Monday, July 31, 2006

The MLP INDEX is up 2.68 at 256.78 as just about the whole group is higher. Two exceptions are Copano Energy which is down 1.11 on 10,000 shares and no news...and Valero LP which is down 79 cents on disappointing earnings and the lack of a distribution increase. Otherwise the group is following the rising energy complex especially Natural Gas which was up huge...1.00 at 8.18.

The AMZ index is up 1.29 this morning and most MLPS continue higher with supportive 10 year yields and very strong natural gas prices. Valero LP is lower by 75 cents as there is some disappointment with earnings and no distribution increase. Boardwalk Partners however is up 1 on its earnings and distribution increase. The vast majority of MLPS are showing fractional gains.

Valero LP headlines are hitting the tape...Looks like earnings were in line and no distribution increase this quarter which is a bit disappointing but the company remains very upbeat about the second half. It is saying it expect q3 results to be similar to Q2 with the negative overhang due to scheduled turnarounds at refineries and maintience. So a mixed bag in my view...we'll see how the markets take it. A few pre-open trades have just crossed even with the close Friday.

Good Morning! Waiting patiently for the Valero LP numbers and will post and comment when they arrive. It should be any minute. Stock futures a little lower this morning with a flat 10 year. Crude oil is up this morning...Natural Gas is soaring this morning up 36 cents and the chart indicates we are trying to breakout above a downtrend line you could draw from the peaks.

This just in! Boardwalk Partners just posted and earnings were good with a distribution increase. It beat estimates by 15 cents...almost double expectations which were at 20 cents! Also we have Alliance Resource Partners with earnings and distribution boost. Still waiting patiently for Valero LP earnings which should be out anytime now...hopefully before the open. Conference call this afternoon and 2:30pm eastern time.

Sunday, July 30, 2006

Take a look at Nat gas futures kids...they're soaring in Sunday night electronic trading. Crude however isn't doing very much at this point.

Just a quick post as we get ready for an interesting week!

Just a quick post as we get ready for an interesting week!

Its not often that i post on a sunday afternoon but i figured i had some time so i will share with you my schedule for this week. Tomorrow i will be around so there will be normal blogging plus i will attempt to live blog the Valero LP Conference call or at least get my hands on the highlights. Tuesday and Wednesday i will be up for 2 days in Saratoga NY for a little horse racing (okay a lot of horse racing) so blogging will be non-existent. I will be back to normal blogging on Thursday. Blazing heat for the mid-atlantic and northeast with Tuesday and Wednesday being the hottest 2 days...temperatures nearing or topping 100 in NYC. This should put big strains on an already strained electrical system. Much of the US will be heat suffering and also watch for the possibility of a tropical system developing in the Northwest Carribbean and heading for the gulf of mexico along about mid-week.

More earnings due out this week as we wait for Valero LP tomorrow morning with a conference call at 2:30 eastern. If the numbers are good, distribution is hiked, and the outlook is good this stock should head to retest the 54-56 level quickly. Atlas Pipeline Partners is due out Tuesday.

More earnings due out this week as we wait for Valero LP tomorrow morning with a conference call at 2:30 eastern. If the numbers are good, distribution is hiked, and the outlook is good this stock should head to retest the 54-56 level quickly. Atlas Pipeline Partners is due out Tuesday.

Friday, July 28, 2006

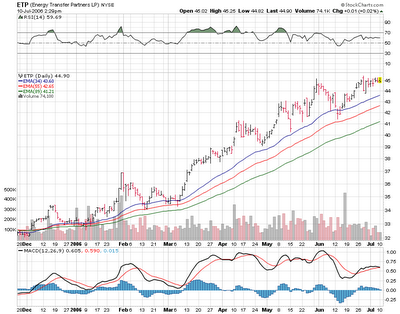

Afternoon broad rally in the overall market...MLPS are mixed to higher. The index is down but again we have some ex-distributions going on and a few of the bigger caps like Valero LP (VLI)and Kinder Morgan Partners (KMP)are down...as per Valero its the first down day after 7 up days in a row so it was due for a pullback. Earnings and distribution announcement coming Monday morning and should be a mover. Calumet Products Partners(CLMT), Crosstex LP(XTEX), Markwest Energy(MWE), and Duke Midstream(DPM)...all fractional winners but under 50 cent gains. Losers include Pacific Energy Partners(PPX), Energy Transfer Partners(ETP), Valero LP and one or 2 others.

10 year rate now at 4.99% and falling. We continue to have the wind at our backs.

10 year rate now at 4.99% and falling. We continue to have the wind at our backs.

Good Friday Morning!

Typing while that pompous windbag Senator Dorgan and the windfall profits tax. When oh when will these idiots just give up!

Meanwhile our MLPS have all the wind at their backs. Good earnings continue..distribution rising...falling 10 year interest rates. I think the AMZ MLP index which sits at 255 could head to 270 and challenge 52 week highs. Regency Partners annoucnes its distribution which is the first full quarter since going public. Another IPO from Atlas America as it will be offering Atlas Energy. I would think this will not have an overhang on Atlas Pipeline Partners (APL) the way the offering of the general partners Atlas Holdings (AHD). This new IPO will also list on the NYSE.

No upgrades or downgrades this morning. We have a few ex-distributions today so there will be the usual price distortions.

Typing while that pompous windbag Senator Dorgan and the windfall profits tax. When oh when will these idiots just give up!

Meanwhile our MLPS have all the wind at their backs. Good earnings continue..distribution rising...falling 10 year interest rates. I think the AMZ MLP index which sits at 255 could head to 270 and challenge 52 week highs. Regency Partners annoucnes its distribution which is the first full quarter since going public. Another IPO from Atlas America as it will be offering Atlas Energy. I would think this will not have an overhang on Atlas Pipeline Partners (APL) the way the offering of the general partners Atlas Holdings (AHD). This new IPO will also list on the NYSE.

No upgrades or downgrades this morning. We have a few ex-distributions today so there will be the usual price distortions.

Thursday, July 27, 2006

With the summer here i've been spending some time at the pool or as in today's case at the beach so blogging has been light. Developments today show a mixed picture and while the AMZ index was down nearly 2 points most of that was the ex-distributions of Kinder Morgan, Oneok LP and a few others. Still there were some winners today...Markwest was up 1 most of the day before closing up about 75 cents as it boosts its distribution nicely higher. Actually this news was out last night and fell through the cracks here. Since the stock offering a few weeks ago the price has gotten everything back and more.

Tonights news centers around Sunoco Logistics as it makes a purchase of pipelines and boosts its distribution. Magellan Midstream Partners did well today after earnings this morning. Duke Midstream Partners announces a nice distribution increase and Williams Partners (WPZ) also announced a payout increase.

So we seem to be moving right along here with interest rates trending lower on the 10 year and a market that is favoring MLPS again. Valero LP earnings are out Monday and if they are good and we get a distribution boost..we could propel over the 55 level very quickly. Also Copano is in breakout mode as we made another 52 week high today.

Good Morning!

First off before we get to earnings this mornning some news leftover from last night as Atlas Pipeline Partners boosts its distribution to 85 cents a share. Buckeye Partners (BPL) announces that it has commenced its IPO of the GP. Once this is priced and starts trading Buckeye Partners (BPL) should see its stock rally as the other LPS have once the IPO is done.

Now to earnings news this morning. Magellan Midstream posts numbers and they look very good. They lower the view on the 3rd quarter but raised full year estimates. We'll see what the market does with these numbers.

Holly Partners on the other hand missed estimates by 23 cents. Reading the release the company distributable cash flow did not cover the distribution this quarter which is not good but the company did say that the decline for this qaurter will be made up in the next 2 quarters due to 1 time issues. We'll see what the market has to say shortly.

No upgrades or downgrades this morning. 10 year is flat and Exxon Mobil earnings

First off before we get to earnings this mornning some news leftover from last night as Atlas Pipeline Partners boosts its distribution to 85 cents a share. Buckeye Partners (BPL) announces that it has commenced its IPO of the GP. Once this is priced and starts trading Buckeye Partners (BPL) should see its stock rally as the other LPS have once the IPO is done.

Now to earnings news this morning. Magellan Midstream posts numbers and they look very good. They lower the view on the 3rd quarter but raised full year estimates. We'll see what the market does with these numbers.

Holly Partners on the other hand missed estimates by 23 cents. Reading the release the company distributable cash flow did not cover the distribution this quarter which is not good but the company did say that the decline for this qaurter will be made up in the next 2 quarters due to 1 time issues. We'll see what the market has to say shortly.

No upgrades or downgrades this morning. 10 year is flat and Exxon Mobil earnings

Wednesday, July 26, 2006

MLPS are moving right along to the upside this morning. The MLP index is closing in on the 256 level up nearly 1 on the day. No real drivers here news wise...just a firm 10 year note with the yield near 5.05% and a steady stream of buyers. Penn Virginia Resources (PVR) Natural Resource Partners (NRP) and Alliance Resource Partners (ARLP) are among the few losers and they are down solid fractions. Otherwise its nice fractional gains for everyone else.

Above we have the charts of Atlas Pipeline Partners (APL)and Valero LP(VLI). These 2 charts were probably the ugliest looking among the MLP group but note that since both companies have completed the IPOS of their GPS the selling pressures has completely disappeared and the stocks have been going up nearly every day. Valero LP has earnings out tomorrow and if they boost the distribution again we could see this one run quickly to 54-55. Atlas Pipeline is due also with earninings and distribution which could propel this one to 44-46 rather quickly. Buckeye Partners is the next one to look for as they are under pressure from the IPO of thier GP which is due out soon.

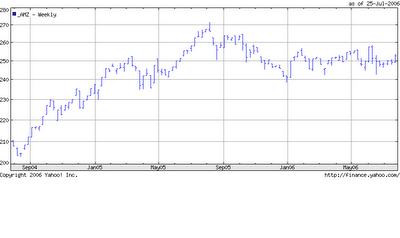

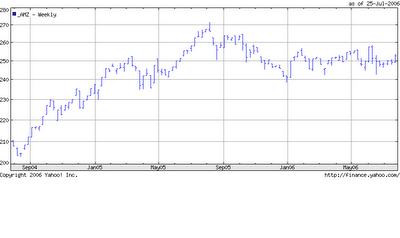

Below we have the chart of the AMZ MLP INDEX which is now around 253. Note that we need to get upt above 270 for an upside breakout. 17 points is lots of headroom and we could be at the beginning of a rally phase that could last awhile...assuming of course that 10 year yields have peaked around 5.25 %

Blogging was light yesterday but am back on the keyboard this morning. First some catch up news from yesterday as Hiland Partners boosts its distribution. Also we have a boost in the distribution of Inergy LP (NRGY) and a bigger distribution boost from Inergy GP.

This morning there are no corporate developemts...at least so far. But we do have Lehman Brothers making positive comments on Markwest Energy this morning as they start coverage with an overweight.

Above we have the charts of Atlas Pipeline Partners (APL)and Valero LP(VLI). These 2 charts were probably the ugliest looking among the MLP group but note that since both companies have completed the IPOS of their GPS the selling pressures has completely disappeared and the stocks have been going up nearly every day. Valero LP has earnings out tomorrow and if they boost the distribution again we could see this one run quickly to 54-55. Atlas Pipeline is due also with earninings and distribution which could propel this one to 44-46 rather quickly. Buckeye Partners is the next one to look for as they are under pressure from the IPO of thier GP which is due out soon.

Below we have the chart of the AMZ MLP INDEX which is now around 253. Note that we need to get upt above 270 for an upside breakout. 17 points is lots of headroom and we could be at the beginning of a rally phase that could last awhile...assuming of course that 10 year yields have peaked around 5.25 %

Blogging was light yesterday but am back on the keyboard this morning. First some catch up news from yesterday as Hiland Partners boosts its distribution. Also we have a boost in the distribution of Inergy LP (NRGY) and a bigger distribution boost from Inergy GP.

This morning there are no corporate developemts...at least so far. But we do have Lehman Brothers making positive comments on Markwest Energy this morning as they start coverage with an overweight.

Tuesday, July 25, 2006

Good Morning!

First off some news after the close last night from Buckeye Partners (BPL) which came out with earnings and another distribution increase. Numbers here look pretty good but the stock remains pressured until the IPO of the GP is done. And that IPO should be coming soon. Out with earnings this morning is Enterprise Products Partners (EPD) and they show a nice rise. The company had already upped its distribtuion last week. Nothing yet on the upgrade downgrade list but the morning is still young.

The MLP group has been doing pretty well with the backdrop of falling ten year rates, higher energy prices and at least so far good earnings and some hefty distribution increases. Seems like we're in the sweet spot here with some MLPS breaking out to new 52 week highs. Expecting the upside to continue today.

First off some news after the close last night from Buckeye Partners (BPL) which came out with earnings and another distribution increase. Numbers here look pretty good but the stock remains pressured until the IPO of the GP is done. And that IPO should be coming soon. Out with earnings this morning is Enterprise Products Partners (EPD) and they show a nice rise. The company had already upped its distribtuion last week. Nothing yet on the upgrade downgrade list but the morning is still young.

The MLP group has been doing pretty well with the backdrop of falling ten year rates, higher energy prices and at least so far good earnings and some hefty distribution increases. Seems like we're in the sweet spot here with some MLPS breaking out to new 52 week highs. Expecting the upside to continue today.

Monday, July 24, 2006

Good Monday Morning even though i'm running late thanks to a double shift last night. A nice start to things this morning and note above the 10 year chart. If 10 year rates have peaked at 5.25% then it stands to reason that MLPS can continue to rally here. Falling rates and rising distributions make for a nice tail wind. The AMZ MLP index is up 1.34 to 252 and change as most MLPS are fractionally higher in here. Penn Virginia Resources, Atlas Pipeline Partners, Sunoco Logistics, Copano, Transmontaigne and Buckeye Partners are up nice fractions so far.

Speaking of Copano Energy the chart of the stock above shows that we are breakout to new 52 week highs and on volume...so far 31,600 shares have changed hands...If you are a fan of buying breakouts on charts...this one may be headed to the middle 50s before too long. Copano is at 50.37 right now up 1.21 on the day

Friday, July 21, 2006

Afternoon trading undeway and while the market is down its off its lows. Holly Partners(HEP) ups its distribution by .015 cents. The group itself is mixed which is okay. Penn Virginia Resources (PVR), Energy Transfer Partners(ETP), and INERGY(NRGY) are fractional losers today. Valero LP(VLI) is up for the 5th straight day as it nears the 51 level. Atlas Pipeline Partners(APL) is also a winner today is it nears the 42 level. Also higher are Markwest Energy(MWE) and National Resource Partners(NRP).

Good Morning!

The Dell disaster this morning just re-affirms what we already know about our little group of master limited partnerships...the best kept secret around...boring but boring works for me! And speaking of boring we have no corporate developments and no upgrades or downgrades.

IPO developments as Atlas Holdings priced last night at 23 bucks at the bottom of the range. However as with Valero LP once its IPO was finished the stock has rallied and i look for Atlas Pipeline Partners to do the same as the shorts come off.

So here comes the open...the ten year yield is down to 5.01% which along with the tech wreck should be supportive for MLPS.

The Dell disaster this morning just re-affirms what we already know about our little group of master limited partnerships...the best kept secret around...boring but boring works for me! And speaking of boring we have no corporate developments and no upgrades or downgrades.

IPO developments as Atlas Holdings priced last night at 23 bucks at the bottom of the range. However as with Valero LP once its IPO was finished the stock has rallied and i look for Atlas Pipeline Partners to do the same as the shorts come off.

So here comes the open...the ten year yield is down to 5.01% which along with the tech wreck should be supportive for MLPS.

Thursday, July 20, 2006

Afternoon announcements from Magellan Midstream Partners (MMP) and Magellan Midstream Holdings (MGG) and they are both increasing their distributions. Glory to their shareholders!

Copano and Oneok both have 1.00 gains with 2 hours to go, Holly Partners (HEP) was up 1.45 at one point but there is a thin float there. Still it and Valero LP (VLI), Plains All American (PAA), and Markwest Energy (MWE) are all up nice fractions.

Kinder Morgan Parnters (KMP) is down nearly 1 with fractional losses in Alliance Resource Partners (ARLP) Hiland Partners (HLND) Penn Virginia Resources (PVR) and Duke Midstream (DPM).

Nice to see those distribution increases coupled with a falling 10 year now at 5.03%

Copano and Oneok both have 1.00 gains with 2 hours to go, Holly Partners (HEP) was up 1.45 at one point but there is a thin float there. Still it and Valero LP (VLI), Plains All American (PAA), and Markwest Energy (MWE) are all up nice fractions.

Kinder Morgan Parnters (KMP) is down nearly 1 with fractional losses in Alliance Resource Partners (ARLP) Hiland Partners (HLND) Penn Virginia Resources (PVR) and Duke Midstream (DPM).

Nice to see those distribution increases coupled with a falling 10 year now at 5.03%

First off let me correct my post from yesterday evening that KMP increased its distribution again...i mis-read the press release and my apologies...the distribution is steady from last quarter at 81 cents. The confusion comes in the comparison they make from same quarter a year ago and not the previous quarter. The market wasn't fooled as the stock is down nearly 1 dollar which is weighing on the AMZ MLP Index which is flat...down 11 cents. But most MLPS are flat to higher. The two companies which did boost distributions sharply higher are both....sharply higher by about 1 point in both cases...ONEOK LP (OKS) and Copano Energy (CPNO). Plains All American (PAA) Energy Transfer Equity (ETE) and Markwest Energy (MWE) also showing nice fractional gains.

Good Morning...and after a day like yesterday for MLPS of course it is a good morning.

And we begin this morning with the charts above of Copano Energy (CPNO) and Oneok LP (OKS) formerly known as Northern Borders Partners. Both are perfect examples of buying high and selling higher and both have been constructing a nice sideways pattern on the verge of upside breakouts. Now the possible catylist for more upside. Oneok LP announced a large distribution increase after the close yesterday...now at $3.80 annual or 7.45% on 51 dollars. And Copano Energy also announced a hefty 7 cent increase in its distribution to $2.70 annual or 5.56% on 48.50. So which is the better buy? I think both are great buys since in the case of MLPS and as our dear friend "chart" has pointed out...past performance is really the only indicator we have of possible future performance. And the fact is Copano has been raising its distribution agressively and there is no reason to believe this will stop as of this quarter. It has the lower yield so the market is telling you its getting a higher price relative to yield since it is a proven grower.

Oneok LP (OKS) is the artist formerly known as Northern Borders Partners and as long term holders probably know you suffered sideways movement for years with no increase in distribution...the Enron overhang etc etc etc. But now thats all gone and we have seen the distribution go from 3.20 to 3.80 annual in 2 quarters. Supposing the market decides to reward this by dropping the yield down to 6.3%. If the view is that we know have a future distribution grower...than a 6.3% yield gives you a 60 dollar price!

In summary you have 2 choices here...if you go with the proven grower (COPANO) you don't have much room for yield shrinkage since the market has priced that in...but if they keep aggressively increasing their distributions and long term rates hold steady or fall you have a winner. If you go with Oneok LP...you have some room for the price to rise forcing the yield down as long as you believe it will be a future grower. We'll see what the market tells us about these 2 shortly.

Meanwhile stock futures are stronger this morning with yields near the flat line...Energy complex has settled back from its spike highs from last week. So it looks to me like more upside. No corporate news this morning and no upgrades or downgrades.

Wednesday, July 19, 2006

Very good day indeed...MLPS all up (with the odd exception) and the MLP INDEX was up 2 and change to 251.77. Nice fractional gains across the board. Crosstex (XTXI) holders enjoyed nearly a 4 point gain back to near 94. Valero LP closed near its high for the day as did many others in the group.

News after the close...Kinder Morgan Earnings were out with an 11% rise and a distribution increase again. Earlier in the day National Resource Partners increased its distribution by 3 cents. More news as it breaks this evening.

By the way Valero GP (VEH) dropped under the IPO price of 22 dollars today...down 50 cents to 21.50. Atlas Pipeline should hit anytime now.

News after the close...Kinder Morgan Earnings were out with an 11% rise and a distribution increase again. Earlier in the day National Resource Partners increased its distribution by 3 cents. More news as it breaks this evening.

By the way Valero GP (VEH) dropped under the IPO price of 22 dollars today...down 50 cents to 21.50. Atlas Pipeline should hit anytime now.

I figured i'd wait for all the dust settle with the news and fed testimony...and the news is good for the stock market and very good for MLPS as 10 year rates are falling back under 5.07%. MLPS are sharply higher with the index up over 1 and change and well over 250. And Valero LP whose chart i posted above has come alive and back over 50. This MLP is so oversold and has alot of upside headroom. Its up 60 cents so far today. And we have a slew of fractional plusses in the group.

Just a few losers like Regency Partners which is digesting last weeks gains.

Tuesday, July 18, 2006

I almost hesitate to post this but is the endless death by a thousand cuts we've seen on Valero LP (UP 46 CENTS) and Atlas Pipeline Partners (UP 52 CENTS) finally over? Is the strength in MLPS today the beginning of a recession based rally and a long term interest rate peak and then decline? Lets hope! At some point investors have to realized that Valero LP and Atlas Pipeline Partners have both gotten very cheap in here. And the IPO overhang on Valero LP is over as VEH came public last week. Atlas's GP will price anytime now.

As for Holly Partners...Its in an area where it has paid to buy in the past as it tends to rally back to the lower 40s and usually pretty sharply.

I bought Crosstex LP (XTEX) back this afternoon after selling this morning...for trading purposes only.

MLPS are still higher while the overall market is breaking down here. The dow is down under 10,700 and if this accellerates this afternoon we could be breaking down to 10,200 before its all over. Meanwhile Crosstex LP is up 86 cents to 36.18. I added some more XTEX at the open at 34.86 and sold out at 36.18. Looking to go long again at 35.39. Also higher is Atlas Pipeline Partners as it sits near 41...up 46 cents. And there are fractional plusses in Global Partners and Boardwalk Partners.

Down are Copano (CPNO) by 30 cents on light volume...losers are mainly keeping losses under 20 cents.

Down are Copano (CPNO) by 30 cents on light volume...losers are mainly keeping losses under 20 cents.

Good Tuesday Morning! Nothing has blown up overnight but crude is back up this morning and MLPS open higher for the most part. The AMZ MLP INDEX is up 70 cents as it nears the 250 level again. We have a nice string of fractional gains with Buckeye Partners, Kinder Morgan Partners, Magellan Midstream, and Plains All American all up 25 cents or more at least to start. Nothing on the corporate front this morning and no upgrades or downgrades to speak of so we'll be on watch this morning for any developments.

Crosstex (XTXI) jumped 2 dollars this morning on a surge of volume at the open but no news there. Distribution announcements for this company and many more are due soon. News will be passed along as it developes.

Crosstex (XTXI) jumped 2 dollars this morning on a surge of volume at the open but no news there. Distribution announcements for this company and many more are due soon. News will be passed along as it developes.

Monday, July 17, 2006

After hours news...Pacific Energy declared its distribution...unchanged from last quarter. Its probably the last one before the merger with Plains All American Pipeline.

No other after market news. We should start to see earnings and distribution announcements rolling in over the next few weeks. It was a flat to lower finish in the group today. I took a new position in Crosstex LP today at 35.49; for trading purposes.

No other after market news. We should start to see earnings and distribution announcements rolling in over the next few weeks. It was a flat to lower finish in the group today. I took a new position in Crosstex LP today at 35.49; for trading purposes.

Stability has taken over in the overall market pending any new developements in the middle east. The MLP index has turned higher up 34 cents. Big energy stock are selling off a bit this morning with the XOI down 18 points. In MLP land no outstanding movers on the winning side. On the losers list Energy Transfer Equity is down 50 cents as it announced earnings this morning that beat forecasts...but i guess the market already priced that in and they are selling the news.

We will watch the markets today as we are at a critical juncture with the dow industrials which on the daily chart look like they're getting ready to break down below 10,700 which is where the last bounce started.

Good Monday Morning! The world has not completely fallen apart over the weekend but the stiches are coming out of the seams....As has been the case for the last several trading sessions we are at the mercy of Middle East developements and the dow industrials are on the verge of a breakdown below 10,700 which would take us to the next support level which is around 10,200. MLPS stand to benefit from a flight to quality but the road could be rocky.

Meanwhile some news from late Friday...Teppco (TPP) announces its distribution for the quarter and its the same as last quarter. However its better news for Enterprise Products Partners (EPD) shareholders as you get a distribution increase!

My first post of the day is an early one since i am working this morning in NYC where its going to 100 degrees today. I also work across the street from the Israeli Embassay which means the potential for protests and God knows what else. I will post again later this morning before the open as we get some headlines about what is going on in the upgrade downgrade department.

Meanwhile some news from late Friday...Teppco (TPP) announces its distribution for the quarter and its the same as last quarter. However its better news for Enterprise Products Partners (EPD) shareholders as you get a distribution increase!

My first post of the day is an early one since i am working this morning in NYC where its going to 100 degrees today. I also work across the street from the Israeli Embassay which means the potential for protests and God knows what else. I will post again later this morning before the open as we get some headlines about what is going on in the upgrade downgrade department.

Friday, July 14, 2006

Bit of a late start this morning since i had to work last night. I guess with all the geo-political stuff going on we're at the mercy of market swings. MLPS are mixed this morning with the AMZ MLP index down 20 cents. Some news on the corporate front as Plains All American raises its distribution a few cents...which is nice. Also Valero GP (VEH) began trading this morning as its ipo priced last night at the low end of the range. Hopefully the death by a thousand cuts that Valero LP has been undergoing comes to an end today as those who shorted this stock ahead of the IPO start to cover postions (we hope!).

I posted charts above and nimble day traders might take a look at Crosstex Energy as in this sell off we could get some very brief buying opportunities below current prices. I would put buy orders 3 or 4 points below the previous days close and play for a 2 point bounce intraday. It usually happens very quickly. This morning for example we had a brief 4 point drop in the first 30 minutes before a bounce back to 88...again for the nimble among you only.

Thursday, July 13, 2006

MLPS are lower as a group as they follow the market but they are holding up better than most other issues...supported by a general firmness in energy and steady 10 year yields. The AMZ MLP index is down just 14 cents at 249.84.

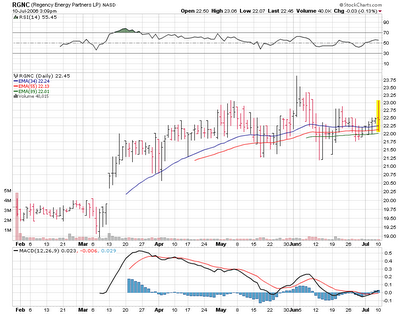

Regency Partners (RGNC) is the big winner today up nearly 1 on its purchase of Tex Star field services. Global Partners (GLP) and Enterprise Products Partners (EPD) are up fractionally.

Losers include Penn Virginia Resources (PVR) as it continues to drop on its IPO announcement a few days ago of its general partner. Duke Midstream (DPM), Trans Montaigne(TLP), Hiland LP (HLND) and Markwest Energy MWE) are all down fractions.

Regency Partners (RGNC) is the big winner today up nearly 1 on its purchase of Tex Star field services. Global Partners (GLP) and Enterprise Products Partners (EPD) are up fractionally.

Losers include Penn Virginia Resources (PVR) as it continues to drop on its IPO announcement a few days ago of its general partner. Duke Midstream (DPM), Trans Montaigne(TLP), Hiland LP (HLND) and Markwest Energy MWE) are all down fractions.

We actually have some corporate developements this morning that should finally allow a long standing prediction to come true. Regency Partners (RGNC) is buying TexStar Field services in an immediately accretive aquisition that will add to the distribution. This should be the catylist break this stock out of the base it has been in for the last 2 months between 21.50 and 23 dollars...should propel it a point or 2 today hopefully.

Not much action elsewhere although big energy is up this morning as crude continues to rise above 75 dollars. 10 year flat at 5.09...overall market a mess this morning on the futures side...MLPS could be a flight to quailtiy and yield if it gets messy. No upgrades or downgrades to speak of.

Wednesday, July 12, 2006

QUIET THIS MORNING ON THE MLP FRONT....

Nothing going on at all this morning in MLP land...the bias is higher which is good but not much else is really happening. No upgrades or downgrades...no corporate news....nothing. Duke Midstream, Atlas Pipeline and one or two others are the biggest losers if you want to call being down a dime a big loss. Crosstex LP (XTEX), Oneok LP (OKS), and Magellan Midstream (MMP) all up fractions.

Will wait for the open to run its course and the oil numbers at 10:30am

Nothing going on at all this morning in MLP land...the bias is higher which is good but not much else is really happening. No upgrades or downgrades...no corporate news....nothing. Duke Midstream, Atlas Pipeline and one or two others are the biggest losers if you want to call being down a dime a big loss. Crosstex LP (XTEX), Oneok LP (OKS), and Magellan Midstream (MMP) all up fractions.

Will wait for the open to run its course and the oil numbers at 10:30am

Tuesday, July 11, 2006

PENN VIRGINA RESOURCES FILES FOR IPO

OF ITS GP...STOCK DOWN....

BUT MLPS SLIGHTLY HIGHER THIS AFTERNOON.

The market turnaround has added more support to MLPS which were higher but not by much. Most issues plus or minus 30 cents of yesterday's close with more higher than lower. Penn Virginia Resources is another MLP who is IPO-ing its general partner. The stock is the standout loser today down 1 and change.

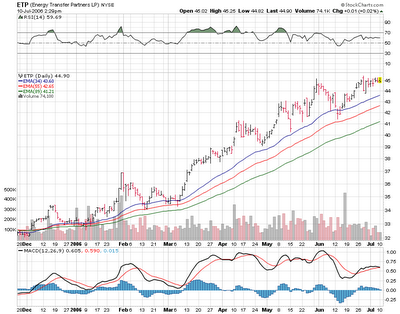

Energy Transfer Partners is flat on the day and its general partner ETE is up 20 cents on good earnings and the conference call. Sometimes it takes a day or two for these to catch fire.

MLPS OPEN HIGHER...ENERGY TRANSFER UP ON GOOD

EARNINGS.

MLPS come out of the gate mostly higher as 10 year yields back away from 5.25....now at 5.10 and dropping this morning. Also energy stocks as a whole are firm so the AMZ MLP INDEX is up above the 250 level. Energy Transfer Partners is up 40 cents on good earnings news yesterday and Energy Transfer Equity is gaining 16 cents. Sometimes these stocks take a day or two to absorb earnings news and don't move right away so my view is patience is in order. Most of the gains this morning are 20 cents or less at least at the start.

Energy Transfer Equity (ETE) is up 44 cents now on the ETP news.

No news nor are there any upgrades or downgrades to speak of.

Monday, July 10, 2006

ENERGY TRANSFER PARTNERS REPORTS BLOWOUT NUMBERS FOR Q2

TAPE LOOKS LIKE IT WANTS TO BREAK DOWN AFTER 3PM....MLPS STILL HOLDING ON TO GAINS.

Market has been in weakening mode this afternoon but MLPS are still just off their highs of the day...seems to me they are keying off the flat 10 year rate and energy stocks as a hold digesting last weeks gains. Plains All American (PAA), Holly Partners (HEP), Pacific Energy(PPX) and Markwest Energy (MWE) all to the upside by up to 50 cents each.

Energy Transfer Equity (ETE) is down about 30 cents as the biggest loser. By the way earnings for this and ETP should be out any day now. Chart has been spectacular.

Market has been in weakening mode this afternoon but MLPS are still just off their highs of the day...seems to me they are keying off the flat 10 year rate and energy stocks as a hold digesting last weeks gains. Plains All American (PAA), Holly Partners (HEP), Pacific Energy(PPX) and Markwest Energy (MWE) all to the upside by up to 50 cents each.

Energy Transfer Equity (ETE) is down about 30 cents as the biggest loser. By the way earnings for this and ETP should be out any day now. Chart has been spectacular.

SORRY FOR THE LATE FIRST POST...MLPS MOSTLY HIGHER..AMZ MLP INDEX BACK ABOVE 250!

Had to work this morning but we start on a slow summer day here. The overall market is higher; energy stocks as a whole trending higher and the 10 year rate is behaving under 5.25% so MLPS are higher; mostly pennies to small fractions. No news drivers at all this morning. Plains All American (PAA) Markwest Energy LP (MWE) are among the bigger gainers but mainly under 50 cents so far today. A few losers but no standouts really and all on light or non existent volume.

Just a theory on my part but 3 MLPS that have been lagging badly are Atlas Pipeline (APL), Buckeye Partners (BPL) and Valero LP (VLI). I think the common thread in these 3 MLPS is that all three have IPO's of their general partners coming anytime. Valero LP is coming out this week. I think what is happening here is that some of the big boys who are getting stock in the GP are hedging their bets by shorting the MLPS until the IPO'S hit the market. Once they start trading...my guess is there should be some short covering in these 3. Valero LP (VLI) will be the first to prove me right or wrong in the next few days.

The MLP INDEX is hitting new highs as I type...up 1 on the day so far. I am looking to establish a position in Energy Transfer Equity (ETE) for a short term trade and Holly Partners (HEP).

Had to work this morning but we start on a slow summer day here. The overall market is higher; energy stocks as a whole trending higher and the 10 year rate is behaving under 5.25% so MLPS are higher; mostly pennies to small fractions. No news drivers at all this morning. Plains All American (PAA) Markwest Energy LP (MWE) are among the bigger gainers but mainly under 50 cents so far today. A few losers but no standouts really and all on light or non existent volume.

Just a theory on my part but 3 MLPS that have been lagging badly are Atlas Pipeline (APL), Buckeye Partners (BPL) and Valero LP (VLI). I think the common thread in these 3 MLPS is that all three have IPO's of their general partners coming anytime. Valero LP is coming out this week. I think what is happening here is that some of the big boys who are getting stock in the GP are hedging their bets by shorting the MLPS until the IPO'S hit the market. Once they start trading...my guess is there should be some short covering in these 3. Valero LP (VLI) will be the first to prove me right or wrong in the next few days.

The MLP INDEX is hitting new highs as I type...up 1 on the day so far. I am looking to establish a position in Energy Transfer Equity (ETE) for a short term trade and Holly Partners (HEP).

Friday, July 07, 2006

MLPS MOSTLY HIGHER THIS AFTERNOON...KEYING OFF 10 YEAR BOND RALLY!

The AMZ MLP INDEX is higher by 70 cents this afternoon and as the market sells off..MLPS are doing fairly well. Most are fractionally higher and the few losers are down by just a few cents. Markwest Energy (MWE) continues to lead up 50 cents. Calumet Products Partners is down 50 cents as the standout loser. Again no news or upgrades/downgrades moving prices today. We're in that window as we wait for earnings and distribution increase announcements that will come in the next few weeks. The 10 year has hit at wall at 5.25%...now at 5.12%. This should keep a floor under these today.

Lets see if the market sell-off can keep from spreading into this winning group today.

The AMZ MLP INDEX is higher by 70 cents this afternoon and as the market sells off..MLPS are doing fairly well. Most are fractionally higher and the few losers are down by just a few cents. Markwest Energy (MWE) continues to lead up 50 cents. Calumet Products Partners is down 50 cents as the standout loser. Again no news or upgrades/downgrades moving prices today. We're in that window as we wait for earnings and distribution increase announcements that will come in the next few weeks. The 10 year has hit at wall at 5.25%...now at 5.12%. This should keep a floor under these today.

Lets see if the market sell-off can keep from spreading into this winning group today.

MLPS RALLY ON FALLING TEN YEAR RATES AND RISING ENERGY

Falling 10 year rates giving a boost to MLPS this morning as most are higher. Doesn't hurt that the XOI index is nearing a new 52 week high as Crude Oil makes new all time highs. Markwest Energy (MWE) continues to rally for the 5th straight day after pricing its offering at 39.75 last Friday. There was such a long overhang on this stock since the offering was known for 3 months that the stock sale was a relief and we're back to where we were 2 weeks ago...it is today's big winner up 60 cents. The AMZ MLP index is up 65 cents to the 249 level. Losers are few and mainly under 20 cents. No news drivers today.

Crosstex (XTXI) is selling off from the 97 level it hit yesterday. Might be another buying opportunity setting up but not until we drop under 90 imho.

Falling 10 year rates giving a boost to MLPS this morning as most are higher. Doesn't hurt that the XOI index is nearing a new 52 week high as Crude Oil makes new all time highs. Markwest Energy (MWE) continues to rally for the 5th straight day after pricing its offering at 39.75 last Friday. There was such a long overhang on this stock since the offering was known for 3 months that the stock sale was a relief and we're back to where we were 2 weeks ago...it is today's big winner up 60 cents. The AMZ MLP index is up 65 cents to the 249 level. Losers are few and mainly under 20 cents. No news drivers today.

Crosstex (XTXI) is selling off from the 97 level it hit yesterday. Might be another buying opportunity setting up but not until we drop under 90 imho.

ITS FRIDAY!...UNEMPLOYMENT NUMBERS AND NOT MUCH ELSE!

For MLPS its been a very very boring week. Outside of the GP IPO offerings being increased at Buckeye and Valero its been pretty much appointment only trading and I can't see much change from that today. The employment numbers will dictate the tune of the 10 year which has been hovering below 5.25%.

There are no corporate developements. In the upgrade downgrade department Alliance Holdings (AHGP) which is the GP of Alliance Resource Partners (ARLP) is being called overweight at Lehman Brothers.

Crude oil continues to make new highs at 75 dollars and change up 50 cents as we type. Natural gas continues to hover around or under the 6 dollar level. Stock futures ahead of the numbers are up...S&P futures are +1.90...10 year at 5.179%...here come the numbers which are below expectations and S&P Futures are soaring now up nearly 7...10 year yield drops to 5.14%

See ya'll at the open.

For MLPS its been a very very boring week. Outside of the GP IPO offerings being increased at Buckeye and Valero its been pretty much appointment only trading and I can't see much change from that today. The employment numbers will dictate the tune of the 10 year which has been hovering below 5.25%.

There are no corporate developements. In the upgrade downgrade department Alliance Holdings (AHGP) which is the GP of Alliance Resource Partners (ARLP) is being called overweight at Lehman Brothers.

Crude oil continues to make new highs at 75 dollars and change up 50 cents as we type. Natural gas continues to hover around or under the 6 dollar level. Stock futures ahead of the numbers are up...S&P futures are +1.90...10 year at 5.179%...here come the numbers which are below expectations and S&P Futures are soaring now up nearly 7...10 year yield drops to 5.14%

See ya'll at the open.

Thursday, July 06, 2006

THURSDAY MORNING OPENING NEWS

Very quiet this morning in MLP land. No pre-opening news and no upgrades or downgrades. We are still in this holiday week enviornment. Most MLPS are 20 cents within yesterday's close up or down...no real outstanding moves in either direction.

Not much else happening. We should be getting earnings soon from Energy Transfer Partners (ETP) and Valero LP's ipo of the GP should be priced soon. The ten year yield seems to be holding below 5.25%.

Very quiet this morning in MLP land. No pre-opening news and no upgrades or downgrades. We are still in this holiday week enviornment. Most MLPS are 20 cents within yesterday's close up or down...no real outstanding moves in either direction.

Not much else happening. We should be getting earnings soon from Energy Transfer Partners (ETP) and Valero LP's ipo of the GP should be priced soon. The ten year yield seems to be holding below 5.25%.

Wednesday, July 05, 2006

Its one of those days today with spiking 10 year rates...world politics...etc etc etc...and we have just about all MLPS down today fractionally...Energy Transfer Partners down 47 cents is the biggest loser so far...the index is down 1 point and off its low for the day. One or two MLPS are up; Regency Partners (RGNC) is up 13 cents with uninspired volume.

We'll see if the selloff speads this afternoon. I have buy points under these levels in a few MLPS.

We'll see if the selloff speads this afternoon. I have buy points under these levels in a few MLPS.

Good Morning!

If you're like memyou have that post 4th of July hangover...mine is from having to drive in post fireworks traffic in NYC last night at midnight. Part of me is still on the road somewhere.

Anyway this morning we have the market reacting to North Korea firing their cute little missles into the Sea of Japan getting everyone totally pissed off. So futures are 5 points lower. Energy Complex is slightly lower this morning...nothing specific going on their. In corporate developements we have Valero LP (VLI) doing its IPO and beginning the process today. Buckeye Partners (BPL) announces it its increasing the size of its offering. Those 2 and Atlas Pipeline Partners (APL) have underperformed the MLP index in the last 6 months as the chart above shows. All three have been growing distributions during this period...so i am theorizing that this must be the overhang on these 3 issues.

Nothing of consequence so far in the upgrade downgrade department. So lets see where the open takes us as trading gets underway.

Subscribe to:

Comments (Atom)