Friday, March 31, 2006

On the winning side Hiland LP is up 75 cents on the asset purchase, Amerigas is up for you propane fans and Martin Midstream which was lower by a little bit is now up by a little bit. Portfolio juggling continues on this last day of q1.

Its end of montha and end of quarter and a Friday so there may be some distortions today although i would think most of the window dressing has been taken care of. Futures are flat this morning. If its a typical Friday much of what will happen will take place between 9:30 and 10am and we'll just sleepwalk the rest of the day. Its a nice day in NYC with temps reaching 70 or better so the itch to be outdoors and away from the trading desks will be there. Nothing in the upgrade or downgrade department.

Blogging will be light this morning as i have a school function to deal with.

Thursday, March 30, 2006

Crosstex (XTXI) is up1 and a fraction while the LP (XTEX) is down 50 cents. Fractional gains in Copano, Plains All American, Enbridge Energy Partners and Holly Partners.

Martin Midstream, Regency Partners, and Buckeye lead the losers; down fractions here. Most other losses are small..less than 20 cents in most cases.

No afternoon headlines on the corporate front so we dance the market's dance until or unless something happens.

Looking at these charts of the 10 year...you think we're headed to 5% or will the April 04 high of 4.93 intra-day hold? Chart action would bet on an upside breakout to a 5 handle. And what impact will this have on MLPS. So far this year as factiods has pointed out...most MLPS have positive returns without including distributions. So maybe its all priced in already and their behavior would indicate that we're "one and done" on rate hikes..and either this was the last one or we have one more coming in May and thats it. On the other hand...inflationary pressures are there...Gold today is up sharply..Oil is at 66 bucks a barrel. That's what makes a trade!

Still nothing on the news front this morning.

Wednesday, March 29, 2006

Meanwhile back to MLPS which are doing well overall today. The losers are few...Plains All American is down 30 cents and small losses in Martin Midstream, Magellan Midstream (MGG) and one or 2 others.

Transmontaigne is up 1 and change..Kinder Morgan is up 50 cents and we have a host of small fractional gainers!

Trying to get my taxes done and entering those wonderful K-1's. So far no issues.

Okay this morning we have upgrades and new coverage. Magellan Midstream (MGG) is started at a buy and you can thank A.G. EDWARDS for that one. We also have Transmontiagne getting an upgrade as Wachovia goes to buy from hold. Recent IPO Regency Partners posts earnings and will have a conference call this afternoon at 3pm.

I don't see any followthrough selling this morning, futures are higher for now.

Tuesday, March 28, 2006

Now for some fun...Althouse blogged about the Sopranos and for you fans of the show it is a must read. And if your really into the symbolism check out the Television Without Pity forum because its loaded with stuff.

Amercian Idol tonight..so far 3 singers and 3 disasters. Lisa was very ordingary...picking a song bt Kelly Clarkson and it did not work. Kelly Pickler went with a song that had soap and suds in the lyrics. A country song that was childish and just didn't work. Ace was awful and he is a cheeseball. Taylor Hicks who I also can't stand is singing Trouble which is an unusual song. It was alright but nothing special. You know what...Althouse will blog about this later...i'll leave it up to her and post her link.

Some stock reinterations on Crosstex and Broadway Partners...no impact.

Meanwhile MLPS are mixed to higher at the open. Copano is up 27 cents as is Magellan Midstream. Buckeye, Crosstex LP and Energy Transfer have small losses.

Good Morning,

Quiet this moring; today its all about the fed meeting and the next 1/4 pt hike. Recent MLP strength suggests to me that the group has sniffed out an end to rate hikes. We'll see what is derived by today's statement.

Meanwhile on the corporate front late last night TMG agreed to be aquired by Semagroup. Transmontaigne (TLP) meanwhile rose on the initial news and has since given the gain back. The question for TLP will be if Morgan Stanley (the new owners) will be aggressive in buying assets to grow TLP or not. TLP has not been around long and if one looks at the chart...there is an almost perfect inverse head and shoulders bottom that was formed and the stock has reached a near breakout point. Back to the TMG/TLP issue i would think Morgan did not buy this GP just to sit around and collect a flat non-growing yield.

No upgrades or downgrades so far this morning. PAA and ETP at 52 week highs and chart breakouts on both. These 2 have emerged as the current group leaders.

Monday, March 27, 2006

Two more charts for your viewing pleasure...Markwest Energy. In the interests of disclosure here i am long this stock...the top chart is the daily chart and its an excercise in futility...however imho if you look at the weekly chart it is far more constructive....the support at the moving averages is holding...and we could be on the verge of an upside breakout...47 plus on volume would do it for me. Problem with this one is the volume is so thin on some days you go insane between trades. Prospects for distribution increases in the 2nd half of 06 could be the driver. Just more food for thought on a day when the MLP remains mixed...although a few more winners are now on view.

Thought I'd put two of the best looking charts in the group as they are at or near 52 week highs! Plains up a dime right now to a new high...Also up 83 cents today is Tortoise (TYY)..no news there. Could be the Wall Street Journal arcticle today on the front page about what is going on in Canada. If it is then its not helping Enbridge any (EEP,ENB). I believe TYY has some Canadian Royalty Trusts or Canroys in it.

Very quiet this morning with no corporate developements so far. I am working this morning so blogging will be light until 11am.

Last wednesday Friedman Billings Ramsey (i'm not sure which one) lowered their price target on APL from 53 to 48 bucks. Could account for midweek weakness...closing near the high for the week was far more important.

Saturday, March 25, 2006

One of the things i will be working on is possibly adding podcasts. Once tax season is out of the way i will try and get this done. One of my main goals will be perhaps to use podcasts in getting relevant interviews with some of the movers and shakers in the companies we invest in. We'll see how it goes.

Friday, March 24, 2006

Meanwhile falling 10 year rates suggesting that the fed may be one and done off the housing data...MLP strength supports this theory.

Buckeye Partners down 50 cents is the only notable loser.

Buckeye Partners seems to be the only standout loser today down 30 cents. No corporate drivers today.

Thursday, March 23, 2006

Last hour...MLPS holding up okay in here...although they have come off their highs a bit as the dow sells off...down 73 points. Nasdaq down as well. Just wish XTXI would stop going down..XTEX seems to have stablized.

I use the 34, 55,89, and 144 day moving averages...why you may ask? They are fibinocci numbers and i've been pretty successful in using them to pick bounce points. Notice that XTXI is resting right on it today...It bottomed there yesterday and its sitting right at that low as i blog. I'm really hoping that this is the floor. We have not taken out yesterday's low of 73.02...but we are close with just 30 minutes left...fingers crossed!

Apparently Goldman raised its target from 100 to 108 on this yesterday when Ray Jimmies did its downgrade. Right now we seem to be focusing on the negative but at some point the market will realize this thing still has growth ahead of it.

Atlas Pipeline Partners has just made a new high for the day! 41.49

Strength holding up nicely in the group while the rest of the mark seems to be laying there. Even a few upticks in Crosstex!

Kinder Morgan Partners gets an upgrade from Citigroup and the stock is up 75 cents. Poor Billy Joe on the MMP and KMP board since he is short both and has a 5 dollar price target on MMP and a 34 target on KMP based on a point and figure chart.

Martin Midstream is down 30 cents but it is just consolidating gains from the last few days. New Issue Regency Partners (RGNC) gets a buy from AG Edwards but the stock is down a few pennies.

Wondering if the group is sniffing out an end to rate hikes?

Will watch carefully of course for any developements.

Wednesday, March 22, 2006

Dan Duncan spent some money as he buys 15000 shares of EPE in the open market yesterday.

First off Trans Montaigne got an offer from Morgan Stanley to buy it out. The stock is up 1.55 to 9 bucks which is a nice move...meanwhle the LP...TLP is up 80 cents. No news on the takeover there...looks like the LP is left to stand alone. Will be checking for details. Not much posting on the TLP board.

Meanwhile Magellan got coverage from Credit Suisse at Outperform and Lehman resumes coverage as well...so that's the reason why that one is up.

The downgrades are impacting the losers today obviously...strangely Crosstex LP traded down nearly 2 points and then rallied back to actually being up on the day...right now its down 61 cents which is well off its low. Crosstex (XTXI) also off its low but it is down 3. Trading is active in both with wide price swings so far. EPE on the sell rating is down 67 cents. Magellan Holdings is down 10 cents as coverage begins there by Duetche Bank with a hold.

Meanwhile most MLPS doing well this morning. Magellan Midstream Partners (MMP) is up 80 cents...no news there..Amerigas, Sunoco Logsitcs, and Kinder Morgan (KMP) are up major fractions. A host of others are also on the upside.

Just another comment on the Markwest insider buy...it is the first open market purchase by a director since December of 2004 when the stock was trading at about the same price.

Back to the Crosstex's...I posted the charts above. XTEX looks better than XTXI for now. Its still a long day of trading ahead.

I

Hopefully a better day today as the Nasdaq will open under pressure with the Microsoft news. That money needs to find a home somewhere. Meanwhile no news this morning. Just want to touch on the Markwest Energy's insider purchase. Purchases in the open market to me have value because its someone putting his or her money where his or her mouth is. In this case the insider more than doubled his position from 2000 shares to 5000 shares. Nice vote of confidence there. Lets see if anyone else joins in.

Tuesday, March 21, 2006

Microsoft had some news about a big delay in its new operating system until sometime next year. Techs are getting sold in after hours...and that could put the tape in a defensive position tomorrow...which would be good for MLPS!

The close today was about even with the rest of the day...more losers than gainers. Hiland LP and Crosstex Energy LP finished higher by about 30 cents they were the biggest gainers. Crosstex (XTXI) was down over a buck with fractional losses in Sunoco Logistics, Copano LP, Plains and a few others. Volume was unimpressive however.

No other breaking news after the close...at least so far.

No other breaking news after the close...at least so far.

On the downside...a few more than on the winning side with Plains All American, Sunoco Logistics, and Teppco..all three losing major fractions. Also no news is driving any particular issue.

Quiet out there this morning has i check news sources...no breaking headlines and no upgrades or downgrades. I t will be interesting to see where the Crosstex's (XTEX,XTXI) go today after positive foward looking distribution/dividend guidance that was not viewed that way at least initially.

PPI will be the driver for the 10 year today along with last nights speech by the fed chairman...right now at 4.65% pre ny open.

Monday, March 20, 2006

That is the link to the Crosstex analyst meeting today where they underwhelmed! Its 3 hours long and honestly i don't have the time to sit through it. But if anyone has the time...and some info please by all means share it with us in the comment section.

On the watch for after market developements.

The continution of a sleepy selloff in most MLPS today...Moves are small...except for the Crosstex action...Buckeye is down 40 cents..Valero down 35 cents.

Crude oil is down a buck so far today. Rates however are doing nicely with the ten year yield down 0.30 at 4.64%.

Headlines this morning from Crosstex as it issues guidance for 2006. Here is the bottom line from the press release.

The Partnership currently expects to pay total distributions for this year between $2.10 and $2.20 per unit. Based on that range the Corporation would receive total distributions between $40.6 million and $44.3 million from the Partnership. The Corporation anticipates direct cash expenses associated with its operations outside of the Partnership of approximately $1.5 million. The Corporation expects that it will incur only nominal current year income tax expense due to tax loss carryforwards and other tax benefits it expects to use in 2006. However, it will continue to set its dividends as if it were a taxpayer. Therefore, it expects to pay dividends of between $2.40 and $2.65 per share in 2006

Conference call to follow beginning at 8:30am. Can't tell anything yet in the pre-market.

More posts as time allows this morning.

Friday, March 17, 2006

Blogger has been down all day so i have not been able to make any additional posts until now. Martin Midstream is the star of the day again...and there were three insider buys done at the market which are always a big positive in my book. Details here for Ruben Martin..here for Robert Bonderant and last but not least here for Massey Scott. Remember insider purchases at the market with their own money is an example of someone puttting his or her money where his or her mouth is!

Holly Energy Partners (HEP) was today's biggest loser on the Lehman downgrade to market perform but when you look at the charts...they really are just stating the obvious. And while it looks like Holly might have broken below the recent range be advised that this stock has a habit of breaking down out of a base and then rallying above it soon after. No guarantees that it will be the same this time around...just pointing it out.

Monday is the Crosstex call..we'll be in on it. Also will post anything important over the weekend.

Markwest Energy (MWE) is up 78 cents...no news there and there is some volume this morning in this one. Copano, Energy Transfer Partners both up again and at 52 week highs.Plains All American and even Teppco is up!

Not many notable losers

Somebody blew out 14,100 shares this morning of Crosstex (XTXI) and also blew out 47,200 shares of Holly Corp (HOC) both trades posted at 8:01 am. I wonder if there is any connection?

Martin Midstream (MMLP) has a 30.75 bid in the pre market. Ask at 31.88

Crosstex holders (XTXI,XTEX)..2006 guidance will be announced Monday morning! Be there or be square.

Not much else happening this morning. Its Friday and trading is usually a little less interesting but i've got my eye wide open for any action. Crude down pennies this morning after yesterday's price surge. Nat gas down 14 cents.

Rigzone has a piece on the big Mexico oil find but nothing hits the market for about 2 years. Also a nice summary read from This Week In Petroleum! Also some peak oil discussions and what Exxon Mobil has to say about this at Econobrowser. Read some of comments as there is no lack of opinion on this.

Also Iraq may not only want to nuke us and Israel but it wants to hit us in the oil pocket as well. Attacks don't always come with fireworks.

Okay kids this should keep you busy for awhile. Martin Midstream has some stock to buy about 15 cents above yesterday's close but nothing offered in the pre-market. Holly has stock for sale about 40 cents below the close. No offers to buy yet.

Thursday, March 16, 2006

Small losses in Valero LP, Duke Midstream, and Crosstex LP (XTEX).

No breaking headlines this afternoon. 10 year yield plunging to 4.64%

The two best looking charts in the MLP group that i could find...imho of course!

The amount of green on the screen is expanding. Martin Midstream is still up1 but now Crosstex (XTXI) joins the group as buyers have moved in there. Strong fractional moves in Plains All American, Hiland LP, Energy Transfer Partners as it heads to 39 and another 52 week high. Copano Energy (CPNO) also at a 52 week high and trying to extend its breakout.

Just a few losers and not by much as Buckeye and Valero see no interest.

No news headlines this morning so far but of course the morning is young. Whoops...we do have an upgrade of Martin Midstream Partners (MMLP) by RBC Capital Markets to outperform!

Small losses in Crude Oil and Natural Gas although its nothing out of the ordinary. I've got my eyes on any breaking headlines before the open.

Wednesday, March 15, 2006

News flash after the close as Plains All American is buying Andrews Petroleum. Details at the link provided.

By the way just a brief note. When stock houses announce coverage on a new issue...they can do it on the 25th trading day. The market figures it out and the stocks usually don't do much when the news hits. Thats why ETE was down today by a dime and showed no response to the coverage. Another day that is usually down is the 31st day of trading. Thats when most houses that participate in the ipo allow their customers to sell if they so choose. Schwab for example has this 30 day rule..if you sell before the 30 days then they may deny you offerings in the future. I guess its a way to prevent flipping...ala the late 90s.

Crosstex near its low of the day (XTXI) down 1.66 on a periodic stock sale by a large owner (yorktown); usually takes a few days to absorb and it does not impact the LP (XTEX). Sunoco Logistics is down 40 cents...and Martin Midstream down 25 cents on its earnings.

Well its nice to go out and come back and see i did not miss much. For Energy Transfer Equity (ETE) Credit Suisse starts at outperform to join Wachovia. Meanwhile ETE is doing much but Energy Transfer looks like its breaking out as its up 51 cents. Copano (CPNO) has not followed through yet to yesterdays potential breakout but it did not move yesterday until the last 15 minutes so lets see if it repeats today.

Crosstex (XTXI) is down 86 cents as it absorbs another sale of Yorktown shares. Crosstex LP is up 37 cents however to near 37. Not much else happening with most moves +25 cents to -25 cents.

Blogging a little early this morning as i have to head to the race track and take care of a few things with my new horse...more on that later. Meanwhile a few things to look foward to today.

Martin Midstream Partners posted earnings late yesterday which beat on the revenue number. So look for some movement there. Also Copano broke out of a handle base late in the day yesterday so we'll look for any follow through today.

Crosstex Energy (XTXI) has another regular sale of shares from Yorktown partners which has been periodically selling off its stake. Here are the forms filed and there is also this one here. If i read this right its another 720,000 shares hitting the market. They do this every three or four months and each time so far its been a buying opportunity. This appears to be a summary filing of what has occured.

Wachovia starts Energy Transfer Equity (ETE) at outperform this morning!

No other news but i am posting early. I should be back early this afternoon and will update and post then

Tuesday, March 14, 2006

Well you can't say i did not warn you...Copano looks like it broke out of its handle base here and if its confirmed tomorrow in higher volume we could see 50 in this one shortly. Fingers crossed for all those that are long. Copano is presenting at the Lehman Conference on High Yield which begins tomorrow. Perhaps there is anticipation the company might say something positive. The chart pattern above to me is extremely bullish. Crosstex (XTXI) had a similar pattern twice before and we've seen breakouts both times. The stock is currently forming another handle.

I was lucky this time in uploading the Copano chart but not so lucky with the Crosstex. Blogspot uploading issues. Just link here for the Crosstex chart and you'll see what i mean.

Martin Midstream earnings after the close and the numbers are skewed by the issue of new units last quarter. Not sure what to make of the DCF coverage of 1.10. Revenue numbers look good as they beat rev estimates even if the earning number was 7 cents under. I've learned that estimate misses in this group are not the most reliable indicator on how the stock trades the next day.

I'm having trouble uploading charts so until i can....use this link to view them

Monday, March 13, 2006

Tomorrow we have earnings from Martin Midstream Partners (MMLP) after the close.

Just a reminder folks...scroll down to sunday evening's post for links to some interesting reads. Or just link here to it directly.

Holly Partners is down 45 cents...but its on appointment only trading so far. The few losers are down 20 cents or less.

4.78 on the 10 year is still holding...MLPS shrugging it off anyway. Oil and Gas stocks are stronger across the board.

Just a thought but since we,ve seen MLPS go nowhere as the yield curve has been flattening what if the rise in the 10 year rate and a potential steepening of the curve turns into a positive for the the group? I guess it all depends whether the fed stops raising short rates and the 10 year rise doesn't get too out of hand.

Atlas America (ATLS) starts trading at a 3 for 2 split today so not to worry if you see the stock down 18 points...its post split!

More shuffling around of the deck chairs at Teppco after the death of the CEO. TPP has been acting in line to the rest of the group lately. This news item is left over from Friday.

Markwest Energy (MWE) conference call had a bit of a positive spin to it according to posters on the Markwest Energy message board.

Ten year yield opens up at 4.787%....we'll see if 4.80-4.90 holds.

Sunday, March 12, 2006

We all have heard about Canada might be the energy savior of the USA. But just how willing will Canadians be to sacrifice some of their own energy security? The Oil blog has a must read piece on this particular thesis.

There is this quote from Big Picture Speculator

North American energy policy makers have not been overly concerned about the delays in getting large northern gas pipelines built. It was assumed that LNG projects could be be relied upon to augment dwindling gas supplies.

Then check out this link on China LNG delays.

God do i love factoids...He does great work. Check out the March update!

Ten yields have been rising but they have seemed to have flattened the yield curve. The implications are discussed on Econobrowser.

So dig in folks...lots here to wet the appetite.

Friday, March 10, 2006

Conference call underway.

MLPS closed higher and many near their highs of the day.

Good morning.

We begin this morning with earnings from Crosstex LP (XTEX) which look very good. The purchasing of puts to hedge themselves last summer on a gas purchase proved very profitiable. Conference call to follow later this morning.

Markwest Energy is to report earnings sometime today. Conference call at 4pm.

Ten year rates holding after the unemployment (or employment) numbers. Energy complex down slightly this morning.

Thursday, March 09, 2006

After hours will post any breaking news.

On ths downside only a few and except for Penn Virginia down 50 cents the others; Crosstex LP, Enbridge and Enterprise are only down by pennies.

Markwest Earnings possibly after the close today or tomorrow morning. Still not sure which.

Watch for earnings from Markwest Energy (MWE) as they will hve their conference call tomorrow afternoon on earnings but they did not say when earnings will be released so my guess is either after the close today or first thing tomorrow morning.

No other corporate developements this morning so far. Ten year rates are behaving today as they sit just under 4.75%. Energy complex is mixed...Crude up 44 cents.. nat gas down a few pennies.

Yesterday's intraday reversal on many MLPS was a good thing...also closing near the highs of the day was nice as well. December lows are holding so far in this retest.

Wednesday, March 08, 2006

On the news front Duke Midstream headlines as they are in some sort of pact with Conoco Philps...good for a whole penny of upside here. No other headlines and nothing that i've seen from the MLP conference.

Here is a list of what these things are yielding as of yesterday's close. I picked 10 at random.

- Martin Midstream Partners (MMLP) 8.20%

- Atlas Pipeline Partners (APL) 7.90%

- Teppco (TPP) 7.50%

- Pacific Energy Partners (PPX) 7.20%

- Magellan Midstream (MMP) 7.10%

- Kinder Morgan Partners (KMP) 6.80%

- Valero Energy Partners (VLI) 6.60%

- Energy Transfer Partners (ETP) 6.57%

- Holly Partners (HEP) 6.30%

- Crosstex Energy (XTEX) 5.50%

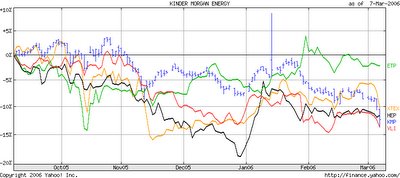

Above i posted 2 charts comparing performance of the top 5 yielding stocks in this random group. The worst performer is Teppco who has not grown their distribution during this 6 month period. There is percieved risk in Atlas Pipeline and Martin Midstream which makes them underperformers...Pacific Energy outperformed in this group.

Note the next group that Energy Transfer is the number one performer but Crosstex LP yielding the lowest finished number 2. I guess we can play around with these numbers and there are other factors...such as the 10 year. Note that in the last year the S&P and Nasdaq are showing relative outperformance but....this does not include dividends.

Breaking headline on Enbridge saying they are planning 11 billion in investments in North America...link to story when it arrives.

News from last night as Energy Transfer Partners (ETP) boosts its distribution by 15 cents on an annual basis. This is 5 cents higher then the pre-announced recommended increase a few weeks ago!

Rates are flat this morning from the close at 4.74 on the 10 year. The energy complex is lower this morning...crude down by 46 cents. No corporate news this morning but a bunch of MLPS are presenting this morning at the MLP conference in New York City. Will post any breaking headlines.

Tuesday, March 07, 2006

XOI down 15 points and the energy complex continues lower. The 10 year is at 4.75 which is off the days high yield at 4.78.

Two charts this morning for for enjoyment..the 10 year yield daily and the 10 year yield weekly...and both aren't pretty. We are about to restest it seems the April 04 high yield of 4.93%. Headwinds for MLPS are continuing so i am expecting lower prices again today. Copano had good earnings numbers last night (CPNO) so they may at least be the opening exception but lately earnings reports; even very good ones have not been supportive of prices. Atlas Pipeline Partners is a good example.

The energy complex is somewhat lower but not as sharply as yesterday so that might be at least one minor positive...or at least something that is less negative. No corporate developements this morning. A bunch of these companies are presenting tomorrow at an MLP conference in New York City so maybe some news might be forthcoming from one or two of these companies.

Monday, March 06, 2006

Magellan Midstream announces some project expansions on its pipeline and terminals. Copano Energy (CPNO) has earning coming out today after the market closes and a conference call for tomorrow morning. Also there is a Master Limited Partnership conference in NYC Wednesday and a number of MLPS are presenting and web-casting.

The ten year rate continues to climb now at 4.72% so there is a stiff headwind. Crude Oil and the energy complex starts the week lower. No upgrades or downgrades so far.

Sunday, March 05, 2006

Thought i'd get started a little early and we'll start with this piece on canada sands production.

Specail thanks to Glenn Reynolds of Instapundit.

If you are and Enbridge Energy investor this is a must read. Looks like Canada will be the major player for oil and energy sooner rather than later. A must read. Also check out this story about Chevron with regards to Canadian sands...also thanks to instapundit.

Winter is just about over and we are already looking ahead to the 2006 Hurricane season on Rigzone

More to follow as i dig around.

Friday, March 03, 2006

Someone wake me up please!

Good Friday Morning.

No corporate drivers this morning to speak of so we wait for the market to open. Energy stocks look poised to open higher again. The ten year rate is at the very top of its recent range so we'll watch for a breakout al,though i wonder how much of any further rate rise is already priced into MLPS.

As a side note we should be hearing soon from Energy Transfer Partners and the next distribution. If they follow last years pattern they could announce today or Monday.

Thursday, March 02, 2006

One of the tell-tale signs that a stock has bottommed is how it reacts to downgrades. In other words...when a major house downgrades a stock...does it go down on the news or does it do the opposite. Today Deutche Banc Securities downgraded Valero to a hold from a buy...they had upgraded the stock to a buy on December 19th 2005. The price of the stock is roughly the same today as it was on 12/19. Also note today's reaction. After a down open of 65 cents the stock is essentially flat. Good sign IMHO.

Atlas Pipeline got a little traction and the stock is up 44 cents on good earnings. Not much else happening today.

Oh somehow i missed this story on Enterprise Products Partners and an offering of 15 million units. Some stories are hitting some news wire sources and not others. Must be the snow!

Sitting here with snow falling and no voice...but one need not speak to blog!

Good Morning.

AtlasPipeline Partners posted blowout earnings last night as they beat estimates by nearly 20 cents. Conference call this morning at 8:30am and it will be available for replay.

Buckeye Partners priced an offereing of 1.5 million shares last night The story says nothing about what the price per share was. When i see something i'll post it.

Not much else happening so far this morning. Futures in stocks a little lower pre-open. Energy complex is higher in all sectors.

Wednesday, March 01, 2006

Atlas Pipeline Partners set to report earnings after the close today. Crude a little higher this morning along with stock futures.