Its one of those mornings where i am actively looking around for something...anything to to write about but sadly...slightly higher oil...flat 10 year and slightly lower stock futures. So under that backdrop i guess it should be more of the same. We closed at another all time high on the MLP index yesterday. Still no sign of a top and i guess as the downtrend in the 10 year continues there will be no top until rates bottom.

I want to revisit LIN Energy as it nears the 30 dollar mark. This i believe was a perfect example of what happens in the MLP group because we are small, somewhat isolated and boring. Back in October the company pre-announced that the distribution for January 07 would rise to 2.07. With the unit price at 22 bucks it was nearly a 10% yield. At a 6-7% group yield the stock should trade closer to 30 bucks. So why was the stock trading so low relative to yield? I think this was a perfect example of what happens in this group. We're not followed...we're not traded very much..no one is interested. As a result opportunities are laid at our doorstep and it leaves us to ask "what is wrong with this picture?" " what is the market seeing that i'm missing?" The answer is to the second question is exactly the reverse...it is what am i seeing that the market is missing. In LIN's case it was missing this ridiculous yield relative to the market. And as a result you had a stock that took 6 weeks to get from 22 to 29. Sometimes you need to have the strength of your convictions.

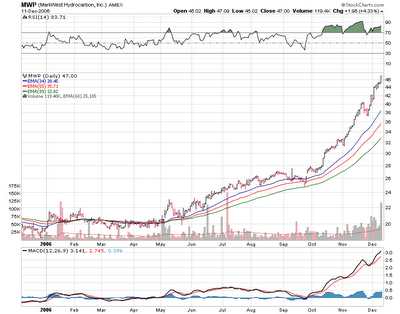

And what about Markwest Hydrocarbon..another one that was not doing much but this one has become a market darling now and has been like a runaway train. One can only watch in awe...and while it put this one on the radar on October 1 when the stock was at 27...never in my wildest dreams did i think we'd get a 20 point upside move.

By the way a reminder...keep an eye on the GPs as they have underperformed the LP's for awhile now. I would think at some point some of these will start outperforming. Valero Holdings (VEH), Atlas Holdings(AHD), and Energy Transfer Equity(ETE) are may favorites and i'm long all three right now. Look for a distribution announcement from Energy Transfer Partners and ETE any day now as they like to go ex-distribution before year end based on past ex-distribution dates.

3 comments:

Excellent comments re LINE and the market sometimes missing things. I made some great $ on LINE as I followed your logic. The industry being underfollowed is a good thing...stay below the radar like a good fighter. Thanks.

Any thoughts on the Spectra deal?

Larry

Dallas

I'm going to wait until it starts trading to see what the reaction is. Barrons arcticle 2 weeks ago likes it and says both Duke and Spectra will move higher.

And being under the radar is indeed very rewarding. I think VEH is another example of something thats being overlooked as they wait for the so-called secondary.

Contrary to LINE, MWP seems to be moving up in anticipation of dividend increases, rather than after them.

I expect some big dividend increases over the next few quarters at MWP.

Post a Comment