom Hilda is running thursday at Aqueduct Race 1....should be the favorite...no guarantees!!!

Oil and Nat Gas down this morning with stock futures up on a rebound attempt after Friday's debacle. MLPS are in the news free zone this morning but they performed quite well on Friday so we'll see if that relative outperformance continues today!

Finally...my horse Vroom Hilda is running thursday at Aqueduct Race 1....should be the favorite...no guarantees!!!

Friday, January 20, 2006

After a day of selling hand over fist with dow -213 and the big oils and gas pulling back to even...MLPS did okay...holding up well in the face of the massive headwinds...Most closed flat...maybe a little lower on average but no damage done here.

Geo politics will be on everyone's mind this weekend...will blog when i can with relevant news events! And of course should any news break after the close!

Geo politics will be on everyone's mind this weekend...will blog when i can with relevant news events! And of course should any news break after the close!

MLPS holding up very well this afternoon for the most part considering the selling everywhere else (except energy)...dow -160.

Breaking news on Northern Borders Partners....the distribution announcment! That 80 cents again!

Breaking news on Northern Borders Partners....the distribution announcment! That 80 cents again!

Oil at 68 a barrel...the dow down 100 points and MLPS are doing nicely today. Most in the group are fractionally higher. No news driver in any particular stock but the action is good this morning.

If the market sell off accellerates it might bring these back to the flat line later on but this should just be a blip.

If the market sell off accellerates it might bring these back to the flat line later on but this should just be a blip.

Good Morning!

Crude oil higher this morning and this is translating into some upside in Exxon in the pre-market so look for the XOI to open up over 1100 in breakout territory. Stocks look a little softer. Ten year supportive at 4.35%. MLPS should continue to move up today after whatever opening noise.

No corporate developements this morning.

Crude oil higher this morning and this is translating into some upside in Exxon in the pre-market so look for the XOI to open up over 1100 in breakout territory. Stocks look a little softer. Ten year supportive at 4.35%. MLPS should continue to move up today after whatever opening noise.

No corporate developements this morning.

Thursday, January 19, 2006

Having trouble posting today...so hopefully this will succed!

Lots of upside today with 1 point pluses in Hiland Partners (HLND) Valero Partners (VLI) with strong fractional plusses in Atlas Pipeline (APL) Buckeye Partners (BPL) Northern Borders (NBP) Plains All American (PAA). Kinder Morgan Partners was up 50 cents but Kinder Morgan (KMI) soared 4 points to 101 a share! Probably a split coming soon.

Copano (CPNO) closed down a fraction despite upping the distribution by a nickle to 55 cents.

Watching the aftermarket for any action.

Lots of upside today with 1 point pluses in Hiland Partners (HLND) Valero Partners (VLI) with strong fractional plusses in Atlas Pipeline (APL) Buckeye Partners (BPL) Northern Borders (NBP) Plains All American (PAA). Kinder Morgan Partners was up 50 cents but Kinder Morgan (KMI) soared 4 points to 101 a share! Probably a split coming soon.

Copano (CPNO) closed down a fraction despite upping the distribution by a nickle to 55 cents.

Watching the aftermarket for any action.

Having trouble posting today...so hopefully this will succed!

Lots of upside today with 1 point pluses in Hiland Partners (HLND) Valero Partners (VLI) with strong fractional plusses in Atlas Pipeline (APL) Buckeye Partners (BPL) Northern Borders (NBP) Plains All American (PAA). Kinder Morgan Partners was up 50 cents but Kinder Morgan (KMI) soared 4 points to 101 a share! Probably a split coming soon.

Copano (CPNO) closed down a fraction despite upping the distribution by a nickle to 55 cents.

Watching the aftermarket for any action.

Lots of upside today with 1 point pluses in Hiland Partners (HLND) Valero Partners (VLI) with strong fractional plusses in Atlas Pipeline (APL) Buckeye Partners (BPL) Northern Borders (NBP) Plains All American (PAA). Kinder Morgan Partners was up 50 cents but Kinder Morgan (KMI) soared 4 points to 101 a share! Probably a split coming soon.

Copano (CPNO) closed down a fraction despite upping the distribution by a nickle to 55 cents.

Watching the aftermarket for any action.

Nice day today with some solid gains in several MLPS like Valero +1.12 and Hiland Partners +1.30. Kinder Morgan Partners was up .46 while Kinder Morgan (KMI) was +4 to over $100 a share! Strong fractional plusses in Buckeye Partners, Northern Borders, Atlas Pipeline, Plains All American, and Enbridge Energy Partners. Some of the distribution hikers did not do much..Copano was down a fraction and Magellan Midstream managed only a penny gain. XOI closed at 1097 and change which is right near a 52 week high. Will pass along any breaking news after the close.

Nice day today with some solid gains in several MLPS like Valero +1.12 and Hiland Partners +1.30. Kinder Morgan Partners was up .46 while Kinder Morgan (KMI) was +4 to over $100 a share! Strong fractional plusses in Buckeye Partners, Northern Borders, Atlas Pipeline, Plains All American, and Enbridge Energy Partners. Some of the distribution hikers did not do much..Copano was down a fraction and Magellan Midstream managed only a penny gain. XOI closed at 1097 and change which is right near a 52 week high. Will pass along any breaking news after the close.

Nice day today with some solid gains in several MLPS like Valero +1.12 and Hiland Partners +1.30. Kinder Morgan Partners was up .46 while Kinder Morgan (KMI) was +4 to over $100 a share! Strong fractional plusses in Buckeye Partners, Northern Borders, Atlas Pipeline, Plains All American, and Enbridge Energy Partners. Some of the distribution hikers did not do much..Copano was down a fraction and Magellan Midstream managed only a penny gain. XOI closed at 1097 and change which is right near a 52 week high. Will pass along any breaking news after the close.

Nice day today with some solid gains in several MLPS like Valero +1.12 and Hiland Partners +1.30. Kinder Morgan Partners was up .46 while Kinder Morgan (KMI) was +4 to over $100 a share! Strong fractional plusses in Buckeye Partners, Northern Borders, Atlas Pipeline, Plains All American, and Enbridge Energy Partners. Some of the distribution hikers did not do much..Copano was down a fraction and Magellan Midstream managed only a penny gain. XOI closed at 1097 and change which is right near a 52 week high.

Will pass along any breaking news after the close.

Will pass along any breaking news after the close.

Nice day today with some solid gains in several MLPS like Valero +1.12 and Hiland Partners +1.30. Kinder Morgan Partners was up .46 while Kinder Morgan (KMI) was +4 to over $100 a share! Strong fractional plusses in Buckeye Partners, Northern Borders, Atlas Pipeline, Plains All American, and Enbridge Energy Partners. Some of the distribution hikers did not do much..Copano was down a fraction and Magellan Midstream managed only a penny gain. XOI closed at 1097 and change which is right near a 52 week high.

Will pass along any breaking news after the close.

Will pass along any breaking news after the close.

Nice day today with some solid gains in several MLPS like Valero +1.12 and Hiland Partners +1.30. Kinder Morgan Partners was up .46 while Kinder Morgan (KMI) was +4 to over $100 a share! Strong fractional plusses in Buckeye Partners, Northern Borders, Atlas Pipeline, Plains All American, and Enbridge Energy Partners. Some of the distribution hikers did not do much..Copano was down a fraction and Magellan Midstream managed only a penny gain. XOI closed at 1097 and change which is right near a 52 week high.

Will pass along any breaking news after the close.

Will pass along any breaking news after the close.

Nice day today with some solid gains in several MLPS like Valero +1.12 and Hiland Partners +1.30. Kinder Morgan Partners was up .46 while Kinder Morgan (KMI) was +4 to over $100 a share! Strong fractional plusses in Buckeye Partners, Northern Borders, Atlas Pipeline, Plains All American, and Enbridge Energy Partners. Some of the distribution hikers did not do much..Copano was down a fraction and Magellan Midstream managed only a penny gain. XOI closed at 1097 and change which is right near a 52 week high.

Will pass along any breaking news after the close.

Will pass along any breaking news after the close.

Good morning.

Kinder Morgan earnings were ok and the stock is up 29 cents this morning. Copano is up 50 cents on a 10% distribution increase from last quarter. Atlas Pipeline is up 34 cents...no news there. Most of the group seeing flat to small pennies to the upside. XOI is up this morning and so is the rest of the market. Any breaking headlines will be passed along as usual.

Kinder Morgan earnings were ok and the stock is up 29 cents this morning. Copano is up 50 cents on a 10% distribution increase from last quarter. Atlas Pipeline is up 34 cents...no news there. Most of the group seeing flat to small pennies to the upside. XOI is up this morning and so is the rest of the market. Any breaking headlines will be passed along as usual.

Wednesday, January 18, 2006

Kind of a wash today really...market held up well considering everything that was thrown at it from Japan to Oil to Intel to Yahoo....MLPS were flat for the most part with the odd gainer like Crosstex LP to 37 but most losses were very small.

After the close Kinder Morgan Partners reported earnings and raised the distribution again. And a healthy 10% boost in the distribution for Copano Energy Shareholders.

After the close Kinder Morgan Partners reported earnings and raised the distribution again. And a healthy 10% boost in the distribution for Copano Energy Shareholders.

Considering everything the overall market had to digest the dow is down just 41 points and most of that is Intel...Oils selling off hard off the 1100 XOI yesterday down 25 pts right now. MLPS not doing much in either direction...a little lower but not by a whole lot on light volume.

News this afternoon as Magellan Midstream raises its distribution again. Crosstex LP (XTEX) up 50 cents but no news there.

News this afternoon as Magellan Midstream raises its distribution again. Crosstex LP (XTEX) up 50 cents but no news there.

Flight to quality and a good CPI number and the 10 year yield is plunging to 4.28% this morning so this is certainly supportive. Overall market going to take a hit at the open but once we get through the initial selling...look for MLPS to move higher. Energy is up again this morning as crude nears 67 bucks on the Nigeria/Iran news. No corporate news so far this morning but Kinder Morgan (KMP) is due out after the close.

Tuesday, January 17, 2006

While the broad market is selling off and oil and gas stocks are higher...MLPS are mixed. We have an upgrade of CPNO from Sanders Morris to buy from hold and the stock is up a dollar on the news. Also the prospectus for the IPO of Atlas Pipeline Partners GP is available and i will post a link when i find it. ATLS (ATLAS AMERICA) owns the GP and they are spinning it off...just in case there was any confusion about this.

Thanks to INSTAPUNDIT...the CARNIVAL OF CAPITALISTS is up. Many links here to some useful money blogs. Take a look.

Thanks to INSTAPUNDIT...the CARNIVAL OF CAPITALISTS is up. Many links here to some useful money blogs. Take a look.

Good Morning!

Okay so Iran wants nukes for electricity and some general geo-political house cleaning (Israel is listening)...so crude oil is back over 65 bucks and climbing. Exxon is back over 61 and Valero gas is up 1 over 59 bucks. So we have some upside pressure on crude by 1 dollar.

MLPS are news free this morning but we will be in earnings season soon with Kinder Morgan coming out tomorrow.

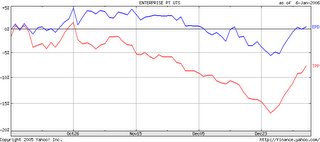

Above is a chart going back before 1990...Suppose you invested $ in an aggressive mutual fund like AMERICAN CENTURY ULTRA as opposed to $ in some of the MLPS that were around at the time...or perhaps Exxon. Guess which one did the worst. This btw is not a knock on A.C. ULTRA...but just one of those interesting charts that speaks volume.

Friday, January 13, 2006

Lots of news from Teppco. First off the distribution for the quarter is .675 which is unchanged from the last couple of quarters. And they also announced a new CFO and he is another graduate from the Enterprise Product Partners (EPD) school. Mr Duncan is circling the wagons!

LIN Energy (LINE) is trading at 22.90 +1.90 from the IPO price of 21. Kinder Morgan +65 cents looks like the biggest winner today...most MLPS are sideways to higher...those that are lower are only down by pennies.

LIN Energy (LINE) is trading at 22.90 +1.90 from the IPO price of 21. Kinder Morgan +65 cents looks like the biggest winner today...most MLPS are sideways to higher...those that are lower are only down by pennies.

Good morning.

Just want to backtrack to late yesterday. Atlas America (ATLS) owns the GP of Atlas Pipeline(APL)...well now they are offering the GP in an ipo. The plan is to spin off the GP from Atlas America.

Also a new IPO begins trading today; LIN Energy (LINE).

No other news of consequence this morning. No upgrades or downgrade. 10 year back under 4.40% thanks to good PPI numbers.

Just want to backtrack to late yesterday. Atlas America (ATLS) owns the GP of Atlas Pipeline(APL)...well now they are offering the GP in an ipo. The plan is to spin off the GP from Atlas America.

Also a new IPO begins trading today; LIN Energy (LINE).

No other news of consequence this morning. No upgrades or downgrade. 10 year back under 4.40% thanks to good PPI numbers.

Thursday, January 12, 2006

Except for Energy Product Partners and Transmontaigne...the whole group was down but no real damage with losses mainly less than 50 cents. Crosstex continues to surge higher up 2 and change to 74 as the Goldman "outperform" continues to have impact.

Watching the aftermarket for any breaking headlines.

Watching the aftermarket for any breaking headlines.

Looks like some profit taking in the group and in the market as a whole. The XOI rallied up to its old high and is now pulling back. No moves that are news related in MLP land. The odd stock here and there is up by a few pennies but just about all are fractionally lower.

News from Kinder Morgan about liquid nat gas storage tanks in New York Harbor...not a real market mover. Dahlman Rose cuts General Maritime (GMR) from a buy to a hold for those of you who follow this one.

News from Kinder Morgan about liquid nat gas storage tanks in New York Harbor...not a real market mover. Dahlman Rose cuts General Maritime (GMR) from a buy to a hold for those of you who follow this one.

Good morning!

No news so far this morning....should be more of the same. Link here to a post on the Yahoo boards regarding goldman's upgrades of the Crosstexes. They like both but they seem to like XTXI more with a 93 buck price target.

Crude up 64 cents this morning....stock futures slightly lower...10 year at 4.438%.

No news so far this morning....should be more of the same. Link here to a post on the Yahoo boards regarding goldman's upgrades of the Crosstexes. They like both but they seem to like XTXI more with a 93 buck price target.

Crude up 64 cents this morning....stock futures slightly lower...10 year at 4.438%.

Wednesday, January 11, 2006

Some profit taking in the bigger gainers of the last few days...Holly Partners is down 1 but up 5 from last week. Most of the others are fractionally higher or lower. No real standouts. 10 year rate back to 4.44% seems to be pressuring some of the interest sensetive stocks.

No breaking news but will watch after the close.

No breaking news but will watch after the close.

When Goldman speaks investors flock like lemmings....as shown with XTXI where for a few minutes it hung at 68.40 before blasting off to 73.99 and its still up 4 and change to 72. Its a breakout with some volume on the charts so up we go perhaps to 80ish? Crosstex the LP after opening higher initially has pulled back to below the flat line.

Buyers also stepping up to the plate with Martin Midstream where a 29.12 offering price for 3 million shares and an 8.38% yield suddenly became attractive. Actually one plus side to this offering is that it doubles the float out there for a stock that usually trades by appointment only and is very hard to get in and out of. So i guess with extra shares out there it has attracted those who have been shy.

Sold some of my Teppco at 38 this morning. Might buy back in on a pullback and picked up some Duke Midstream (DPM) at 25.75.

Buyers also stepping up to the plate with Martin Midstream where a 29.12 offering price for 3 million shares and an 8.38% yield suddenly became attractive. Actually one plus side to this offering is that it doubles the float out there for a stock that usually trades by appointment only and is very hard to get in and out of. So i guess with extra shares out there it has attracted those who have been shy.

Sold some of my Teppco at 38 this morning. Might buy back in on a pullback and picked up some Duke Midstream (DPM) at 25.75.

When Goldman speaks investors flock like lemmings....as shown with XTXI where for a few minutes it hung at 68.40 before blasting off to 73.99 and its still up 4 and change to 72. Its a breakout with some volume on the charts so up we go perhaps to 80ish? Crosstex the LP after opening higher initially has pulled back to below the flat line.

Buyers also stepping up to the plate with Martin Midstream where a 29.12 offering price for 3 million shares and an 8.38% yield suddenly became attractive. Actually one plus side to this offering is that it doubles the float out there for a stock that usually trades by appointment only and is very hard to get in and out of. So i guess with extra shares out there it has attracted those who have been shy.

Sold some of my Teppco at 38 this morning. Might buy back in on a pullback and picked up some Duke Midstream (DPM) at 25.75.

Buyers also stepping up to the plate with Martin Midstream where a 29.12 offering price for 3 million shares and an 8.38% yield suddenly became attractive. Actually one plus side to this offering is that it doubles the float out there for a stock that usually trades by appointment only and is very hard to get in and out of. So i guess with extra shares out there it has attracted those who have been shy.

Sold some of my Teppco at 38 this morning. Might buy back in on a pullback and picked up some Duke Midstream (DPM) at 25.75.

Good Morning.

Goldman steps up to the plate this morning and starts coverage on Crosstex Energy (XTXI) at an outperform. I'm not 100% sure if they are referring to XTXI, or XTEX or both because the headline crossed under both tickers...but i'm guessing its just for XTXI.

No confusion on this one as Citigroup starts DCP Midstream at a buy.

No other market moving news this morning. Waiting for Martin Midstream to announce the price of its offering and they just did on their 8k. $29.12 is the price and with a $2.44 yield going foward you have a yield of 8.38% !

Futures are higher in stocks this morning...slightly off in the energy complex.

Goldman steps up to the plate this morning and starts coverage on Crosstex Energy (XTXI) at an outperform. I'm not 100% sure if they are referring to XTXI, or XTEX or both because the headline crossed under both tickers...but i'm guessing its just for XTXI.

No confusion on this one as Citigroup starts DCP Midstream at a buy.

No other market moving news this morning. Waiting for Martin Midstream to announce the price of its offering and they just did on their 8k. $29.12 is the price and with a $2.44 yield going foward you have a yield of 8.38% !

Futures are higher in stocks this morning...slightly off in the energy complex.

Tuesday, January 10, 2006

There was an excellent running summary of the Energy Transfer Partners conference call on the yahoo ETP message board. Start with this message and then go foward and read through. Lots of good information.

Holly Partners was a big winner today up over 42 when it was 37.70 just a few days ago. Up 1.60 today...no news. Also some solid gains in many issues today such as Atlas Pipeline Partners, Crosstex, Energy Transfer Partners, Sunoco Logistics, Northern Borders Partners and several others. Teppco was down but not by much...breaking an 8 day winning streak.

Holly Partners was a big winner today up over 42 when it was 37.70 just a few days ago. Up 1.60 today...no news. Also some solid gains in many issues today such as Atlas Pipeline Partners, Crosstex, Energy Transfer Partners, Sunoco Logistics, Northern Borders Partners and several others. Teppco was down but not by much...breaking an 8 day winning streak.

Okay went back to the old format...let me know if its back to normal!

Looking good today with fractional gains in MLPS and losses confined to just small amounts. Teppco is down but after 8 straight updays it was due. Crosstex is buying a company and the market adds 60 cents to the Crosstex stock price.

Atlas Pipeline Partners and Energy Transfer Partners are both up on yesterday's news items. Conference call at Energy Transfer begins at 3pm eastern.

Looking good today with fractional gains in MLPS and losses confined to just small amounts. Teppco is down but after 8 straight updays it was due. Crosstex is buying a company and the market adds 60 cents to the Crosstex stock price.

Atlas Pipeline Partners and Energy Transfer Partners are both up on yesterday's news items. Conference call at Energy Transfer begins at 3pm eastern.

Good Morning!

Stock Market futures are lower this morning as we'll see some early selling thanks to profit taking plus Alcoa. BUT the uptrend should continue. MLPS coming off another good day and two movers today should be Atlas Pipeline Partners with a distribution increase to 3.32 annual and a 7.9% yield on yesterday's close. And Energy Transfer Partners which has done nothing since the new year...should play catch up today on yesterday's spectacular earnings than came after the close. Stock rose $1.50 after the news came out.

I don't see any headlines this morning at least so far but of course i will be posting as any important news hits.

Stock Market futures are lower this morning as we'll see some early selling thanks to profit taking plus Alcoa. BUT the uptrend should continue. MLPS coming off another good day and two movers today should be Atlas Pipeline Partners with a distribution increase to 3.32 annual and a 7.9% yield on yesterday's close. And Energy Transfer Partners which has done nothing since the new year...should play catch up today on yesterday's spectacular earnings than came after the close. Stock rose $1.50 after the news came out.

I don't see any headlines this morning at least so far but of course i will be posting as any important news hits.

Monday, January 09, 2006

Lots of after market action for a change today. Record Earnings from Energy Transfer Partners and the stock traded to 35.05 which is 1.25 above the 4pm close.

Also Atlas Pipeline Parnters raised its distribution to 83 cents per share which is a record and to $3.32 annual going foward. Stock trades 12 points below Valero LP with almost the same distribution (VLI= .86).

Sunoco Logistics makes an aquisition!

Should add to bullishness tomorrow. Teppco up for the 8th consecutive trading day as its back above 38!

Also Atlas Pipeline Parnters raised its distribution to 83 cents per share which is a record and to $3.32 annual going foward. Stock trades 12 points below Valero LP with almost the same distribution (VLI= .86).

Sunoco Logistics makes an aquisition!

Should add to bullishness tomorrow. Teppco up for the 8th consecutive trading day as its back above 38!

As the Dow flirts with 11k..MLPS are mostly higher. Buckeye is up 65 cents on news reported Friday that it is buying BP 's assets. Dukes LP is up 68 cents as well. Enbridge, Sunoco Logistics Northern Borders Teppco and Holly Partners are all up major fractions. What minus signs there are...small in nature and not news driven.

Dow just broke through 11k. Lets see if there is follow through into the close.

Dow just broke through 11k. Lets see if there is follow through into the close.

Good Morning.

No major news this morning but i suspect the uptrend should continue or at worst we'll back and fill today. Energy complex is mostly firm...Nat gas is lower by 17 cents. Martin Midstream still absorbing its stock offering.

Inergy (NRGY) re-affirms its earnigns guidance for 2006. Waiting for the open!!!

No major news this morning but i suspect the uptrend should continue or at worst we'll back and fill today. Energy complex is mostly firm...Nat gas is lower by 17 cents. Martin Midstream still absorbing its stock offering.

Inergy (NRGY) re-affirms its earnigns guidance for 2006. Waiting for the open!!!

Sunday, January 08, 2006

Good Sunday afternoon and of course GO GIANTS!

What i'm going to do is begin a running post as i gather info and just add on until tomorrow's open. This way i don't have to go crazy all at once.

Please take the time read the always insightful Cactus Jack on the Northern Borders Partners message board on Yahoo. Saturday nights post is filled with specualtion about Iran and what will happen when that powder keg blows. Can you say $100 oil?

Speculation continues about the fate of Teppco and if or when Dan Duncan of Enterprise will swallow it. One post on the message board made an interesting point. If you look at the charts of both these companies...one could argue that Teppco is going to aquire Enterprise. Dan Duncan owns the GP. I would argue that it might not make a difference. If the bottom is in for MLPS then Teppco might react the same way as Valero did when it announced it was buying Kaneb Pipeline...both stocks rose. Valero went from 55 to nearly 65 before the big correction back to 53. Having owned both I remember Kanab rising 6 points on the news and Valero rising 2 and change. So either way it could be win/win. Again this is just speculation.

In the "gift" department...take a look at Martin Midstream. As pointed out Friday its now yielding 8.37% thanks to a distribution increase coupled with a 3 million share offering. Thats 4 points above the 10 year for a company that just raised its distribuion from 55 to 61 cents in the last 2 quarters. Might be dead money for awhile until all the shares are absorbed but longer term it might be a nice play.

6pm Sunday 1/8/06...So much for the Giants....maybe next time they ought to show up when playing. You can't win football games when your time of posession was 17 x 43 minutes against and you can't get inside the carolina 40 for the entire game...very sad!

Friday, January 06, 2006

Breaking after the close...dow jones reports Buckeye Partners buying some assets of BP but no confirmation from Buckeye. Thanks to Lawrence for the info!!!!

> By Shasha Dai> Of LBO WIRE> > NEW YORK (Dow Jones)--Buckeye Partners LP (BPL), a pipeline operator backed > by private equity firms Carlyle Group LP and Riverstone Holdings, is in a > tentative deal to acquire certain assets from BP Pipelines (North America) > Inc. (BP), according to person familiar with the situation.> > The tentative deal has received the green light from the Federal Trade > Commission, according to a regulatory filing with the agency. However, > Buckeye and BP Pipelines, a unit of energy giant BP PLC, haven't signed a > definitive pact yet, the person said.> > A spokesman for Buckeye said he wasn't aware of any agreement but he didn't > rule out the possibility of one.> > BP has been seeking a buyer for the pipelines for a some time, and Buckeye > is among the companies interested in acquiring it, said the spokesman, > Stephen Milbourne.> > "We look at refined [petroleum] assets all the time," Milbourne said.> > A BP spokesman declined to comment.> > Buckeye, of Emmaus, Pa., operates some 3,900 miles of pipelines that > transport refined petroleum products - gasoline, jet fuel, diesel fuel, > heating oil, and kerosene - for oil and chemical companies. Buckeye also > runs bulk storage facilities in Illinois, Indiana, Michigan, New York, Ohio > and Pennsylvania.> > It isn't clear what assets Buckeye will buy from BP Pipelines, as some of > the BP unit's operations don't fit Buckeye's core business. Based in > Warrenville, Ill., BP Pipelines transports refined products, as well as > crude oil, natural gas liquids, carbon dioxide, and chemicals.> > All told, BP Pipelines accounts for about 9% of the U.S. liquids pipeline > market, the company said on its Web site.> > Carlyle and energy investor Riverstone acquired Buckeye from privately-held > Glenmoor Ltd. in March 2004 for an undisclosed sum. The purchase was done > through Carlyle/Riverstone Global Energy and Power Fund II LP, a $1.1 > billion fund joined managed by the private equity firms.> > In September 2004, Buckeye bought some petroleum pipelines and terminals > from Shell Oil Co. for $517 million. Months later, Buckeye paid Carlyle and > Riverstone $60 million in dividends after it raised $165 million in loans.> > (LBO Wire, published by Dow Jones Newsletters, covers buyouts and private > equity.)> > by Shasha Dai; LBO Wire> > 201-938-4298;shasha.dai@dowjones.com> > > (END) Dow Jones Newswires>

> By Shasha Dai> Of LBO WIRE> > NEW YORK (Dow Jones)--Buckeye Partners LP (BPL), a pipeline operator backed > by private equity firms Carlyle Group LP and Riverstone Holdings, is in a > tentative deal to acquire certain assets from BP Pipelines (North America) > Inc. (BP), according to person familiar with the situation.> > The tentative deal has received the green light from the Federal Trade > Commission, according to a regulatory filing with the agency. However, > Buckeye and BP Pipelines, a unit of energy giant BP PLC, haven't signed a > definitive pact yet, the person said.> > A spokesman for Buckeye said he wasn't aware of any agreement but he didn't > rule out the possibility of one.> > BP has been seeking a buyer for the pipelines for a some time, and Buckeye > is among the companies interested in acquiring it, said the spokesman, > Stephen Milbourne.> > "We look at refined [petroleum] assets all the time," Milbourne said.> > A BP spokesman declined to comment.> > Buckeye, of Emmaus, Pa., operates some 3,900 miles of pipelines that > transport refined petroleum products - gasoline, jet fuel, diesel fuel, > heating oil, and kerosene - for oil and chemical companies. Buckeye also > runs bulk storage facilities in Illinois, Indiana, Michigan, New York, Ohio > and Pennsylvania.> > It isn't clear what assets Buckeye will buy from BP Pipelines, as some of > the BP unit's operations don't fit Buckeye's core business. Based in > Warrenville, Ill., BP Pipelines transports refined products, as well as > crude oil, natural gas liquids, carbon dioxide, and chemicals.> > All told, BP Pipelines accounts for about 9% of the U.S. liquids pipeline > market, the company said on its Web site.> > Carlyle and energy investor Riverstone acquired Buckeye from privately-held > Glenmoor Ltd. in March 2004 for an undisclosed sum. The purchase was done > through Carlyle/Riverstone Global Energy and Power Fund II LP, a $1.1 > billion fund joined managed by the private equity firms.> > In September 2004, Buckeye bought some petroleum pipelines and terminals > from Shell Oil Co. for $517 million. Months later, Buckeye paid Carlyle and > Riverstone $60 million in dividends after it raised $165 million in loans.> > (LBO Wire, published by Dow Jones Newsletters, covers buyouts and private > equity.)> > by Shasha Dai; LBO Wire> > 201-938-4298;shasha.dai@dowjones.com> > > (END) Dow Jones Newswires>

Heading into the close...MLPS are all higher with just one or two exceptions. No big movers but some nice fractional moves higher in Plains All American (PAA) Atlas Pipeline Partners (APL) and Kinder Morgan Partners (KMP) up 50 cents or more. Valero LP (VLI) is down 35 cents and one or two others are off by a few pennies.

Teppco is up now 7 days in a row...up another 48 cents here with 20 minutes to go. Nice to see it close near its high for the week.

Teppco is up now 7 days in a row...up another 48 cents here with 20 minutes to go. Nice to see it close near its high for the week.

Good Friday Morning.

They loved the employment numbers as the futures have taken off this morning...and the 10 year is unchanged which is supportive.

Watch Martin Midstream Partners this morning. It raised its distribution yesterday to 61 cents a share so at $2.44 going foward so its priced to yield over 8% as of yesterday's close. Then they announced a 3 million share offering. Granted the distribution increase and the very recent MLP trends will be supportive. But thin traded nasdaq stocks tend to move quickly and if one is nimble enough you might be able to catch this in the 27s where the yield would be in the 9% range. But one has to be quick. I plan to ladder 3- 500 share orders at 27.95, 27.45 and 26.95 and play for a bounce. No guarantees from the management here.

No other news to speak of this morning so far.

They loved the employment numbers as the futures have taken off this morning...and the 10 year is unchanged which is supportive.

Watch Martin Midstream Partners this morning. It raised its distribution yesterday to 61 cents a share so at $2.44 going foward so its priced to yield over 8% as of yesterday's close. Then they announced a 3 million share offering. Granted the distribution increase and the very recent MLP trends will be supportive. But thin traded nasdaq stocks tend to move quickly and if one is nimble enough you might be able to catch this in the 27s where the yield would be in the 9% range. But one has to be quick. I plan to ladder 3- 500 share orders at 27.95, 27.45 and 26.95 and play for a bounce. No guarantees from the management here.

No other news to speak of this morning so far.

Thursday, January 05, 2006

If its a sign then its a good one that Martin Midstream Partners increased its distribution by 4 cents to 61 cents a share . That hopefully tells us that MLPS did well in the 4th quarter.

Of course this was immediately followed by an announcemet of a 3 million share offering by MMLP. There may be an opportunity here if you see a reaction plunge of a couple of points. That could send the yield to 8.50% or higher...but one must be nimble. Right now at today's close its priced to yeild 8.1% based on $2.44 annual.

Of course this was immediately followed by an announcemet of a 3 million share offering by MMLP. There may be an opportunity here if you see a reaction plunge of a couple of points. That could send the yield to 8.50% or higher...but one must be nimble. Right now at today's close its priced to yeild 8.1% based on $2.44 annual.

Waited until now to see if anything would happen...mostly backing and filling but with a bit of an upside bias to most MLPS. No news at all but its nice to see these maintaining a firm footing after a couple of good days.

Holly Energy Partners is up 76 cents and up nearly 2 from yesterday morning. Teppco digesting its gains from the past few days and up a nickle. Crosstex +1.24 after being down about the same yesterday.

Holly Energy Partners is up 76 cents and up nearly 2 from yesterday morning. Teppco digesting its gains from the past few days and up a nickle. Crosstex +1.24 after being down about the same yesterday.

Good Morning!

It is not normal for me to get political but there is an opinion piece in the Wall Street Journal that while very long is worth the read. It will leave with a feeling of despair.

Okay enough of that. No news on the MLP front this morning...no upgrades or downgrades so we'll see if this rally can be extended yet again. 10 year not doing much this morning which is favorable.

In the news is the stroke of Aieral Sharon. Instapundit provides a link to live blogging of the situation.

It is not normal for me to get political but there is an opinion piece in the Wall Street Journal that while very long is worth the read. It will leave with a feeling of despair.

Okay enough of that. No news on the MLP front this morning...no upgrades or downgrades so we'll see if this rally can be extended yet again. 10 year not doing much this morning which is favorable.

In the news is the stroke of Aieral Sharon. Instapundit provides a link to live blogging of the situation.

Wednesday, January 04, 2006

Nice and firm in the last hour; good followthrough from yesterday. Fractional plusses across the board. What few minus signs on the board...small in nature.

Crosstex GP (XTXI) down 1.81 but there is no news here. Tortiose energy is +1.79 which is a big percentage move for this one.

Teppco off its high but still up 85 cents on solid volume.

Crosstex GP (XTXI) down 1.81 but there is no news here. Tortiose energy is +1.79 which is a big percentage move for this one.

Teppco off its high but still up 85 cents on solid volume.

Waited to let the early trading get through the system...most MLPS holding or even adding to yesterday's gains which is extremely encouraging. There was a rare oppportunity in the last week to get some of the closed end MLP funds...some of which have taken off like Tortiose Energy which last Friday traded under 26 briefly...now over 29. FEN has a nice looking chart where it appears to be emerging out of a base. It is still at a slight discount to NAV while Tortoise was nearly -11% before pulling even at this time.

Good morning!

Rallies are about follow through so lets see where we're going today. No upgrades or downgrades this morning to speak of. The XOI index of big oils now beginning a run to its 52 week high near 1100. Also ten year yield has been falling. So it looks like we finally have the wind at our backs for now.

With just a few exceptions like Energy Transfer Partners and Sunoco Logistics for example...the charts of MLPS look terrible but bottoms have to start somewhere.

Tuesday, January 03, 2006

Just about every MLP is up and up sharply....the best day we've seen in a long time. UP 1 or more include Atlas Pipeline (APL) Buckeye (BPL) Teppco (TPP) Valero(VLI) Enbridge LP (EEP) with strong fractional plusses in Kinder Morgan (KMP) Northern Borders Partners (NBP) and a host of others.

No individual company news and the 10 year yield dropping to 4.35. Fed saying in its notes that it may be almost done raising rates.

No individual company news and the 10 year yield dropping to 4.35. Fed saying in its notes that it may be almost done raising rates.

Good morning and sorry for the late posting this morning as i had another double shift plus a headcold.

First things first is Teppco which opened strongly +1 and change to 36 and is still holding a 1 point gain. Probably a combination of the tax loss selling pressure coming off and the ceo resignation/takerover prospects. Also Valero is +1 and Enbridge LP +1 and change. Strong fractional plusses throughout the group with just the occasional minus sign for Crosstex and Copano. No corporate news this morning of consequence but the whole energy complex is up today and that is certanly helping here.

There are a few issues concerning Teppco and others that i will blog about later once i catch up on my sleep and have a clearer head.

First things first is Teppco which opened strongly +1 and change to 36 and is still holding a 1 point gain. Probably a combination of the tax loss selling pressure coming off and the ceo resignation/takerover prospects. Also Valero is +1 and Enbridge LP +1 and change. Strong fractional plusses throughout the group with just the occasional minus sign for Crosstex and Copano. No corporate news this morning of consequence but the whole energy complex is up today and that is certanly helping here.

There are a few issues concerning Teppco and others that i will blog about later once i catch up on my sleep and have a clearer head.

Subscribe to:

Comments (Atom)